Other than the Bitcoin halving, which we’ve previously covered at length, the market is looking for new catalysts to sustain the 1Q24 rally that was triggered by the approval of US spot bitcoin ETFs. The sustained rise in stablecoin issuance and the growth of total value locked (TVL) in DeFi protocols suggest continued strength in onchain activity. Meanwhile, continued platform innovations at the layer-1 (L1) and layer-2 (L2) levels joined with improved wallet tooling for better user experiences form the foundation of some of the narratives we think will be most relevant in the coming months.

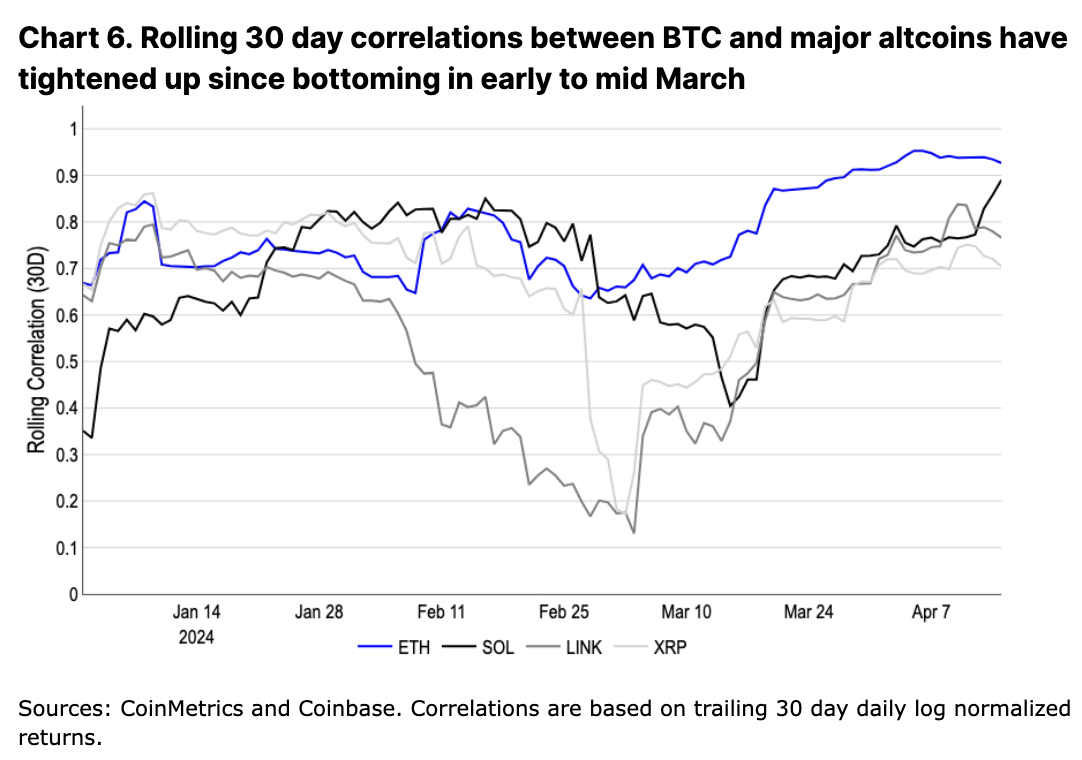

That said, we think that activity in the short term is more likely to be driven by macro factors, even as crypto fundamentals overall remain strong. These factors are largely exogenous to crypto and include increased geopolitical tensions, higher for longer rates, reflation, and rising national debts. Indeed, the recent elevated correlation of altcoins against BTC underlines this, indicating BTC’s anchor role in the space even as BTC firms its position as a macro asset.

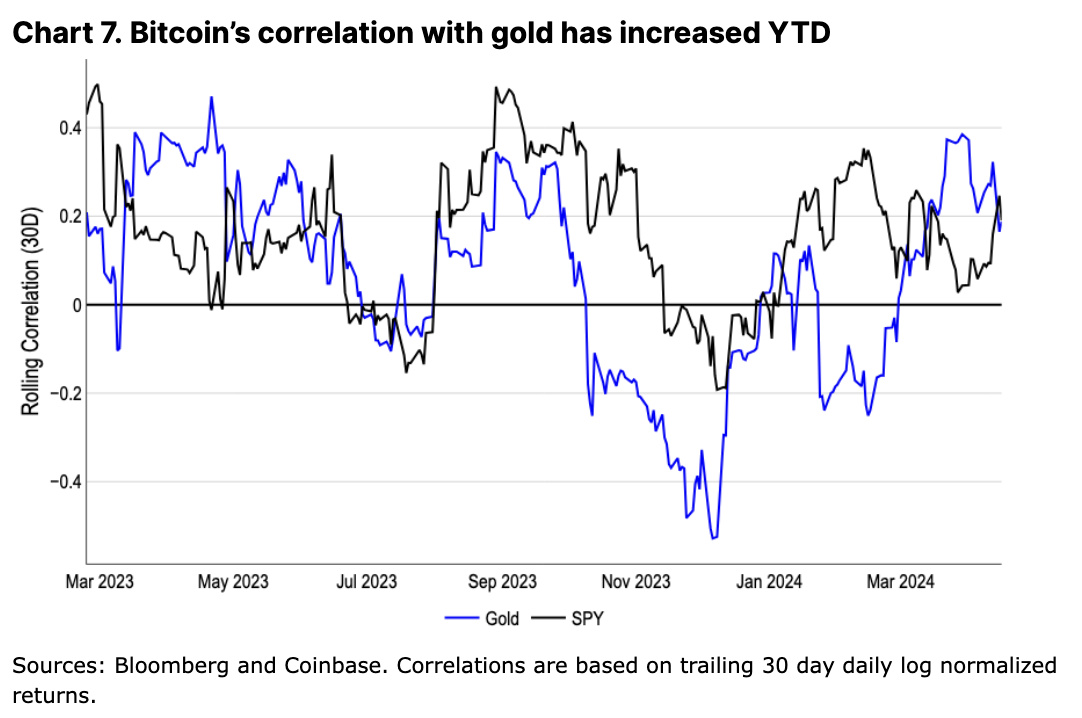

While crypto historically has largely been seen as a risk on asset class, we believe bitcoin’s continued resilience and the approval of spot ETFs has created a bifurcated pool of investors (for bitcoin in particular) – one which sees bitcoin as a purely speculative asset, and another that treats bitcoin as a “digital gold” and hedge against geopolitical risk. We think a growth of the latter camp in light of broader macro risks partially explains the reduced magnitude of pullbacks we have seen so far this cycle.

Post-halving patterns

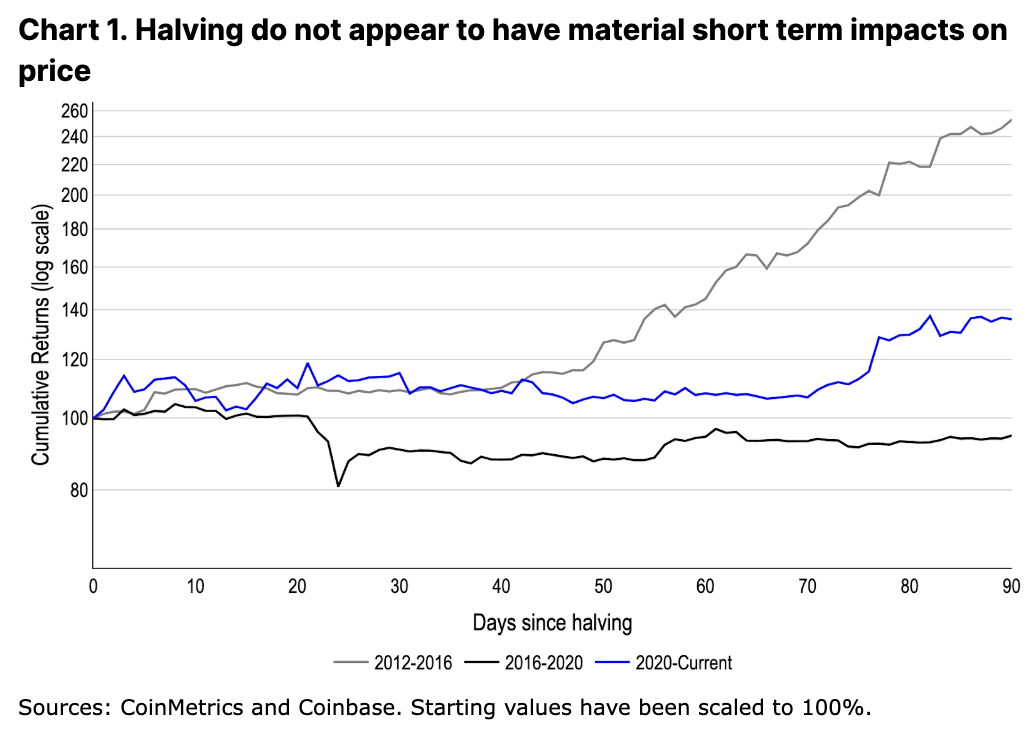

Prior halvings have often been accredited for initiating cyclically bullish trends, though the immediate effects of halvings appear to be largely immaterial in the near term. In fact, BTC traded down 19% in the month following the 2016 halving, while remaining broadly unchanged more than two months following the 2020 halving (see Chart 1). Likewise, we don’t anticipate this coming halving to be a tightly traded narrative, though we feel its relevance in flows has been somewhat overlooked as a result – at $63,000 BTC, the halving equates to a $10.3B reduction in annual BTC issuance, a similar magnitude of offset to BTC outflows as the $12.4B net US spot BTC ETF inflows to date.

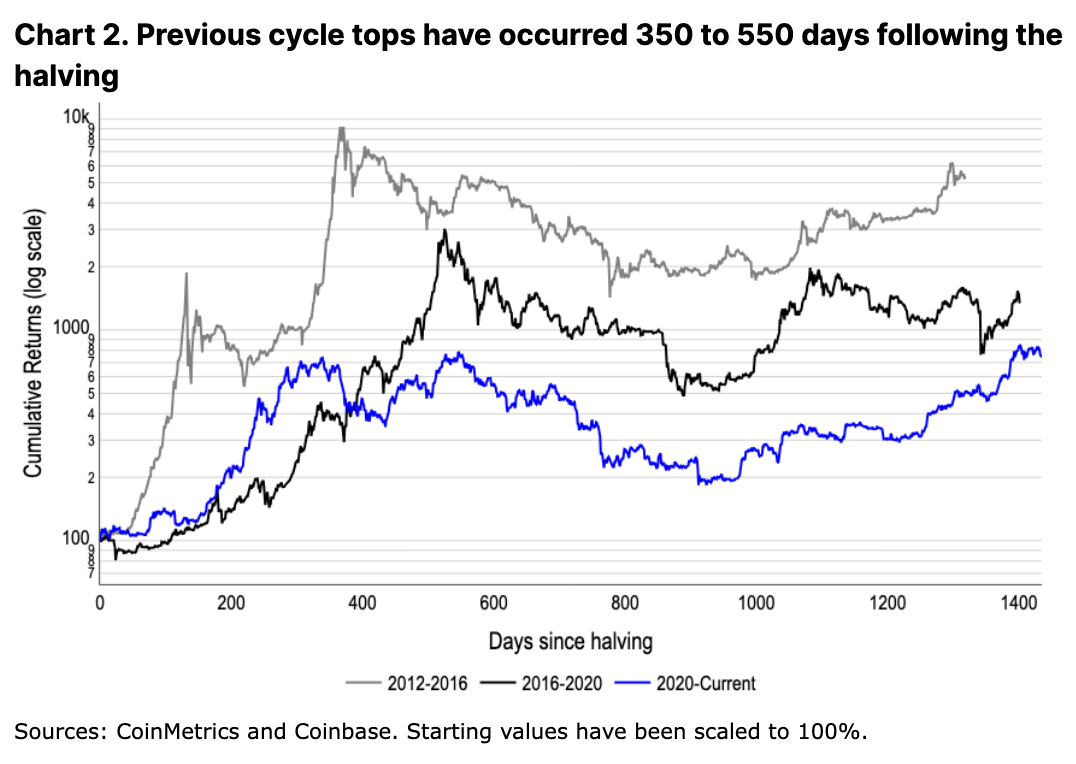

Indeed, we believe that the increased access to a wider capital base via spot ETFs coupled with new supply-side dynamics are long term constructive for the asset class. This could take months to fully realize, however, if previous cycles are any indication. Post-halving tops have occurred between 350 to 550 days after the event (see Chart 2), though this cycle timing is already different. Bitcoin reached new all time highs more than a month prior to the halving on the back of spot ETF inflows, and we could expect further deviations from previous timing trends.

Halvings have not only been bullish for bitcoin, however. As this industry has matured, constructive narratives in parallel crypto verticals have also typically taken place following halvings. In the wake of the 2016 halving, the Initial Coin Offering (ICO) boom carried euphoric markets well into 2017. LIkewise in 2020, DeFi summer kickstarted the rise of decentralized applications (dApps) like Uniswap and Maker, which unlocked nearly two years of experimentation in DeFi primitives and other early stage products.

Sources of liquidity

The number of crypto verticals today have ballooned ten-fold as new tooling and use cases emerged. Blockspace has never been cheaper nor has the amount of “things to do” onchain been greater. Social apps like Farcaster are seeing promising early adoption, while a range of polished blockchain-powered games are starting to come online. Improvements to wallets have empowered developers to deploy a more seamless onboarding journey, and DeFi primitives continue to expand into sectors like liquid restaking and novel onchain derivatives. At the same time, major inroads are being made in tokenization projects across different financial products and jurisdictions, and the overlap between onchain financialization and offchain physical assets continues to grow. Much of this has been powered by the incredible growth in infrastructure groundwork built during the bear market.

We think this could lead to a divergent pattern this cycle where more distinct sub sectors simultaneously outperform (rather than an industry concentration around one or two major themes). Particularly in a world of standalone applications (with blockchain components abstracted from the user) belied by ever-increasing technological complexity, the variation across token and revenue models has become increasingly wide. This breadth has enabled new forms of revenue streams that were generally not available in previous cycles. For example, BonkBot, a telegram bot partnered with the BONK community, regularly generates more than $100k/day in fees (with a peak of $1.4M fee revenue in a single day).

We further believe the distinction between crypto verticals this cycle could cause more pronounced rotations of capital between sectors. Indeed, we have already seen some signs of this through the early attention on artificial intelligence (AI) projects followed by an outsized focus on memecoins and restaking.

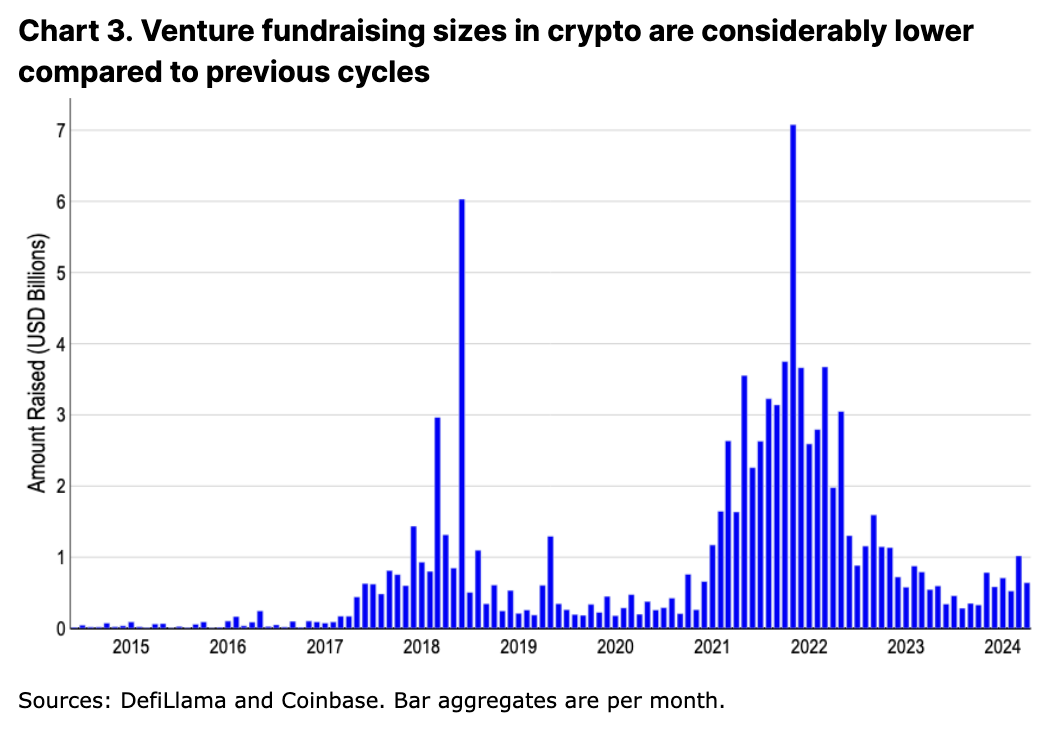

The muted levels of crypto fundraising (relative to previous cycles) bolsters this view. It reduces a major avenue of new liquidity for higher beta assets. Average fundraising amounts in 2024 remain under $1B monthly, below even 2017-18 levels and approximately one quarter of that seen in 2021-22. This reduction in funding is as much a byproduct of harsh previous cycle fallouts as it is part of a more macro pullback. Private markets have broadly contracted in 2023, and venture capital funds in aggregate have raised the least amount of capital in 6 years, down 60% since 2022.

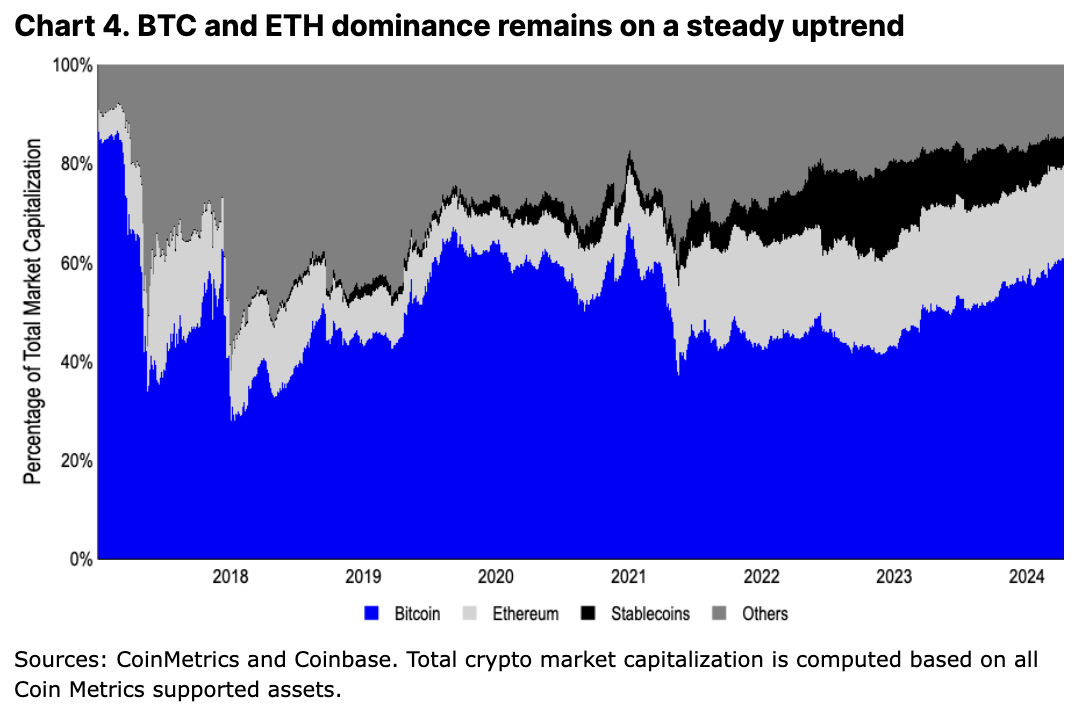

The relative dearth of fundraising begs the question of how liquidity is being injected into the space. Spot ETFs are certainly one major avenue we’ve discussed previously. They unlock access to a much wider pool of capital ranging from registered investment advisors (RIAs) to potential allocations by other managed funds. Blackrock, for example, has laid out plans to incorporate spot bitcoin ETFs into its Global Allocation Fund. However, these capital inflows are limited to BTC (and possibly ETH in the future), and are unlikely to be rotated further down the risk curve. Without material changes to this market structure, we think this positions BTC dominance to remain elevated for some time.

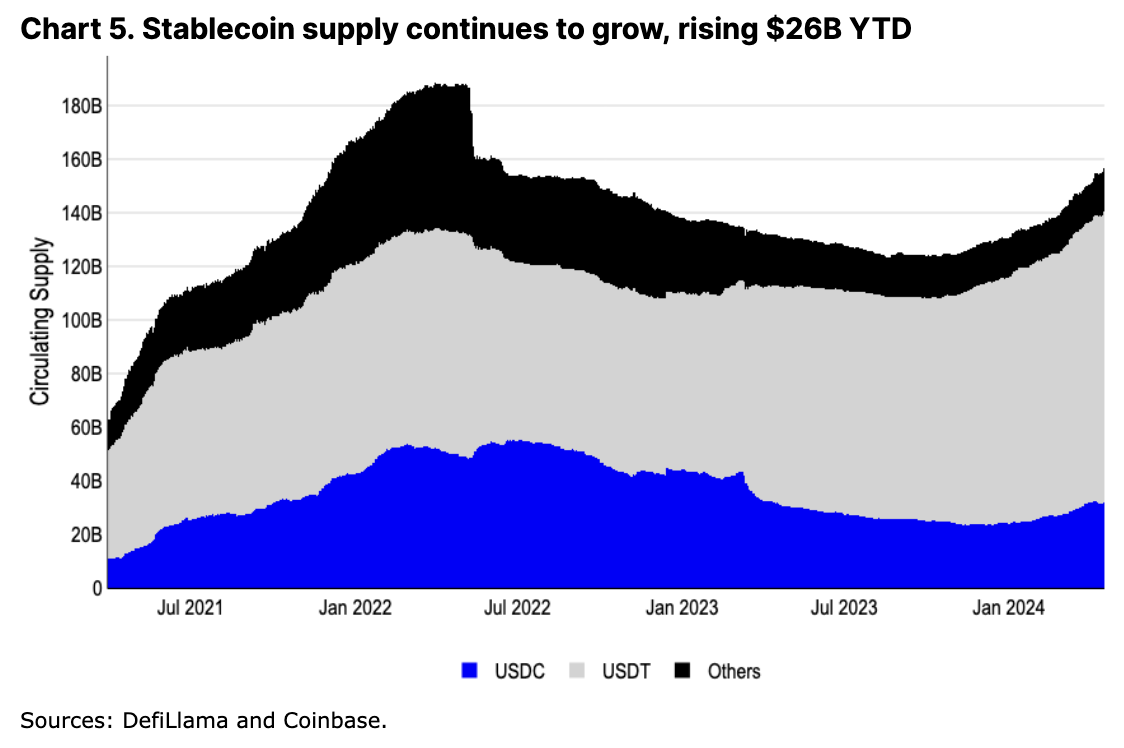

On the flipside, we think the primary means of injection to altcoin liquidity – outside of leverage – comes from net stablecoin growth. Stablecoins are involved in a majority 65% of the $2.6B of average daily trading activity on decentralized exchanges (DEXs), and are further used by a number of centralized exchanges (CEXs) as trading pairs. While the total stablecoin market cap remains below its peak in 2022, the combined issuance of USDC and USDT has already breached all time highs, and is continuing to climb. If we discount the impact of the now defunct TerraUSD on total market cap, stablecoins holistically are in fact near their previous all time highs.

Mulling over the macro

While we anticipate the rise of future catalysts endogenous to crypto, we think the macro picture will play a more major role in the near term. Indeed, macro tailwinds have also been important following previous halvings, possibly even more so than crypto-native catalysts. The primary effects of the 2012 halving were bolstered by the impact of the Federal Reserve’s quantitative easing program and the US debt ceiling crisis. Likewise, in 2016, Brexit and a contentious US election may have stoked fiscal concerns in the UK and Europe. The COVID-19 pandemic in early 2020 also resulted in unprecedented levels of stimulus that drove liquidity sharply higher.

We believe this cycle is no different and that the macro environment today is similarly important for bitcoin and cryptocurrencies more broadly. The recent flushout of leverage following heightened conflicts in the Middle East has reset funding rates to near zero. Continued warfare in the Ukraine-Russia front and separate tensions in the South China Seas also paint a global picture of uncertainty. We think the rising importance of geopolitics globally amidst the broader trends of deglobalization and reshoring are likely to be a defining macro characteristic of this cycle. This is particularly true in the event of a risk off environment. Following unclear market directionality, correlations between BTC and most other cryptocurrencies have consolidated upwards after decoupling somewhat during the runup in 1Q24.

Bitcoin’s rising correlation to gold in March and April amidst concerns of higher inflation also signal its increased footing as a sensitive macro asset in the absence of crypto-specific catalysts like spot ETF approvals. This behavior is promising regarding bitcoin’s proposition as a store of value, though we think this narrative has actually already been reinforced during the recent bear market.

Bitcoin saw strong bidding amidst uncertainty around the US debt ceiling in January 2023 as well as during the subsequent regional banking crisis in March that year. Compressed price appreciation (like the one experienced throughout the past 6 months) could distort this signal somewhat as it introduces an element of speculation and euphoria. Still, we believe that bitcoin’s value as a geopolitical hedge has contributed to more aggressive dip buying thus far where maximum drawdowns have been limited to 18% (compared to 30%+ in previous cycles).

Separately, the rising level of US national debt is another theme bitcoin proponents have honed in on. The Congressional Budget Office has forecasted $870B will be spent servicing national debt in 2024, up from a 2023 record of $658B. Certainly, this is cause for concern and is driving inverted yield curves in bonds in our view – higher for longer interest rates may be fiscally unsustainable as US national debt comes up for refinancing.

That said, even as the pace of the US’s debt burden is growing, it’s also possible for the US to grow its way out of debt (or balance the budget by reducing spending or raising taxes, though this doesn’t seem likely in the short to medium term with incoming elections). Stronger than anticipated GDP growth and high employment figures are likely to increase overall tax earnings. While we do not think current growth rates could offset the entirely of the increased debt burden, it’s not a possibility to fully discount. Together, these risks of geopolitics, inflation, and national debt are poised to form the macro backdrop for this cycle.

Conclusion

Bitcoin halvings are innately constructive events, all else equal, though we think the macro environment and tangential breakout crypto verticals have historically played a major role in catalyzing the cyclical bull market. While this process has historically taken place on the order of months, it varies across cycles – the changing market structure with major ETFs inflows and reduced venture funding are likely to contribute to some of this cycle’s uniqueness in our view.

We further believe that the previous cycle cemented bitcoin’s sensitivity to global liquidity following COVID-19 induced stimulus. However, global liquidity no longer appears to be increasing in similarly large clips, and has taken a backseat to more material instability both domestically and abroad. In light of this, we think that this coming cycle will center as a test on bitcoin’s store-of-value narrative bolstered by a wider dispersion of crypto catalysts across different verticals.