(Author: Vincent @thecryptoskanda; Xuan twitter: @lvxuan147)

The Sui mainnet has been up and running for nearly a month, and let me tell you, it’s been quite a rollercoaster ride. From airdrop farmers throwing fits to ETH maxis relishing in its potential failure, it seems like Sui has managed to grab the spotlight as the most “hated” chain of the moment.

But amidst all the noise and drama, let’s get down to brass tacks. What is really going on with Sui? As an investor and active participant (or a ‘Suinami rider’) in the Sui ecosystem, I’m here to give you the lowdown on its current state based on publicly available statistics and concrete facts.

- The Sui Fundamentals

- The Sui Ecosystem

- My Two Cents

The Sui Fundamentals

1. On-chain Liquidity

TVL — The current TVL of Sui stands at $19.02m, with a peak at $36m in the past 30 days

(source: DeFillama)

The CLMM DEX, Cetus, takes the lead as the largest contributor to TVL, accounting for over 65% of the total. Following closely is Turbos. 60%+ of the total TVL consists of stablecoins.

(source: DeFillama)

Trading Volume(7D) — $32.37 million (№20th by chain ranking). The majority of trading activities occurred on Cetus.

2. On-chain Activities

Total transactions (7D): 1,129,884

Total Objects (smart contracts, coins, NFTs etc.): 8.3m+

Daily Active Addresses: 22k+

Total Active Addresses: 570k

If by Artemis’ methodologies, then the stats could look even more hideous with a comparison against Solana, and Aptos — two iconic non-EVM Layer 1s

From a trend perspective, the on-chain activities of Sui have been experiencing a downward trend over the past week. It’s worth noting that since the launch of the Sui mainnet, on-chain activities are closely correlated to IDOs of major projects or DeFi movements within the ecosystem.

The peaks can be explained by:

- 5.10 Cetus IDO

- 5.12 Turbos IDO

- 5.15 Suia IDO

- 5.19 Permissionless pool feature open on Cetus/ Meme token chain-wis e massive airdrop

3. $Sui On-chain Liquidity

As the native token and primary reserve asset of the Sui network, the liquidity of $Sui plays a significant role in determining the on-chain asset liquidity of Sui, especially in the absence of an on-chain native stablecoin. Now, let’s not delve into the future unlocking situation of $Sui, but focus solely on its current circulating status.

Sui utilizes a DPOS consensus mechanism, where $Sui is currently staked to 104 validators, and the staking rewards are distributed in $Sui. The current circulating supply of $Sui is approximately 528 million, while the staked $Sui amounts to a whopping 7.29 billion (staking ratio 72.9%).

Although the circulating supply valuation is at $500+ million, it does not reflect in the TVL and there is quite a significant gap between the two.

The on-chain liquidity insufficiency, although contrary to many people’s intuition, has been obvious in the previous IDOs. The IDOs of Cetus and SUIA were oversubscribed by a staggering 135x and 18x, respectively. This directly led to the near depletion of the $Sui lending pools on OKX and Binance, which accounted for 1/5 of the total supply of $Sui.

The fundamental cause can be explained by $Sui holding stats, where almost all of the circulating supply (including the majority of $Sui staking reward emission) is currently not staked. Among them, we speculate that the largest holders are centralized exchanges, estimated to account for more than 4%. In other words, only a very small portion of $Sui is actually being used for on-chain activities.

Staking rewards can be seen as an on-chain risk-free interest rate (similar to US Treasury bonds), and currently, on Sui, this rate averages at less than 6%. Clearly, such a rate is not attractive to investors considering the token is yet to have any significant vestings. Additionally, without an LST (liquidity staking) solution in place, $Sui cannot be used as collateral to leverage for higher yields on-chain. This further explains why the majority of the holders choose to leave their bags in CEXs.

4. Cross-chain Bridges

Currently, Sui only has one bridge — Portal by Wormhole, supporting 17 assets from 7 chains.

The volume and total stablecoin minted through Portal are currently unknown. This is due to the fact that the Sui Bridge of Portal did not use the object standard for $USDT & $USDC recommended by Mysten, hence the totalSupply field in the TreasuryCap cannot be read. You can find the token address of supported native ETH and Solana assets here.

Only the minted supply of two pegged tokens has been found, with a supply of 1949.96442242 for $WFTM and 31.64116756 for $WAVAX.

The Sui Ecosystem

Who Is Carrying Sui?

DEX: Cetus

As the backbone of Sui DeFi, or even the entire Sui ecosystem at this moment, Cetus is dominating in both TVL and volume. Yet, this is clearly not a healthy situation.

Aggregator: Mole

Mole is a yield aggregator built on Sui and Aptos that supports both single-asset and LP yield farming. It also features leveraged farming similar to Alpaca on BNB Chain. Currently, Mole has a Total Value Locked (TVL) of $180,000.

NFT Marketplace: Souffl3/Clutchy

Souffl3 is an NFT trading marketplace on Aptos and Sui that supports 0% royalties. It offers two ways of launch: Launchpad and Free mint. Additionally, it includes a mini-task module called Bake Off.

Cluthy.io is an NFT and gaming marketplace on Sui with strong exclusively launched collections like Fuddies. Much attention was brought to this platform through Twitter sharing. It also comes with a gaming pad but has yet to capture significant usage.

NFT Collection: Fuddies

The ‘Moonbird but dumber’, and the BAYC of Sui, at least for now. As the collection with the highest ratio of Twitter PFP, Fuddies is one of the best candidates to tell the narrative of Sui to outsiders.

GameFi: Abyss World

Abyss World is a 3A title ARPG game similar to Dark Souls, with its developer, Metagame Industries, just finishing a round of fundraising at $100m valuation. The game demo is now available on Epic with great pre-mainnet campaigns and PR.

However, Abyss World chose to do its IDO on Polygon but all in-game settlements on Sui

2. User Onboarding Gateways

Wallet and task platforms serve as the main gateway for user onboarding. Sui is currently supported by the following wallets:

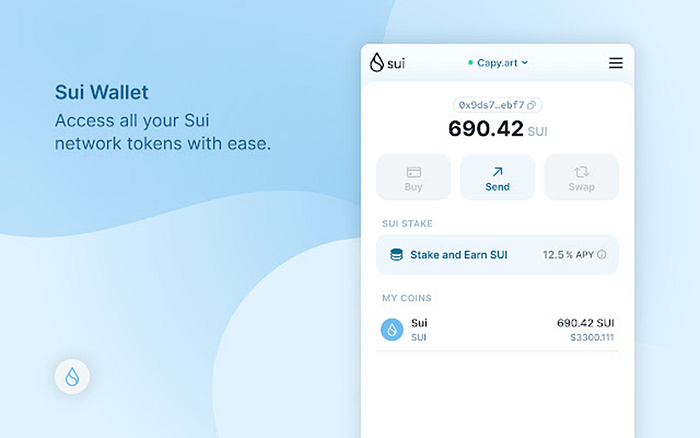

Chrome Wallet

1. Sui (https://shorturl.at/sBJ02)

2. Suiet (Suiet.app)

3. Martian (martianwallet.xyz/)

4. Ethos (ethoswallet.xyz/)

5. OKX Wallet (www.okx.com/web3)

6. Surf Wallet (surf.tech)

Mobile Wallet:

Glass(https://glasswallet.app/ )

Supporting both iOS and Android. However it comes with low dAPP support.

Bitkeep(https://bitkeep.com/)

OKX (https://www.okx.com/web3)

Supporting $Sui and Sui wallet. Not supporting Sui dAPP and other Sui assets in explorer yet.

Task Platforms

Port3

Port3 is a multi-chain task platform. It offers both on-chain and off-chain tasks for users to engage in. Users can link their Web2 social media accounts and Web3 wallets to complete specific tasks and earn rewards.

Suia

Suia is an activity-based NFT and social platform built on Sui. It allows users to mint campaign-related POAPs. Users can also track activities associated with those projects by following on chain.

My Two Cents

I personally was not surprised by the challenges that Sui is faced with: not many projects are live for users to play with, highly anticipated projects are down bad since IDO, incomplete infrastructure… You name it. Bear market with draining liquidity, it’s definitely not a fun place to be for a new ecosystem in its infancy.

Of course, it takes time to build and we can’t change the overall market conditions, and what’s done is done so never mind the fudders. However, Mysten Labs and the Sui Foundation still have plenty of room for quick improvements:

1. Lower the Validator Requirement, and Introduce Liquidity Staking (LST) Mechanism

Sui currently has 104 Validators, and the requirements to become a Validator are deemed as a big hurdle not for the hardware, but for the high staking threshold of 30m $Sui. This could unintentionally centralize Sui and hinder competition among validators, thereby reducing the robustness of the network.

Additionally, the current staking rewards are not attractive enough to users, and it’s not possible to use staked tokens as collateral for better yield, leading to most $Sui being held in CEXs, causing insufficient on-chain liquidity, and lack of consensus on $Sui as a reserve asset. Introducing LST is a proven solution to create fresh utilities without increasing emissions. Remember, $Sui is way too early stage that we need to do everything to reaffirm its position as a reserve, not to worry about ‘overloading the consensus’ like Vitalik.

2. More Bridges!

Like it or not, no one can go without a cross-chain bridge. How popular a chain could be is somewhat dictated by the number of bridges to it: more bridges, more arbitrage, more volume, more users, and eventually stronger consensus — even more so for Sui as a high-speed, low-fee chain.

Look, Wormhole is great, Jump is great — battle-tested, very reliable. But it’s also true that Wormhole cannot provide equal convenience of native liquidity to ‘tourists’ from all chains. Plus, you can’t stop occasional ‘transaction stuck’ incidents. So why can’t we have more bridges?

3. Support Native Stablecoin

Even with good bridges, you cannot compete with native stablecoins, which takes away the anxiety and pumps the willingness of users to stay. In other words, a native stablecoin is key to the on-chain prosperity of a chain from the stage of bootstrapping to maturity, proven repetitively by Ethereum, BNB, and Solana.

Before Sui, there have been many bold attempts. It’s time for a native stablecoin team with a clear pathway of credit expansion and continuous discovery of new use cases to shine on Sui.

4. Speed Up Mobile Wallet Support

There are so few mobile wallets supporting Sui available. You could imagine how frustrated I could be when I created 20 addresses for Cetus IDO only to find I had to import them one by one into Martian on my cheap laptop. No need to mention how bad it looks for complete newbies to Sui.

Therefore, we are in dire need of more easy-to-use mobile wallets, both iOS and Android. Even better if we can have a WalletConnect-like middleware or a multi-Sui-wallet integration API to boost the dAPP compatibility.

5. Better Data Availability

Hate to say that but Sui probably has the roughest data availability among all chains I have used. You can barely find the max supply of tokens and NFTs most of the time on Suiscan, Sui Explorer, and SuiVision.

Yeah I know Sui isn’t EVM but that’s not an excuse for not doing great in data availability. Users who have been with EVMs in the secondary market have got a smooth, convenient data tool experience for a while. Not to mention what’s missing here is exactly what they use to make aping decisions.

dAPP teams on Sui also have a long way to go as we are missing some very basics when it comes to branding and marketing with data. Why hasn’t DappRadar blessed us with a Sui dApp dashboard yet? How come those already launched DeFi projects haven’t linked up with DeFillama for TVL and volume data? And again why we can’t see the stats on Portal bridge. Again, stats tell stories, stories create hype. Without the stats, even I found it difficult ‘shilling’ for Sui.

6. Let It Ride

I’m confident to say, as an eco-participant, that Sui is a hardworking team that’s engineer-centric and super friendly to Asian developers. They take on more stack-related workloads themselves instead of leaving the headaches to devs in the community. But this could be a double-bladed sword where too much focus is put on the ‘metanarrative’. Initiatives not ‘align’ with the ‘metanarrative’ could be seen as ‘illegitimate’ — devs with wild and crazy ideas could be marginalized, resulting in innovation being snuffed too soon. This has been seen somewhat happening among the Ethereum community where Vitalik had to discuss what is meant by legitimacy during EDCON.

So let’s find the right balance. I love what meme chasers always say: ‘Let it ride’. Take it easy and let’s embrace diverse and unconventional ideas from the dev community, nurturing a vibrant ecosystem where innovation thrives.