The spot Ethereum ETFs are finally here.

And based on their initial trading volume, their launch was quite a success.

Yet as we’ve all seen, ETH started dipping after their launch.

In this issue, I’ll discuss why this is happening, what I believe is next for ETH price, and two major upcoming catalysts for Ethereum.

What I expect in terms of ETH price action

In my opinion, ETH is now underperforming BTC for 2 main reasons:

- The launch of the spot ETH ETFs was a sell-the-news event - The same thing happened with BTC in the short term after the spot BTC ETFs launched.

Since the spot ETH ETFs were approved a few months ago, everyone wanting to buy ETH because of them has had plenty of time to do so until now. That’s why catalysts known in advance often end up being sell the news events.

- The ETH ETFs launch unlocked $9 billion of ETH from Grayscale’s Ethereum Trust - All this ETH has been locked for years, and now that its holders can finally sell it, a lot of them are obviously doing that

So how long will it take until this dip is over?

In the case of BTC, it hit the bottom ~2 weeks after the spot BTC ETFs launched in January this year. After that, its price moved sideways for a few days, and then went straight to new all-time highs.

If the demand for the spot Ethereum ETFs proves to be high over the next few weeks, the same thing could happen with ETH. But for this to happen, the ETH ETFs netflows need to first flip positive.

Yesterday for example, the ETH ETFs saw $133M in outflows due to the selling pressure from Grayscale’s Ethereum Trust.

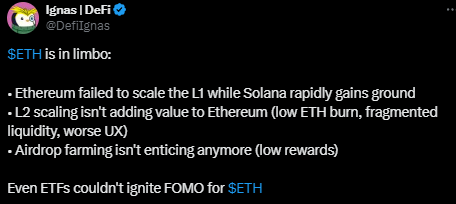

There are also some valid concerns around ETH in the short term:

Ethereum’s upcoming catalysts

I also want to talk about 2 major catalysts that Ethereum has on the horizon.

The first one is the approval of Ethereum ETF staking. This could significantly increase the demand for the spot Ethereum ETFs.

While an annual yield of ~3.2% from ETH staking might not seem like a lot, the staking feature for ETH ETFs could make ETH more attractive than BTC to some institutions, given its lower annual inflation and that it pays you to stake it.

According to an SEC Commissioner, Ethereum ETF staking is "always open for reconsideration”, so its approval is a matter of when not if.

The 2nd catalyst is the release of Pectra, Ethereum’s next hard fork.

This is the next big upgrade for Ethereum, and it’s expected either in late Q4 this year or Q1 2024. Pectra will introduce several major changes:

- make Ethereum account addresses more programmable

- increase the maximum ETH validator stake from 32 to 2,048 ETH

By making Ethereum account addresses more programmable, Pectra will bring some major on-chain user experience improvements.

For example, it will enable sending batched transactions, developing social recovery features for wallets, and it will allow dApps to pay users’ gas fees.

UX upgrades like this are what crypto needs to reach mass adoption.

Together with Intent Trade

The most powerful AI trading tool for Solana

Imagine being able to do your on-chain activity via text prompts.

Intent.Trade, a flagship product of gmAI, which is the first operating layer of Solana AI, makes this possible. gmAI’s token is rumored to launch at the end of July after 4 months of building.

With IntentTrade, you can automate your trading strategies, eliminate your emotional bias, and save time exponentially.

Here’s what you can do using it:

- Trade coins by simply typing text prompts

- Place limit orders via text prompts

- Snipe new coins with specific filters while you sleep

- Get in and out of trades in a very small no. of clicks

- Analyze tokens using AI

The team’s goal is to create AI-powered tools that significantly simplify web3 interactions for crypto natives and newbies alike.

A copy trading feature has also recently gone live on the platform. With it, you can copytrade any Solana wallet via text prompts.

Soon, the protocol will also enable its users to:

- Text to Yield & Airdrop Farming

- Text to Arbitrage

In a few words, text to do basically any on-chain interaction. It’s never been easier to interact with on-chain applications.