By @jainargh

Today's AI agents in crypto are stuck in chat. They analyze tweets, make predictions, and tell you what to do - but that's where they stop. When you ask them to "swap ETH to USDC", you're just chatting with an LLM that ends in an API call. It's a Telegram bot with extra steps, and you've been farmed.We believe AI agents can do more. They should act autonomously, protect your assets, and execute strategies without constant hand-holding. That's why we're launching ConsoleKit, which gives developers:

- Full-stack tools to deploy agents instantly or build custom workflows for on-chain presence.

- Security-first execution powered by SAFE wallets and modular policies.

- Programmability to create adaptive, multi-agent systems for any chain or protocol.

How to make Agents Autonomous On-chain?Multiple developers have different frameworks; but we believe the start of Agents in DeFi is via what we call Specialised Agents, that run on “workflows” enforced with policies (Guardrails).

Specialized Agents are protocol-specific systems fine-tuned with in-depth knowledge to autonomously execute workflows, enhance dApp interactions, and help users deploy capital efficiently, manage risks, and protect assets on-chain, enabling smarter and safer DeFi experiences.

Imagine depositing into Morpho, but instead of just a static APY display, you get an agent that:

- Actively monitors market conditions

- Rebalances between lending markets for optimal yield

- All while you maintain full control

Our first implementation, the Morpho Agent, does exactly this. Beyond the familiar vault interface, it brings intelligence to every interaction. No more watching charts or rushing to modify positions - your agent handles it all.Want deeper control? Chat directly with your agent. But unlike today's agents, when you say "rebalance to the highest yield pool", it actually happens. Every conversation leads to action.

How Specialized Agents Work

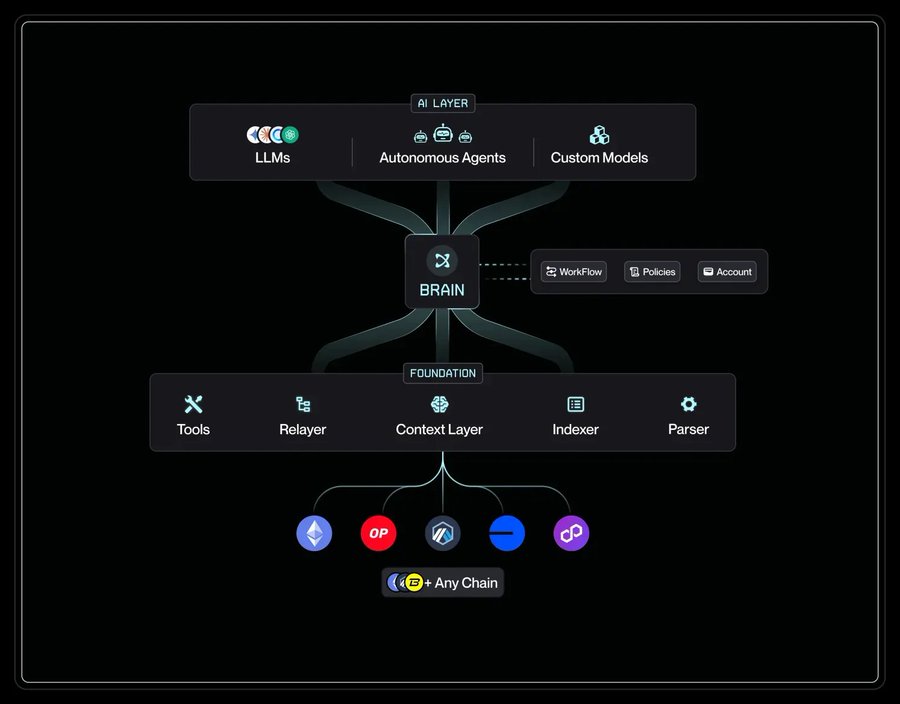

Specialized Agents operate through an architecture that combines deterministic execution with adaptive intelligence. Here's how it works together to enable autonomous on-chain operations:

AI Layer: Intelligence

LLM: Makes strategy decisions based on:

- User preferences and risk tolerance

- Market conditions and opportunities

- Historical performance patterns

RAG: Grounds these decisions with:

- Protocol documentation and mechanics

- Past transactions and outcomes

- Real-time market context

Brain: Control

Workflow: Sequence actions into end-to-end strategies

- Deposit → Monitor → Rebalance flows

- Multi-step position management

- Cross-chain operations

Account: Powered by @safe

- Smart contract wallets

- Batched transactions

- Access controls

Policy: Security guardrails

- Transaction limits

- Approved protocols

- Risk parameters

Foundation: Execution

- Tools: Core DeFi actions

- Relayer: Transaction delivery

- Indexer: State tracking

- Context: Market data feeds

- Parser: Protocol interpretation

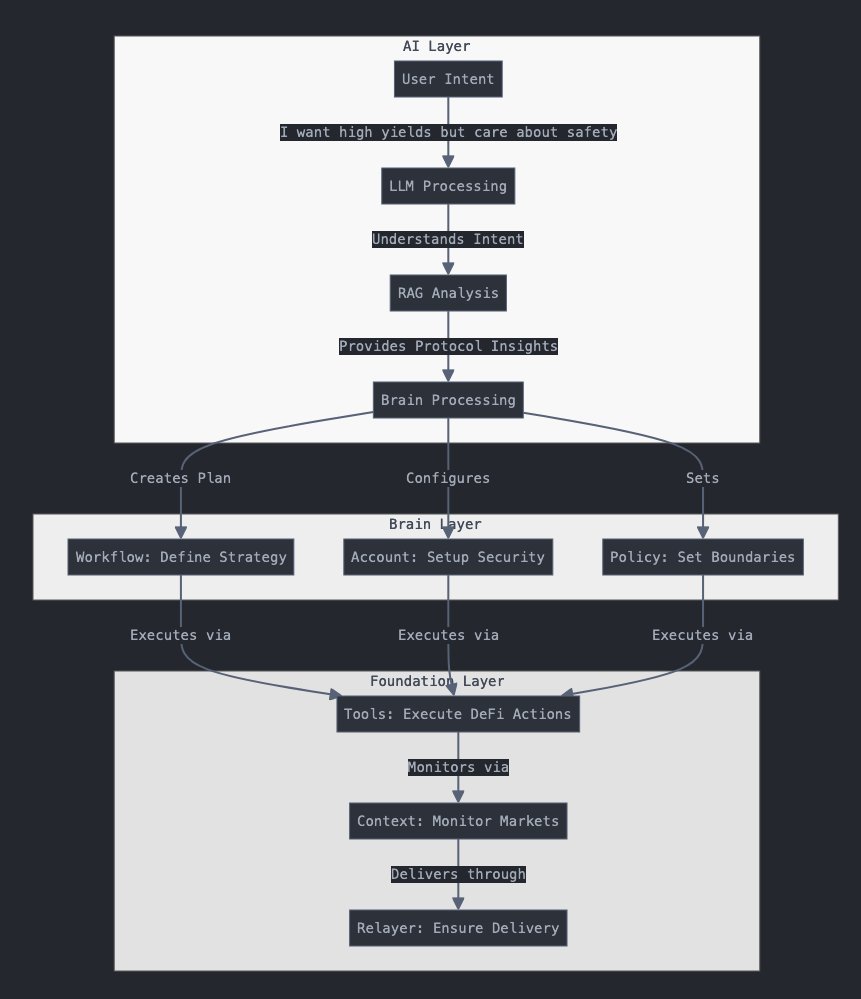

How It All Works Together

Take the Morpho Agent:

How will the Interfaces look like for Agents in DeFi?

(1) Embedded AgentsAt first glance, the Morpho Agent looks just like any other DeFi vault - a clean interface showing APY, deposit amount, and rebalancing options. But under the hood, each position is powered by a dedicated agent that actively manages your funds using real-time market data, historical APY patterns, liquidity metrics, and TVL trends.0:00 / 0:23How it works:

- Connect your regular EOA wallet

- ConsoleKit creates a secure smart account (powered by SAFE) in the background

- Configure your risk preferences and rebalancing parameters

- The agent actively manages your position within strict policy guardrails

- The user retains custody

Customize Your Strategy Through Chat:

You: "I want to optimize for yield but I'm pretty risk-averse" Agent: "I'll focus on stablecoin pools with >$10M TVL. Current best options are: - Morpho-Aave USDC: 4.8% APY, $50M TVL - Morpho-Compound USDT: 4.6% APY, $45M TVL Would you like to set any other preferences?" You: "Yes, only use vaults curated by Gauntlet and rebalance weekly" Agent: "Understood. I'll optimize within Gauntlet-curated vaults and rebalance every Monday for best yields while maintaining your risk parameters."

(2) Meeting Users Where They Are: Agents Across DeFi How Agents will work on AAVEWe envision a future where developers build millions of Specialized Agents for public goods like Aave, Uniswap, and Morpho using ConsoleKit. Anyone can create agents that help users interact with these protocols more effectively - from optimizing yields on Aave to managing liquidity positions on Uniswap. These agents aren't tied to a single UI—they live wherever users need them, making DeFi more accessible and efficient for everyone. Imagine this: A user on Aave wants to supply and borrow assets. Instead of manually managing multiple steps, a Specialized Aave Agent steps in to batch the transactions seamlessly. It doesn’t stop there—it can also set up triggers based on the user’s health factor, proactively managing risks to prevent liquidations.Developers will embed agents directly into wallet interfaces, enabling smarter interactions. Whether through mobile apps or browser extensions, these agents will allow users to access powerful DeFi strategies without complexity. With ConsoleKit, agents are everywhere users need them, making DeFi smarter, safer, and more accessible.

How Agents will work on AAVEWe envision a future where developers build millions of Specialized Agents for public goods like Aave, Uniswap, and Morpho using ConsoleKit. Anyone can create agents that help users interact with these protocols more effectively - from optimizing yields on Aave to managing liquidity positions on Uniswap. These agents aren't tied to a single UI—they live wherever users need them, making DeFi more accessible and efficient for everyone. Imagine this: A user on Aave wants to supply and borrow assets. Instead of manually managing multiple steps, a Specialized Aave Agent steps in to batch the transactions seamlessly. It doesn’t stop there—it can also set up triggers based on the user’s health factor, proactively managing risks to prevent liquidations.Developers will embed agents directly into wallet interfaces, enabling smarter interactions. Whether through mobile apps or browser extensions, these agents will allow users to access powerful DeFi strategies without complexity. With ConsoleKit, agents are everywhere users need them, making DeFi smarter, safer, and more accessible.

The Future of Agents on DeFi

Users interact seamlessly with Specialized Agents built on ConsoleKit, enabling them to deploy capital or configure workflows with a single click while retaining full ownership of their assets via @safe. The complexity of on-chain execution—multichain transactions, real-time decisions, or protocol integration—is abstracted, giving users a simple, powerful tool for navigating DeFi. Agents act as trusted executors, following precise instructions without taking custody.For developers, ConsoleKit streamlines agent creation and deployment with minimal code, allowing them to focus on building interfaces and workflows. ConsoleKit ensures agents are multichain-ready, connected to every major protocol, and capable of executing reliably. Protocols can embed Specialized Agents into their dApps or build new interfaces, improving user experience and unlocking new possibilities.In the future, millions of Specialized Agents will be built on public goods like Aave, Uniswap, Morpho, and Hyperliquid, each performing specific tasks autonomously. These agents will collaborate—sharing insights, pooling resources, and optimizing outcomes. For instance, a Morpho Agent optimizing yields could coordinate with an Aave Agent managing collateral, while a Uniswap Agent handles liquidity provisioning, collectively enhancing efficiency and risk management.As agents evolve, they’ll work in swarms, collaborating to create an entirely new financial experiences and primitives. These swarms will unlock workflows no single agent could achieve alone, managing decentralized treasuries, building yield strategies, and tailoring market conditions to user needs. This future of interconnected, intelligent agents is fast approaching, bringing smarter, more collaborative DeFi.