Bitcoin is a week away from the fourth halving. So as it is customary every four years, now is the time to speculate. Is the halving priced in already or not?

For what it’s worth I’m going to say no.

The ultimate narrative combo would go something like that:

- Only X Bitcoins are mined every day.

- The demand for the ETFs alone is capturing more than X on daily basis.

- After the halving we’ll drop to X/2.

- Head explode…

I don’t think that narrative has been pushed very hard until now. Hence my “not priced in verdict”. So let’s dream.

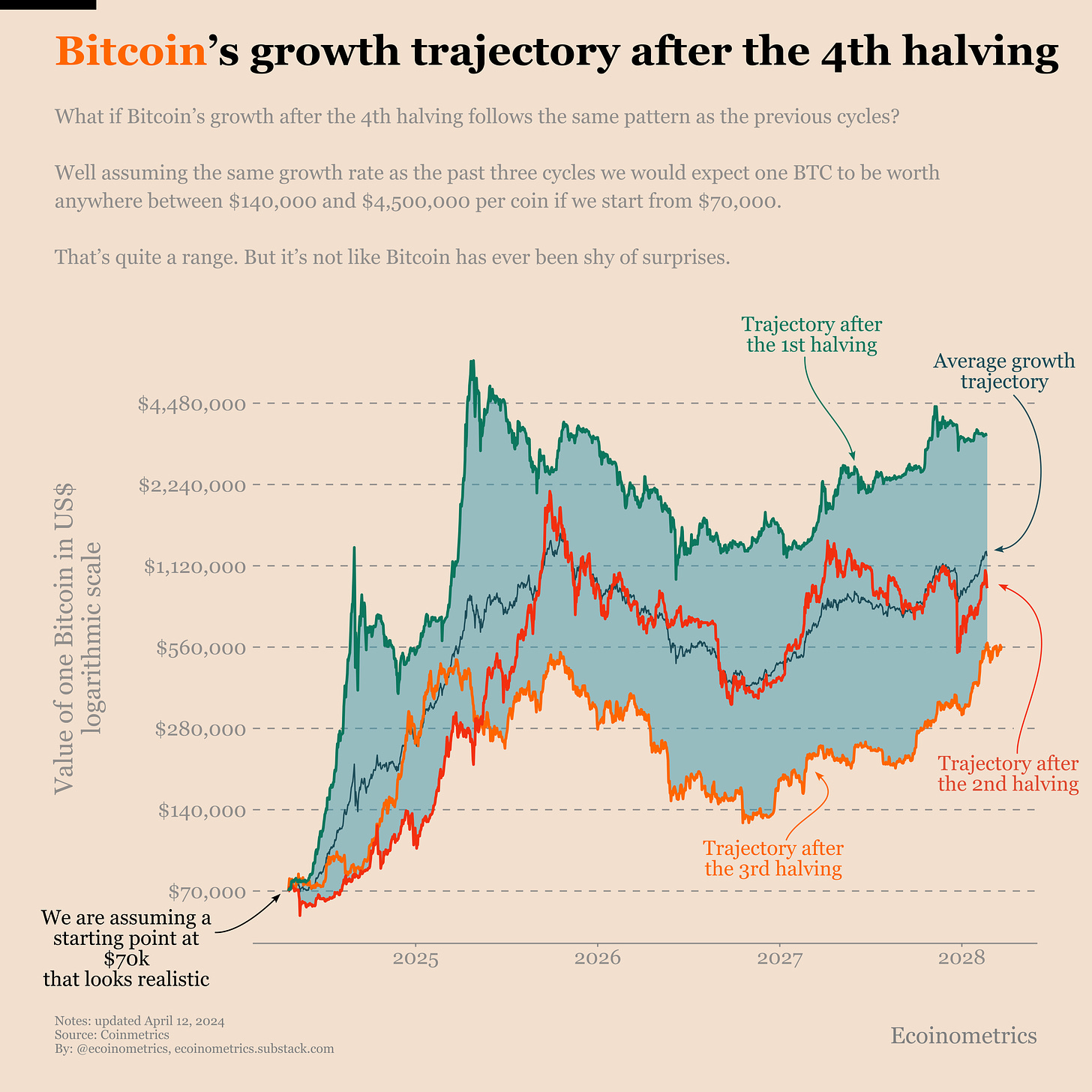

Bitcoin is at $70k per BTC as I writte those lines. It is likely to stay around this level until the halving. And if Bitcoin was to follow a similar post-halving growth trajectory than in the previous cycles we would have BTC go anywhere between $140k and $4.5m per coin.

That quite the range for sure but the point is that the lower bound is in the six figures range…

We’ll update the chart below with the actual post-halving trajectory on this page daily.

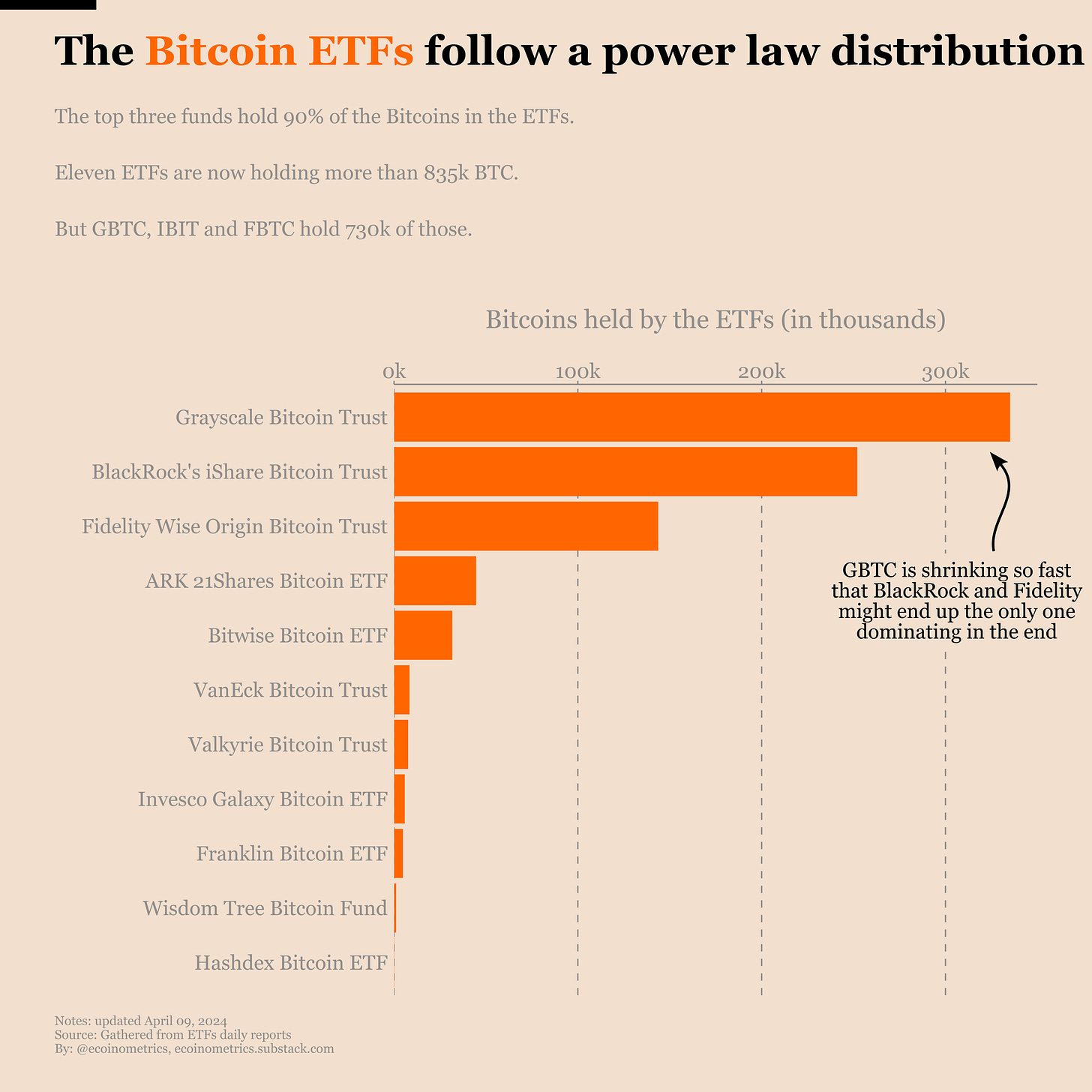

Power law in the Bitcoin ETFs

Here is an observation: 90% of the Bitcoins held by the ETFs are held by 30% of those ETFs.

We have 11 ETFs and they hold about 835k BTC. The three ETFs GBTC (Grayscale), IBIT (BlackRock) and FBTC (Fidelity) hold a total of 730k Bitcoins.

That’s not exactly a 80/20 rule but that’s close enough. And as Grayscale continues to shrink we’ll probably reach a situation where 2 ETFs control 80% of the Bitcoins held by funds. It is just a question of time.

Power laws are everywhere.

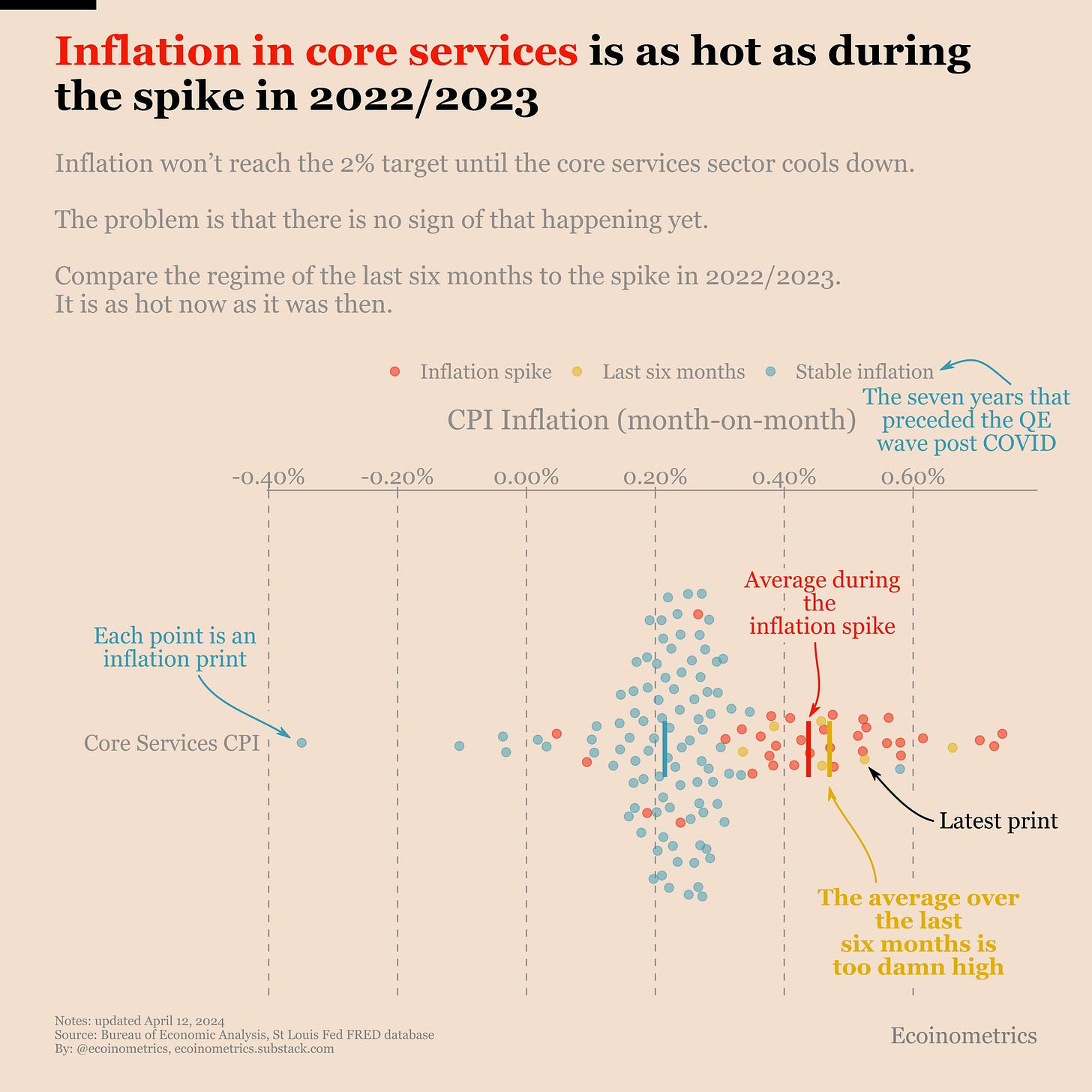

Sticky inflation

This week we had the much anticipated CPI inflation print for March. In is still too damn high. But that’s not a surprise.

What do you want me to say?

If you are reading every single issue of this newsletter you are probably already sick of me repeating the same thing over and over again about inflation. But since most people are only waking up to it now let me do that one more time…

Core services are the issue. They have been the issue for half a year. Other sectors of the CPI are cooling down over all. Or at least we can say that they have transitioned back to pre-COVID regime.

But core services, which are a huge part of the US economy, have not transitioned. The distribution of the month-on-month inflation for core services has not changed since the spike in 2022/2023. It is significantly different from the pre-COVID regime of inflation.

Don’t expect inflation to reach the 2% goal in those conditions.