I’ve started to like memecoins and even bought MOODENG.

The FOMO got to me. My default expectation is that the price will go to $0, but I don’t want to miss out if it becomes the next Doge. I want to be part of the success story. Part of that bullish community.

Indeed, buying memecoins, more than other utility tokens, comes from an inherent need to belong, to be part of a story, and to join a community that shares the optimism of “making it”.

You see, this optimism and bullishness is hard to find in other crypto sectors.

Ethereans expect just a 3x to 4x pump for ETH this cycle, with BTC possibly doing the same. SOL might reach $1,000. For low-float, high FDV tokens, the general sentiment is quite grim.

It also goes against my promise to myself not to trade memecoins. I won't buy most of those shilled on my X feed, but I'll take my chances on a few that I believe could take off.

I changed my mind because my top rule in crypto is to stay open-minded and try new things. Being a maximalist yourself is risky, but spotting and investing in maximalist communities can be highly rewarding.

So, this blog post explores new developments, particularly focusing on emerging methods of introducing tokens into the market.

Identifying the latest token printing trends could be the most profitable trade we can make. Memecoins is just one of the trends, with others emerging this cycle.

The Short History of Token Printing

Crypto being a hedge against fiat money printing is the biggest lie we tell.

While Bitcoin might be an exception, the crypto industry as a whole prints money in ways that would make central banks envious. There are 14,741 cryptoCURRENCIES listed on CoinGecko, with thousands more that don't survive long enough to make it there.

And each cycle money printing gets easier.

I talk about the token printing history in detail and what to expect this bull run a year ago, but I must quickly recap as the blog post is now for paid-only subscribers.

Here’s a breakdown of the key money printing metas you should know and how it changes the game (feel free to skip this section if you’ve read my previous blog post).

- Litecoin and Early Altcoins Era (2011): Litecoin was one of the first altcoins, launching in 2011 as a fork of Bitcoin. Until Litecoin we believed Bitcoin was the blockchain! But the BTC fork also “forked” our understanding that we can create our own, private money. This era saw a handful of Bitcoin forks and Proof of Work altcoins, including Bitcoin Cash and Bitcoin SV. These fork tokens gave Bitcoin holders ‘free’ tokens during forks, creating opportunities for profit.

- ICO Boom (2017): The ICO boom was fueled by Ethereum’s ERC20 standard, which made it cheap and easy to create new tokens. No need for PoW hardware anymore! Thousands of tokens were launched, each with ambitious promises. ICOs often raised large sums of money, but many projects failed to deliver, resulting in massive losses after the 2018 crash. This was a key phase of speculative “money printing” as teams launched tokens with minimal effort, leading to the market’s eventual collapse.

- DeFi and Liquidity Mining (2020): The next innovation came during DeFi Summer in 2020, when liquidity mining and yield farming became popular. Projects like Compound (COMP) and Susiswap introduced liquidity mining rewards, where users were given governance tokens for participating in protocols. This incentivized liquidity and user participation, but the flood of new token emissions eventually overwhelmed demand, leading to market crashes.

- Fair Launch Era: Short lasting one. Yearn Finance’s YFI token was a notable example of the “fair launch” concept, where tokens were distributed to users without an ICO or pre-sale. It allowed anyone to participate, and YFI's initial farming rewards attracted widespread attention. However, people realized that ‘fair launches’ weren’t fair at all. Pre-mining before marketing were widespread, and teams had little to gain from real fair launch approach, so incentives were not alligned.

- NFT and Ponzitokenomics (2021): The NFT craze, best known by Bored Ape Yacht Club, introduced a new type of money printing. The creation of endless NFT collections mimicked the same speculative token creation that caused prior crashes. Attention and capital eventually diluted, leading to the collapse of many new NFT projects. NFTs are like memecoins but with the size of community was capped due to max 10k NFTs per collection and expensive sale prices excluded many.

While the way we issue “money” into the market differs, the market eventually implodes when the amount of “money” printed overtakes the “harder money” entering the market.

We ended up printing too many tokens to keep up with the demand.

The Money Printing Stories of 2023-2024 Bull Cycle

The first stage of the current bull run was marked by the rise and fall of the points-for-airdrop trend.

The points meta naturally evolved to address some liquidity mining issues. By providing teams with more flexibility to execute TGE and attracting capital to the protocol, it pushed the growth of TVL, “proving” product-market fit. This, in turn, enabled teams to secure higher valuations from VCs.

Initially, it worked wonders as Jito and Jupiter generously rewarded users. However, once the rules of the points-for-airdrop meta game became clear, the ROI from airdrops often turned negative.

Degens leveraged farming to earn points but ended up paying more in interest than they gained in airdrops. Additionally, the points system lacked the transparency that liquidity mining campaigns from the DeFi summer era had.

They made you believe that staking “DYM” or “TIA” you’ll get multiple airdrops (that never came) to make you rich.

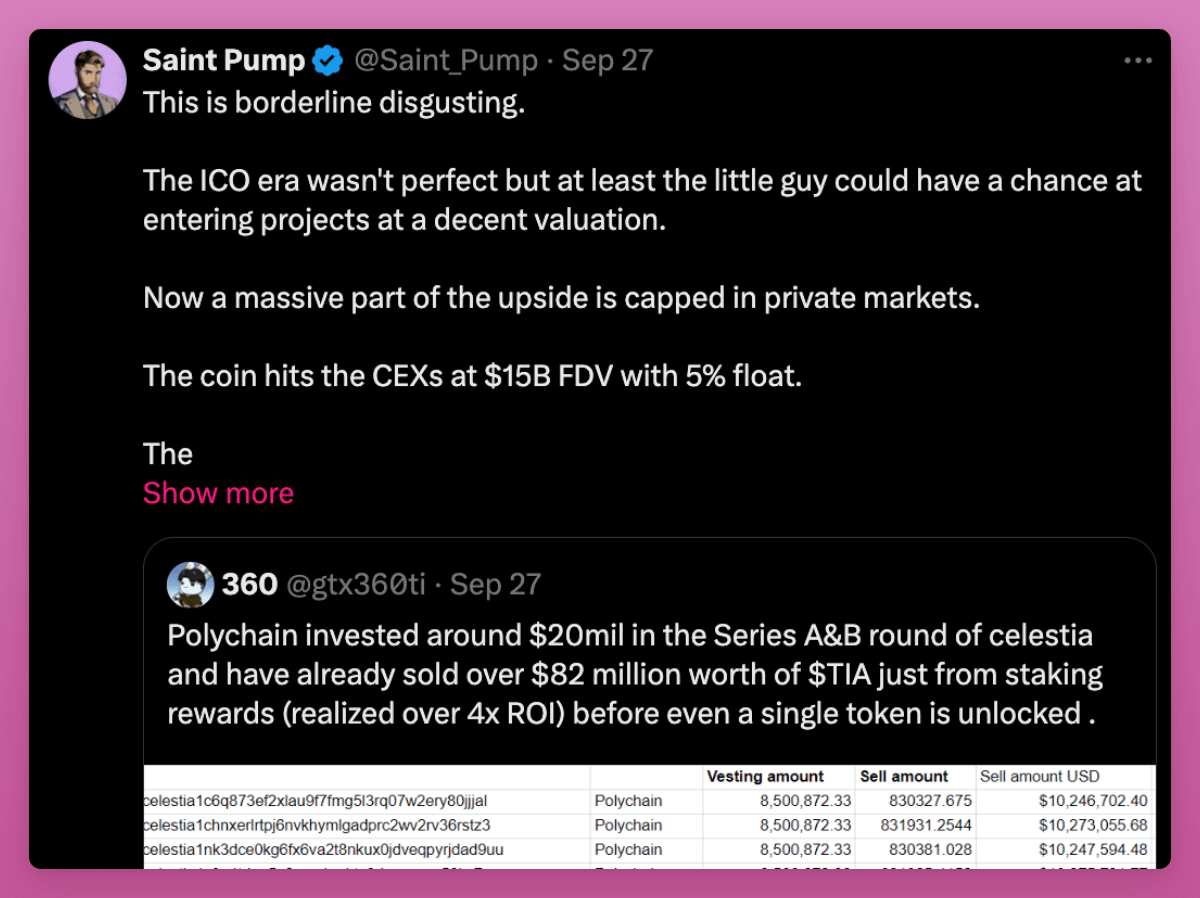

Yet the worst culprit marking the decline of the trend was low-float, high FDV token launches. As TVL grew, the market deemed those protocols more expensive, therefore tokens launched at crazy high valuations that left no upside for new buyers.

High FDV is not a meme, we learned.

Points are not going away altogether but the decline in sentiment and usage is fading away. For example, Eigenlayer decided not to go with Season 3 airdrop and opted for “programmatic incentives” which is a fancy way of saying liquidity mining.

Currently, most major protocols are in their second, third, or fourth season of point farming, and the excitement for new protocols with point farms has waned. I used to share "Top farms of the week" on this blog, but I'm now finding it difficult to identify great point opportunities in the market.

New protocols that missed the points-boat have to innovate with token issuance model that attracts users and make the rich. Here are a few token printing metas that are emerging.

Public-Private Token Sale

ICOs are dead. Long live ICOs.

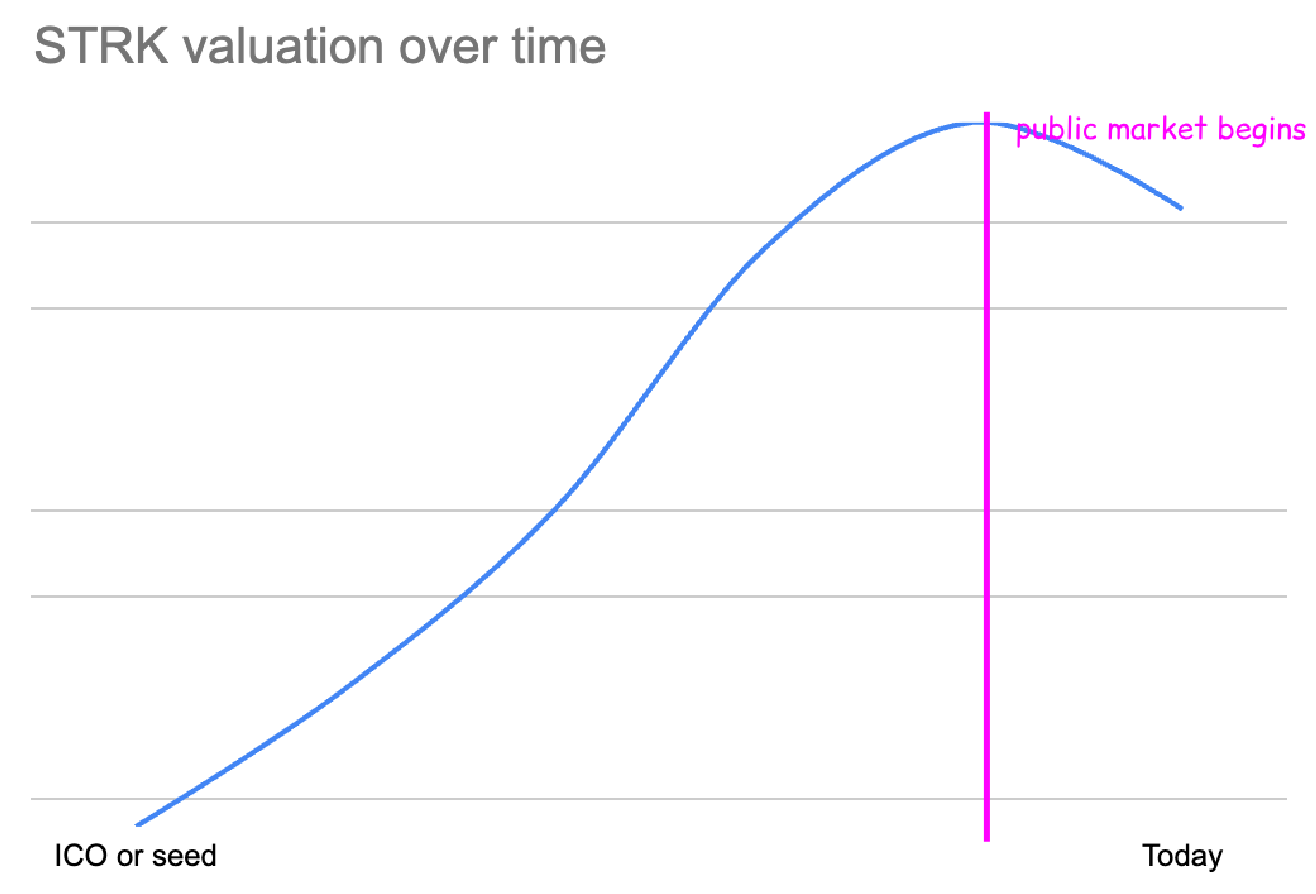

Perhaps the most influential CT trader, Cobie, wrote in his blog post in May, that the current issue with the crypto market centers around new token launches being largely uninvestable for regular participants due to "private capture" of upside.

Most price discovery happens in private funding rounds with VCs, who lock in low prices before tokens are available publicly. As a result, by the time these tokens hit the market, they are overvalued with inflated fully diluted valuations (FDV), leaving little room for public investors to profit. This benefits insiders while public buyers face high-risk, low-reward opportunities.

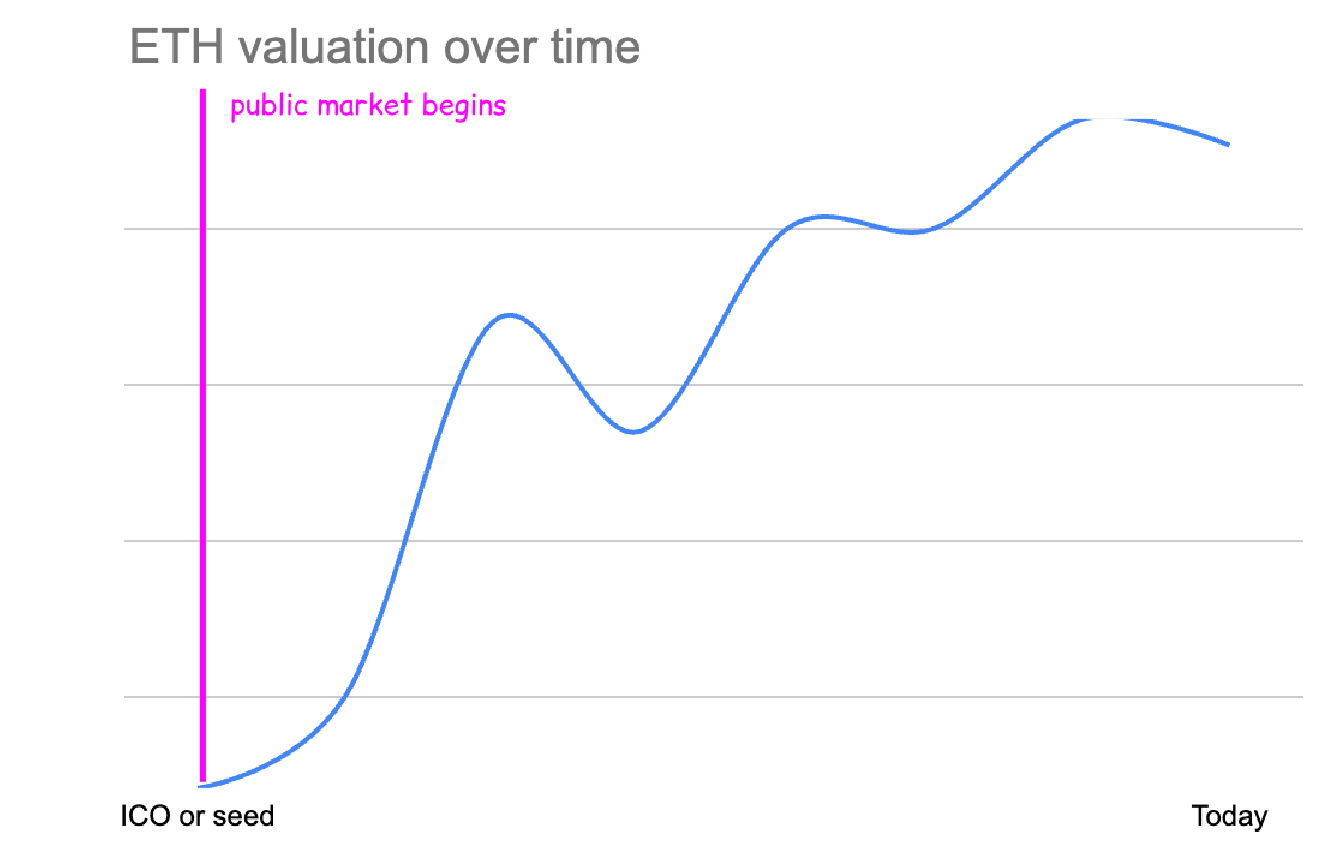

For example, ETH valuation at seed or ICO left huge upside for buyers.

Yet, that’s not the case anymore with low-float, high FDV tokens like STRK, EIGEN or any other from this cycle.

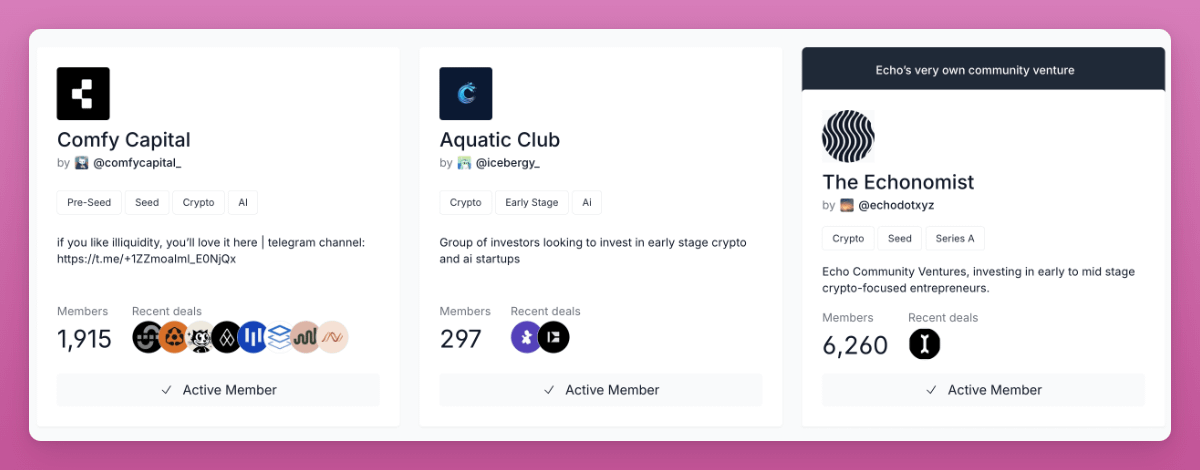

So, Cobie’s solution is the launch of Echo - platform for early-stage investing in tokens.

Here’s how it works:

- Group Leads: “Experienced investors” (or KOLs) create groups and share investment opportunities with members. Group members can then choose to follow and invest in these deals under the same terms as the lead.

- Investments on-chain: All investments happen on Base L2 using USDC

- Smart Contracts: The investments are legally managed by Echo through smart contracts, so the lead investor never directly handles your funds. Only you can decide when to sell your tokens in case of token investments.

- For Founders: Founders who want decentralized, community-driven funding can raise money from Echo groups, avoiding concentrated VC ownership and distributing equity or tokens to real, on-chain native investors.

You need to pass KYC, connect your X or Farcaster account, pass the questionnaire, and then join groups to see the deals.

Their first major deal was Initia, raising $2.5M from at least 500 participants at a $250M valuation, 28.57% lower than the $350M valuation for the Series A (according to The Block). Max ticket size was $5k.

It's cool that Echo participants could invest at a lower valuation than Series A. But this concept largely moves back to early ICO models from the past. Which many of us missed.

Sure, I could create my own group and invite my followers to invest in early-stage protocols together. The protocols could benefit from larger community compared to VC rounds, but this doesn’t solve many of the pain points faced by projects, like larger capital injections, industry connections, strategy guidance, marketing & credibility, and long-term support.

Still, I believe projects can benefit from a mix of fundraising sources: secure significant backing from notable VCs and then join Echo for a community-building round. Like Initia did.

However, Echo is currently an exclusive community and that’s exactly why can be so profitable: Most in demand ICO platforms like Coinlist make it hard to get in. And allocation sizes are very small.

If you can get in, try it out.

“Patron Sales”

I've only done two KOL rounds: Bubblemaps and Vertex.

Recently, I've sort of joined a third one: Infinex. I say "sort of" because it wasn't a typical KOL round.

In a typical KOL round, an influencer is reached by a project offering investment “opportunities” with better terms than those offered to VCs. The catch? KOLs need to tweet some posts about the project. The lack of these shilling terms attracted me to Bubblemaps and Vertex. But what’s the point of having me as an investor if I don’t shill?

Kain from Synthetix approached it differently for the Infinex token sale.

Besides gamified yield farming campaign, he ran Patron NFT sale. I received a DM from Kain telling me I could invest by choosing one of three lock up and valuation terms: Unlocked one, yearly vesting, or 1-year cliff with 2-year vesting for a 75% discount.

Infinex raised $65M from 41k patrons!

In the podcast with Blockworks, Kain argued that the prevalent token distribution methods, which depend largely on airdrops and private sales to accredited investors, are flawed.

He advocates for a fairer approach where everyone, from VCs to influencers and everyday investors, has the same opportunity to purchase tokens at an equal price.

“Everyone is on an equal playing field. And that's the best that you can do, right? Like, if everyone has the same rules, you give everyone as much information as you can. You prevent, you know, someone from FOMOing in that doesn't know what's going on.” - Kain

Like Echo, Infinex is looking from inspiration from the ICO era as well as point trend but adapting it to the current era. Yes, many were influential CT personalities, so the sale puts a large community outside the window. But there were different ways to qualify for the sale (point farming).

Unfortunately, this model might not work for less popular projects. However, I would definitely join more token sales if they offered no-strings-attached KOL sales with options on their website, instead of requiring a SAFT contract with unclear TGE timelines.

But there’s a new trend that allows anyone to join a token sale.

Runes or Other Token Model on Bitcoin

Personally, BTCfi is the most exciting 0 to 1 innovation in crypto this cycle. I had great fun minting Ordinal NFTs and playing with BRC20/Rune tokens.

I admit, infrastructure and UX/UI isn’t great but it’s improving. Still, ORDI (first BRC20 token) was minted for free and reached $1.8B market cap, generating insane profits for early adoptoooors. That’s a success story we should look for!

I held it too, but sold too early…

BTCfi was one of the hottest narratives but the hype ended shortly after Runes protocol launched.

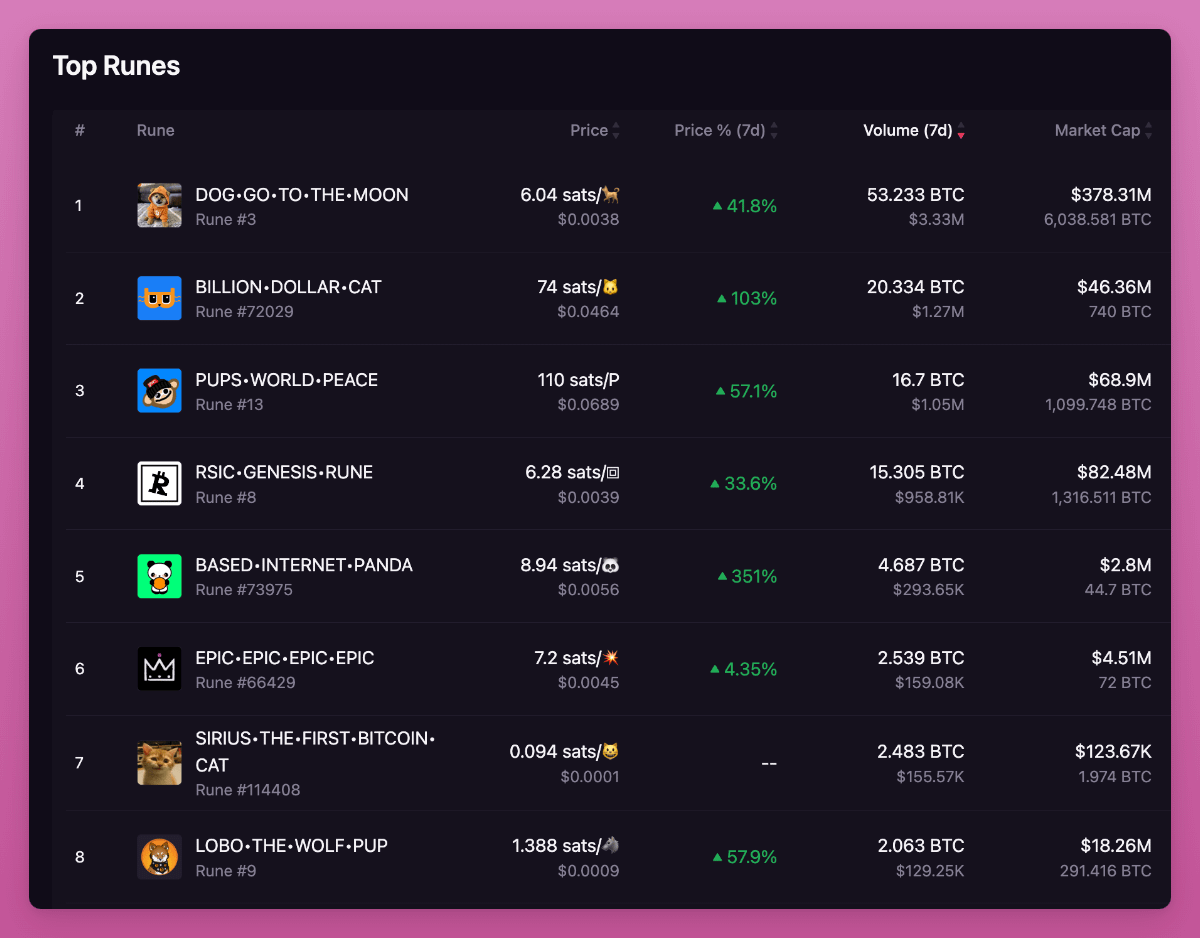

And yet… I still believe BTCfi can do great: infrastructure is improving, community is strong (and is largely based in Asia so you hear about BTCfi less on CT). The prices are also recovering. Check out the top 10 Rune performance of 7 days.

But most important BRC20s and Runes innovation is how they are issued to the market.

Rune tokens can be minted by anyone on bitcoin by only paying BTC transaction fee. To try, go to Luminex and choose a token to mint. Or you can launch your own memecoin and choose a % of premine. This premine will be clearly visible to all.

I am bullish on Runes because they oppose everything we dislike about VC rounds, pre-sales, low-float tokens, and lack of transparency of current memecoin launches. Runes represent the fairest token launch model available.

Additionally, the small Bitcoin transaction fee and very slow transactions adds just enough friction to prevent overprinting of tokens and concentration in a few wallets that memecoins on other chains suffer from.

I believe there’s a need of a new catalyst to instill a new FOMO wave.

Currently, Fractals L2 is having a moment so perhaps it will build hype for Runes as well as Runes can first be minted on Bitcoin and later bridged to Fractals (or other Bitcoin L2) where they get smart contract capabilities.

On a side note, Fractal’s token FB is mined like BTC, and you can join cloud mining by renting PoW machines. Due to high inflation FB is going down only.

Finally, a new token standard on Bitcoin might prevail, perhaps through the OP_CAT upgrade leading to innovative token models.

My point is that fairly launched tokens on Bitcoin have immense speculative potential, and it's worth your time to closely follow the BTCfi ecosystem.

Tap-to-Earn Ton Mini-Apps

Tapping phone screen is not my favorite activity to earn money.

Yet, Ton and Telegram enabled tap-to-earn mini apps have amassed millions of users. Users, that are often not based in the US, therefore most of the CT is missing out on the new narrative.

In my previous post, we wrote about what makes South Asia a unique crypto market.

We learned that for many in third-world countries, tap-to-earn airdrops provide a new source of income amid economic challenges. This better aligns with the promise of blockchain to democratize crypto, making it accessible to everyone, not just the wealthy who benefit most from the point-to-airdrop model.

But after the craze of DOGS, Catizen, and Hamster it’s not clear what comes next. All tokens are on dumping mode right now, so a next catalyst is needed for Ton mini-apps to attract a new degen crowd.

Become the first to notice the trend change to profit the most.

Memecoins

Memecoins are tokenized communities.

Murad done amazing job explaining the value proposition of memecoins in the video below. He explains clearly how memecoins are superior to many utility tokens at the current state of the market (VC unlocks, lack of transparency, regulatory problems…)

However, he only presented one side of the memecoin story.

His screenshot showcasing memecoins' outperformance overlooks that 99.5% of them dump to zero within a day or two.

Contrary to his optimistic view, memecoins are typically launched by insider groups with large premined supplies, promoted by KOLs who either got paid or received significant allocations, and are ready to dump on new buyers.

There’s no real community of it. Just selling the illusion of a community. That’s the reason I stay away from memecoins: finding the real gem in the pile of shit is messy and time consuming. You can burn your capital very fast by jumping from memecoin to memecoin. So, you’ll just better off holding BTC.

Yet, memecoins is the sector with the most bullish community in crypto. This greediness is key feeding ground for a real gem, a Doge contender, to appear. That’s why I’m not 100% giving up on memecoins.

Plus, this cycle platforms like Pumpdotfun innovated by introducing a fairer launch mechanism to prevent insider trading, solved initial liquidity problems using a dynamic bonding curve, and mitigated many security risks.

A good bet might be on memecoin launchpad tokens like Ethervista or the upcoming Rush platform. I know the people that build Rush, so shouldn’t be a rug. Can use my link to join waitlist. However, exercise caution: the Ethervista token has been declining since its launch.

Repackaging + New Token

Old coins are boring and degens want new stuff.

What if you could change your brand name, create a new token ticker, and start fresh with a new chart? That’s exactly what’s happening. I first wrote about this trend in June.

We’ve got multiple rebrands like MATIC to Polygon with the new POL token, Orion changing to Lumia (ORN to LUMIA tokens), Covalent (DA protocol for AI era) migrating from CQT to CXT token, Connext rebranding to Everclear (and introducing new tokenomics), and many more!

Most interesting example is Fantom migrating $FTM to $S, as well as Arweave launching AO Protocol.

Arweave decided to launch a new token for AO Protocol (AO) instead of using AR. Makes sense as AO is a different protocol, but the beauty of it is mining AO token by simply holding AR in your wallet. Money printing brrrrrr!

Unfortunately, token performances of these rebrands don’t give much hope for the trend. Perhaps only Fantom rebrand is picking up steam while even Polygon is struggling this cycle.

Still, keep an eye on rebrands that gather community interest. It shows that the teams are still here, haven’t abandoned the protocol, and are still building.

Community/Social Tokens

Fucking FriendTech and 0xRacer.

One of my biggest mistakes of the cycle.

They had the opportunity for a consumer app that might have reached beyond crypto degen crowd. But they chose the easy path to scam people.

In any case, FT changed the industry by normalizing usage of Privy to improve user experience and popularizing Social Tokens.

In FT v1 social tokens were based on KOL personality, and in the V2 the goal was tokenizing communities.

Like memecoins, community tokens are centered around the community, providing access to an exclusive club.

The most successful example is the DEGEN token, which was recently listed on Coinbase and pumped by 127%! Initially, it was a community token airdropped to active Farcaster members. Personally, I earned ~$40K USD from simply posting on Warpcaster.

The beauty of DEGEN lies in its community-driven launch and its integration into Farcaster, thanks to the platform's open nature. Tokens like DEGEN reward participation, helping to solve the classic chicken-and-egg problem of social platforms: users don't post because there aren't enough users. By generously rewarding early members, other social apps can adopt a similar strategy. Lens had their own airdrop

My point here is to try out new decentralized social applications, like Phaver (I got 250 USD airdrop for a few posts on it, too).

However, their utility within a specific app limits their adoption. DEGEN decided to launch their own L3 to expand so keep an eye on what other community tokens decide to do.

Cherry on top: We are very likely to get Farcaster, Lens, OpenSocial and other SocialFi tokens.

What to Look for This Bull Run?

The best returns come at the start of a new, emerging meta. Liquidity mining, point farming, fair launches, and NFT mints have generated millions for early adopters. My mission is to identify these new token minting trends and find ways to capitalize on them.

A good signal of high potential is initial confusion mixed with love or hatred from the community. As long as people care, pay attention.

Study how this token minting creates a flywheel effect, where early users are rewarded and incentivized to stay in the ecosystem. It may seem like a Ponzi scheme, but the best money-printing mechanisms often share similar features.

And remember to always keep an open mind. Try new things and let me know if you find something interesting!