By Dirty Bubble Media

Sam Bankman-Fried, better known as SBF, has a reputation for being the smartest guy in the room. The crypto billionaire controls both one of the largest crypto hedge funds, Alameda Research, and one of the largest crypto exchanges, FTX. He has appeared in the thick of multiple crypto company failures, bailing out crypto lender Blockfi and acquiring most of the assets of Voyager Digital after their respective failures. Some have even compared his role during the recent crypto rout to J.P. Morgan during the crisis of 1907. However, a recent leak suggests that SBF’s crypto empire rests on some questionable foundations.

On November 2nd, a report from Coindesk shared some critical financial details from Alameda Research, the crypto hedge fund controlled by crypto mogul Sam Bankman-Fried (“SBF”). Coindesk reported that they had obtained a copy of the hedge fund’s Q2 balance sheet. According to their reporting, the company’s balance sheet is comprised of:

-

Total assets: $14.6 billion. This is comprised of $5.8 billion FTT token, $1.2 billion Solana token (SOL), $3.37 billion in unidentified “crypto held,” $2 billion in “investments in equity securities.” This leaves roughly $2.2 billion in assets. According to our sources, hundreds of millions of dollars of the remaining assets are comprised by Alameda’s holdings of the Serum (SRM), Oxygen (OXY), MAPS, and FIDA tokens, all of which are from other SBF projects. According to this balance sheet, Alameda only had $134 million in cash on hand in June 2022.

-

Total liabilities: $8 billion, of which $7.4 billion is “loans,” with another $292 million worth of FTT token owed. The remainder is unidentified by the Coindesk article.

This purported leak of Alameda’s financials demonstrates that the firm’s largest asset is its holdings of “FTX Token (FTT),” issued by none other than SBF’s FTX Exchange. The FTT token on Alameda’s balance sheet is roughly 1/3 of their total assets and equal to 88% of Alameda’s net equity. In other words, the firm’s largest asset is a crypto token issued by SBF’s other company, with a very significant portion of their assets in tokens issued by other related parties.

It’s almost as if SBF found a way to hack the financial system, printing billions of dollars out of thin air against which he was able to borrow massive sums from unknown counterparties. Almost as if he discovered a financial perpetual motion machine…

A flywheel, perhaps?

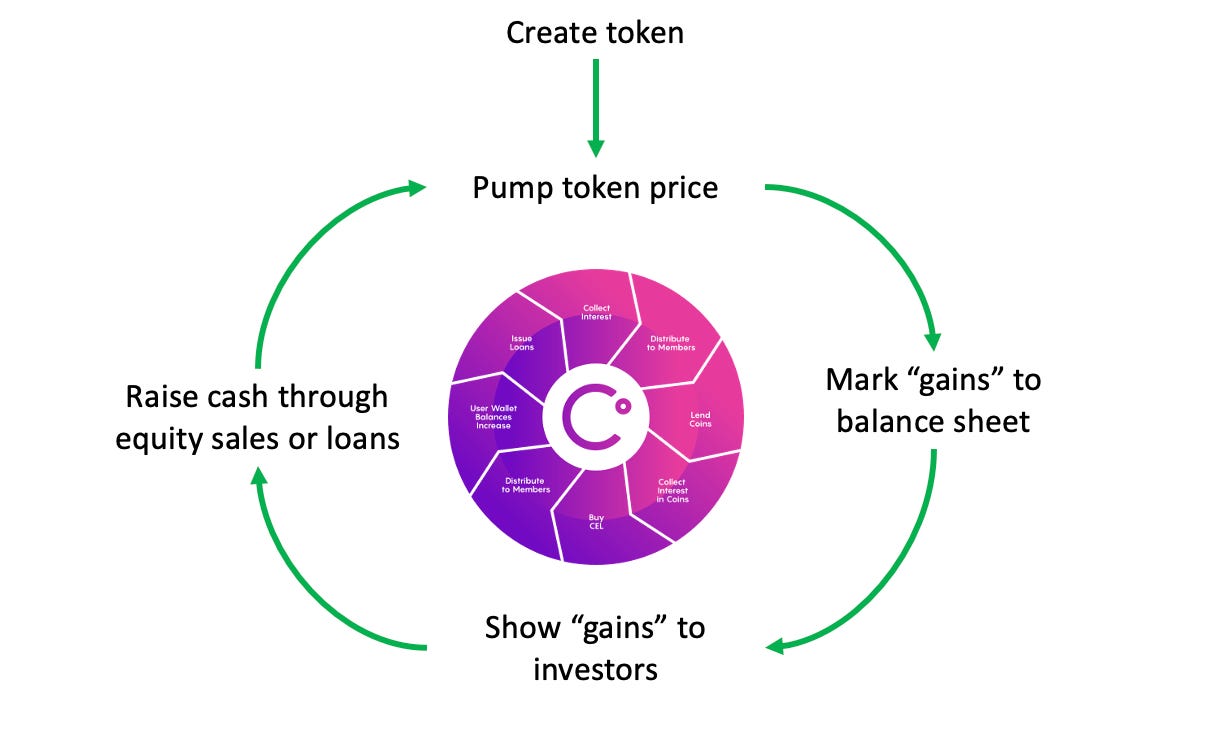

The basic architecture of a flywheel scheme

Readers of this site will recall that the now-defunct Celsius Network, a multi-billion dollar crypto lending firm (Ponzi scam) with very close ties to SBF, was destroyed in part by its token, CEL. Celsius Network was built around the CEL token, under the brilliant idea that it could be used to spin up billions of dollars in free assets. The structure of a flywheel scheme is quite simple:

-

Create a token: Tokens are literally just bits of code on a blockchain. Program that sucker up and get rolling. Make sure you retain the majority of those tokens on your balance sheet for maximum flywheeling.

-

Pump the token’s price: Retain a “market maker.” Buy tokens using your customer’s assets. Wash trade it to infinity. Do whatever it takes to drive that price sky-high! And since you kept most of the tokens for yourself, there’s that many fewer tokens out there to pump.

-

Mark those babies to market: That’s right! Now you reap your rewards; at least, on paper. Now you can show billions of dollars in “assets” on your balance sheet.

-

Show off your success: Now’s the time to cash in. Hook some savvy investors (suckers), like pension funds, into massively overpaying for your equity or into making you big loans collateralized by your token.

-

Keep that flywheel spinning: Now you have real dollars. Buy yourself something nice, like stadium naming rights, politicians, or failed crypto companies. But don’t forget: If the flywheel stops spinning, you’re gonna have a bad time.

Of course, nothing is really this simple. It turns out that the flywheel scheme is just another bit of unsustainable financial engineering, for a couple of reasons. First, as your drive the price of your token higher, it begins to cost more to keep the price up; the people that own the token are increasingly incentivized to sell out, forcing you to buy more tokens at higher prices. Eventually, you either run out of money, own all of the tokens in existence, or stop buying. Which you can’t do, because if you stop it all comes crashing down.

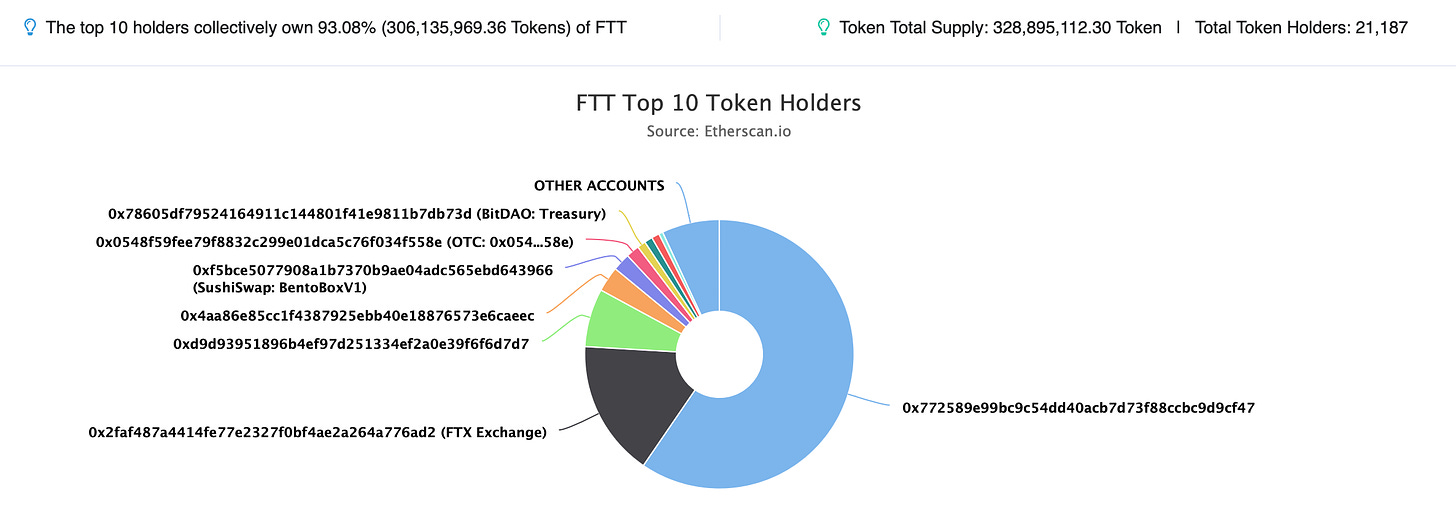

More critically, it turns out that marking massive quantities of totally illiquid assets to market only generates wealth on paper. Celsius, despite holding hundreds of millions in CEL above liabilities, cannot liquidate any significant portion of those tokens without crashing the price of the token to zero. Such is the danger of controlling over 90% of the total tokens in circulation when nobody wants to own them in the first place!

And if you think we are being unfair or cynical, read how Sam Bankman-Fried himself described token schemes in an interview with Bloomberg.

FTT Token Is Another Stupid Flywheel

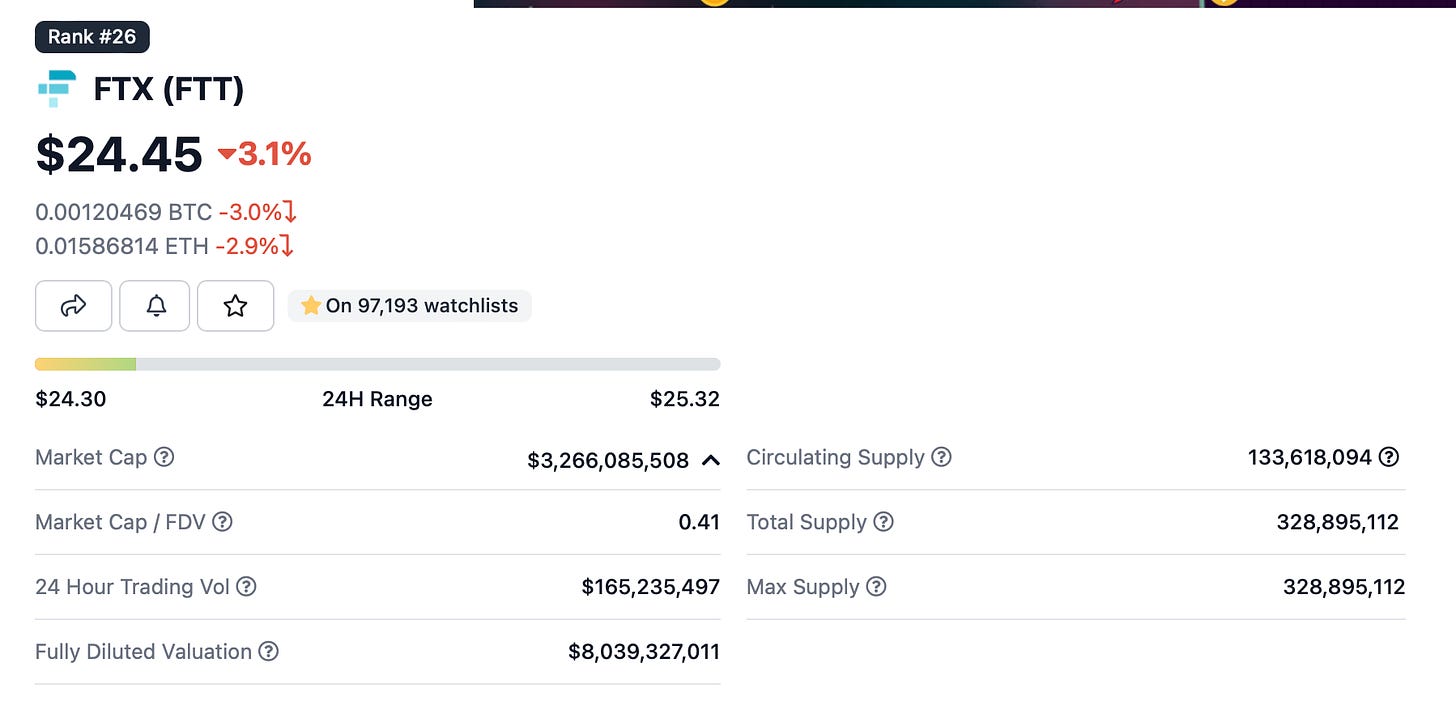

According to Coindesk’s report, Alameda owned $5.8 billion FTT tokens in June of 2022. According to market aggregator CoinGecko, this is equivalent to 180% of the total circulating supply of the tokens:

A scan of the blockchain confirms that FTT ownership is highly concentrated, with 93% of the total tokens held by only 10 addresses:

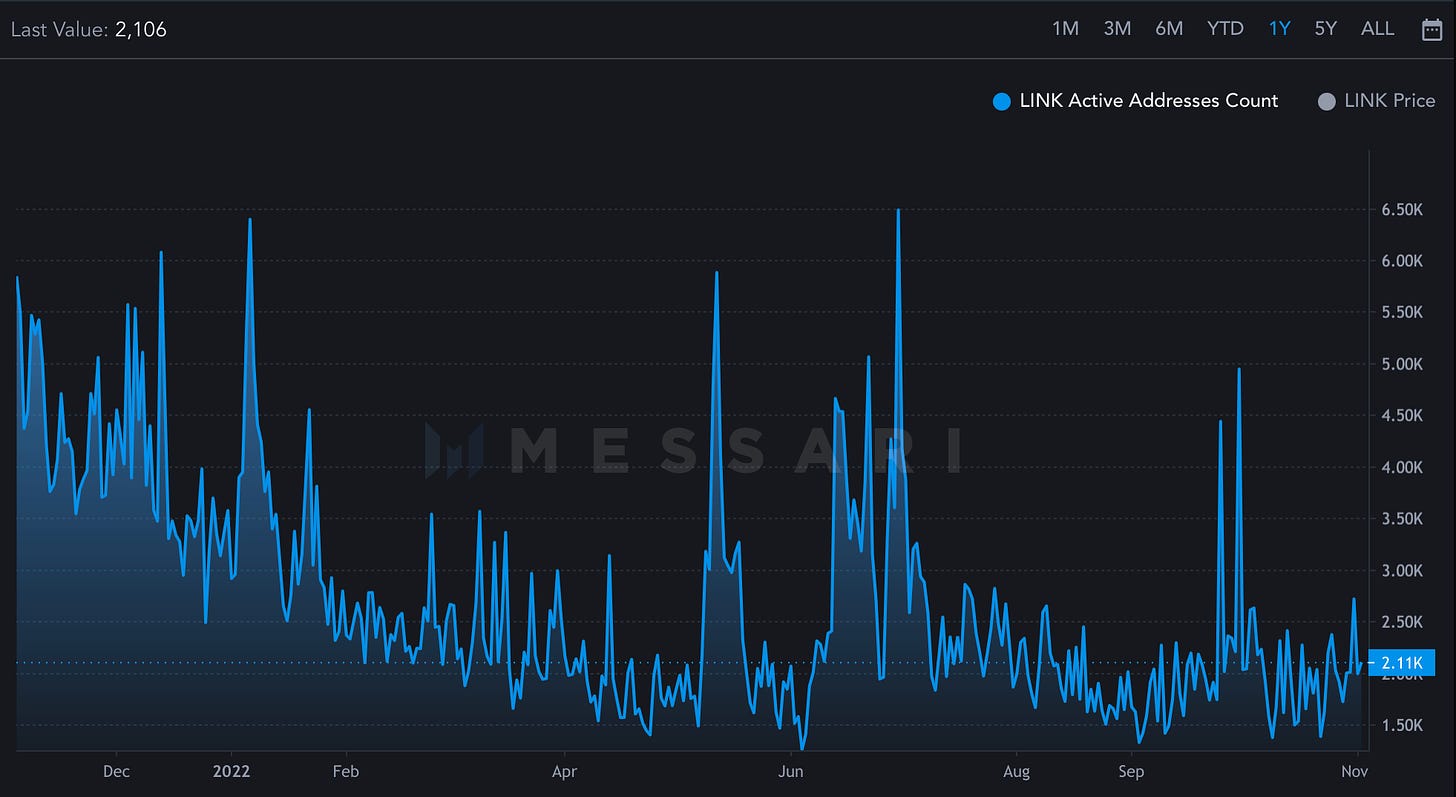

Even more concerning, the blockchain analytics firm Messari shows that there are only 180-200 addresses actively transacting in FTT tokens. The one outlier was on August 5th, 2022, when suddenly around 10,000 addresses briefly became active (???). This further demonstrates the very small number of individual FTT holders, as well as the low overall demand for this token:

For comparison, let’s look at a crypto token with a similar market cap, Chainlink (LINK). There are more than ten times more active LINK wallets than FTT wallets:

FTT’s trading volume speaks to its lack of popularity. Over the last month, FTT’s daily trading volume has fluctuated between $6 million to $42 million, equal to 0.1% - 0.8% of Alameda’s total FTT holdings. As a comparison, Messari shows real trading volumes for LINK have ranged between $25 million to $173 million, roughly four times greater than FTT.

FTX has admitted to being an active buyer of FTT token, claiming to spend “33% of fees generated on FTX markets” making weekly purchases of FTT. FTX then “burns” these tokens to decrease the total supply. Over the past couple months, FTX’s weekly purchase of FTT has ranged between $2.5 to $5 million.

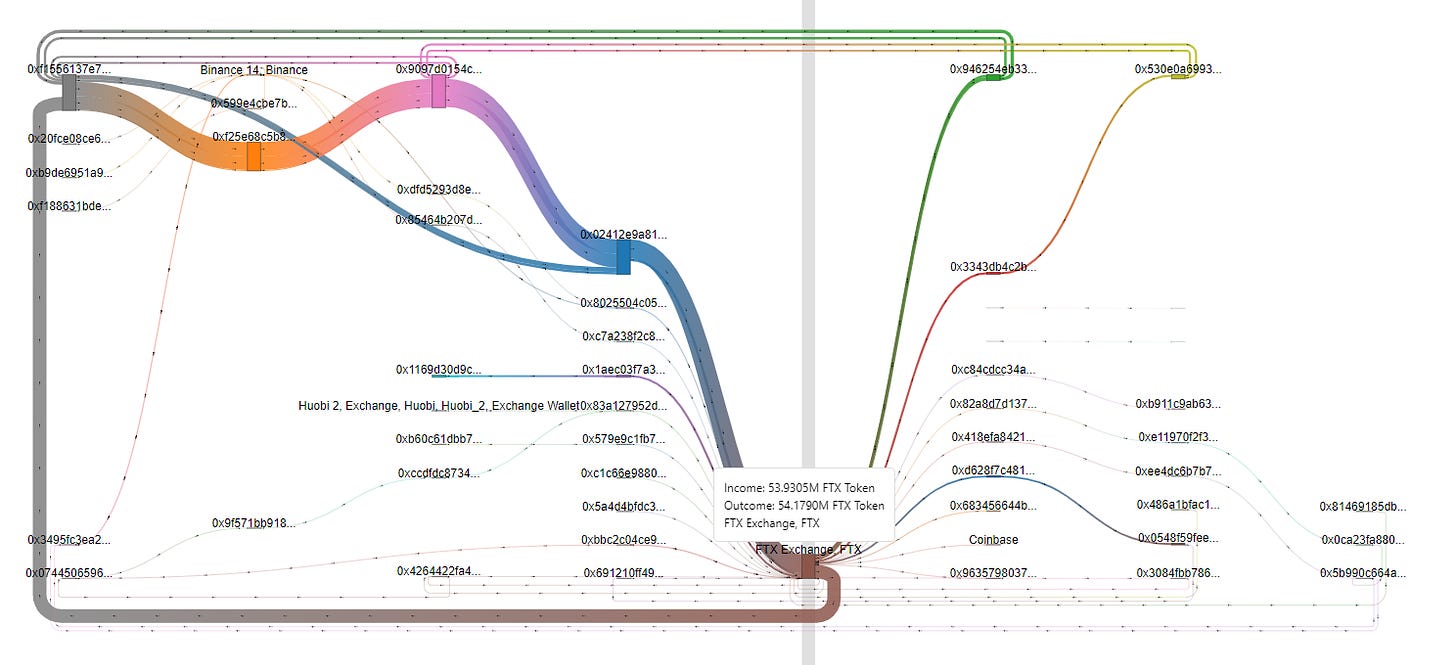

Let’s take a look at blockchain flows of FTT through FTX exchange, the host of the majority of FTT trading volume, over the last month:

Huh, all of the tokens go in a giant circle. That sure suggests organic market demand. I haven’t ever seen this before! By the way: the number of tokens going through the largest wallets means that this is Alameda churning millions of FTT token through the exchange. For what purpose?

All this to say that Alameda will never be able to cash in a significant portion of FTT to pay back its debts. There are few buyers, and the largest buyer appears to be the very company Alameda is most closely tied to. The reality of this situation is that the vast majority of the value Alameda accrues to FTT token is unrealizable, and the fair market value of their FTT in the event of large sales would rapidly approach $0.

What about the other SBF project tokens?

Alameda also shows tokens from several other SBF-associated crypto projects on its balance sheet. These include Serum (SRM), a decentralized exchange on SBF’s Solana blockchain; MAPS, the token for a map application with a DeFi plugin (lol, lmao); Oxygen (OXY), a “prime brokerage on the blockchain;” and Bonfida (FIDA), another Solana-linked project hosting the “Solana Name Service.” Shockingly, most of these projects were duds.

According to our sources, Alameda holds at least several hundred million dollars “worth” of these four tokens on its balance sheet.

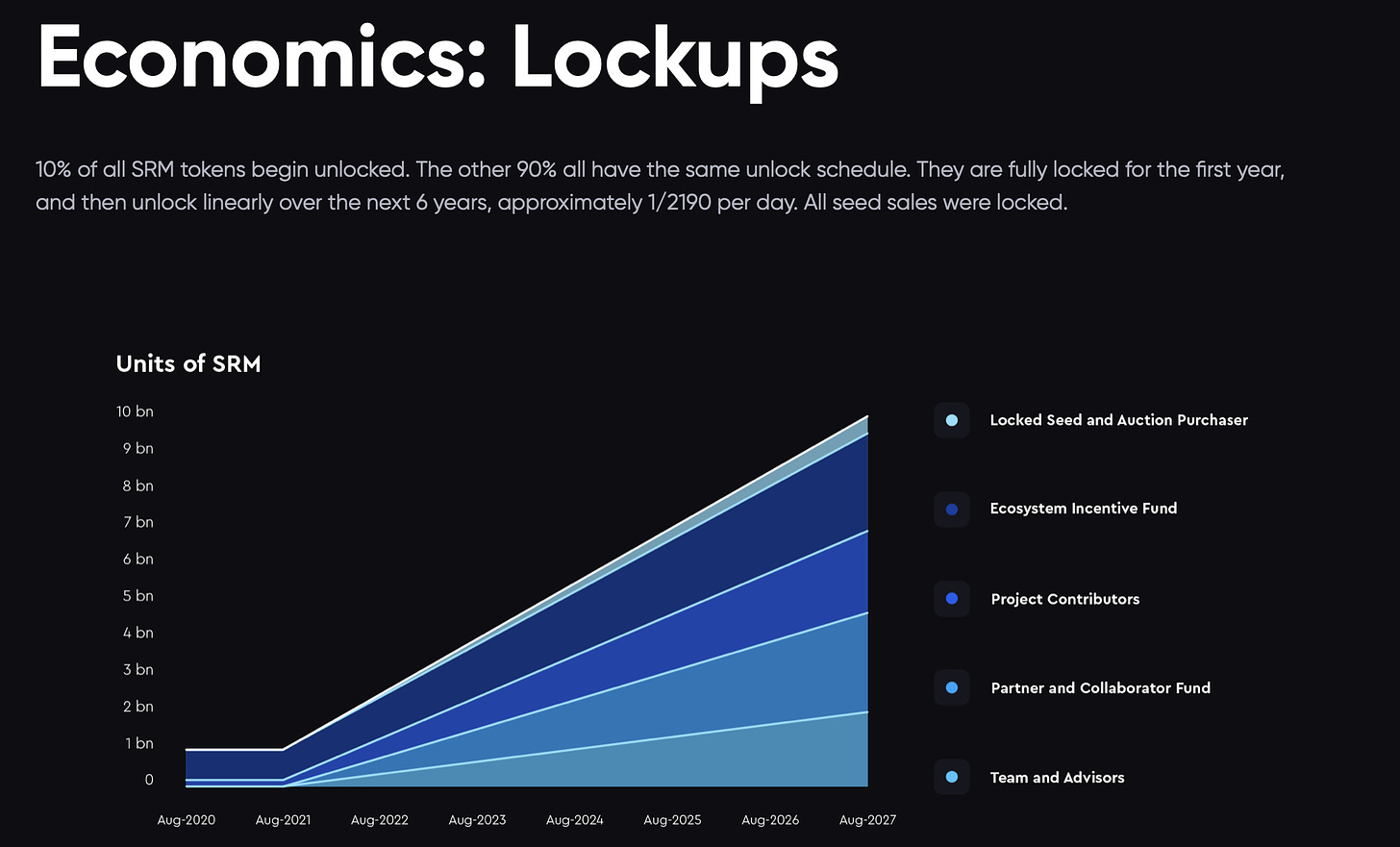

The total circulating marketcap of SRM, OXY, MAPS, and FIDA is $321 million. In other words, Alameda’s holdings of these tokens again far exceeds the total tokens currently in circulation. This is possible because the majority of the tokens for these projects are still “locked” and are not yet circulating. For example, SRM token will eventually have a total circulation of 10 billion tokens by 2027:

Again, it would be literally impossible for Alameda to liquidate any significant portion of these “assets” to pay back debts without driving the price of these tokens to near $0. Nobody wants them, because nobody cares about these failed projects. Let’s take a quick look at the data on these tokens:

-

SRM: The token for SBF’s decentralized exchange on his Solana blockchain network. SRM’s real daily volume over the last 30 days has fluctuated between $1.6 to $8 million. SRM’s total circulating market cap is only $189 million; this is a tiny fraction of the total “market cap” of SRM, which at today’s price would be some $7 billion. Based on our analysis and sources, Alameda holds liquid and locked SRM well in excess of the total circulating market cap of the token.

-

MAPS: Maps.me is a “mapping application” that somehow has DeFi features and a token crammed into the project. Of course, almost nobody uses this thing; MAPS has only 28,000 followers on Twitter. (For comparison, we have almost 21,000!)

Hm. Maybe not the next PayPal? The project has been so inactive that in August 2022, they posted this on Twitter, stating that they were “sorry” for “not being in touch for a while” and introducing “new features” for their project:

👋 Hey Travellers! Sorry, we haven’t been in touch for a while. We’ve been working hard for you. We have a ton of new features for you! Please check out some highlights below and let us know what you think. More to come👇 #mapsme #travel #maps #adventure #offlinemaps

👋 Hey Travellers! Sorry, we haven’t been in touch for a while. We’ve been working hard for you. We have a ton of new features for you! Please check out some highlights below and let us know what you think. More to come👇 #mapsme #travel #maps #adventure #offlinemaps

Look at those engagement numbers! And Maps.me’s token has a similarly anemic level of engagement. Their daily volume over the last month has ranged from $3,000 to as high as $350, 000; this is against a circulating market cap of only $10 million. Yet Alameda chose to break this asset out specifically on its balance sheet… Like SRM, there are 10 billion of these tokens in existence, most of which are still “locked.” Again, our data suggests Alameda holds tokens far in excess of the circulating market cap, greater than 10-fold this amount. MAPS is down 93% from its all-time high.

-

OXY has a circulating market cap of only $8 million, with a maximum market cap after unlocking of $440 million. Its daily trading volume has ranged between $800 to $31,000 (lol, lmao). It is down some 98% from its all-time high. Alameda appears to hold many-fold more tokens than currently in its circulating market cap.

-

FIDA: $280,000 to $4 million daily volume against circulating market cap of $25 million. It is down 96% from its all-time high. FIDA appears to be the only instance where Alameda doesn’t hold more than the total circulating market cap; however, their holdings represent the majority of tokens in circulation.

Coda: Who is holding billions of dollars worth of unsecured Alameda debt?

If this leaked balance sheet is accurate, Alameda Research has $6.6 billion in net equity. According to our sources and conservative estimates, Alameda’s net equity is exceeded by the value assigned to their illiquid holdings of FTT, SRM, OXY, FIDA, and MAPS. As we have demonstrated, FTT markets are highly illiquid and dominated by Alameda and FTX. The other tokens are associated with unpopular and failed projects that have no traction, little engagement, and are all down more than 90% from their all-time highs. In other words, Alameda finds themselves in a near-identical situation as Celsius Network

This analysis doesn’t even touch the $2 billion in “equity investments” that Alameda includes on their balance sheet. Given current market conditions and the massive write-downs being taken in both public and private markets, Alameda could easily see hundreds of millions in losses on these investments should they need to sell. Also, we wonder what percentage of these equity investments are in failed projects like Maps.me? We also didn’t touch on the rosy assumption that Alameda’s Solana holdings (worth over $1.1 billion) are fairly valued (a big assumption to say the least!).

The kicker here is that Alameda’s balance sheet lists $7.4 billion in loans, with $2.2 billion of those loans collateralized with FTT token. Who knows how much is collateralized with the other worthless tokens on Alameda’s balance sheet…

Who holds this debt? And what are the chances they will ever get paid back?