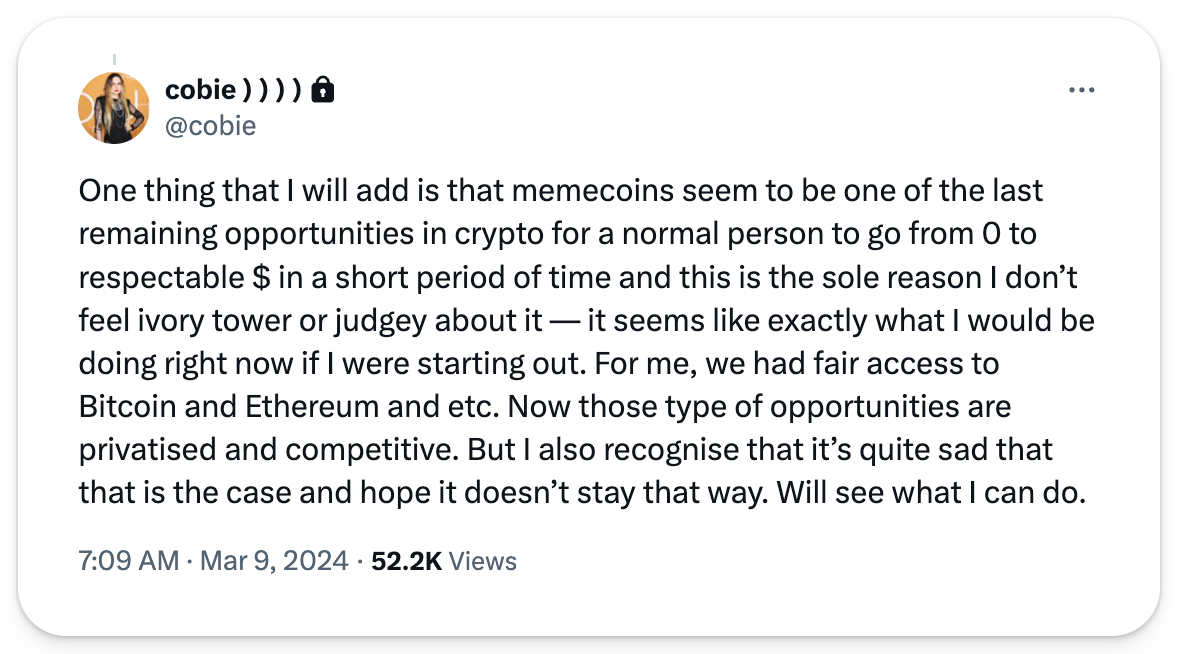

We're back in the Wild West of bull market gains.

Tokens can surge from the ground in an instant, and volumes can take networks to market caps that would be unimaginable in less bullish times.

To trade in crypto, whether altcoins or memecoins, you must stay ahead of the curve.

Retail investors need to have the right toolkit to find the right tokens at the right times and ensure they don't miss opportunities.

In this article, we’re outlining 5 indispensable tools to put in your token-hunting arsenal. 👇

🔴 Dexscreener

A newcomer’s dream and a veteran’s ally, Dexscreener rapidly became the go-to platform for those hunting memes and altcoins.

With its real-time data streams giving you the ability to examine charts down to five-minute intervals, Dexscreener stands out as the Swiss Army knife for spotting budding memecoins across 30 chains and tracking them as they flourish—or flounder.

Furthermore, Dexscreener’s iOS and Android apps mean you always stay in touch with the market's pulse, thanks to the ability to enable push notifications tailored to percentage changes, price targets, or price moves in set periods of time. If you’re looking to ride the waves of token launches on Solana and Ethereum, or even just keep a finger on the pulse of DeFi, Dexscreener will be your lifeline.

🔴 Arkham Intelligence

Arkham Intelligence shines a light on the often opaque nature of blockchain transactions, offering users a peek behind the curtain of anonymity.

Arkham boasts many features, from an on-chain intelligence marketplace where users can trade intel related to specific wallet addresses to tools that showcase a wallet’s current/historical holdings as well as their overall profits and losses (PnL).

Together, these tools allow traders to curate a list of high-signal holders to inform your allocations, whether you’re investing or trading. Like Dexscreener, Arkham also lets you enable real-time push notifications to update you on the movements of particular wallets, with delivery options including Telegram, email, or even Slack — your choice.

Another great feature comes from its ability to identify the top holders of tokens, providing insights into whether they are experienced onchain actors, identifiable by their use of an Ethereum Name Service domain (ENS) or activity as an OpenSea user, or if they are simply throwaway wallets.

Overall, whether you aim to uncover the next big thing, safeguard against fraud, or simply track the movements of influential wallets, Arkham’s AI-powered intelligence platform offers a suite of tools to unearth insights on the blockchain.

🔴 Zapper

Zapper transforms blockchains into a social media platform, helping you navigate trending DeFi apps and tokens, veteran DAOs, and NFT collections with ease.

This monitoring can be filtered by network (i.e.; Base, Arbitrum, ETH) or a number of other qualifiers, including top holders of tokens, recent buy and sell orders, or the most profitable traders. This user-friendly interface invites both novices and seasoned voyagers to track their digital footprint across networks while also digging deeper, monitoring portfolios, and even swapping or bridging assets across EVM chains. Further, it doubles as a SocialFi platform, providing the ability to create or enter token-gated chats if you choose.

Overall, Zapper approaches the blockchain as a social network – which it quite arguably is — laying out trending tokens, projects, and NFTs in a familiar, easy-to-read format to help you keep up with its breakneck pace.

🔴 DefiLlama

In the land of DeFi, where the ground shifts almost daily, DefiLlama stands out as a tool for tracking where it's moving, monitoring Total Value Locked (TVL) across all DeFi, blockchains, and the dApps built on top of them.

With an easy-to-use database, DefiLlama allows users to get a birds-eye view of the DeFi landscape overall, evaluating trends like stablecoin flows and volumes over specific time frames while also enabling users to zoom in on particular ecosystems and protocols to analyze trends — like how token prices correspond to TVL or user growth over a set time. Further, it tracks raise announcements for new protocols, categorizing them by type and backers to help you pattern match.

Whether you’re analyzing market volumes, peering into protocol revenues, or tracking the moves of venture capital, DefiLlama ensures you have the most current and comprehensive data at your fingertips.

🔴 Coinglass

For those who tread in the more nuanced waters of cryptocurrency derivatives, Coinglass provides an indispensable resource.

This platform stands out for its comprehensive data on cryptocurrency derivatives, such as futures trading volumes, open interest — both frequently referred to for identifying the market’s fear or greed —and the quite useful Bitcoin Rainbow Chart.

The Rainbow Chart can help users navigate Bitcoin’s volatile market cycles, offering insights into whether the flagship cryptocurrency currently appears to be over or under-bought and the action one should take as a result. As you can see above, it also depicts the lessening of Bitcoin’s volatility as it matures, giving a sense of what area on the chart and at what price Bitcoin might peak at this cycle. With Coinglass, you can transform educated guesses into calculated decisions.

🏴 In our current bull market, every second and satoshi counts, making these tools not just conveniences but essentials.

From the real-time tracking of Dexscreener and the environmental insights of Coinglass to the sharp analysis from Arkham, the data aggregation of DefiLlama, and the familiar format from Zapper, each tool adds unique capabilities to your crypto arsenal.

Whether you’re a day trader, a long-term investor, or somewhere in between, leveraging these tools can mean the difference between thriving and merely surviving in the dynamic world of crypto.