Intro

GM fellow crypto enthusiasts. For today’s report, we're diving deep into the ecosystem that has been flying under the radar ever since its inception, and in today’s article, we're aiming to answer why.

Created by MystenLabs, Sui is said to be the next-generation blockchain built to suit the needs of the ever-growing blockchain adoption. Who is adopting blockchain, you may ask? It's the web2 world that is gradually finding its way and transitioning to the web3 realm as it offers new lands to conquer with marketing, user acquisition, and network effect.

Areas linked to mainstream usage like the metaverse, gaming, social layer, and even commerce all need a particular type of blockchain to serve their needs - and we all remember how costly Ethereum can become whenever the interest spikes. Can anyone recall the spike during Otherside NFT mint where more than $150M was burned in ETH gas fees? Indeed, that is why over the recent months - and even during the last bull run, we have seen the need for a fast and cheap Layer 1 blockchain that will meet the needs of the upcoming mainstream adoption - or at least mainstream hype if adoption is too big of a word yet.

- But what about Layer 2 ecosystems like Arbitrum or Optimism? Aren't they the solution to Ethereum's high gas fees?

Yes, but there's still much to do in terms of Layer 2 adoption - so it's a topic for another Deep Dive, and if we will meet huge demand from the Tradfi world, we have to offer something right here, right now, and that's exactly where Monolithic blockchains can reign supreme.

Bullet Points

- What is Sui and why is it compared to Aptos?

- Recent growth of Sui ecosystem

- Things to look out for

- Closing Thoughts

Understanding Sui - The World of Parallel Chains

Sui is often compared to Aptos as both projects were released at a similar point during the last bear market, and both are associated with the long-forgotten Diem project by Facebook. The Diem project was developed primarily to handle light payment traffic between a limited number of wallets but got halted as it was too soon for the public to accept blockchain - and for the US Gov to allow a giant like Facebook to introduce payment processing infrastructure. That is why it’s no wonder Sui and Aptos are both Layer 1 based on Proof of Stake - PoS consensus, and both utilize parallel execution that is here to serve the needs of the upcoming mainstream adoption. Although there are numerous technical differences like differences in the consensus mechanism or data architecture, we’re not going to dive into those as it’s irrelevant to our today's discussion.

What is relevant, though, is that both Aptos and Sui were seen as projects heavily influenced by venture capital, which resulted in a rather unwelcoming atmosphere from the broader crypto world, which wasn’t hard to notice while looking at their early price action after the launch.

Another resemblance is that both blockchains are using the Move programming language; however, there are slight differences in how the language is used. Aptos, on one hand, adopted the way in which Move was used in Diem, while Sui decided to change some concepts and adopted an object-oriented approach that results in being more suitable for mass adoption purposes - and that is exactly why it falls within the growing trend of Parallel Layer 1 blockchains.

In the coming months, we will witness another iteration of Layer 1 Wars that were the leading narrative during the 2020/21 cycle. This time, however, we will see new contestants in the arena, namely Aptos, Sui, Sei, Solana, and the anticipated one that is not yet here - Monad. All of those are monolithic chains, all of them support parallel execution, and all of them aim to win market share in the same niche.

Against the Consensus - Recent Growth

As stated before, the Price Action of Sui after launch didn’t surprise, as the primary trade CT decided to take was to open a short position and leave it for months - which turned out to be quite profitable. However, in October 2023, when Bitcoin began its climb to finally break $30,000 for good, SUI decided the bottom was in and began its climb up as well.

However, the price wasn’t the only thing that began to climb up - TVL on Sui did as well. From around $80M in October 2023 to $567M as of today, the Sui ecosystem attracts more capital, but here lurks the question - how and with what?

The most recent reason may be the upcoming Wormhole airdrop speculation that drives the use of bridging and boosts TVL on various chains. Needless to say, this liquidity will not stay there once the snapshot for the airdrop is taken, but how much of the recent TVL surge is related to Wormhole speculation remains a mystery.

What about the DeFi ecosystem on Sui? Right now, we see a couple of major DeFi protocols that offer Liquid Restaking - NAVI, Lending and Borrowing - Scallop, DEX and Perps - Cetus and BlueFin, building the core infrastructure for the growing ecosystem. Doubling down on this idea, we can say that incentivizing DeFi protocols can be the way to attract users and liquidity; however, it has to go on par with attracting developers who will build a multitude of different dApps and protocols. It’s also worth saying that BlueFin has recently entered into a partnership with Elixir - a protocol that aims to boost liquidity on DEX-orderbooks. This resulted in a spike in BlueFin’s TVL by about 50% - from almost $9M to $13.1M today. Whether it’s the beginning of cross-chain integrations or a single event spreading Elixir’s influence is hard to say, so it’s worth keeping an eye on further integrations that the Sui ecosystem may see in the near future.

If you’d like to learn more about Elixir and understand why it’s growing to be the key protocol in the DeFi world, you should read our Deep Dive on Elixir, which you can find below.

There is one more selling point that can become an ace up Sui’s sleeve when it comes to attracting users and heating up emotions - the lack of ecosystem project’s tokens. If there is one marketing hack a crypto project can do, it’s teasing users with the upcoming airdrop as a reward for using the said project - even better is if the airdrop campaign spreads across the entire ecosystem, and this scenario is quite possible on Sui.

On top of that, we have also seen the introduction of Stardust, which brings wallet-as-a-service infrastructure and aims to attract GameFi builders who will utilize all Sui has to offer. On top of this, we have seen an interesting partnership between MystenLabs - creator of Sui, and Team Liquid - one of the most recognizable eSport teams from Europe. In other words, Sui is trying to enter the GameFi world, but why do we see this shift?

It has to be said that every ecosystem in the highly competitive Parallel Layer 1 space has to find its own sub-niche to attract users and TVL instead of fighting for the same overgeneralized audience. Solana seems to have found its selling point in crypto culture with its NFTs and memecoins, and instead of copying one’s success story, Sui seems to move on and tries to attract the GameFi audience thanks to its object-oriented Move language and UX that is far better than the one we see, for example, on StarkNet.

Facing the Future - Looming Issues

While it all may sound overly positive and promising, let’s not forget to consider all the risks involved as well as the upcoming unlocks that may affect the price of the SUI token.

As mentioned before, the price of SUI has been on a steady rise ever since its pico bottom at $0.36 in October 2023, and has risen by almost 100% since the beginning of 2024, almost managing to reach the $2.00 mark only to retrace when the parallel ecosystem narrative slowed down. This signals that there indeed was money to be made for those who took the risk and it’s always a great incentive to explore the ecosystem and bet on its projects and memecoins if the price goes up. However, it wasn't the case with Sui.

The most notable DeFi projects we’ve mentioned before - i.e. BlueFin, Aftermath, or Scallop, don’t yet have their tokens - except for Cetus, which may bring airdrop speculation in the future. For now, however, it severely limits the attractiveness of the ecosystem as there are no tokens worth speculating on or investing in.

The most explicit example can be the memecoin season on Solana which spawned over multiple mini cycles with short cool-off periods in between. During those cooling periods, the broader market had time to switch to other trends which often were linked to memecoins on different chains - and Sui had one as well. The most anticipated memecoin launch on Sui was the memecoin with the ticker $FUD which followed the most hyped trend of that time - i.e. dog-themed coins. However, the price action had little to offer as after the initial spike, the interest waned and liquidity quickly left the chain.

What seemed like a promising venue of attracting liquidity to the ecosystem turned out to be extremely short-lived as the liquidity went away within a couple of hours after the launch. On top of this, we can add the negligible number of makers - i.e. people buying and selling tokens, which revolves around 150-ish for the top 4 memecoins and is slightly above 250 for $SUI itself. Needless to say, the interest is non-existent as even on the Solana chain that has lost its momentum, we see thousands of makers on a daily basis.

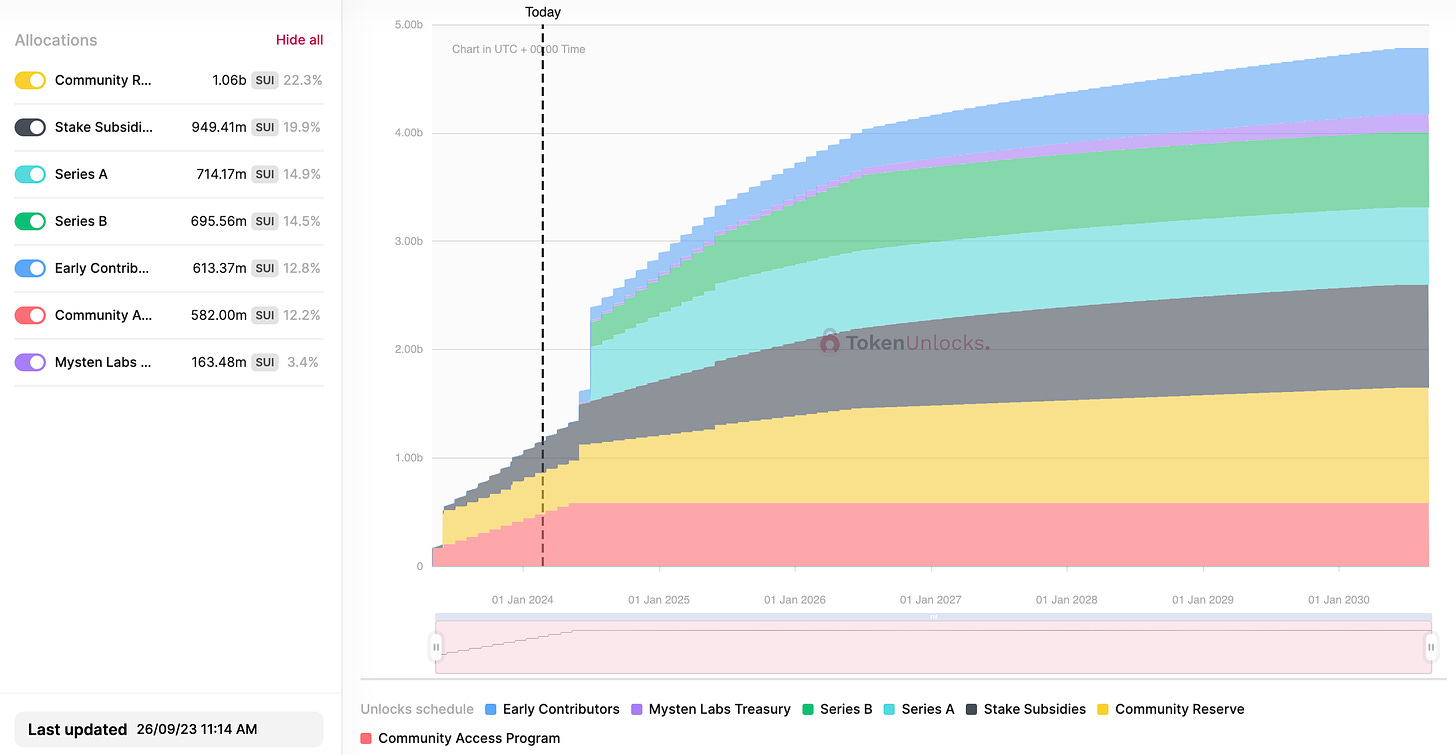

There’s one more thing that’s looming over the ecosystem, and it’s the unlock schedule. Monthly unlocks are set to revolve around 0.65% of the Max Supply, which equates to around 5.5% of the current Market Cap or $110M in dollar terms - those are rough estimations as the price of $SUI is changing and so does the McCap % and the dollar value. While the monthly supply seems to be absorbed by the market, the unlock that is about to take place in May can severely affect the price.

Source - Token Unlocks

Source - Token Unlocks

On May 3rd, Sui will see an 8.27% increase in its supply, which translates to around $1.4 billion in dollar terms and accounts for around 71% of the current Market Cap. It’s hard to predict how the market will react to such a heavy unlock; however, what we may see is the gradual build-up of the so-called “liquidity cushion” that will negate the released supply to some extent - as it is often the case with $DYDX unlocks. On the other hand, taking into account a rather low interest in the Sui ecosystem right now, it may be hard to attract enough liquidity to build such a safety cushion, and the market will begin to price-in the unlock weeks before it happens.

While it is impossible to predict the future, observing the market and Volume to Market Cap ratio on SUI can tell a story of how the market will try to approach the upcoming unlocks.

Closing Thoughts

The future of the upcoming months and years could see explosive growth in the blockchain adoption of not only mainstream users but also web2 brands - as we’ve already seen this trend forming in 2021 during the Metaverse craze. Taking all this into account, there is a growing need for fast and cheap blockchains that will be able to facilitate millions of users exploring the new exciting frontier and numerous dApps that will follow.

Sui isn’t the only contender in this niche as there are strong competitors like Solana, Aptos, Sei, and the upcoming Monad, who will all fight to win its market share in the - let’s call it, “mainstream-facing” niche. On top of this, we will see a surge in the development of Layer 2 ecosystems that - maybe with a bit of time-lag, will offer similar features that, combined with the overall strength and network effect of Ethereum, may become a solid competitor to fight for the market share in the same niche as Sui.

The leading theme of the previous cycle was the war between Alternative Layer 1 projects. This time we are going to see a similar scenario playing out; however, instead of Layer 1 ecosystems, we will see the great wars of the sub-layer 1 projects and monolithic chains that will fight to become the go-to place for “mainstream-facing” dApps.