In this research we studied on-chain data and applied address clustering algorithms to analyze the amount of money in the overall NFT market in 2023. Specifically, we looked at whether the amount of money invested in the space has seen any meaningful growth, and if such growth is mainly contributed by new entrants or existing players.

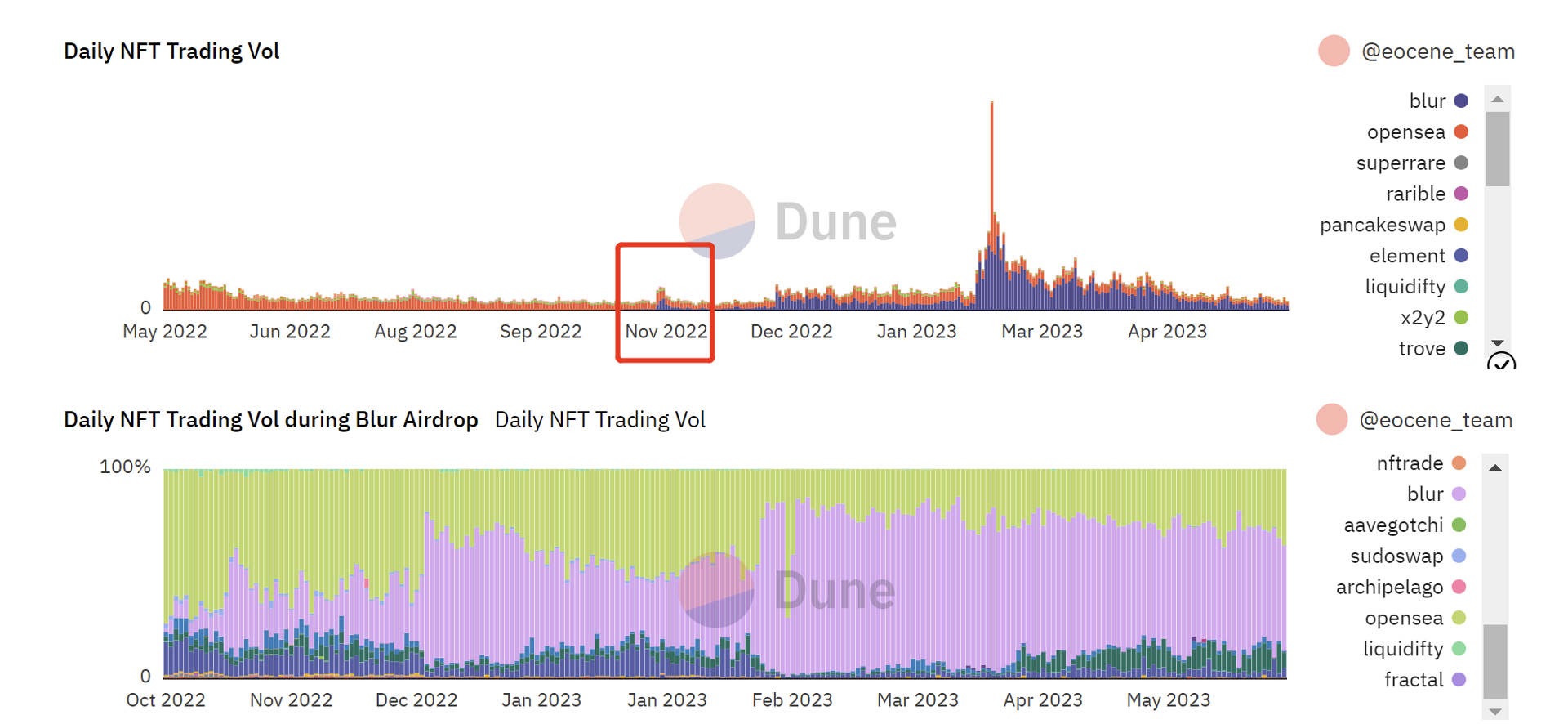

The NFT bear market started in June 2022 and lasted until October when Blur was launched. The Blur airdrop program reignited interests in the NFT space and trading volume has been growing gradually since then. But the market really witnessed exponential growth after 2/14/2023 when the BLUR token was successfully launched.

The Blur airdrop program that rewards provision of liquidity and the successful launch of the BLUR token are without doubt the biggest factors that caused the surge in NFT trading volume in 2023. But behind the soaring trading volume, what is really happening in the market?

Specifically, is there an actual increase in investments in the NFT market, or is the increased trading volume merely a result of reward farming? And if there is indeed new capital flowing into the market, is it due to existing players doubling down, or did the space attract new entrants?

To answer these two questions, we 1) compared the amount of money invested into the NFT market between Blur's season 1 and season 2; and 2) compared the level of investments from existing and new address entities in each season.

Methodology

- Calculate level of capital for all market participants

- First, we divide the timeframe we focus on into two periods: period A (2022/10/10 to 2023/2/14), and period B (2023/2/15 to 2023/5/31) [^1];

- Then we obtain the buy-side trading data for each address, as our goal is to analyze market participants' investments in NFTs;

- There was close to a million wallets during the research period, but 8% of top trading volume addresses contributed to 90% of all trading and capital volume. For the convenience of analysis, we limit the scope of focus on these 8%, or ~70K, wallets;

- Finally, we eliminated wash trades[^2] to ensure we focus on the real traders.

[^1]: Period A corresponds to Blur airdrop season 1, period B corresponds to season 2. The day on which the BLUR token was launched is used as the dividing line. The rationale is that the launch has significantly stimulated activities in the NFT market.

[^2]: We eliminated all txs where 1) buyer = seller, or 2) buyer and seller share a common source of funding from an EOA. In other words, we decided to keep txs that might involve back-and-forth trading or a wallet trading a token multiple times. This is intended as we believe capital involved in these trades should be considered as investments in the NFT market.

- Calculate level of capital invested by each market participant

- Using the data on trading volume and number of trades obtained from the previous step, we calculate the amount each wallet paid for each NFT they traded[^3];

- Sum up all the investment amounts of each buyer to get the amount of funds invested in NFT by each address.

[^3]: When token_standard=erc721, each token_id corresponds to a unique token, so the amount invested for each token_id is calculated as the average price paid for buying the token (avg price=sum of paid amount/#of purchases). When token_standard=erc1155, each token_id can correspond to a number of tokens, so we assume that the investment amount for each erc1155 token_id is the total amount spent to buy tokens of the same token_id.

- Group addresses into entities (when applicable) using address clustering algorithms

We developed address clustering algorithms that identify connections between wallets based on funding correlations. Addresses that are highly likely to be controlled by the same entity are grouped into the same cluster. This allows us to analyze trading volume and level of capital at entity level in each period, and helps to more accurately attribute data between existing and new players. - Clustering is performed based on the following criteria[^4]: 1) There have been ETH or stablecoin transfers between two addresses; 2) Both sides of each wallet pair should have sent funds to each other, with one direction having sent 3+ txs, and the other direction at least 1 tx; 3) All these transactions must have happened in 2023.

- We added two labels: s1_ind and s2_ind to each wallet to identify whether a wallet has participated in NFT trading in period A and period B[^5]. If a cluster contains at least one address with s1_ind=1, the address group is an old/existing entity; if the all addresses in a cluster have s1_ind=0, the address group is considered a new entity.

[^4]: The algorithm can identify both direct and indirect linkages between wallets. "Direct" means the interactions between two NFT players satisfy the above criteria. "Indirect" linkage is established when multiple NFT players have interacted with the same address (that might be out of scope) and interactions satisfy the above criteria.

[^5]: Possible combinations: s1_ind=1 and s2_ind=1 indicates that the address participated in NFT trading in both periods; s1_ind=1 and s2_ind=0 indicates that the address only participated in period A; s1_ind=0 and s2_ind=1 indicates that the address only participated in period B.

Results

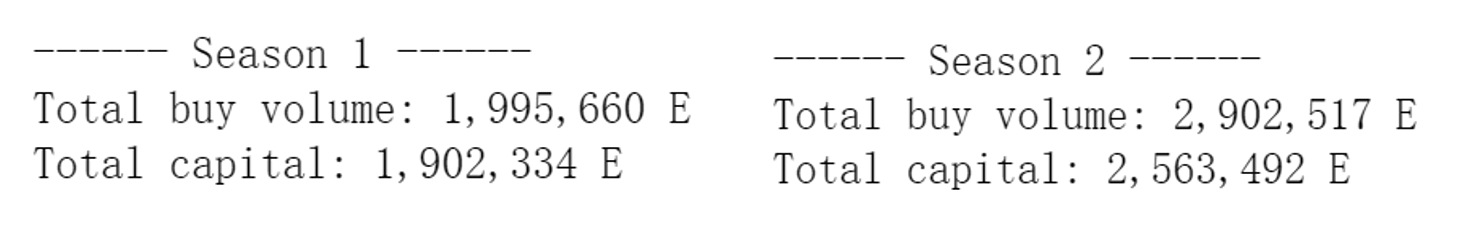

- Data[^6]1.1) Total buy volume and amount of capital in each period:

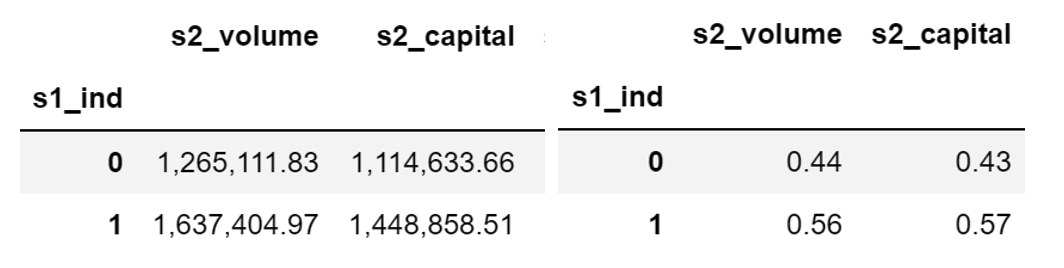

1.2) Buy volume and capital for new and old addresses[^7] in period B (left: amount in ETH; right: % of total):

1.2) Buy volume and capital for new and old addresses[^7] in period B (left: amount in ETH; right: % of total):

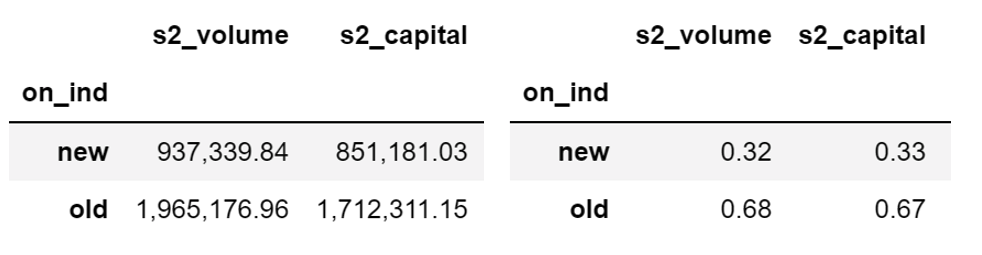

1.3) Buy volume and capital for new and old entities[^8] in period B (left: amount in ETH; right: % of total):

[^6]: The purpose of showing data at both address and entity level is to make up for possible defects of the clustering algorithms (such as misclassifying the addresses of some new entities into old entities, resulting in inflated trading and capital volume of old entities).

[^7]: For each address, if s1_ind=1 then 'old', if s1_ind=0 then 'new'.

[^8]: For each entity, on_ind indicates whether it is old or new.

- Analysis2.1) Money growth in the NFT market

Both trading volume and level of capital in period B are significantly higher than in time period A, with the incremental amounts being 906,857 E and 661,159 E respectively. Specifically, the increased level of capital shows that the amount of funds invested in the NFT market has grown since Blur airdrop season 2.2.2) Sources of the new funding

The increase in the overall level of capital is smaller than the total amount of capital from new entities in period B ( 661,159 E vs 851,181 E). This indicates that the new funds mainly come from new entrants, while at least some existing players have reduced their investments in the NFT market.2.3) More implications on new and old entities

Combining the data on trading volume and level of capital from both the perspective of addresses and entities in period B, the proportion contributed by old/existing entities is estimated to be roughly between 55%-70%. - Old entities account for more than 50% of trading volume and level of capital in period B, indicating that old entities are still the main contributor to the overall NFT market;

- Nevertheless, new entities also contributed a significant proportion, implying that the impacts of new players on the NFT market are non-negligible.

Conclusion

By studying the buying volume and level of capital in the NFT market, we found that the amount of funds invested in the NFT market has grown by a significant 35% since the BLUR token launch. And by analyzing the contributions from new and old entities, we found that the new funds mainly came from new entrants to the market. Nonetheless, long-time NFT traders (or old entities) are still the main contributors to activities in the NFT market, while new entrants (or new entities) represent the source of the new momentum in the NFT market.

It should be noted that the increase in capital and the entry of new players do not necessarily signify that the NFT market is booming. This is because most of the increments is concentrated on Blur, which is most likely attracted by Blur's token rewards rather than the actual value of NFTs per se. How to maintain the long-term prosperity of the NFT market post-airdrop is still a major challenge that has yet to be solved.

Co-authored by: Helena L., Zixu H.