Ronin: Retail Beta + Superior Fundamentals + Undervalued + Several Re-rating Catalysts

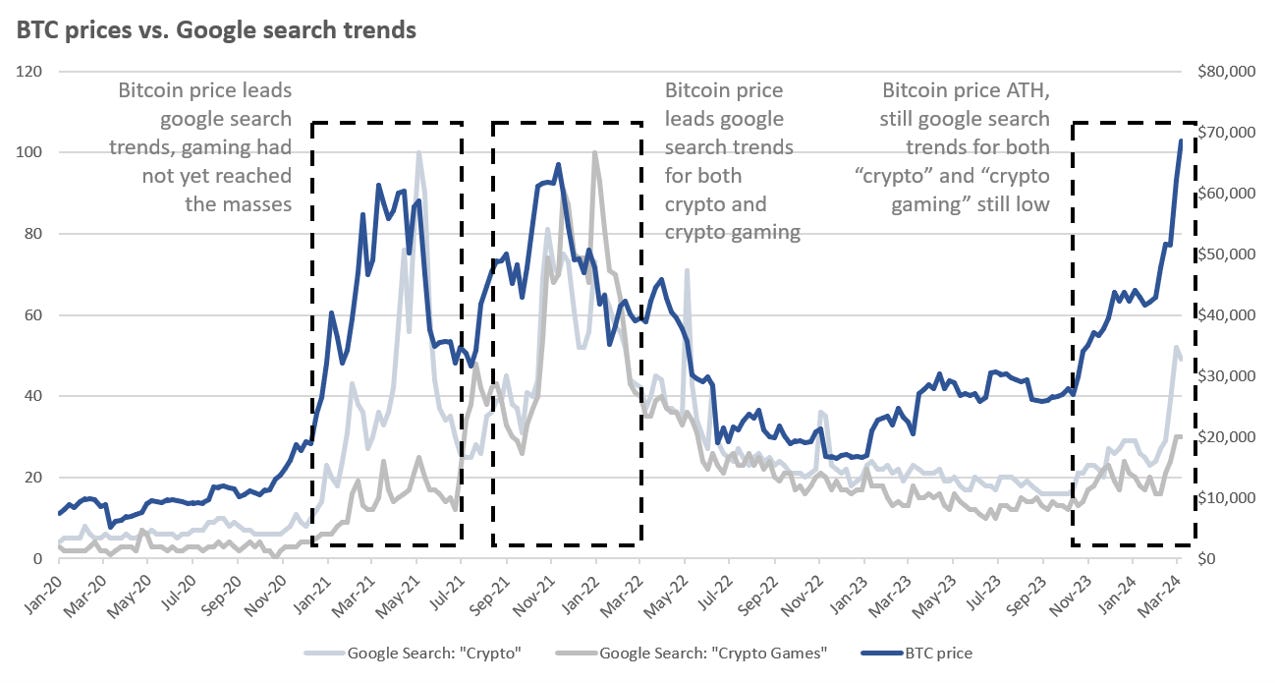

Retail is coming back. Bitcoin prices are near all time high but it feels like retail is not yet back. We think there is a good reason for this - it takes time for mainstream news outlets to report and bring attention to retail. This has resulted in an empirical 2-3 month lag between Bitcoin prices and crypto Google searches (which we think is a proxy for retail interest).

Source: CoinGecko, Google, Ouroboros Research

Source: CoinGecko, Google, Ouroboros Research

And we like Gaming. We have been thinking hard about what fits the bill as a longer-term investment idea which has strong beta to retail presence - Gaming comes to mind (memecoins too, but that is an idea for another article).

Picking the right play. While it is relatively easy to call for a web3 gaming comeback, it is notoriously difficult to pick a winning game in what has historically been a winner-takes-all market. We could theoretically try to pick a basket of gaming tokens, but we think infrastructure plays have a better risk-reward profile since they tend to be affected by fewer idiosyncratic factors and provide wide exposure to a large range of games.

We have grown increasingly bullish on RON which stands out on several fronts:

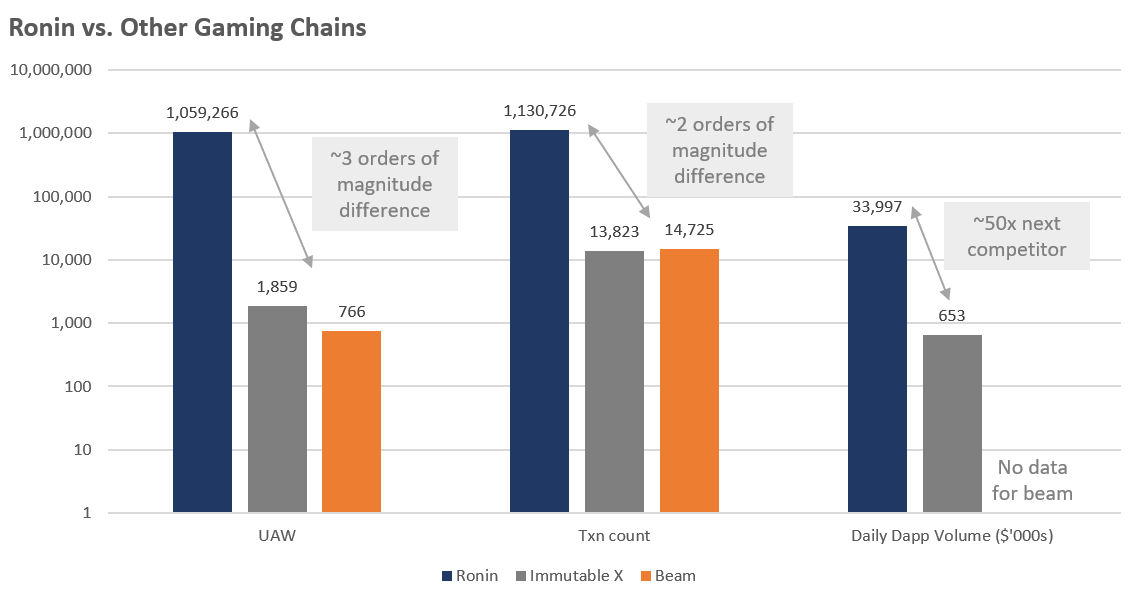

- Ronin has best-in-class network effects with metrics at 50-1000x competitor chains. Despite this, RON is still relatively cheaply priced

- The chain is seeing strong and growing UAW metrics, with more room for growth as more games are onboarded

- RON has several catalysts that could help it rerate, including 1) increasing launchpad traction and airdrops, 2) tokenomics changes, 3) CEX listings and 4) its ZK L2 launchSubscribe

Investment Thesis

#1 Best-In-Class Gaming Chain, Priced Cheaply

Gaming platforms are inherently two-sided marketplaces. It is typically difficult for new platforms to onboard both gamers and game developers as each side wants the presence of the other side before joining the platform. Game developers want immediate access to a large user base while gamers want access to top-quality games (and/or incentives).

Ronin already has network effects. Ronin, built by Sky Mavis, the creator of Axie Infinity, has bypassed this issue by onboarding the entirety of Axie’s user base onto the chain. This has resulted in immediate network effects at a scale not seen by other crypto platforms.

Source: DappRadar, Avax Subnet stats, Ouroboros Research

Source: DappRadar, Avax Subnet stats, Ouroboros Research

50-1000x better metrics than other gaming networks. Ronin has 1000x more unique active wallets, 80x more transaction count and 50x more dapp volume than its peers. We think this alone should warrant higher valuations for RON, yet BEAM trades at a 60% MCap premium while IMX trades at a 260% MCap premium.

#2 Users At All Time Highs, Expect More Growth

The largest Web3 games are on Ronin. The Web3 gaming space is still relatively nascent, with only a handful of titles achieving over 1-10k DAUs. Highlighted in yellow are (some) games built on Ronin:

Source: Coingecko, various game websites, Ouroboros Research

Source: Coingecko, various game websites, Ouroboros Research

- Axie Infinity (AXS): Saw 2m users at its peak in 2021, currently has over 350k active users on its Axie Classic and Axie Origins game titles

- Pixel (PIXEL): Recently launched, had 260k DAUs prior to its token debut which has since grown to ~700k strong today, with more growth likely to come from Chapter 2

- Wild Forest (WF): A real-time strategy (RTS) game with >10k DAU, pre-token

- Apeiron (APRS): Soon-to-launch game, just completed a successful $3m token sale last week with over $75m of RON staked for allocations

- Kaidro: Soon-to-launch game, garnered over 346k mints for their first NFT mint (max mint of 1 NFT per wallet)

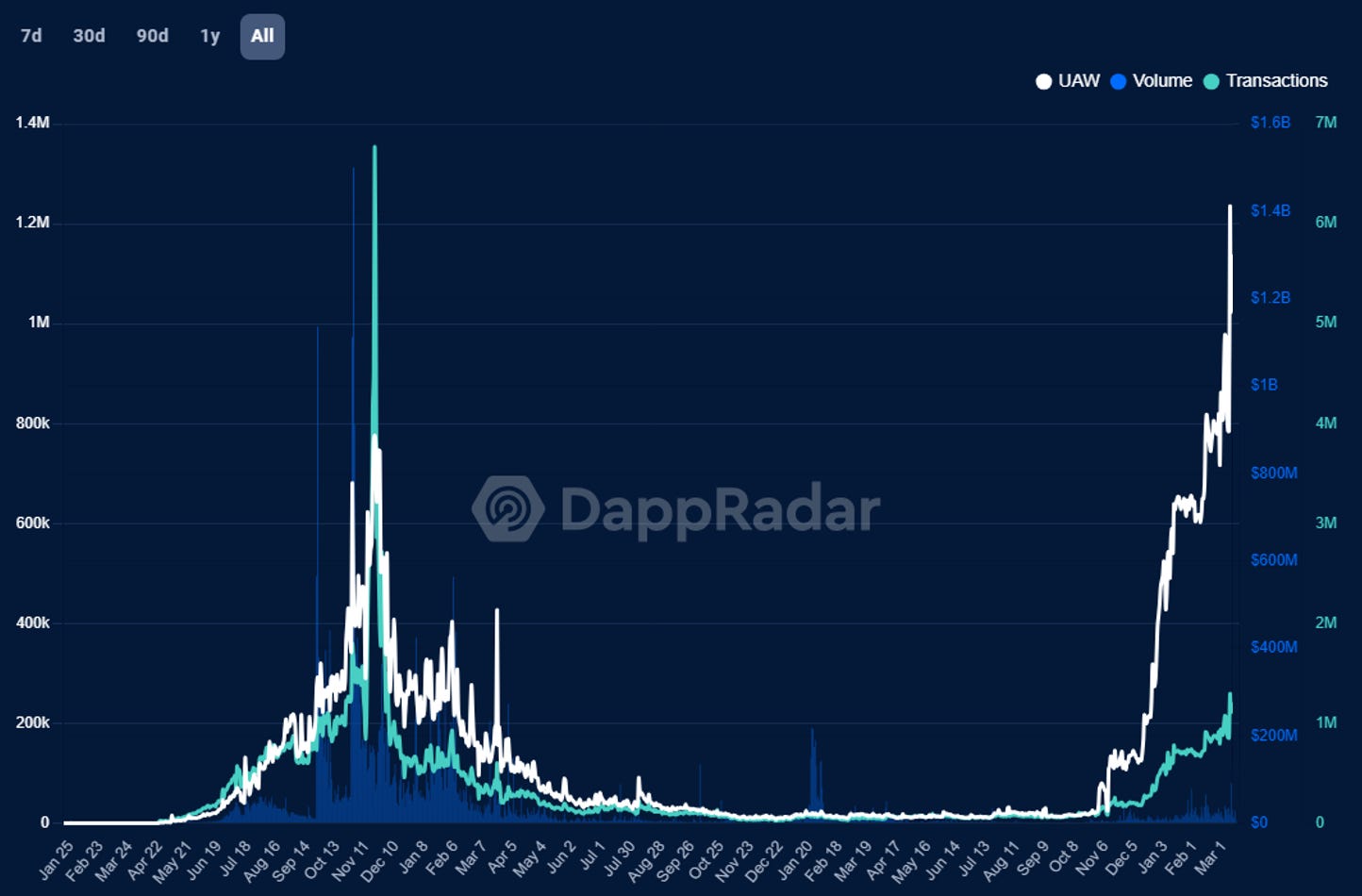

Pixels x Ronin’s symbiotic relationship will attract more game partners. Ronin has historically been portrayed as a chain that had users because of Axie. The success of Pixels, which has seen exponential DAW growth since it joined Ronin (from Polygon), proves that non-Axie games can also be successful. In fact, this suggests that not only will Ronin benefit from the inbound game’s existing user base, it also grows the game's user base, resulting in a symbiotic relationship.

Source: Jiho’s tweet

Source: Jiho’s tweet Source: DappRadar

Source: DappRadar

The Ronin flywheel. We believe other game developers have noticed this “Ronin effect” (where users grow post onboarding to the chain) and will be willing to migrate to Ronin to access more users. We think this could kickstart a flywheel where:

Good game titles migrate to Ronin → grows the user base → validates “Ronin effect” → attract more game titles

The list of games that have upcoming launches has been growing and we would not be surprised to see Triple A tier games joining Ronin in a bid to reinvigorate their user bases. The list of upcoming launches include: The Machine’s Arena, Axie Champions, Tribesters World, CyberKongz, PlayFightLeague.

#3 Multiple Catalysts: Launchpad, Tokenomics changes, CEX listings, L2 ZK Implementation

Ronin has a fundamentally stronger competitive position than its peers and we see it growing further. On top of this, we see four primary catalysts which could help the token realize its value:

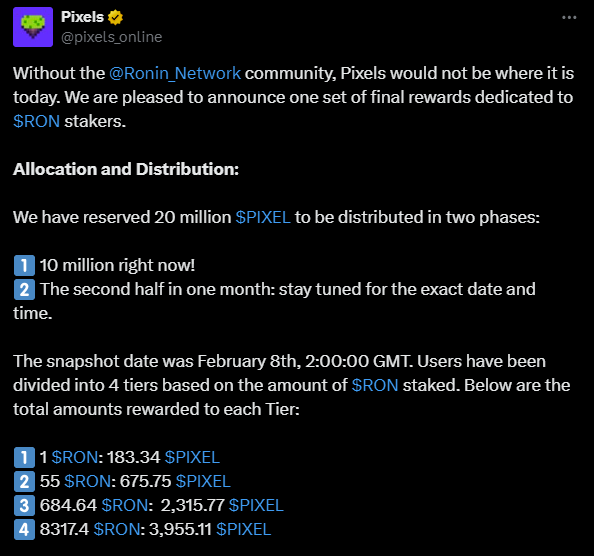

1. Ronin Launchpad: Stake to earn = Demand for RON + Airdrops to RON Stakers. Ronin has partnered up with Impossible Finance for future games launches on the chain. In order to acquire new game tokens, RON holders will have to stake their tokens, which will naturally drive up demand for RON. Pixels has also set a precedent in airdropping tokens to RON stakers, this has yielded between 10% to 3700% of RON's value (using today's RON and PIXEL prices).

Given the long list of upcoming launches, we expect there to be incremental buy pressure for RON from users who are seeking access to these games.

Source: X

2. Value Accrual / Tokenomics changes. At present, Ronin collects fees from several dapps - Katana DEX (0.05% commission on trading volume), Mavis Marketplace (NFT marketplace, 0.5% commission on volume) and Ronin Name Service (30% commission). These fees are currently collected in RON and go to Ronin’s treasury. While there is no direct value accrual to RON holders yet, co-founder Jiho has suggested there could be value accrual via staking rewards and/or buybacks, which we think could drive a re-rating in the token.

Source: X

3. CEX listings. Ronin has recently launched on Binance, and has just completed its Coinbase Listing. We expect the Coinbase listing to be significant for Ronin to grow penetration in the Western markets (current exposure is largely Asia-centric). We also see Korean CEX listings as a possibility - AXS and IMX are currently listed on Upbit but not RON.

Source: X

4. Not just a chain but a gaming ecosystem. Ronin’s head researcher Phuc Thai has teased a Layer-2 ZK implementation, R2 which will allow Ronin to not only increase its performance and capacity but also onboard games that prefer more blockchain customization (eg. Maplestory on Avalanche’s subnet).

Source: Ronin blog

Valuation + Conclusion

Target (base case): Given its superior metrics, we see RON minimally trading to BEAM / IMX’s MCap, which implies a +60% / +260% upside or a price of $6.0 / $13.5 respectively.

Target (bull case): If the catalysts come to pass and Ronin becomes the premiere platform to launch Web3 games and rivals major game publishers and distributors such as Valve and Epic Games. We see RON’s valuation rising higher than these companies (Valve is at $7.7b based on a Bloomberg forecast, while Epic Games was last priced at $22.5b) given Web3 gaming’s significantly higher levels of user monetization vs. traditional gaming.

We conclude this investment report by reiterating the key takeaways from the above analysis:

- Ronin has significantly better metrics than its peers but has a significantly lower valuation

- Ronin’s flywheel of onboarding great games → attract users → attract games is just beginning

- While fundamentally undervalued, the token has several catalysts that could help it rerate, including: increased launchpad traction, tokenomics changes, CEX listings and its ZK L2 launch

We believe that the Ronin ecosystem has kickstarted a strong flywheel of attracting gamers and games, and that the next generation of Web3 games which will disrupt the sector, will emerge from Ronin - the Kingmaker.

Appendix #1: References & Credits

We also would like to give shoutouts to the Sky Mavis team (in particular @bottomd0g) for assisting with our research, as well as other peers who have provided valuable information and feedback; they are: @s4msies (Ronin: A New Era), @DarkForestCap, @JavierAng_, @ahboyash, @NotSoAnonJoo, @isaac_mung, @0xMize.

Appendix #2: Mythbusters

Myth #1: Ronin suffered the largest bridge exploit in 2022. Is Ronin chain solvent?

Validator private keys were compromised, and attackers managed to drain $600m from the bridge. Users were made whole after being able to recover some of the losses, and a full reimbursement from Sky Mavis' balance sheet.

Ronin has since moved on to Delegated Proof of Stake, with Sky Mavis owning just 1 of 22 reputable validators, showing their commitment to decentralization.

Myth #2: Ronin’s inflation is concerning

~500m of RON will vest across a long period of 7 years, as opposed to most other projects at < 4 years.

Source: Token Unlocks

Source: Token Unlocks

The following categories of unlocks going into 2025 are:

- Staking rewards: 36m tokens. This is non-dilutive as long as RON holders stake.

- Community incentives: 30m RON. Largely used to incentivize growth, pays for itself if RON is able to use this war chest to attract strong games.

- Sky Mavis: 63m RON / Ecosystem fund: 20m RON. Sky Mavis and Ecosystem fund allocations are non-inflationary as Sky Mavis has not sold any RON (except for employee compensation).

Myth #3: FTX Estate still holds RON and will result in further selling pressure

Since Binance listed $RON, the FTX estate has been selling via Binance. They have sold a total of 10.2m RON and as of writing, have sent out their last clip of 1.2m tokens a day ago.

Appendix #3: What is Ronin?

Sidechain built for gaming. Ronin is a blockchain platform developed by Sky Mavis in 2020-2021, designed to tackle the scalability and cost challenges faced by conventional blockchain networks. Focused on the blockchain gaming and NFT markets, it operates as an EVM-compatible Blockchain optimized for high-volume, low-cost transactions, making it an ideal environment for its flagship project, Axie Infinity as well as other Web3 Games.

Not just a gaming platform; Player communities/guilds too. Building upon the initial success of Play-to-Earn (P2E) games in 2021, the Ronin ecosystem has secured a strong foothold in gaming communities within emerging markets. This was achieved due to its strong synergy with various P2E guilds, especially Yield Guild Games (YGG). These collaborations have and continue to facilitate user onboarding through the guilds’ extensive network and content localization.

Mobile wallet for mass adoption. One key component that has allowed Ronin to effectively penetrate masses is the integration of the Ronin wallet into mobile devices as a norm. This experience is critical especially when targeting emerging markets where mobile penetration is high.