Introduction

Telegram trading bots burst on the scene last summer, offering the market a much-needed fun new concept in the midst of a lethargic bear market. Trading bots were a major driver in the memecoin rally that pushed PEPE to ~$1.5B market cap in Jul. 23.

The bot narrative lost steam as the memecoin phase subsided, but trading bots have continued to gain users and add new features. Despite such a small sample size, Telegram bots clearly have a lot of potential, which we previously explored in Ghosts of Cycles Past. In this report, we will unpack Telegram trading bots’ impressive fundamentals and discuss their role in the DEX landscape moving forward. Are telegram bots a profitable niche, or income giants just getting started?

Telegram Bot Onboarding

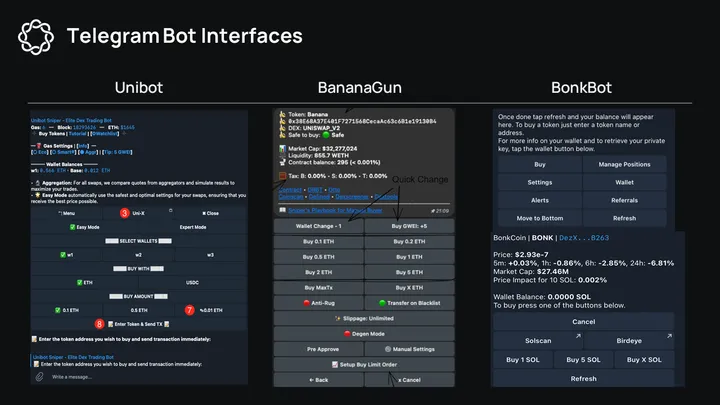

X/Twitter, Telegram and Discord are crypto’s main arenas. Bots have had a role in Discord and Telegram groups for a long time, integrating with the platform API and allowing users to conveniently fetch protocol related updates, prices or recent trades. Telegram trading bots take this a step further, allowing users to provide commands and execute trades over chat without ever leaving the Telegram app.

Trading bots generate private keys for the user within the app, allowing them to interact with smart contracts and complete a variety of on-chain tasks from within Telegram. The onboarding process involves adding a bot’s Telegram channel and following a string of simple commands that generate a private key within the chat. Users can import the private key to a wallet app such as Metamask for a more familiar desktop experience in addition to Telegram’s on-the-go accessibility.

Bots offer users a makeshift mobile experience within a familiar environment, but come with some security concessions.

- Private key generated on the internet (hot wallet)

- Custodial wallets with private keys stored in the cloud

- Mobile use brings increased risks due to SIM swaps and other attack vectors

- Most telegram bots are closed-source and lack transparency. users rely on audit results for trust.

- Centralized components could allow personal data or order flow to be exploited

Due to these risks, users should limit these wallets to minimal cash balances, and transfer excess capital to cold wallets on a frequent basis. The reluctance of users to migrate to DEXs after repeated failures from CEXs suggests these risks will not inhibit Telegram bots’ growth.

Telegram bots offer many quality of life features for avid traders:

- Rapid trading experience (<1 second)

- Sniping token listings

- MEV protection

- Anti-rug

- Limit orders, stop-loss

- DCA orders

- Auto buy (paste contract address, bot buys instantly)

Competitive Landscape

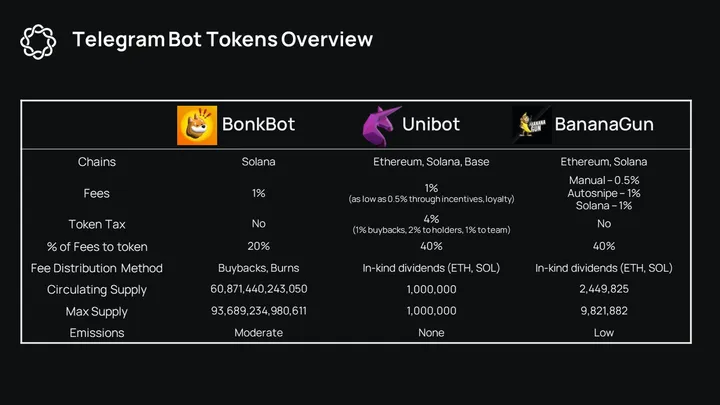

Maestro was the first telegram bot to gain traction, dominating the scene since its launch in Jun. 22. Unibot and Banana Gun utilized a native token to create a flywheel, distributing a portion of fees directly to token holders. A tax on the native token trades helped to bootstrap revenue, resulting in impressive ETH yield, often above 30% APR.

BananaGun has established itself as the leading trading bot on Ethereum, overtaking Unibot and Maestro with unique features and a competitive advantage in sniping and fees.

‘Sniping’ refers to the process of users engaging in gas wars to earn top of block trades and get first access to new token listings. It is a key element of memecoin launch trading. Banana catered to snipers early with extensive features and customization. Banana’s lead in sniping creates economies of scale, as more users bidding leads to higher overall tip value, leading to more Banana bundle wins. This has allowed Banana Gun to win nearly 88% of bundles, 8x more than Maestro in second.

Solana’s rise in Q4 2023 rejuvenated memecoin interest and attracted lots of new users. Solana’s architecture and cheap fees allow for additional bot features such as DCA orders. Unibot was the first of the established bots to deploy on Solana, beating Banana by a week. Despite only a small head start, Unibot has won significantly more volume on Solana so far, and is catching back up to Banana in aggregate market share.

Solana represents a massive opportunity for Unibot, Banana Gun, and other new trading bots. Solana trading bot landscape has thus far been dominated by Bonkbot, which is servicing a staggering amount of volume and fees.

Anecdotally speaking, users seem to regard Bonkbot as a less refined experience than Unibot and Banana Gun, having a higher frequency of issues and being later to add features like copy trades, sniping, and limit orders. Bonkbot’s first mover advantage and memecoin network effects have been instrumental in its rise, but it could be vulnerable as established bots settle in on Solana. Bonkbot’s effort to defend its market share in the lucrative Solana ecosystem will be a key theme moving forward.

Saturation of Telegram bots is an additional threat for Bonkbot, Unibot, and Banana Gun. Last week, 16 Telegram bots serviced over $100K volume. Given the profitability of the business, there is a large surface area for unique token designs lure market share away from established leaders. This happened once with Unibot and Banana Gun’s token tax boosting their growth at the expense of Maestro.

Token Fundamentals

Unibot

Unibot was the first Telegram bot with a high profile token, and has become the unofficial blue chip of the sector. The token supply is fully diluted, it has a digestible fee structure, and a strong revenue share bolstered by a token tax. But there are several recent headwinds curbing Unibot’s momentum.

Token Tax Reliance

Unibot charges a 4% tax on all UNIBOT token swaps. 50% of this fee (2% of all trading volume) is distributed to UNIBOT holders alongside bot revenue share. This token tax has been popular among other telegram bots, including Banana Gun, and can be an effective way of jumpstarting the bot user acquisition flywheel. However, the tax is a steep cost that will hinder projects as they mature. CEX listings act as a potential workaround for the token tax, rendering it a regressive tax on on-chain users, who theoretically drive the most value.

The token tax is being phased out, with BananaGun and others moving away from it. Unibot is in an awkward position here, as the token tax makes up an alarming portion of its total income. 78% of Unibot’s cumulative revenue on Ethereum comes from the token tax. This is a result of UNIBOT’s high amount of trading volume and its decline in market share on Ethereum. Unibot is not in a position to deprecate the tax while it makes up such a large portion of income.

As the telegram bot that started the bot narrative last summer, Unibot has earned its spot as the proxy speculation vehicle for this narrative, and in many ways deserves the tax revenue. Unibot’s tax income is certainly an asset in this regard, but it’s an alternate source of funds, not a core part of the business, and should not be relied upon moving forward. It will continue to dwindle as CEXs list the tokens and users voice disapproval.

Token Split

Unibot is splitting off its presence on Solana under a new token, UNISOL. The justification for this move is that the Solana deployment is under the purview of a different team etc. The token split has been a divisive topic within the Unibot community. The original token split plan received a significant amount of backlash, prompting the team to respond to criticism with a amended path forward.

As it currently stands, UNIBOT on Ethereum will remain unchanged, earning 40% of fees and 50% of the token tax revenue. UNIBOT will also earn 50% of the revenue share from Solana (presumably 20% of total fees) and will be airdropped UNISOL. UNISOL will earn the other 50% of revenue share on Solana and will not have a token tax.

The APR from Ethereum bot fees alone trends in the low single-digits. Solana bot fees and token tax fees both contribute more to total APR than Ethereum bot fees.

UNISOL could be an interesting play as it will represent a concentrated spinoff on the part of Unibot that is working. Depending on their valuations, there could be an opportunity to sell UNIBOT for UNISOL after the airdrop and come out ahead, considering Unibot on Ethereum is starting to become a token tax play.

Wash Trading Accusations

Unibot has seen an impressive start to its time on Solana, supporting far more volume than Banana Gun despite only a small head start. This growth is unsurprising, considering the onboarding initiative in which there are no fees for major pairs plus WIF. X user bobtherebuilt recently posted a thread claiming 70% of Unibot’s Solana volume was wash trading between zero-fee pairs such as USDC-USDT.

The analysis gained a lot of discourse, and it remains likely that a significant amount of Unibot’s Solana volume is wash trading or airdrop farming, though likely less than 70%. The original analysis included popular pairs like SOL-USDC as wash trades, and Unibot’s user and fee growth on Solana is impressive. Nonetheless, the wash trading claims had enough validity to cast additional doubt on the current direction of the project.

If Unibot can capture sustained growth on Solana from fee paying users and put the token split controversy behind them, Unibot could get back on track.

Banana Gun

Banana Gun has been consistently grabbing market share for months and is proving the viability of a low cost, user-centric approach to growth. The main question mark for BANANA is low circulating supply and its massive ~64% treasury allocation. This token structure is often a lingering issue, but these instances are often associated with aggressive liquidity mining campaigns or large insider unlocks. In BANANA’s case, the high FDV may not be material.

BANANA’s non-circulating tokens are made up of the team and treasury tokens. The team has a 5% share of the supply with an 8 year lock up and revenue share enabled, effectively making them preferred shares. These tokens are immaterial in terms of sell pressure and are only relevant for cash flow/dividend forecasting. The team has an additional 5% allocation without revenue share that is locked for 2 years with a 3 year linear vesting period. BANANA in only ~6 months old, and these tokens are largely immaterial for our analysis.

The treasury tokens make up ~64% of the supply and vest linearly (~250K per month) in order to fund the Banana Bonus program. Banana Bonus gives users 5% cashback in BANANA on fees paid. This direct link between volume and emissions is helpful in assessing the impact of the treasury tokens. Since fees on Banana Gun are 0.5% or 1%, there is a soft upper bound of BANANA emissions at 0.0375% of total volume (assuming 50/50 split of trades by fee tier). With BANANA’s current price at $18.39, Banana Gun would need to reach monthly volume of ~$12.3B in order to tap the 250K of monthly tokens vested.

Excess tokens not needed for Banana Bonus or operations are relocked. There can be ad hoc campaigns utilizing vested treasury tokens, however. 10K BANANA were recently used to incentivize users in a ByBit listing vote competition.

BONKbot

BONK is a memecoin first and foremost, and a telegram bot second (among several other products). For this reason, BONK isn’t a perfect candidate for this analysis, but Bonkbot is far too successful to ignore.

Bonkbot charges a 1% fee on each transaction. Fees are used to buyback BONK before being distributed to the following buckets:

- 30% – BonkBot team

- 20% – Referrals

- 10% – Burn BONK

- 10% – Bonk community contribution

- 10% – cover infrastructure costs and future development

- 10% – BonkDAO Multisig

- 10% – BonkLabs

60% of BonkBot fees are effectively controlled by the team, with 20% to referrals or partners, and 20% to the token. Only 10% of fees directly benefits the token, as there is some ambiguity in the community contribution. These tokens likely help support BonkRewards.

Not only does Bonkbot have a lower percentage of revenue share than Unibot and Banana Gun, it uses a less attractive distribution method – 10% fees buyback & burn, 10% fees buyback & distribute native token. Additionally, BONK’s lofty market cap due its status as a blue chip memecoin mutes the effectiveness of the buyback & burn strategy.

BONK does not have a massive non-circulating supply like BANANA, but its non-circulating tokens are significantly more material. BONK currently has ~61T tokens circulating out of ~94T total supply (initially 100T before burns).

The non circulating supply is made up of the DAO treasury and Marketing allocations, which make up 21.1% (15.8%/5.3%) of total supply and are fully vested. There is also a 21% allocation to 22 early contributors, which vest linearly for 3 years starting Jan-23. BONK has a sustainable sink for tokens via burns, and it is important to note that BONK is more than BonkBot.

Bonkbot is able to leverage its strong community through unique initiatives such as its BonkBot Memecoin incinerator program, which essentially licenses the 20% referral fee bucket to partnered memecoins to burn their tokens.

BONK could find itself in an awkward middle ground of memecoin or fundamental based project. Though impressive, BONK’s newfound fundamentals give the memecoin something to anchor itself to. Is BONK a suite of strong products that enjoys a memecoin premium, or memecoin slowly being tethered to to some multiple of a tangible product? BONK is being pursued by bots on the product side, and memecoins that focus on vibes from the community side. If BONK can continue to straddle this line without losing an edge in either, it is poised to perform extremely well. Solana ecosystem DAOs are starting to allocate treasury funds to BONK, a trend that could catch on given BONK’s improving fundamentals.

Telegram Bots Valuation

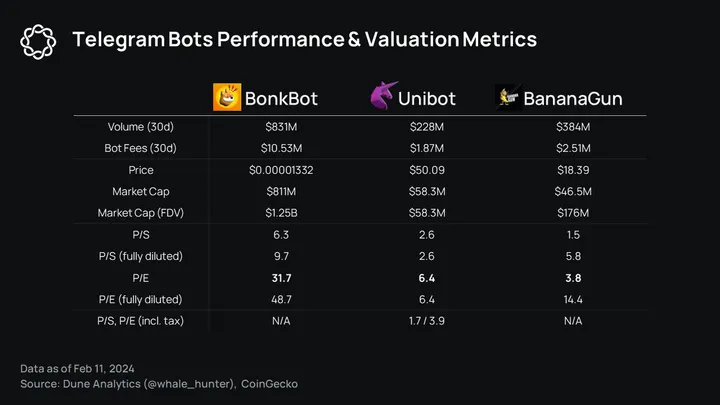

Due to these tokens having an overall friendly outlook for circulating supply, large cash flows and real value accrual, circulating P/E is most relevant comparison metric. Banana Gun’s 3.8 circulating P/E, and 3.9 fully diluted P/E (incl tax) highly impressive, even for TradFi’s standards.

Valuation ratios are calculated using rolling 30d metrics. BONK, UNIBOT, and BANANA’s valuation ratios all exhibit a sharp downward trend throughout 2024 so far. Unibot’s P/E including tax is included in the chart above as a contextual metric. We believe the token tax is a ‘bonus’ on top of the core business and should not be relied upon or included in valuation discussions, but offers insight into UNIBOT’s total return.

Telegram bots’ current cashflows make them priced at roughly fair value according to the zero-growth dividend discount model (DDM) with a 20% discount rate. The zero-growth DDM is typically used for mature companies in low growth environments. As such, the discount rate used in these models will normally fall on the lower end of the spectrum. Telegram bots’ capacity to support these valuations with a crypto industry discount rate makes it even more impressive. The zero-growth DDM valuations assuming 100% of fees are distributed to token holders is included in the above chart for context.

The market is clearly pricing Telegram bots as if they are a flash in the pan. Telegram bots are new and their long term viability is a legitimate concern, which makes the zero-growth DDM a ideal metric to evaluate a bear scenario.

Due to Banana Gun’s impressive growth, the uncertainty of Unibot’s current outlook, and the difficulty of isolating the BonkBot business from the broader BONK initiative, we will take a deeper dive into BANANA.

Banana Gun Valuation

Discounted cashflow has become the default valuation and forecasting method for crypto given our lack of cash flows in many cases. In the case of Telegram bots, the DDM is more appropriate.

Choosing the Discount Rate

As one of only three inputs, the DDM is highly sensitive to the discount rate. Discount rates in crypto range from 15-40%, given the nascency of the industry, its higher perceived risk, and lack of current cash flow. We will use a build up approach to arrive at the most accurate rate possible and allow for adjustments. The discount rate is made up of several components:

- Risk Free Rate of Return: 4%

- Market/Equity Risk Premium: 4%

- Size Premium: 1.5% – While these tokens are considered small cap with the exception of BONK, the financials are characteristic of a large company later in its lifecycle.

- Industry premium – N/A, crypto not mature enough for sector specific premiums

- Emissions premium: 0.27% – Calculated as # of BANANA bought via cash back per $100 in fees at current prices.

- Company Specific Risk Premium: 10% – Yield is paid in ETH/SOL and no services are required to earn yield (i.e. safety module staking). Uncertainty around long term growth potential for Telegram bots, should not assume the business is a going concern.

- Total: 19.77%

The forecast period will be 1.5 years with monthly compounding. The last month will be annualized to arrive at the terminal value. This setup should help capture the unique position of the Telegram bots sector and emphasize short term performance.

Bear: Our bear scenario utilizes zero-growth dividend discount model. The zero-growth DDM is popular for mature companies. This method is ideal for valuing Telegram bots if they are peaking, and assuming they will remain in the sniping/memecoin niche.

Base: The base scenario utilizes an H-model, assuming 50% annual growth rate for 8 months and a 6-month transition period to 2% growth thereafter. This scenario assumes Telegram bots will cede growth later in the year as better alternatives become available.

Bull: The base scenario utilizes an H-model, assuming 75% annual growth rate for 12 months and a 6-month transition period to 5% growth thereafter. This scenario assumes that Telegram bots are still in the midst of their rapid-growth early stage market discovery phase, and will enjoy strong growth throughout 2024.

Given its cashflows, BANANA is slightly undervalued assuming zero growth. The reasonably attainable base and bull assumptions estimate BANANA’s value at $35.11 and $65.4, respectively. The 100% payout ratio acts as the price-to-sales equivalent of the model, giving us a glimpse of how powerful the entire scope of revenue is. BANANA could very easily 2-4x from current levels if its growth continues at this rate.

This upside could be shared by Unibot, Bonkbot, or other Telegram bot upstarts, but Banana Gun has a lot of momentum right now and has quietly been leading this sector for a while.

Searching for Comparables

Banana Gun and other Telegram bots have a legitimate claim to be crypto’s premier cash cows. RollBit also makes a strong case, but isn’t exactly a crypto project as its core business doesn’t exist on-chain. Surprisingly, Telegram bots’ best comparable is Metamask Swaps.

Telegram bots are generating volume and fees in the neighborhood of Metamask swaps and have a very similar business model. At $137.5M, BananaGun has flipped both Bonkbot and Metamask swaps in weekly volume. Bonkbot has led Metamask swaps in weekly volume consistently for several weeks.

Metamask Swaps and Telegram bots are selling convenience, and charging a similar clip for it. Metamask Swaps charges 0.875% fees, which roughly equal to Telegram bots’ traditional 1% fee after discounts. Metamask Swaps’ sustained success suggests that Telegram bots can drive value and grow long term without becoming a polished, end-game worthy mobile experience. Users are willing to pay handsomely to eliminate steps when interacting with dApps.

There is certainly stigma around Telegram bots, supported by their valuations and performance against comparables. This is likely due to trading bots’ proximity to degen memecoin culture. People just aren’t convinced about Telegram bots’ long term prospects, and there is some validity to these concerns.

The Next Wave of Mobile DeFi

Telegram bots offer two key benefits to users: mobile experience and UX improvement. The mobile experience element is the more fragile component of Telegram bots’ value proposition long term. There is a long list of potential threats that may offer a more refined mobile experience than Telegram bots can achieve:

Progressive Web Apps (PWA) + Account Abstraction: Friend Tech dazzled the crypto community with its innovative onboarding flow. This could become a popular playbook moving forward, but is somewhat reliant on cooperation from Web2 powers like Apple and Google who appear to be clamping down on PWAs.

Uniswap app – Uniswap has initiated a 0.15% front end fee and has been pushing its Uniswap Wallet app. Uniswap may be planning to capture value through its front ends long term. If Uniswap were to incorporate its own sniper functionality or equivalent, it could be a major blow to Telegram bots, though it would be a very off-brand move.

X Everything App – Elon Musk has been teasing an X “everything app” recently, rumored to support banking, messaging, media and more. Due to Twitter/X’s existing proximity to crypto, a successful X everything app could be the most serious threat to Telegram bots.

Better Wallets – Metamask Swaps is more than just a swaps product, and wallets will continue to play a bigger role in how users interact with dApps.

Intents, chat optimization – Dialect is a Solana-based telegram bot optimizing around chat based commands. It offers zero fee trading and works with existing self custodial wallets. It offers self custody by functioning as a dApp; it brings the user to Phantom wallet to confirm the transaction and then back to Telegram chat. This experience is more clunky that the Telegram bot experience and resembles a mobile wallet wrapper in its current state, but it is much cheaper and is early sign of where the mobile experience is heading.

The Path Forward for Telegram Bots

Telegram bots offer a brand new way of interacting with smart contracts. Their value proposition is just as much about the ability to bypass the on-chain experience as it is the mobile use.

Trading bots are still new, and the design space will continue to expand. Trading terminals are very popular among CEX users and will pair nicely with Telegram bots simple app experience. Unibot’s trading terminal, Unibot X, is live, and BananaGun is launching one soon. Telegram bots could become a full-stack professional trading front end across desktop and mobile, with an embedded social layer.

Their perpetual proximity to the hot new thing via Telegram makes trading bots well positioned to capitalize on new narratives first and acquire users. The recent craze around Pandora and ERC404 helped drive Banana Gun to all-time high weekly volume and fees. From Feb.7 – Feb.10, Banana Gun’s top 10 pairs were all ERC404 related.

Ideally, we would like to see volume continue to increase while the percentage of trades as snipes trends slightly down. This would suggest that the sniping feature serves as a strong user acquisition tool, while other features retain users and convert them into power users. Otherwise, Telegram bots will likely be highly cyclical as demand is reliant upon narrative shifts to jumpstart greed and speculation.

Metamask Swaps and Telegram bots show us that offering shortcuts for interacting with smart contracts is perhaps the most lucrative on-chain business right now. Telegram bot tokens have strong fundamentals and will likely be one of the best yield plays in 2024. They act as a natural hedge against a stagnant crypto user experience, but must continue to innovate to remain viable in the long run.