Author: armonio

2024 is a crazy year for the digital encryption market. Among them, the BTC elephant dance is the craziest among many asset classes. In the past month, BTC has increased by more than 50%. What is the mechanism behind such crazy market performance? Can the madness continue? Let’s dive in and take a closer look:

The price increase of any asset is inseparable from the reduction of supply and the increase of demand. Let’s break it down into the supply side and the demand side and analyze them separately.

As BTC continues to be halved, the impact of the supply side on BTC prices continues to weaken, but we still have to formally observe potential selling pressure:

supply side

In terms of supply, according to consensus, less than 2 million BTC may be newly generated. Moreover, the issuance rate will usher in another halving. The new selling pressure will decrease further after the halving. Looking at the miners’ accounts, they have remained above 1.8 million for a long time. Following this trend, miners have no tendency to sell.

Number of BTC held by miners remains stable

On the other hand, the number of BTC held in long-term holding accounts continues to grow and is currently around 14.9 million. The number of truly highly circulating BTC is extremely limited, with a market value of less than 350 billion. This can also explain why the continuous buying of an average of US$500 million per day will lead to the crazy growth of BTC.

There is no short-term selling pressure on BTC.

demand side

The increase in demand comes from many aspects:

- 1. Liquidity brought by ETFs;

- 2. The value of assets held by the rich increases;

- 3. Financial business is more attractive than short-term investment benefits;

- 4. For funds, BTC can be bought wrongly but cannot be missed;

- 5. BTC is the core of traffic.

ETF is the scarcity that cannot be replicated in this round of BTC

BTC passed the SEC’s ETF approval, giving BTC the qualification to enter the traditional financial market. Compliant funds can finally flow into BTC, and traditional financial funds can only flow into BTC in the crypto world.

Deflationary BTC is an asset structure that is prone to Ponzi and Fomo. As long as funds continue to buy BTC, the price of BTC will continue to rise. Funds holding BTC will have higher returns, and the fund can expand its capacity to buy further BTC. Funds that do not buy BTC will face performance pressure and even face capital withdrawals. Wall Street has been playing this game in real estate for decades.

The properties of BTC are more suitable for playing this Ponzi game. In the past month, the average net buying per trading day was less than $500 million, which resulted in a market increase of more than 50%. Such purchases are a drop in the bucket in traditional financial markets.

BTC ETF Fund Flow

ETFs also increase the value of BTC in terms of liquidity. The scale of global traditional finance, if real estate is included, will reach 560 trillion in 2023. This proves that the current liquidity of traditional finance is sufficient to support financial assets of this size. We know that BTC is far less liquid than traditional financial assets. Traditional finance's access to BTC can certainly create liquidity that allows BTC to have a higher valuation. Please note that the compliant liquidity here can only flow to BTC and cannot flow to other digital crypto assets. BTC no longer shares liquidity pools with other digital crypto assets.

With higher liquidity, assets will have higher investment value. Only assets whose value can be realized instantly can carry greater wealth. This brings us to the next point:

BTC, which the rich prefer, will inevitably become more and more expensive

I did some small-scale market field research. According to my survey, billionaires in the currency circle often hold a large proportion of BTC in bull markets, while most people in the currency circle with the same wealth as me, who are middle class or below, hold no more than 1/4 of their positions in BTC. Currently BTC dominant is 54.8%. Readers, take a look for yourself. If the proportion of BTC held by people in the same circle as you is far less than this ratio, then whose hands will the BTC be?

BTC is in the hands of rich people and institutions.

A phenomenon is introduced here: the Matthew effect—the assets held by the rich will continue to rise, while the assets held by ordinary people will continue to fall. If there is no government intervention, the Matthew effect will definitely occur in the market economy. The rich get richer and the poor get poorer. This has a theoretical basis. Not only because rich people may be inherently smarter and more capable, but also because they naturally have a lot of resources. Smart people, useful resources, and information will naturally seek cooperation around these rich people. As long as people's wealth is not obtained by luck, they can form a multiplier effect and become richer. Therefore, things that conform to the aesthetics and preferences of the rich will definitely be more expensive, and things that conform to the aesthetics and preferences of the poor will become cheaper and cheaper.

The situation in the currency circle is that wealthy people and institutions will use non-mainstream coins as a means to empty the pockets of ordinary people, while using mainstream coins with high liquidity as a means of storing value. Wealth will be poured into altcoins by ordinary people, harvested by wealthy people or institutions, and then poured into mainstream currencies such as BTC. When the liquidity of BTC becomes better and better, it will be more attractive to wealthy people and institutions.

The price of BTC is insignificant, the key is whether it can capture the BTC financial market share

After the SEC passed the BTC spot ETF, it triggered market competition at multiple levels. Institutions including BlackRock, Goldman Sachs, and Blackstone are vying for the leadership position of ETFs in the United States. In the global market, many financial centers including Singapore, Switzerland, and Hong Kong follow. Institutional crashes are not unavoidable. For the small amount of BTC accumulated in the short term, if it is sold to the market, it is unknown whether it can be recovered without causing a liquidity shortage in the international environment.

Moreover, without the BTC spot backing the ETF, the issuer not only loses handling fees, but also loses its say in BTC pricing. The corresponding financial market has also lost the pricing power of BTC, this kind of digital gold, the ballast stone of future finance, and will also lose the market for BTC spot derivatives. This is a strategic failure for any country and financial market.

Therefore, I believe that it is difficult for the world's traditional financial capital to form a conspiracy to smash the market. Instead, it will form FOMO in the process of continuous competition for funds.

BTC is the “inscription” of Wall Street

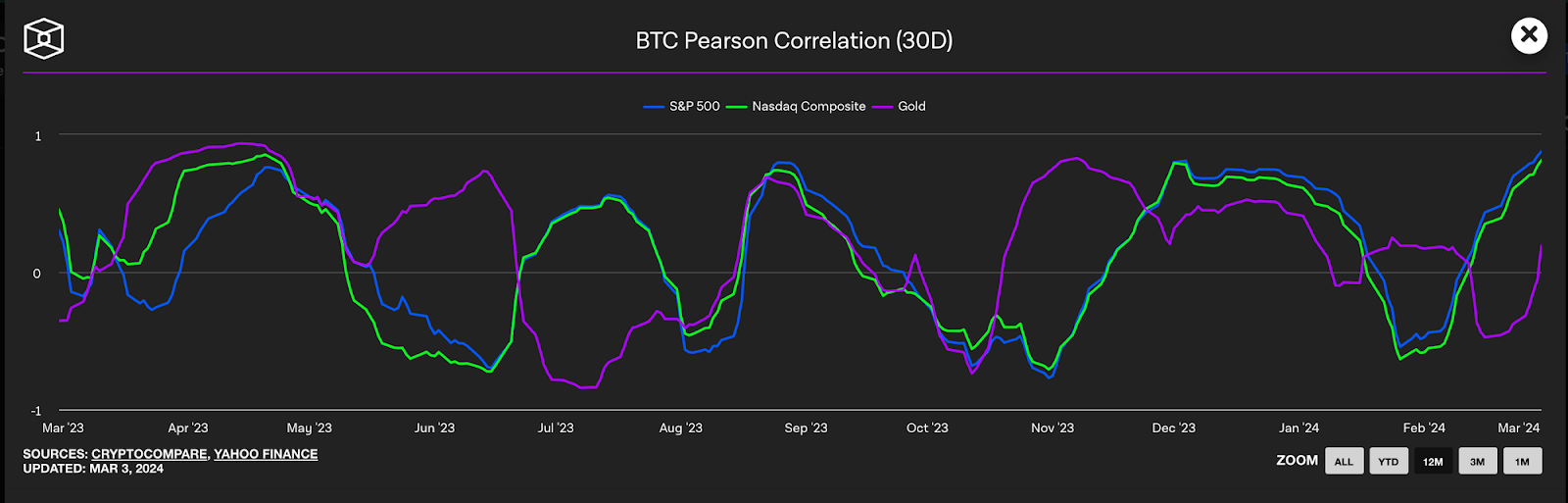

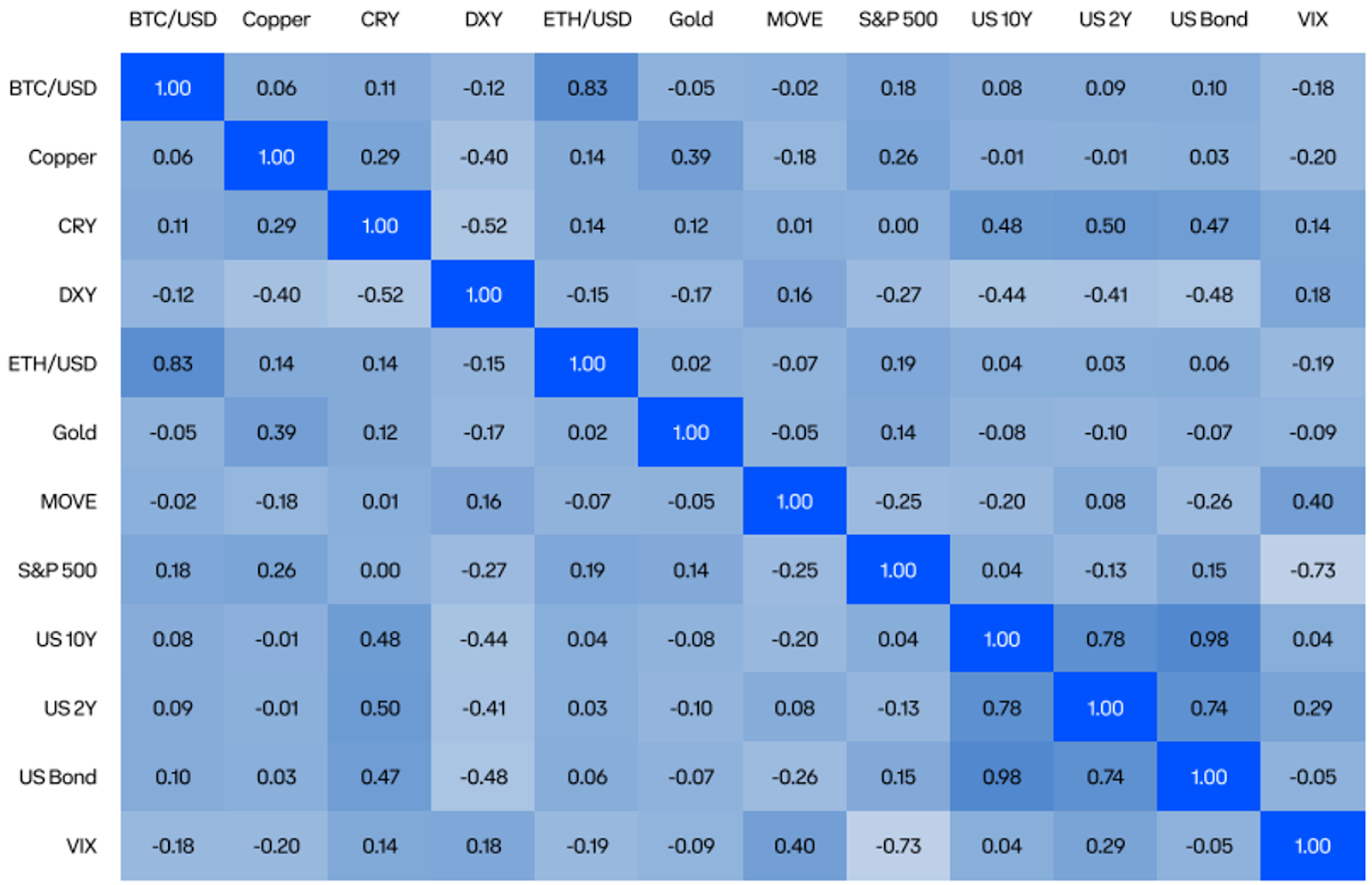

For inscriptions, investors in Chinese-speaking areas may be more understanding. For that kind of low-cost, high-odds asset. A small amount of offsets and strikes can significantly increase the return rate of the asset portfolio and prevent your asset portfolio from facing overturning risks. The current valuation of BTC is still a drop in the bucket in traditional financial markets. Moreover, the correlation between BTC and mainstream assets is not large. (Although not as negative as before) So for mainstream funds, isn’t it logical to hold a little BTC?

What's more, assume that BTC becomes the asset with the highest return in the mainstream financial market in 2024. How should a short-term fund manager explain to its LPs? On the contrary, if you hold 1% or 2% of BTC, even if the fund manager doesn't like it, even if you lose money, the performance will not be affected by the excessive risk of BTC, and it will be easier to report to investors.

BTC asset prices are not highly correlated with mainstream assets

BTC is a natural rat position for Wall Street fund managers

I just talked about why Wall Street fund managers hold their noses and buy BTC. Now we want to talk about why they are willing to buy BTC.

We know that BTC is a naturally semi-anonymous network. I believe there is no way for the SEC to penetrate the BTC spot accounts of regulated fund managers like securities. Yes, KYC is required for depositing and withdrawing tokens and conducting OTC on trading platforms such as Coinbase and Binance. However, we know that offline OTC can still happen. Regulatory agencies do not have adequate means to supervise the spot positions of financial individuals.

The many discussions just made are enough for fund managers to write a detailed report on investing in BTC. Since BTC itself lacks liquidity, a small amount of capital can move the price of BTC. So as fund managers, if there are sufficient objective reasons, what factors would prevent them from using public money to support themselves?

Project traffic self-pickup (bootstrap)

Self-drawing of traffic is a phenomenon unique to the currency circle, and BTC has benefited from this phenomenon in the long term.

BTC's traffic self-drawing means that other projects have to build up the image of BTC in order to take advantage of BTC's traffic, and ultimately inject their own traffic back into BTC.

Looking back at all altcoin issuances, they will all talk about the legend of BTC and the mystery and greatness of Satoshi Nakamoto. Then he talked about how he is like BTC and wants to be the second BTC. BTC does not need to be operated, and projects that will be imitated will be passively operated and passively branded.

Project competition is now more intense. Dozens of Layer 2 and tens of millions of inscription projects on BTC are all trying to borrow traffic from BTC, working together to promote massive adoption of BTC. This is the first time in the BTC ecosystem that so many projects have withdrawn BTC, so the withdrawal of BTC traffic this year will be stronger than in the past.

Summarize

Compared with last year, the biggest variable in the market is the adoption of BTC ETF. Through analysis, we found that all factors are pumping the price of BTC. Supply has shrunk and demand has skyrocketed.

To sum up, I think: BTC is the largest Alpha in 2024