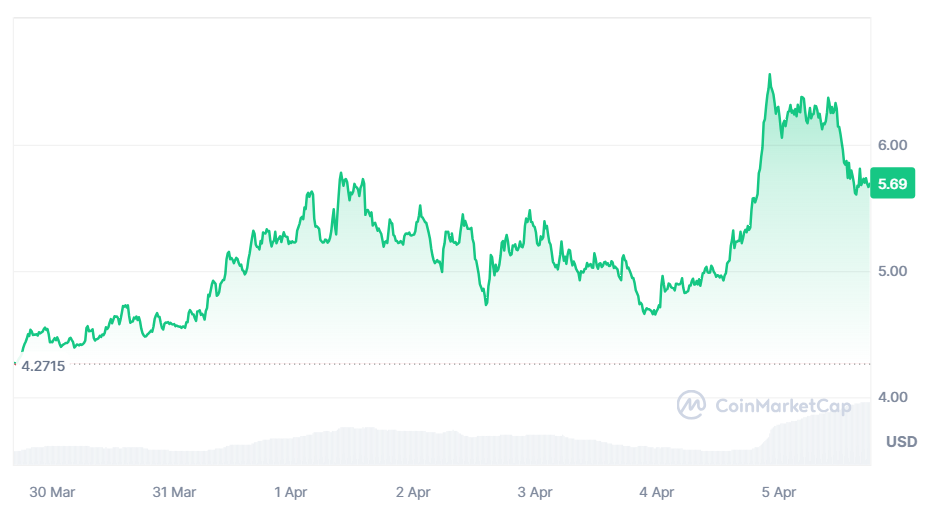

The yield trading platform Pendle (PENDLE) has seen a notable increase in both its token price and total value locked (TVL). PENDLE has increased by more than 33% in the last 7 days and is now trading at $5,69. Strong investor interest and market activity are indicated by the $330 million trading volume that accompanies this price hike.

Users appear to be responding favorably to Pendle's fundamental idea of dividing yield-bearing assets into tradable yields and underlying assets. With a total trading volume of over $10 billion, the platform has attained a TVL of over $4 billion. Notably, trading volume reached an astounding $400 million in a single day on April 2.

According to data from DeFiLlama, Pendle Finance has grown by more than 1,500% since the start of the year, going from just $233 million to $3.97 billion on Thursday. Pendle is currently the biggest DeFi yield mechanism on the cryptocurrency market as a result.

What is causing the spike?

Pendle has profited from the current ether restaking boom. The platform observes a significant concentration of trading activity centered on liquid restaking tokens that are connected to ether and its yield. The value locked on Pendle has increased dramatically as a result of inflows from various platforms. For example, Pendle's weETH (wrapped Ether from EtherFi) assets have increased by 13% in the past week to reach $920 million. Renzo, another liquid restaking procedure, shows similar patterns.

There has also been a lot of trading activity in relation to the synthetic dollar process Ethena. With the recent introduction of its yield pools on Pendle, Ethena's stablecoin USDe has increased the platform's TVL by over $500 million. The CEO of Pendle, TN, highlights the company's dedication to providing user-centric services and goods while acknowledging the benefits of Ethena's expansion and the recent spike in restaking activity.

Pendle is growing in popularity on Layer 2 alternatives like Arbitrum and Mantle, even though the majority of trade activity is placed on the Ethereum network. In addition, the community is buzzing about possible Solana deployment, which was initially revealed by The DeFi Investor.

Pendle has reached new all-time highs in a number of important indicators thanks to its recent climb. With a $1.36 billion market valuation at the moment, it is firmly established as the 82nd most valuable cryptocurrency. This noteworthy ranking is a reflection of the market's increasing faith in Pendle and investment interest. There are presently 238 million PENDLE coins in circulation, and the recent price gain indicates that the market is optimistic about PENDLE's prospects and upcoming projects.

Pendle's price has not peaked despite the surge in activity. The entire amount locked in is greater than its $517 million market capitalization. Crypto analysts expressed concern on Tuesday on the hazards associated with restaking protocols and the potential dangers of reusing liquid restaking excessively, despite the potential attraction of significant profits from restaking.