Key Insights

- As DAOs have evolved, many have adopted the working group structure to distribute internal labor.

- Amongst the 10 DAOs covered, over $100 million was allocated to internal DAO labor in 2022. Of this $100 million, 55% went to product and development initiatives.

- To remain competitive with traditional organizations in attracting and retaining top talent, DAOs should explore innovative funding methods.

Introduction

Decentralized autonomous organizations (DAOs) have emerged as more decentralized and democratic alternatives to traditional organizational governance and decision-making. DAOs comprise tokenholders who govern the protocol, elect working group contributors or leaders, and distribute the protocol’s treasury. DAO treasuries hold funds from initial native token distribution and protocol fees, which are used to fund DAO initiatives.

Like any other organization, DAOs must allocate resources effectively to realize their long-term visions. This report examines DAO working groups, an umbrella term encompassing the structures that DAOs use to organize labor, including subDAOs, workstreams, core units, guilds, and more. The report compiles DAO budget payments across 10 DAOs and 5 categories and observes currently funded sub-units to provide an overview of how and where DAOs allocated resources in 2022.

(Disclaimer: This report aims to provide a comprehensive overview of DAO compensation. However, in some instances, the lack of publicly available resources may have limited our ability to provide this data.)

Defining DAO Working Groups

As DAOs have evolved, many have adopted similar working group structures to distribute tasks effectively. Working groups vary in their names, responsibilities, contributors, and terms. But generally speaking, each working group is a lean, autonomous group of contributors focused on predetermined tasks within the DAO. For their contributions, working groups are paid by the DAO with resources from the community treasury.

Because protocols are contracts stored on the blockchain, they are designed to run autonomously and in perpetuity. By definition, they do not require maintenance or upkeep, unlike many traditional software products today. However, like traditional products, they often benefit from upgrades, parameter optimization, and marketing.

Further, protocols are typically created by small teams. DAOs use working groups, workstreams, subDAOs, and other avenues to shift tasks from these initial core teams to the broader community. Working groups facilitate progressive decentralization while ensuring contributors adhere to the same rigorous standards as the founding core team.

Advantages and Disadvantages of Working Groups

Working groups were one of the first attempts to organize a DAO’s labor in a decentralized fashion, and they are still in effect because of some of the advantages they bring to the table. These groups provide small teams that can respond quickly to the rapidly changing landscape of crypto. By concentrating resources on specific challenges or issues, DAOs can use working groups to optimize their strategies to achieve their evolving visions. Another significant advantage of working groups is that they are employed by the DAO and not by any centralized entity, ensuring censorship resistance and an open playing field for new contributors.

However, working groups can also be challenging for contributors. Contributor performance is often subject to review by the DAO, and contributors must regularly prove their value to the DAO via budget renewal proposals. This setup introduces several anomalous complications:

- Naive DAO members can undervalue or underappreciate contributor work.

- Market volatility can hinder the DAO’s willingness to deploy more funds.

- There can be fierce competition for resources among working groups.

- Contributors can become obsolete due to the ever-changing needs of the DAO

Analyzing Working Group Funding

We collected 2022 payment data from DAOs to their respective working groups to analyze the funding. Our selection of DAOs was based on their respective structures, targeting those that operate via internal working groups. Despite these criteria, some historical data is incomplete due to the novel organizational structures and processes of the DAOs covered. For example, not all DAOs report or keep historical records of FTEs at the time of compensation. Some DAOs lack accounting transparency and agree upon a dollar amount in an off-chain vote, which is then paid at an undisclosed time in an undisclosed amount of stablecoins and/or native tokens.

However, it is worth noting that some DAOs provide complete transparency of their internal funding, such as Gitcoin’s workstreams. The Gitcoin workstreams propose amounts in their budget proposal, and the proposals must pass an on-chain vote providing accurate historical payment data. In addition, the workstreams provide extensive documentation within their Notion pages specifying roles, accounting, initiatives, and more.

After selecting the 10 DAOs to cover, we categorized these payments into five expense categories: Product & Development, Growth, Operational, Marketing, and Community.

(Refer to this Miro Board for the full breakdown of specific working groups in each category and source.)

Funding by Category

Throughout 2022, $102 million was allocated from the DAOs’ treasuries to internal DAO labor. Of this funding, over 58% went to Product & Development expenses, with the second highest category being Growth (22%). Each category and its specific composition play an essential role in determining a DAO's long-term success.

Product & Development

The Product & Development category focuses on the technical aspects of the protocol. It is responsible for a protocol’s development, security, reliability, and scalability. This working group category ensures the smooth operation of a protocol, which is essential for the DAO's longevity.

Product & Development costs encompass various product-focused areas within DAOs. Examples of these groups include Gitcoin's Gitcoin Product Collective (GPC) Workstream, MakerDAO's Development & UX Core Unit, and ShapeShift's Engineering Workstream.

MakerDAO's Protocol Engineering Core Unit

MakerDAO allocated a leading $38 million in funding to Product & Development initiatives in 2022. Product-related initiatives represent 75% of the total $51 million MakerDAO allocated to Core Units in 2022 (note: some will vest over time and is not immediately paid out). The Protocol Engineering (PE) Core Unit received the most funding within MakerDAO's Product & Development expenses, with $11 million allocated in 2022.

Comprising 16 full-time employees, the PE unit’s core responsibility “is to extend the functionality of the Maker protocol, assist with the maintenance and operation of existing smart contracts and ensure the safety and correctness of protocol design and implementation.”

(Source)

The PE's primary responsibilities include:

- Extending the protocol's functionality via new smart contracts and other censorship-resistant mechanisms.

- Assisting in the maintenance and operation of existing smart contracts.

- Ensuring the safety and correctness of the protocol at the design and implementation levels, from bytecode to game theory.

Growth

The Growth category covers a range of initiatives that aim to grow protocol usage. Some examples of these groups include Balancer's Grants program, MakerDAO's Growth Core Unit, and ENS's and Gitcoin's Public Goods initiatives.

Funding to develop innovative ideas is a necessary expense for many DAOs. While growth initiatives may have varying strategies, they typically revolve around increasing usage regarding integrations, partnerships, and deepening dependencies built upon the dApp. Many protocols also promote broader ecosystem growth by actively funding public goods and donations to ecosystem core developers.

Balancer's Grants Program

Balancer's Grants program is one of the two initiatives Balancer funded under the growth category, alongside Orb. The grants program funds innovative projects and teams contributing to the Balancer ecosystem. It aims to support projects across various domains, including development, research, education, and community building. The program operates through a decentralized and transparent process, wherein all proposals are evaluated by the Balancer community and the Balancer Grants Committee. Successful applicants receive funding in Balancer’s native token BAL.

Operations

Despite being the third largest category, Operations is essential for the functioning of DAOs. This category covers legal and corporate compliance, DAO processes, and daily operations. Operational expenses include foundations, compliance groups, and treasury management groups.

Nine DAOs allocated funds to initiatives falling into the Operations category in 2022, making it the most commonly funded category.

Gitcoin's DAO Ops Workstream

Gitcoin's DAO Ops workstream is a key component of its Operations expenses, responsible for accounting, hiring, onboarding new contributors, tooling, and community governance.

The DAO Ops workstream handles a large number of operational tasks. To keep different contributing groups aligned with Gitcoin’s mission, there are cross-stream operations efforts that emphasize collaboration amongst Gitcoin’s workstreams. DAO Ops is also in charge of increasing Gitcoin Steward engagement in the DAO, handling people operations that ensure contributors are empowered to grow in their roles, providing support for Gitcoin Grantees, and also responsible for all of the DAO’s tooling needs.

Marketing

The Marketing category comprises working groups dedicated to promoting the platform and increasing user engagement. Examples include Gitcoin's Merch, Memes, & Marketing workstreams, ShapeShift's Marketing guild, and Balancer's Orb Marketing service provider. In an effort to grow their respective protocols, these working groups will host events, attend conferences, sponsor hackathons, and run social media campaigns.

In 2022, Gitcoin's Merch, Memes, & Marketing workstream received the highest funding allocation for DAO marketing, totaling $1.9 million.

ShapeShift's Marketing Workstream

ShapeShift's Marketing workstream was the second highest funded group in the Marketing category at $1.1 million. The workstream is responsible for promoting the platform and increasing user engagement. It employs various marketing initiatives, including:

- Executing marketing campaigns to support product launches, partnership agreements, and project integrations.

- Producing and distributing quality marketing content for the community.

Community

Groups within the Community category focus on fostering a strong and inclusive community centered around the DAO's protocol. They also facilitate member engagement and provide education and support to the community. Examples of these groups include Balancer's Balancer Maxis, MakerDAO’s Ambassador program, mStable’s Community subDAO, Bankless DAO’s Educational and Translator guild, and PoolTogether’s Community team.

A strong community is essential for the success of a DAO. It not only helps attract new users and contributors, but it also encourages existing members to take on more significant roles within the organization. Community-focused initiatives often involve educational workshops, webinars, and meetups to empower and educate users on the protocol's intricacies.

Bankless DAO’s Community-Focused Guilds

The Bankless DAO’s Educational and Translator guilds, funded at $69,000 and $73,000, respectively, are great examples of how DAOs can prioritize an inclusive community and education.

The Educational guild is responsible for:

- Onboarding new members, educating new members on DAOs and tools, and hosting informational sessions for members.

The Translator guild is responsible for:

- Creating and spreading a global understanding of crypto and Bankless DAO’s mission via translation.

Comparing Funding Allocations

Comparing funding allocations among different DAOs yielded some trends and patterns in resource distribution. Product & Development is the highest-funded category across the board, receiving the highest average payment at $460,000 in 2022. The category was followed by Growth, Operations, Marketing, and Community. This pattern indicates that DAOs are aggressively investing in building and maintaining robust technical foundations.

The Marketing category ($4.5 million total funding) has a surprisingly higher average payment than Operations ($12 million total funding), partially due to the category breakdown resulting in the Marketing category comprising only 9 teams while the Operations category included 28.

The data provides a general overview of the funding initiatives and aims to serve as a benchmark for a healthy funding distribution. However, these comparisons are limited, as DAOs optimize their payments differently over time depending on their changing missions and values. Despite this, the data serves to highlight the most funded categories and could give insight into the characteristics of successful strategies.

Evolving DAO Funding

As the blockchain ecosystem evolves, the funding methods must also continue to adapt. While many DAO tools are already available, new innovations and strategies may attract talent by improving the work atmosphere for contributors.

Increased Emphasis on Performance Measurement and Accountability

DAOs face issues with accurately pricing contributions, performance measurement, and accountability. To ensure sustainability, DAOs must ensure that resources are allocated effectively and that contributors follow through with their commitments.

To improve accountability, DAOs could seek to implement rigorous and standardized performance metrics for working groups. While the lack of performance metrics has not posed any significant issues yet, DAOs might need to become strict in a scarce funding environment.

Focus on Contributor Retention & Satisfaction

Full-time DAO contributors undoubtedly face considerable career risk, as they are subject to the latest successful funding proposal. Many DAOs struggle to entice professionals who already enjoy a clear career path with steady income and benefits. As the blockchain industry grows and competition for top talent intensifies, DAOs may need to emphasize retaining and satisfying their contributors more strongly. These strategies could include:

- Implementing more attractive and competitive compensation packages, including a mix of token-based and stablecoin payments as well as additional perks and benefits.

- Providing more certainty for contributors via signing bonuses and severance agreements.

- Developing comprehensive onboarding and support programs for new contributors to ensure they feel valued and well-integrated into the DAO.

- Encouraging and facilitating career growth and development within the DAO, allowing contributors to take on more significant roles and responsibilities.

These changes would lead to more structured compensation packages, as in traditional organizations, including fixed salaries, bonuses, and benefits. More competitive compensation packages would likely increase specialization among working groups and contributors, creating a more efficient market.

Experimentation with Novel Compensation Models

DAOs could also benefit from exploring and experimenting with new compensation models for their contributors. Some examples include:

- Quadratic funding mechanisms.

- Reputation-based incentives.

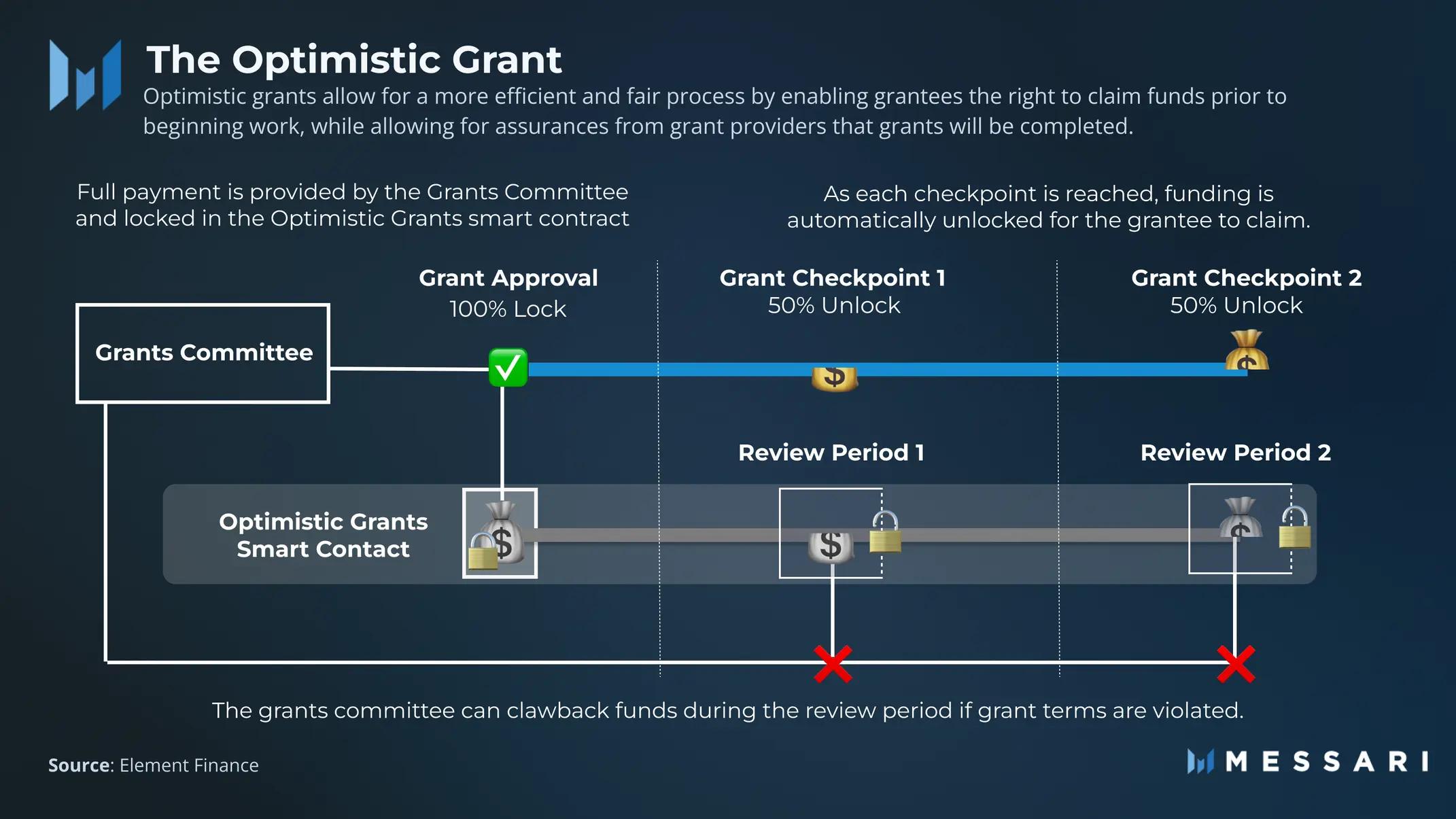

- Element Council - Optimistic Funding.

- UMA Optimistic Grants.

(Source)

Multi-DAO Collaboration and Compensation

As more DAOs join and begin to collaborate in the space, they could someday turn to a central source for funding grants and ecosystem initiatives. Rather than working independently, DAOs could increase capital efficiency by co-sponsoring mutually beneficial grants, working groups, or development. For example, DAOs could create an ecosystem-wide public goods group, where DAOs can co-fund the initiative and provide a contributor that reflects their specific mission and values.

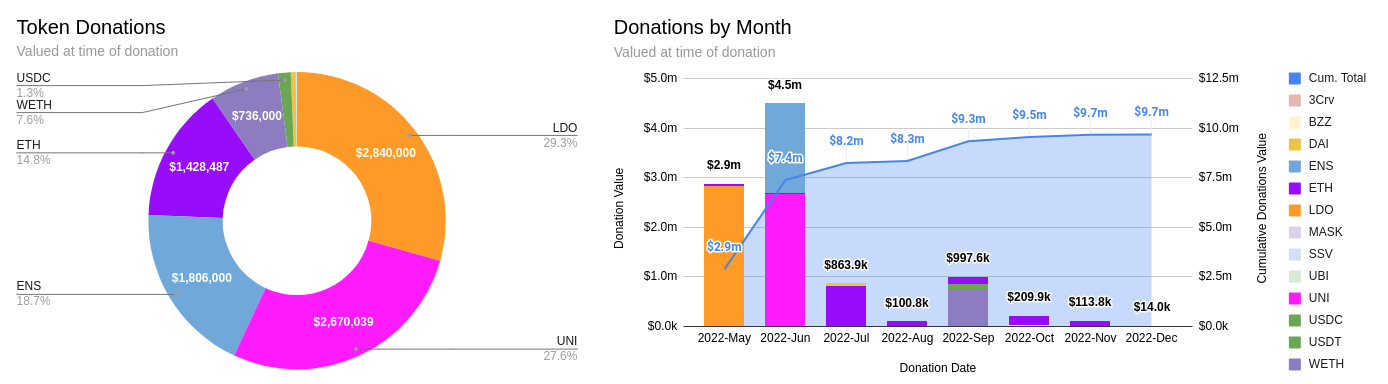

This idea put into practice can be seen in the Protocol Guild Pilot Program. In this program, DAOs such as Lido, Uniswap, ENS, Nouns, and Moloch collectively donated to support developers as they developed and implemented EIPs for the Ethereum protocol.

(Source)

Balancing Decentralization and Contributor Retention

As DAOs continue to decentralize, they must balance decentralization and the retention of high-quality contributors. Because working groups increase contributor autonomy, DAOs must ensure that their compensation models are fair, transparent, and competitive enough to retain talent.

To achieve this balance, DAOs should:

- Regularly review and adjust their compensation models to ensure they remain competitive.

- Foster a culture of recognition and appreciation for contributors, rewarding them for their efforts and encouraging long-term commitment to the organization.

- Implement transparent performance evaluation systems and feedback mechanisms that reflect contributors’ impact and identify areas for growth.

- By prioritizing decentralization and contributor retention, DAOs can create sustainable and thriving ecosystems that attract and retain top talent while maintaining their values of decentralization and democracy.

Conclusion

It’s clear that funding product and development initiatives was a major point of emphasis throughout 2022. However, as DAOs become more mature, this emphasis may change.

Regardless of the current trend, DAOs will continue to invest time into exploring ways to attract and retain top talent, given the innovative tools they have at their disposal. As best said by Antonio Juliano; "We should aim to long term make working on the protocol feel as or more prestigious as working at FAANG companies."