Introduction

Despite outperforming the S&P 500, Nasdaq and also Gold, Ethereum has spent most of last year in the shadows of its peers whom saw greater price appreciation and ecosystem growth.

Surprisingly Bitcoin had nearly double the returns and Solana briefly touched quadruple digit returns at the end of 2023.

The sentiment surrounding Ethereum on Twitter wasn’t the greatest either entering the new year. Public support and morale has been at an all time low, and people going long are considered contrarians and heretics. But it seems things are about to turn around with several catalysts in store for the Ethereum ecosystem this year.

With the 2024 Roadmap as our guide, let’s take a look at what’s in store for Ethereum.

#1 EIP-4844 ⚙️

Included in the upcoming Dencun upgrade, EIP-4844 (also known as Proto-Danksharding) introduces novel mechanics that greatly benefit L2s.

Relevant features of this EIP are:

- blobs

efficient means of storing large amounts of transaction data at a low cost; - blob-carrying transactions

transactions that contain a list of references to blobs included in it;

EIP-4844 implementation on Ethereum

EIP-4844 implementation on Ethereum

Utilization of blobs allows a pseudo layer to be created, improving data availability and therefore streamlining communication between L2s and Ethereum.

These new concepts would radically change the way roll-up sequencers post transaction data to Ethereum.

The current method of doing this involves adding bundled transaction data to the “notes section” of a transaction (calldata), and sending that to the L1, which is fairly expensive.

However using blob-carrying transactions to post data to Ethereum would significantly reduce gas fees since only the references to blobs containing L2 transactions are available to the Execution Layer, which means that the blob data can’t be re-executed. All of the data contained in the blobs is stored on the Consensus Layer (beacon nodes) for a limited time. A small trade-off for cheaper transactions are increased block sizes, requiring more storage capacity from nodes.

A large reduction in transaction costs on Ethereum rollups have several benefits. First, it allows for new use cases that currently are too expensive to run on a rollup such as certain order book trading protocols, web3 games and more. Second, reduced costs for posting transactions to Ethereum mainnet also results in the profit margin of rollups increasing. This is therefore also a direct catalyst for L2 tokens like ARB, OP, METIS and more.

#2 ETH Spot ETF 📊

Whereas a spot Bitcoin ETF approval seems likely, the situation surrounding a similar product for Ethereum remains in a state of ambiguity. The SEC, having delayed making a decision on several of these ETFs, will most likely reach a resolution after the Bitcoin counterpart is made available to the public.

Ignoring the disappointing performance and capital inflow of Ethereum Futures ETFs, institutional interest towards a spot product is evident. Numerous well-known entities are actively looking to capitalize on a new investment vehicle that is aligned with the currently relevant ESG meta present in traditional finance.

All of the listing applications are pending at the moment, but a favorable outcome is expected despite the delays. Given the impact the spot BTC ETF filings have had on the price of BTC throughout the second half on 2023, these ETH ETF filings alone could cause ETH to outperform the market over the coming months.

#3 Restaking 🔂

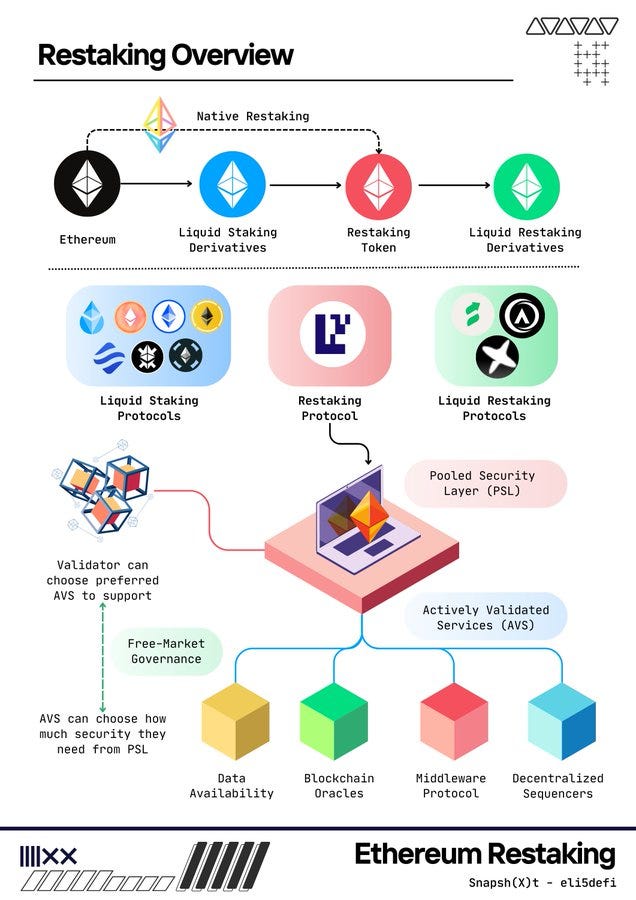

Source - eli5defi

Restaking is a novel concept introduced by EigenLayer in which services can tap into the security and consensus of Ethereum. EigenLayer is a market place for connecting ETH restakers and so-called ‘actively validated services’ (AVS’). Actively validated services can be everything from oracle networks to sidechains to bridges looking to inherit the security of Ethereum. ETH stakers can chose to delegate their ETH to the AVS by restaking their ETH and in return earn increased staking yield. In essence, ETH stakers are able to participate in additional services beyond block validation, such as data storage, computation or something else.

In addition to this being a large narrative for Ethereum and ETH this year, as EigenLayer gears up for their mainnet launch, the platform is doing a points program in which early ETH depositors can farm their upcoming airdrop. With the EIGEN token potentially launching at a multi billion dollar valuation, this airdrop could act as a significant wealth creation event which could turn out to be a positive catalyst for Ethereum native protocols.

#4 L2 Growth 📈

As a result of improved capital efficiency stemming from the Dencun upgrade, currently available solutions will be a lot cheaper, making L2s more competitive in a space where alternatives are fast and cheap. In addition, use cases that were previously out of the question, could now be explored.

The user base of L2s is expected to increase significantly in the coming year, with plenty of promising catalysts on the horizon.

Optimistic Roll-ups

Generating the most buzz in the space, optimistic roll-ups have released exciting details about upcoming developments.

Optimism;

In a bid to unify all otherwise isolated L2s, Optimism has decided to double down on the infrastructure provider idea by attempting to create a network of interconnected chains based on their open source tech stack.

The Optimism Superchain

The Optimism Superchain

All of the chains included in the “Superchain” adhere to the same standard, which ensures maximum interoperability across the board and allows developers to build protocols that can be used by all the sub-chains.

Arbitrum;

By using one of the Arbitrum chains as a settlement layer, builders can easily deploy a dedicated chain with customizable configurations.

Orbit chains are useful for building apps that have specific network requirements, all the while leveraging Arbitrum’s technology with additional functionality suited for various use cases:

- permission access control - reading the chain’s data or deploying contracts can be restricted by the owner;

- custom gas token - transaction fees can be collected in any token;

- self-governance - the Arbitrum DAO does not govern Orbit chains, which means that the owner has full control over their network;

Metis;

Looking to address the centralization and security concerns associated with most L2s using a singular sequencer, Metis is experimenting with the concept of a decentralized sequencer pool. Leveraging it’s already existing peer-to-peer validators, this approach will greatly reduce centralization and give their native token stakers a chance to run their own sequencer.

The Coinbase > Base Funnel

Attracting new users has always been a challenge for L2s due to the tedious process of bridging and having to interact with Ethereum, which is a no-no to certain users that are looking to avoid expensive transactions and want a simple user experience.

As the operators of one of the biggest exchanges in the world, Coinbase attracts a great deal of new users to their platform year over year from all over the globe.

Global number of verified Coinbase users from 1st quarter of 2018 to 4th quarter of 2022 (in millions) - data is sourced from Statista

This is the perfect scenario for Coinbase to advertise their L2, Base to their mostly centralized exchange native audience. Having a huge addressable market helps increase visibility and awareness of on-chain applications. Coupled with a simple bridging solution between the exchange and the roll-up, even a small conversion rate would be a big net positive for the ecosystem.

Eclipse

Another interesting development in the rollup-space is Eclipse, an Ethereum L2 launching later in Q1. Eclipse is unique in the sense that it uses the Solana Virtual Machine for the execution environment, Celestia for data availability and Risc Zero for proving. With a focus on attracting Solana dapps to Ethereum, this could pose as yet another catalyst for the Ethereum ecosystem this year.

#5 ETH as Money💰

In terms of fee generation, Ethereum alone accounted for more than 50% of total fees generated by L1s across the board in 2023. It’s dominance has now weakened, largely due to the emergence of Bitcoin’s ecosystem following the ordinals craze.

Strictly looking at financial reports, Ethereum is one of the few major blockchains with positive earnings.

Since the Ethereum network generates more in fees than it dilutes the token supply with emissions, ETH can provide a net positive real staking yield as the nominal staking yield is not offset by inflation. Due to token burns introduced in the London upgrade and the big move to proof-of-stake in 2022, the supply of Ether is shrinking at a rate of ~0.215% a year by being in a net deflationary state.

With new upgrades aiming to scale Ethereum even further and the existing concepts holding their ground, the Ultra Sound Money thesis may have merit after all.

Conclusion 🤔

All in all it will be an eventful year for Ethereum after a slow 2023. The tech and narratives are definitely bullish, but whether the charts share that sentiment is to be determined. Historically network upgrades have been welcomed by favorable price action.