I became an ‘influencer’ by accident. But it is a happy accident because it raised my awareness on how this space operates. There is a lot that happens behind the scenes and this is your window into it.

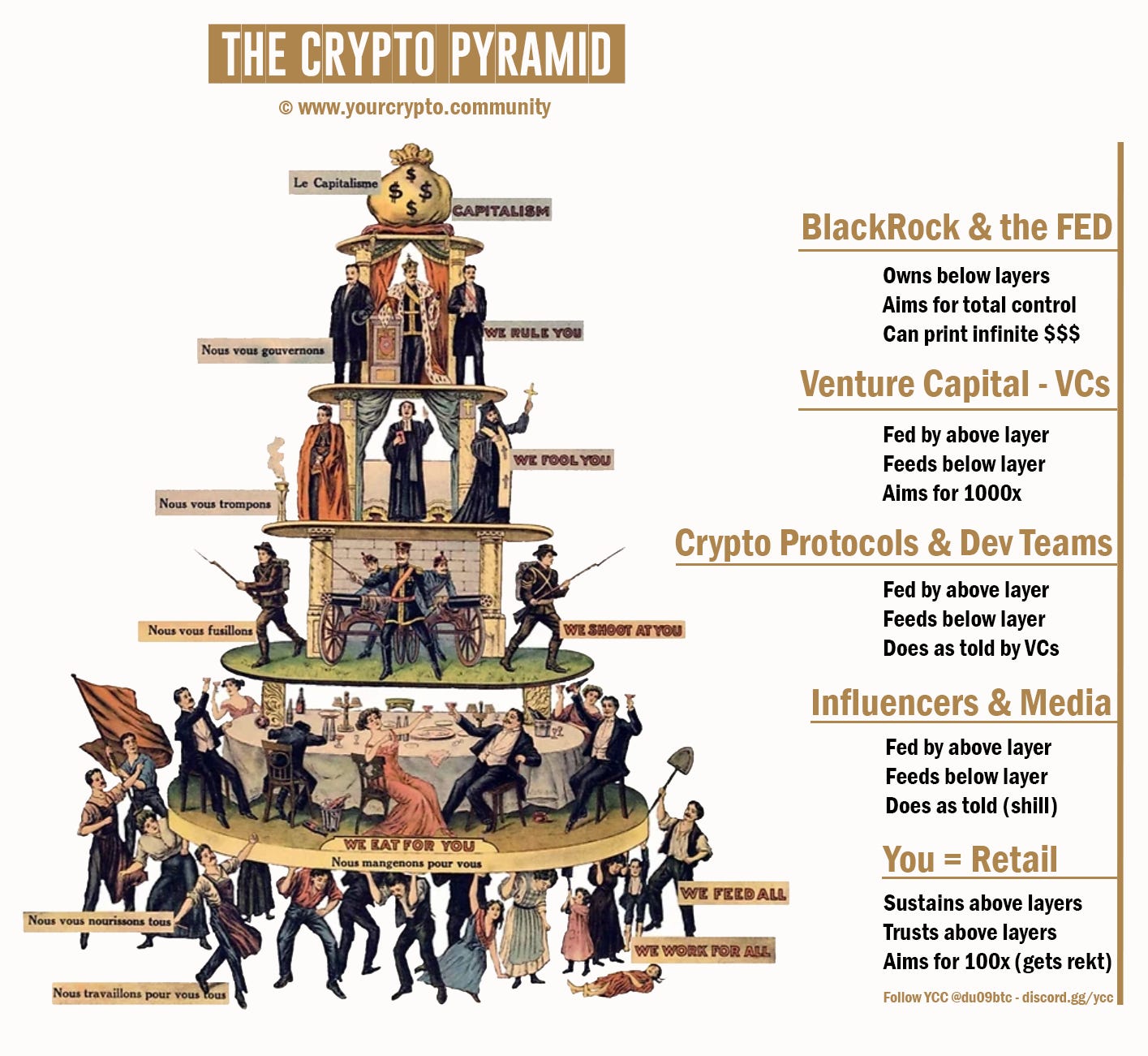

Crypto works in layers. It’s a classic pyramid. The higher you are, the better the returns. You, or retail, are at the bottom of the pyramid.

Here’s how it works. TLDR at the end.

Around 2020 I started posting my technical analysis on Twitter, and to my surprised, my content took off. Four years later, here I am with a great community I call home.

I didn’t have a home in crypto for years.

I started with Bitcoin in 2014 and felt mostly lost for a good while. Most places I stopped by were absolutely terrible, and in most cases, a good way to get scammed, rugged, or similar.

This is why Your Crypto Community exists. It’s a safe space from all of that and you are welcomed to join us or become a Patron.

With that said, let me introduce you to this other side of crypto which is mostly hidden to Retail. I’ll take you through each layer, one by one.

The Crypto Pyramid and its layers in one picture.

Layer 1: You a.k.a. Retail

Naive and trusting, the retail layer is abused and exploited regularly. They are enticed to participate in the game by the promise of 100x returns. Few ever make that, and those that do, quickly lose it in the crypto casino due to their newfound greed.

This is the base layer in crypto. It feeds and sustains all the above layers. When VCs make 1000x on one of their investments, that money comes from Retail.

Whenever a token is released via a TGE (Token Generation Event), IDO (Initial Dex Offering) or other methods, that’s when all layers above you cash out. That includes influencers, media partners, dev teams, exchanges, and VCs.

Who’s buying and being hyped? You are.

This is the purpose of the layer above you. To make you believe the narrative. If a big influencers says it’s a great investment, it must be true. Right?

WRONG.

They are after your money. Period.

The layers above you buy the tokens before the TGE/IDO at significant discounts or dev teams simply generate them with a few lines of codes out of thin air.

You buying is giving value to that token or rather you transfer value to the above layers. That’s your key function in the pyramid. To be exploited and provide value to something created from thin air.

Layer 2: Influencers & Media

Influencers and media companies in crypto serve the layers above. They say and do whatever they are told because they are paid for it. They are fed from above and they feed the Retail layer whatever it wants to hear (e.g. a juicy new token that will 100x).

Most influencers cannot be trusted by Retail because incentives are not aligned. The bigger the influencer the more suspicious you should be.

The reason?

They are probably being sponsored by any of the above layers to promote a certain narrative which may not be in your interest. That new token may well be a copy-paste project from the last cycle with a new name. Don’t fall for it. Always do your research. Most meme coins are just that.

Media companies may also work with influencers or a group of influencers to act as one unit creating “organic” engagement around a token or topic. This is nothing new. Crypto protocols and VCs have budgets for marketing and they will use it.

You are their target and the role of this pyramid layer is to sell it to Retail.

Whenever you see influencers make a thread with a list of new crypto gems, most of those gems are promo work mixed with real tokens to make unassuming readers think it’s a legit research piece.

It’s not. They did not discover any gems. They were paid to do it.

Over time, you will be able to tell who’s for real and who’s not, but if you’re new to crypto, assume everyone is after your money and work yourself backwards. Only trust Bitcoin because it is the most decentralized and hard to control.

Layer 3: Crypto Protocols & Dev Teams

The most honest developer was Satoshi. Everything that came after got perverted. This is why there are over 13,000 altcoins in 2024. 99% of them are a shameless money grab. There is no tech or innovation. It’s mostly hype to take money away from Retail.

Whenever a dev team releases a new crypto protocol or blockchain with its associated token or coin they are in effect doing an unregistered securities offering.

This is mostly illegal in USA, but unregulated in most parts of the world. It is the quickest and easiest way to make money, and fast. The merits of that new protocol or network are irrelevant. Terms like DeFi, RWA, DePIN, SocialFI or GameFI are meant to confuse you, and hide the truth, in most cases.

This is why when you read about a new project, the most prominent part of their documentation relates to their token or the functions of that useless token. Note that some teams do this every cycle with a new name or brand and they have plenty of money from previous cycles to pay influencers a level below them to do their bidding.

If some developers can sell a promise and raise money on that promise, then they have been successful. Delivering on that promise is not the point. Their only reason to exist is to make money for themselves and the layers above. The VCs that sponsor such teams expect profits on their investments, not innovation.

This is the main purpose of most altcoins. They are not here to help you or solve any problems. They are here to make quick money since a bull market is short-lived. Bull markets are like a forest after the rain, full of new mushrooms or altcoins. But watch out - some are toxic!

Few protocols are here to actually build something long-lasting. That’s why I recommend you pay more attention to coins and tokens that have been around for a while and actually have a real use case. A minimum of two crypto cycles is best.

Only consider new projects if they truly innovate. The rest are just hype thanks to promotion by influencers. The AI narrative in crypto is just the latest example, 99% hype, 1% real use case.

Crypto is fueled by greed and part of the blame also rests with Retail dreaming about that 100x all the time. The pyramid layers from above oblige and create all sorts of crypto projects that lead to nowhere but broken dreams for Retail.

Layer 4: Venture Capital or VCs

These are the moguls of crypto. Rich and powerful, they call the shots. They can pump or crash markets, exchanges, or even kill tokens. They also fuel the crypto casino by investing in new projects pitched by various crypto developers from the layer below.

Make no mistake, VCs are here to make money. While Retail dreams of 100x, VCs actually make 1000x profits during a crypto bull market. What they bought for a few cents on the dollar, they sell for hundreds of dollars to retail.

They are the ones pumping the market to start a bull run and also the ones selling when the market makes new highs, because they are taking profits on those 1000x investments (aka smart money). Once the hype is gone, and they’ve done a killing, they stop playing. We call that a bear market.

VCs caught on the wrong side of this game, because it is a free for all, get crushed. Plenty of examples came out due to the Terra Luna and FTX implosions in the last cycle.

VCs get their money from the above layer, but can also sit on a huge bag of their own cash if they are successful in their investments. A quick look at Solana’s price will tell you some VCs made a killing. Vitalik Buterin, in his early days developing Ethereum, was surrounded by VCs. They are all rich now.

VCs use this money to sponsor new development in crypto. They grow the space, which is good, but they can also create tremendous damage. VCs are as greedy as Retail, you just have to add a few extra zeros to their greed. Nevertheless, they serve an important role in the crypto cycles as they are very much a part of them.

Dev teams sometimes hate VCs and refuse to work with them or accept their bribe because they lose their freedom in that exchange. In such cases, VCs call the shots and sometimes Retail gets hurt. Some dev teams care about that, some don’t.

This is also why some good dev teams with a great project never make it. They are not in the club where VCs hang out. If you hang out with the VC club members then all the layers below them will support your project, including Retail which is ready to eat anything the layers above feed them (aka dumb money).

Layer 5: BlackRock & the FED

BlackRock recently joined crypto in a public way via their Bitcoin ETF. Privately, they’ve been in the space for years using VCs. They own traditional finance and crypto is their latest expansion. The FED role is rather simple, they print as much US dollars as needed, on demand, from thin air. They decide when the market pumps or crashes.

BlackRock is the world’s largest asset manager on the planet. They basically own everyone. It was natural that they would not ignore the latest asset that’s making waves: Bitcoin.

They joined the Bitcoin train in a public way this year with the Bitcoin ETF approval. People from lower layers in the pyramid tried for over 10 years to get a Bitcoin spot ETF approved, but only when BlackRock decided to join this was actually approved. We call that power.

In private, and mostly in secret, BlackRock has been accumulating Bitcoin for years using their Bitcoin private trust. Them going public was inevitable. They know where Bitcoin is going and they are already very much a part of that.

The FED role in crypto is simple. They decide when liquidity floods the market or not, just like in traditional markets. Crypto is not immune to that, at least not yet. When the FED prints dollars out of thin air, the crypto market pumps. When they stop, it crashes.

They effectively control the lives of everyone in all the layers and BlackRock is there to do the rest. BlackRock or the FED are not here for a 1000x. They can already print as much money as they need whenever they want. Money is a non-issue for them.

Their main mandate is control and power over the layers below. They maintain it via monetary policy and other tools. We are a victim of their decisions with no power to influence or stop that. They do as they please as the kings of the pyramid.