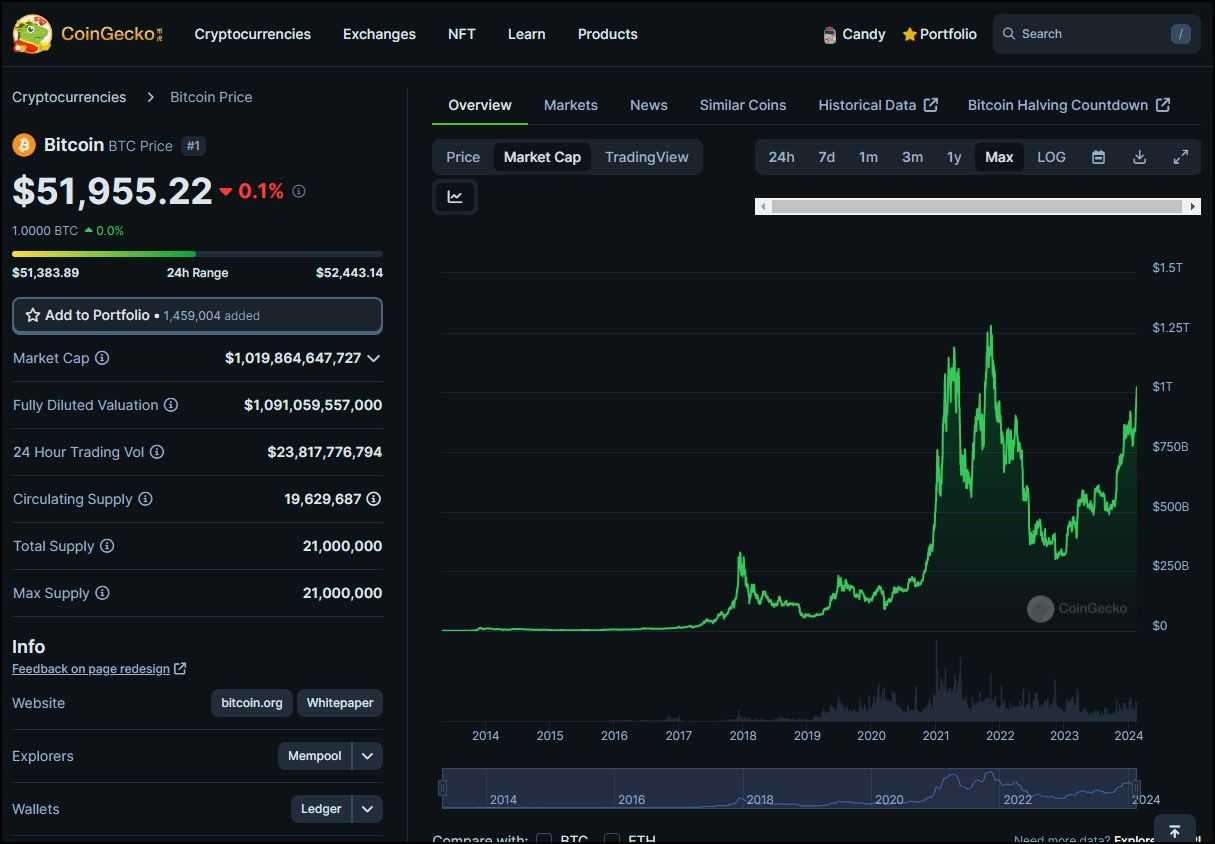

In the crypto realm, the Bitcoin network stands unrivalled in its value, security, and decentralization. As of February 2024, this pioneering blockchain commands a market capitalization exceeding a trillion dollars, a testament to its enduring appeal and robustness.

Bitcoin, often heralded as “digital gold,” is the cornerstone of the cryptocurrency realm and the most sought-after asset. It is celebrated for its attributes as a store of value and an 'inflation hedge.' Its unparalleled status has made BTC the most-held crypto asset globally, a clear indicator of its profound impact and the trust it commands among investors.

Bitcoin Hitting $1T Valuation For the First Time Since 2021 | Image via CoinGecko

The widespread adoption of Bitcoin set the stage for the success of the Lightning Network, an innovative layer-2 solution designed to facilitate faster and more efficient payments atop the Bitcoin network.

While the Lightning Network marked a significant leap forward, addressing some of the scalability issues that have long challenged Bitcoin, it also sparked a realization among its users and developers: the potential of the Bitcoin network was far from fully realized. This growing sentiment paved the way for groundbreaking projects that sought to unlock new capabilities within this venerable blockchain.

One such transformative movement is the Bitcoin Ordinals, which has dramatically expanded the scope of what's possible on the Bitcoin network. The Ordinals project has showcased Bitcoin's versatility beyond peer-to-peer payments and ignited a renaissance among developers by enabling the inscription of unique digital artefacts directly onto Bitcoin's blocks. Inspired by the secure and immutable nature of the Bitcoin blockchain, these developers are now exploring and constructing sophisticated smart contracts and layer-2 execution environments that promise to enrich the ecosystem further.

This analysis delves into the burgeoning landscape of Bitcoin layer-2 innovations that transcend the functionalities offered by the Lightning Network. It aims to illuminate the cutting-edge solutions emerging within the Bitcoin ecosystem. It highlights how developers leverage the network's unparalleled security and trust to build more intelligent, more versatile applications. As we embark on this exploration, we will uncover the pioneering efforts that enhance Bitcoin's utility and reinforce its position as the bedrock of the cryptocurrency world.

SegWit and Taproot – Upgrades That Elevated Bitcoin

Bitcoin's evolution is marked by continuous innovation and adaptation, with two landmark upgrades, Segregated Witness (SegWit) and Taproot, playing pivotal roles in its ongoing revolution. These upgrades addressed some of the network's most pressing challenges and laid the groundwork for a new era of development and expansion within the Bitcoin ecosystem.

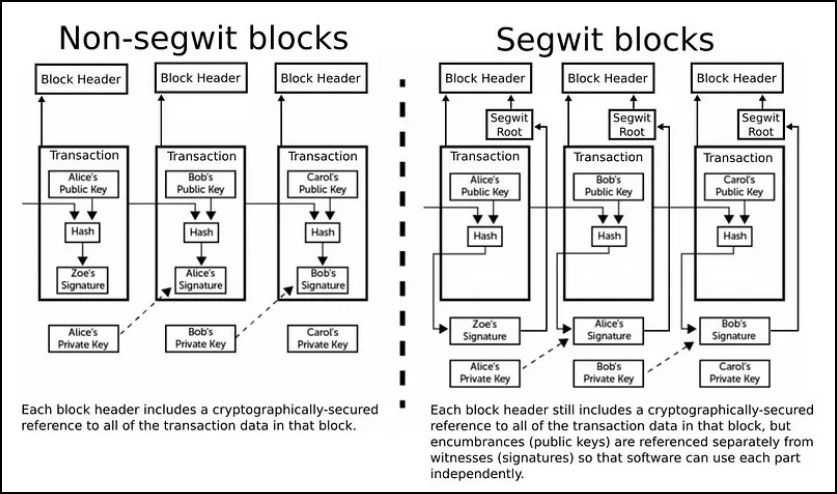

SegWit: Improving Memory Efficiency

SegWit was a groundbreaking upgrade implemented in 2017 aimed at addressing Bitcoin's scalability challenge:

- Increased Block Capacity: By separating (or "segregating") the digital signature (the "witness") from the transaction data, SegWit effectively reduces the size of transactions, allowing more transactions to fit into a single block without increasing the block size limit. SegWit enabled Bitcoin blocks to theoretically support up to 4 MB of transactions under optimal conditions.

- Solved Transaction Malleability: SegWit fixed a critical security issue that allowed the modification of transaction details before confirmation on the blockchain. This enhancement improved security and facilitated the development of second-layer solutions like the Lightning Network, boosting transaction speed and efficiency.

Post-SegWit Block Design | Image via Medium

Taproot: Making Bitcoin Smarter

While SegWit laid the groundwork for enhancing Bitcoin's scalability and security, the Taproot upgrade, activated in November 2021, brought additional improvements focusing on privacy, efficiency, and smart contract capabilities:

- Schnorr Signatures: Replacing the ECDSA signature scheme, Schnorr signatures allow for aggregating multiple signatures into one. This consolidation simplifies and secures complex Bitcoin transactions, making them indistinguishable from simple transactions on the blockchain.

- Enhanced Privacy and Efficiency: By making multisig transactions appear the same as regular ones, Taproot enhances user privacy and optimizes space on the blockchain, leading to increased transaction throughput and reduced fees.

- Smart Contract Functionality: Taproot facilitates the deployment of more complex and efficient smart contracts on the Bitcoin network, enabling developers to create innovative applications that leverage Bitcoin's security and decentralization.

SegWit and Taproot upgrades are more than just technical enhancements; they are transformative milestones that have significantly expanded Bitcoin's capabilities beyond its original purpose as a peer-to-peer electronic cash system. These upgrades laid the foundation for the burgeoning Bitcoin layer 2 ecosystems we will explore in the following sections.

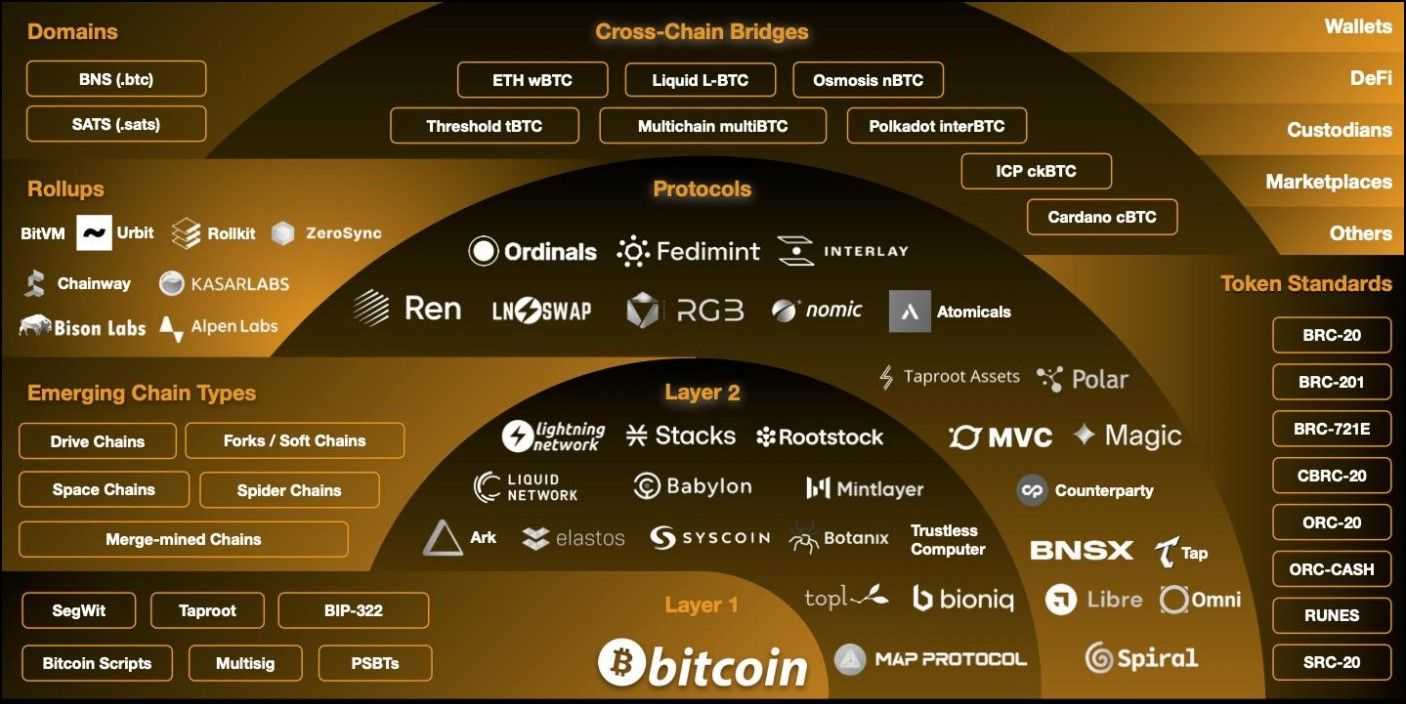

The Bitcoin Ecosystem

The Lightning network was the first major Bitcoin scalability solution, which introduced Bitcoin micropayments. It improved the Bitcoin network's capacity by creating layer-2 payment channels to process numerous transactions off-chain and settle the final state on-chain.

While the Lightning network exacerbated Bitcoin's utility as a store of value by making it more accessible for everyday value exchange, SegWit and Taproot primed the network for capabilities well beyond this initial purpose. The latest Bitcoin scalability solutions tap into Bitcoin’s characteristics that remained vastly underutilized all these years – its value as the most secure and decentralized distributed ledger.

Post-Taproot Bitcoin layer 2s are improving Bitcoin’s proficiency and expanding the dynamics of its capabilities by introducing:

- Programmability:

- Smart contracts: Facilitating complex and programmable smart contracts that achieve finality in the Bitcoin network.

- Token Standards: Creating new standards for issuing new tokens, expanding the scope of decentralized finance.

- DeFi inclusion: Bitcoin largely remained outside DeFi, owing to its rigidness and lack of programmability before these updates.

- DApps: Building applications on networks built on Bitcoin to enhance its utility.

- Scalability: One of the critical innovations in the Bitcoin ecosystem is creating high-through networks that can improve the scalability of the Bitcoin network with a modular blockchain design where the Bitcoin mainnet ensures finality to applications and transactions executing on layer 2s.

- NFTs: Even beyond ordinals, networks built on Bitcoin are creating non-fungible token standards and building an NFT ecosystem.

- Synthetic BTC: L2s are creating trust-minimized two-way pegs with the Bitcoin mainnet to issue its synthetic version on layer 2s and enable DeFi on BTC.

The Bitcoin Ecosystem | Image via Spartan Research

The evolution of both Bitcoin and Ethereum reflects a shared vision for enhancing scalability, security, and efficiency within their respective ecosystems, albeit through different technological approaches.

Ethereum's transition to Ethereum 2.0 and its rollup-centric roadmap highlights a strategic focus on optimizing the mainnet to serve as a secure and decentralized foundation for layer-2 scaling solutions. Key upgrades, such as Danksharding, aim to bolster the Ethereum network's capacity to support rollups more efficiently, enhancing throughput and reducing transaction costs while maintaining the network's decentralized ethos.

The Bitcoin ecosystem is witnessing a similar evolution, with the emergence of smart contracts-capable layer-2 solutions like Stacks and the Liquid Network. These innovations are capitalizing on Bitcoin's unparalleled security and decentralization to build efficient virtual machines and application layers atop the Bitcoin blockchain. Just as Ethereum's rollups leverage the mainnet's strengths to offer scalable solutions, Bitcoin's layer-2 projects harness the core blockchain's attributes to expand its utility beyond simple transactions.

This movement towards building on Bitcoin's robust foundation mirrors Ethereum's strategy, underscoring a broader trend in the blockchain space towards layer-2 solutions that enhance functionality without compromising on the principles of decentralization and security.

The upcoming sections will explore the leading scalability solutions in the Bitcoin network, particularly Rootstock, Stacks and the Liquid network.

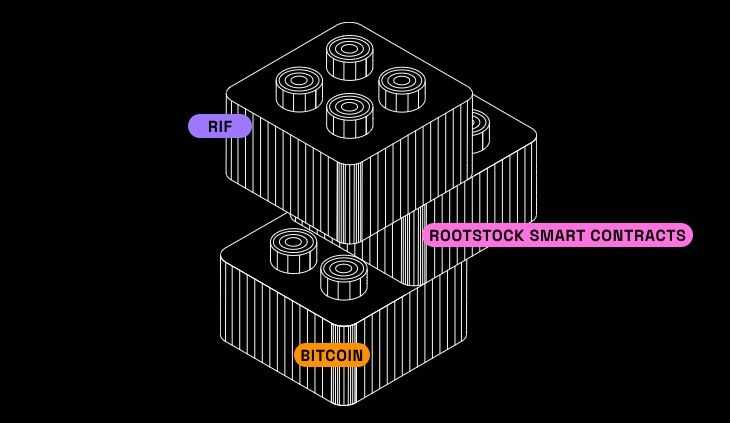

Rootstock

Rootstock (RSK) represents a significant advancement in integrating smart contract capabilities with the security and widespread acceptance of the Bitcoin network. As a two-way pegged sidechain to Bitcoin, RSK enables the deployment of decentralized applications (DApps) and smart contracts without compromising Bitcoin's core principles.

This breakdown explores the critical features and components of the RSK network, highlighting its unique position in the blockchain ecosystem.

Rootstock Technology Stack | Image via Rootstock Docs

Two-Way Peg to Bitcoin and RBTC

RSK operates with a native cryptocurrency called RBTC, pegged 1:1 to Bitcoin (BTC). This pegging mechanism is facilitated through a bridge, ensuring secure and seamless conversion between BTC and RBTC. Users can also deploy smart contracts and use DApps on the RSK network.

Merged Mining with Bitcoin

RSK's security model leverages Bitcoin's existing mining infrastructure through merged mining. This approach allows Bitcoin miners to mine Bitcoin and RSK blocks simultaneously, using the same computational work. Merged mining enhances RSK's security without requiring additional energy consumption, aligning with Bitcoin's proof-of-work (PoW) consensus mechanism. Miners earn most of the RSK network transaction fees from the RSK block they mine.

RSK Virtual Machine (RVM)

The RVM is fully compatible with Ethereum's Virtual Machine (EVM), allowing for the execution of Ethereum-designed smart contracts on the RSK network. This compatibility enables developers to deploy their existing Ethereum DApps on RSK, leveraging Bitcoin's security while benefiting from Ethereum's smart contract capabilities. The RVM processes smart contracts and runs DApps, fostering a rich ecosystem of decentralized applications.

Decentralized Federation and Security Measures

The Federation further enhances RSK's security and functionality. A group of semi-trusted third parties is crucial in managing the two-way peg and providing additional features such as Oracle information and transaction acceleration. This setup contributes to the network's security.

Scalability Solutions and RIF Services

To address scalability, RSK incorporates off-chain transaction solutions and is integrated with the Rootstock Infrastructure Framework (RIF), offering a range of services to enhance the user experience and scalability. These services include RIF Storage, RIF Identity, and RIF Payments, which support various applications and use cases within the RSK ecosystem.

Rootstock Ecosystem and DApps

The RSK ecosystem hosts a variety of decentralized applications, including Sovryn, a comprehensive DeFi protocol; Money on Chain, offering crypto-backed stablecoins and decentralized staking; Liquality, a cross-chain wallet with built-in swap functionality; and Tropykus, a lending protocol with flexible repayments tailored for emerging markets.

In summary, RSK seamlessly integrates Bitcoin's finality and liquidity with Ethereum's versatility and adaptability of smart contracts, creating a unique and powerful platform for decentralized applications. By leveraging merged mining, a two-way peg with Bitcoin, and EVM compatibility, RSK not only enhances the functionality of the Bitcoin network but also opens up new avenues for developers and users seeking to engage with the broader blockchain ecosystem.

Stacks Network

The Stacks Network is a Layer 2 solution built on the Bitcoin blockchain, designed to extend Bitcoin's functionality by introducing smart contracts and DApps while leveraging Bitcoin's unparalleled security and finality.

Here's a comprehensive breakdown of the Stacks network and its features:

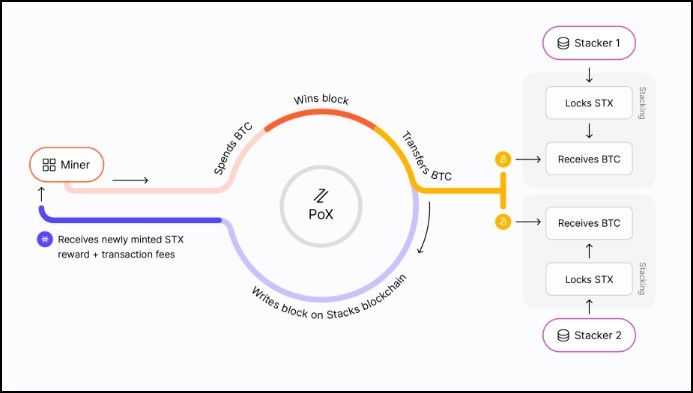

Proof of Transfer (PoX) Consensus Protocol

Proof of Transfer | Image via Stacks Docs

Stacks innovates with its Proof of Transfer consensus mechanism, connecting the Stacks and Bitcoin blockchains. This unique protocol allows the creation of new Stacks (STX) blocks, with miners earning STX tokens for their efforts. Simultaneously, STX holders (referred to as "stackers") can earn BTC by participating in the network's consensus, thereby fostering a symbiotic relationship between the two ecosystems.

Nakamoto Hard Fork

Named after Bitcoin's pseudonymous creator, the Nakamoto hard fork represents a significant upgrade aimed at enhancing transaction speeds, improving block production through a tenure-based system, and bolstering the security of Stacks transactions by incorporating the hash of Stacks microblocks into Bitcoin blocks. This upgrade addresses minor extractable value (MEV) issues and introduces sBTC, a trustless synthetic representation of Bitcoin on Stacks, maintaining a 1:1 peg with BTC.

Clarity Smart Contracts

Stacks uses the Clarity language for smart contracts, emphasizing safety and predictability. Clarity is designed to prevent bugs and exploits prevalent in smart contract development, making it an ideal choice for developers looking to build on a secure platform.

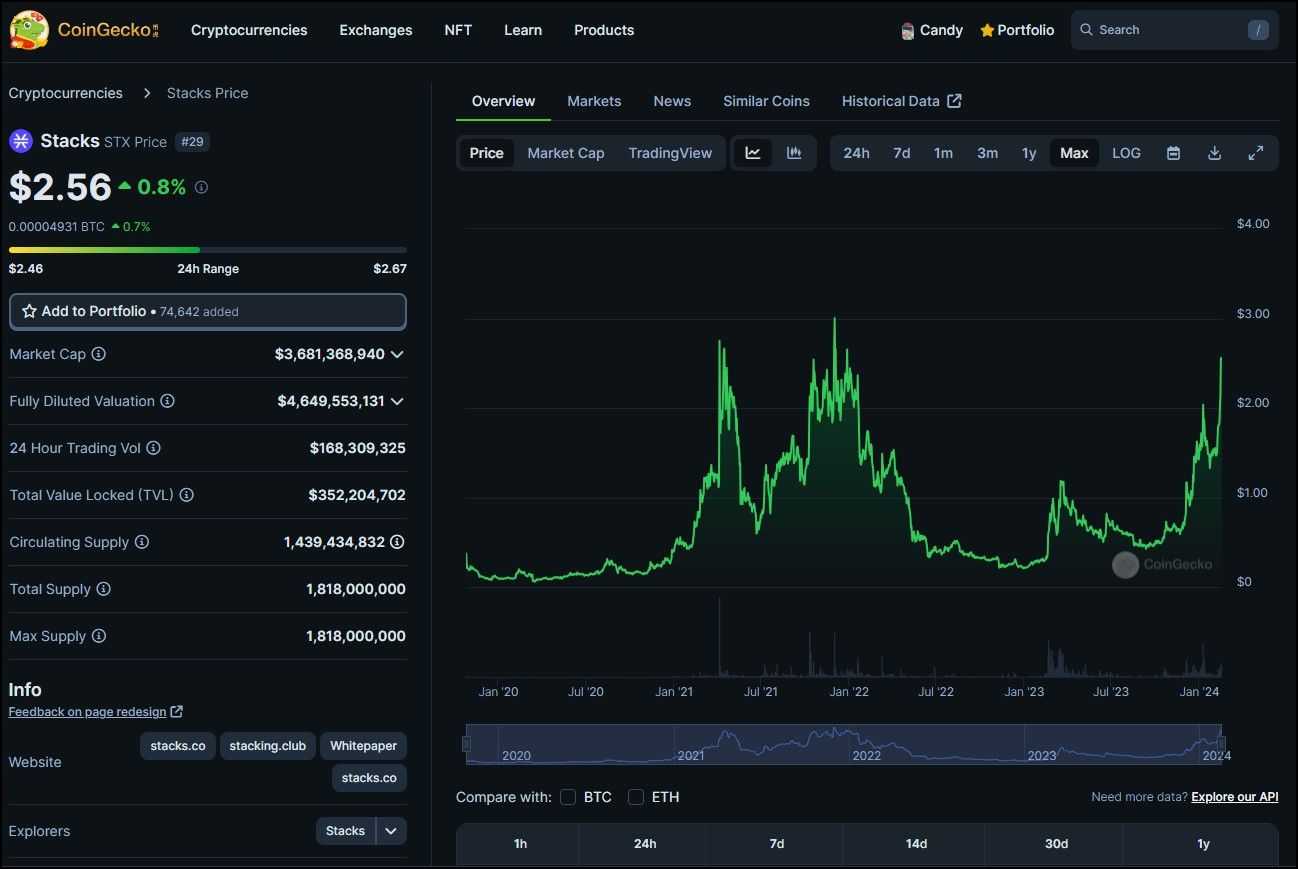

STX Token

The STX Token | Image via Coingecko

The native token of the Stacks network, STX, plays a pivotal role in network operations, including transaction fees and rewards for stacking. STX's tokenomics are closely tied to Bitcoin, influencing miners' commitment to the network.

Stacks Ecosystem

The Stacks ecosystem is vibrant and diverse, featuring Bitcoin NFTs, the Bitcoin Naming System (BNS), and various DApps like Boom, Arkadiko, StackingDAO, and Arcane. These applications span DeFi, yield, stacking, and NFT platforms, showcasing the versatility and development potential within the Stacks network.

Stacks NFTs on the Gamma NFT Marketplace

Stacks distinguishes itself from other Layer 2 solutions by recording its entire transaction history on the Bitcoin blockchain, claiming the same security and immutability as Bitcoin. Furthermore, Stacks is exploring the integration of rollups to enhance scalability and functionality.

In summary, Stacks stands as a testament to the evolving landscape of blockchain technology, where the foundational principles of Bitcoin are expanded upon to create a more versatile and functional ecosystem. Through its innovative consensus mechanism, smart contract capabilities, and continuous development efforts, Stacks aims to unlock the full potential of Bitcoin as a platform for decentralized applications and financial instruments.

Liquid Network

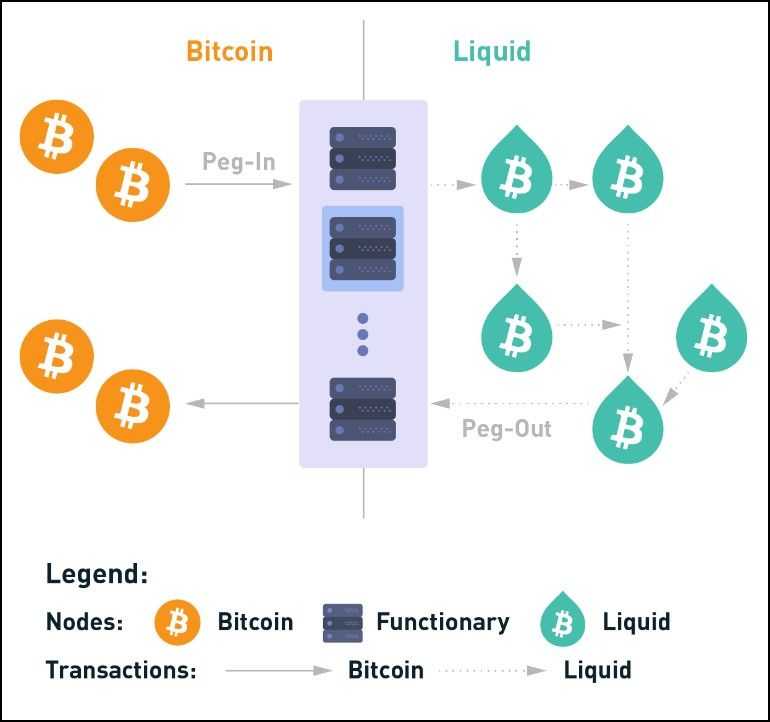

The Liquid Network is a layer-2 solution for enhancing the Bitcoin ecosystem by providing faster, more confidential transactions and enabling the issuance of digital assets. This network operates as a sidechain to Bitcoin, built on the Elements open-source platform, which is grounded in Bitcoin's codebase. Elements facilitate the creation of standalone blockchains or sidechains that connect to other layer 1s, offering features such as confidential transactions, a federated two-way peg, asset issuance, and Schnorr signatures.

Liquid Sidechain's Key Features and Operation

The Liquid Network supports the seamless transfer of Bitcoin between the Bitcoin network and Liquid through a two-way peg, allowing for the minting of Liquid Bitcoin (L-BTC) on the Liquid sidechain. This process is facilitated by a consortium known as the Liquid Federation, comprising large exchanges, financial institutions, and Bitcoin-focused companies spread across the globe, ensuring no single point of failure due to its decentralized nature.

Participant Roles within the Liquid Network:

- Block Signers: These are responsible for generating blocks every minute and ensuring the security and consistency of the Liquid blockchain through a federated consensus model. This model requires a supermajority for decisions, enhancing the network's security and reliability.

- Watchmen: This role involves managing the Bitcoin held by the federation, overseeing the peg-in and peg-out processes between Bitcoin and Liquid, and ensuring the integrity of funds moving across the network.

Liquid Network TwoWay Peg | Image via Liquid Docs

Asset Issuance and Confidential Transactions

Liquid's ability to issue assets opens up many possibilities for tokenized fiat, cryptocurrencies other than Bitcoin, digital collectables, and more. These issued assets are assigned unique identifiers, and their transaction details can be confidential, providing privacy for users on the network.

Advantages and Use Cases

The network's design aims to improve Bitcoin transaction speeds and confidentiality. With block times of just one minute and the ability for transactions to achieve finality quickly, Liquid is particularly beneficial for traders and institutions requiring fast, private transactions. Issuing digital assets on Liquid, including stablecoins and security tokens, further broadens the scope of Bitcoin's utility.

Liquid's introduction of features like confidential transactions and asset issuance without compromising Bitcoin's security premises allows for various applications, from financial instruments to gaming assets. Its operation by the Liquid Federation ensures a level of decentralization, with the federation members playing a crucial role in maintaining the network's integrity and functionality.

In essence, Liquid Network leverages Bitcoin's robust security model to offer enhanced features for digital asset issuance and transactions, addressing specific needs within the cryptocurrency ecosystem that are not met by Bitcoin's mainchain alone.

Other Emerging Bitcoin Layer 2 Solutions

While Rootstock, Stacks, Lightning, and Liquid are among the most widespread Bitcoin-centric innovations in the ecosystem, plenty of other projects are building numerous scaling solutions, trusted bridges, and innovative Bitcoin layers. Let’s list some more notable ones:

Babylon

Babylon aims to scale Bitcoin to secure the Proof-of-Stake (PoS) economy. It introduces a Bitcoin Staking Protocol, allowing Bitcoin holders to earn yields from their idle bitcoins without needing to trust a third party, bridge, or peg their bitcoins to another chain. This is achieved through a trustless, self-custodial mechanism that grants them the right to validate PoS chains and earn yields.

Key features of Babylon's approach include:

- Trustless Staking: Bitcoin holders can lock their bitcoins in a self-custodial manner to gain rights to validate PoS chains and earn yields, emphasizing a trustless ecosystem where no third-party trust is required.

- Security Against PoS Attacks: The protocol is designed to offer complete security against PoS attacks, ensuring the safety of staked assets.

- Fast Unbonding and Scalable Restaking: These features are intended to provide maximal liquidity and yields for Bitcoin stakers, allowing them to enjoy the benefits of staking without significant drawbacks.

- Ecosystem Partnerships: Babylon's ecosystem includes partnerships with various blockchain projects to enhance Bitcoin's utility and security for the decentralized economy.

Interlay

Interlay focuses on integrating Bitcoin with decentralized finance (DeFi) across multiple blockchains, offering a comprehensive platform for trading, lending, borrowing, and creating leveraged positions using BTC. The project introduces iBTC, a trustless representation of BTC in DeFi, which is secured by a decentralized network and insurance mechanisms, aligning with the description provided.

Key aspects of Interlay include:

- Modular Approach: Interlay is designed as a modular, programmable layer between Bitcoin and the multi-chain ecosystem, facilitating novel decentralized use cases for BTC.

- Control Over Private Keys: Users maintain control over their private keys while engaging in DeFi activities, emphasizing security and user sovereignty.

- iBTC: This mechanism allows users to lock their BTC securely, mint iBTC at a 1:1 ratio, and engage in DeFi activities across various blockchains. iBTC can be redeemed for native BTC on Bitcoin, ensuring a trustless interaction.

- Security and Trustworthiness: Built on cutting-edge, peer-reviewed research and audited by leading firms in blockchain security, Interlay aims to provide a high level of security and trustworthiness for its users.

- Decentralized Governance: Interlay is governed by the community through the voting power of governance (INTR) tokens, allowing stakeholders to participate in decision-making.

Mintlayer

Mintlayer is a blockchain solution designed to revolutionize DeFi by enhancing token interoperability and enabling efficient asset trading and system functionalities. Built on Bitcoin, it aims to address current blockchain limitations by offering:

- Legal Tokenization: Facilitates compliant tokenization of assets like equity and real estate, supporting complex tokenomics without a native gas token.

- Decentralized Trading: Improves scalability and security with a unique consensus mechanism, promoting decentralized trading.

- Cost Efficiency and Throughput: Reduces transaction costs and increases throughput via transaction batching and the Lightning Network.

- Bitcoin Compatibility: Maintains compatibility with Bitcoin, allowing for two-way pegging and cross-blockchain transfers.

- Enhanced Privacy: Offers enhanced privacy features through UTXO structure and optional "Confidential Transaction" mode.

Mintlayer's innovative approach aims to create a more inclusive, efficient, and secure DeFi ecosystem, leveraging Bitcoin's infrastructure for broader financial market applications.

Threshold Network

Threshold Network enhances user sovereignty on public blockchains by leveraging threshold cryptography to secure digital assets. Key features and functionalities of the Threshold Network include:

- tBTC: A decentralized bridge for Bitcoin in DeFi, allowing users to deposit and redeem BTC without intermediaries, facilitating seamless integration of Bitcoin into the DeFi ecosystem.

- TACo Plugin: Offers end-to-end decentralized encryption for DApps, ensuring privacy and security by managing access to data encrypted via TACo through groups of independent Threshold nodes.

- DAO Governance Model: The network operates under a DAO governance model, enabling T token holders to participate in decision-making processes, reflecting a community-driven approach to network governance.

- Security and Decentralization: Threshold leverages threshold cryptography to distribute operations across independent parties, enhancing security, reducing trust assumptions, and ensuring privacy on the public blockchain.

The network aims to provide a secure, private, and decentralized infrastructure for digital assets, underpinned by a robust governance framework that empowers users and token holders.

Drivechain

Drivechain proposes a method for Bitcoin to interact with sidechains through BIPs 300 and 301, enabling new functionalities and applications without compromising the main blockchain's security. Key points about Drivechain include:

- Peer-to-Peer Bitcoin Sidechains: Drivechain allows for the creation, deletion, and transfer of BTC between Bitcoin and sidechains, enabling users to opt-in to new features or trade-offs.

- Permissionless Innovation: It emphasizes the ability for anyone to create new blockchain projects and for Bitcoin to adopt any beneficial features from other cryptocurrencies, fostering an environment of innovation.

- Zero-Risk Solution: Drivechain is presented as a zero-risk solution that can be easily reverted if necessary, addressing significant challenges for Bitcoin, such as scalability and flexibility.

- BIPs 300 and 301: These Bitcoin Improvement Proposals detail the technical mechanisms behind Drivechain's operation, including "Hashrate Escrows" and "Blind Merged Mining" to facilitate sidechain interactions.

Drivechain's approach to enhancing Bitcoin's functionality through sidechains aims to provide a scalable, flexible, and secure framework for developing new applications and features within the Bitcoin ecosystem.

Are Bitcoin and Ethereum Layer 2s Equivalent?

Many Bitcoin Layer 2 networks we discussed have a common claim — inheriting Bitcoin’s security, finality, and decentralization. So let’s dig into this statement and critically analyze it against prominent layer 2 architectures on Ethereum:

Ethereum Layer 2s and Validator Interaction

In Ethereum's L2 solutions like optimistic rollups and zk-rollups, validators on the Ethereum network play a critical role in ensuring the security and integrity of L2 transactions. These solutions involve mechanisms where:

- Optimistic Rollups require validators to challenge fraudulent transactions within a dispute window, assuming transactions are valid unless proven otherwise.

- Zk-Rollups uses zero-knowledge proofs to allow validators to verify the correctness of transactions without seeing the full data, ensuring privacy and scalability while maintaining security.

This model means that Ethereum L2s directly leverage the security mechanisms of the Ethereum mainnet, including its validators, to ensure the integrity of L2 transactions. Validators are provided with the necessary data (or proofs, in the case of zk-rollups) to reconstruct the L2 state and verify transactions, making the security of L2s closely tied to the Ethereum mainnet.

Bitcoin Layer 2s and Validator Interaction

Post-Taproot, Bitcoin has enhanced its capability for more complex transactions and smart contracts with improved efficiency and privacy. However, the nature of Bitcoin's consensus mechanism and its approach to L2 solutions, like those using the Stacks protocol, Rootstock (RSK), or the Liquid Network, doesn't inherently change the role of Bitcoin validators in verifying L2 block data directly.

- Bitcoin validators continue to secure the network by verifying and confirming transactions within Bitcoin blocks without directly engaging with the execution or verification of L2 transactions. L2 solutions on Bitcoin thus rely on their own mechanisms for security and consensus, albeit often anchored to the Bitcoin blockchain's finality and security.

Implications

This operational difference implies that while Ethereum's L2 solutions can claim a direct security inheritance from the Ethereum mainnet through active validator verification, Bitcoin's L2 networks may not inherit Bitcoin's security in the same direct manner. They benefit from Bitcoin's finality for transactions that settle back on the mainnet but rely on their own security protocols for verification within the L2.

Consequently, Bitcoin L2 networks might face challenges where malicious transactions could potentially achieve finality if the L2's security mechanisms are compromised without direct intervention from Bitcoin validators. This necessitates robust L2-specific security measures and potentially introduces different trust assumptions compared to Ethereum's L2 solutions.

However, this does not necessarily diminish the security of Bitcoin L2 solutions; rather, it highlights the importance of the design and implementation of those L2 networks' security models. It also underscores the need for users to understand the specific trust assumptions and security guarantees of any L2 solution they use, whether on Bitcoin or Ethereum.

Challenges of the Bitcoin Layer 2 Ecosystem

The Bitcoin Layer 2 (L2) ecosystem is at a pivotal stage of development, facing a series of challenges that span technological, economic, and regulatory domains. Addressing these challenges is critical for fostering growth, adoption, and innovation within this space. Here's a comprehensive look at the nine key hurdles, with examples and supporting data where relevant:

- Technological Limitations: Unlike Ethereum L2s, where validators actively participate in verifying L2 transactions, Bitcoin L2 solutions like Stacks and RSK rely on separate mechanisms for security. This divergence necessitates robust independent security models, potentially limiting direct security inheritance from the Bitcoin blockchain.

- Ethereum-centric DeFi: Ethereum's dominance in the DeFi sector is bolstered by extensive developer activity and a wide array of DApps. For instance, data from DeFi Llama shows Ethereum's DeFi platforms locking in billions of dollars in value, highlighting the challenge for Bitcoin-based DeFi to attract similar engagement.

- Bootstrapping New Liquidity: New Bitcoin L2 platforms must offer compelling reasons for liquidity to shift from established ecosystems. Initiatives like liquidity mining on Ethereum have shown how incentives can attract significant capital; Bitcoin L2s may need similar strategies.

- Developer Learning Curve: Developers must navigate the intricacies of Bitcoin-specific programming languages (e.g., Clarity for Stacks) and unique consensus mechanisms, which can slow down the pace of development and innovation.

- Interoperability and Integration: The ability for assets to move freely between chains, as seen with wrapped tokens like WBTC on Ethereum, underscores the importance of interoperability. Bitcoin L2 solutions must develop or integrate cross-chain communication protocols to facilitate similar functionality.

- User Adoption and Experience: The success of platforms like Uniswap demonstrates the value of user-friendly design in attracting non-technical users to DeFi. Bitcoin L2s must prioritize simplifying user interactions to enhance adoption.

- Regulatory and Security Concerns: As global regulatory frameworks evolve, Bitcoin L2 projects must stay agile to comply with diverse legal requirements, all while ensuring the utmost security to protect against hacks and exploits.

- Network Effects and Ecosystem Development: Developing a thriving ecosystem involves more than just attracting developers and users; it requires building a community and fostering partnerships. Ethereum’s annual Devcon exemplifies how community engagement can drive ecosystem growth.

- Scalability and Throughput: Ensuring that Bitcoin L2s can handle high transaction volumes without degradation in performance is crucial. Solutions like zk-Rollups on Ethereum have shown promise in scaling throughput while maintaining security, a model Bitcoin L2s could learn from.

Addressing these challenges requires a multifaceted approach, involving technological innovation, strategic incentives, regulatory navigation, and community building. The evolution of Bitcoin's L2 ecosystem hinges on its ability to adapt and overcome these hurdles, thereby unlocking new possibilities for Bitcoin's utility beyond its original design as a digital currency. As the blockchain space continues to mature, the solutions developed to meet these challenges will not only shape the future of Bitcoin L2s but also influence the broader landscape of decentralized finance and blockchain technology.

Is Bitcoin Still a Commodity?

The SEC's acceptance of Bitcoin as a commodity and its distinction from securities was a significant milestone that clarified the regulatory landscape for Bitcoin. This classification was largely based on Bitcoin's characteristics as a decentralized digital currency designed primarily as a store of value and medium of exchange, without the involvement of a central issuer or promises of returns, typical hallmarks of securities.

The emergence of smart contract-capable Layer 2 solutions on the Bitcoin network brings it a few steps closer to Ethereum’s functionality. Therefore, is Bitcoin’s classification potentially under challenge? Let’s analyze this thought:

No Change to Bitcoin’s Core Consensus

The L2 solutions discussed above operate on Bitcoin without altering its underlying consensus mechanism. Bitcoin’s primary function as a peer-to-peer transaction network and the miner’s role in securing the network remains unchanged.

The architectural separation between Bitcoin and its layer 2s ensures that the innovations and complexities introduced by L2 do not affect Bitcoin’s consensus.

Regulatory Perspective on Functionality vs. Classification

From a regulatory standpoint, the classification of an asset as a commodity or a security typically hinges on its issuance, the expectations of profit from the efforts of others, and the degree of decentralization. The addition of L2 functionalities does not necessarily imply an expectation of profit or the involvement of a centralized party responsible for the asset, which are critical considerations in security classification.

Precedents in Other Commodities

The evolution of products and services around traditional commodities (like gold or oil) that add layers of utility or financialization does not change the fundamental classification of the underlying commodity. Similarly, the development of L2 solutions on Bitcoin can be seen as analogous to these enhancements, expanding utility without altering the commodity's core characteristics.

In conclusion, while L2 developments on the Bitcoin network enhance its utility and bring its capabilities closer to those of Ethereum, they do not inherently contradict Bitcoin's classification as a commodity. The core principles and functionalities of the Bitcoin network remain focused on its role as a digital store of value and medium of exchange, with L2 solutions acting as complementary enhancements rather than modifications to its fundamental nature.

Closing Thoughts

As the Bitcoin ecosystem embraces new developments, it finds itself at a fascinating juncture, drawing closer to Ethereum in terms of functionality and innovation. While Bitcoin remains unparalleled as a store of value, its technical framework has traditionally lagged behind Ethereum in supporting the complex infrastructure required for DeFi.

Conversely, Ethereum, despite not being as widely recognized for its store of value properties, dominates the DeFi landscape, hosting a supermajority of activity and innovation in this space. This divergence highlights the unique strengths and trade-offs between the two leading cryptocurrencies. The value of each, therefore, hinges on what qualities investors and users prioritize: the unmatched security and store of value offered by Bitcoin or the dynamic and expansive DeFi ecosystem enabled by Ethereum.

As both ecosystems evolve, the interplay between these foundational aspects will continue to shape the future of the digital asset space.