In this article, we focus on the economics of Proof of Work Layer 1 (PoW L1), Proof of Stake Layer 1 (PoS L1) and Proof of Stake Layer 2 (PoS L2) blockchains.

Introduction

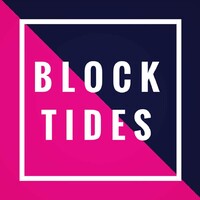

The chart below visualizes the daily fees for the blockchains featured in this article over the past 180d.

Blockchains provide infrastructure for the coordination of economic activity. Blockchains are smart contract execution environments that allow for the permissionless creation of smart contract-based businesses or DAOs. These open-source platforms are globally accessible, 24/7 auditable, and provide a predictable ruleset for both the platforms themselves and the businesses that choose to operate on them. Blockchains collect fees from users who make payments and interact with businesses built onchain. Since there's limited space in each block of data, a fee market based on supply and demand is born.

In the past, we had to rely on third parties to mediate economic activity. This mediation added extra costs due to regulatory and operational friction and presented risks of censorship and corruption. Trustless transactions made possible by blockchains have generated a range of novel use cases and business opportunities. For blockchain-based businesses, many parts of their business operations are global from day one. The time and money it takes to incorporate your business varies greatly between countries and jurisdictions, and it’s often extremely time-consuming and costly to sell products and services across borders. Blockchains bring down the cost of incorporation to one function call. Once a DAO is deployed on a blockchain, it inherits the advantageous features of blockchains: access to global capital markets, global participation from contributors and customers, transparent and highly automated rules of operation, and an immutable audit trail.

The economic models of blockchain networks are designed to ensure the trustless operations of these decentralized platforms. The key components that typically make up the economic structure of a blockchain are transaction fees, inflationary block rewards (incentives), and fee burns. Transaction fees represent the market price for blockspace. Incentives are financial rewards that encourage people to take action like validating transactions. Fee burns are a mechanism that removes from circulation a part of each transaction fee. Given the limited capacity of a single blockchain, we’re going to see a world with multiple different blockchains – each optimized for different use cases – that interoperate with each other. The Blockchain market was initially dominated by Bitcoin, an extremely simple and limited contract execution environment. With the launch of Ethereum, it became possible to (in theory) deploy arbitrarily complex contracts or programs on a blockchain. Now, with the rise of scaling solutions, application-specific blockchains, and cross-chain bridges, it has become possible to deploy arbitrarily complex contracts also in practice (scalability is no longer a limitation). In this article, we will break down the economic models of the most common types of blockchains.

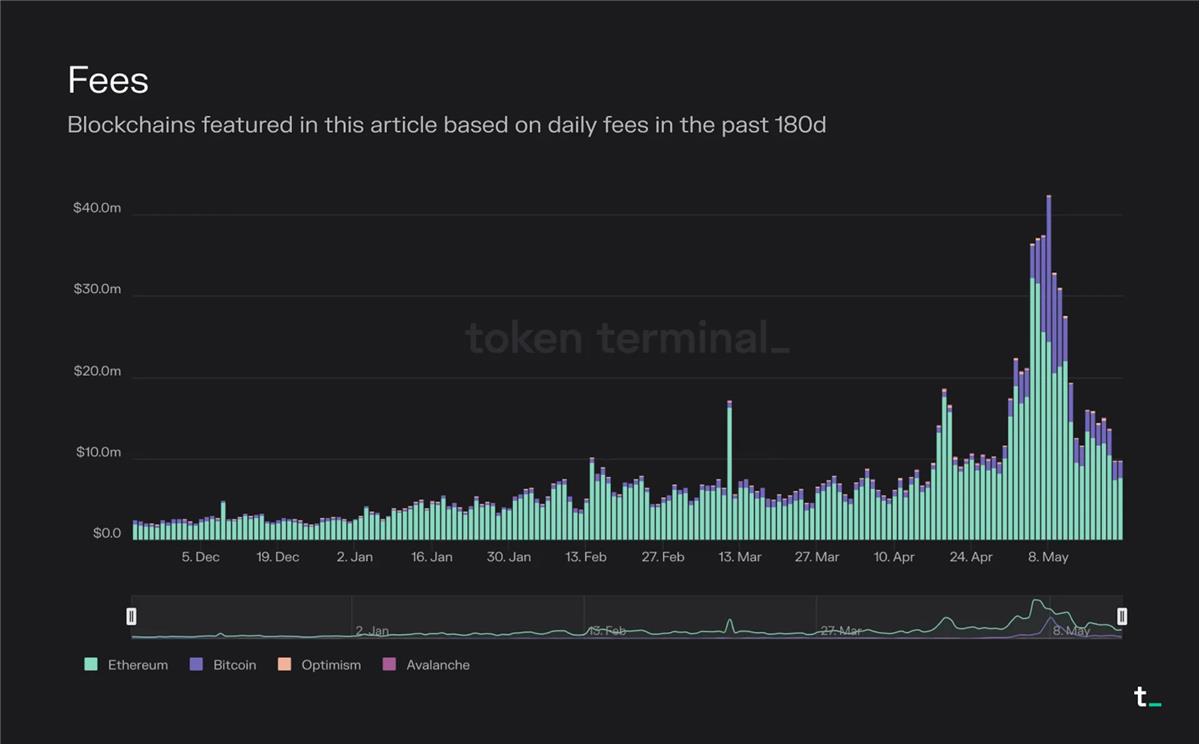

Proof of Work Layer 1

What happens here?

- Users pay 1 BTC in transaction fees for a block

- Miner receives all the fees (1 BTC)

- Miner earns 1 BTC from the block rewards (newly issued BTC)

End result:

- Miner receives 2 BTC

Key takeaways:

- Demand to submit transactions on Bitcoin creates a marketplace for blockspace. Users pay miners for blockspace. Miners are further incentivized with block subsidies, which are newly minted BTC that increase the currency’s total supply. Currently, all fees and block subsidies on Bitcoin go to miners.

- Bitcoin provides security from CPU power. The value proposition of Bitcoin is to create a secure, transparent, and immutable global ledger that allows trustless and irreversible value transfer. These values are upheld by security derived from CPU usage. Each block requires a large amount of CPU power to be expended to be validated on the network. Essentially, 1 CPU corresponds to 1 vote on the network. Therefore, as long as the majority of CPU is in the hands of honest miners, the network is secure.

- Bitcoin’s economics are determined by two variables: transaction fees and block subsidies. Transaction fees are determined based on supply and demand for the network's blockspace. Block subsidies are inflationary rewards that increase the circulating supply of BTC. Currently, the miner of a block is rewarded 6.25 bitcoins, with this number halving every four years. Eventually, Bitcoin will reach its maximum supply of 21 million (estimated to happen in ~2140), and block rewards will consist solely of transaction fees. This means that user adoption is crucial for the network to maintain economic sustainability.

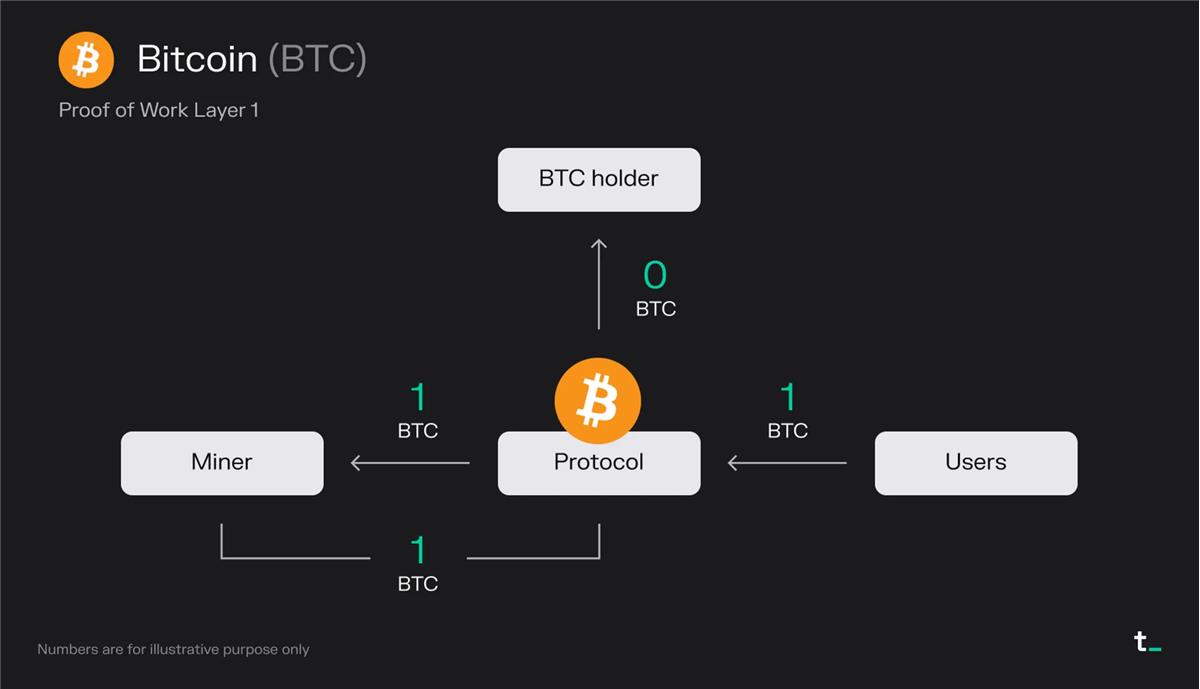

Proof of Stake Layer 1

What happens here?

- Users pay 1 ETH in transaction fees (incl. MEV) for a block

- 0.8 ETH gets burned —> “share buyback” that benefits all ETH holders equally

- Validator earns 0.2 ETH from the fees

- Validator earns 1 ETH from the block rewards (newly issued ETH)

- Since the validator has received half its stake from delegators, the validator has to share 50% of its revenue with those ETH holders

End result:

- 0.8 ETH is burned

- Validator receives 0.6 ETH

- ETH holders that staked via delegation receive 0.6 ETH

Key takeaways:

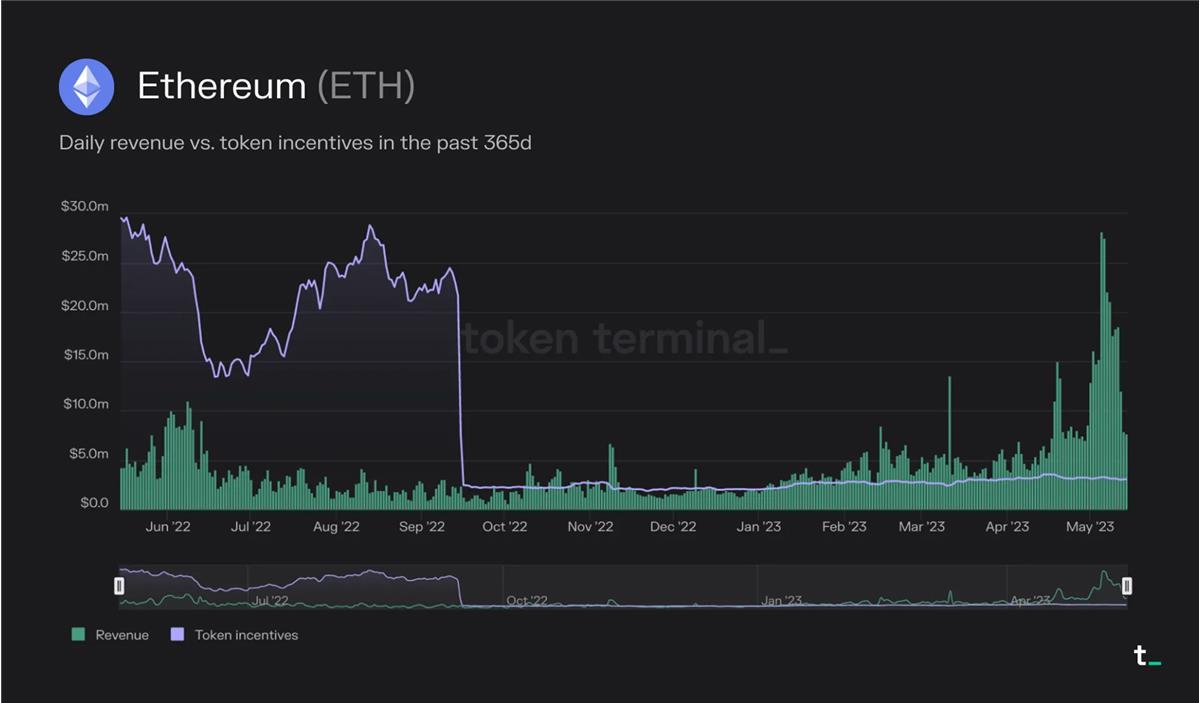

- On Ethereum, ~85% of total transaction fees paid get burned, effectively serving as a "share buyback" that equally benefits all ETH holders. The validator, meanwhile, earns the rest of the fees and an additional staking reward, which is newly minted ETH. Ethereum has averaged ~$15 million in daily fees over the past 30d.

- The fee-burning mechanism, implemented via EIP-1559 in August 2021, turned ETH into a productive asset. In addition, the transition from PoW to PoS reduced the rate of newly issued ETH. Since the Merge, in September 2022, Ethereum has no longer distributed block rewards to miners. This change saw the issuance of new ETH drop by ~90% (~14k ETH/day block rewards were replaced by ~1.7k ETH/day staking rewards). This has resulted in the ETH supply being deflationary during periods of high usage.

- The economic structure of Ethereum has three key components: total transaction fees, the portion of transaction fees that are burned, and staking rewards. Transaction fees are determined based on supply and demand for the network's blockspace. Staking rewards are inflationary rewards that increase the total supply of ETH. Transaction fee burns lead to deflationary pressure on ETH, and a reduction in circulating supply could increase the token's value over time.

Post Merge, the ETH supply has been deflationary during periods of high usage. For instance, in May this year, the amount of ETH burned (revenue) has constantly been greater than the amount of ETH minted as staking rewards (token incentives).

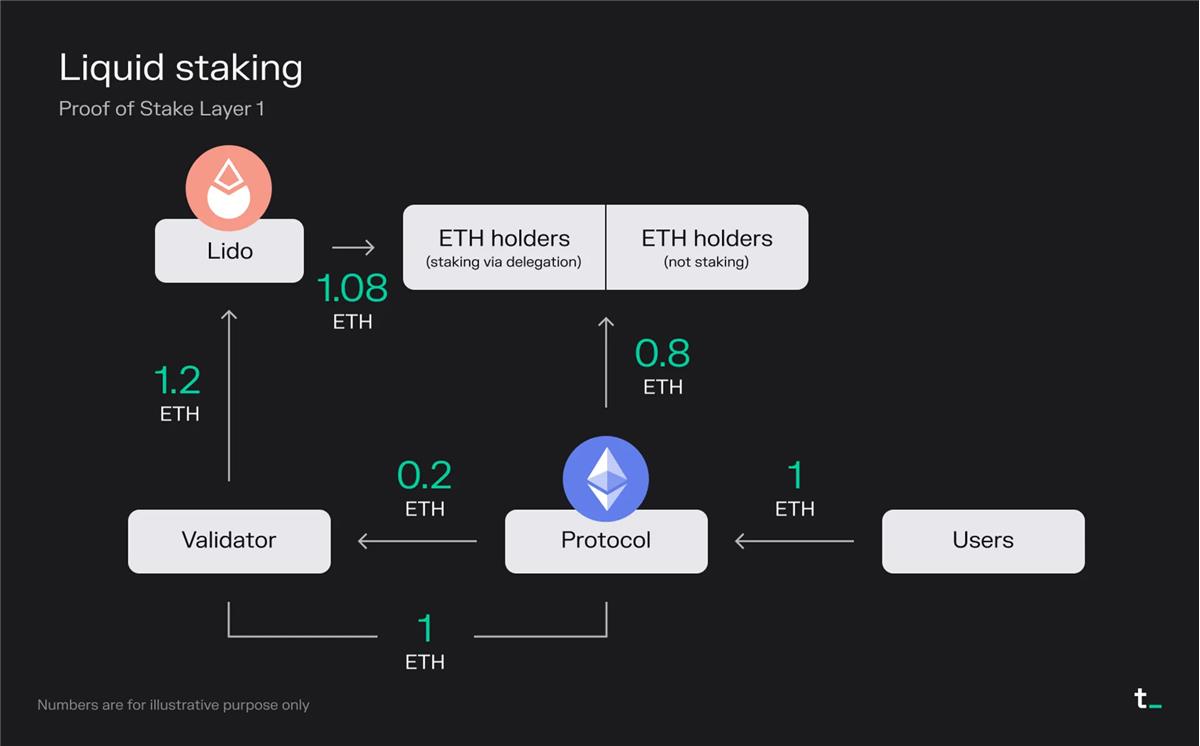

Liquid staking projects allow users to stake their assets and maintain liquidity via a derivative liquidity token (liquid staking derivative, LSD) that represents the underlying asset.

What happens here?

- Users pay 1 ETH in transaction fees (incl. MEV) for a block

- 0.8 ETH gets burned —> “share buyback” that benefits all ETH holders equally

- Validator earns 0.2 ETH from the fees

- Validator earns 1 ETH from the block rewards (newly issued ETH)

- The validator has received its entire stake from users who have deposited their ETH via the liquid staking protocol Lido, so it shares 100% of its revenue with those ETH holders

- Lido takes a 10% cut (0.12 ETH) of the total staking reward for providing its service, and distributes the remaining 90% (1.08 ETH) to ETH holders staking via Lido

End result:

- 0.8 ETH is burned

- Validator receives 0 ETH

- Lido receives 0.12 ETH (50% of this is used to cover node operation costs)

- ETH holders that stake via delegation receive 1.08 ETH

Key takeaways:

- Liquid staking protocols enhance user experience. Staking, inherently a technical and high-maintenance process, has been simplified by protocols like Lido. By allowing users to lock up their ETH and receive a transferable utility token (stETH), Lido facilitates seamless staking while enabling users to receive rewards tied to validation activities. For providing this service, Lido extracts a 10% fee from the total yield. This fee is split evenly between node operators and the Lido DAO.

- The technicality and high capital requirements of staking open up business opportunities for liquid staking protocols. Traditional staking on Ethereum requires users to maintain a node, put up a large amount of capital (32 ETH), and sacrifice token liquidity. In contrast, Lido batches users' tokens to stake with validators, removing the 32 ETH barrier. By simplifying the user experience, providing liquidity, and democratizing staking, Lido and similar protocols are unlocking a rapidly growing market sector.

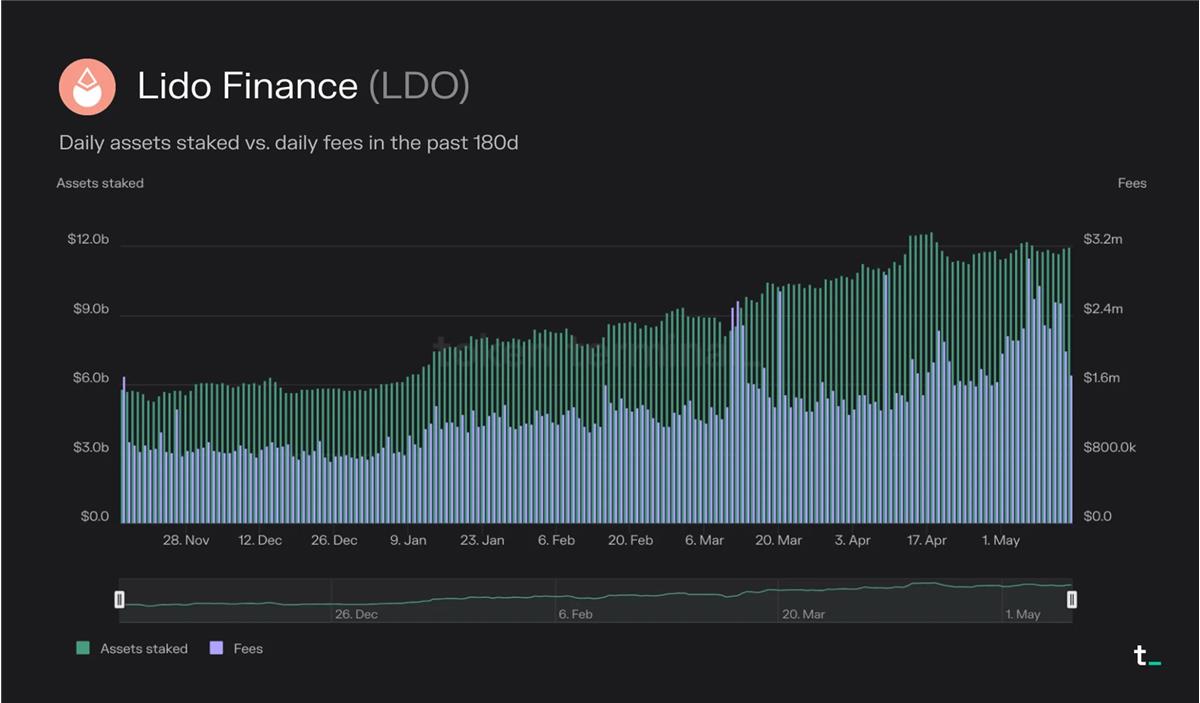

- The democratization of staking allows for broader investor participation. The liquid staking market sector is, in addition to Blockchains (L2), among the fastest-growing market sectors on Token Terminal. The successfully executed Shapella upgrade (April 12th) arguably reduced the risks associated with ETH as an investment, and ETH as a yield-earning asset. As a result, it is expected for the ETH staking ratio (assets staked / circulating market cap) to grow and reach parity with other PoS chains. Currently, the staking ratio for ETH sits at ~15%, which is relatively low compared to other PoS chains. For example, Solana and Avalanche currently boast staking ratios of over 60%. Given the higher market cap of ETH, ~$220 billion at the time of writing, we could see multibillion-dollar growth in assets staked over the coming quarters.

Lido has established itself as the current market leader within the liquid staking market sector, with a total of $12 billion of assets staked. This figure is up 38% year over year, and 105% over the past 180d.

Over the past 30d, Lido generated $60.4 million in fees and captured 10% of that, so $6.04 million, as revenue. This revenue is split 50/50 between node operators and the Lido DAO.

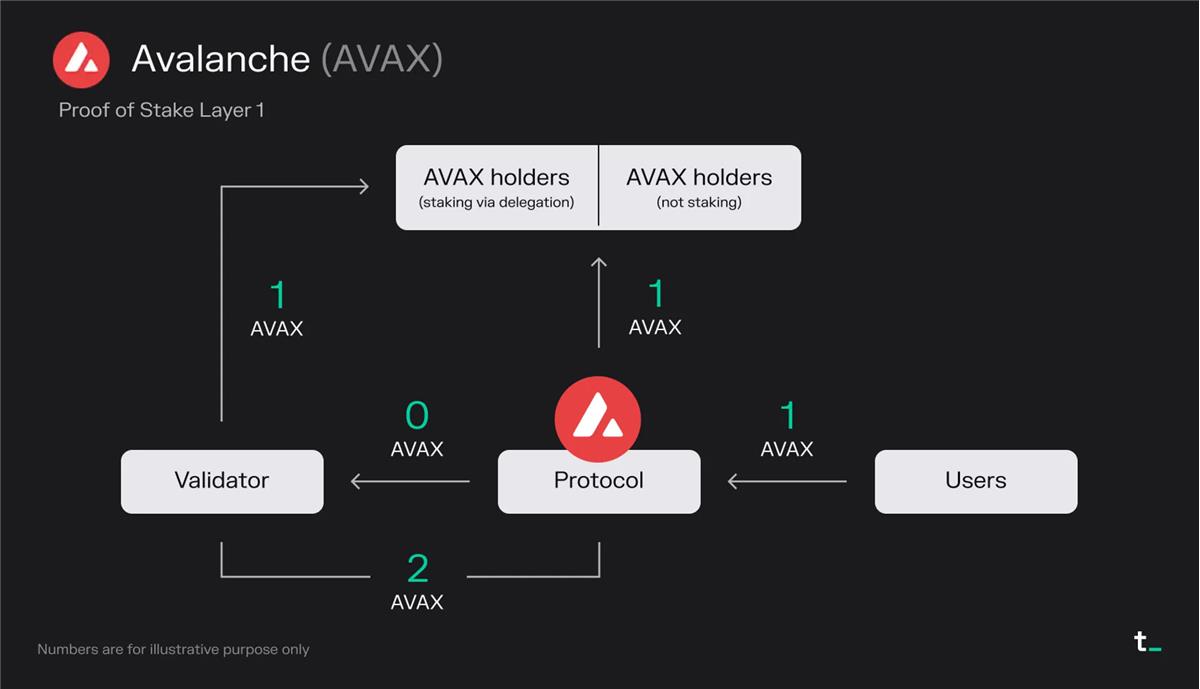

Avalanche is a blockchain (L1) that competes with Ethereum by prioritizing scalability and faster transaction speeds. It uses a novel consensus algorithm that provides strong security, quick transaction finality, and high throughput while maintaining decentralization.

What happens here?

- Users pay 1 AVAX in transaction fees for a block

- 1 AVAX gets burned —> “share buyback” that benefits all AVAX holders equally

- Validator earns 0 AVAX from the fees

- Validator earns 2 AVAX from the block rewards (newly issued AVAX)

- Since the validator has received part of its stake from delegators, the validator has to share its revenue with those AVAX holders

End result:

- 1 AVAX is burned

- Validator receives 1 AVAX

- AVAX holders that stake via delegation receive 1 AVAX

Key takeaways:

- On Avalanche, all transaction fees are burned and validators’ sole source of income is via staking rewards. The burning mechanism serves as a "share buyback" that equally benefits all AVAX holders. Avalanche has been averaging ~$64k in daily fees over the past 30d.

- Being a relatively recent addition to the blockchain landscape, Avalanche is issuing a significant amount of AVAX tokens to reward its validators. This method has commonly been used as a way to bootstrap growth in a platform’s early stages. These rewards draw in validators and stimulate growth and activity within Avalanche’s ecosystem.

- The economic model of Avalanche is subject to future changes. The fee and reward structure is not set in stone and can be adjusted by future governance decisions. Currently, 50% of the total AVAX token supply is allocated to be used as staking rewards for validators. This distribution is scheduled to happen over a decade, from 2020 to 2030. As the staking reward distribution will eventually come to an end, in the future we could see a portion of transaction fees being redirected to validators.

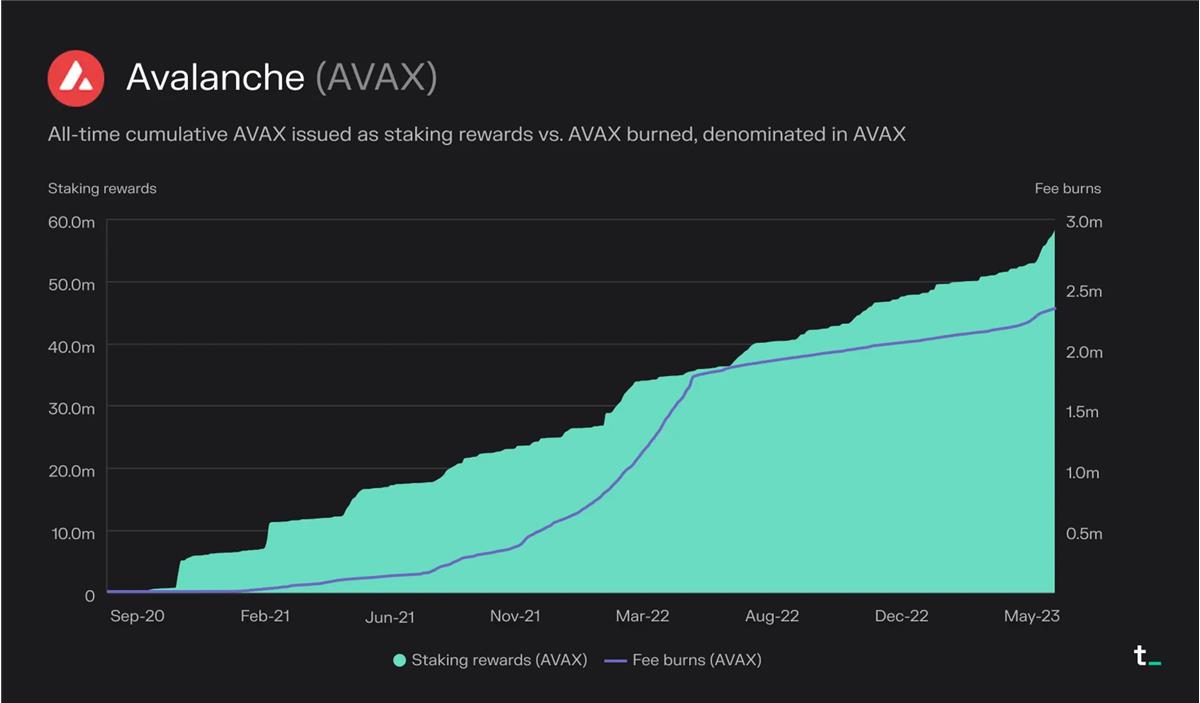

A total of ~2.3 million AVAX has been burned, and ~57 million AVAX have been distributed as staking rewards since the network’s launch in September 2020.

Proof of Stake Layer 2

Optimism is a scaling solution (optimistic rollup) that aims to make Ethereum better by increasing its transaction speed and throughput. Optimism executes transactions on L2 and submits them in batches to L1 for finalization. This results in roughly 5-20 times lower gas fees depending on the type of transaction.

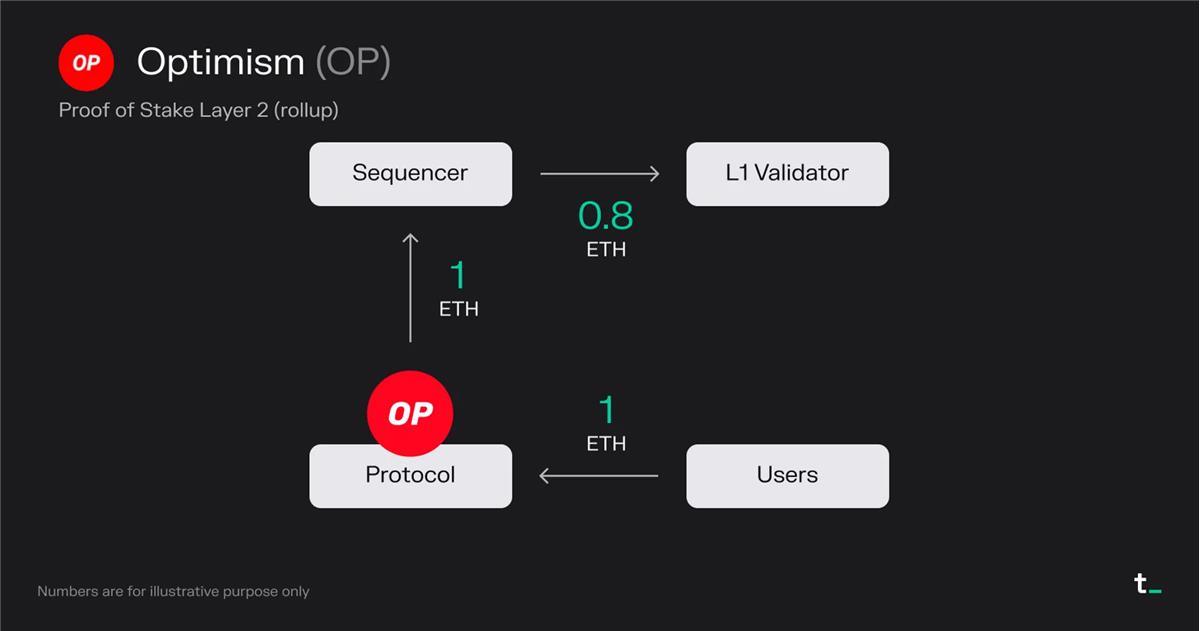

What happens here?

- Users pay 1 ETH in transaction fees for a block

- All transaction fees (1 ETH) go to the sequencer run by Optimism Foundation

- Sequencer pays 0.8 ETH in transaction fees to submit transactions to L1 (Ethereum)

- Sequencer (in this case Optimism Foundation) keeps 0.2 ETH as profit

End result:

- 0 ETH is burned (not including burns on Ethereum)

- The sequencer receives 0.2 ETH

- L1 Validator receives 0.8 ETH

Key takeaways:

- Layer 2 blockchains scale applications. L2 blockchains allow widely used L1 applications, such as Uniswap, Blur, OpenSea, etc. to move their transaction activity from the L1 to a separate chain, which periodically settles its transactions back to the L1. Currently, over 30% of Uniswap’s trading volume comes from L2s.

- Layer 2 blockchains empower a more optimized UX. As an L2, the app can optimize the UX (transaction fees / MEV collection and rebates, onchain privacy, etc.) for its use case (e.g. trading). This optimization can be implemented while still maintaining transaction records on the more secure L1.

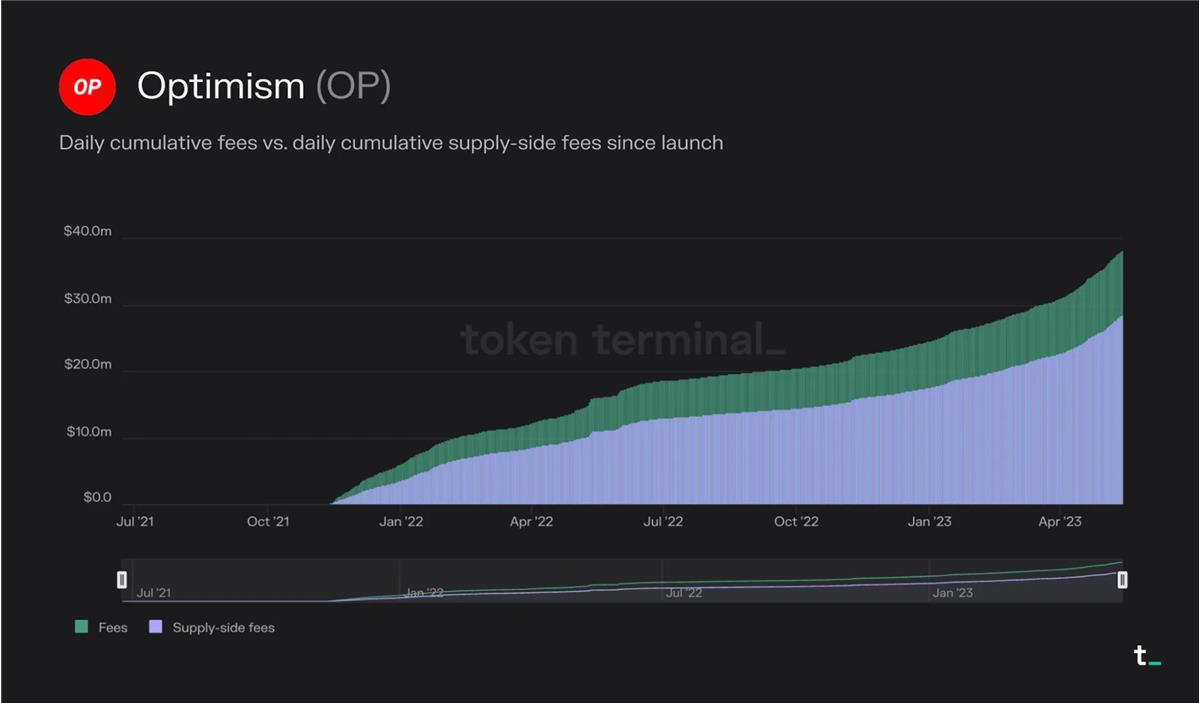

- The economics of layer 2 blockchains are driven by two variables: fees collected by the L2 and the cost of settling transactions to the L1. The primary business model for L2 blockchains is to generate revenue by taking a cut of the transaction fees paid by users. The revenue margin is determined by the cost of settling transactions to the L1. For example, users on Optimism have paid a total of $38.2 million in transaction fees since launch. Of those fees, $28.5 million has been used to cover gas fees to submit transactions to Ethereum. Thus, Optimism captured the difference, so $9.7 million, as revenue. Margins for L2 blockchains can be expected to drop as competition increases. L2 blockchains that are able to best optimize their gas expenditure on Ethereum through data compression and other techniques, further minimizing fees on L2, are likely to gain market share in the future.

Users on Optimism have paid a total of $38.2 million in transaction fees since the network’s launch. Of those fees, $28.5 million has been used to cover gas fees to submit transactions to Ethereum.

Conclusion

Blockchains are redefining the infrastructure for economic activity by providing the architecture for decentralized, secure, and transparent transaction processing. In a rapidly developing industry like crypto, we see continuous innovation in the economic models of these computing platforms. Despite their differences, investors can use frameworks like the above to compare their economic performance, potential, and sustainability.