To investors,

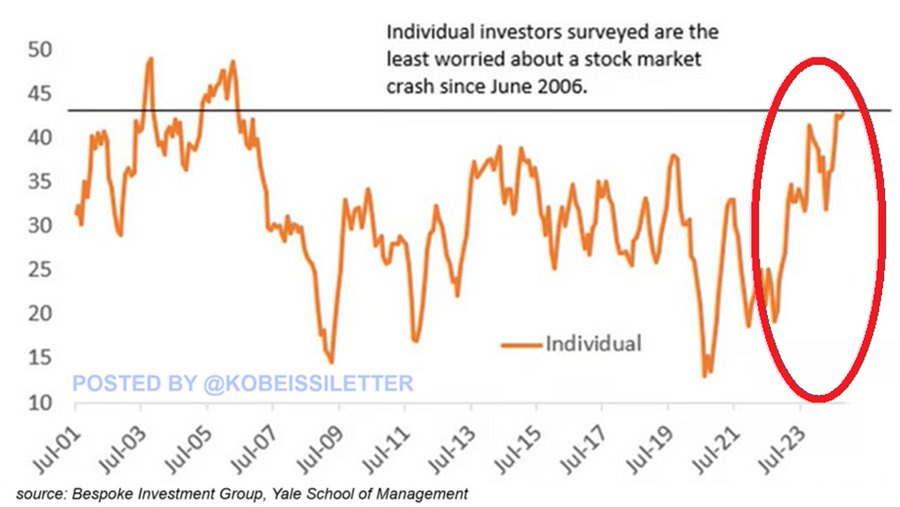

Optimism has infiltrated the market and it is changing the flow of capital. Adam Kobeissi writes:

“Individual investors have rarely been so confident about the market: 46% of US individual investors believe there is less than a 10% probability of a market crash over the next 6 months, the highest share since June 2006. The percentage has DOUBLED over the last 2 years, according to the Yale School of Management survey.

In other words, investors are the least worried about the stock market in 14 years. This comes as the S&P 500 has rallied ~50% since it bottomed in October 2022. On the other hand, investors believe the market is now the most overvalued since April 2000, a month after the Dot-Com Bubble popped. Euphoric market sentiment is through the roof.”

Here is the crazy part about optimism — optimists are usually right over the long run. I believe this is becoming increasingly true in financial markets because the Federal Reserve broke the market about 16 years ago. We have never recovered, nor do I think we will ever recover.

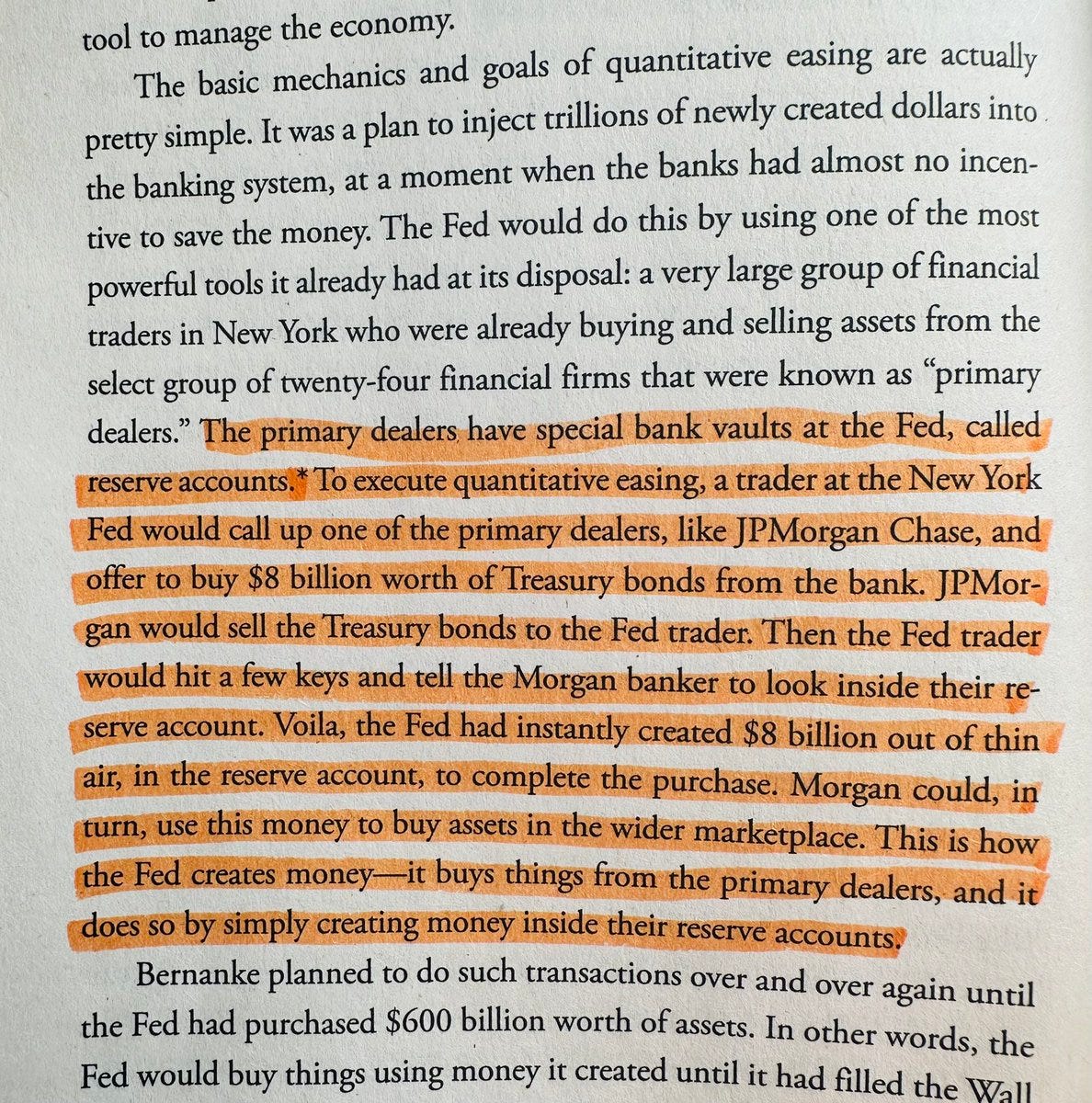

I read a book over the weekend called The Lords of Easy Money written by Christopher Leonard. It details the last few decades at the Federal Reserve with a specific focus on the rise of quantitative easing and the unseen ramifications on markets and financial assets.

A big takeaway from the book was a key error that economists, investors, and market commentators made in the last decade and a half — everyone was obsessed with measuring price inflation due to QE, but not enough people were worried about asset inflation from the same root cause.

There are two ways to look at asset inflation. One aspect is that asset prices shouldn’t be able to grow up-and-to-the-right forever, so if quantitative easing is creating that scenario then we should expect the asset bubble to pop. The second aspect contradicts the first point and argues that asset bubbles can’t pop if the central bank is always willing to suppress interest rates and print more money when asset prices start to fall.

I fall in the second camp. There is a very strong argument that we will never see another 18+ month bear market in the US economy as long as the US dollar exists as a fiat currency. That may sound like a bold statement, but let me explain.

Central banks have perfected the quantitative easing playbook. They can cut interest rates and print money at an incredible speed now. During the 2020 pandemic, interest rates were cut to 0% with emergency rate cuts and we saw trillions of dollars created out of thin air. Asset prices had “crashed,” but they quickly recovered and hit new all-time highs months later.

This is the new normal. This is the world of asset prices growing forever. This is the world of optimism.

I know the new world is confusing to people who have grown up in an economy before the invention of QE, but we now have nearly two decades of data that proves we are in a new regime.

As Christopher Leonard points out in his book, money has become fake numbers on a screen that get created out of thin air and handed to the select primary dealers.

If you give someone a money printer, they are going to print money.

And if the Fed is printing money, then asset prices are going higher and higher. This may lead some of you to ask “what if the Fed stops printing money?” The analysis would change, but the important part of the story is the United States can no longer afford to stop printing money. We are addicted to cheap, plentiful capital.

This is why I believe it is nearly impossible for us to see an 18+ month bear market. If the Fed sees asset prices falling aggressively, they will step in quickly and intensely.

The market doesn’t respond to the Fed, the Fed responds to the market.

There is one part of Leonard’s book where he outlines a perfect example of this — Ben Bernanke’s Fed wanted to conduct QE at a smaller scale and slower rate than the market expected, but Bernanke had to fulfill the market’s expectations because he and his colleagues worried about asset prices falling if they diverged from expectations.

So why am I calling this out? The optimism I pointed to at the top of today’s letter is incredibly important for one reason — the Fed is essentially required to intervene in the market and push asset prices higher. Market participants are expecting it, so the Fed has to do it.

The market is the captain now.

This development means you have a choice to make as an investor. You can believe everyone has gone crazy and a multi-year bear market is right around the corner, or you can recognize the Fed broke financial markets and they will stimulate the economy at any sign of trouble until they hyper-inflate away the dollar (which will take much longer than most people think!).

I am an optimist and I am a student of history. You only have to go back to the Global Financial Crisis to realize the rules of the game changed. Time in the market is more important than timing the market.

Bears sound smart, but bulls make money.

Hope you have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

How To Make Millions With Small Business

Codie Sanchez is the founder of Contrarian Thinking, and the author of a brand new book called “Main Street Millionaire: How to Make Extraordinary Wealth Buying Ordinary Businesses.”

In this conversation, we discuss the process to find, buy, and scale small businesses, the amount of wealth that can be generated, how you can do it, and why it is so important for you to own upside in whatever you do.

Enjoy!

Podcast Sponsors

- Ledger - Ledger secures 20% of the world’s digital assets. Upgrade to Ledger Flex this Black Friday and get $70 in Bitcoin or save up to 40% on select wallets.

- Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

- BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

- Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

- Xapo - Xapo Bank is the only way to bank with Bitcoin.

- Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.