Welcome Avatar! If you’ve been trading or investing in crypto markets over the last 12 months you’ll have noticed a common theme among altcoin performance: dispersion. In other words, the market has gotten smarter, the number of altcoins has ballooned, and the amount of capital available to buy these altcoins has roughly stayed the same or declined slightly. These factors combined have made altcoin selection a critical piece of succeeding in the crypto market.

We recently emphasized that crypto favors an active strategy and “buy and hold” is not going to lead to significant outperformance. Anyone who wants Bitcoin or Ethereum can now access it. Unless you want to trade against Citadel and Jane Street, your edge is going to have to focus onchain in altcoins. Go to where the easiest market participants are.

Sidenote: The ETH ETF has thus far underwhelmed. Our thought process around this is that crypto’s inherent reflexivity has not disappeared simply because the ETF now exists. A broader market bid for risk assets such as crypto is going to positively impact ETF inflows. Sharp selloffs in Bitcoin will negatively impact ETF inflows. In simple terms: you will see inflows balloon at market peaks, just like interest in crypto increases when prices are higher. There may be some ongoing institutional bid at value prices (especially on BTC), but retail inflows will respond to reflexive increases in price, the same as past cycles.

In today’s post we’d like to provide DeFi Education readers with some frameworks for analyzing and investing/trading altcoins. Purely for the purposes of today’s post, when we talk about altcoins we are excluding “memecoins.” Memecoins have an entirely different framework/approach which we will not cover here.

Understanding the Altcoin Market

An altcoin is simply a token that is part of an underlying protocol, application, or other type of crypto project. Typically, these tokens are transferrable and tradeable. Onchain coins make use of liquidity pools to enable trading, and some portion of these coins get listed on exchanges either as a result of scale/volume or simply paying the exchange for listing.

Altcoin Lifecycle

How a token is brought to life and who owns it is a crucial aspect of understanding alts. Are there VCs and angel investors sitting on massive gains launching into a weak market where there’s a small exit door? That could mean passing on the coin or finding an opportunity for a short.

The early investor base can be make or break a token’s success. The valuation it launches at (aka the price you can access it at) will be significantly impacted by wherein the market it originated.

Tokens either originate from the private markets (VCs, angels, private pre-sales, etc.) or launch directly in public markets (onchain stealth launch, public pre-sale, ICO, farms, etc.).

Private market deals involving VCs and angels are usually executed as a SAFE + token warrant or a SAFT where there is an eventual liquidity event that gives the investor a pro rata token allocation at some (often undetermined) future date. Like traditional startups, investors will give money to a crypto project at a defined valuation for a stake. Then at a later date the project allocates the token supply to its various stakeholders and launches to the public. This is the onchain equivalent of “going public.”

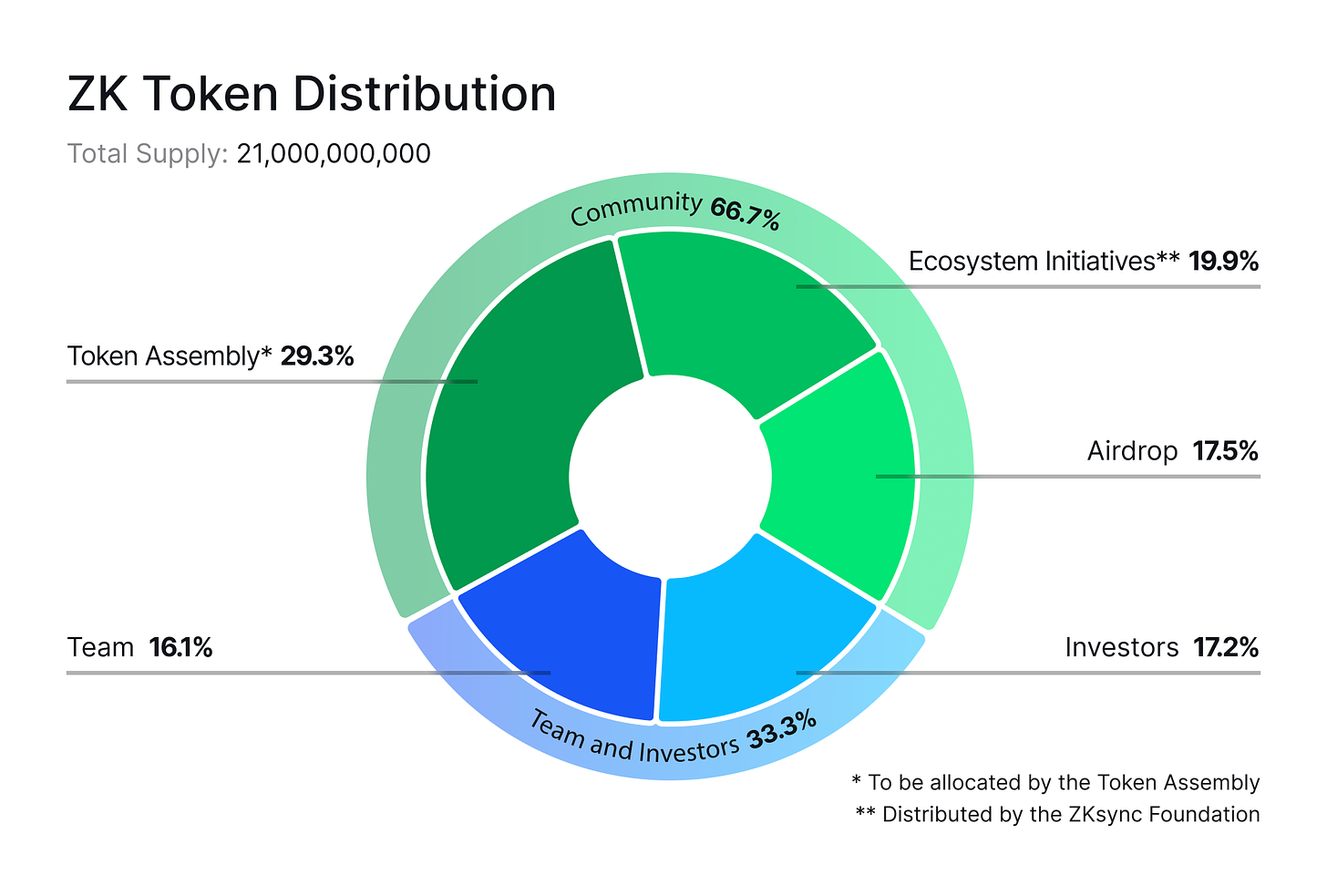

Here’s an example of what a token distribution can look like from Ethereum L2 zkSync’s token:

Source: ZK Nation

Source: ZK Nation

Tokens held by the team and investors almost always come with vesting when it’s a legit project. In the case of zkSync both the team and the investors have a one year cliff (no tokens can be sold) followed by linear vesting for 3 years (0.82% are unlocked per month). ZkSync was founded in 2019. That’s a whopping 9 years from inception through to the end of the token unlocks. Airdrop recipients received their tokens instantly, and in the case of zkSync it was a fairly generous airdrop for a project of their scale.

So why does all this matter? All the investors who risked their capital on a risky venture and the members team who put their blood sweat and tears into building the company will eventually need to sell these coins to realize the value of their equity. Understanding these “unlock schedules” and their impact on the price of a coin is instrumental for longer term trades.

Once a coin crosses the rubicon from private to public markets, it’s widely accessible to every type of investor and trader onchain.

Dumpy’s Law

Absent a strong narrative and ravenous buyers on the other side, coins over a long time horizon trend downwards as the team and private investors unload and public markets lose appetite. At best altcoins rise and fall with majors, performing well on a USD basis but failing to outperform BTC over a multi-year period. That’s why getting into coins at the right valuation and riding the periods of outperformance (which can be extreme in many cases) is imperative.

Teams often sell equity on the way up in secondary markets prior to token launch and also sell locked tokens at a discount “over-the-counter”. That means those team tokens may be hitting the market from participants who are not the team.

The most conservative approach is to operate under the principles of what we call “Dumpy’s Law”.

Dumpy’s Law states that anything that can be dumped will be dumped. If you operate under Dumpy’s Law, you know the value of the supply the market needs to be able to absorb. The price (or expected price) of a token along with the supply unlock schedule will tell you how many new tokens could be sold and over what time period. The broader market regime (i.e. uptrend vs downtrend, trading volumes, narrative sentiment) can then let you asses whether the market is prepared to absorb this supply.

Humpty Dumpy sat on wall

Humpty Dumpy sat on wall

Public Markets (aka “Liquid Tokens”)

This is the area of crypto where retail participants are going to have the greatest access. It’s also where the all other participants will be looking for “exit liquidity”, making it an extremely competitive market with potential for both huge gains and huge losses.

Liquid fungible tokens can be traded by anyone on a DEX. Alts trade based on a combination of narratives, fundamental catalysts, and technical/market-driven factors.

Narratives develop from bullish price action on specific coins. For example, memecoins outperformed all other categories for ~6 months. Coins like PEPE and WIF hitting multiple billions from small market caps along with the past success of megacap coins like DOGE and SHIB cemented the memecoin narrative.

Over this period coins of tech projects in DeFi, infrastructure and other real tech categories underperformed and (we believe) have now bottomed. With certain tech coins like Aave and Sui outperforming for the last month or so, the dominant narrative and focus of traders has shifted accordingly. Whether or not this is organic outperformance is besides the point. What we know is that market participants generally hone in on uptrending coins with liquidity and volume. A coin’s price performance strongly influences not just its own demand, but the demand for coins in its category as well as adjacent categories.

In other words, AAVE outperforming is good for UNI, CRV, and other DeFi coins and vice versa. SUI outperforming (should it continue) is good for other alt-L1s and for SUI ecosystem coins. PEPE and WIF outperforming would be good for memecoins. This is a core dynamic that drives the crypto market. And. It can be worth it for VCs, liquid funds, market makers, and other well-capitalized market participants to spend some capital and bid strong coins within a category to benefit their portfolio more broadly. Crypto VCs can’t exactly go to their investors and explain to them that the crypto-centric future they sold them on is memecoins. This is a fundamentally sound reason to believe that altcoins will shine yet again. The alternative would be a deathblow to the crypto investment management business!

Managing Information Asymmetry

Attention and the flow of information drives decision making in crypto, with a single tweet sometimes being enough to change a perspective on a coin/narrative. New entrants can find themselves confused as to why their coins react unexpectedly (such as being sold on the announcement of something bullish after the coin has been trending up for days). Information asymmetry in altcoins is a risk that needs to be managed and, eventually, honed into an advantage.

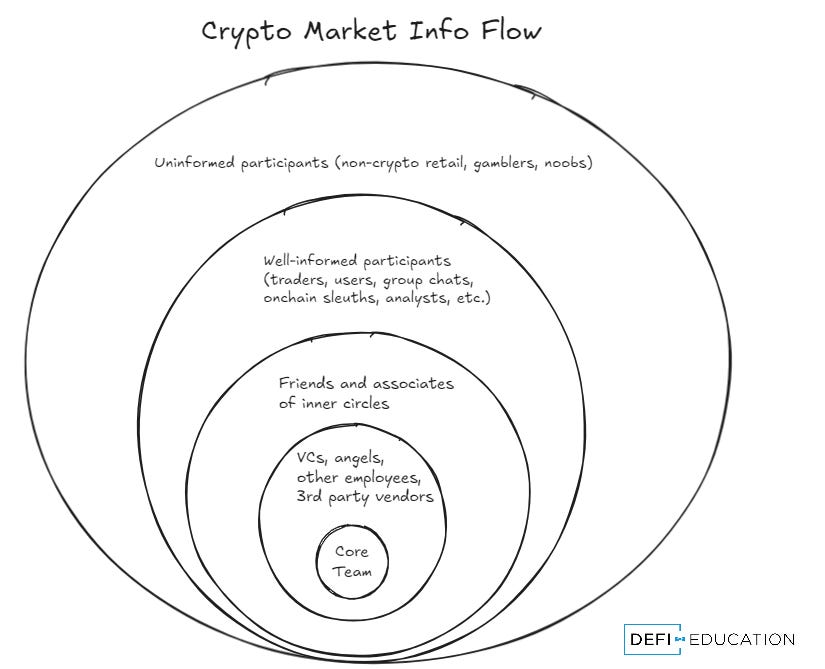

Below is a diagram we’ve made to help you visualize what you’re up against. This is part of our framework for altcoins and should help regardless of what your strategy is (trading, investing, narratives & catalysts, etc.).

Imagine a piece of developing information such as a project partnership or new product launch. This piece of information flows up and out from the inner circles to the outer ones.

- Core Team: These are the people building the project. It should come as no surprise that the core team of a project is usually going to be where news and data originates from considering they are the “root cause” of the change. You are not likely to outtrade the core team, but it’s helpful to try and understand their incentives, track record, etc.

- VCs, angels, other employees, 3rd party vendors: This information will then reach private investors and other people who work with the core team such as marketers and influencers as part of the course of doing business. It’s normal for key product updates and events to be shared to this group from the core team. Dumpy’s Law usually applies here.

- Friends and associates of inner circles: Once the information crosses into this category, it is likely to be of market interest. The participants just outside the insider circle are unlikely to have free tokens to dump and will seek to position themselves around bullish news. Market activity coming from this layer can be informative, although not always easy to uncover. In more PvP market conditions market reactions are so weak that even this group can be exit liquidity.

- Well-informed participants: This is the layer of the circle that turns information into buying and selling at scale. Well-informed participants find the alpha, bid the coins, form the narratives, and aim to profit along the way. Well-informed participants know enough about the inner workings of the crypto industry to develop an edge even without being the first to know something.

- Uninformed participants: This is where everyone starts out but (hopefully) does not stay for long. If you’re new to crypto you’re in this group, even if you don’t believe you are. These are the people waiting for “Twitter influencers” to tell them what to buy and sell and when, while developing no critical thinking of their own.

Note that this flow chart is dynamic — you may float from one layer to another depending on the context. This is why we tell new joiners to focus on a specific area of crypto to master (e.g. DeFi), then branch out. In situations where you are the uninformed participant, it is best in almost all cases to not invest or trade at all and instead reduce your active risk and work towards becoming a well-informed participant.

If you know where you sit along the info flow spectrum you will have a better sense for the risk you’re willing to take. Hard, actionable info that moves markets gives you a lot less time so if you’re close enough to it you can make a lot more. The ETH ETF announcement was a great example where ETH jumped nearly 20% in a matter of minutes. You had ~5 minutes to position yourself even after such major news came out! It’s not a lot of time but still far slower than TradFi markets.

You can also develop a view around what each layer of the flow chart intends to do (buy/sell/hold), over what timeframe, and use that to inform your decision making.

Don’t Fight BTC

The crypto equivalent of “don’t fight the fed” is “don’t fight BTC.” Alts can selectivelyoutperform in tougher market conditions but eventually the steam runs out as market participants progressively derisk or lose capital. Despite crypto having matured over the years, the altcoin market is still highly correlated with BTC. In fact, under the current market regime you can likely achieve altcoin returns by just trading BTC on 2-3x leverage (not that we are recommending leveraged trading - just for context).

However there were multiple instances throughout 2024 where you could have massively outperformed by purchasing coins onchain (mostly in memes). That’s why it’s still important to be plugged into alts. When altcoins do takeoff, they give you 100%+ returns in a short amount of time.

Scalability Considerations

A key consideration for people with more capital (such as many of our paid subscribers) is scalability. It’s difficult to clip $50K+ in and out of a small or even midcap memecoin on Solana due to slippage and your influence on holder sentiment. If you’re working with more capital you want to focus on coins with much deeper liquidity than the average memecoin. This is another reason we believe the altcoin market will continue to thrive — whales and funds need a playground too.

Concluding Thoughts

That ended up being a lot longer than we expected when we set out to give a high level lay-of-the-land for altcoins. We will continue to expand on this topic in future posts. If there are specific aspects of succeeding in the altcoin market you’d like to learn more about paid subscribers can put in content requests. To brush up on your fundamental crypto knowledge you can run through the academy.