Ethereum’s spot ETFs could begin trading any day now!

One big question remains: how will we sell ETH to Wall Street?

It's a question that has perplexed the industry at many times. While Bitcoiners have solidly clung to the easy-to-understand narrative of “digital gold,” Ethereum’s fans have often had a tougher time landing on a shared, succinct narrative that sparks external interest in the ecosystem.

Today, we’re evaluating six of the most prominent narrative contenders that encapsulate the essence of Ethereum. We then explain the thought process behind why each could be potent in onboarding the next generation of investors to Ethereum, and assign each one a narrative grade ranking based on how successful we think they will be in courting adoption among prospective ETF buyers👇

"It's a Tokenization Platform"

Tokenization has already been touted by financial luminaries, including BlackRock CEO Larry Fink, as representing a paradigm shift for financial markets for its promises to drastically decrease friction and cost while improving accessibility and liquidity. Additionally, it aims to unlock unprecedented levels of transparency and composability!

Explaining Ethereum as the world’s leading tokenized asset platform spells out why the Network is important in terms that TradFi participants can understand.

Although tokenization does not delve into the positive relationship between increasing onchain activity and ETH price, it demonstrates the central role Ethereum could play in modernizing the financial system; achievement of this goal alone would make ETH the most valuable crypto asset in existence.

The narrative captures Ethereum’s role as a global settlement layer for real world assets, making it easier for TradFi to rationalize Ethereum’s role as the global settlement layer for an interconnected network of chains and its pursuit of modular scaling.

Narrative Grade: B

Despite stated excitement for tokenization from numerous financial institutions, the narrative is hampered by some regulatory uncertainty, but fortunately, investor excitement for tokenization could catalyze needed legislative action to provide regulatory clarity on digital assets and their role within financial markets.

"Ethereum is the Onchain App Store"

Unlike Bitcoin, Ethereum offers highly expressive smart contracts that unlock financial programmability for developers, enabling the network to become an onchain equivalent of Apple’s App Store.

Those who download and fund an Ethereum-compatible crypto wallet receive unfettered access to a litany of consumer applications that facilitate a wide variety of financial, gaming, and cultural interactions. In this digital economy, ETH must be used to pay for gas fees, inciting demand for ETH the asset, and transaction fees payments become revenue for Ethereum, which then trickles down to holders via the Burn – a crypto-native version of stock buybacks!

An investment in ETH is akin to buying direct ownership in the App Store, a purchase many investors would be willing to make given its lucrative cash flow generation capabilities and its strong network effects – both qualities which Ethereum possesses.

Narrative Grade: C

While this narrative has gained traction in recent weeks as the best way to present ETH to TradFi and draws similarities to familiar products, it is unclear if external participants have a good understanding of the types of interactions that can be performed onchain, potentially leading them to ascribe little value to such activities.

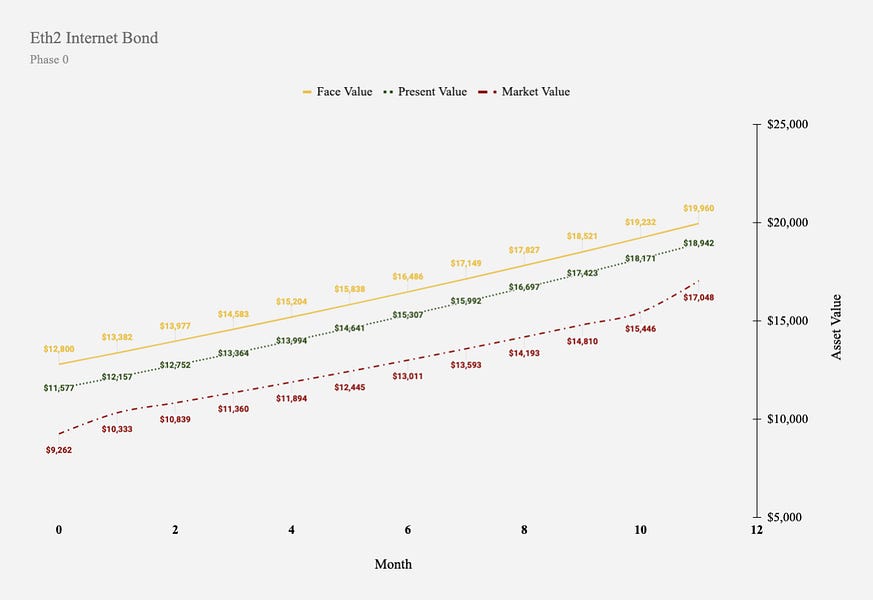

"It's an Internet Bond"

Parallels can easily be drawn between crypto-native staking schemes and fixed income instruments in TradFi.

In exchange for providing 32 ETH as validator collateral (principal), stakers accrue rewards (interest). Unlike in TradFi, this relationship does not depend on any party’s ability to repay the loan, and is instead backed by immutable code and the future economic activity of Ethereum – in the form of block fee revenue and inflationary block rewards.

Investors of all kinds love earning passive income off their assets, leading many to assume this would be a slam dunk narrative for Ethereum, particularly in comparison to the only TradFi traded alternative: non-productive BTC.

Narrative Grade: C

Unfortunately, spot ETH ETFs will not be launching with staking, and while crypto natives can continue to generate yield via this avenue, it is unlikely that the “Internet Bond” narrative will be compelling among investors who can not access this feature, at least until staking-enabled ETFs are launched.

"ETH is Ultra Sound Money"

Bitcoin maximalists have long espoused their chosen digital currency’s “sound money” principles, emphasizing that the network’s programmatic block reward issuance schedule is resistant to debasement, giving BTC its store of value status.

“Ultra Sound Money” was created by the Ethereum ecosystem to meaningfully differentiate it as an investment against Bitcoin, and was was first popularized by Ethereum Foundation researcher Justin Drake in September 2020 immediately prior to last cycle’s boom.

Although Ethereum does not presently have a guaranteed emissions schedule, ETH supply can turn deflationary as block demand increases thanks to EIP-1559, reducing the number of tokens in circulation over time to theoretically imbue the token with superior store of value qualities, thus creating an “ultra sound money.”

Narrative Grade: D

Surging prices throughout 2021 made the idea of a deflationary token highly attractive, but this narrative become decidedly less attractive alongside the sharp drop off in inflation; should policy makers resort to debasement to stimulate a global economy in decline, Ultra Sound Money could emerge as as premier narrative. Then again, it may be too degen of a descriptor for Wall Street.

"It's Digital Oil"

Bitcoin may have already taken the moniker of “digital gold,” but who cares about a shiny rock when you can own an alternative decentralized commodity that fuels the global economy?

When making transactions on the Ethereum L1 and many of its L2s, users must pay for their transaction fees using Ether to get execution; due to the widespread prevalence of onchain transactions within the Ethereum ecosystem, many see ETH as the digital corollary for oil.

Like oil, which derives intrinsic value for its usage as a key commodity input, Ether benefits from usage of the applications on Ethereum that require the payment of gas to access.

Narrative Grade: D

Increasing usage of Ethereum’s onchain applications should have positive implications for Ether by showcasing the close connection between activity and price, but this narrative seems difficult to sell to traditional market participants who have displayed resilience in making onchain interactions and do not fully grasp what the onchain economy is.

"It's Internet Money"

By virtue of Ethereum’s expressive smart contracts, developers can create applications on the blockchain as discussed in the case above for representing Ethereum to TradFi as the next generation equivalent of the App Store.

Within this ecosystem, ETH is the native “internet money,” serving as the medium which many store their value in and use for payments. Further, the existence of these smart contracts makes this money programmable, enabling its automated usage by applications.

Among earlier generations of crypto users who sought out utility for their assets, the ability to use Ether as money was an attractive use case that drove many to adopt crypto technology, however, it is probably far-fetched to assume that the narrative can produce any excitement for remaining TradFi hold outs.

Narrative Grade: F

To start off, the concept of internet money may not be taken seriously by the types of sophisticated/older investors that ETFs are meant to attract. Moreover, people do not typically invest in monies due to their inherent inflationary properties and propensity to lose purchasing power over time, an association which could make it difficult for investors to see value in an asset categorized as such.

🧐 Wait, why no “A” grades?

Keen-eyed readers may have noticed that none of the above narratives received an “A” grade!

While each narrative certainly comes with its own attractive features, none in isolation are the silver bullet solution required to onboard the next generation of investors to Ethereum.

All are either stale or unproven, and while narratives help investors understand aspects of Ethereum, an understanding of the network in its entirety is necessary to fully grasp the revolutionary impacts this technology could yield…

For the non-crypto natives that spot ETFs are intended to attract, it will likely be the concept of tokenization that allows them to recognize that importance of block space, the acknowledgement of which is a prerequisite to grasping the notion of Ethereum is the onchain equivalent of the App Store and unlocks their ability to appreciate Ether as digital oil and a new form of money!

Regulatory clarity is required for Ethereum’s tokenization and internet bond narratives to truly gain traction, but in the meantime, the ecosystem can always fall back to Ultra Sound Money should policy makers resort to debasement to kickstart the faltering global economy.

Ethereum may be too complex to distill down to a single narrative, but efforts to do so present the ecosystem in an approachable format to external investors that could potentially pique their excitement and lead them to dive deeper down the crypto rabbit hole!