A few years ago, Ethereum was the scrappy younger sibling to Bitcoin, known more for DeFi degenerates, pixelated NFTs, and wildly creative smart contract experiments than anything “serious.” But fast-forward to 2025, and Ethereum is turning heads on Wall Street.

Goldman Sachs perfectly captured the old institutional thinking back in 2021 when they dismissed Ethereum as “too volatile and speculative” for serious investors, calling it a “solution in search of a problem.” Their research team argued that smart contracts were overhyped technology with limited real-world applications, and that institutional clients had “no legitimate use case” for programmable money. They weren’t alone , JPMorgan called it a “pet rock,” and traditional asset managers avoided it like the plague.

Well, that aged about as well as calling the internet a fad. Today, Goldman Sachs is quietly building Ethereum-based trading infrastructure, JPMorgan processes billions through their Ethereum-powered Onyx platform, and those same asset managers are launching Ethereum products faster than they can file the paperwork.

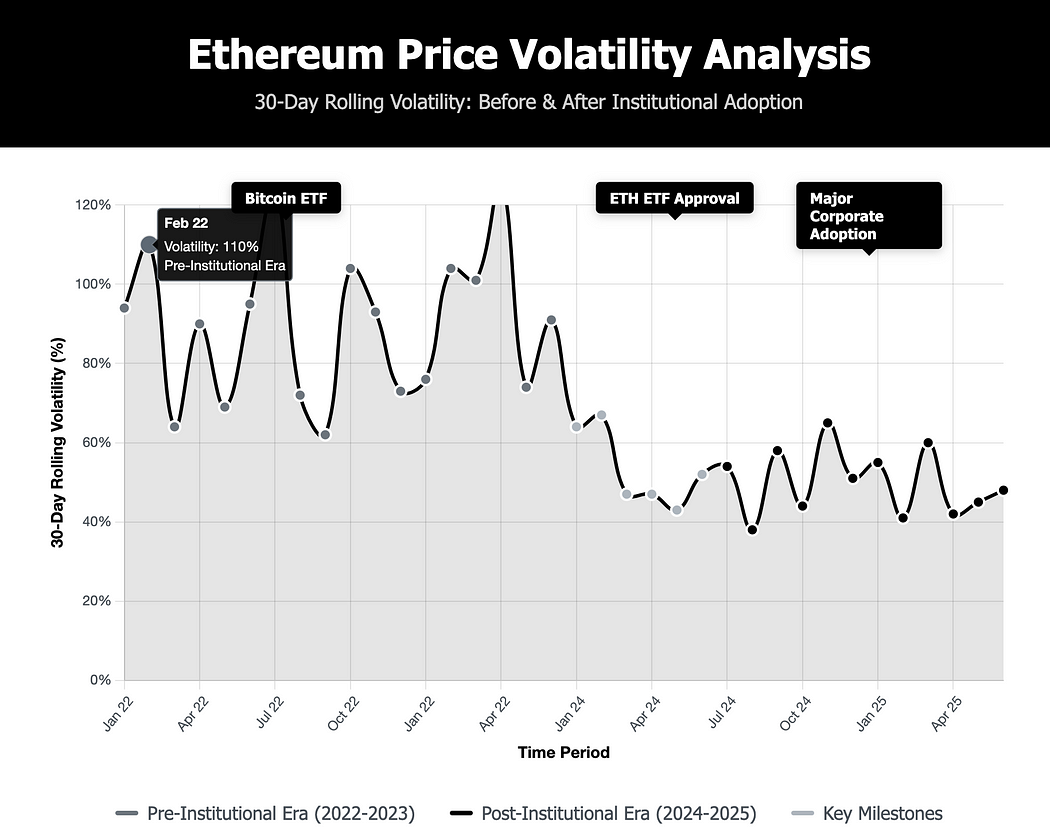

The real turning point was 2024 when the SEC finally approved spot Ethereum ETFs. Now, I know regulatory approvals aren’t exactly thrilling dinner conversation, but this one was massive. Unlike Bitcoin, which regulators could easily categorize as digital gold, Ethereum presented a puzzle. How do you regulate a programmable blockchain that powers everything from decentralized exchanges to digital art markets? The fact that they figured it out and gave it the green light tells you everything about where this industry is headed.

The ETF Floodgates Open

For years, there’s been skepticism around Ethereum’s regulatory clarity, especially with the SEC’s waffling stance on whether ETH is a security. But the approval of ETFs signals something significant: Ethereum has matured into a legitimate, investable asset for pension funds, asset managers, and even conservative family offices.

BlackRock led the charge with their iShares Ethereum Trust, and honestly, watching that launch was like witnessing institutional FOMO in real time. Fidelity jumped in, Grayscale converted their existing products, and suddenly every major asset manager had an Ethereum offering. But here’s what caught my attention, these weren’t just basic ETFs tracking the price of ETH. Some of these products started incorporating staking rewards, meaning institutional investors could earn yield on their holdings just like any DeFi participant.

Visualization showing Ethereum’s price volatility before and after institutional adoption

Corporate America Goes All-In

What’s really fascinating is how corporations are integrating Ethereum into their actual business operations. This isn’t speculative treasury management like we saw with some Bitcoin purchases. Companies are building their digital infrastructure on Ethereum because it solves real problems.

The reason why Ethereum’s real value for institutions lies in its infrastructure, is because it is a programmable blockchain capable of handling tokenized money, digital contracts, and complex financial workflows.

And that’s exactly where institutions are jumping in.

- Franklin Templeton, a $1.5 trillion asset manager, tokenized one of their mutual funds on Ethereum. Investors now hold digital shares on the blockchain, with all the benefits of transparency and 24/7 settlement.

- JPMorgan, through its blockchain arm Onyx, is testing tokenized deposits and asset swaps using Ethereum-compatible networks like Polygon and their own enterprise fork of Ethereum (Quorum).

- Amazon Web Services and Google Cloud now offer Ethereum node services, making it easier for businesses to plug into the network without spinning up their own infrastructure.

- Microsoft is also in the mix, collaborating with ConsenSys to explore enterprise use cases, from supply chain tracking to compliance-friendly smart contracts.

We’re not just talking about crypto-native players here. These are the titans of traditional finance waking up to what Ethereum can offer: fast, secure, automated finance without middlemen.

The conversation with Fortune 500 CFOs has completely changed. They’re not asking whether blockchain makes sense, they’re asking how quickly they can implement smart contract automation for their vendor payments, supply chain financing, and internal processes. The efficiency gains are too obvious to ignore.

The gaming and entertainment industries have been particularly aggressive here. Major studios are tokenizing in-game assets, music platforms are automating royalty distributions, and streaming services are experimenting with decentralized content monetization. The transparency and programmability of Ethereum solves decades-old problems in these industries almost overnight.

Why is Ethereum so appealing to institutions now?

Ethereum allows assets, whether that’s dollars, stocks, real estate, or even carbon credits, to be digitized, tokenized, and programmed. Combine that with stablecoins like USDC or USDT (which live primarily on Ethereum), and you suddenly have the building blocks of a new financial operating system.

- Want instant settlements across borders?

- Want programmable payments tied to contract milestones?

- Want transparency without sacrificing control?

Ethereum is handling all of that, and more.

Now add Layer 2 networks like Arbitrum and Optimism into the mix. These scale Ethereum’s capacity, reducing fees and making the network lightning fast. Many institutions are now choosing to build on L2s for efficiency while still tapping into Ethereum’s liquidity and security.

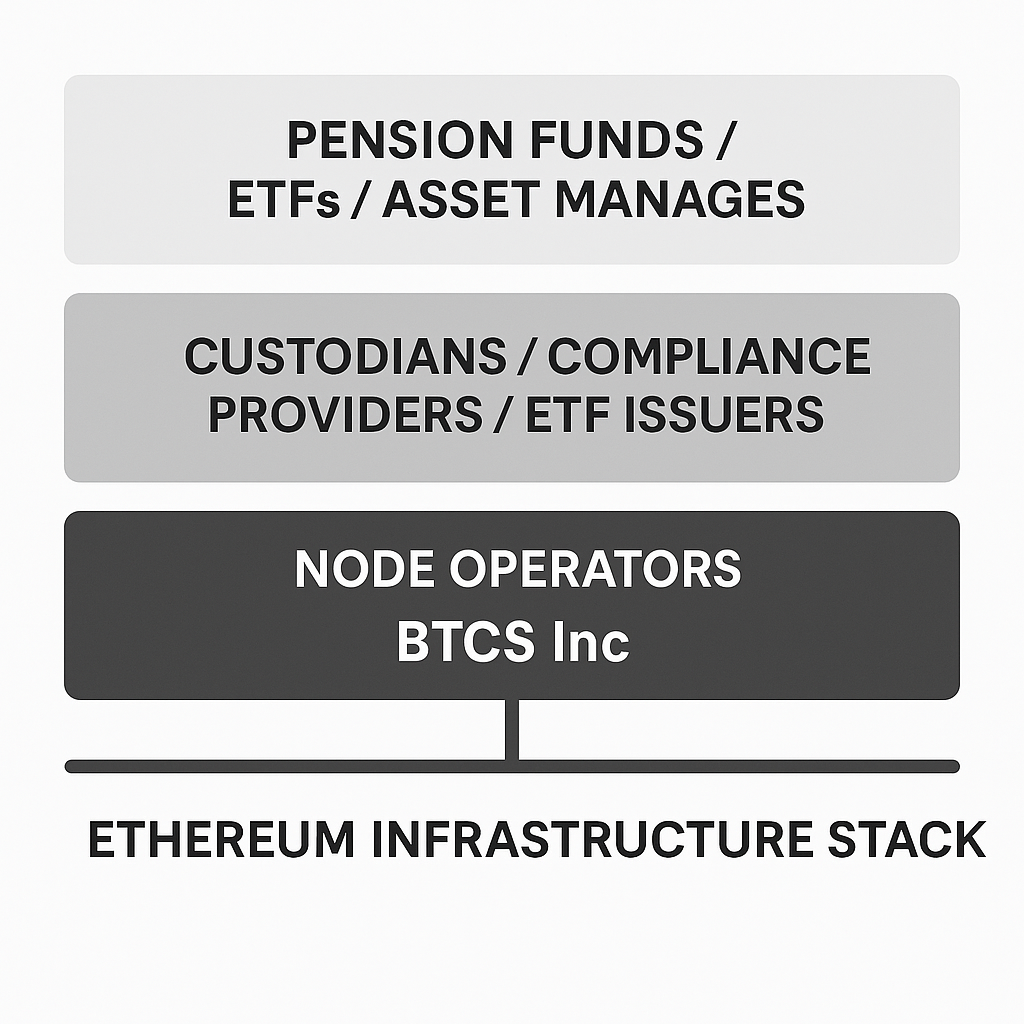

None of this institutional adoption would be possible without the infrastructure layer that most never think about. Companies like BTCS Inc are playing a growing role in supporting the infrastructure needed for traditional finance institutions to gain exposure to Ethereum and products like ETH ETFs. BTCS focuses on operating secure, enterprise-grade Ethereum validator nodes, which help maintain the network’s integrity and enable institutions to participate in staking without having to manage the technical complexity themselves. While they are not custodians or ETF issuers, their validator operations contribute to the broader ecosystem that underpins Ethereum’s functionality and trustworthiness. By ensuring reliable, compliant staking infrastructure, BTCS supports the kind of network resilience and transparency that institutional investors require.

Looking Forward

Where does this lead? The trajectory seems pretty clear to me. Ethereum is becoming the foundational infrastructure layer for programmable finance. We’re not just talking about cryptocurrency trading anymore — we’re talking about automated lending, programmable insurance, tokenized real estate, and supply chain financing that operates 24/7 without human intervention.

The integration with central bank digital currencies represents another massive opportunity. As governments develop their digital currency strategies, many are looking at Ethereum-compatible solutions that would allow seamless interaction between government-issued digital money and the broader DeFi ecosystem.

Perhaps most importantly, this institutional embrace is driving the regulatory clarity that the entire industry has been waiting for. When major financial institutions are building products around Ethereum, regulators have strong incentives to create workable frameworks rather than blanket restrictions.

We’re witnessing the maturation of a technology that started as an experimental platform and is now becoming critical financial infrastructure. The ETF approvals were significant, but they were just the opening act. The real story is how Ethereum is fundamentally changing how financial services operate, how corporations manage their operations, and how value flows through the global economy.

And honestly, I think we’re still in the early stages of this transformation. The institutional adoption we’ve seen so far is just the beginning of what happens when programmable money meets traditional finance at scale.