Introduction

Since the beginning of this bull market, ETH has been quite disappointing price-wise. While Bitcoin managed to break its past all-time high, up over 350% since its cycle lows, ETH has been a sort of laggard. Slower price action, no clear catalysts, and relatively weak price reactions when Bitcoin was pumping.

But recently, it seems that we have witnessed a shift in the pendulum. And now, the question on every one minds is: Is it finally time for ETH to shine?

In today’s piece, we’re going to venture into this million dollar question.

But bear in mind, no one can predict the future. So what follows are just ideas, and ideas do change a lot, especially in crypto. As the trading legend Peter Brandt says perfectly, “strong opinions, weakly held.”

With that in mind, let’s dig in.

Want access to more free research reports? Subscribe below and join 11,300+ weekly readers 🗂

Subscribe

The current state of the network is promising

To properly unpack the potential case for ETH, it is important to first analyze the current state of the Ethereum blockchain. At a high level, this is what makes ETH valuable and attracts investors.

Total Value Locked (TVL)

After a significant decrease in TVL throughout the last bear market, activity has considerably rebooted on the Ethereum blockchain. TVL is currently up approximately 200% over the past year. While there is still some room to reach its ATH, the upward trend is nonetheless clear.

Active adresses

Active addresses have shown a lot of resilience over the past two years, never dropping below 300k even at the depth of the bear market. This demonstrates that Ethereum has grown beyond just an initial phase of hype and is now an established blockchain that stood the test of time.

Value flows

Value flows, a measure of revenue for both holders and stakers, has also been on the rise over the last rolling year.

You can learn more about this measure in this recent piece on Blockchain Profitability & Issuance:

Core developers

Core developers are an important metric because ultimately, it is developers who build the future of a blockchain. With over 440 full-time developers, Ethereum is one of the most active chain in terms of development, and this number continues to be in an uptrend, which means that Ethereum is still fancy for developers.

Different catalysts for ETH

In addition to healthy and growing on-chain metrics, there are a lot of upcoming catalysts ahead for ETH. Below is a list of some of the major ones:

Spot ETF down the road

Without a doubt, this is one of the biggest catalysts for ETH. The unexpected approval of the ETH ETF has strongly reinforced the value proposition of crypto as an established asset class and should create a new wave of demand for ETH. Given the success of the spot Bitcoin ETF, there is a lot of reason to be excited.

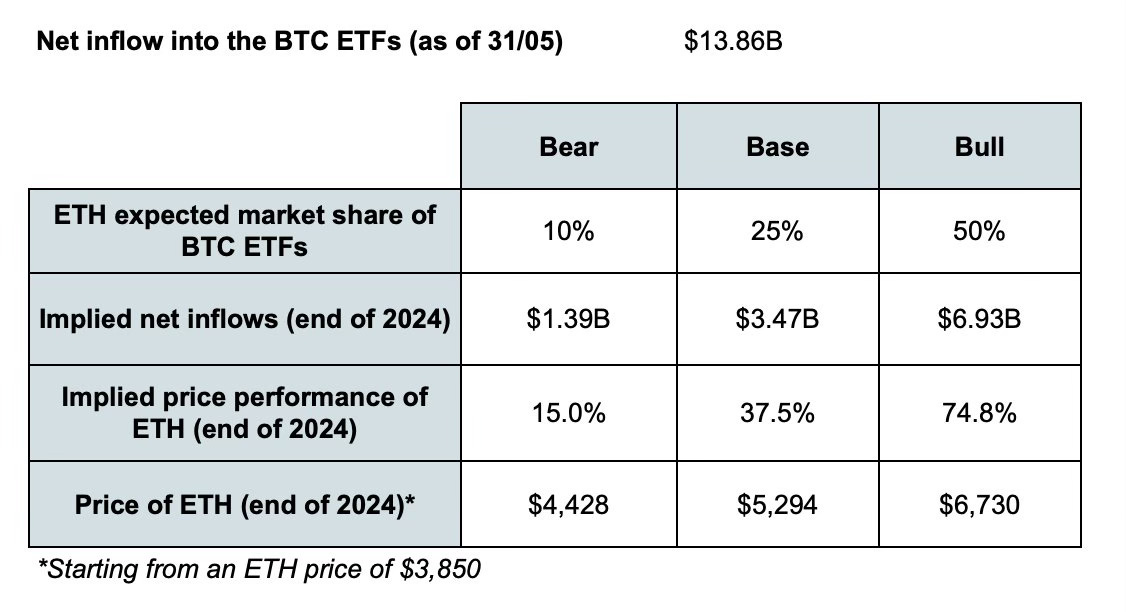

While it is not an easy task to estimate with precision the potential inflows into the ETH ETFs, we can instead come up with a range of expected values using predictions from various experts. This gives us different potential scenarios for net inflows in year 1, ranging from $1.39B to $6.93B.

The next step is to estimate the price impact of these potential inflows for ETH. Again, there is no easy way to do this, but one option could be to draw some assumptions based on the recent spot Bitcoin ETF and adjust for ETH, namely because:

- BTC FDV is currently ~3.15x that of ETH.

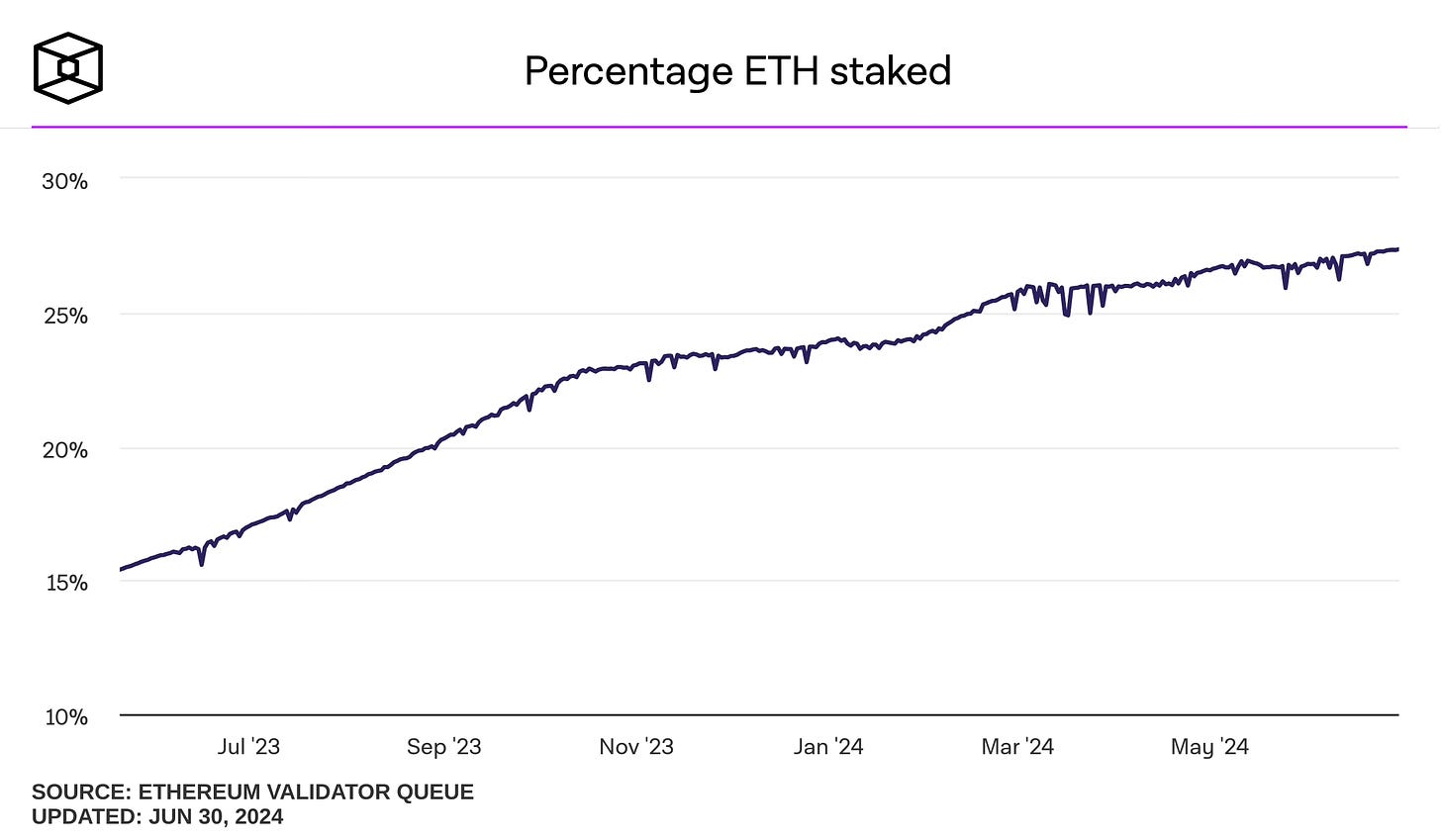

- Around 27% of all ETH is staked which means less float available for buying and selling and more potential for explosive price actions.

- ETH supply has, in overall, been deflationary (-0.184%) since the Merge.

Hence, a reasonable assumption could be that ETH is four times more reactive than BTC, meaning that for the same inflow, ETH will move four times as much as BTC.

Given all of this, we can derive different estimates on the price performance of ETH by the end of 2024.

You can check out this post for a more detailed analysis:

Regulatory clarity

More than just a potential source of new demand, the approval of the spot ETF also brought much-needed clarity regarding the status of ETH (a commodity). We all know that markets, in general, love clarity, so the more regulatory issues around crypto are resolved, the better.

The Dencun upgrade

This recent upgrade was really important for Ethereum. It brought several technical improvements to solidify Ethereum’s infrastructure, but one major feature is that it considerably reduced the transaction fees of the layer-2 network by enhancing data availability. This is a crucial move towards establishing Ethereum as a scalable settlement layer.

US presidential election

Crypto has become a significant topic in the upcoming election. On one hand, Donald Trump, the current favorite, has firmly established himself as pro-crypto. If elected, this could be a positive catalyst for crypto adoption, benefiting ETH. On the other hand, Biden’s administration has been somewhat unclear on the subject but has shown signs of easing up. Overall, the outlook is net bullish.

ETH supply being constrained

At the end of the day, supply and demand are the only two variables that move prices. And now we are in a situation where, in addition to the potential increase in marginal demand, notably due to the various catalysts explained earlier, ETH supply is also being constrained. This is shown by the deflationary supply of ETH since the Merge.

Moreover, the percentage of ETH being staked is at an all-time high and growing. This means there is less supply available on exchanges for buying and trading, which implies that less demand is needed to move the market and so more potential for explosive price action.

Subscribe

Subscribe

Price action

Over and above of the different catalysts ahead, the current setup for ETH also looks really interesting.

Zooming out, we observe that after its bottom in June 2022, ETH consolidated sideways for nearly a year and a half before breaking out into the first leg of its bull run. Now, for over four months, ETH has been forming a consolidation pattern near its past ATH and we are currently on some key levels of resistance and there is maximum fear on the timeline. This could provide interesting buying opportunities for the mid-to-long term horizon.

The current ETH/BTC chart is also near a key inflection point. After a long-term downtrend where BTC dominated, ETH/BTC has recently rebounded from a multi-year low with strength. If this momentum holds and ETH/BTC breaks out of the downtrend channel, we can expect ETH to attract significant market attention.

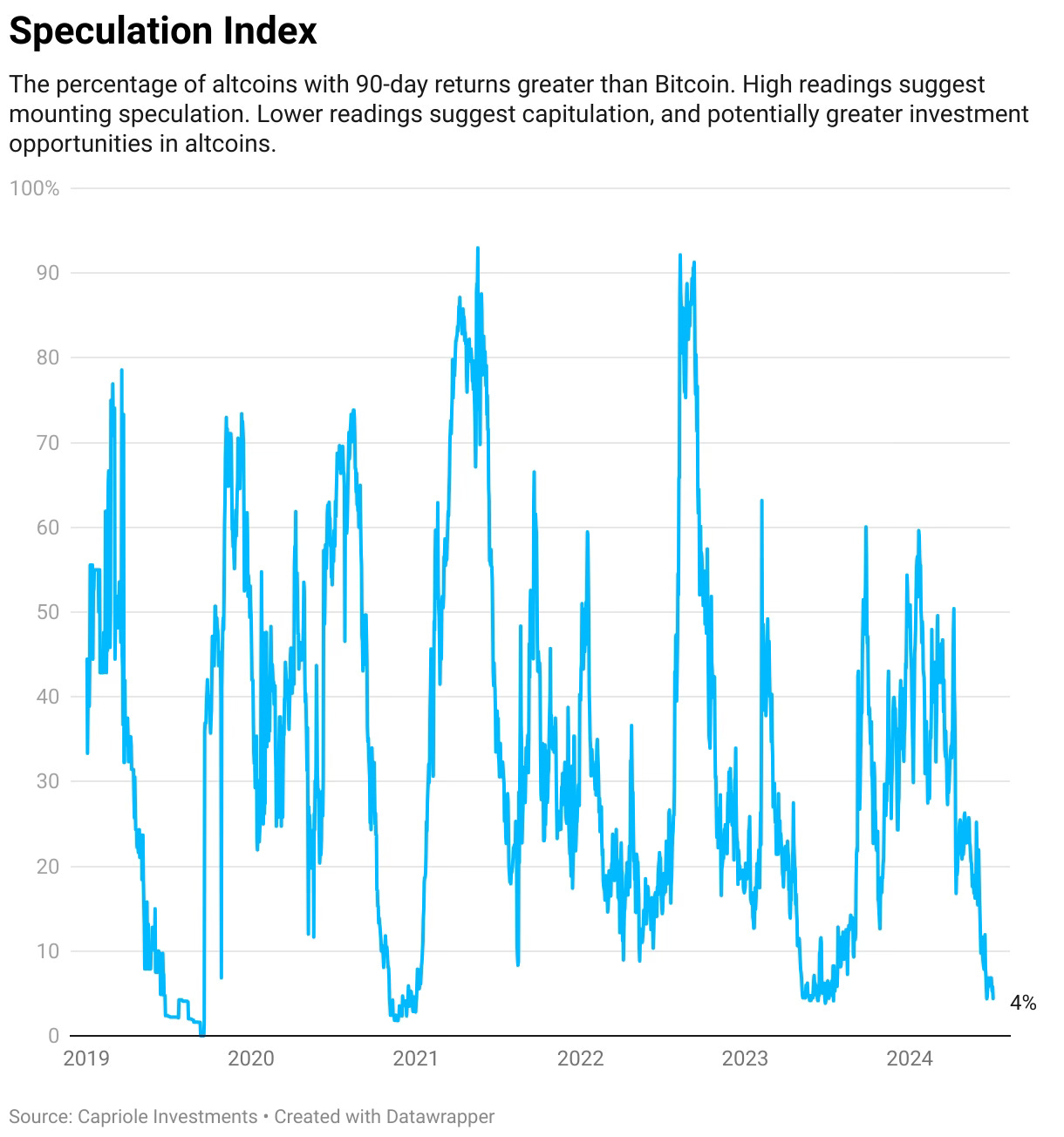

Last but not least, it seems the timing is right for the beginning of an alt season. So far, this bull run has been mainly driven by Bitcoin, with the exception of a few outliers. And currently, we are near a record low for altcoin performance relative to Bitcoin. However, we expect this trend to reverse at some point as investors shift their focus back from Bitcoin to altcoins. This potential market rotation aligns well with our current bullish bias for ETH.

Some things to keep in mind

As with all things in life, it pays to maintain a critical eye. Therefore, when analyzing the global outlook for ETH, it is also important to remain aware of potential drawbacks that could negatively impact ETH:

Global market performance: ETH is highly sensitive to the general market sentiment. It is unlikely that ETH will perform well if the overall trend of the crypto market is down. While this is not our expected scenario, this is nonetheless something to keep in mind.

ETF expectation: Negative surprises around the ETF, in terms of net inflows and interest generated, could also affect ETH negatively, at least in the short term. Andrew Kang wrote an interesting piece on a not so bullish case for the ETH ETF if you are interested:

TradFi finds it harder to understand ETH than BTC: When the spot BTC ETF was launched, Bitcoin was pitched as digital gold and TradFi easily understood the narrative. But for ETH, the story is a bit different and there is no clear consensus around its value proposition. Some see ETH as a global computer, others as the Web3 app store or as a decentralized financial settlement layer, etc. This confusion around what ETH really is could make it harder for TradFi to make a clear allocations to ETH in their portfolios.

Ethereum v/s next generation of blockchains: Ethereum has been highly criticized because of its slow speed and high cost, especially compared to newer blockchains. Here, there are two sides to the debate. On one hand, some people think that this will lead to the slow death of Ethereum, while others argue that this is not a problem as it solidifies Ethereum as a settlement layer for other layers to build on and create a scalable infrastructure. Whichever side of the debate you’re on, it is important to maintain on open eyes.

Concluding thoughts

After initially lagging behind in the beginning of this bull market, ETH appears to be at an interesting point right now.

The current state of its blockchain is promising and reinforces its evolution into an established L1 blockchain that has stood the test of time. Furthermore, there are several bullish catalysts ahead for ETH, both on the demand and supply side of the equation, and the current price action of ETH aligns with these factors.

But as always, nothing is either black or white and it important to remain aware of potential drawbacks that could negatively impact ETH.