Dear Investors,

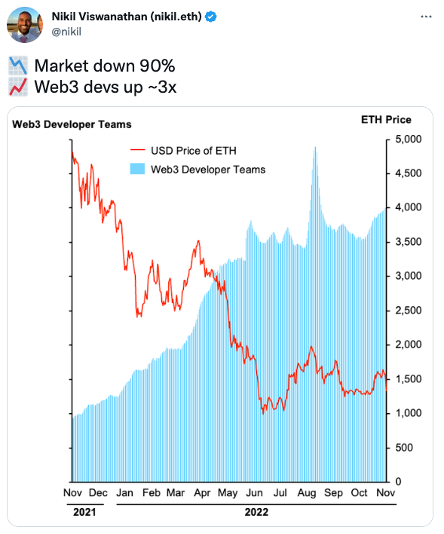

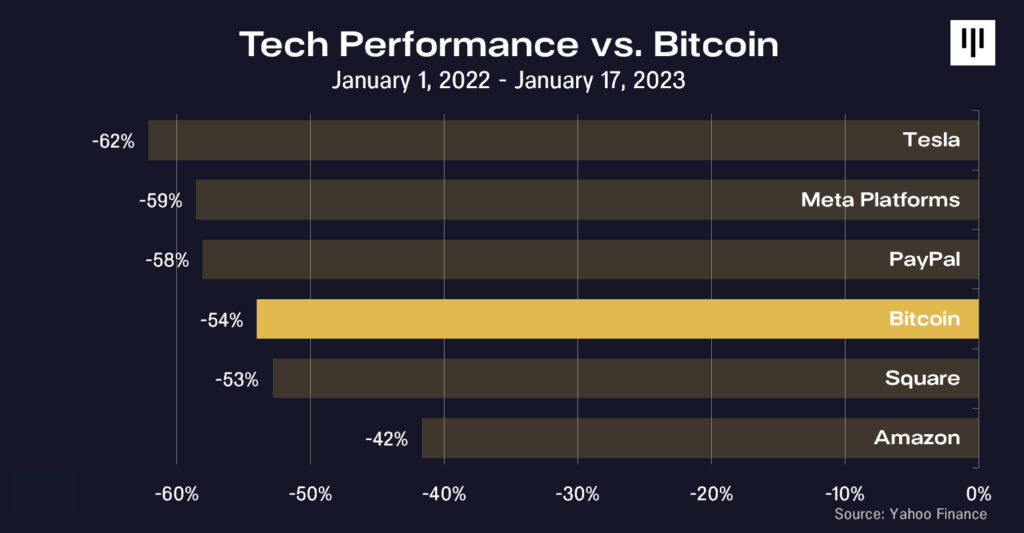

Let’s pretend it’s January 1, 2022. Imagine that I told you that by January 17, 2023 Tesla would be down 63%, Meta down 60%, Amazon -42%, PayPal -57%, Square -54%. It was the worst-ever year on record for U.S. bond investors, according to an analysis by Edward McQuarrie, a professor emeritus at Santa Clara University who studies historical investment returns:

“Even if you go back 250 years, you can’t find a worse year than 2022.”

Now, I ask you to guess how much Bitcoin would be down. I’d imagine that the majority would say more than 54%. (Bitcoin as a proxy for our industry is down 54% from January 1st, 2022.)

That doesn’t even account for truly mind-blowing alleged crimes of Sam Bankman-Fried/FTX/Alameda against five million people and old school blow-ups like Three Arrows Capital, TerraLUNA, Genesis, BlockFi, Celsius, et al.

Blockchain’s resilience in the face of a terrible macro market for risk assets and historic idiosyncratic disasters is impressive.

However, it’s not surprising. Pantera has managed blockchain funds through three previous “crypto winters”. Each one had supposedly catastrophic events. For example, when Mt. Gox went down it represented 85% market share – much larger than FTX today.

Blockchain is going to change the world. It will certainly survive these issues.

I believe that it has already bottomed and we will see blockchain assets continue their 13-year 2.3x per year appreciation trend soon. [1]

![]()

TABLE OF CONTENTS

2. Our 2023 Outlooks:

3. Announcing the Pantera Blockchain Summit 2023 :: April 3-4 2023, San Francisco, CA

![]()

2022 YEAR-IN REVIEW :: BY CAT FOLEY & JESUS ROBLES, III, CONTENT ASSOCIATES

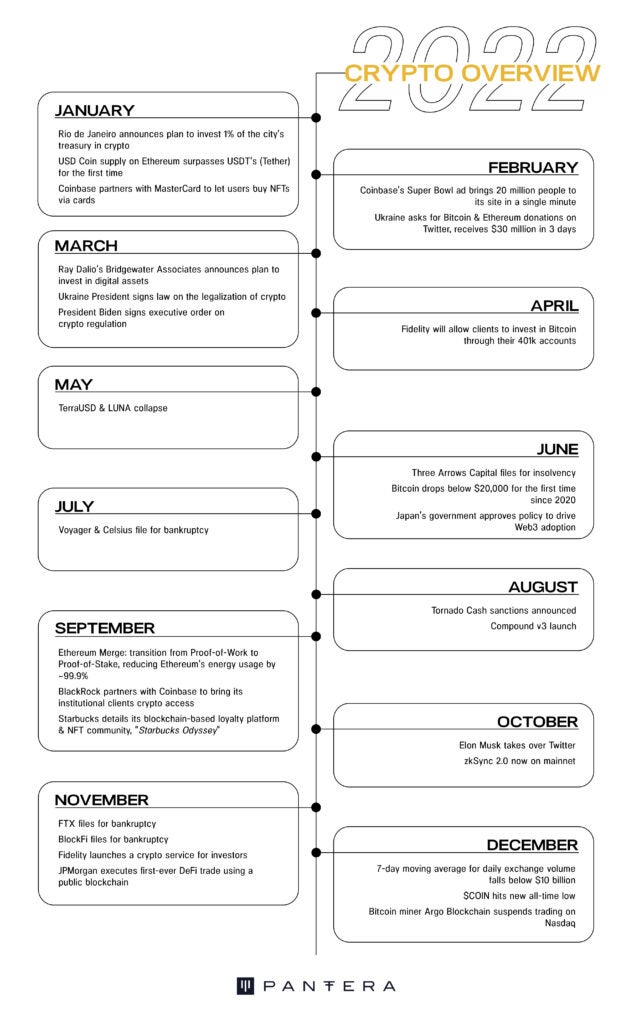

2022 was a wild year for the blockchain industry. Some of what we witnessed:

-

The Ethereum Merge, an upgrade which reduces Ethereum’s energy usage by ~99.9% and facilitates a less inflationary ether — a monumental achievement in blockchain coordination.

-

The astonishing collapses of Three Arrows Capital, TerraLUNA, Celsius, Voyager, and the once second-largest exchange by volume, FTX.

-

Increased institutional adoption and R&D investment into DeFi protocols and products, e.g., JPMorgan’s first-ever DeFi trades on a public blockchain in coordination with the Monetary Authority of Singapore. Adoption like this also occurred in the public sector, with a number of major countries experimenting with blockchain-based central bank digital currencies (CBDCs).

Here is a recap of some of the major highlights of 2022:

![]()

CRYPTO MARKET OUTLOOK :: BY JOEY KRUG, CO-CIO

Looking back, 2022 was probably the biggest year of upheaval in crypto history. Multiple times throughout the year, I found myself saying, “this feels bigger than Mt. Gox.” Back when Mt. Gox was hacked, it kicked off the next phase of significant development within the crypto space: transitioning to a more global architecture of trust minimization and removing intermediaries beyond just within payments.

In practice, self-custody solutions like Ledger and Trezor took off in the early days. They made it so individual retail crypto holders could store their funds in something more secure than just their computer, while not having to trust a centralized exchange to hold their assets. On the institutional side, firms like BitGo made it so institutions could also store funds using secure multi-sig solutions, again removing any need to “trust” exchanges. These shifts seem small/evident in hindsight, but they were meaningful — enabling people to hold their crypto more securely.

A more significant shift happened with the build-out of Ethereum and smart contracts. This technology would make it possible to engage in a wide range of value transfer transactions (whether financial or otherwise), globally, and without having to trust any person or entity. The vision also included making the financial system more efficient, more accessible, and dropping the cost of financial intermediation.

However, many of those benefits still depend on the further build-out and integration of scalability improvements. At the time, there were a handful of people talking about the idea of being able to trade crypto without using exchanges, whether via atomic swaps — a sort of glorified OTC transaction doable in a way that doesn’t require trusting the counterparty — or via the advent of full-fledged Ethereum smart contract-based decentralized exchanges (DEXs). If you fast-forward to today, it’s easy to make crypto-to-crypto trades via DEXs like Uniswap and 0x. And back in 2013 and 2014, those ideas were just mere twinkles in the eyes of developers who had but written a handful of early thoughts on forums.

History Doesn’t Repeat, It Rhymes :: DeFi Is The Foundation For The Next Crypto Cycle

2022 felt quite similar to the late 2014 era in crypto. Many projects and companies that exemplified the antithesis of crypto’s fundamental principles blew up. People were saying, “crypto is dead,” yet I I believe it was one of the best times to get in the space, start building serious things, and a great time to deploy capital into crypto. It really is darkest before dawn.

And while there’s a temptation to say “this time is different because…”, things are rarely that different. While the exact cause of destruction was different, the theme of centralized entities failing because they were either hacked or became greedy and started doing sketchy/illegal things is a tale as old as financial markets. Actual crypto — like on-chain, smart contract, protocol-based crypto — really mitigates these problems because you don’t need to hand all your money over to one entity that claims, “trust us.”

One exception/caveat to this is that smart contracts are just code — code is dumb and computers generally do exactly what you tell them to do (ignoring the possibility of solar flares). So, writing a smart contract that creates a risky financial product is still risky, even if you no longer need to trust some centralized exchange, legal system, or whatever to execute that product. If I make a smart contract that lets you do uncollateralized lending, it’s not the computer program’s fault if your loan doesn’t get paid back.

With that disclaimer out of the way, the short version of “what was different” about the centralized finance (CeFi) blow-ups in 2022 was the exuberant crypto credit market. Three Arrows Capital, TerraLUNA, BlockFi, Celsius, Voyager, FTX, and Genesis have a pervasive thread: effectively lending vast amounts of capital to relatively risky counterparties, either without sufficient collateral posted or sufficient risk limits on that collateral, if any collateral was posted at all.

What’s interesting to note here, on the other hand, is that decentralized finance protocols, which lent to largely unknown counterparties, didn’t blow up. The reasoning behind why DeFi protocols managed to succeed has a couple of levels to it. The surface level is that these protocols (e.g., Compound, Aave, and Maker) force people to post collateral and enforce aggressive risk controls. The great irony is that those risk controls are the same kind of controls centralized entities often anecdotally said were “too tight, just inefficient”. They’d tell us, “these protocols can’t monitor risk like we do”. Mere months later, one of my closest friends told me about the favorable borrowing terms one of these companies gave him — the company was taking on absurd amounts of blow-up risk. I told him something along the lines of, “the next cycle will likely blow up due to these centralized lender entities. They’re picking up pennies in front of a steamroller.”

In software, there’s a common phrase: “worse is better,” meaning simpler systems that “just work” are better than highly intricate designs that increase the risk of failure. DeFi’s risk controls are, in my view, a great example of the worse is better philosophy, but for finance. Those centralized lenders that we spoke with sure had “elegant” systems, but none of their systems worked. Many of the hottest, “best” growth rounds of the prior cycle are zeroes. Some because their businesses weren’t real businesses — they were just akin to betting against downside volatility —and others because they were outright scams.

The second level of why DeFi protocols worked well in 2022 is the more critical, higher-level reason. Decentralized protocols can’t just say, “trust me, I went to MIT and want to donate everything to charity”. DeFi protocols are more of a “you don’t have to trust us” nature or, as Google put it so well before they dropped it: DeFi protocols “can’t be evil.” The only option at the protocol layer is to build something that works, something from first principles, in the open, against a pseudonymous playing field of rational economic actors, where your code is public, and anyone can scrutinize and read it.

Nick Szabo put it best: “trusted third-parties are security holes.” 2022 crypto in a nutshell.

Looking Towards 2023

Looking forward, I think it seems fairly evident that the historical arc of the world’s financial rails will end up as blockchain-based systems using smart contracts. The real questions are how we get there and what needs to happen to get there.

Despite lower prices, I think the space is clearly in a much better position than ever. We finally have scalability solutions that enable transactions with sub-ten cent transaction fees. With a couple more upgrades to Ethereum and Layer-2s (protocol extensions), it’s hard not to see transaction fees down to about a penny. That’s important because decentralized exchanges can’t compete with centralized exchanges if fees are too high.

The other significant paradigm shift — versus 2017 — is that developer infrastructure was practically non-existent back then. It’s just so much easier to write smart contract-based systems now than in the previous cycle. In 2017, I was the first primary user of Alchemy and everyone was messing around with janky node infrastructure on AWS or DigitalOcean. That and other problems have already been solved for new developers as they enter the space. And it’s not just nodes. Every other area of the stack has improved, whether test suites or automated tools to catch common bugs in smart contracts, to having IDE support for Solidity.

If we look towards what’s next, I believe there are two interesting questions:

1. What does the end state look like?

2. What enabling innovations and companies/protocols need to be built to let that happen?

Of course, I believe both areas are interesting to invest in.

The end state, in my view, is one where decentralized finance protocols and apps essentially solve many of the problems discussed above. The average person will have apps on their phone that give them access to DeFi, where they’ll be able to engage in financial transactions without banks/brokers, with lower fees, global liquidity, and markets operating 24/7. The internet, but for finance. The problem with fintech is that it’s mostly lipstick on a pig, and the pig is the existing financial system. To enable the true vision of crypto, we need to create a new economic infrastructure from the ground up. The good news is that many of the primitives of a new financial system exist today.

For instance, we already have currencies (both dollar-pegged and free-floating), exchanges, lending markets, etc. The world in this universe looks like one where when you want to trade an asset, you use a decentralized exchange where you can access a global liquidity pool to trade without first depositing your assets to an exchange. Even things like OTC trading — typically used by HNWIs (high net-worth individuals) or institutions — could take place in DeFi. Why send money to an OTC desk and hope that they send the other trading pair back to you? Instead, the OTC desk should be able to automatically send you a link that contains their quote, which only you can fill.

When you want to lend or borrow an asset, I believe the most logical place to do so is on one of the DeFi lending protocols. Currently, DeFi lending protocols are some of the few venues where it’s possible to borrow or lend in crypto at all, especially given that, with a few exceptions, many of the larger centralized lending businesses in the space have become insolvent.

There’s also an exciting innovation in financial markets that originated within crypto called “perpetual contracts”. These enable traders to get leveraged exposure like what one can get with futures contracts but without expiration dates. Instead, interest is paid continuously to the side with less demand (i.e., if there’s more demand to go long, it’s paid to shorts, and vice versa).

There are a handful of decentralized perpetual exchanges with traction. While the failure of FTX is undoubtedly a catalyst for “perpetual exchanges” to take off at scale, I believe we need to first build some enabling innovations. Long-term, that’ll happen within apps that are easy to use, where end-users may not even know they’re using DeFi. And very long-term, real-world assets will exist and be tokenized on chain. So, the steady end-state looks like a new, parallel financial system that enables everything you can do in the legacy system and much more. Similar to what the internet did with content creation, crypto enables the creation of an endless suite of custom financial markets on anything.

The Path To Success

To enable all of this, I believe there are a handful of problems that must be solved for adoption to take off further. The issues fall into two categories:

1. Increasing liquidity within and for the DeFi ecosystem

2. Making DeFi as easy as possible to use

Liquidity-wise, to get more institutional capital using DeFi, there needs to be more asset custodians that support using Ethereum directly. While there are great solutions like Fireblocks, the major issue is that most, if not all, of these solutions are not regulated custodians from an SEC standpoint. Some custodians that have received charters from federal or state agencies to operate as regulated custodians in the crypto space, like BitGo, support using DeFi protocols through a partnership with MetaMask Institutional, but still other regulated custodians must also add support for using DeFi protocols. This should bring much more liquidity and capital into DeFi.

Another way of increasing liquidity is to aggregate liquidity across multiple chains, Layer-2s, and liquidity pools on those chains. These aggregators will enable users to submit a trade and apps will source liquidity across multiple venues, across multiple chains, to get users the best price and best execution. To build that, we’ll need fast and secure cross-chain bridges. Many of the cross-chain bridges constructed to-date strike me as hacky — not in a cool “hacking the PlayStation” sort of way but more “slapping some stuff together that really only works if you trust (insert trusted third-parties here)”. The kind of trust, as we’ve seen, that is a “security hole”. The bridging problem has always been a software problem and should be solved with software in my view — not oracles, trusted multi-sigs, etc. The ideal way to solve this is to use zero-knowledge proofs, which, once Ethereum ships “single-slot finality”, should enable the ability to bridge to other chains exceptionally quickly. At that point, pooling liquidity becomes much more feasible.

The second set of issues — the usability issues of DeFi — is just as crucial as the liquidity part. While usability has improved a lot over the years, a common retort is, “the web was super hard to use in the early days, usability shouldn’t be a barrier”. Since the early of days of the web however, user expectations for usability have risen orders of magnitude. People expect things to be easy to use. I believe three usability problems need to be addressed. If addressed, DeFi adoption may grow more rapidly:

1. The first is the problem of the user experience (UX) surrounding wallets. I love MetaMask and what it’s done for the space as much as the next person, but there’s just something about the UX there that leaves me wanting. It’s a simple browser extension that users download, rather than a robust application with a carefully designed UX. It has a confusing layout, can be overwhelming if you don’t know much about crypto, and there’s way too much going on in the UI (user interface). It reminds me of those old-school Palm or Windows handheld devices that existed before the iPhone (i.e., they may work, but they are clunky and confusing, even if you know what you’re doing). Maybe the long-term answer here looks like a sort of MPC-based wallet for retail.

2. The second problem is the issue of having to pay transaction fees in ETH. This makes it so that you need ETH in addition to whatever asset you’re sending/trading/transacting. The idea of economic abstraction solves this issue. That’ll be a protocol-level native upgrade to Ethereum that makes it so you can pay transaction fees in tokens other than ETH. One can easily envision how this makes it so that if you want to swap USDC for ETH, you can send USDC to your wallet and then trade for ETH without paradoxically needing to acquire ETH first. It sounds simple but it’s a vast UX advantage centralized exchanges currently have over decentralized ones. It’s also useful for a whole swathe of other apps with more mainstream users who aren’t familiar with ETH or the concept of why they’d need it to do a transaction.

3. The third problem — one of the more pernicious ones — is getting better fiat on-ramps that can integrate natively within decentralized apps (dApps). A mass-market, Stripe-like integration, — where dApps can add a fiat on-ramp to allow users to buy crypto in a few clicks and where the fees aren’t exorbitant — doesn’t exist yet. It needs to be embeddable as a widget within a UI, where no one controls the UI (i.e., dApps). While cool, Stripe’s new crypto on-ramp product doesn’t solve the problem here.

The solutions to this current suite of problems will take another two to three years to be solved and built out. Many of them, and the future innovations they enable, will provide excellent investment opportunities. As they do get solved, they create an exciting groundwork for the next cycle of crypto being driven by DeFi. To me, the most exciting thing about that is DeFi’s enablement of a new open, global, and more efficient financial system.

![]()

STATE OF BLOCKCHAIN VENTURE :: BY PAUL VERADITTAKIT, GENERAL PARTNER[3]

Key Metrics

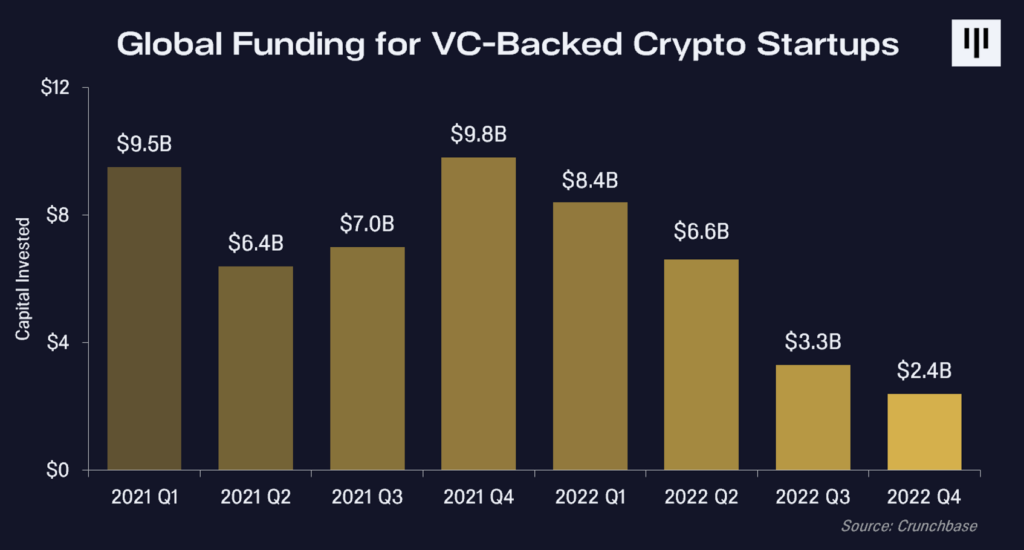

While crypto prices began declining in January of last year, private market deal activity continued, at least in the first half of 2022.

Private market valuations tend to lag behind public market pricing. Compared to the previous bear markets, this last bull market saw the rise of consumer crypto and other sectors such as DAOs (decentralized autonomous organizations), crypto gaming (play-to-earn model), NFTs (non-fungible tokens), and the Web3 creator economy.

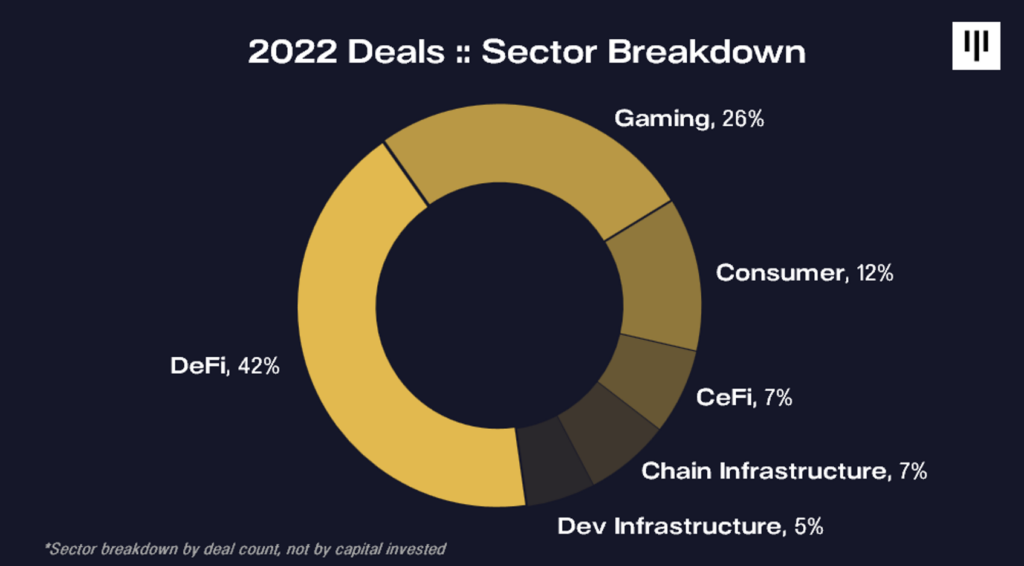

From the pie chart above, on the sector breakdown for Pantera’s 2022 deals, DeFi took pole position, with the gaming/consumer sectors hot in second place. DeFi investment was focused around the following areas:

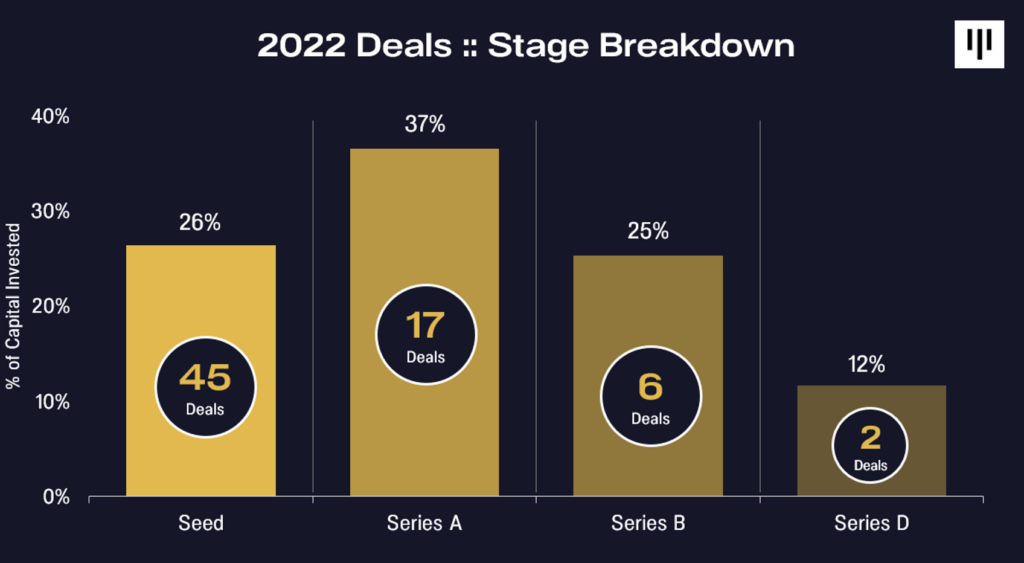

On the gaming side, we focused on experienced teams (Metatheory, Revolving Games) building fun, engaging games with crypto economics. Consumer DeFi companies focused on areas like identity (Unstoppable Domains) and the fashion metaverse (Spacerunners). During the bull market and up through Q2 of 2022, Pantera invested with a barbell strategy in terms of capital deployment, mostly into the seed rounds of startups.

During the latter half of 2022, we have been waiting for private market valuations to reset. While the absolute numbers of startups fundraising during that time decreased a bit, we are seeing a higher percentage of startups coming to market with strong teams — entrepreneurs coming out of established crypto startups like Coinbase, larger tech companies like Facebook, Uber, and Square, and legacy financial institutions like J.P. Morgan and Goldman Sachs.

What matters most to VCs is the quality and amount of talent entering the ecosystem. From Alchemy’s data, the number of developers building on their leading platform has tripled during this bear market:

As I mentioned in my recent blog post on 2023 predictions, there has been a consolidation of the spaces that entrepreneurs are focused on, which usually happens in every bear market. I see a shift into infrastructure and areas like decentralized finance, tokenization of world assets onto the blockchain, developer tooling, and data infrastructure.

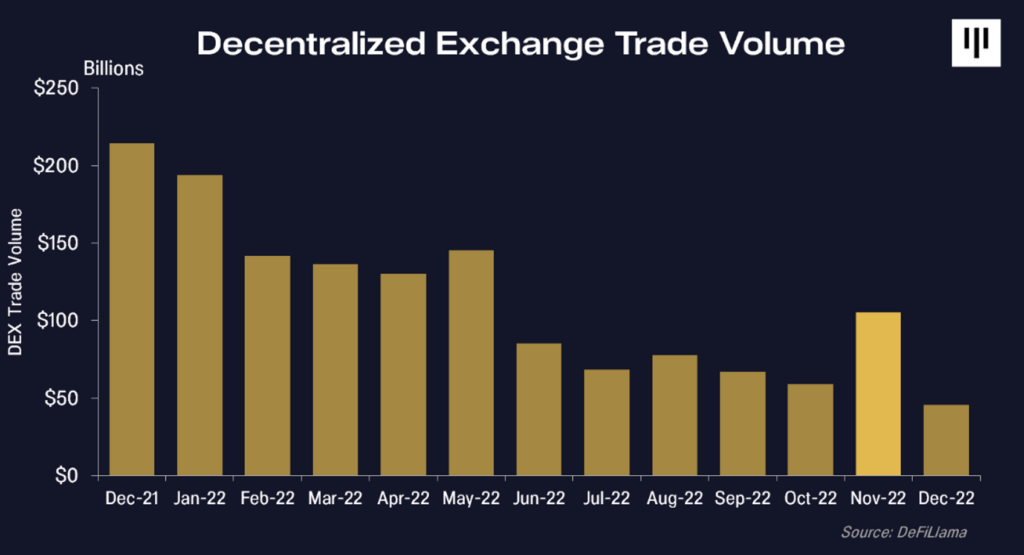

Post-FTX, volume has shifted to highly regulated exchanges like Coinbase and Bitstamp, as well as DeFi-based decentralized exchanges. Below is decentralized exchange volume within the last 12 months, with November (the month of FTX’s collapse) having a remarkable uptick in volume.

With more scrutiny around trust and security, we believe there are opportunities for startups in areas like self-custody, security, insurance, and identity. Another trend that is similar to past bear markets is that we expect a higher percentage of deals to be started by domestic founders versus international founders, because of the focus on infrastructure versus applications. As we start to escape the bear market, we expect to see Asia emerging with a larger share of NFTs, gaming, and decentralized social applications. Asia is in a better position on the application layer due to cost of labor, vibrant influencers and brands, and strong social mobile penetration.

The Time Is Now

We believe this is a tremendous time to start a company in the blockchain space. On average, talent is more educated and passionate about the industry than in previous cycles. A plethora of capital has been raised ($121B raised from the entire VC industry in H1 2022[4]) and is awaiting deployment. Many new crypto VCs have emerged. In our experience, bear markets typically represent a time where there is less noise and distraction from building. In addition, we’ve observed that institutions and enterprises are more open than ever before to working with blockchain companies to enhance their businesses.

Valuations for private deals in the second half of 2022 have dropped quite a bit, with growth-stage valuations dropping more dramatically than those of early-stage deals. The majority of the deals that we are seeing involve both equity and tokens in the same round. We believe entrepreneurs should prioritize making sure they have enough runway and buffer to last through the bear market and into the next bull market, optimizing for the right investment partners and not valuation. More mature companies are expected to be pushing towards profitability. Secondary transactions and acquisitions are likely to be more common during this time, providing liquidity for both employees and investors.

We believe Pantera is open for business, and actively looking for compelling seed and Series A opportunities. We want to partner early with entrepreneurs we believe can accelerate development of the new economic layer of the internet.

![]()

BLOCKCHAIN INFRASTRUCTURE :: BY WILL REID, INVESTMENT ANALYST

[With thanks to Liron Hayman from StarkWare and A.J. Warner from Offchain Labs for help with the Layer 2 insights in this piece.]

We could write a small book on everything that’s happened in crypto infrastructure in 2022, and on everything in the pipeline for 2023. But for the sake of brevity, we’ll cover just a few of the key areas we think are worth reviewing from 2022, and worth thinking about for the year ahead.

Ethereum :: The Merge, And The Rise Of The “Urge”

Ethereum’s Merge is one of the most technically impressive software updates ever performed. Crudely likened to switching out the engine of a rocket ship mid-flight, the transition from Proof-of-Work to Proof-of-Stake Ethereum in September 2022 has made the network more economically sustainable, user-friendly, and environmentally sound. The network has cut its inflation schedule from around 3.6% per year, to virtually flat, improved transaction inclusion times to a point where the network feels competitive with credit card point-of-sale systems, and has reduced its electricity consumption from roughly the country of Austria’s, to something closer to San Marino’s or the Vatican’s.

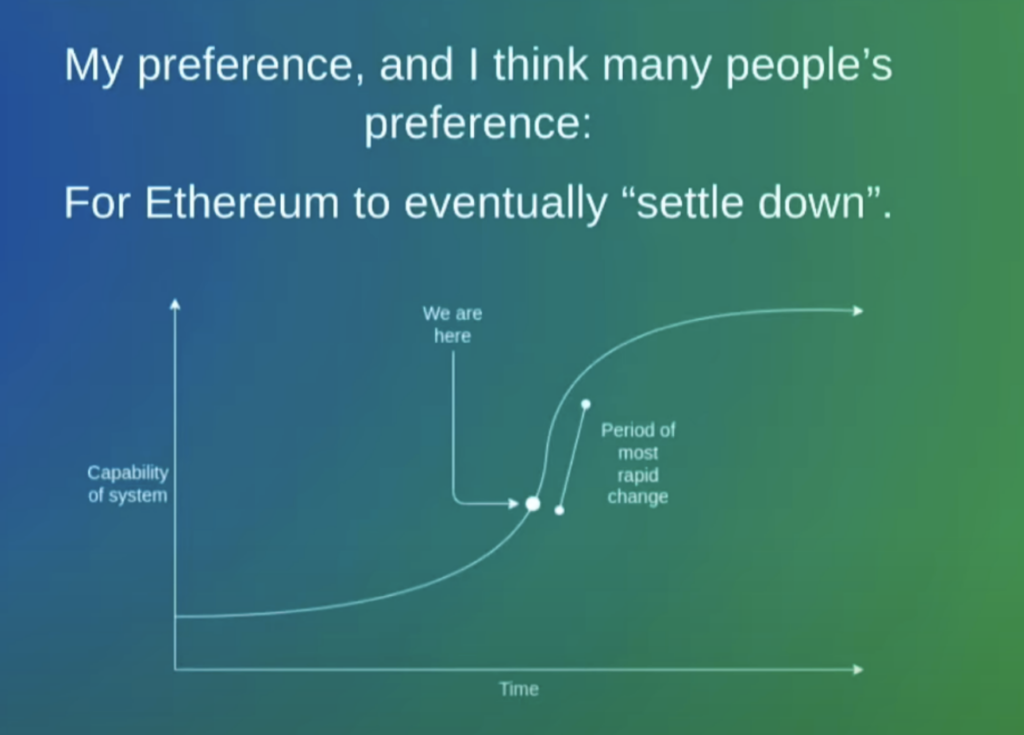

Ethereum’s development, however, is far from complete. The Merge marks just the start of an inflection point in Ethereum’s full scaling roadmap. Vitalik Buterin — the founder of Ethereum — outlined this inflection point in a talk at EthCC in July:

Source: Vitalik Buterin, EthCC Paris, July 2022

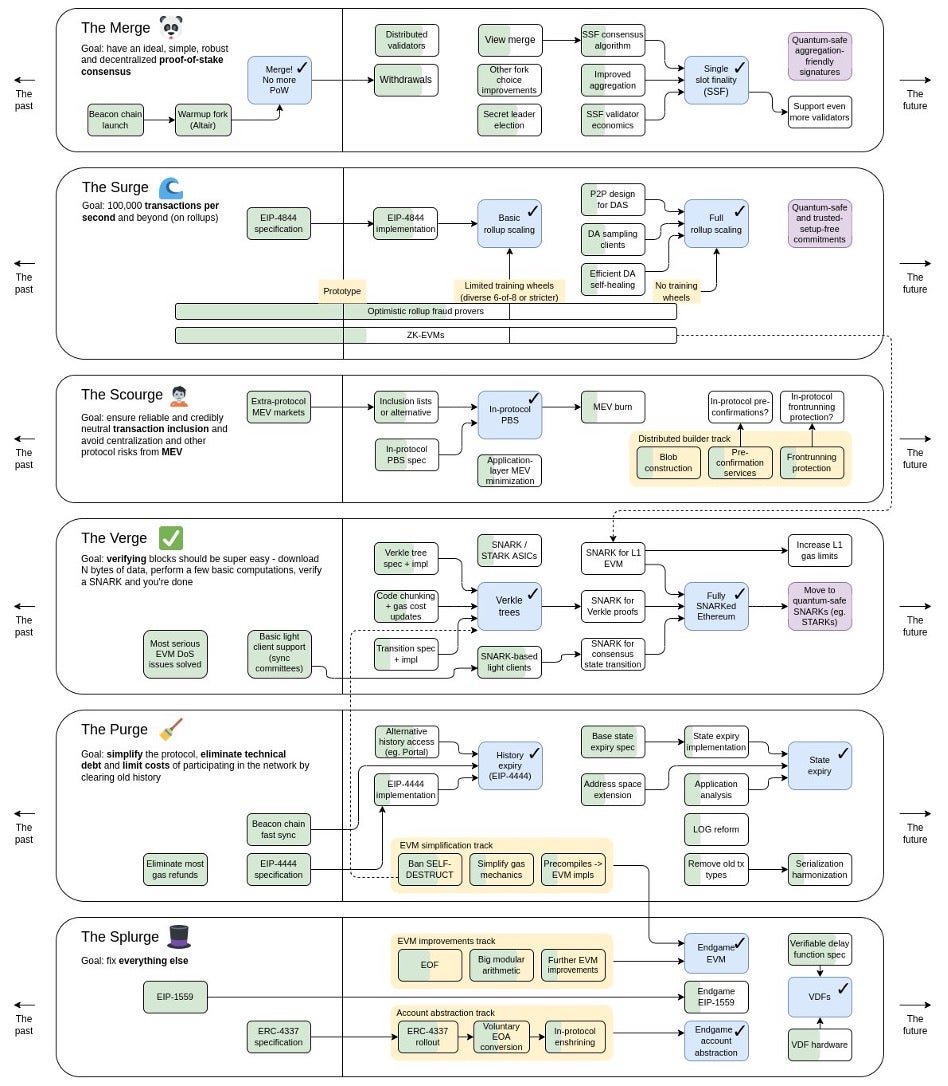

Looking further ahead, Vitalik has split Ethereum’s “period of most rapid change” into 6 distinct sections: The Merge, The Surge, The Scourge, The Verge, The Purge, and The Splurge.

Source: Vitalik Buterin, Twitter

The time it takes to develop and deploy these “urges” will extend well beyond 2023, but as each piece is critical to understanding the vision for the base layer of the largest ecosystem in crypto, we’ll briefly outline each of them here:

-

The Merge: Although the main and most technically complex event of merging the Ethereum mainnet with the Beacon Chain to migrate from proof-of-work to proof-of-stake is complete, there are still several meaningful upgrades left to execute in ‘The Merge’ section of the roadmap over the coming months and years. The Shanghai upgrade, which will allow Ethereum stakers to withdraw their staked assets, is expected in March of 2023, and single-slot finality, which would reduce transaction confirmation time from ~15 minutes to ~12 seconds, represents a longer term goal. Distributed Validator Technology will provide critical risk management features for Ethereum stakers.

-

The Surge: This is about scaling Ethereum’s transaction throughput. The goal is to reach 100,000 transactions per second (up from ~30 currently). To achieve such a significant scale-up, Ethereum will introduce a new transaction type, allowing “data blobs” attached to a transaction to contain a large amount of transaction data which wouldn’t need to be accessed when the transaction is executed. The first instantiation of these new transactions will be “Proto-Danksharding”, a precursor to “Danksharding”, which will be delivered as part of the EIP-4844 upgrade to Ethereum (expected in May or June of 2023).

-

The Scourge: A newer addition to the roadmap, The Scourge aims to address the risks posed by maximal extractable value (MEV). The Scourge should, “ensure reliable and fair, credibly neutral transaction inclusion, [and] solve MEV issues”, according to Vitalik. The first stage of this is to enshrine proposer-builder separation (PBS) in the core of the Ethereum network. The current earliest estimate for in-protocol PBS is sometime in 2H23, and Flashbots are leading the charge on PBS research and development.

-

The Verge: “Fully SNARKed Ethereum” aims to make verifying blocks much less costly (so you could even have a verifier on your cell phone) by introducing Verkle trees, a more efficient version of Merkle trees, which have powered Ethereum since its inception. Verkle trees are also the first step towards a stateless client for Ethereum. These upgrades will ensure further decentralization and resilience for the Ethereum network.

-

The Purge: This section is focused on simplification and performance improvements for Ethereum. Starting with EIP-4444, which will significantly reduce the overhead for Ethereum clients to store historical data, The Purge will perform a number of upgrades aimed at facilitating other parts of the Ethereum roadmap, such as removing the well-known ‘SELF-DESTRUCT’ opcode from Solidity to enable the Verkle trees rollout, and ultimately building state expiry into the network (a system to reduce the amount of data clients need to store to a flat ~20-50 GB).

-

The Splurge: The “fix everything else” section includes account abstraction (significant UX improvements for the network) and verifiable delay functions (another efficiency booster).

So what can we make of all of these upgrades? Ultimately, Ethereum is moving towards a faster, less costly, fairer, and more decentralized, secure, and user-friendly network than the Ethereum of today. As the blockchain matures, applications built atop will be able to more effectively leverage the core features of blockchain technology (like the removal of trusted intermediaries), unencumbered by the restrictions of the underlying protocol.

Much like higher bandwidth internet connections allowed for progressively more diverse content and applications to be built in the early days of the internet, higher bandwidth, more secure, and more user-friendly blockchains should allow for a similar Cambrian explosion of applications and use cases in Web3.

The Rise And Rise Of Layer-2s

Although The Merge had many positive impacts on the Ethereum ecosystem, lowering gas fees wasn’t one of them, and so Layer-2 scaling solutions remain a critical piece of the Ethereum ecosystem infrastructure. Protocol layers beyond the base blockchain (e.g., Layer-2s) are developed to extend the feature set and/or solve issues (typically scalability issues) inherent to their relative base blockchain.

Layer-2s have held up relatively well so far in the bear market, with a number of important upgrades such as Arbitrum’s Nitro upgrade and StarkWare’s introduction of recursive proofs (and upgrade to Cairo v1.0), the excitement around the launch of zk-EVMs, and a rotation out of alt-L1s (alternative layer-1s) providing tailwinds to the sector.

To illustrate the sector’s success, Arbitrum has had a 516% growth in active developer teams since January. Cumulative volume traded on all StarkEx platforms has more than doubled to $795 billion from a little over $300 billion at the start of the year.

However, the sector wasn’t entirely immune from the effects of the bear. Total value locked on Layer 2s on Ethereum was down 40%+, from ~$7 billion in January to ~$4 billion in late December. Total value locked (TVL) is a DeFi performance metric indicating the capitalized amount of crypto-asset value staked or parked in a protocol for a time. That said, metrics like DAUs (daily active users) and TVL can be misleading since they can be gamed and often don’t reflect organic growth. At this stage in the development of Layer-2s, a more important focus is on technical progress. Key developments that need to be monitored include support of fraud proofs for optimistic rollups, zkEVMs working in production, decentralization of sequencers and provers, and gas reductions versus Layer-1s.

Looking forward, Layer-2s will need to contend with the implementation of EIP-4844, which is expected to reduce rollup fees by a factor of 10-100x. However, the ecosystem could equally benefit from the end of costly alt-L1 incentive programs that are running out of funding and which were designed to draw users away from the Ethereum ecosystem.

Key KPIs to track for the Layer-2 ecosystem will be inflows from non-DeFi verticals. Inflows from gaming and NFT-use cases are expected to be particularly strong growth vectors as transaction fees come down and will be key indicators of a Layer-2’s ability to attract mindshare from a larger audience beyond crypto-native DeFi users.

Finally, the topic of Layer-3s received a good amount of attention in 2022. While the term hints at a “scaling solution on a scaling solution”, or “scaling squared”, it actually encompasses a number of possible visions, including customized functionality (such as privacy), customized scaling (such as data compression optimized for specific use cases), and weakly-trusted scaling solutions (which would use Validiums for a cheaper, lower security rollup, which could serve ‘enterprise blockchains’ particularly well). However, application specific Layer-3s will have to contend with the costs associated with setting up entirely independent blockchains, and so there may be higher barriers to entry than the Layer-3 hype would suggest. A DeFi chain for instance would need to pay for a sequencer, RPC nodes, price feed oracles, indexers, and bridges — a considerable overhead to get the chain off the ground.

Overall, we believe the Layer-2 space will perhaps be the most closely watched of any crypto ecosystem to gauge overall crypto adoption and performance in 2023. We will be monitoring it closely.

Cross-Chain Interoperability

Cross-chain interoperability remains a significant pain point in crypto, with over $2bn lost in bridge hacks in 2022, accounting for over 70% of total crypto hacks for the year. Bridges at a high-level can be categorized as trustless (a.k.a. natively verified) or trusted (a.k.a. externally-verified). Most bridges so far have been trusted, or externally verified, but the rise of trustless, or natively verified bridges, such as IBC, could prove to be the antidote to the bridge hacking issue.

IBC saw enormous success in 2022, emerging as the de facto bridge for Cosmos and one of the top three crypto bridges by volume. The Merge and recent advancements in ZK-tech have also created a possible path for IBC to be launched on Ethereum.

Finally, zero-knowledge based bridges developed by the teams at Succinct Labs and zkBridge offer another solution to building trustless bridges and have seen considerable attention in the final quarter of 2022. Both teams are set to launch the mainnet versions of their products some time in 2023.

Ethereum Middleware

Flashbots, Eigenlayer, and Obol Network are creating the foundation of a new ‘Ethereum middleware’ sector.

For Flashbots, the rollout of proposer-builder separation and the development of the builder market will be the key areas to watch in 2023.

For Eigenlayer, we will be monitoring the rollout of their re-staking product, which allows for re-staking of ETH and extension of Ethereum’s base layer security to provide other services and products on the network.

For Obol Network, the launch of Distributed Validator Technology (DVT) on mainnet should catalyze institutional staking adoption, as the risk of slashing from ETH staking is significantly mitigated. We’re very excited about DVT as a core piece of infrastructure that we think simply “needs to exist” in the Ethereum ecosystem. We can’t wait to see what the Obol team has in store for 2023.

Alt-L1s

The app-chain thesis continues to gain momentum, with the Cosmos ecosystem having received a particularly high proportion of developer and user mindshare in 2022. New Layer-1s (L1s) like Aptos and Sui offer a more familiar Web2 developer experience, all whilst promising higher transaction throughput from their initial launch. Application specific L1s like Sei and Injective promise to offer a more compelling DeFi experience, with order-book logic built directly into the base layer of the protocol. Protocols like NEAR continue to build cutting edge tech directly into the Layer-1 — did you know that NEAR has already solved for account abstraction at the protocol level?

![]()

DEFI :: BY CHIA JENG YANG, INVESTMENT ASSOCIATE

“Structurally Safe DeFi” :: What Does Safe Mean?

Crypto has seen its share of criminally greedy actors. We can never eliminate criminally greedy actors, especially in finance, but what we can do is reduce their ability to succeed. In my view, there are three pillars for a Structurally Safer DeFi:

1. Programming and code as “the executor”

2. Traditional legal structures and regulations — law as “the guarantor”

3. Market expectations as “the filter”

Traditional legal structures and regulations should be seen as a good but incomplete means of safety and are merely a partial means to an end for Structurally Safer Finance. As decentralized technology, uncapturable by any single, centralized authority, DeFi operates outside of regulations. In order to succeed, DeFi must be able to protect user funds with only code — and in an increasingly adversarial, open global environment. Fortunately, there is no enforcement mechanism more structural than code.

Going into 2023, we should expect to see TradFi (traditional finance) best practices extend to DeFi, with better legal frameworks being helpful here. The founders of Cega understood how to backstop losses through structural and contractual backstops, exemplifying how their TradFi backgrounds have given them an edge in the DeFi world. Cega became a market leader in establishing counterparty risk management because of strong internal practices, such as requiring ISDA for every market maker. Code can try to be law, but law and code are not mutually exclusive.

As an industry, we have been focused on pillar1 (above), forgetting that TradFi has a deep history of taking advantage of pillar 2 and 3. Increased regulation will help lead to greater legal certainty, but we also know that regulatory capture and reliance is not the point of DeFi. If we want to create a balance and bring about a world with minimally viable regulatory scrutiny, our industry’s ability to self-govern through a market expectation of minimally safe behaviors must exist.

What I mean by this is eschewing behaviors that would not otherwise have flown in traditional finance. As an example, undercollateralized lending did not fail because of some esoteric aspect of the blockchain. It failed because lenders were willing to take WhatsApp messages as proof of AUM. Similarly, treasury managers in TradFi have always had to consider counterparty risk for custodial services in ways that some CFOs have failed to do. We will also continue to see an increased emphasis of market-standard information provision for users of various DeFi protocols. Clearer communication of the risks that liquidity providers undertake for certain liquidity pools will go a long way to creating a fairer system that attracts less regulatory scrutiny.

The current debate for centralized exchanges over the use of blockchain-based proof-of-reserves and proof-of-liabilities is a great example of this. We, who comprise the market, need to set expectations for the minimally safe behaviors of counterparties we deal with. It may be the case that the market will expect fully audited exchanges as a base case for doing business with others.

In our view, CeFi’s (centralized finance) ability to obfuscate their backend is only a short-term advantage, whereas infrastructure weaknesses and shortcuts give rise to long-term vulnerabilities. Part of why FTX failed was because Alameda had preferential accounts. Alameda was allowed to trade with no auto-liquidation mechanics when they were overleveraged. There are no backdoors or preferential treatment in DeFi. Avoiding backdoor dealings and sweetheart deals is exactly what we’ve repeatedly pointed out as a core strength of DeFi.

This brings us to a key insight into how to think about DeFi moving forward. DeFi is a far more adversarial environment than CeFi and/or TradFi. This feature of the market has meant that, despite the many headlines of hacks and exploits, the industry as a whole has learned from these mistakes and permanently hardened its infrastructure moving forward. Where best practices in TradFi are passed down through rulebooks or, more likely, memories of executives, DeFi passes down knowledge in code.

TradFi best practices need incorporation into DeFi. DeFi infrastructure needs incorporation into CeFi/TradFi. Embracing this symbiosis is the key to the next level.

The Great Bifurcation Of DeFi

We believe 2023 will see the bifurcation of regulated and censorship-resistant infrastructure.

It is important to remember that blockchain promises both the creation of new financial rails (in which TradFi institutions are interested) and a new financial system (in which censorship-resistant actors are interested).

There has always been a great deal of skepticism about enterprise DeFi, much of which I believe is unwarranted. Non-decentralized, permissioned blockchains that facilitate existing relationships between financial actors, as opposed to creating new ones, is a very different vision from a censorship-resistant financial ecosystem that can weather tyrannical governments and intermediaries.

At the same time, this reflects the immense promise of blockchain technology — by creating a horizontal technology that facilitates two (at least) very different camps of builders. It is important to remember why we are here: credibly neutral infrastructure benefits everyone, badly designed biased infrastructure benefits no one.

First, a reminder of how far we have come for enterprise DeFi. As Coinbase noted in their 2023 report, J.P. Morgan’s intra-day repo application on Onyx Digital Assets has processed more than $430 billion of repo transactions since its launch in November 2020. Additionally, J.P. Morgan, DBS Bank, and SBI Digital Asset Holdings traded tokenized currencies and sovereign bonds via Polygon in November 2022. These developments mean that regardless of how the rest of the market plays out, blockchain will have its place in the enterprise tech stack. Institutions are still investing in and researching DeFi despite what the current market downturn may imply.

At the same time, the events of OFAC, FTX, MakerDAO, etc., support skepticism in allowing centralization compromises within DeFi infrastructure. Also at the same time, we will see increased regulatory clampdown and challenges towards many DeFi dApps and infrastructure, making the need for building a credibly neutral infrastructure turn from a question of long-term stability to a condition for existence.

The bifurcation and development of these two very different ideologies will emerge in a big way in the market, and for many investors who have not needed to confront these latent tensions in the bull market.

Areas Of Interest In 2023 :: Macro Affects Portfolio Construction

The past few years has seen the development of a “risk-on” on-chain financial infrastructure. We will see the development of what a “risk-off’ financial ecosystem looks like as the macro-environment favors a rush to safety. As real-world portfolio allocations stay risk-off and seek safer instruments, particularly in the fixed-income space, we should expect to see more real-world yield and fixed-income assets grow on-chain.

Where bonds and real-world fixed-income assets become more attractive, the proper reaction is an excitement to this — a clearly identified problem statement — as well as a good understanding of which part of the value-chain represents the greatest opportunity to invest in for real-world assets on-chain. I am particularly excited about taking this one step further per the promise of crypto unlocking global liquidity: providing real world assets for customers all over the world in ways that traditional fintech institutions are constrained. Companies that focus on “0-1” access to financial instruments as opposed to incremental access will do well in particular.

Just as the last bull market was a catalyst for alternative investment platforms, so too will this bear market be a catalyst for a new wave of safer investment instruments.

Application Weaknesses Lead To Infrastructure Opportunities

Why was it easy to find so many weaknesses in DeFi infrastructure and dApps? Because when we are building a financial system from scratch, we are also both building a business and its infrastructure from scratch. This is hard to say the least, and rife with challenges. There are bound to be suboptimal infrastructure components to existing businesses or reliance on shortcuts due to a lack of available external infrastructure providers. As the market and regulations demand better practices, there will be demand in-tandem for infrastructure providers to better support safer practices.

Going back to the example of counterparty deposit risk, a similar problem was faced in TradFi and solved by companies like IntraFi, which help break apart a treasury into separate accounts to take advantage of the $250k FDIC insurance. As companies realize that they need to manage counterparty risk in a similarly stringent manner, we will see increased demand for various types of infrastructure players to tackle previous issues.

In other words, as Union Square Ventures noted in a different way, infrastructure booms lead to app booms lead to infrastructure booms. As they noted, we can build great apps before the infrastructure arrives, but sometimes those apps break and lose money. We learn from those experiences to demand better outsourced infrastructure and to build safer apps. We are continuously investing in better infrastructure and safer apps across DeFi and other sectors.

Lessons From TradFi Fintech Investing

Prior to Pantera, I invested in emerging market fintech and have always held a strong belief that many aspects of crypto investing resemble fintech investing in relatively thin emerging markets. These markets demonstrate difficulty monetizing, a need to build core infrastructure internally, distribution and user education challenges, with large public and private incumbents occupying monopolistic market share. The ecosystem around the Unified Payments Interface (UPI) in India is a fantastic example of some of these challenges, particularly around the ability for companies build on UPI to monetize on what are essentially public rails. For the TradFi folks in the room, I always joke that staking and MEV (maximal extractable value) are the new lending.

The main lessons I learned from those experiences was that success meant an intense ability to build on a product roadmap that focuses on occupying mindshare of extremely valuable customers within existing markets, and which has an incremental ability to monetize through a wider range of revenue streams than traditional startups. Some of the most innovative fintech startup strategies have arisen in India precisely because of this dynamic.

As founders building in crypto double down on finding product market fit, many TradFi lessons will extend to the fold of crypto.

![]()

PANTERA BLOCKCHAIN SUMMIT 2023

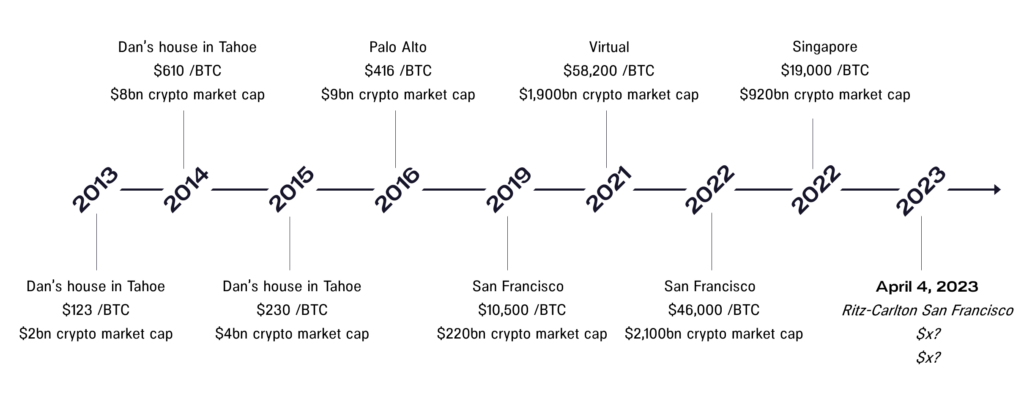

Pantera Blockchain Summit 2023 will be taking place on April 3-4, 2023 in San Francisco. This is our ninth summit in a series of gatherings we’ve hosted since 2013.

This year also marks the 10th anniversary of the blockchain fund industry in the U.S., starting with the launch of Pantera Bitcoin Fund, and our team is especially honored to bring together our family of portfolio companies, partners, and investors for a day of learning, inspiration, and connection.

Pantera Blockchain Summit 2023 is an invite-only event, curated by the Pantera investment team and focused on the most important and exciting topics in the blockchain industry. Our goal is to uncover valuable insights, foster great conversations, and empower the entire Pantera network to move our industry forward. We host industry leaders of diverse backgrounds including entrepreneurs, developers, and regulators at our summits.

Confirmed speakers for 2023 include:

-

Chris Giancarlo, Former CFTC Chairman

-

Mike Belshe, Co-founder and CEO of BitGo

-

Amir Bandeali, Co-founder of 0x Labs

-

Roneil Rumburg, CEO of Audius

-

Ola Doudin, Co-founder and CEO of BitOasis

-

Bradley Kam, Co-founder of Unstoppable Domains

-

Sumit Gupta, Co-founder and CEO of CoinDCX

-

Eric Chen, Co-founder and CEO of Injective

-

Nathan Allman, Co-founder and CEO of Ondo Finance

-

Arisa Toyosaki, Co-founder and CEO of Cega

-

Don Ho, Managing Director at Quantstamp

You can check out highlights from Pantera Blockchain Summit 2022 here.

If you are interested in attending, you can submit an application here and a member of our Capital Formation team will contact you regarding availability.

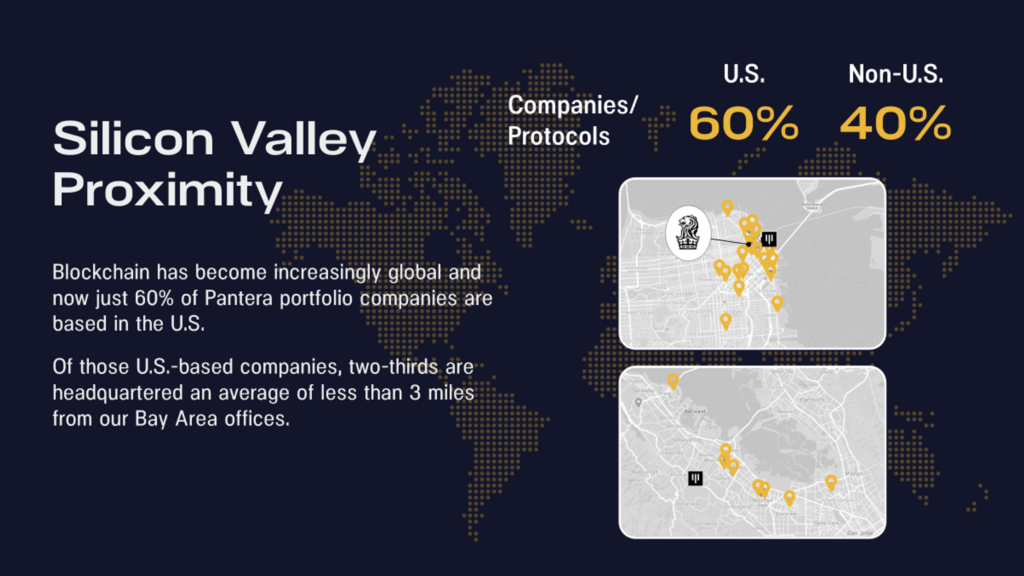

Silicon Valley Proximity

It’s fun to host the event in downtown San Francisco. Although we’ve invested in dozens of countries over our ten years, nearly half of all the projects we’ve ever invested in are within three miles of our two San Francisco-area offices. The Ritz-Carlton is smack in the middle of all the gold dots:

This allows our San Francisco-based team to be able to communicate much more freely with entrepreneurs and teams we’re supporting. We literally bump into each other on the streets.

We’ll be hearing from many of these founders at this year’s summit.

History of the Pantera Blockchain Summit

The purpose of the Pantera Blockchain Summit is to bring industry leaders, academics, regulators, and lawyers together to discuss the most important topics in blockchain.

Our 2013 Summit served as the basis of Nathaniel Popper’s book Digital Gold. It was a small gathering in a private residence with thirty crypto-enthusiasts and early developers.

Since then, the industry has grown from what many considered a small-scale science project to a trillion dollar asset class. The community has come a long way! The timeline of our summits is a proxy for the growth of the industry:

The Summit historically concludes with a poker tournament. At Pantera poker tournaments, paper money is no good. You can only buy in with crypto. In 2015, everybody threw in a bitcoin, which was a couple hundred bucks at the time. The 23 BTC pot is nearly half a million in today’s paper money.

Join us in celebrating ten exciting years of investment and technology.