Hello readers,

The post-pandemic era has been defined by fiscal dominance — an economy fueled by government deficits and short-term Treasury issuance that kept liquidity elevated even as the Fed held interest rates high.

Today, we’re entering a phase of private-sector dominance, where the Treasury is withdrawing liquidity through tariffs and spending constraints compared to the past administration.

That’s why rates need to drop.

In this week’s report, we break down the current cycle through the lens of Global Liquidity to highlight why the current iteration of the “debasement trade” is on its final legs.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

The DeFi Report is powered by BIT Digital, the leading global platform for high-performance computing infrastructure and one of the largest ETH Treasury firms. NASDAQ: BTBT

Let’s go.

Is Fiscal Dominance Ending?

We always want to zig when everyone else is zagging.

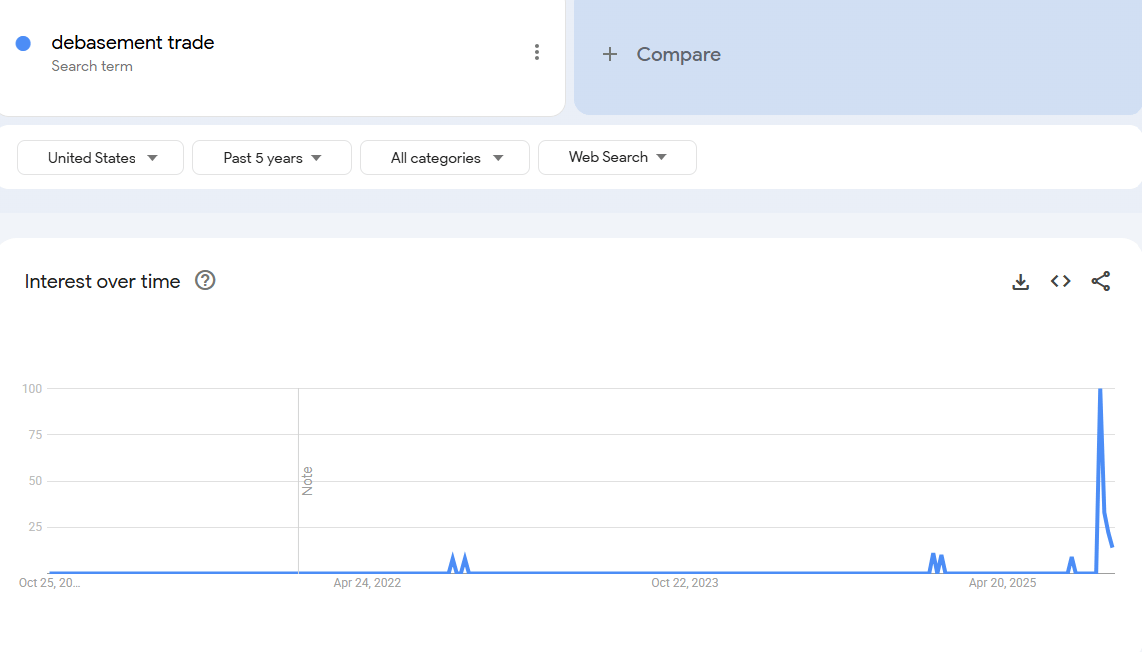

That’s why all the talk about the “debasement trade” of late is catching our attention.

Data: Google Trends

It’s our view that the time to be interested in the “debasement trade” was a few years ago. When BTC was $25k. And Gold was $2k. Back when nobody was talking about it (besides crypto & macro analysts).

The “trade” has largely played out, in our opinion.

And so, it’s our job to understand the conditions that created it, and whether those conditions will continue to persist.

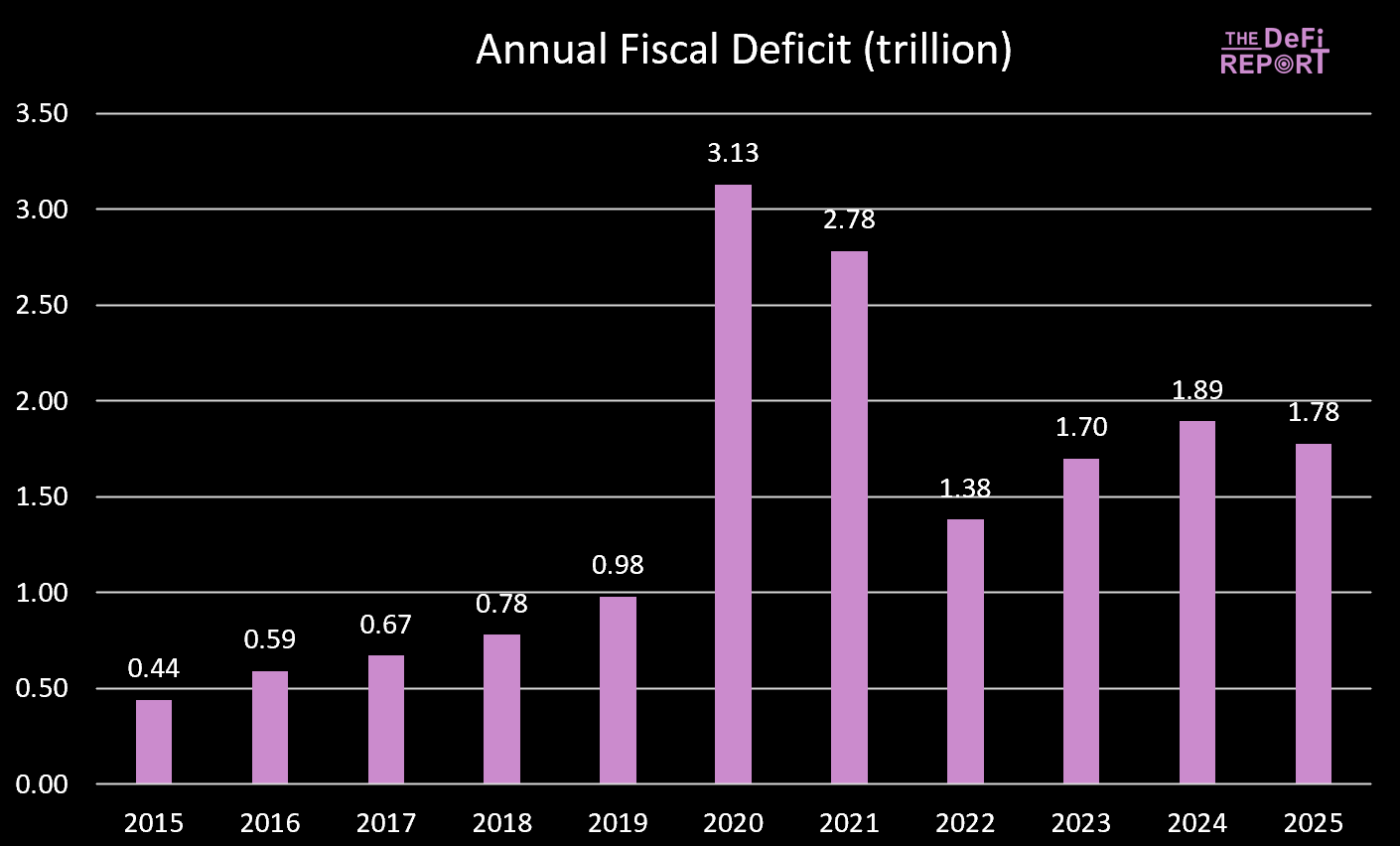

What drove the trade? Two primary factors, as we see it.

- Treasury Spending. We ran massive fiscal deficits under Biden.

Data: US Treasury

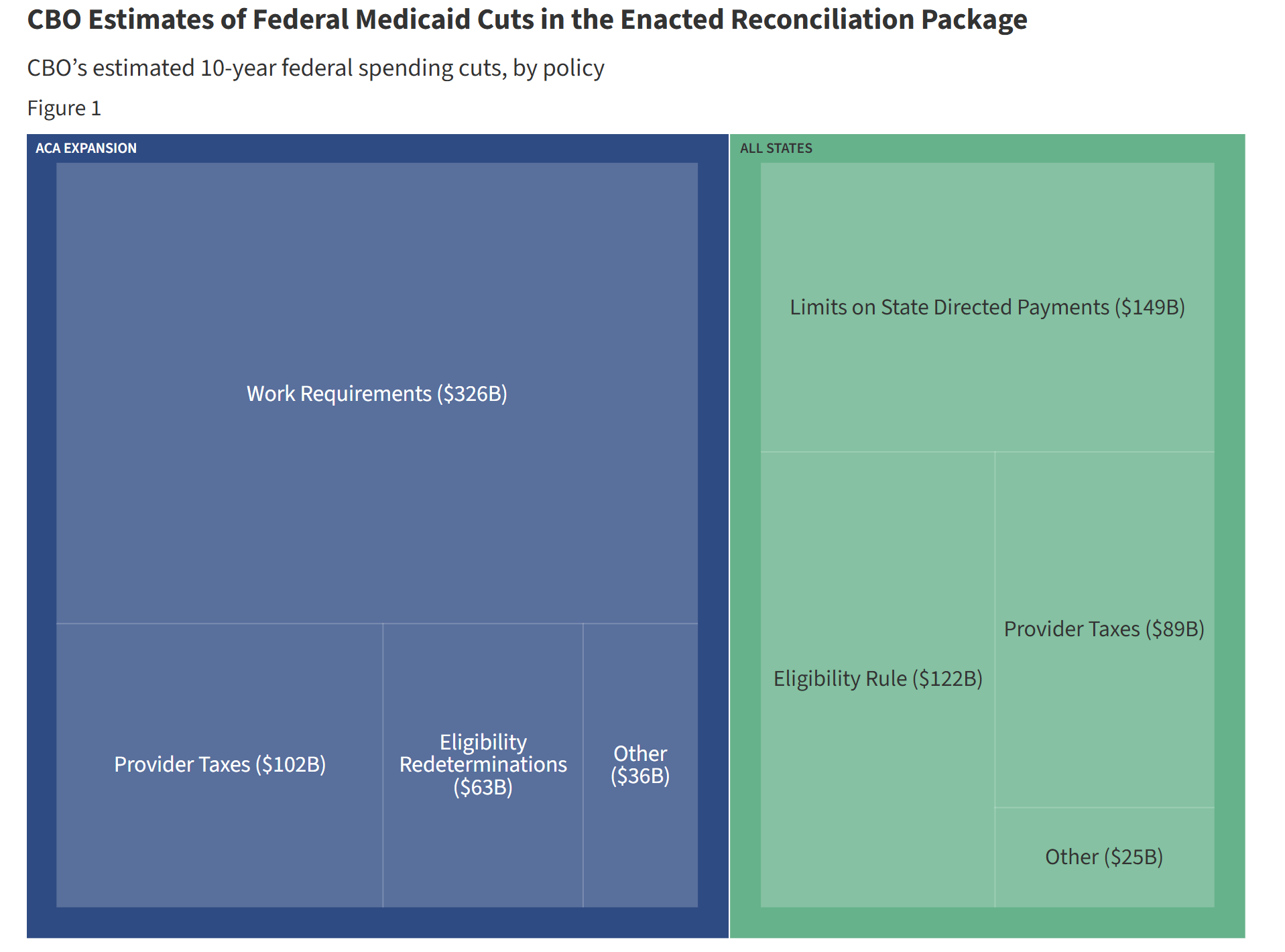

FY ‘25 just ended with the deficit dropping slightly — mainly due to rising tax receipts (tariffs) rather than a drop in spending. However, spending cuts are anticipated in the Big Beautiful Bill via reductions to Medicaid and SNAP benefits.

Data: KFF cuts relative to current spending trajectory

During the Biden years, government spending and transfers provided a steady injection of liquidity into the economy. But under the Big Beautiful Bill, the spending growth slows.

That’s less capital being pushed into the economy from the government.

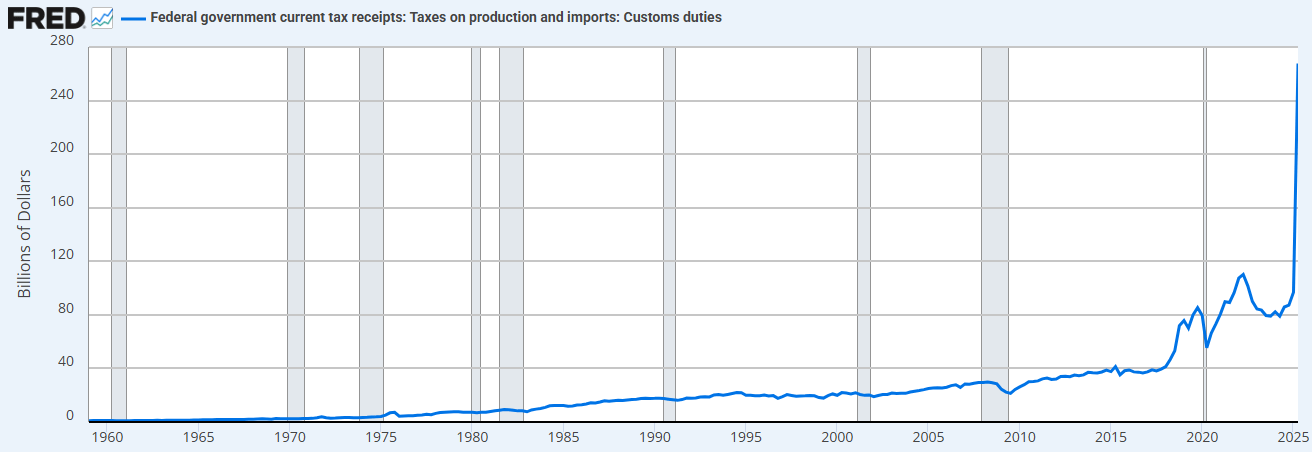

Furthermore, we have the government pulling capital out of the economy via Tariffs.

Data: FRED

The combination of spending restraint (relative to the prior administration) and tariff increases means the Treasury is now absorbing liquidity rather than supplying it.

That’s why we need rate cuts.

“We are going to re-privatize the economy, reinvigorate the private sector, and shrink the government sector.”

-Scott Bessent

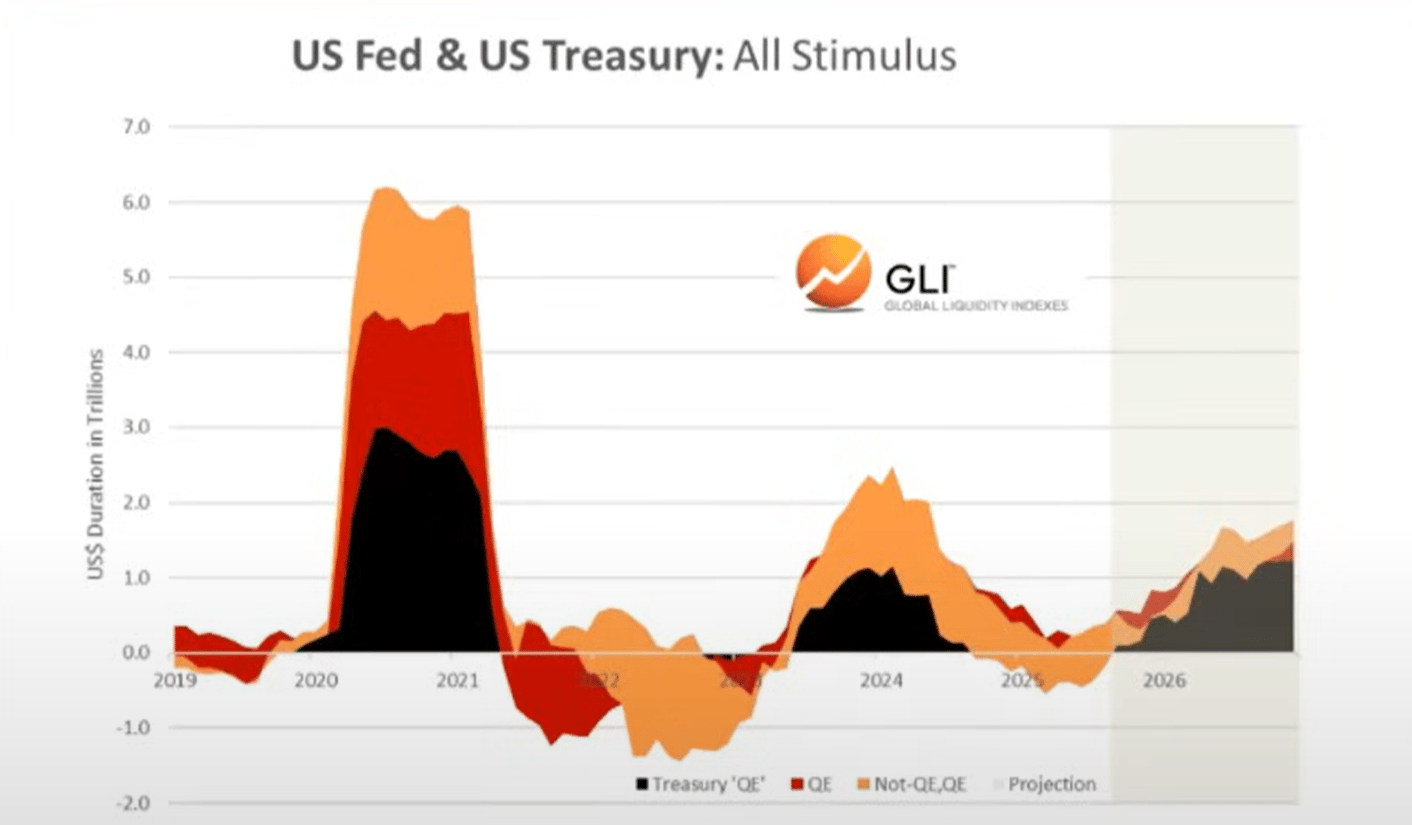

- “Treasury QE.” To fund the excessive spending via the Treasury under Biden, we also saw a new form of “QE.” We can observe this below (black). “Treasury QE” helped to prop up markets by funding government expenditure via short-dated bills, rather than longer-dated coupons.

Data: Global Liquidity Index

It’s our view that treasury spending and treasury QE are what drove the “debasement trade” and the “everything bubble” we’ve seen play out over the last few years.

But now we are transitioning to the “Trump Economy,” with the private sector taking the baton from the Treasury.

Again, this is why they need rate cuts. To get the private sector going via bank lending.

As we enter this transition period, the Global Liquidity cycle appears to be cresting…