Coming out of the trenches, 2024 has been a thrilling year for Layer 1 (L1) blockchains, with tokens skyrocketing by over 7,000% since January. In the fast-moving crypto space, a few unexpected tokens are redeeming the top performer spot this year. Let's take a closer look at the biggest L1 winners and losers in 2024.

Market overview

The cryptocurrency market in 2024 went vertical, encouraged by Donald Trump’s Presidential Election victory. The demand for L1 solutions has surged as it provides the platform for dApps and Smart Contracts, with competition picking up between L1 blockchains to claim the top spot. However, they face stiff competition from Layer 2 solutions, which aim to improve transaction speeds at a fraction of the costs of established blockchains like Ethereum.

What are the top-performing Layer 1 coins?

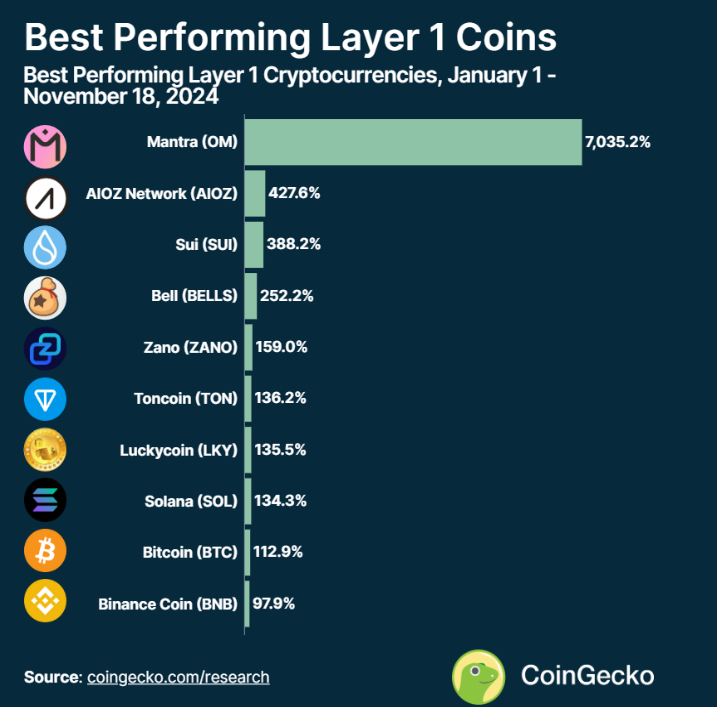

Among the top performers, Mantra (OM) has experienced unprecedented growth, with its value skyrocketing by 7,035.2%. This surge can be attributed in part to Mantra’s partnership with Zand, a UAE-based digital bank that enables the tokenization of real-world assets (RWAs) in compliance with Dubai's Virtual Asset Regulatory Authority (VARA). Additionally, the demand for RWA products has picked up, with traditional finance institutions bringing their money funds and bonds to the blockchain.

Apart from that, AIOZ Network (AIOZ) is another standout performer, posting a remarkable 427.6% increase Year-to-Date (YTD). The platform's decentralized content delivery network has seen growing adoption, driven by continuous ecosystem enhancements. Sui (SUI) rounds out the top three with a 388.2% YTD increase. This token has benefited from increased traction within its ecosystem, including innovative dApp launches that capitalize on its scalability and developer-friendly features.

Other notable performers include Bellscoin (BELLS) (+252.2%), Zano (ZANO) (+159%), and Toncoin (TON, +136.2%), which has successfully leveraged its integration with Telegram to host dApps and tap-to-earn games.

The top 10 Layer 1 coins by market cap showed moderate gains

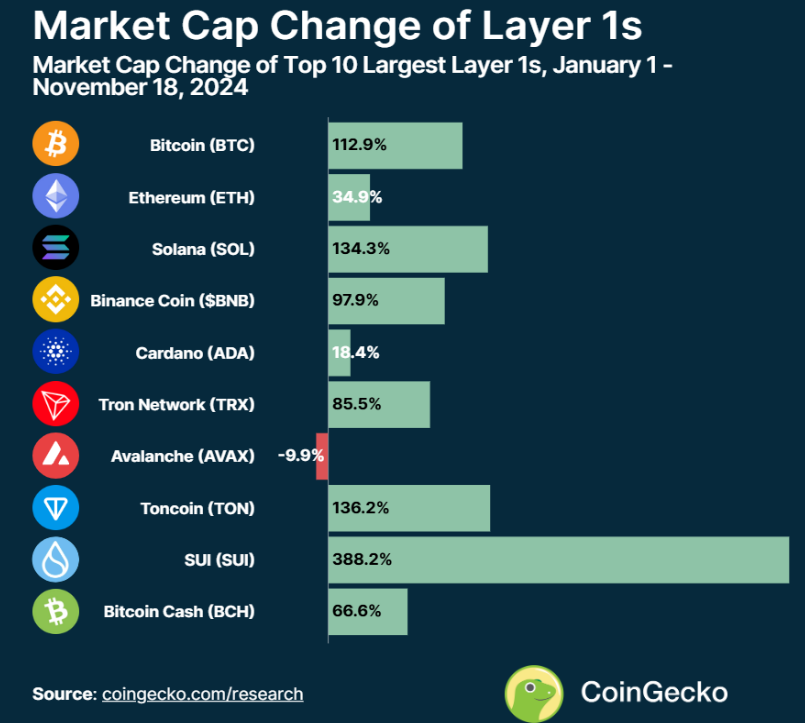

Despite the explosive growth from mid- and small-cap layer 1’s, larger market cap coins such as Bitcoin, Ethereum, and Solana still proved to be solid investments. Bitcoin (BTC) showed positive growth, with a 112.9% YTD increase, while Ethereum (ETH) saw a 34.9% increase, underperforming its peers. Its dominance in the space has slowly waned throughout the years, with the emergence of new layer 2s and other blockchains. This is despite the launch of the spot Ethereum Exchange Traded Fund (ETF) in the US. However, it still managed to outperform the S&P 500 index, which is up 24.8% in 2024.

Solana (SOL) has risen from the ashes of FTX’s bankruptcy in 2022 and has surged respectably by 134.3% YTD. The majority of its gains were made in 2023, when it surged from $15 to $120, driven by memecoin mania. This trend also transitioned to blockchains such as Tron Network (TRX), which increased by 85.5% YTD. On the other hand, Toncoin (TON) had a staggering 136.2% increase as it leverages hosting dApps on Telegram, a widely popular social messaging app. Tap-to-earn games have grown to become immensely popular on Telegram.

The most noticeable gains were seen in Sui, which had 338.2% YTD increase. This pump was driven by increasing investor interest, growing on-chain activity, and expanding utility with significant dApp growth. Additionally, Circle’s USDC has been integrated into the network, and a shift in capital from Ethereum to Sui has been observed.

The biggest declines

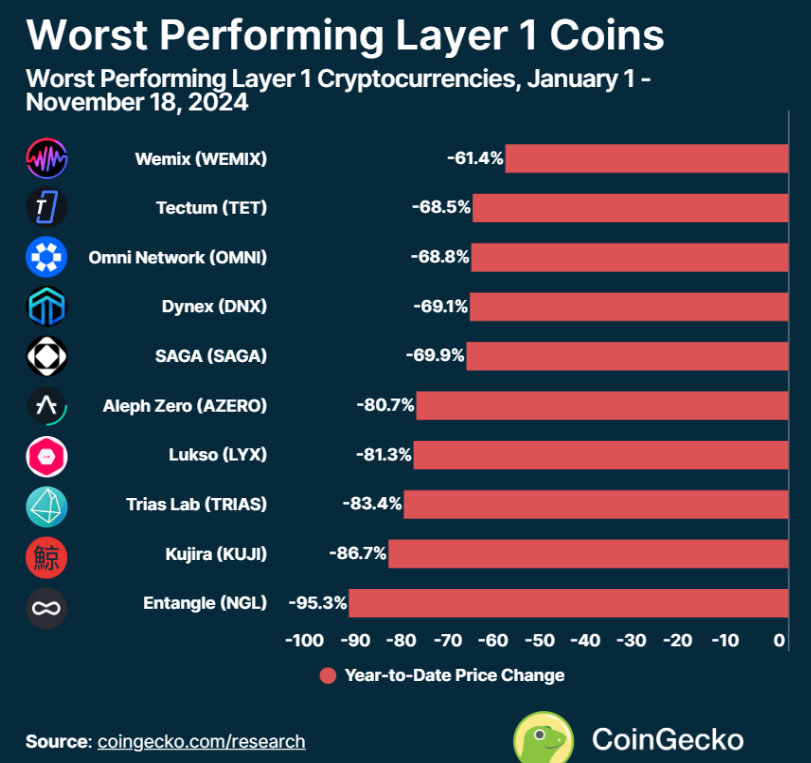

On the other side of the spectrum, several coins declined up to -96% YTD. Coins such as Entangle (NGL) scraped the bottom of the barrel with a -95.3% drop YTD, followed by Kujira (Kuji) and Trias Lab (TRIAS) with -86.7% and -83.4%, respectively. NGL launched at a rather high valuation in March 2024, and its price has been trending downwards since. On the other hand, Kujira’s performance suffered from the team’s risky leveraged liquidity positions, which backfired during a period of market volatility.

How did Layer 1 coins launched in 2024 perform?

Several Layer 1 cryptocurrencies launched in 2024 have seen mixed performances, reflecting the challenges of breaking into an already competitive market. Aleo (ALEO), launched in September, has declined by -58.1% since its debut, while Saga (SAGA), which launched in April, has faced similar struggles, with a YTD decline of -69.9%. Omni Network (OMNI), starting in April as well, has fallen -68.8%, and Zeta Chain (ZETA), which debuted in February, is down -57.3%.

Router Protocol (ROUTE), launched in July, has dropped -24.8%, and Ice Open Network (ICE), active since January, has experienced a milder decline of -34.5%. Meanwhile, Kaia (KAIA), the most recent entrant in late October, showed a slight positive growth of 5.2%. These performances highlight the volatility of new L1 projects and the need for sustained innovation and adoption to gain traction.

Top 10 Layer 1s by price performance

Conclusion

In 2024, the L1 blockchain sector had a mix of performances. Mantra’s staggering 7,035% YTD gain leads the way, underpinned by strategic partnerships and cutting-edge blockchain use cases. Established players like Bitcoin, Solana, and Toncoin have demonstrated solid performances, proving their staying power in an evolving market. Meanwhile, newly launched coins have faced a challenging uphill climb, having launched with high valuations.

As competition intensifies between Layer 1 and Layer 2 solutions, the focus on scalability, utility, and regulatory compliance will define the next wave of winners in the ever-dynamic crypto space.

Methodology

This study examined the price returns of the top 100 cryptocurrencies from CoinGecko’s Layer 1 category, sorted by market cap. Year-to-date price performance was taken between January 1 and November 18, 2024. The data reflects a snapshot of the market, capturing each coin's nuanced performance in the context of broader market dynamics.