In the Ethereum ecosystem, we have fungible ERC-20 tokens for digital cash use cases and non-fungible ERC-721 tokens for digital collectible use cases.

But what if you could blend the best of both worlds here?

That blending is precisely what ERC-404, a new experimental token standard, was created to address. For today’s post, let’s get you up to speed on the basics of this unofficial standard and on Pandora, the first project built using this specification.

What is ERC-404?

The 101: Developed by the Pandora team, ERC-404 is a new unofficial token standard that aims to bridge the divide between fungible tokens and NFTs.

How it works: ERC-404 creatively mixes elements from the ERC-20 and ERC-721 standards, which are traditionally not designed to interact. Its ERC-721 approach deviates from the norm by relying on token mints and burns for fractional transfers.

“This aspect of the concept's design is deliberate, with the goal of creating an NFT that has native fractionalization, liquidity, and encourages some aspects of trading/engagement to farm unique trait sets,” the standard’s GitHub page reads.

Why it matters: We’ve seen NFT fractionalization protocols where you can lock an NFT and effectively issue shares against it. In contrast, ERC-404 is designed to achieve fractionalization natively within NFT projects that implement the standard. This offers new avenues for experimentation and trading NFTs.

Why is it unofficial?

Not vetted: ERC-404 is an unofficial standard whose connection to “ERC” status is in name only. In other words, it hasn’t been developed through the traditional Ethereum Improvement Proposal (EIP) and Ethereum Request for Comments (ERC) processes, which ensure any changes to Ethereum or new features undergo thorough discussion and community vetting.

The contrast: Official ERCs, like ERC-20 and ERC-721, have been extensively vetted for security, utility, and compatibility within the Ethereum ecosystem. This formal introduction system helps mitigate risks associated with implementing new standards. Despite ERC-404’s innovations, its lack of formal vetting means potential vulnerabilities and inefficiencies may not have been adequately addressed.

Raised risks: Innovation is important, but the risks of integrating unaudited and potentially flawed systems into projects can compromise security around the Ethereum ecosystem. Many unofficial standards floating around would provide many low-hanging exploit targets for blackhats. Adopting ERC-404 without official recognition raises concerns about the precedent it sets for other experimental standards.

The Pandora 101

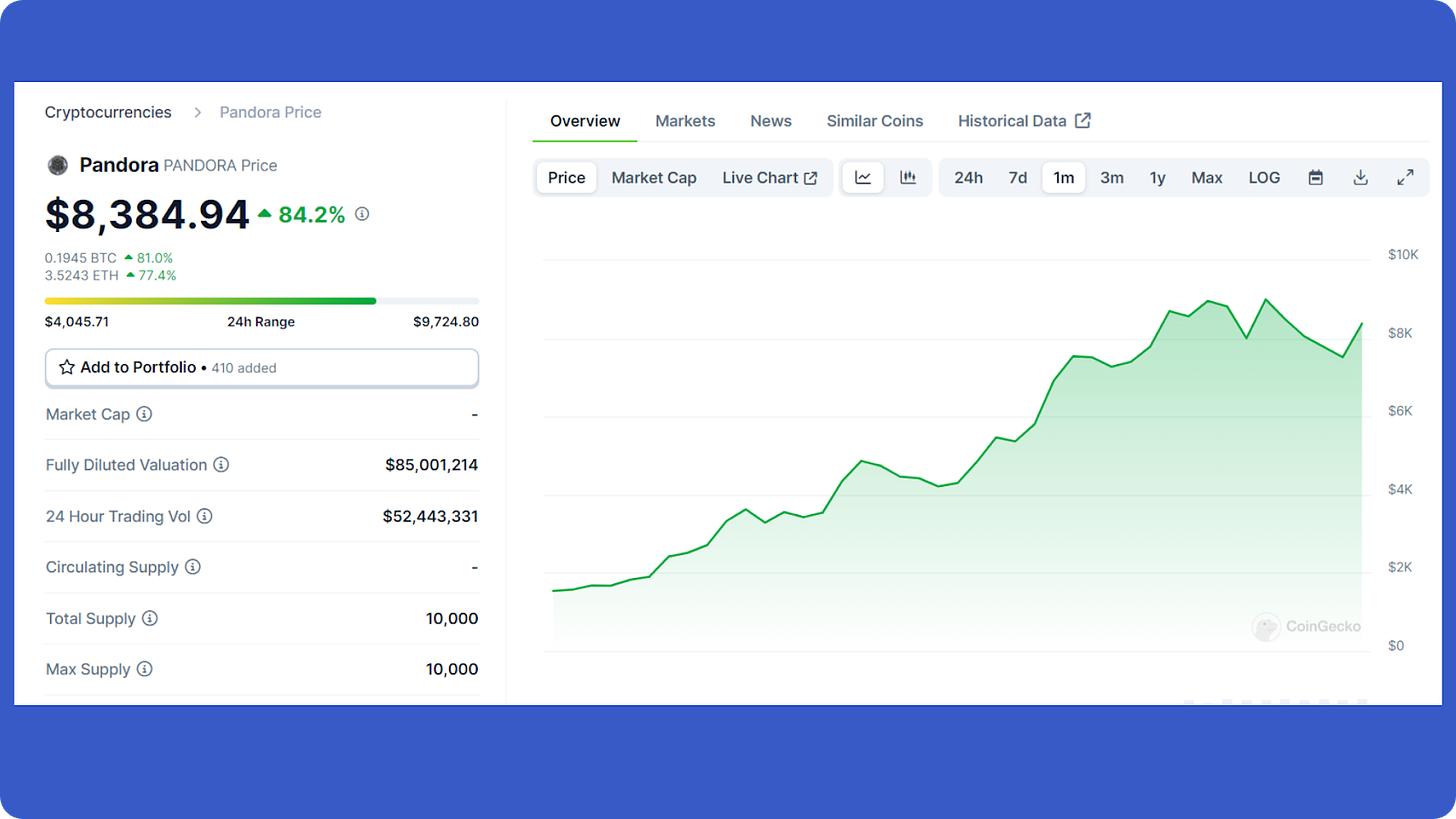

The basics: Pandora, the first project built on the ERC-404 standard, offers 10,000 ERC-20 tokens and 10,000 associated “Replicant” NFTs. If you buy one full PANDORA token on an exchange, 1 Replicant NFT will be minted to your wallet. If you sell 1 PANDORA token, its connected NFT gets burned.

How rarity works: Every time a Replicant NFT is minted to your wallet, it will appear with a unique rarity. The most common Replicants are green, while the rarest are red.

Accordingly, it’s possible to trade PANDORA tokens to “reroll” the rarities of the Replicants you receive. Since the collection’s name is Pandora and Replicants are currently represented as boxes, it’s safe to say they will “open” to reveal something later.

Supporting platforms: Since ERC-404 is experimental, many platforms won’t automatically be able to support the standard. However, PANDORA is already trading on decentralized exchanges like Uniswap and on NFT marketplaces like Blur and OpenSea.

To the moon: In less than a week since launching, PANDORA and Replicants have seen their value boom as excited traders have piled in. PANDORA has risen +440% in that span to its current price of ~$8,385 (~3.52 ETH), while the floor of Replicants is presently ~3.7 ETH on Blur.

Fad or here to stay?

The bottom line: Pandora is an interesting experimental implementation. Its code isn’t as gas-efficient as it could be, but it has innovated fractionalization at the level of an NFT’s smart contract, and this pioneering will pave the way for more experiments to come. On the flip side, though, it may inspire other unofficial standards to go to market without undergoing the EIP and ERC processes, which would raise the prospects of losses of funds via unvetted vulnerabilities.

What to watch: Going forward, look for more collections to launch atop ERC-404, and look for more platforms to integrate the tech. On the latter front, we’ve already seen some recent embraces by smaller projects like Wasabi Protocol and Peapods Finance.

Be careful: ERC-404 is currently unaudited, meaning it may potentially have flaws that haven’t yet been discovered. In other words, don’t put more money into an ERC-404 project than you can afford to lose in these early experimental days. Also, when you sell a PANDORA token, the last Replicant you’ve received will be burned—make sure you don’t mistakenly burn one you’re wanting to keep!