The following article examines a selection of the most promising Layer 1 Bitcoin Dexs and AMMs. Most of these marketplaces are still in development, some still only on testnet. These marketplaces can generally be divided into 2 different categories: OrderBook exchanges and AMMs. Research interviews were conducted with most of the teams covered in this report.

Defi on Bitcoin is coming. We have had little tastes of what defi on Bitcoin could look like, with the emergence of Ordinals, Runes, and metaprotocols such as BRC20 and TAP. The community wants to trade “Shitcoins on Bitcoin”, but the infrastructure just isn’t there yet. But it is coming!

Currently the trading experience for tokens on BTC is subpar and full of friction. On marketplaces such as Unisat and Magic Eden, sellers of a token (BRC20 or Runes) must list a specific amount of a token at a specific price and wait for a willing buyer to come along for that exact number of tokens at that exact price. This causes friction in the trading experience.

There are many teams who are trying to solve this problem and bring AMM and Dex style trading to Bitcoin; that familiar trading experience that we are used to from EVMs. Because Bitcoin uses the UTXO model, rather than the account-based model used by EVMs, certain functionalities have to be reimagined. In-fact, UTXOs have some technical features which are unavailable to EVMs in terms of the various ways a PSBT (Partially Signed Bitcoin Transaction) can be designed to create atomic swaps.

I analysed each marketplace with specific criteria in mind; User experience when swapping, level of decentralization, permissioned versus permissionless and other trade-offs.

Most teams are innovating with PSBTs and Sighashes. A Sighash is a mechanism for signing the inputs and outputs of a Bitcoin transaction. There are 6 different types of Sighash, ranging from “Sighash All”, which is the most secure but least flexible, to “Sighash None — Anyone Can Pay”, which is the least secure but most flexible. Current popular marketplaces such as Unisat and Magic Eden use “Sighash-Single” to create their PSBTs. This means that not all outputs have been signed, leaving the transaction open to MEV sniping. Using “Sighash-All” means all inputs and outputs are fully signed, so any transaction signed in this way is protected from MEV sniping.

There are many other factors to consider when analysing a Dex or Swap, such as liquidity & slippage, maker and taker fees, LP incentives, trade volume etc. However, since most of the marketplaces analysed below are still in testing or early release, it will take time before these other metrics are pertinent.

Fluid BTC

Website: https://btc.fluidtokens.com/swap

Twitter: https://x.com/FluidtokensXBT

Fluid Tokens is an orderbook based DEX. Users can currently trade Runes-BTC, and Runes-Runes functionality is coming shortly. Fluid is essentially a marketplace for peer to peer trading. When a trader wants to create an order (maker), they make an offchain “commitment” (eg. I want to sell 1,000 $DOG and receive 0.001 BTC in return). These commitments are posted as limit orders in the order book. When a taker comes along to take the order, ie to market buy or sell, they initiate the PSBT, which details all the inputs and outputs as previously defined by the commitment of the maker. The original maker is then be notified (by email or in-app) that their limit order has been matched, and they then sign the PSBT to broadcast the transaction to facilitate the trade.

This trading design is completely permissionless and peer to peer. The marketplace is essentially a facilitator of these trades. The trade-off in this case is the back-and-forth user experience. Maker makes commitment, posts limit order — Taker matches order and initiates PSBT — Maker then signs and finalises the PSBT. This friction essentially slows down the trading process, and generally does not allow for that quick sell that traders often need. Another possible issue could be manipulation or spoofing of orders, where a maker creates an order that they have no intention of fulfilling, to try manipulate the price for example. To mitigate this, the Fluid platform only currently allows one maker commitment order per pair per address. Therefore laddering of orders, to scale into a position is not possible yet, but that functionality is on the roadmap.

All the trades on Fluid are fully permissionless, and also MEV protected and sniper resistant since “Sighash All” can be used in the PSBTs, meaning the transaction is only verified if both the maker and taker addresses are part of the trade. A third party cannot “snipe” the transaction, an issue that often occurs with trades on current popular marketplaces such as Magic-Eden and Unisat. Fluid have prioritised fully permissionless and secure trading, with the drawback of a less smooth trading experience. Fluid are launching their marketplace in the coming weeks.

Saturn BTC

Website: https://www.saturnbtc.io/

Twitter: https://x.com/Saturn_btc

Saturn BTC is an orderbook based on-chain exchange, originally launched for rare sats in Summer 2023. They have just launched their marketplace for Runes trading. They have focused on creating a trading experience which is very similar to the smooth experience on centralised exchanges. They have a “peer to peer” orderbook where users can place on-chain limit orders to fill the order book, and users can also market buy, ‘taking’ the existing limit orders in the book. This user experience is quite slick, particularly since the user does not have to worry about splitting up UTXOs or matching the exact requirements of the order placed by the maker. This is a huge improvement on the traditional, more cumbersome Runes trading experience on Unisat and Magic Eden, described above. Saturn also have a “Swap” function, but this is not a swap in terms of AMM style functionality with liquidity pools. By swapping, the user simply market buys the appropriate amount of sell orders that are in the order book, and vice versa.

To achieve this improvement in trading experience and functionality, particularly in relation to their limit orders and matching engine, Saturn currently requires users to “deposit” their funds onto a “trading account” which is a multisig, signed by the user and co-signed by Saturn. This “trading wallet” will be replaced by single use multi-sigs in their next iteration. When a user creates a limit order, they sign a “Sighash None” PSBT, which technically hands control of the tokens/btc involved in that specific order to the Saturn platform and matching engine, in a 2/2 multisig. The transaction is finalised with “Sighash All” before being broadcast to the mempool, ensuring sniper protection. This trading process means the trader must trust Saturn with the specific funds involved in the transaction, as long as the order remains open. Therefore, the trading experience is not fully permissionless and has some centralised aspects to it.

Saturn have taken an interesting and innovative approach, by taking the smooth trading experience on centralised exchanges and replicating it directly on chain on BTC Layer 1. They even have full charting functionality in their platform, courtesy of Trading View. There is no need to split orders, the platform takes care of this and there is an ability to have partial fills and multiple wallets in the same transaction. Saturn is a very user friendly, intuitive Dex, with many product improvements and additions in their roadmap.

UniTap

Website: https://unitap.io/

Twitter: https://x.com/Uni_Tap

Unitap is a Dex being built for the TAP ecosystem. The TAP metaprotocol, enables various aspects of Defi functionality and operations to be carried out directly on Bitcoin Layer 1, using a system of decentralised indexers to aid in computation and account balancing.

Unitap are building a marketplace to trade not only Tap based assets, but also Tap to Runes. They have a Runes to Tap bridge in development.

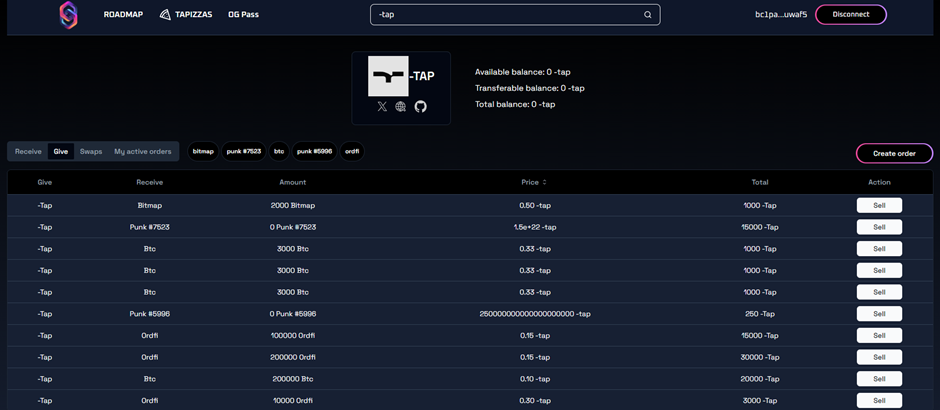

Unitap have designed a completely non-custodial swapping system. Users who wish to sell a token (-tap for example) create a PSBT using “Sighash Single” to specify the exact amount of tokens they wish to sell and what exactly (token and amount) they want to receive in return. This may be BTC or another Tap or Rune token. This creates a very specific sell order, that may take some time to find a match, especially in a less liquid market. To help overcome this friction, Unitap places this sell order into a marketplace among all other orders that match the buy side of that specific sell order. For example, if I would like to sell some $-tap, I can select that token and click on the “Give” tab. This will open a marketplace that contains every buy order of $-tap, where sellers of other assets are looking for $-tap in return for the sale of their asset (see the screenshot above). This adds some flexibility to the marketplace and can help facilitate that quick sell that traders like. Currently Tap-Tap assets are tradeable, with Tap-Runes and Runes-Tap swaps arriving in the coming months.

Unitap are also launching their own wallet in the coming weeks which will support all TAP operations and support cross-protocol swaps such as Tap-Runes or Tap-BRC20.

Dotswap

Website: https://www.dotswap.app/

Twitter: https://x.com/dot_swap

Dotswap is a BTC Layer 1 native AMM style swap for BRC20s, ARC20s and Runes. The trading experience is very similar to how Uniswap works. Users can already swap between BRC20/Bitcoin and Runes/Bitcoin, with Runes/Runes swaps coming soon.

The Atomic swaps are completely permissionless and non-custodial, using “Sighash All” PSBTs. Users select how much BTC/tokens they want to swap and receive the appropriate amount of the other token in the swap, all in the same transaction. The use of Sighash-All means all transactions are sniper resistant.

The “trade-off” here is that the Liquidity Pools are custodial. When a liquidity provider sends funds into the liquidity pool, these funds are stored in a multisig system, as BTC has no smart contracts to which you can send funds. Dotswap’s unique MMM (Multilayered Multisig Matrix) custody scheme was developed in house and operates in collaboration with custodians Safeheron and BitGo. The process of adding and removing liquidity is as simple as one would expect, similar to the experience on EVM AMMs. Dotswap were the first team on BTC to implement a centralised sequencer to protect transaction ordering, and therefore pricing, between block confirmations.

Dotswap have also developed a launchpad for new Runes tokens, which works in a similar way to pump.fun on Solana. Upon launch, participants purchase the specific Runes token with BTC, and the majority of this BTC is used to seed the liquidity pool for that token. Therefore, any Rune that launches on this platform has an immediate liquidity pool where users can swap and trade in a fully permissionless way. Launchpad contributors therefore also own their proportion of the liquidity pool and can earn trading fees.

Dotswap have developed an AMM which is completely permissionless and non-custodial for the trader/swapper. The liquidity providers are the ones who take on trust assumptions. To this date Dotswap has done over $40M in trading volume. If Dotswap are successful in attracting more liquidity to their pools (favourable trading fees, liquidity mining etc), increased trading volume should follow.

Ordiswap

Website: https://app.ordiswap.fi/

Twitter: https://x.com/OrdiswapLabs

Ordiswap is an onchain AMM for swapping BRC20 or Runes tokens. Users can swap, provide liquidity, remove liquidity, create a new pool — all on BTC L1. Ordiswap were the first AMM to appear in the BRC20 space last year.

When a user initiates a swap on Ordiswap (eg. swap BTC for ORDI), they create a transaction which sends their BTC to the Ordiswap LP. This transaction also includes a script, which contains the details of the swap. The Ordiswap back end indexer reads this script and sends the user the appropriate amount of ORDI in a subsequent transaction. This means the user must trust the Ordiswap API when they sign a transaction to initiate a swap.

Ordiswap uses a combination of off-chain servers, oracles, indexers and BTC nodes to create the AMM functionality. Ordiswap’s server updates the off-chain balances of the users involved in the trade and periodic settlements are performed on-chain. All swaps are currently handled by the Ordiswap API. This is a slightly less elegant solution than using PSBTs for atomic swaps, which can complete the entire swap in the same transaction. However, atomic swaps on the roadmap.

The Liquidity Pools are once again custodial, and discussions with custodial partners are currently underway to upgrade security. Their V2 BRC20 swap was live for 2 months and did about $500k total trading volume.

Ordiswap also has potential to be a leading AMM on Bitcoin, if they can achieve everything they have set out. It’s an ambitious, modular swap implementation on Bitcoin. They are currently in their V3 main-net closed beta stage. Reports are that testing is progressing nicely and they are perfecting the final aspects of their swapping mechanism.

RunesDex

Website: https://www.runesdex.com/

Twitter: https://x.com/RUNES_DEX

Runes Dex is another recently launched AMM on Bitcoin Layer 1, for Runes-BTC trading. They are well funded with a big team and are developing fast. They are currently in their Alpha testing phase on Mainnet. Users can test swapping their native Rune IS•THIS•WORKING. Like the aforementioned AMMs, trading on RunesDex is completely non-custodial and permissionless, but the liquidity pools are custodial. Currently RunesDex is in full control of the private keys, they are stored in a vault using AWS. Custodial partnerships are in the pipeline.

They are also building a pump.fun style lauchpad, a Runes-tracker which can take into account pending transactions in the mempool, and a Runes bridge which will bridge memecoins from other chains such as Solana onto Runes. They use “Sighash All” for their Dex swap PSBTs, which means that every swap will be sniper resistant. They plan for their LP providers to earn fees in BTC. They have also created an automatic UTXO splitter on the LP side to ensure smooth experience when swapping. RunesDex AMM will be fully live within the coming weeks. Another AMM with potential.

Runeswap — Swapsats

Website: https://rune-testnet.swapsats.io/

Twitter: https://x.com/Swapsats_io

The Runeswap by Swapsats is a Runes-BTC AMM style swap being developed by the team behind the OG sub 10k Ordinals collection Ordinal Eggs. The swap will operate in a similar manner to the swaps mentioned above; a permissionless swapping experience but with a custodial Liquidity Pool.

Their philosophy, as a group of collectors, is to build a Dex with their community in mind. Holders of their collections will receive benefits on the Dex, such as reduced trading fees and revenue share from Dex income. They are prioritising a slick UI and user experience, to help further cultivate their community. The swap is currently in the alpha testnet phase, with main-net due to go live in the coming weeks.

RunesFi

Website: https://runesfi.io/

Twitter: https://x.com/Runes_Fi

RunesFi are aiming to be a one stop infra hub for BTC assets. They intend to build a Runes Block Explorer, Launchpad and Incubator, Runes Engraver and most importantly, a Runes and BRC20 Dex. They are currently in testnet phase of their Dex, with their mainnet product expected to go live before the end of 2024.

There are some other dexes in development that promise some more decentralisation than those listed above, such as Omnisats and Motoswap (OPNet?). I can analyse these when they are closer to launch and more information is available. Unisat have also recently announced their new BRC20 swap module, which will include liquidity pools etc. This is currently in development and should be functional within 6 months. Magic Eden too are teasing about upcoming swap functionality, although the timeline is unclear.

Concluding Remarks.

Building on Bitcoin is challenging, especially if trying to directly replicate the functionality of EVMs. Bitcoin’s UTXO model differs from the account based model of EVMs, and those teams that embrace the uniqueness of Bitcoins Mechanics (PSBTs, Sighashes, etc) are more likely to be successful in the long run, versus those who solely try to recreate the EVM stack.

Teams currently creating innovative solutions are balancing different trade-offs. For example, regarding Orderbook Dexes, Saturn have prioritised a super-slick user experience and functionality, at the expense of fully permissionless trading. Fluid have taken a different approach, prioritising fully decentralised and non-custodial trading, albeit with a little friction in the trading experience. It will be interesting to see which philosophy the market values more.

In the AMM space, most teams are creating a system where traders can trade in a fully permissionless way, but the liquidity pools are held in some version of a vault, multi-sig or semi-custodial solution. This may be an acceptable trade-off, since most traders will not care how the liquidity pool is set up, as long as they can swap quickly and permissionlessly. Also, considering how many bridges and contracts have been exploited on Ethereum, LP provision to a well known custodian might even be a more attractive solution. At the current moment, Dotswap has the advantage here, as they are furthest along in terms of development, product offerings and their LP custody solutions. However, other teams such as RunesDex and Ordiswap are hot on their heels, with their products launching very soon.

I’m sure there are other teams building that I am unaware of at the time of writing. If you would like your project to be included in this analysis, please contact me:

Email: jonnyhimalaya@gmail.com

Twitter: https://x.com/Enter_the_krypt