The market is turning from boring to uncertainly bullish.

Since May, the crypto market has been rather boring. Prices are stagnant, airdrops are disappointing, and fatigue regarding infrastructure projects is evident (people no longer read technical threads), retail (not us but the buy-anything retail) is not here.

Crypto Twitter is now discussing politics more than crypto….

The market is still uncertain, but this uncertainty is bullish rather than bearish.

Let me explain what I mean.

The External Uncertainty

First, Ethereum ETFs are finally live, and the numbers are starting to come in.

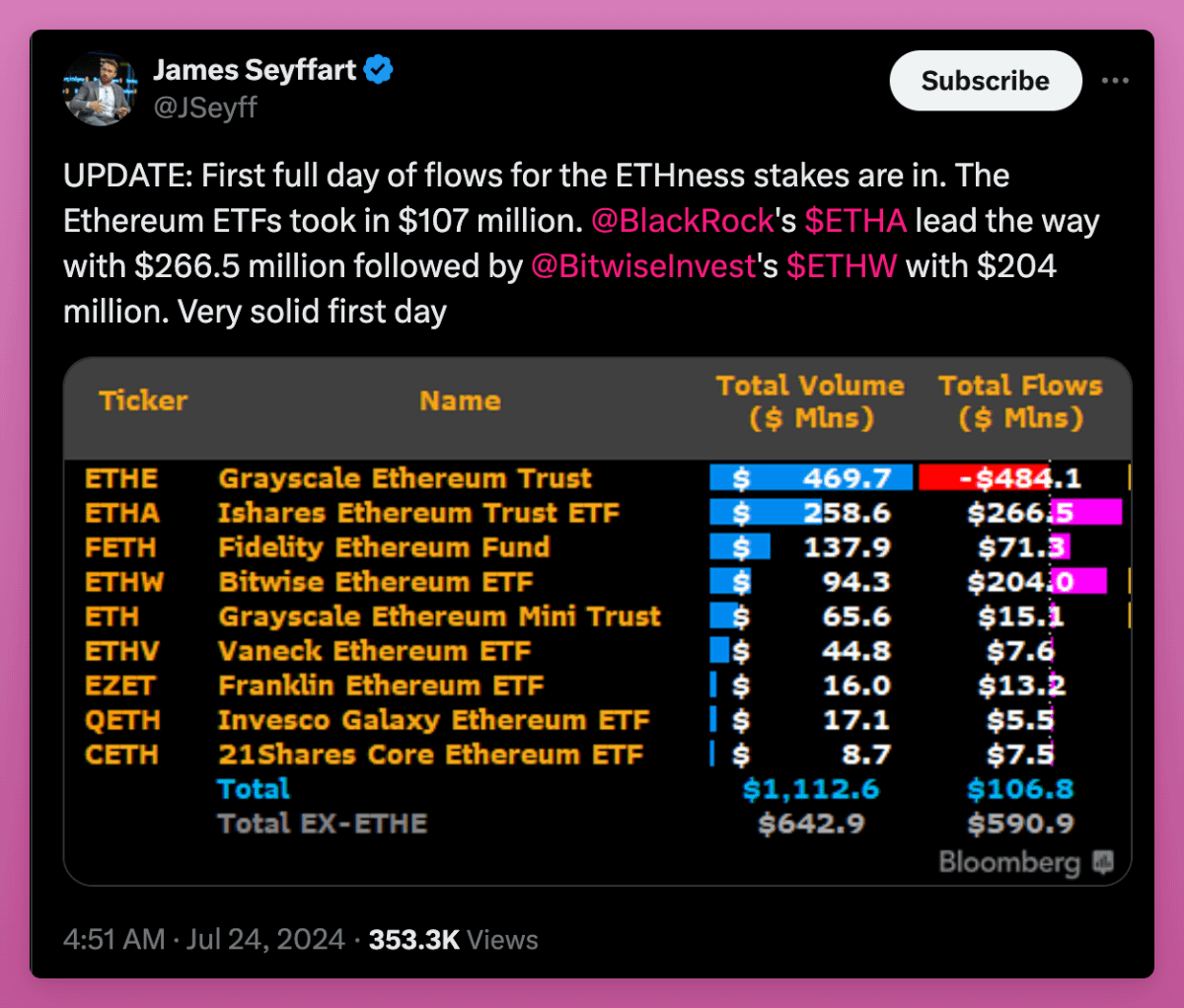

On the first day, ETH ETFs achieved $1B in volume, which is 25% of the BTC ETFs' volume. Most analysts had expected ETH ETFs to fall between 10% to 20%, making this a bullish sign.

But will the trend continue? Will inflows outweigh Grayscale outflows?

This is the primary uncertainty for ETH at the moment, pushing ETH price down. But with every passing day the uncertainty will grow weaker, and Grayscale’s ETH holdings will diminish.

Every passing day we hold this price level is bullish.

Next, the US elections. Will Trump win? Will he announce Bitcoin as a reserve asset (not currency!) at the conference in Nashville? Is Kamala genuinely willing to change the Democratic stance on crypto?

SO MUCH UNCERTAINTY.

The market doesn't like uncertainty; it wants answers. However, I believe the US government will eventually shift its negative stance on crypto. This change is part of the natural progression of technology.

I was writing the same "First they ignore you… then you win" cliche when I saw Adam tweeting it. 100% in agreement here. The government has little to gain and much to lose by opposing crypto. We will win.

It's not just the US. China is reportedly considering unbanning crypto. While this isn't a confirmed fact, the uncertainty here is bullish.

Third, Mt Gox creditors. Will they dump their BTC, hold it? Or perhaps sell BTC and buy other crypto assets?

We don't really know yet. This uncertainty is negatively impacting crypto prices, but one day we'll realize it doesn't matter. Just like Germany selling BTC, Mt. Gox will pass too, leaving behind the selling overhang we've feared for years.

So, what’s my point?

They say fear and greed are too opposing forces in the market. Yet I believe fear is stronger than greed.

Loss aversion is a powerful force in investing, making fear a more dominant driver than greed. The pain of losing money hits harder than the excitement of making it, leading us to be overly cautious. This fear causes early selling or makes people unwilling to invest, even when good opportunities are on the table.

In the market, this means fear tends to drive decisions more than the lure of potential gains, leading to conservative and too bearish reactions.

With each passing day, our fear will diminish, and FOMO will set in. The current external uncertainties are temporary. Grayscale will eventually run out of ETH to sell, Mt. Gox creditors who want to sell will do so, and even if Trump loses and the Democrats remain anti-crypto, we can continue to thrive as we have for years under this anti-crypto government.

Still not convinced? In a podcast with Blockworks, Lyn Alden predicts a typical liquidity cycle with a boom in 2025. If the above discussed positive events occur, the chances of performing on the upside increase.

Yet, external uncertainty is just part of the bullish sentiment. There’s finally something interesting happening within crypto.

The Internal Uncertainty

Internal factors refer to decisions made by the native crypto community, such as builders, traders, and airdrop farmers.

This bull run is quite boring because it’s driven by external factors:

- BTC/ETH ETFs

- Government policy flip flopping

- Potential interest rate decreases, etc.

We really lack strong internal innovations to attract retail and keep them entertained.

There were only two internal catalysts for FOMO this bull run so far:

- Memecoins

- Airdrop farming

Airdrop farming reignited both old and new DeFi dApps, generating seemingly bullish engagement metrics that turned out to be mostly fake, driven by degens using dApps solely for airdrops.

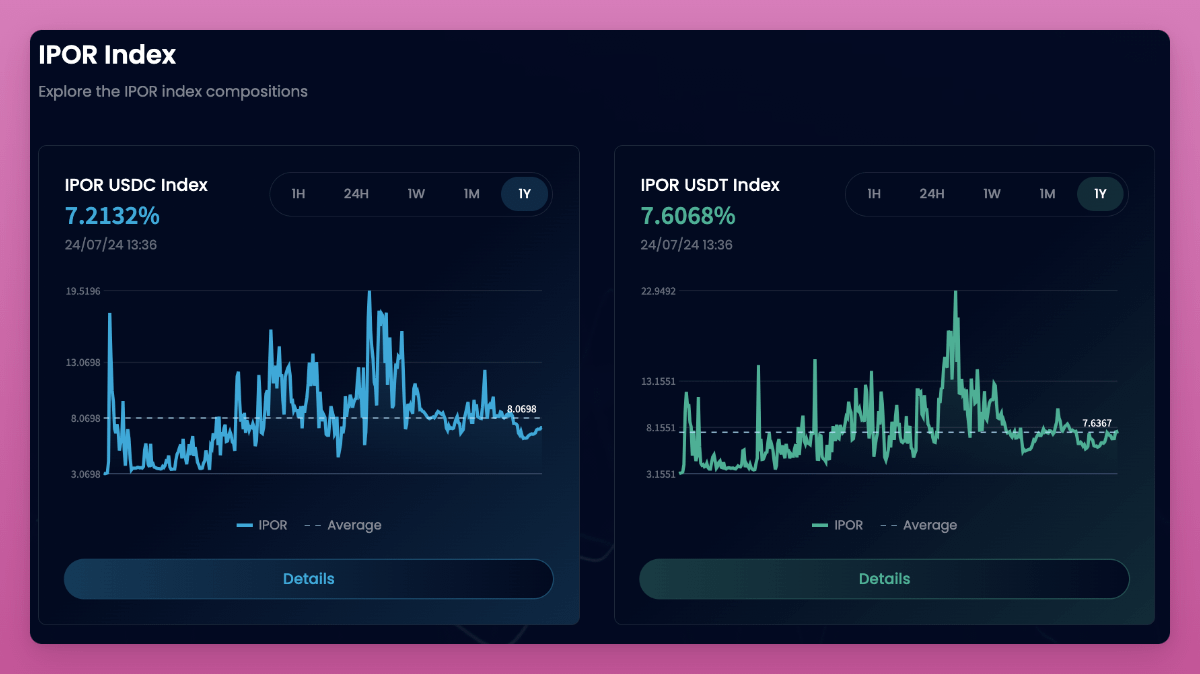

The excitement around airdrop farming has diminished, clear in declining sentiment on X and reduced interest rates on lending platforms, as farmers borrowed assets to maximize their farming.

You can see stablecoin IPOR index dropping from 20% to 7% since March but still higher than a year ago.

This is not news to anyone. The uncertainty is how we continue to print money tokens into the market and convince people to buy those tokens.

It's my biggest headache. Every cycle, we find new ways to issue tokens to the market. Points-for-airdrop was just the latest trend, but certainly not the final one. And being first to realize how the printing press works, generates the highest ROI.

I wrote about how it works even before this bull run started.

I took a bet that Friend Tech with 100% airdrop could revive the ‘fair launch’ meta, but I lost.

Similarly, Nostra's 100% unlock at launch and Ekubo's 1/3 allocation airdrop to the community, with another 1/3 sold over two months, are producing mixed results. The tokens are finally rising, but the airdrops were small, and market caps remain low.

Then we have some experimentation with point gamification. I wrote about the trend in my previous blog post on 7 emerging trends. Yet it’s yielding mixed results ($CLOUD) airdrop was disappointing for me.

Token migration with brand ‘repackaging’ is also promising. This happens when protocols adopt a new brand and migrate tokens for a fresh start, rather than opting for a simple v2 or v3 upgrade. We'll see how the Fantom migration to Sonic performs, but the Connext to Everclear migration and Arweave’s new AO token farming with AR are delivering mixed results.

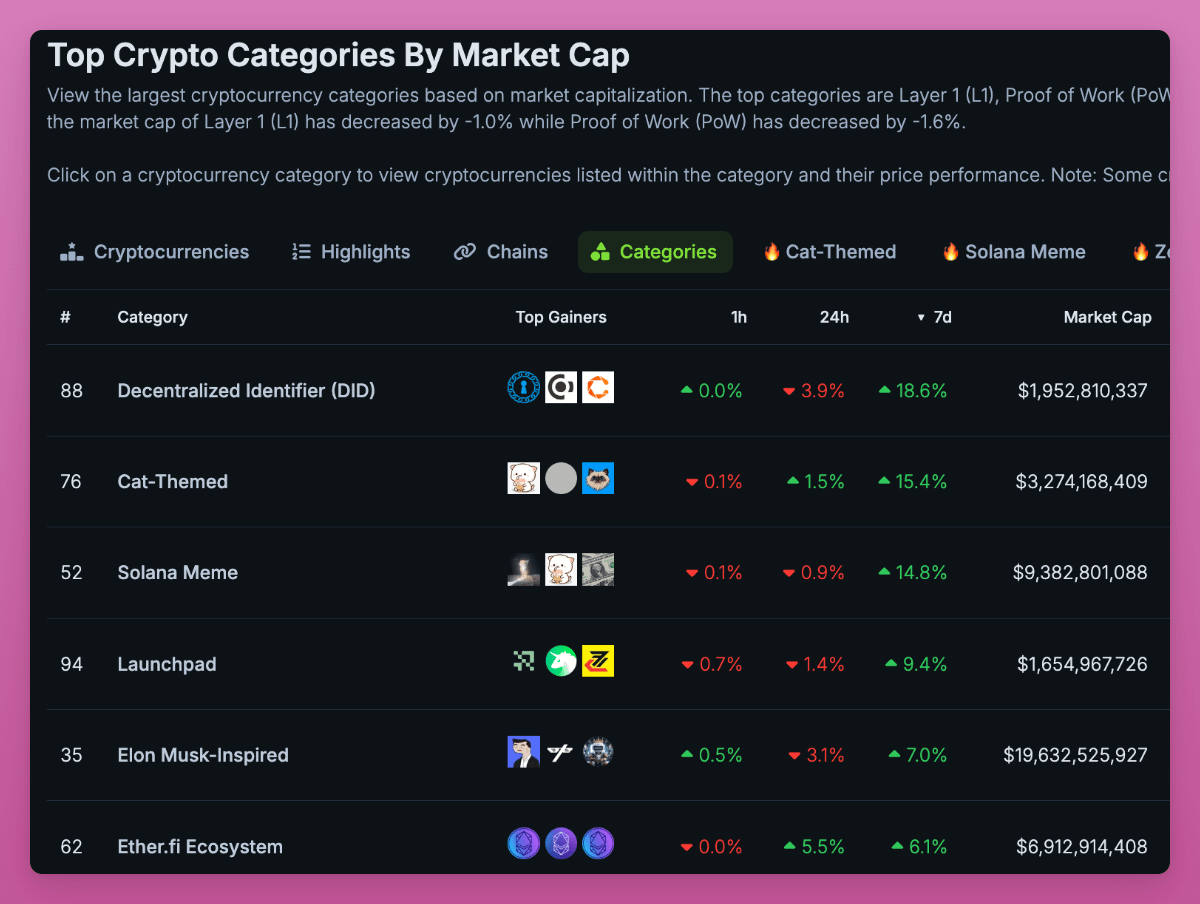

It seems that only memecoins are still performing somewhat OK.

As the market turned bullish this week, memecoins became the top-performing sector. This means that degens are bullish but waiting for the right moment to ape in.

With nothing besides memecoins going up, teams are desperate. No surprise that Jupiter decided to partner with Irene for a new ‘experimental’ memecoin.

In short, some crypto teams are innovating, but most prefer to go-safe (like deBridge) as nothing new works well enough: Newly launched tokens are dumping as unlocks weigh heavily (though ZRO is performing well).

Making money on memecoins is equally challenging, as thousands of them hit the market, with most going straight to zero.

I believe this uncertainty of what’s next for token issuance is why DeFi tokens could perform well later in the cycle.

DeFi OG tokens, such as UNI, MKR, LDO, AAVE, and SNX, have a large circulating supply, reducing the risk of heavy dumps.

With potential regulatory clarity, these tokens, backed by solid business models and revenue generation, could attract increased inflows. Especially, as the market grows tired of memecoins and new tokens flood the scene, DeFi OG tokens offer an interesting counter-trade.

Currently, memecoins perform well because tokens with utility are perceived as "securities" by regulators, while memecoins, lacking utility, are seen as less risky from a regulatory standpoint. A positive signal from the government could shift the crypto mentality significantly.

But all this is still uncertain.

Consumer Apps

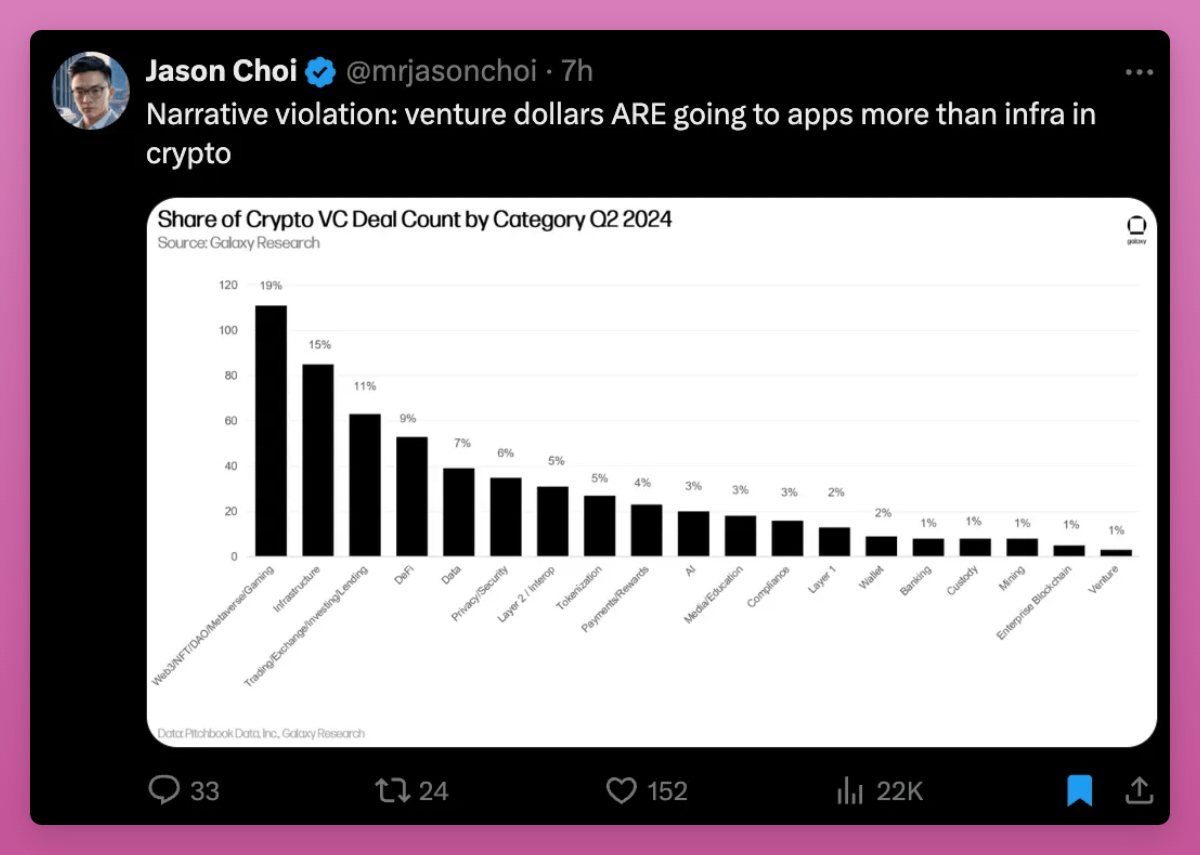

Fatigue over overpriced infrastructure projects is real. Few are excited about the new AI-based zk L2 (Zircuit lol), However, this is bullish news.

We’re finally realizing the need for consumer apps to benefit from that infrastructure.

The VC money is finally flowing to apps more than infra. Let’s hope that something useful will come out of it.

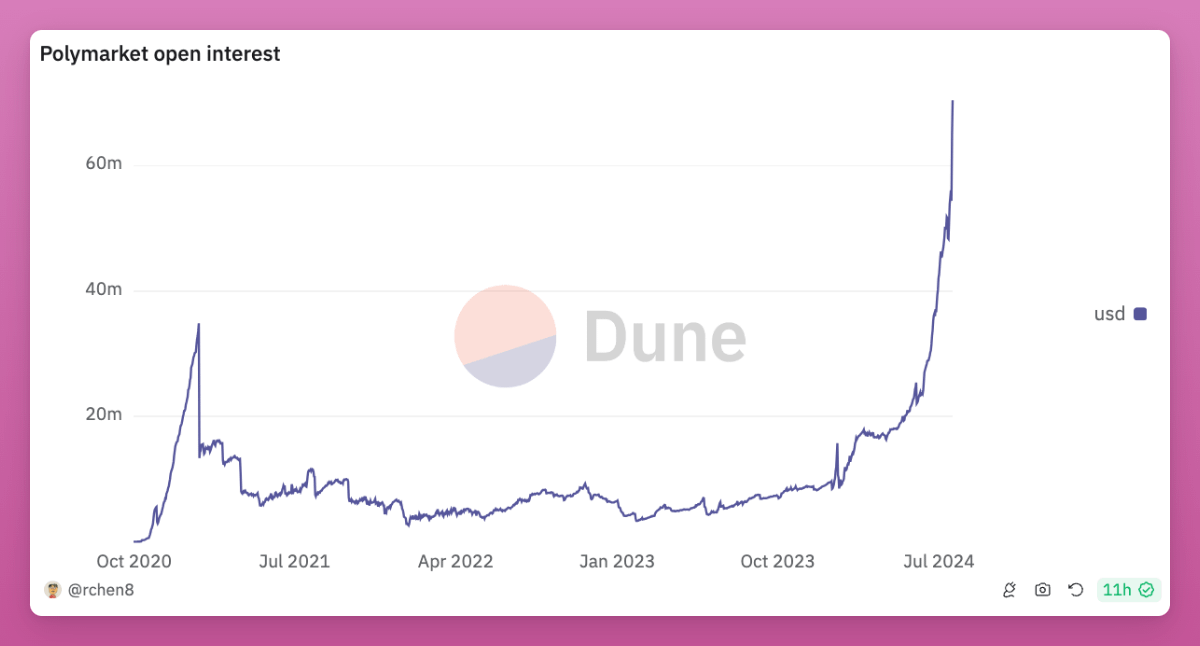

The big winner in the consumer narrative is Polymarket. Not only is it great for speculation, but it also serves as a reliable source of truth in an age dominated by biased legacy media.

Despite being the coolest crypto consumer app, we have no way to bet on it! However, I'm positioning myself for an airdrop by betting on multiple markets with multiple wallets.

If Polymarket is daring enough, they should launch their token just before the US election when the hype is at its peak.

If Consumer Apps become the new meta, I recommend trying out to see what you personally like and find a way to bet on it before anyone else. That’s what I’m going to do.

A few consumer apps to try out:

- Receipts: share your runs, rides, and workouts and earn points (not live yet)

- Sound.xyz: discover new music and prove that you were there first

- Fileverse: privacy-enhancing, peer-to-peer docs

- Check others on this post by David.

And finally, you must try Farcaster and Lens. These might be the biggest winners in consumer meta.

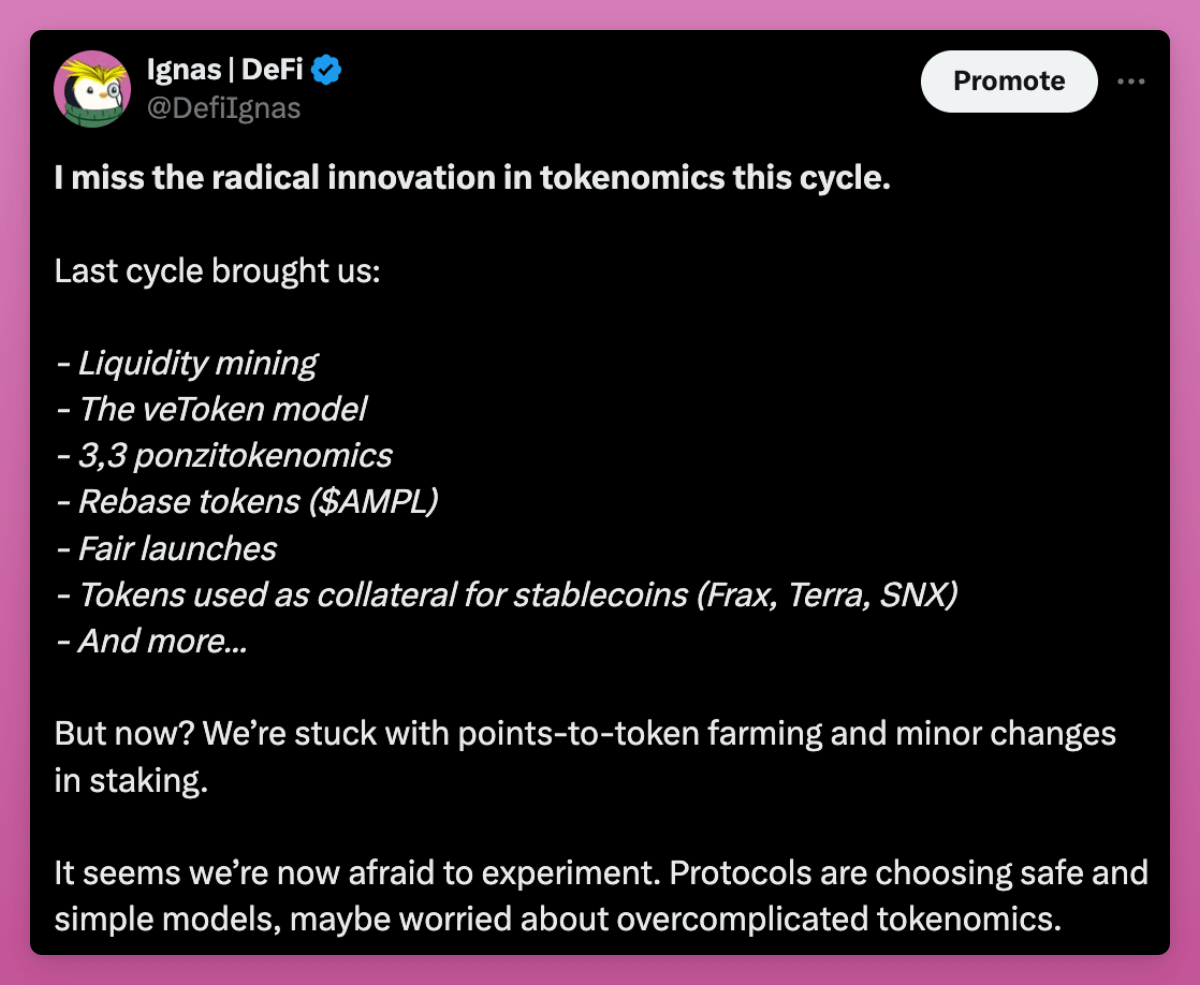

New Tokenomics

This cycle sucks when it comes to internal innovations. And radical innovation in tokenomics is badly needed.

Even memecoins saw more innovation than DeFi with the bonding curve launch model on pumpdotfun. But aside from the bonding curve, memecoins also abandoned previous experiments like transfer taxes.

One area of 0-to-1 innovation is restaking with AVSes.

- Eigenlayer’s dual token structure (EIGEN and staked bEIGEN) allows forking to be managed through social consensus.

- Dual-staking models: Extra demand for the token that helps to maintain floor price.

- Ethena, with Symbiotic, is experimenting by adding economic security to utility tokens.

Recently, Karak announced partnership with Etherfi and Maker to launch their restaked tokens.

Karak’s “universal restaking” brings staking functionality to any token. It boosts token utility by helping to decentralize on any chain and add extra utility features that wouldn’t be possible otherwise.

We’ll need to see how it works out in practice, but staking on Karak will automatically migrate your MKR to the NewGovToken which is in Maker’s Endgame Roadmap.

Similarly, you can restake ETHFI to earn Karak XP points, but I’m very curious what other restaking enabled features Etherfi x Karak will introduce.

If Ethena, Etherfi, and Karak restaked utility models succeed, we could see Liquid Restaked Tokens for other DAO increase drastically, which would boost valuations for restaking platform tokens (notably Symbiotic and Karak as Eigenlayer doesn’t yet support other assets), but also DAO token themselves.

Imagine a world of lrtMKR, lrtAAVE, and any other token…

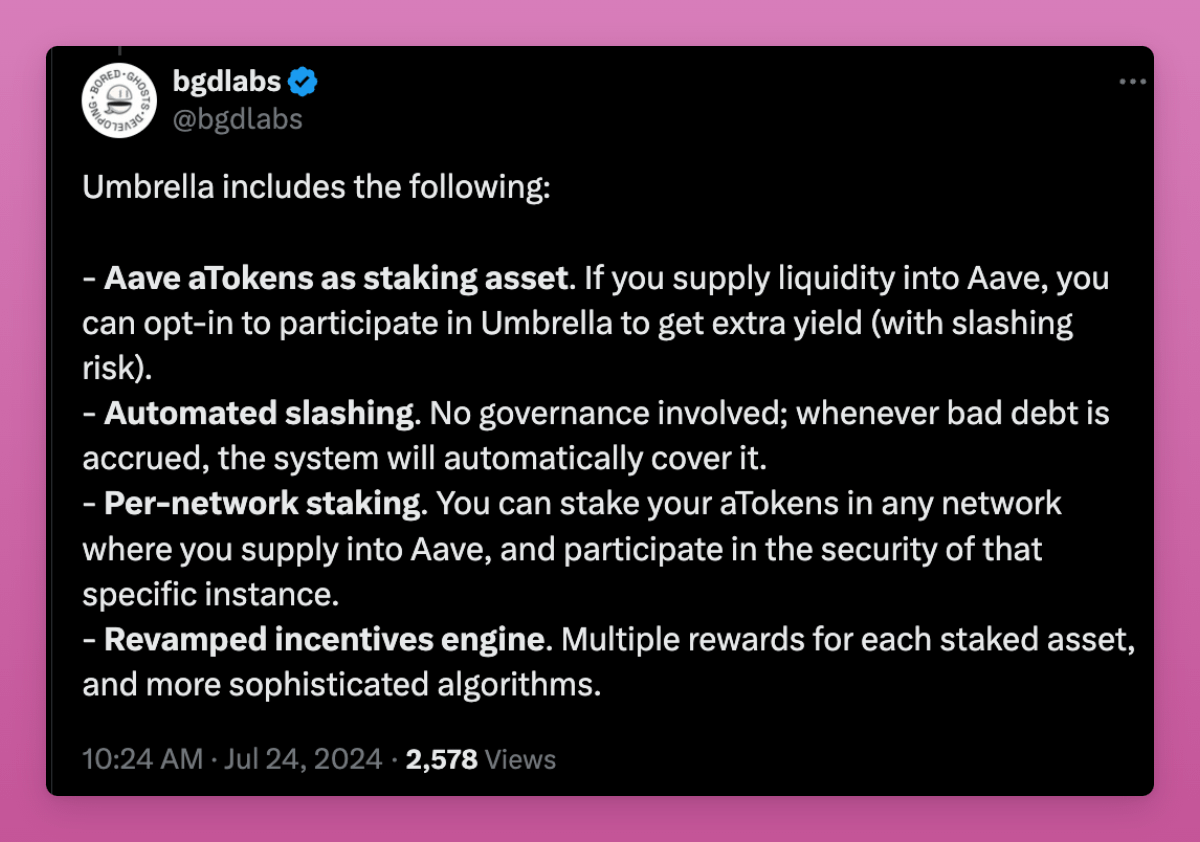

Speaking of Restaking, Aave has launched something quite cool.

Aave’s Umbrella is a new Safety Module where users can use aTokens as staking assets.

Imagine you lend USDT and want to earn extra yield. You supply aUSDT to the Safety Module and in case of bad debt, part of your aUSDT will be used to cover the bad debt.

It’s so simple yet powerful I’m not sure why others didn’t consider before.

This is also a major move from “governance tokens as security” guarantee that stkAAVE was used previously. Think about it, if Aave becomes insolvent, token dumps anyway.

The uncertainty surrounding crypto markets has always been significant. Despite this, we have success stories in global crypto adoption, such as ETFs, RWAs, and crypto becoming a political issue. I believe this adoption trend will continue.

This uncertainty is actually bullish, as it enables us to overcome obstacles and progress. Like religion, crypto reaches more and more people. However, once it becomes a dominant force and uncertainty fades, growth potential diminishes.

Uncertainty is the fuel for growth.

Internal uncertainty is of a different type. What previously worked no longer does. We've hit a roadblock and need new, innovative ways to move forward. While some innovation is emerging, it's unclear what will truly revolutionize the new token printing machine.

I'm bullish because I believe I can be among the first to find it.