There’s a popular belief in crypto that you need to survive three crypto cycles to truly make it: One to get rekt and learn important lessons about how crypto works, the second to make some gains and feel comfortable, and the third to achieve generational wealth.

For me, this is the second bear market and soon will be the third bull run. My body is ready.

Every part of me feels like I've experienced this current stage of the crypto market before. Because I did. Specifically, the 2019-2020 market cycle.

But I’m not simply talking about the downtrend price movement. It’s the entire sentiment: the regulatory crackdowns by governments, the general population's indifference or accusations of crypto being a scam, and the PvP mode of rotating one gains from one token to another.

If you joined crypto during the last bear market or even before that, you might feel the same way. This familiarity is a huge advantage, as your past experiences in crypto sets the stage for the next bull run to come.

Every bull and bear market is slightly different, but the big picture remains largely similar.

This blog post is about how the past can teach us on the beginnings of the next bull market, based on my own experience.

The Déjà Vu Market

The first bull run & the crash

Déjà vu is a phenomenon of feeling as though one has lived through the present situation before. While this moment usually lasts for just a few seconds, the current crypto deja vu stage lasts for a few years.

I joined crypto late in 2017, after being exposed to BBC articles on how BTC kept reaching new all-time highs. My first-ever FOMO kicked in.

I bought some BTC and it doubled in price in no time. I felt euphoric and thought I was so smart and early to a new financial paradigm. This euphoria soon grew into confidence that I could make much more money if I invested in newer and cheaper tokens.

I Googled the top exchanges for altcoins as my first-ever exchange (Bitstamp) didn't have many shitcoins, and somehow found Gate.io CEX. I liked their old UI because I could clearly see all the tokens by symbol and, most importantly, logo.

I did some ‘research’ by reading their websites, whitepapers, and all of these projects looked revolutionary. Decentralized supply-chain management, decentralized storage, DECENTRALIZED BANKS! The FOMO got stronger.

I kept putting more of my scholarship money into these tokens, but at one stage there were too many of them and they all looked similar, so I decided to spray and pray without much due diligence by... color of token logos. I think red tokens ended up outperforming the market.

Long story short, I lost most of my money. How could that be? I diversified my portfolio, read whitepapers, and believed the projects would deliver on their promises to build their products.

They all disappeared without building anything substantial. All there was is just a website and a whitepaper.

This is a common story among newcomers to crypto. The combination of greed, naive belief in new ideas, and a lack of experience/knowledge about how crypto markets operate leads to disaster. Many lose too much and ultimately abandon the crypto space. However, those who stay and learn from their mistakes have a better chance of succeeding.

I, too, felt disappointed yet curious about what went wrong.

That curiosity serves as my primary motivation for continuing to write about crypto. While my blog sponsorships may not bring in much money, it keeps me engaged and informed about the market trends that truly matter. In this post, I will cover two of those trends.

The second bull run & the crash.

The curiosity mixed with greed are powerful reasons to wake up in the morning.

After the BTC crash in 2017-18 I continued to be interested in crypto and followed all the news. In late 2018, this passion for crypto lead me to the first job at a Korean CEX where I spent ~4 years. It was a great experience as I learned how the market makers work, analyzed hundreds of tokens, talked to their teams, and attended a dozen of conferences.

But the market was boring & quiet. This relative quietness of the market is just one similarity to the current market stage. Other similarities include:

- Regulatory crackdown on ICOs, especially in Asia vs regulatory crackdown in the West right now.

- Crypto being called a scam, dead and a ponzi at least 385 times to date.

- Waiting for institutional adoption: Start of BTC buying by institutions vs. spot BTC ETF right now.

- Rotation of crypto gains from one token to another without increasing the total size of the crypto market

- Waiting for crypto mass adoption.

There are many more similarities, but common claims that there’s nothing to do in crypto right now are nothing in comparison to the last bear market.

Back in 2018-19 there was indeed little to do. There was no DeFi, no NFTs, all my trading and holdings were on CEXes. The most fun was IEOs (Initial Exchange Offerings), and probably the EOS token sale, which raised the record braking $4.2B and delivered (almost) nothing.

The market was pretty much devoid of excitement.

Yet, seemingly out of nowhere, things started to change. In early 2020, I discovered a new hot token AMPL (Ampleforth) that completely changed my understanding of tokenomics. It was the first token with elastic supply.

AMPL’s smart contract increases or decreases the total supply automatically based on the target price, between $1.06 and $0.96—a process called “rebasing.” If the price goes over $1.06, at 2 AM the protocol will automatically print more AMPL in order to bring the price down to the target. If the price goes below $0.96, the protocol will burn excess tokens. Long story short, it means that you don’t own a certain amount of AMPL, but a percentage of the supply. Investors see their AMPL tokens increasing or decreasing, which is not the usual way things work with any other currency. - Be(in)crypo.

It was new, exciting, and it earned me money. I didn’t really grasp the point of it (speculation on what others do during rebases is the main one), but I liked seeing the number of AMPL tokens growing in my wallet. It was a new hot thing, and there were very few back then.

Soon more new hot things started to appear, with the most exciting ones being BAL, and COMP token liquidity mining. They rewarded protocol users with free tokens proportionally to how much you deposit to their smart contract.

It was a WTF moment. And the WTF moment is always when you should pay attention!

Because once in a while, a token model appears that is so innovative that it changes the trajectory of the industry. The originality of new tokenomics pushes the industry forward and can jump-start a new bull market - My take on the top 5 innovative tokens from DeFi summer.

Why would they give tokens for free? Didn’t really make much sense at the beginning as previously you either had to buy new tokens in ICO/IEOs or do million tasks for a $5 USD airdrop.

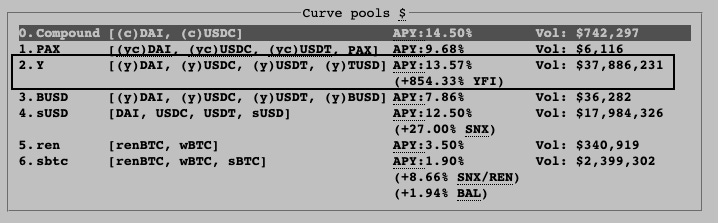

The craziest was Yearn Finance YFI token emissions. By simply depositing my stablecoins to Curve, I earned free YFI at a rate of 1000%+ APY.

Things got weirder and crazier with SushiSwap liquidity mining. The mechanics was to deposit ETH/USDT to earn SUSHI or buy SUSHI and deposit it into the ETH/SUSHI LP farm to earn more SUSHI.

This Pool2 token mechanism is a true Ponzi because the price of SUSHI would only grow if more people joined.

Tens of Pool2 farms launched and collapsed daily. The game theory to win was simple: Enter first, farm as much tokens as you can, and dump when the new money entering was less than token emission+money leaving.

Eventually, the sheer number of new hot farms diluted the attention and amount of ETH/USDT that would enter these new farms that kept popping up daily. They all collapsed as the token price decrease led to lower APY, and subsequently, the TVL left to where yields were higher.

But this collapse was an important lesson and a pattern that keeps repeating in crypto, which ultimately offers the best opportunities in crypto. If you know when to exit on time.

How Bull Market Start and End.

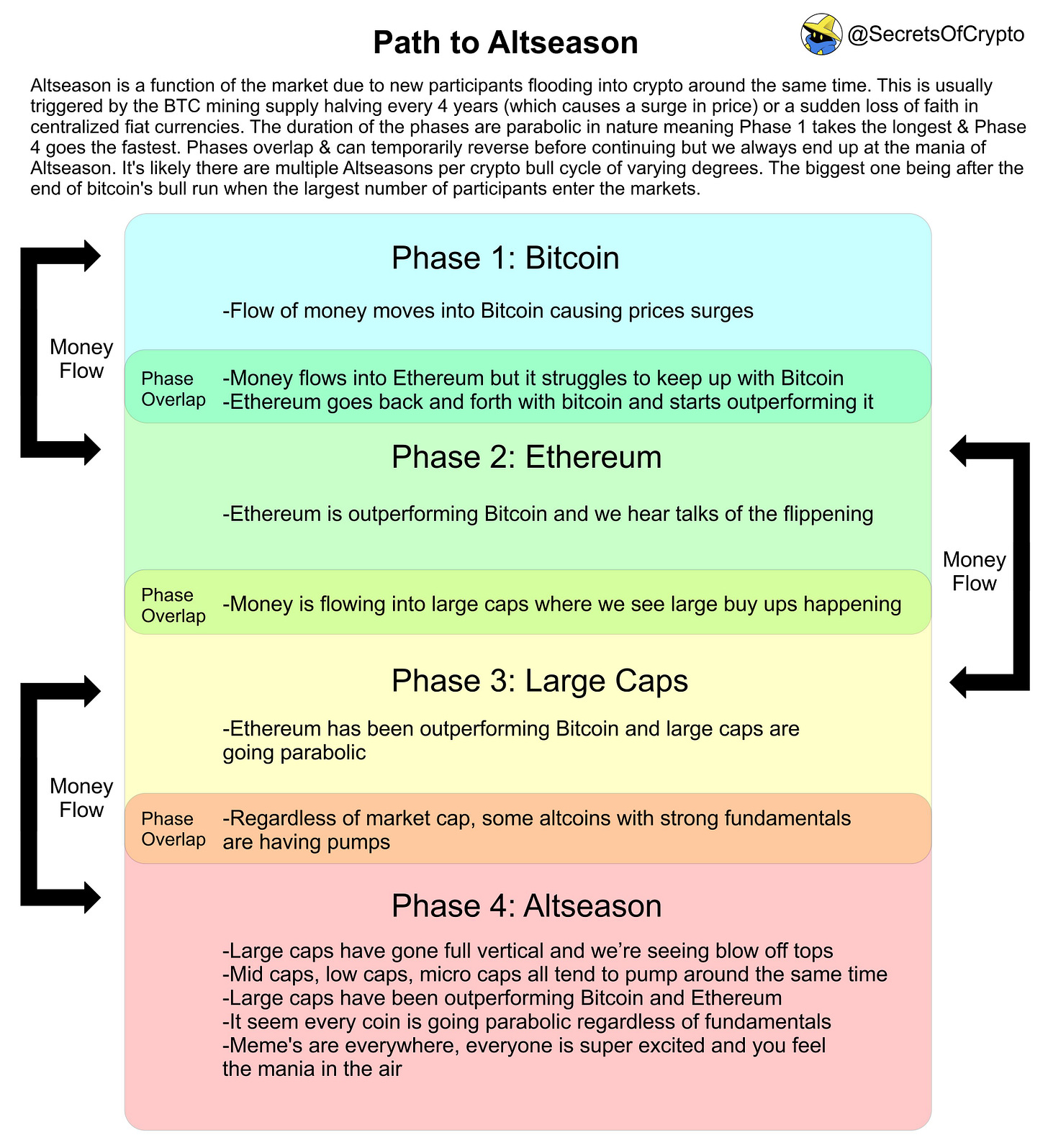

The below summary of "Path to Altseason" by SecretsOfCrypto offers a great summary of how money enters the crypto ecosystem via BTC and trickles down to altseason.

But I believe there's one more key ingredient for the bull story: the innovative money printing.

And by this, I don't mean the money printing carried out by central banks, which certainly benefits crypto prices. What I'm referring to is the money printing machine inherent to crypto.

In crypto we claim to hate money printing by central governments because it dilutes fiat’s purchasing power, increases inequality, and ultimately leads to collapse of the currency.

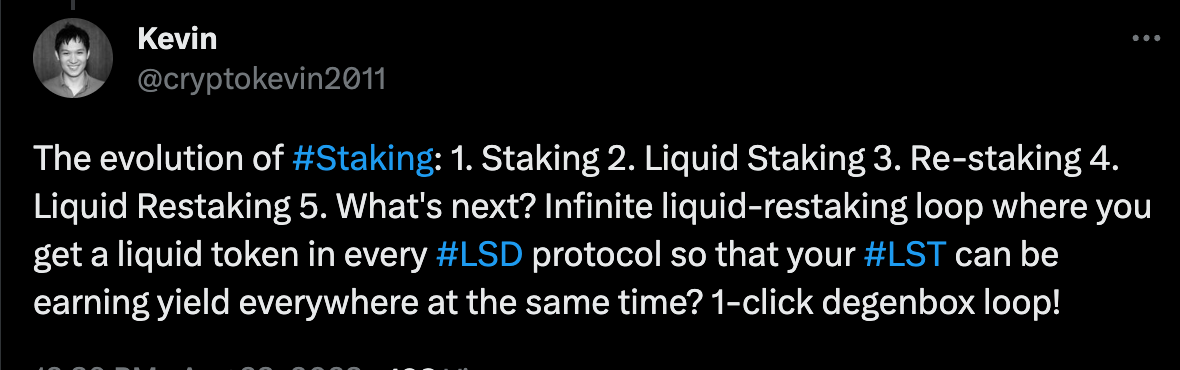

Yet, crypto industry is the best at printing money, and it gets easier with every bull market.

Consider this: After Bitcoin first launched, it took a few years until prominent competitors emerged. Litecoin was the first altcoin, launching in 2011. Then Ethereum launched in 2015. Later years were marked by Bitcoin forks such as Bitcoin Cash, SV, and Gold. It was the original layer 1 season.

But it was expensive to launch a new coin, as these Proof of Work machines require electricity to maintain network security.

Issuing new tokens became much easier and cheaper thanks to Ethereum smart contract-enabled ERC20 tokens. Now anyone could issue a token at a low cost. Thousands of new tokens were launched with just a website, whitepaper and big promises.

However, the most significant impact of Ethereum and ERC20 was not technical; it was social. Before ERC20, coins were primarily regarded as currencies for payment or as a store of value. But with ERC20, tokenization became possible for everything. The use cases of cryptocurrency multiplied alongside the rise in crypto prices.

Then, seemingly out of the blue, the prices collapsed.

The crash occurred because the money flowing into the crypto system couldn't sustain the exponential growth of new tokens being launched every day. We ended up printing too many tokens to keep up with the demand. Additionally, with a larger number of tokens in circulation, attention became diluted, leading to a general sense of confusion regarding where to invest.

Then the similar patterned repeated during the DeFi summer.

During this time, protocols distributed tokens for free to users through airdrops to liquidity providers or users. The stated purpose of these tokens was more humble and ethical this time around: to decentralize the protocol in line with the crypto ethos.

Back in 2017, during the ICO bust, it seemed like everything needed a token for utility. Now, in the DeFi space, protocols require a token for governance. We're still predominantly at this stage, but disappointment in DeFi governance is rapidly increasing.

However, the true underlying motivation behind these tokens was, and still is, to bootstrap liquidity. Without liquidity, protocols such as Aave, Uniswap, or Curve hold no value.

Like in 2017, the crash in DeFi occurred when the daily issuance of tokens outweighed the amount of money entering the system. It was a different story, but same underlying reason for the crash.

Interestingly, NFTs also experienced a crash for the same reason. Crypto Punks and BAYC generated FOMO among those who missed out, resulting in the creation of new NFTs. However, the market eventually imploded when attention and new NFT inflation couldn't sustain the price levels.

Currently, only a few NFT collections have managed to survive, leading me to believe that the NFT market may be approaching its bottom.

The New Bull Market: New Stories, Same Mechanism.

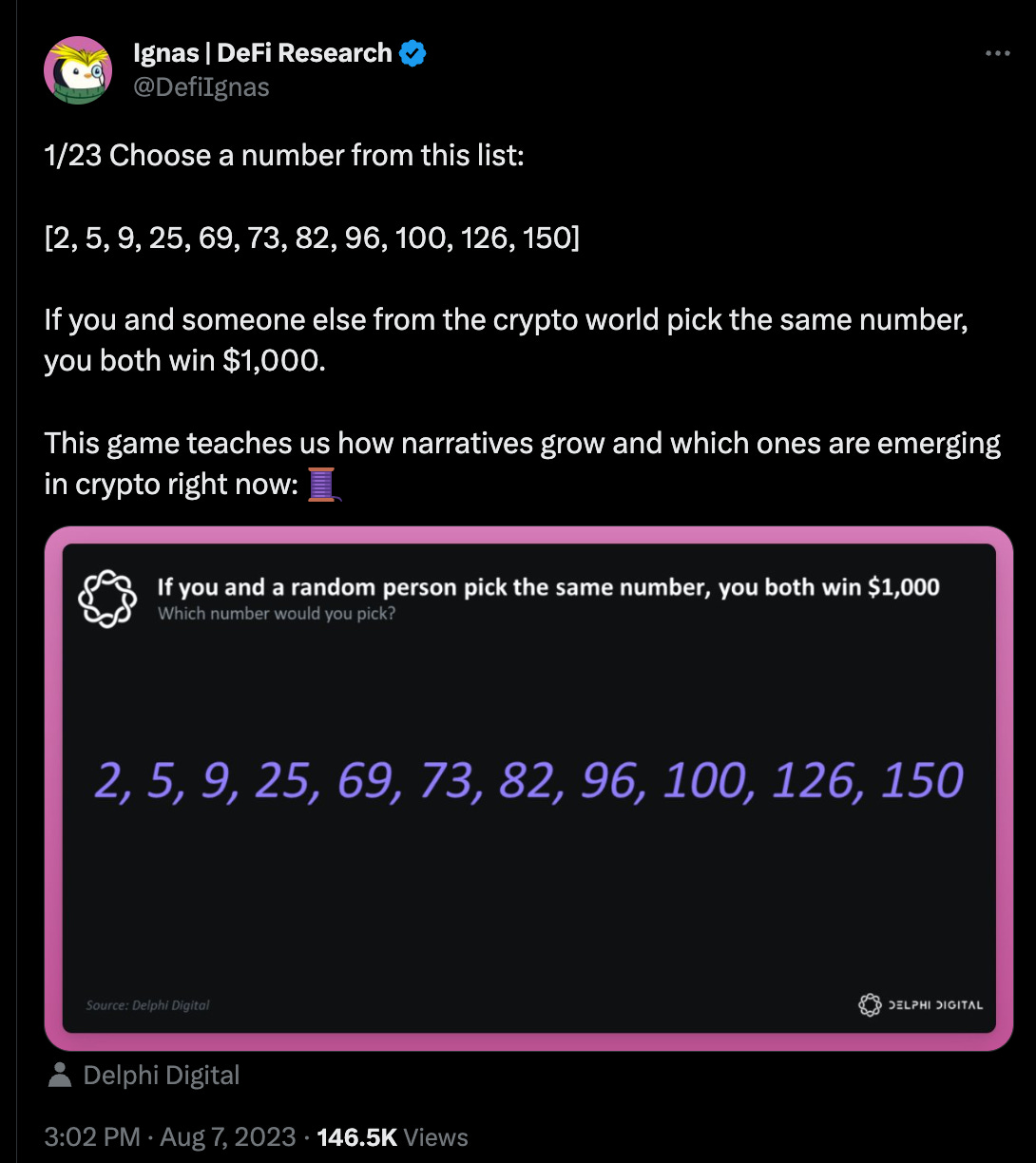

Let’s briefly come back to the “Path to Altseason”by SecrestsOfCrypto. Here the claim is that bull markets start when new fiat money enters BTC, and then the money trickle downs to the lower market cap tokens.

But I believe the bull market money making opportunities will start before new money enters the system with innovative leveraging & recycling of the existing crypto capital.

A case in point is DeFi summer: DeFi tokens were pumping left and right before ETH and BTC started to skyrocket in price. Crypto natives deposited ETH, and stablecoins to farm totally new tokens that were selling an appealing story of a new financial system. Some were dumping those tokens, but many believe(d) the DeFi story and HODLed those tokens.

The pre-bull DeFi echo bubble and the riches generated from it were captivating enough to persuade newcomers to enter the crypto system and buy ETH/BTC. Of course, the low interest rate environment had a much bigger effect than our relatively modest money printing, but more on this in just a second.

What intrigues me the most is that the infrastructure for DeFi summer had been built before the DeFi summer, but few cared about DeFi before until liquidity farming became a thing.

I believe we are currently in a similar pre-DeFi bull market season, where the groundwork is being laid for innovative money printing and the creation of compelling narratives. In light of this, I wanted to highlight the top opportunities that have the potential to create an echo bubble even larger than the short-term narrative we witnessed during this bear market.

Each of these topics deserves its own separate blog post. Here, I will provide a brief introduction to how these innovations matter for the echo bubble money printing.

Restaking

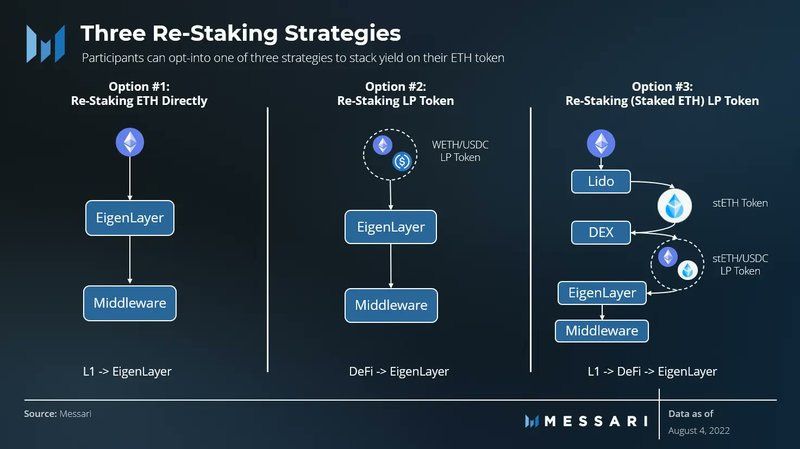

EigenLayer is at the fore-front of this narrative.

Simply put Ethereum's security can be "rented" out by allowing Ethereum stakers to "restake" their ETH, securing multiple networks simultaneously. However, it comes with increased risks, and to compensate, restakers earn higher rewards. You guessed, it. You’ll get a new shitcoins with big promises to change the world we live in.

Many farming ponzitokenomic strategies will be invented, each of them more creative to keep you from selling. Our focus will be to find those tokens that create a flywheel effect so the dApp adoption would grow with the inflation of the token.

And that’s already starting, with Stader’s rsETH - a liquid restaked token.

But restaking is much bigger narrative that goes beyond Ethereum. Cosmos launched Replicated Security where ATOM stakers lend its security to other blockchains, with the first Neutron. I expect more blockchains will catch up with the restaking idea, like they did with liquidity mining rewards during the DeFi summer.

Our task is to understand how restaking works before the echo bubble begins, as time will be money by then.

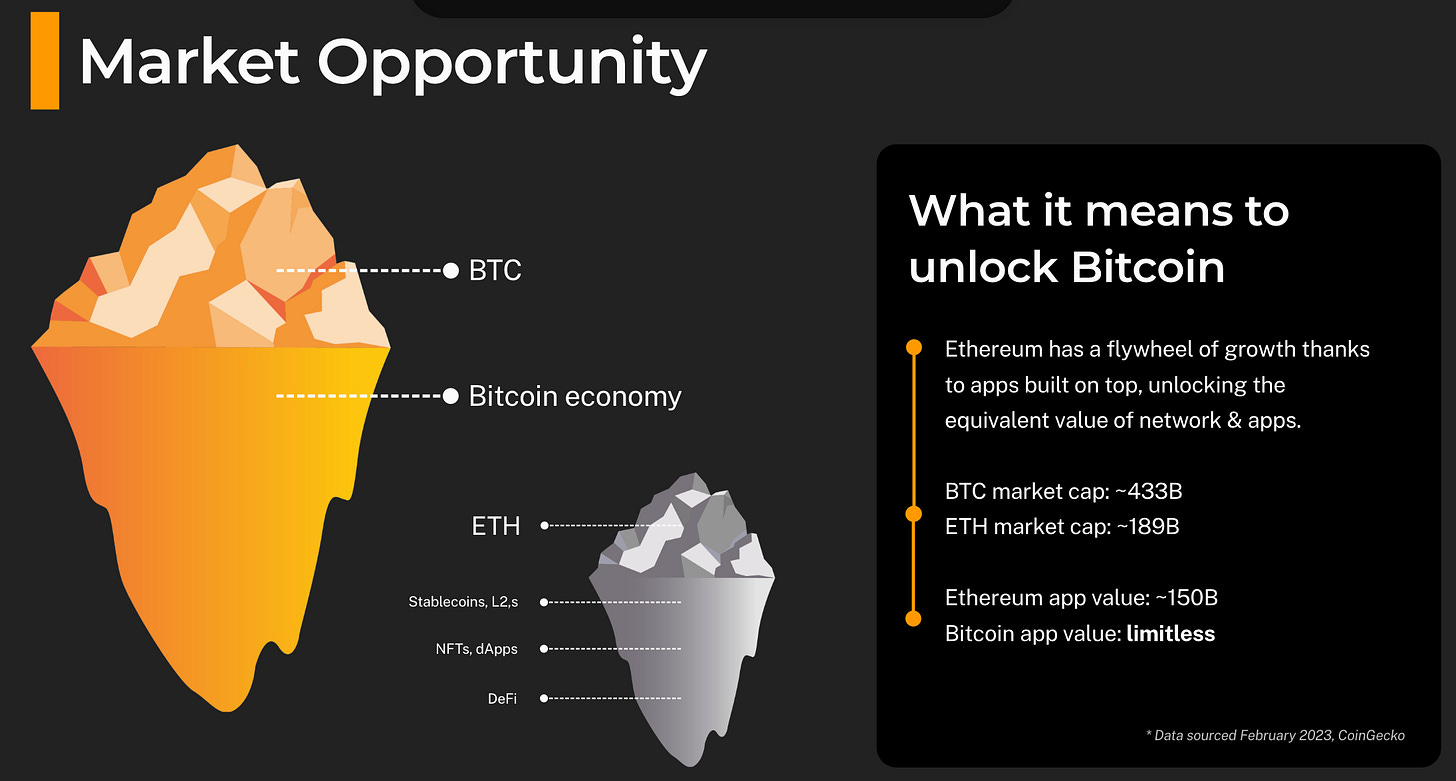

Bitcoin DeFi

This a totally new narrative that still flies under the radar even among EVM DeFi fans.

I am optimistic about Ordinal and Inscriptions potential to flourish, but currently they have no ponzitokenomics to sustain the inflation of new tokens being issued to the market.

A reminder, that Bitcoin Ordinals are the fundamental units of Bitcoin, i.e., satoshis or sats, which have been minted and integrated with a unique piece of information. As a result, the satoshis can become unique and have the same identity as a basic non-fungible token. - 101 Blockchains

Yet, I believe things will change. Ordinals and Inscriptions have demonstrated a strong demand for NFTs, fungible tokens, and DeFi within the Bitcoin ecosystem. Stacks, with its improved features and deep integration with Bitcoin, is well positioned to address this demand.

Stacks is a Bitcoin layer for smart contracts where DeFi apps are executed on Stacks and settled on Bitcoin. Stacks is getting ready for a major launch of sBTC.

sBTC is a decentralized Bitcoin peg system facilitating BTC transfers between Bitcoin and Stacks. BTC sent to Stacks becomes sBTC at a 1:1 ratio. Converting back to BTC has trust assumptions, making it trust-minimized, but not trustless. Unlike wBTC or RBTC, sBTC avoids centralized custodians, using an open user network, improving Bitcoin liquidity for DeFi and NFTs on Stacks.

I’m bullish on Stacks as BTC will will soon enter its ecosystem and are currently there’s not much where to put it. It’s a good thing, because capital and attention will be concentrated on a few applications that are first to launch.

One of them is Alex. ALEX is increasing its lead in Stacks DeFi, emphasizing crypto trading and lending with Bitcoin settlement. Its core is the AMM protocol, powering both its Launchpad and the Orderbook. It also has an BSC/Ethereum USDT bridge to Stacks Chain.

Crucially, Alex also launched BRC20 token on-chain indexer (wrapper) so you could trade BRC20s on Stacks and add any ponzitokenomics you want.

When Bull?

The two narratives mentioned earlier stand out for their ability to issue new tokens while managing inflation, driven by compelling stories (Security Sharing and DeFi on Bitcoin) and innovative tokenomics.

That being said, the infusion of fresh capital is crucial for sustainability and determining the lifespan of the echo bubbles. Currently, narratives emerge and fade due to a lack of new money entering the system. However, I believe these particular narratives have the potential to draw external capital into the overall crypto market, especially buyers of ETH for restaking, and buyers of BTC for BTC DeFi narrative.

But remember, these two narratives will also have a bust. Too many tokens will be minted for the demand and attention to keep up. Don’t blindly buy the stories they will sell you, so have an exist strategy before it’s too late.

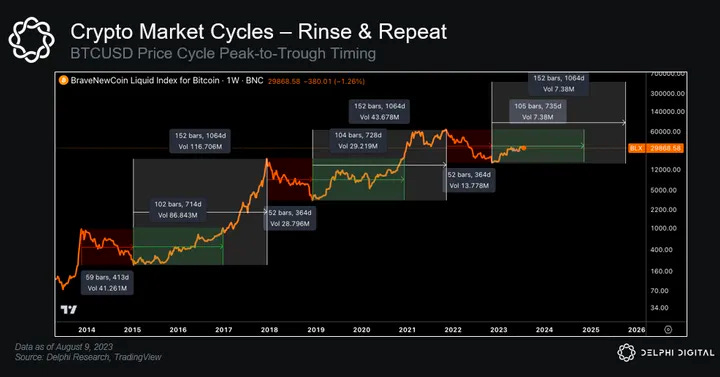

The key is timing and the most important element is still the macro situation, which is improving as well. We’ve been hit by 3 heavyweight narratives in the past few years: Fed liquidity cycle, wars, and new government policies. Yet, recently we’ve seen a shift with regulatory crackdown slowing down, China entering deflation, and inflation and interest rate hikes peaking. More on this in my thread below.

If we believe in crypto cycles, we can expect to reach ATH of $69k by Q4 2024, and a crazy bull run until the new ATH in Q4 2025.

If this is the case, these two money printing ponzi echo bubble period will start just before the new ATH.

Right now is the time to research and study, because when the fun starts, we need to be ready.