Good morning! and… Sticker drop! I’m very excited to share this with you - I’m doing a limited merch drop! It’s a sticker pack. 4 original designs. $22 + free shipping. Only 200 available. These are stickers that explain the economy (sort of…). You can slap one on your laptop, your journal, your friend, etc. Thank you for being part of this community! Whether you read, watch, listen, or support in other ways, I appreciate you so much. This drop is just a small way of bringing the internet into the real world, one sticker at a time. 🙂 The designs are not coming back in sticker form and the proceeds will be going towards a project I am working on around independent economics education!

The Commons

In economics, the tragedy of the commons is what happens when a shared resource - like farmland, fisheries, or clean air - is exploited so extensively that it eventually collapses. Today, we're experiencing a modern variation of this tragedy, not just in physical resources, but in our essential societal infrastructure:

- The social commons: trust, relationships, community.

- The cognitive commons: curiosity, education, critical thought.

- The economic commons: stable markets, shared prosperity, institutional trust.

- The informational commons: language, reality, basic consensus.

Unlike traditional commons, which collapse through actual physical depletion, these invisible resources are slowly dismantled through systemic incentives that reward isolation, compliance, instability, and division.

And this is a swing here - but what we seem to be left with is an infrastructure of incelism1 - not as some internet phenomenon, but as society’s default operating system. Incelism is a subculture of people who “define themselves as unable to find a romantic partner” which translates into '“resentment and hatred, self-pity, racism, misogyny, and misanthropy”. I think we are seeing some scaffolding of that applied to the commons - isolation, outsourced cognition, flattened identities, and performative grievance become profitable norms. It’s governance and culture via meme, resentment, and algorithm-driven outrage.

The Social Commons

A stable society starts with stable relationships - between friends, neighbors, coworkers, families. These connections form the basic scaffolding that allows larger, abstract ideas like democracy or economic growth to function.

But this is… not doing so well. So many people have written about this. Derek Thompson got the cover story in the Atlantic with his incredible Antisocial Century. This point - that we are looking past and through one another - is very well known.

There is a seeming collapse of meaningful connection across genders, class, and politics. Much of this is the bending of post-pandemic social infrastructure where we lost shared norms and collective rituals. But what replaces trust and community? Transactional connections. Platforms monetizing loneliness. Algorithmic tribes that offer a false sense of belonging, but really just reflect your preferences back at you. Every social interaction, from friendship to romance, is increasingly refracted through an economic lens where it is optimized, ranked, gamified. (And to be clear, there are beautiful elements of the Internet and dating apps, but the pendulum seems to be swinging towards negativity).

And honestly, a society built on transactional interactions and shallow connections is inherently fragile. People who can't trust each other in daily life don't suddenly trust each other at the ballot box. People who can't commit to friendships or partners might have trouble committing to democratic institutions or civic engagement. I am being sweeping in my assertions, but think of the foundation - a society without stable relationships can't sustain stable democracies.

Without genuine community ties, citizens disengage. Civic participation declines, and as Guy Debord warned us - politics devolves into spectacle rather than substance.

The Cognitive Commons

We don’t teach people to think — we teach them to comply.

I wrote about this extensively last week so you can read more there if you’d like, but curiosity is increasingly seen as risky or inefficient. As I previously wrote:

This is a pattern: no one wants to take a risk. Not elected officials. Not 19-year-olds picking college majors. Because in this economy, everything is compliance now. As the Italian philosopher Umberto Eco warned in his essay "Ur-Fascism," social systems don't collapse overnight. They erode through small surrenders, through the gradual normalization of compliance as a civic virtue.

Take Cluely, for example. It’s a product that lets you wear glasses on a date and ‘cheat on everything’. Part of that is pure marketing - how can we enrage people for clicks, etc - and part of that is the ethos of the cognitive commons at the moment. The AI companies that are being created are asking us to consider what being a human really means - and their answer is ‘efficiency and optimization’. And you know. Maybe it is.

the Cluely manifesto

AI steps in - not to aid thinking, but replace it. Products like Cluely advertise: “We built it so you never have to think alone again.” AI isn’t just a productivity tool, it’s attempted cognitive outsourcing. Critical thought, ambiguity, creativity, all the beautiful things that probably define what being a human is, are all replaced by optimized, immediate answers.

This shows up everywhere. It’s in our politics, where nuance has become politically dangerous and Congress refuses to stand up to President Trump. It’s even in our leisure time, when hobbies are measured by their side-hustle potential.

Anne Helen Petersen has a nice essay on that here, writing “the logic we’ve internalized is pernicious and persistent: if you’re spending time doing something, and there’s a potential to make money off that thing, leaving that money on the table is fiscally irresponsible.” The obsessive, monetized pursuit of hobbies isn't mere escapism but a reaction to general pressures: education-driven burnout, economic precarity, and performative living. It's a way for people to assert identity and agency within structural limitations. Optimization, efficiency, monetization. Repeat!

Without curiosity or critical thinking, we become vulnerable to manipulation, susceptible to polarizing narratives, and ultimately lose the ability to make independent judgments, which is really important for democratic citizenship.

The Economic Commons

Policy as projection - when the people who despise the system become the system

Economies run on trust - not just money or policy, but predictable rules and reliable institutions around that money and those policies. And right now, that credibility is evaporating. Why? Because economic policy has become a stage for personal grievance, emotional reaction, and political theatre. It’s all ~trust~ as I've written about a lot too. Take tariffs as Exhibit A. Tariffs can be strategic tools! But recently, they haven’t been that at all. Rates are toggled randomly, supply chains disrupted, and businesses left guessing.

- Treasury Secretary Scott Bessent privately (!!) acknowledged this instability in an investor meeting arranged by JPMorgan as reported by Bloomberg, admitting openly that the current tariff status quo (145% rates on China) is simply unsustainable.

- Bessent suggested an imminent de-escalation (despite negotiations not even starting yet) acknowledging that container bookings between China and the U.S. were already down 64% as reported by Eamon Javers.

- He explicitly stated, "The goal isn't to decouple," but rather push China toward a consumption-based society and the US toward a manufacturing-based society.

Which is wild, because that does really imply we are in the Chinese century. The US is giving up the comfiest seat in the house. And man, when you see China manufacturing - which is things like an Xiaomi factory “that produces 1 phone per second, has no production employees (just maintenance), operates 24/7, with the lights off” you have to wonder what the point is.

And of course, there are all these other questions, like… why are critical updates being shared behind closed doors at exclusive JPMorgan investor events rather than transparently with the public? Part of it is not wanting to question Trump - Bessent seems to leak a lot of information, because direct questioning is seen as too risky politically. The other part is some of element of handshake-high five-you’re-my-guys go-trade-on-this-news, maybe.

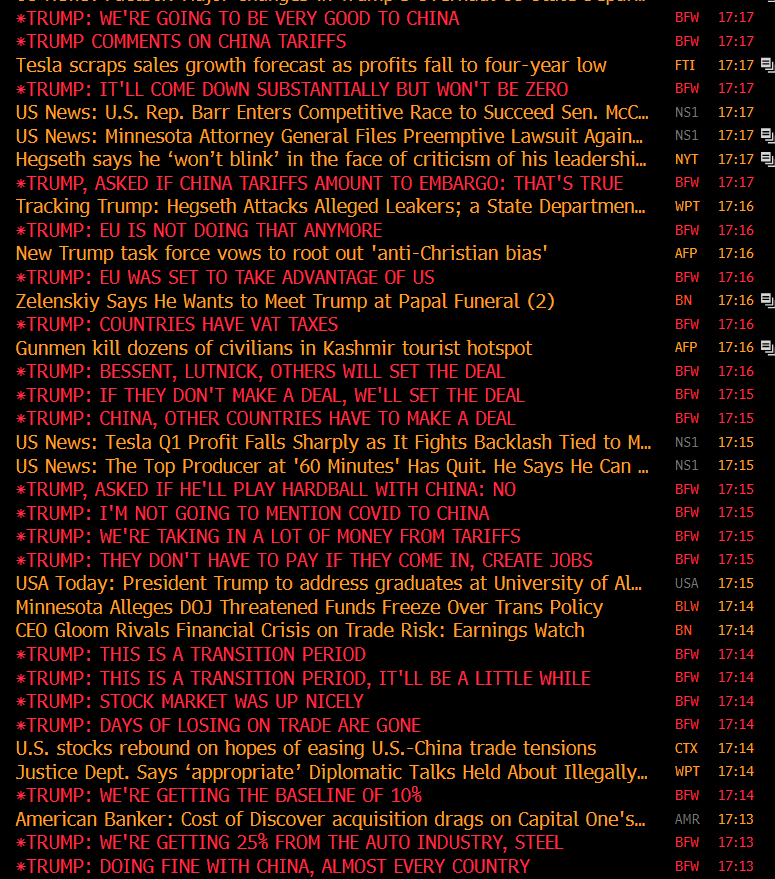

Meanwhile, on the public stage, both sides fluctuate between aggressive posturing and vague promises. Trump openly stated he won't "play hardball" with China, signaling de-escalation, at least right now. He also backed down on firing Powell. The markets of course rallied on the news, but it’s just news. The economy is still going to be in trouble from all of this.

The market is purely running on straight vibes at the moment. And who can blame them, when these are the headlines, which read like someone just having an entire conversation with themselves.

Source: Tschay Mishal

China then signaled openness to talks but only under conditions of mutual respect and reduced threats. And like… they should demand that? It seems like Japan went to the negotiation table and the United States was like “hey… we don’t know what we want but we certainly want something” like how a kid does when asked to pick out a toy at the toy store. The result has been a constant, exhausting cycle of headline-driven market swings and diplomatic stalemates.

Martin Wolf captured it really well on Odd Lots: America enjoys immense economic power because of the dollar's reserve currency status, allowing it to run enormous deficits effortlessly. Yet rather than carefully leveraging this advantage, the US seems determined to squander it through chaotic, emotion-driven policy decisions. Wolf puts it bluntly: "You're rich. You're fat. You're safe - unless you screw up monstrously. So WHY are you screwing up monstrously? That’s where we are now."

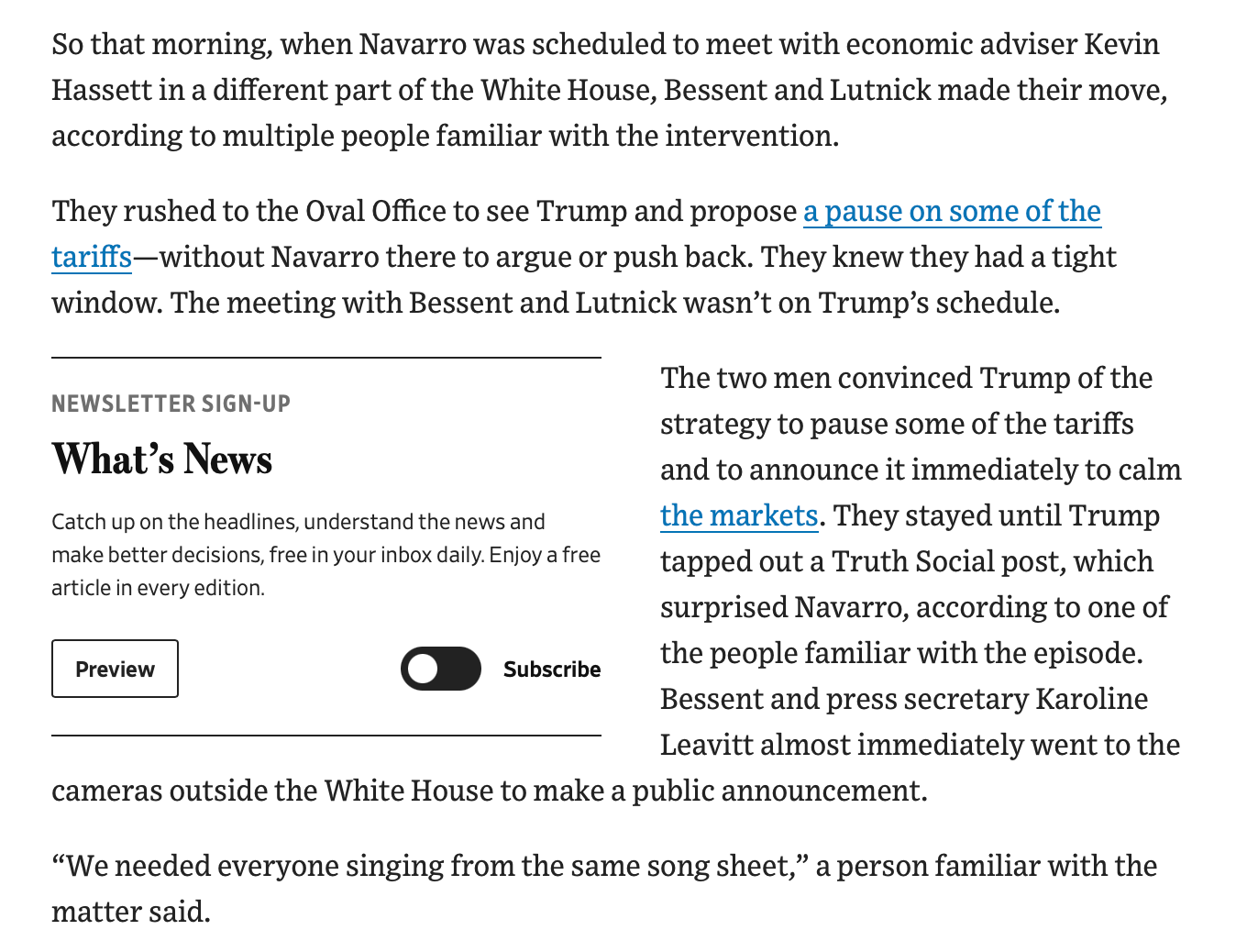

And we all know (even the people who rooted for tariffs at first) that this is deeply irrational governance style, policy shaped not by economic logic, but by resentment and projection. And there is no plan - Bessent and Lutnick had to corner Trump away from Navarro, the tariff guy, and get him to call them off. Look at this!

Meanwhile, ordinary Americans brace for impact. CEOs of Walmart, Target, and Home Depot privately warned Trump that tariffs risked disrupted supply chains and empty shelves. And who benefits from a trade war? Government linked firms, according to NBER! There is a reason Tim Cook called direct!

Hiring freezes proliferate nationwide, creating economic pain at the ground level - real, real costs for abstract grievances. The potential reduction in the full federal workforce, including contract and grant employees, could be as high as 1.2 million. $90 billion lost in reduced tourism, or about 0.3% of GDP according to Goldman Sachs. Real costs. And for what?

We burned our economic commons, not because it makes sense, but because our political leaders have confused economic policy with personal vendettas. The market for chaos is booming, and trust is evaporating.

Informational Commons

We no longer have a shared reality—just overlapping simulations.

Here’s a quick way to tell if a space has healthy informational commons: Can you describe reality without immediately sparking an argument? Can we agree on a common language, basic facts, or even what words mean? Increasingly, the answer is: No. I have written about this too, back in 2022.

The informational commons - language, reality, and basic consensus - is collapsing because we've monetized division. Social media platforms aren't built for clarity or understanding; they're optimized for engagement, outrage, and polarization. Algorithms don't reward nuance; they reward certainty, controversy, and emotional triggers.

What replaces consensus reality? Loyalty realities. Tribal realities. Personalized realities!! We no longer debate ideas or solutions - we debate whose facts count, whose feelings matter, whose truth wins. Truth itself becomes a loyalty test, not a shared ground. And without a shared informational commons, cooperation becomes impossible. We don’t solve problems, we fight over who gets to define them! Language is weaponized and reality is fractured.

Conclusion

So… what to do? Well, Bitcoin is on the move again. It’s finally decoupled from the Nasdaq, up 10% since Liberation Day versus the S&P 500’s down 6%. And its rise isn’t optimism, it’s a direct vote in the face of collapsing trust (and it’s diversified away from the US). The rise of assets like gold, silver, defense stocks, and crypto is a practical reflection of the ebbs and flows across social, cognitive, economic, and informational spheres.

Each of these commons has been chipped away, monetized, and exploited. Social trust turned into transactional loneliness. Curiosity replaced by compliance and cognitive outsourcing. Stable economic governance overtaken by chaotic spectacle. Shared reality splintered into competing tribes and personalized truths.

In other words, we've institutionalized "incelism" - again, not simply romantic isolation, but systemic, profitable disconnection built into the very structures of society. The market implications are clear: as trust erodes, volatility increases, and traditional safe havens regain prominence. Investors going into this reality are either getting secrets from the administration or diversifying into assets that offer stability amid uncertainty like precious metals, infrastructure, dividend payers, and global portfolios that hedge against erratic domestic policy.

The societal infrastructure isn't gone forever. Unlike a depleted fishery or farmland, these intangible resources can regenerate if we choose connection over transaction, critical thought over compliance, substance over spectacle, and shared reality over isolated tribes, etc. But, you know, for now… bitcoin?