Real World Assets (RWAs) in crypto have a long history, starting with fiat-backed stablecoins such as Tether (USDT). However, since the introduction of DeFi in 2020, and the bear market of 2022, a more diverse variety of RWAs have been tokenized to cater to the needs of on-chain investors. While RWAs are still predominantly focused on debt / credit, other assets such as real estate, art & collectibles, etc have also piqued the interest of investors.

Fundamentally, RWA projects live at the intersection between the real world and blockchains, and between issuers and investors. Whether they can act as an effective intermediary at these intersections will be pivotal to their success. While there will inevitably be reliance on third parties, such as oracles, custodians, credit assessors, and more, how these are effectively utilized and managed will remain crucial for their continued operations.

We’ve summarized the key highlights, but be sure to dig into the full 22 slides below.

Top 4 Highlights of CoinGecko’s RWA Report 2024: Rise of Real World Assets

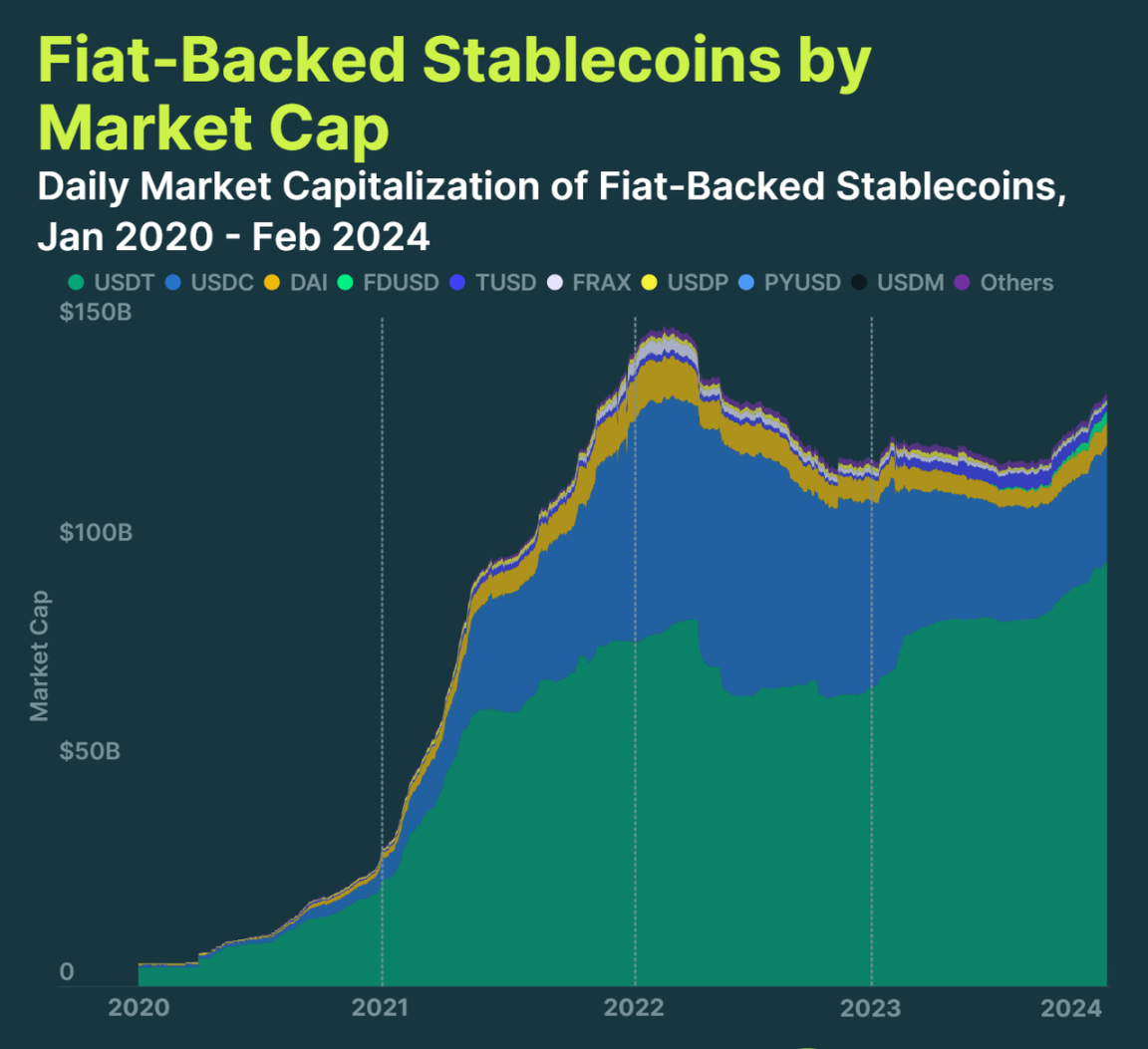

- USD-Pegged Assets Dominate Fiat-backed Stablecoins, Accounting For 99% of All Stablecoins

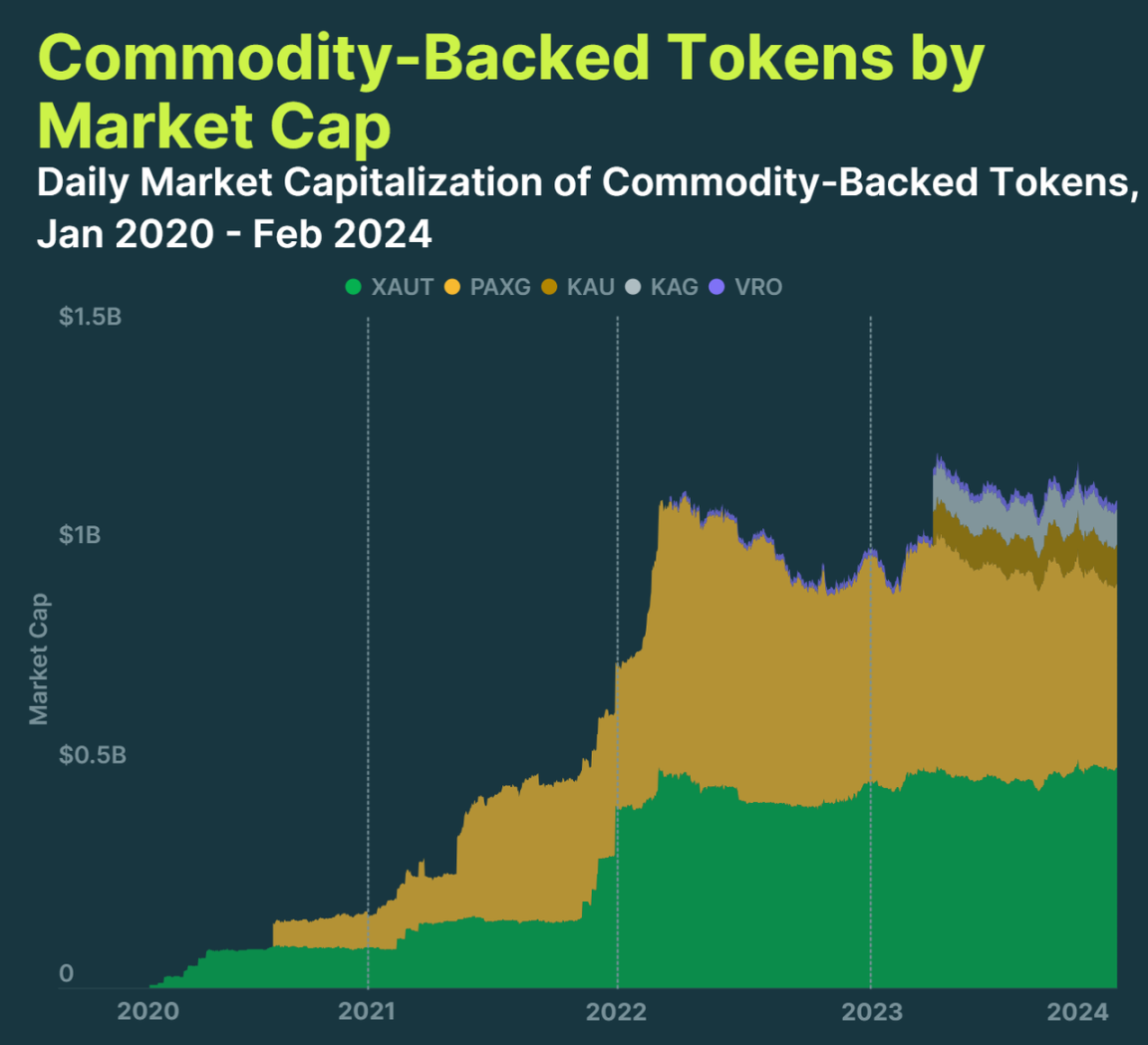

- Commodity-Backed Tokens Hits $1.1B in Market Capitalization, Gold Remains Most Popular Commodity

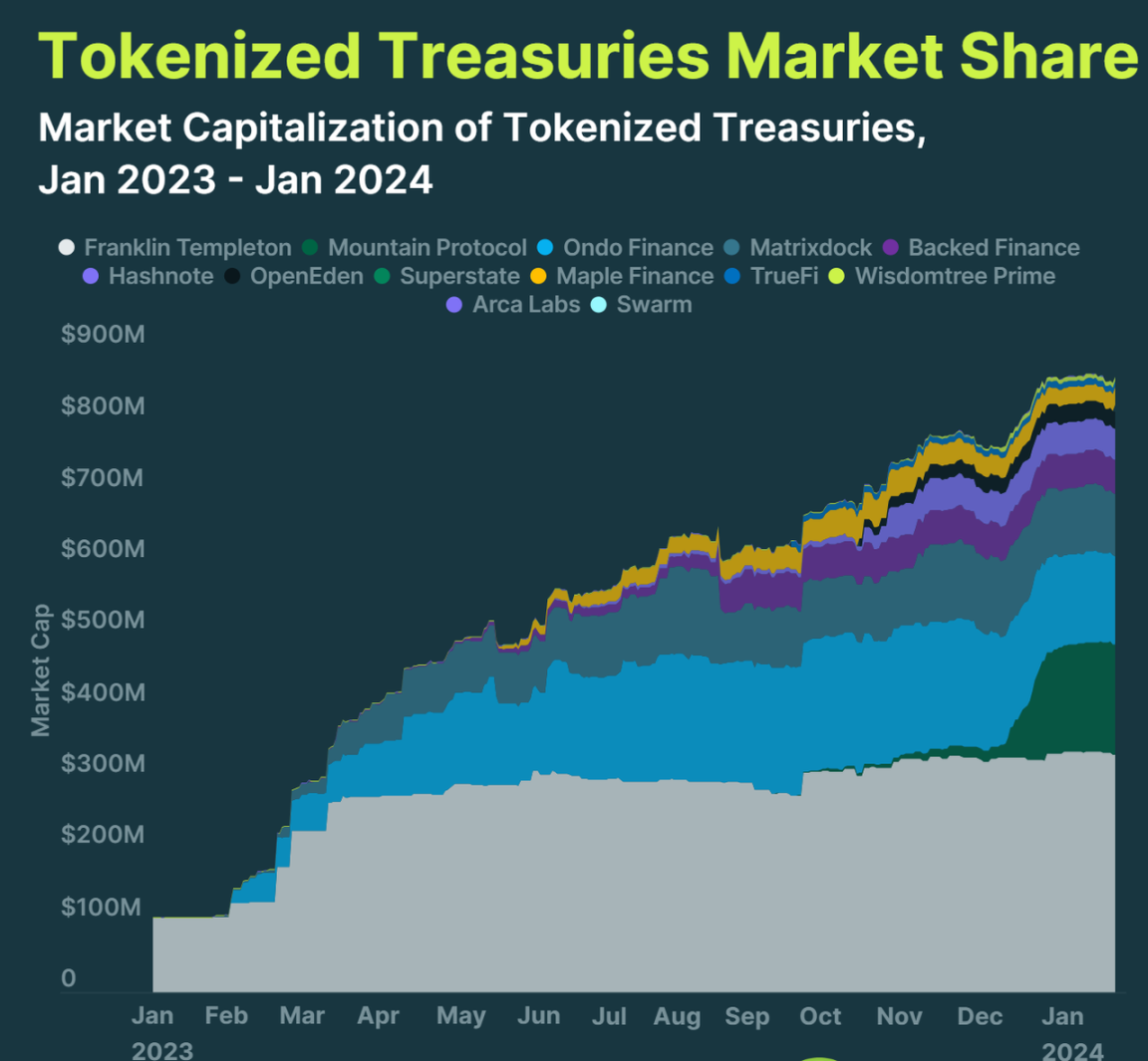

- Tokenized Treasury Products Have Grown 641% in 2023, Worth Over $861M Now

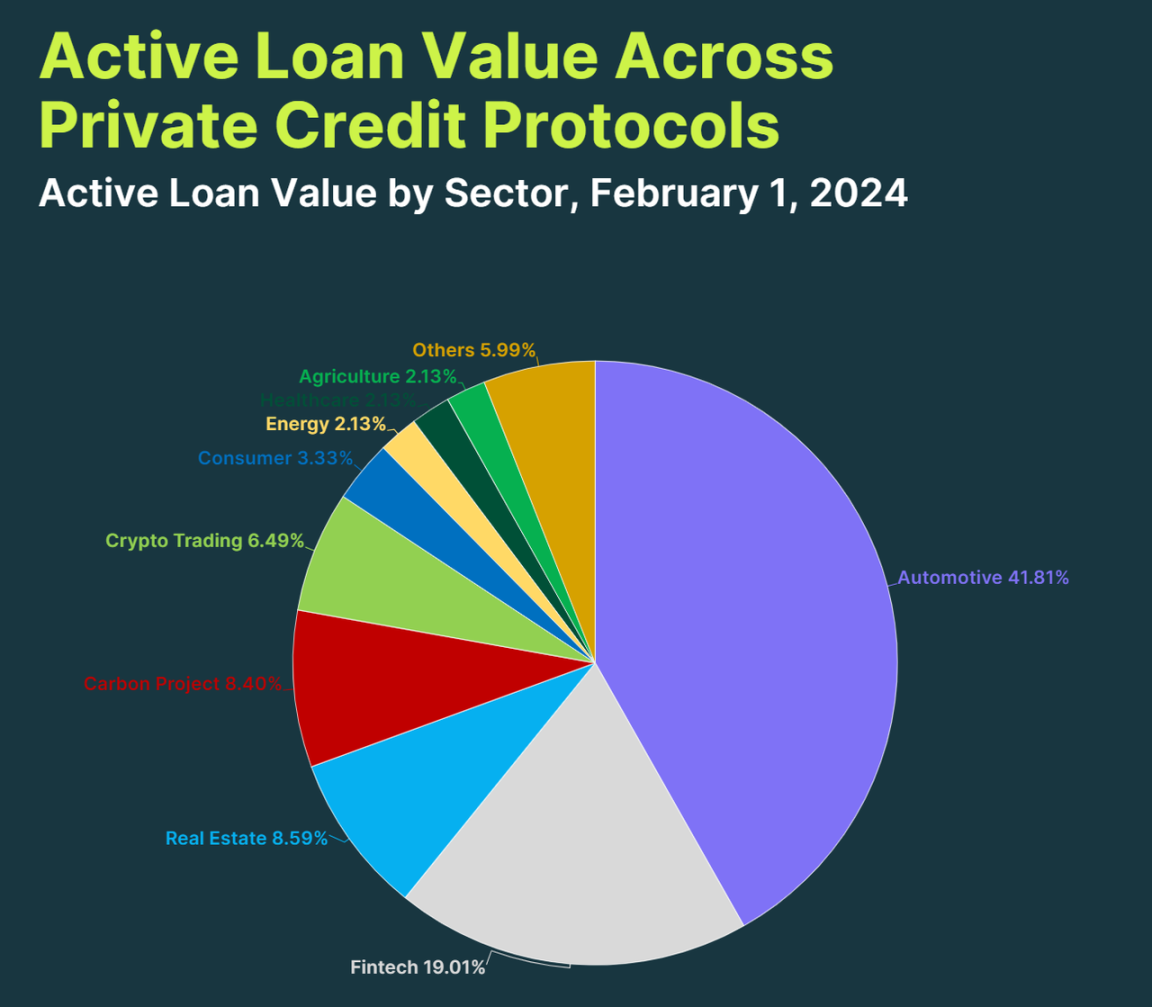

- The Demand For Private Credit Is Largely Concentrated In The Automotive Sector, Comprising 42% Of All Loans

Introduction: What Are Real World Assets (RWA)?

Real World Assets (RWA) in crypto refers to the tokenization of tangible assets that exist in the physical world, that are brought on chain. This includes the growing issuance of capital market products on-chain, where digital securities are tokenized and offered to retail customers. Examples of these include real-estate, art, commodities, and even stocks that users can purchase through permissioned platforms.

One of the earliest forms of RWAs exist in the form of stablecoins. The existence of stablecoins as a tokenized version of fiat currencies allowed for a stable unit of exchange in a volatile environment. Since 2014, firms such as Tether and Circle have issued tokenized stable assets that are backed by real-world collateral such as bank deposits, short-term notes, and even physical gold.

In 2021 and 2022, the emergence of private credit markets through uncollateralized lending platforms such as Maple, Goldfinch and Clearpool allowed established institutions to borrow funds based on their creditworthiness. However, these protocols were affected by the collapse of Luna, 3AC and FTX, and experienced significant defaults.

As DeFi yields cratered in 2023, tokenized treasuries saw explosive growth as users flocked for exposure to rising US T-bill rates. Providers such as Ondo Finance, Franklin Templeton and OpenEden saw massive inflows as the TVL of tokenized treasuries surged by 641% from $114M in January 2023 to $845M by year’s end.

1. USD-Pegged Assets Dominate Fiat-Backed Stablecoins

Currently, the majority of real world assets (RWA) are USD-pegged stablecoins.

The top three USD stablecoins alone make up 95% of the market, with Tether (USDT) at $96.1 billion, USDC (USDC) with $26.8 billion, and Dai (DAI) with $4.9 billion. USDT continues to dominate the space, with a market share of 71.4%. Meanwhile, USDC which saw its market share plummet after its brief depegging during the US banking crisis in March 2023, has failed to recover.

Stable assets outside of USD-pegged stablecoins make up just 1% of the market. These assets comprise other fiat currencies such as Euro Tether (EURT), CNH Tether (CNHT), Mexican Peso Tether (MXNT), EURC (EURC), Stasis Euro (EURS), and BiLira (TRYB).

Stable assets have seen a meteoric rise in market cap from just $5.2 billion at the beginning of 2020, to a peak of $150.1 billion in March 2022, before declining gradually throughout the bear market. However, it has seen its market cap grow by 4.9% in 2024, from $128.2 billion at the start of the year, to $134.6 billion as of February 1.

2. Commodity-Backed Tokens Hits $1.1B in Market Capitalization, Gold Remains Most Popular Commodity

Tokenized precious metals such as Tether Gold (XAUT) and PAX Gold (PAXG) make up 83% of the market cap of commodity-backed tokens. Tokens such as XAUT and PAXG are backed by one troy ounce of physical gold, while Kinesis Gold (KAU), and VeraOne (VRO) are pegged to one gram of gold.

Despite the dominance of tokenized precious metals, tokens backed by other commodities have also been launched. For example, the Uranium308 project has released tokenized uranium which is pegged to the price of 1 pound of U3O8 uranium compound. It can even be redeemed, but strict compliance protocols will first need to be passed.

While commodity-backed tokens amount to $1.1 billion in market cap, it represents only 0.8% of the market cap of fiat-backed stablecoins.

3. Tokenized Treasury Products Have Grown 641% in 2023, Worth Over $861M Now

Tokenized US treasuries saw a surge in popularity during the bear market, with its market cap increasing 641% in 2023, from $114.0 million to $845.0 million. However, that momentum has since stalled in 2024, with growth at 1.9% in January, with a market cap of $861.0 million.

Franklin Templeton is currently the largest issuer of tokenized US treasuries, with $332.0 million in tokens issued from its On-Chain US Government Money Fund. This gives it a market share of just over 38.6%.

Issuers of yield-bearing stablecoins such as Mountain Protocol and Ondo Finance have also proven to be popular. As of February 2024, Mountain Protocol has minted $154.0 million Mountain Protocol USD (USDM) tokens since its inception in September 2023, while Ondo has a market cap of $132.4 million Ondo US Dollar Yield (USDY).

The majority of tokenized treasuries are based on Ethereum, with a 57.5% market share. However, firms such as Franklin Templeton and Wisdomtree Prime have opted to issue on Stellar, which currently has a 39% dominance.

4. The Demand for Private Credit Is Largely Concentrated in the Automotive Sector, Comprising 42% of All Loans

Of the $470.3 million in outstanding loans made by private credit protocols, 42% or $196.0 million are used for car loans. Meanwhile, debts for the fintech and real estate sectors make up just 19%, and 9%, respectively.

Auto loans saw a large increase throughout 2023, with over $168.0 million being lent across 60 loans. The fintech sector took out no new loans during the same period.

Real estate and the crypto trading sectors have received a total of 840 loans, though only 10% of the loans are currently active. The rest have been repaid, while some have defaulted. Notably, 13 loan defaults occurred in the crypto trading sector in the wake of the collapse of Terra and Three Arrows Capital (3AC).

When it comes to the demographics of borrowers, the majority of firms are from emerging markets such as Africa, South-East Asia, Central America, and South America. 42 loans or 40.8% of all loans are from African countries.