Decentralization is the key innovation enabled by blockchain technology and one of the most important characteristics of web3 protocols. As a result, web3 participants, policymakers, and regulators must develop a more uniform and nuanced understanding of what constitutes decentralization to enable more accurate assessments and comparisons of the decentralization of various web3 protocols. This will also better position web3 regulation and policy to understand and account for how decentralization can reduce risk and ultimately incentivize web3 builders to pursue decentralization in such a way that maximizes the public benefits that web3 promises.

To that end, we define three types of decentralization and suggest factors relevant for each type of decentralization in the context of (1) tokenized blockchain protocols (e.g., layer 1 and layer 2 blockchains like Bitcoin, Ethereum, Polygon, Solana, Optimism, Arbitrum, zksync, etc.) and (2) tokenized smart contract protocols deployed to blockchains (e.g., Uniswap, Aave, Compound, Curve, etc.). We also introduce two tables – one for (1) tokenized blockchain protocols and one for (2) tokenized smart contract protocols, viewable at their respective links – that should help enumerate the components of decentralization to provide a more concrete and standardized definition.

Any analysis of the decentralization of a blockchain protocol or smart contract protocol must consider the totality of the circumstances surrounding such a protocol. The factors we lay out here are an attempt to chart a course for such analysis.

Why decentralization?

Web3 has ushered in a new age of the internet – the age of “read, write, own.” The technology underpinning web3 enables “trustless computation,” which removes the need to rely on a centralized entity to navigate the web and databases. This makes it possible to develop more complex and sophisticated protocols that offer the functionality of the modern internet but that can also be owned by users. For example, a decentralized social media protocol could enable various applications to be built, all of which leverage the same protocol to distribute ownership and control over that protocol to a broad constituency of developers and users through token ownership.

Decentralization is the critical feature of web3 protocols that enables this paradigm shift. Decentralization will drive the creation of a democratized internet and will enable three important shifts: promoting competition, safeguarding freedoms, and rewarding stakeholders.

First, decentralization enables web3 systems to be credibly neutral (they cannot discriminate against any individual stakeholder or any group of stakeholders, which is critical to incentivize developers to build within ecosystems) and composable (to mix and match software components like Lego bricks). As a result, web3 systems function more like public infrastructure than proprietary technology platforms. In contrast to the gated software of Web2, web3 protocols provide decentralized internet infrastructure on which anybody can build and create an internet business. Crucially, in web3, this can be done without the permission of the original deployer of the protocol or the need to use a centrally controlled interface. For example, contrast, say, Twitter with a web3 protocol that provides an underlying data architecture designed for social media that is controlled by the public through token ownership rather than a corporation. In such a system, anyone could build their own client or application on top of the protocol and gain access to its network of users.

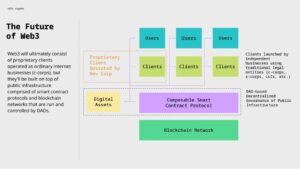

This is abstract, so consider this diagram of a web3 ecosystem, with a decentralized blockchain, a decentralized smart contract protocol governed by a DAO of token-holders, and several proprietary clients operated as separate businesses using traditional entity forms on top of the network and protocol. Each of the blockchain and smart contract protocols functions as decentralized internet infrastructure on which businesses can build, compete, and innovate.

Second, decentralization necessitates the broad distribution of control and participation in web3 protocols, ensuring that the evolution and usage of the network reflects the input of a wide variety of stakeholders and not just the companies that created them. Properly structured protocols that promote decentralization limit the power that can accrue to one or a small group of companies. As such, decentralization should limit corporate or individual power to gatekeep, and ensure that any changes to the protocol are aligned with its broad ecosystem of users that hold tokens and ultimately govern the network.

Third, decentralization enables the design of systems that prioritize stakeholder capitalism – systems that are designed to more equitably serve the interests of all participants rather than a certain subset of them. Token-incentivized stakeholder capitalism distributes ownership and control to a broader set of stakeholders rather than prioritizing equity holders over all other stakeholders, including customers and employees. As a result, web3 protocols and networks serve as a fertile design space for systems that more equitably serve the interests of all stakeholders. And such decentralized protocols provide more stable internet infrastructure on which a broader group of stakeholders can confidently build.

Types of decentralization

There are three different but interrelated lenses through which to view decentralization: Technical, Economic, and Legal. All three are important but often have competing interests, creating a complex design challenge in maximizing overall decentralization and utility.

Technical decentralization (T)

Technical decentralization relates primarily to the security and structural mechanisms of web3 systems. Programmable blockchains and autonomous smart contract protocols can support technical decentralization by providing an autonomous, permissionless, trustless, and verifiable ecosystem in which value can be transferred. Products and services can be deployed and run without requiring trusted, centralized intermediaries to operate (or pull the rug out from under) them, opening a vast world of possibilities.

For blockchain protocols, technical decentralization is an exceedingly challenging problem, and one that requires a balancing of several competing forces. But for smart contract protocols, this type of decentralization can be achieved relatively quickly and easily, by making the smart contracts immutable (i.e., uncontrollable and unupgradable by anyone). (For more examples, see here and here.)

Economic decentralization (E)

The ability of blockchains and smart contract protocols to make use of their own native tokens unlocks the potential for these open source and decentralized systems to have their own decentralized economies (i.e., autonomous free-market economies) and for more people to participate in and benefit from these decentralized ecosystems.

Builders of web3 systems can facilitate the formation of decentralized economies through careful design decisions that lead to the exchange and accrual of value — whether information, economic value, voting power, or otherwise — from a broad array of sources. Decentralized ecosystems, if properly structured, can use tokens to incentivize participants to contribute value to the ecosystem and correspondingly distribute that value more equitably among system stakeholders according to their contributions. To achieve this, web3 systems need to vest meaningful power, control, and ownership with system stakeholders (via airdrops, other token distributions, decentralized governance, etc.). As a consequence, the value of the ecosystem as a whole accrues to a broader array of participants rather than one central entity and its shareholders.

The ongoing balancing of incentives among the stakeholders — developers, contributors, and consumers — can then drive further contributions of value to the overall system, to the benefit of all. In other words: all the benefits of modern network effects, but without the pitfalls of centralized control and captive economies.

Legal decentralization (L)

Legal decentralization depends on whether the decentralization of a system eliminates the risks that a specific regulation may be intended to address.

For instance, technically decentralized blockchains and smart contract protocols can eliminate the risks associated with trusted intermediaries. As a result, the technical decentralization of such systems may also mean that they are legally decentralized when it comes to regulations that target trusted intermediaries.

Systems that are technically and economically decentralized can eliminate additional risks, including those associated with a web3 system’s tokens and their underlying value. Such decentralization would negate the need to apply U.S. securities laws to transactions of tokens that might otherwise significantly restrict their broad distribution.

Based on SEC guidance, we can define this level of legal decentralization as that point at which a web3 system can eliminate both the potential for significant information asymmetries to arise and reliance on essential managerial efforts of others to drive the success or failure of that enterprise. Upon meeting such a threshold the system may be “sufficiently decentralized” so that the application of U.S. securities laws to such system’s tokens should be unnecessary. As a threshold matter, this necessitates that a given token does not provide its holder with any contractual rights with respect to the ongoing efforts, assets, income, or resources of the issuer or any of its affiliates.

Factors of decentralization

In web3 systems that make use of native tokens, the three types of decentralization — technical, economic, legal — must be viewed holistically. Changes to one may affect the others. For example, decentralized economies help drive systems towards legal decentralization by prioritizing decentralized ownership among stakeholders, value accretion from decentralized sources, and value distribution to decentralized stakeholders. All of these decrease the risk of information asymmetries and the need to rely on managerial efforts of individuals.

Conversely, if the value of a digital asset of a web3 system is dependent on the ongoing managerial efforts of the original development team, then the decentralization of the system on all three levels may be jeopardized. For example, the management team’s departure could place enormous downward pressure on the price of the digital asset, which could make the system more susceptible to a 51% attack.

Given this interplay, we have broken down decentralization into the many factors that may influence it. Tables 1 and 2 present a comprehensive list of the most important factors that influence the decentralization of tokenized consensus blockchain protocols and tokenized smart contract protocols, respectively. These factors are broken down by both type (Technical, Economic, and Legal) and category (Computational, Development, Governance, Value Accrual, and Usage & Accessibility).

***

Decentralization is a process that is assessed not on an absolute basis but on a spectrum that includes the totality of the circumstances of any web3 system. The relative importance of the factors will change depending on the web3 system and the purpose of the assessor. Additionally, the preferred tradeoffs between different types of decentralization may differ between projects and people.

The two matrices we’ve prepared should prove, we hope, useful tools in providing a more concrete and standardized definition of decentralization. In turn, we hope this allows web3 participants to contribute to building more decentralized projects while empowering policymakers and regulators to design regulatory frameworks that recognize the power of decentralization to reduce and eliminate risks.