After months of wait, Frax Finance is finally launching Fraxtal, their own chain.

This is proof their resilience and vision to revoluzionize DeFi: from an algorithmic stablecoin protocol Frax has reinvented themselves after the crash of Luna, leading to the creation of new primitives, including Liquid Staking (frxETH), bonds, Real World Assets, and more.

Fraxtal is the culmination of their vision: a modular blockchain with a unique scaling roadmap and incentives to incentivize user growth and development.

Fraxtal is an EVM-compatible rollup built on the OP Bedrock stack, guaranteeing full EVM equivalence, Ethereum alignment and security, and facilitating the deployment of dApps.

The name Fraxtal comes after “fractals”. In mathemathics, a fractal is a geometric shape containing detailed structure at arbitrarily small scales, usually having a fractal dimension strictly exceeding the topological dimension.

The particularity of Fractals is being infinitely complex, with patterns that seamingly repeat themselves forever. Furthermore, every part of the fractal, regardless of how zoomed in, looks very similar to the whole image.

This concept is reflected in the strategic vision for Fraxtal.

As Sam has mentioned repeteadly, Fraxtal is a tech thesis-driven chain, and is not intended to be a standalone app-chain.

Instead, Fraxtal wishes to be modular L2 rollup incentivizing others to build on it.

Currently, there’s two main currents of thoughts with regard to the future architectural developments on blockchains: monolithic versus modular.

To sum it up, the modular view sees the main components of the blockchain stack (validation, execution, Data Availability etc.) as something that can be separated or combined, to tailor to specific use cases and improve the efficiency of blockchain networks.

This short piece introduces Fraxtal, the way they incentivize users to build on their L2 and the role of FXS within this new ecosystem.

Introducing Fraxtal

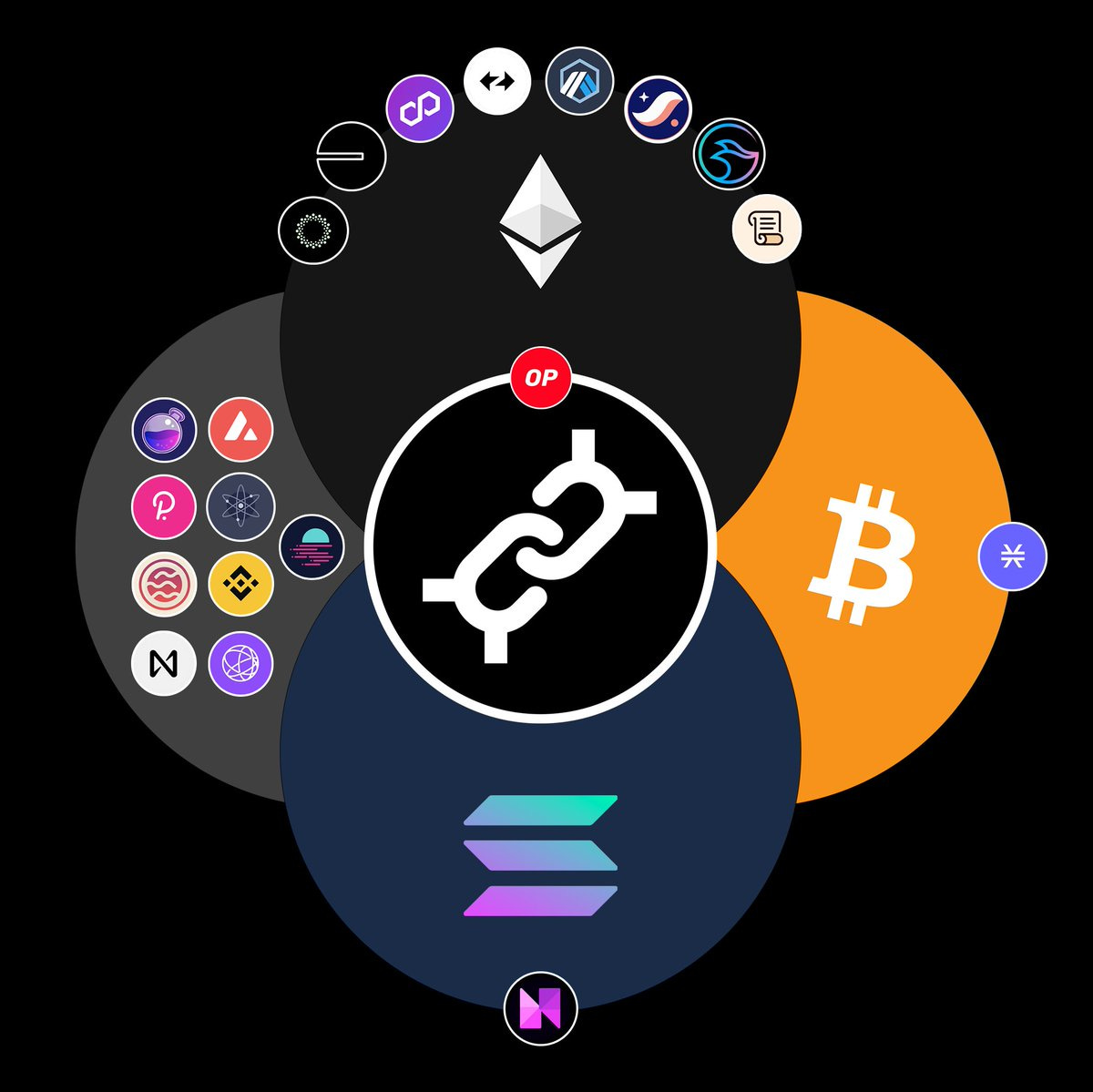

Fraxtal benefits from the backing of Frax Finance, one of the most resilient DeFi protocols, with tentacles in almost all primitives.

This provides Fraxtal with a strong network and utility from the beginning, with the presence of several primitives that users can take advantage of.

The purpose of Fraxtal can therefore be intended as a general compute chain, with a roadmap plenty of future integrations with Data Availability protocols, more L1 and other blockchain components.

One of such integrations regard Eclipse, a protocol using a Solana Virtual Machina but settling on Ethereum. As a modular rollup, Fraxtal will features several infrastructural and middleware components, “for other chains and networks to use, connect to, deploy L3s, and build on top of”.

As an example, Fraxtal uses a in-house data availability module developed by the Frax Team.

From its launch, expected in the 2nd week of March, Fraxtal will have a buffer period to allow developers to launch dApps, reflecting their paced down approach, making sure that everything is perfectly set.

This is often the case for Frax, which has preferred to focus on long-term goals, rather than a short term view. In the words of Sam, the founder of Frax, this approach consists in seeing “where the industry is going and make sure that you can create the most value there, with a long term grow oriented mindset”.

This also means not jumping on trend following or catching, and maintain a core focus on the long term vision of the protocol.

To achieve this purpose and incentivize development, Fraxtal has chosen a different path compared to many L2 launching these days.

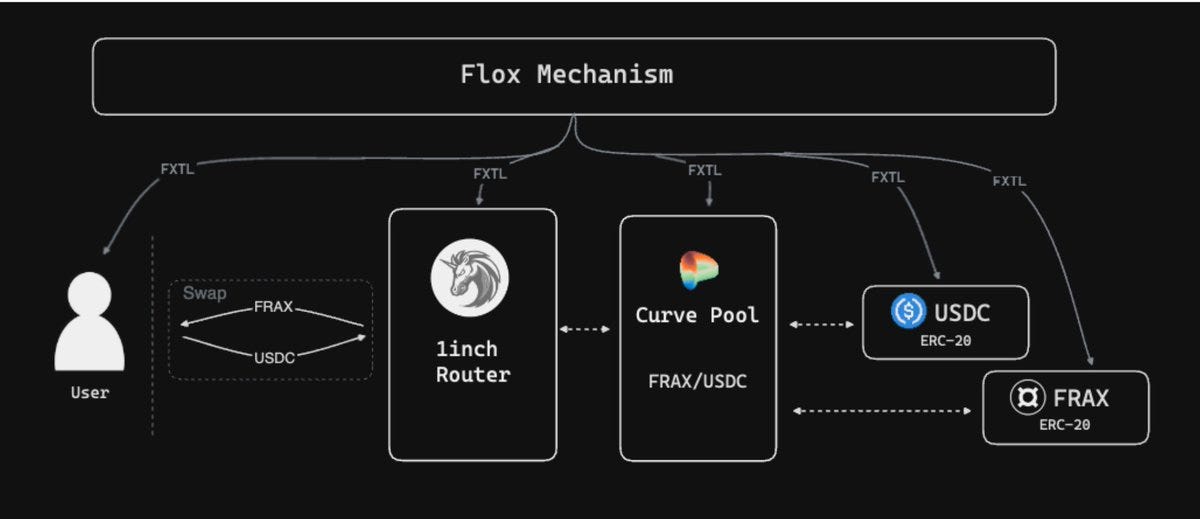

Instead of bootstrapping Fraxtal with the promises of an airdrop, the Frax team has come up with FLOX, a series of blockspace incentives for users and developers that are using the Fraxtal chain.

FLOX are a system where users who transact on the chain and developers who deploy popular smart contract get to earn FLOX points at every epoch.

Epochs will be initially set with a weekly lenght, but their lenght can be further customized to avoid gaming of the mechanisms, and have more granular time frames.

Until now, gas rebates have been relatively inefficient in attracting users, as they often happen one-shot and not over a long period, and their money contribution is often negligible for projects.

The same can be said for airdrops, which are a one-off stimuli that fails to contribute to user stickiness and retaining users.

For this reason, Fraxtal has created FLOX points, which can be intended as a “perpetual airdrop” rewarding users for real usage.

To avoid having mercenary capital or users gaming the system using their own contracts, Fraxtal introduces 3 mitigation mechanisms:

- Blockspace usage: how much blockspace is this contract contributing to? How much fees is it creating for the Fraxtal network?

- Contract Ranking: this is similar to how Google ranks pages for domains, taking into account the popularity and ranking of the contract within the Fraxtal ecosystem. This ensures that a single user cannot game the system, making an average of how many users are effectively using this contract and how much each is depositing and spending.

- Random Block Sampling: similarly to how Data Availability Sampling works, Fraxtal uses a random block sampling to ensure the availability of asset at any point in time.

Combined, these mechanisms will reduce Sybill attacks, and prioritize organic sources of demand and a fair rewarding mechanism.

To sum it up, FLOX can be regarded as recurring incentives for usage and block space consumed. FLOX incentives will be represented by the ticker FXTL, and will be “tokenized no later than 12 months after Fraxtal chain genesis”.

Currently the team has left open whether “FXTL points will be tokenized as a separate staking token for the chain (FXTL) or convert to FXS tokens at a specified ratio (or a combination of both)”.

The FLOX incentives will go live on March 13th, with an airdrop of FLOX points to veFXS stakers.

Which brings us to the next question: what happens to FXS now?

The Role of FXS within the Fraxtal Ecosystem

Dear FXS holders, fear not, for FXS will still have a central role within the Fraxtal ecosystem.

In fact, FXS will assume the role of native token for Fraxtal, accruing value from the network and having the purpose of long-term staking tokens — with several flywheels as incentives.

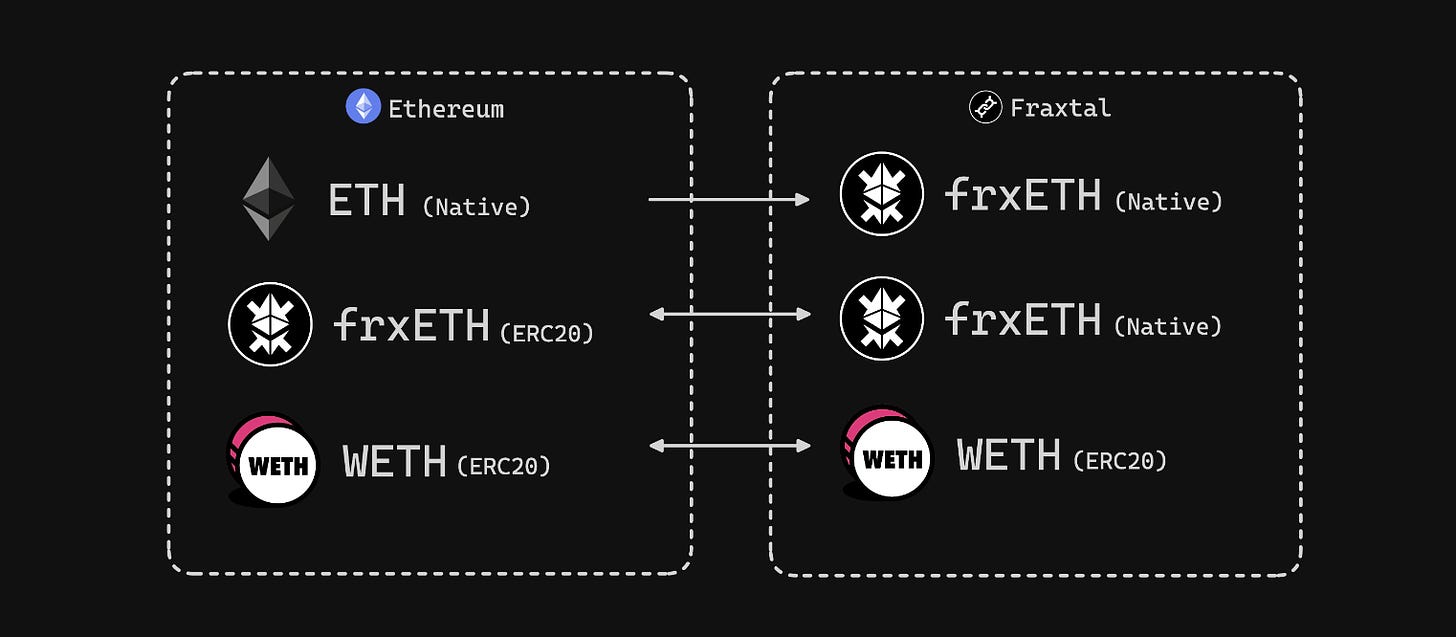

However, it is important to mention that gas fees on Fraxtal are paid in frxETH.

Fraxtal also brings further utility to veFXS.

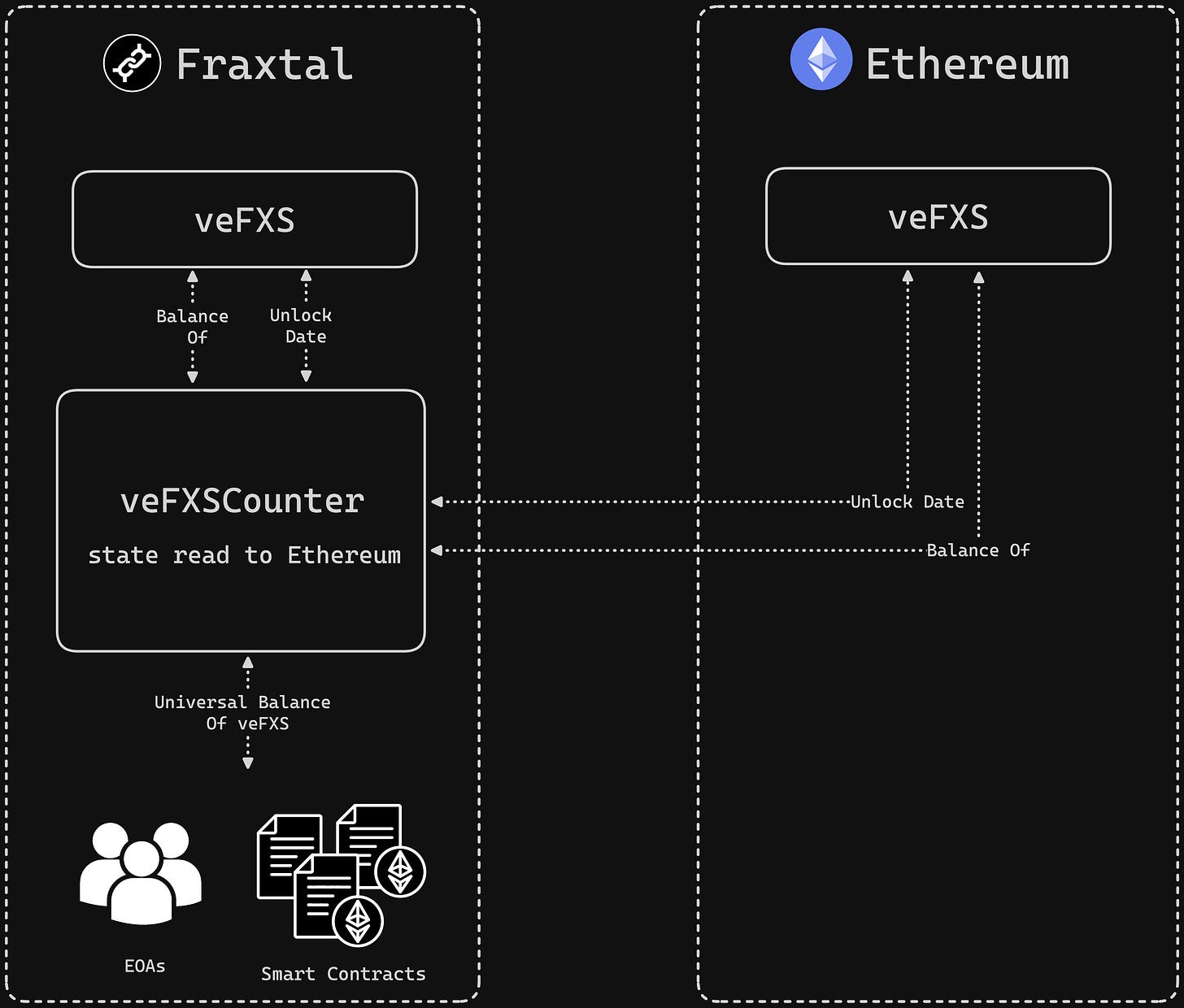

Users can now stake veFXS on Fraxtal with a unified balances with Ethereum Mainnet, which will serve to get FLOX points, vote on governance and more.

More on Fraxtal

Fraxtal will also launch a Frax version of Bitcoin, named frxBTC.

How does frxBTC get yield? As Frax’s goal is to be the larger issues of the most important economical units of account and become a general-purpose chain.

As such, one of the largest addressable markets, aside from the ones already captured by Frax (USDT, ETH), is Bitcoin.

From launch Fraxtal integrates Redstone Oracles:

https://twitter.com/redstone_defi/status/1758506563416068121

Great explanation on FLOX by the one and only Flywheel team:

https://twitter.com/FlywheelDeFi/status/1757845971751567617

Fraxtal launch thread by Frax Finance:

https://twitter.com/fraxfinance/status/1755386501926433087I

The incentive systems, rewards and FXTL point will start later in March, with the purpose to allow partners & developers enough time to deploy their dApps and stake FXS to become eligible.