Long-term subscribers know that our research tends to zoom in and out — from high-level thesis reports to deep analysis covering the economics of the tech stack. As ever, our goal is to help you identify where value will accrue within the Web3 tech stack and why.

To that end, we spend a lot of our time studying developer ecosystems, network effects, on-chain data, emerging use cases, and the fundamental value proposition of public blockchains and open-source technology.

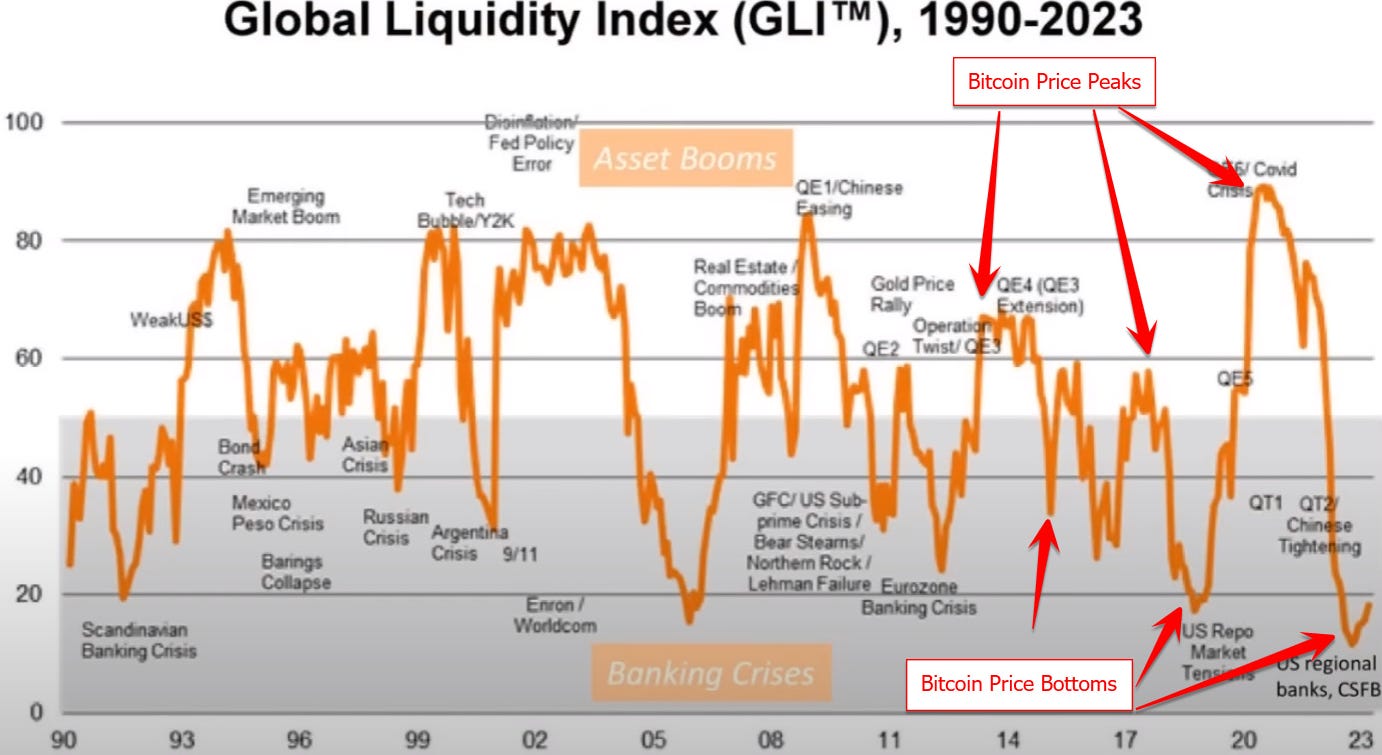

When we’re not deep in the weeds, our focus is on crypto’s intersection with macro, global liquidity, and the business cycle. This two-pronged process of zooming in/out helps us to marry our high-level thesis to market conditions as we shift from risk on/off through cycles.

In this week’s report, we’re focused on the second prong. Topics covered:

- A data-driven look back on past cycles

- Looking forward: the setup for the next cycle

- Current on-chain market signal

- Risks

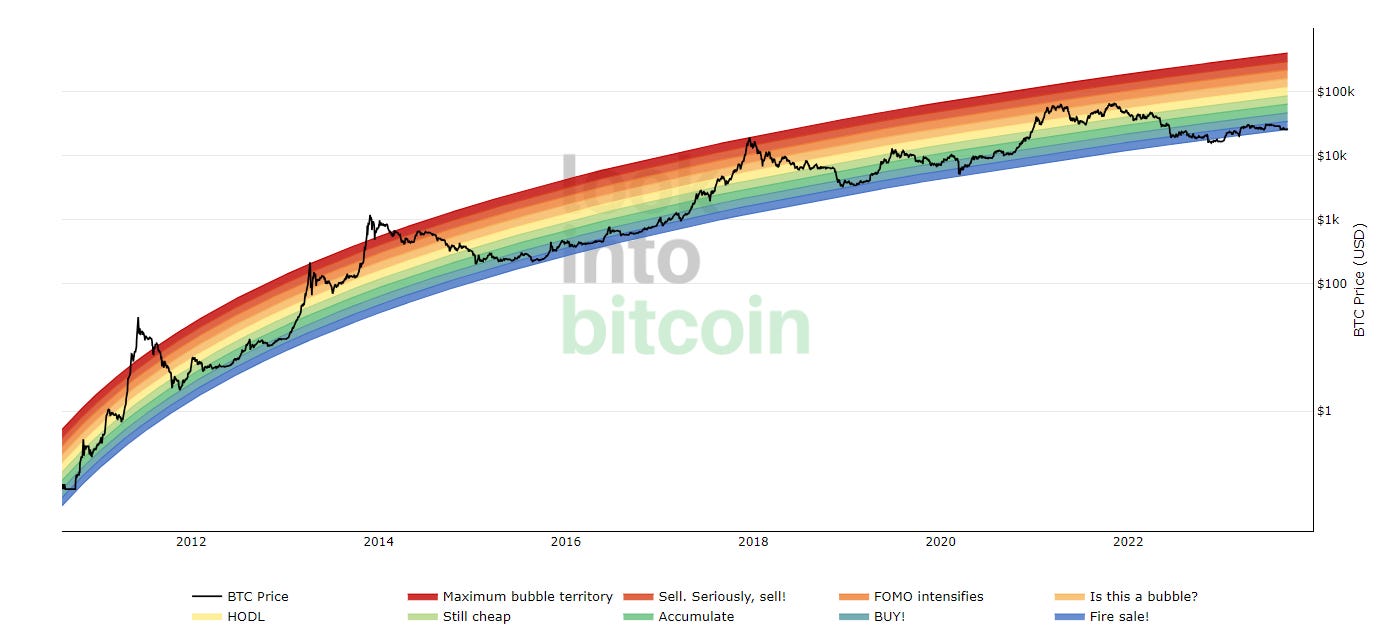

Bitcoin Rainbow Price Chart Courtesy of Look Into Bitcoin

If you find our free research & analysis helpful, please like the post — which can be done directly from your inbox via the heart button in the upper left. Let’s make quality free content a win/win. This helps grow the community and responsibly introduce more people to DeFi and Web3.

The Ethereum Investment Framework is still 50% off. Glassnode will be sponsoring our Q3 update, but the price is also increasing. You can lock in quarterly updates here at just $27.72/issue: The Ethereum Investment Framework

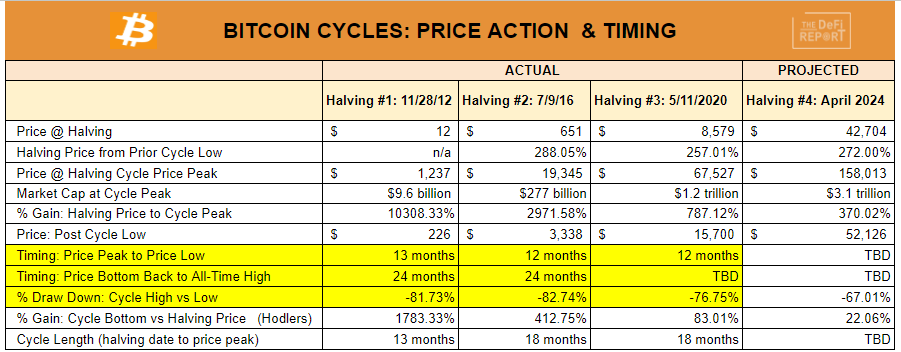

Looking Back on Past Cycles

To outsiders, crypto may look like it lacks any rhyme or reason. However, crypto markets are actually quite cyclical. Using Bitcoin as our benchmark, we’ve seen remarkable consistency over the last three cycles:

- % drawdown from each cycle peak: roughly 80%

- Timing of cycle bottom: 1 year from peak

- Time to recapture new all-time highs from cycle bottom: 2 years

Data: Glassnode (discount link: https://studio.glassnode.com/partner/thedefireport)

Furthermore, each cycle has lined up almost perfectly with cyclical changes in the business cycle using the ISM Manufacturers PMI.

Data: Delphi Digital

Which also aligns with global liquidity cycles:

Looking Forward

7 months out from the next Bitcoin halving, and BTC has already suffered through a roughly 80% drawdown from the prior cycle high. Right on queue, it took about a year for the bottoming process to play out. We’re now 10 months into the recovery.

If history were to repeat again, we should be breaking all-time highs in roughly 14 months (Q4-24), and peaking out in Q4 of 2025.

Of course, that’s a big if.

To chart our course, we are looking for the intersection of the following factors:

- A shift in the business cycle (driven by monetary policy and global liquidity)

- A strong market narrative (s)

- A continuation of the innovation cycle

- New market entrants & renewed speculation (leverage)

So far so good. Let’s dig into why.

The Business Cycle & Liquidity

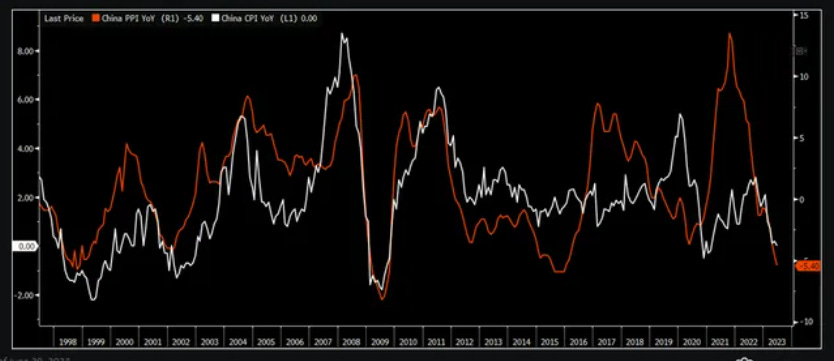

We believe global liquidity bottomed in October of ‘22 (see above). Since that time, we’ve seen a bout of stealth QE out of the Fed (related to the banking crisis in March). And now China is battling deflation.

China PPI & CPI YoY Turning Negative:

Data: Delphi Digital, Bloomberg

Which has resulted in recent interest rate cuts from the PBOC.

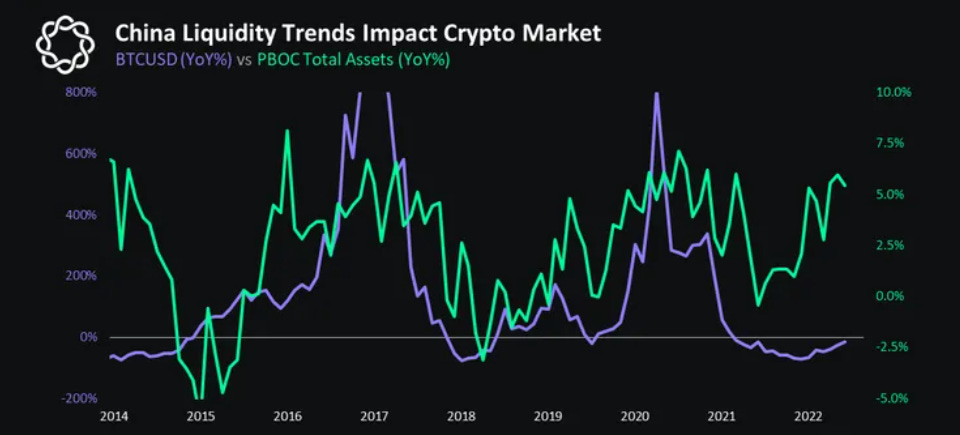

1 This bodes well for global assets such as BTC — as the chart below indicates.

China: BTC vs PBOC Total Assets

Data: Delphi Digital, Bloomberg

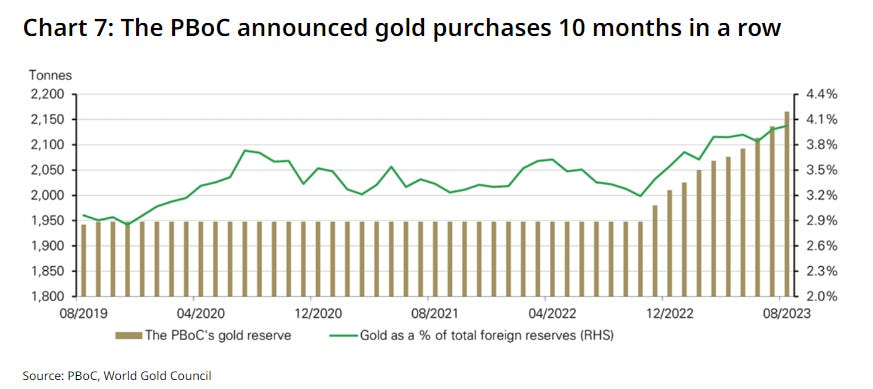

Meanwhile, the PBOC has been buying more gold, sending the spot price in China more than $120/ounce higher than global prices.

2 Is the PBOC getting ahead of a weakening Yuan?

Shifting to the US, over $7 trillion of debt is maturing over the next year.

3 We think the Fed may have to purchase a lot of this debt as it is refinanced. Furthermore, interest payments on the debt are now over 31% of tax receipts (red line) — which are in decline and indicate a recession is on the horizon (gray lines). How do you increase tax receipts? You lower interest rates (green line).

Data: Federal Reserve FRED database

43 million Americans will be resuming student loan payments at an average rate of $503/month in October.

The commercial real estate sector has over $1.5 trillion of debt that needs to be refinanced over the next few years.

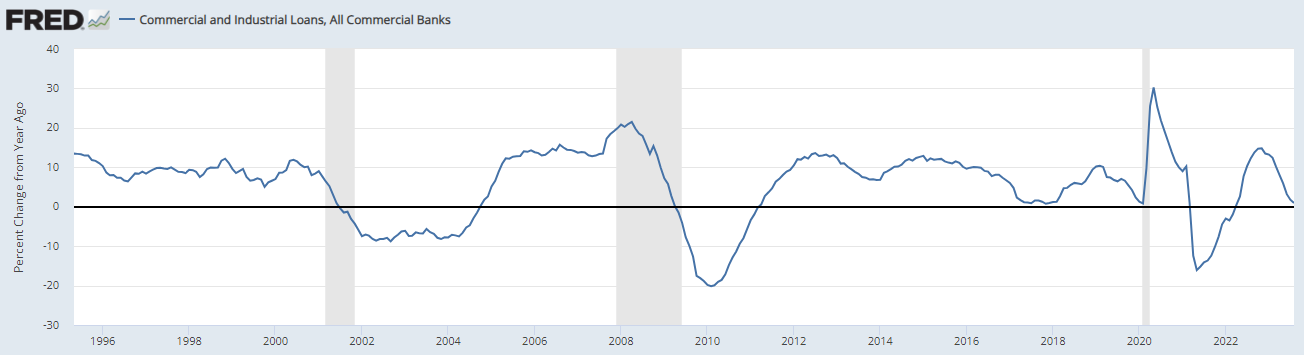

Commercial Bank lending is now at recessionary levels in the US (gray lines = recession):

Data: Federal Reserve FRED database

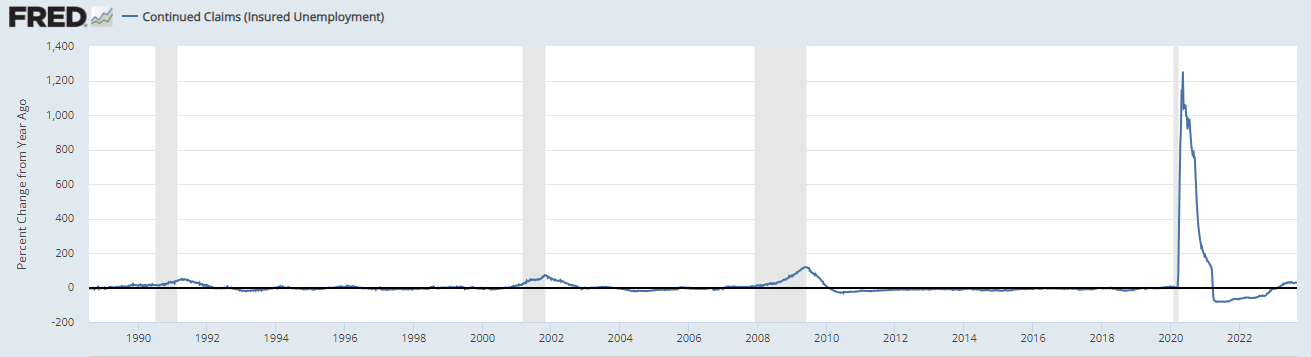

And continued unemployment claims are starting to increase:

Data: Federal Reserve FRED database

Summarizing the Business Cycle/ Liquidity Set Up

We’ve looked at a number of data points on the FRED database. The vast majority of them are pointing to a recession. Given that liquidity appears to have bottomed in Oct. of ‘22, we think it’s more likely that we’ll see an easing of monetary policy in the coming months into 2024 — but only if the economy truly starts to sputter.

Assuming we enter a recession within the next 6 months or so, a more dovish Fed policy could align nicely with the Bitcoin halving schedule.

The Innovation Cycle

Despite the ongoing crypto winter, we continue to see significant progress in terms of infrastructure build-out on public blockchains. To highlight a few bright spots:

- Bitcoin is scaling on the lightning network and the Ordinals Protocol is driving new demand for block space:

Data: Blockworks Research

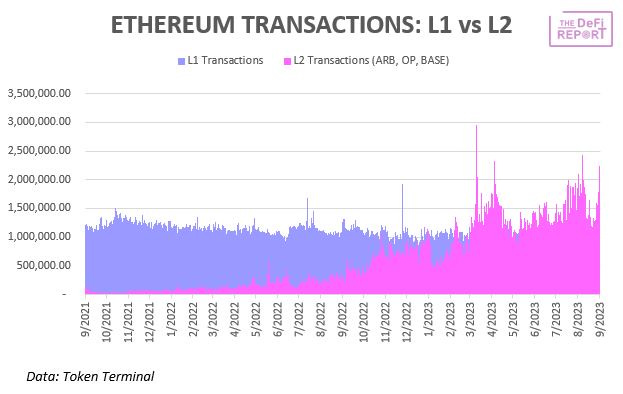

- Ethereum is also scaling via Layer 2 as Moore’s Law plays out:

- EIP 4844 (scaling upgrade) is slated to be implemented in Q4. We’re observing significant progress across important improvements such as account abstraction (pertains to user experience bridging assets), smart contract wallets, tokenization of real-world assets, stablecoins, liquid staking protocols, Eigen layer (restaking), data availability (Celestia), and the DeFi blue-chips.

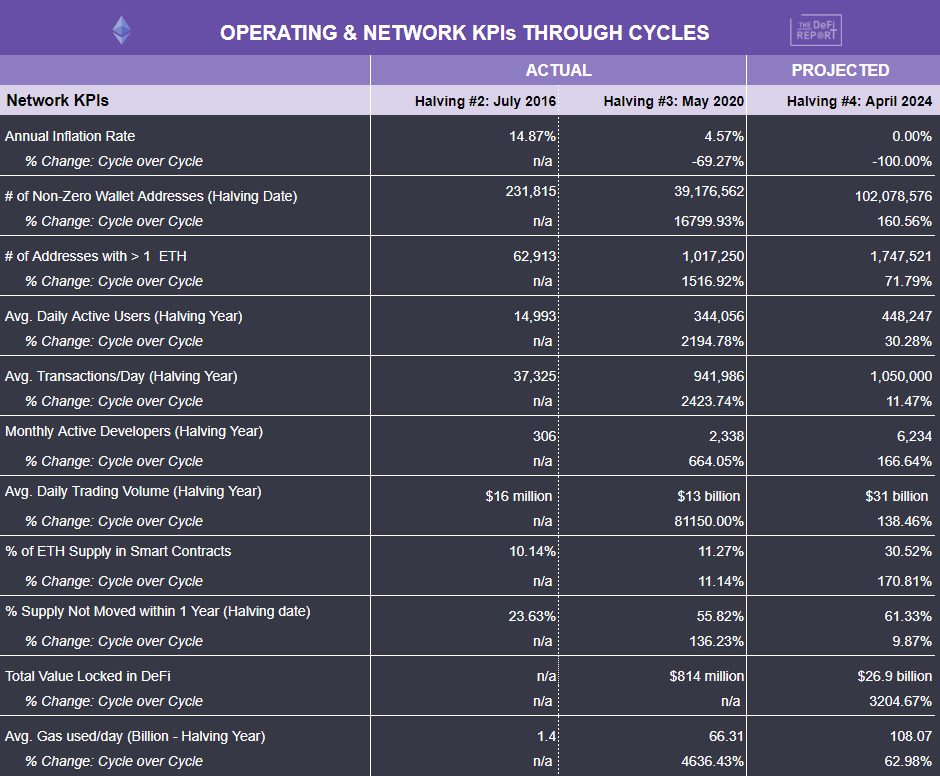

To highlight the growth of operating and network KPIs through cycles, here is a quick view of some additional Ethereum data:

Data: Token Terminal, Glassnode

We think crypto’s “broadband moment” is nearing — which could usher in the next wave of consumer apps and new users.

Finally, competing L1 architectures such as Solana are showing signs of serious staying power. Stay tuned as we’ll be revisiting the Solana ecosystem in the coming weeks and months.

Narratives

Here’s a direct quote from renowned investor Jeff Gundlach, speaking at the recent Future Proof conference :

“Here’s the big picture. I think the dollar will weaken tremendously in the next recession. I think it’s because the response to the next recession is going to be a complete disaster relative to our fiscal position. That’s going to be the wake-up call where we realize that the United States is bankrupt. That we cannot honor our liabilities. The United States has nearly $200 trillion of unfunded liabilities — that’s almost 8 times GDP. For us to pay that back in today’s purchasing power, we’d have to pay 10% of GDP for 80 years. 4 generations of depression. We’re not going to do that. We’re going to have a complete abandonment of… the dollar. And we’re going to see a restructuring of the United States financial system.”

If this actually plays out, here’s what we’ll see:

For the record, we’re not expecting to see this. Not yet anyway.

But it’s important to consider that narratives like this could take over if certain conditions were to emerge.

Narratives are hard to predict. Did anyone foresee Paul Tudor Jones publicly sharing his Bitcoin thesis last cycle? How about Michael Saylor and Microstrategy? Did anyone think that Tesla, Square (Block), and Mass Mutual would buy Bitcoin to put on their balance sheet?

And did anyone predict that Blackrock would be applying for a Bitcoin ETF ahead of this cycle?

Keep in mind that the *stigma* related to crypto is finally starting to wear off. Blackrock is a catalyst here. This means that crypto is now entering its “turning point” phase in the adoption cycle — where new regulations “bless” the new technology as it becomes more integrated with the traditional financial system. Recent wins in the courts (Ripple, Grayscale, Uniswap) point to the emerging sea change.

Not to mention, the media LOVES crypto. There’s a reason that major platforms like CNBC and Bloomberg continue to build out their crypto coverage. Crypto drives eyeballs. These outlets can’t wait to start pushing the next narrative.

At the end of the day, market conditions will determine what narratives emerge. We don’t know what they’ll be right now — but they’ll play a role in catalyzing the next adoption cycle.

Which appears to be aligning with the business cycle in the US, the global liquidity cycle, the innovation cycle on public blockchains, and the Bitcoin halving cycle.

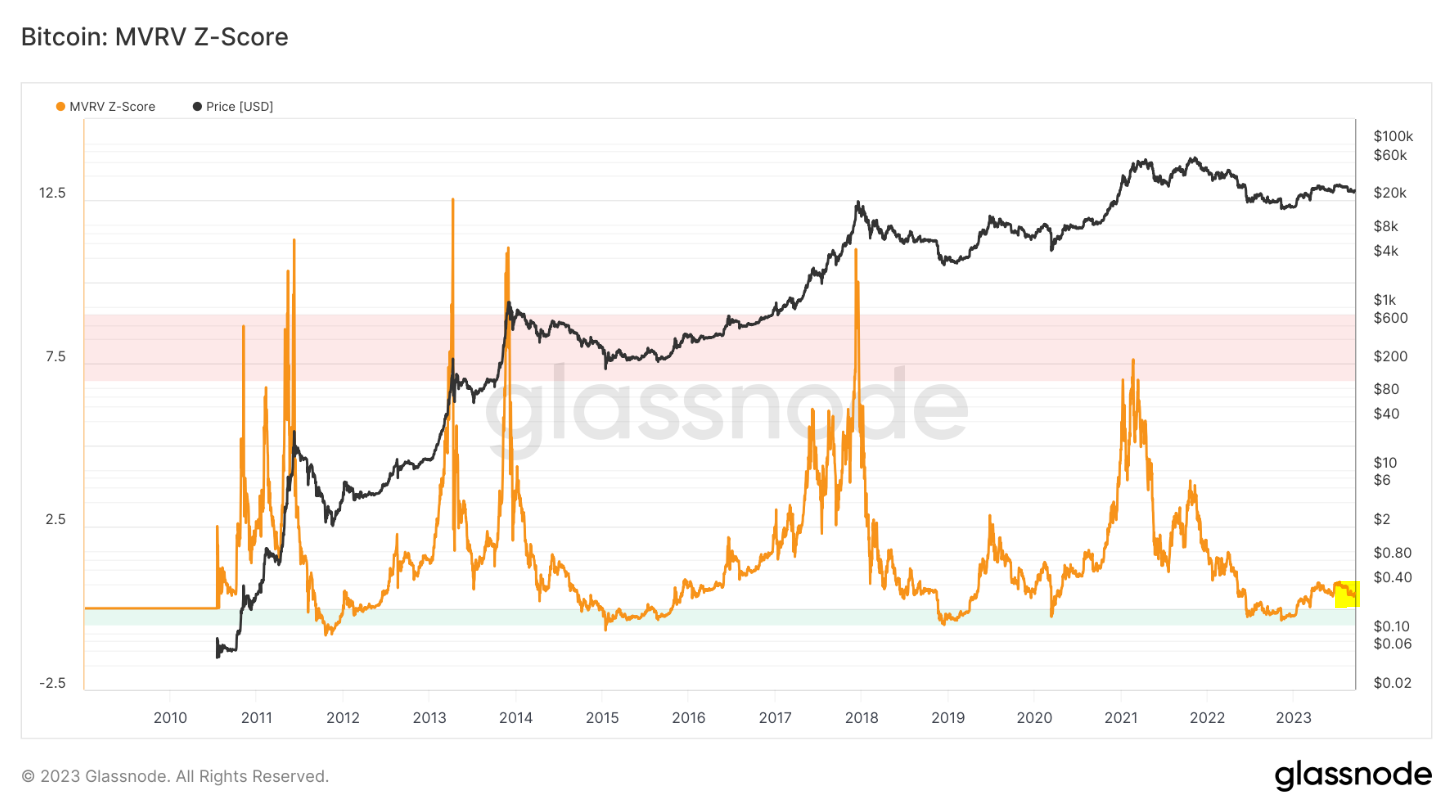

On-Chain Data Signal: Market Value to Realized Value

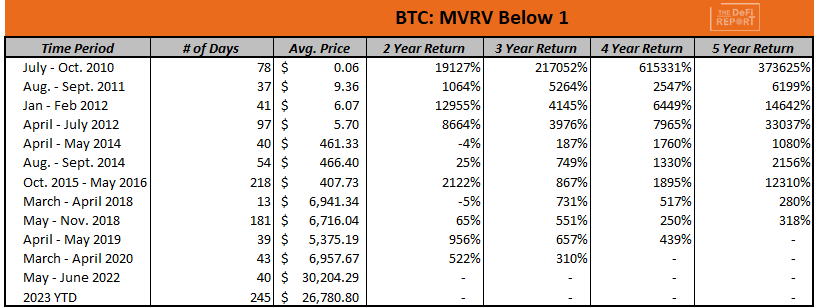

Before we wrap it up, a quick view of one of our favorite on-chain signals: MVRV. Market Value to Realized Value is currently sitting at .41.

Historically, those with long time horizons have done well by entering the market anytime the MVRV signal drops below 1. A quick breakdown:

Data: Glassnode (discount link: https://studio.glassnode.com/partner/thedefireport)

Risks

The setup here looks good. With that said, of course, nothing is guaranteed. So where could things go wrong? We think there are a few items to keep in mind:

- Inflation. If inflation does not continue to come off (or accelerates), we think it will be very difficult for the Fed to shift monetary policy. This could delay or negate our thesis concerning the business cycle and a pivot in monetary policy.

- No recession. As much as I hate to say it, the economy needs to truly sputter for the Fed to pivot monetary policy. If that doesn’t happen, our thesis is less likely to play out.

- Regulation. It’s still possible that the SEC continues to play hardball and blocks the Blackrock ETF. We think this is unlikely, but it’s still something we need to consider.

Keep in mind that if we are right that the business cycle is poised to shift, this could come during a liquidity event and a market sell-off. As the recession sets in, the Fed will likely be shifting monetary policy as the sell-off plays out.

This could be the optimal time to be buying — and why it may not be prudent to try to front-run the Fed.

Of course, nobody has a crystal ball. We’ll continue to call it as we see it and provide data-driven updates as market conditions evolve.

Thanks for reading.