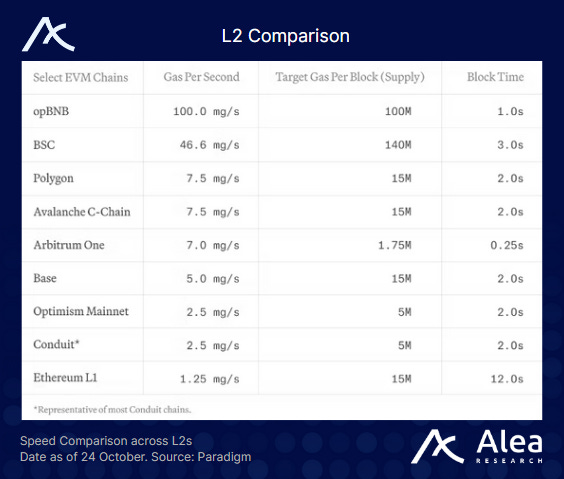

MegaETH has become one of the most talked‑about scaling projects on Ethereum, aiming to deliver web2-style responsiveness for web3 dApps. MegaETH is building an L2, with targets of 100,000 TPS and 1ms block times.

This focus on raw speed to build a “better Ethereum” attracted developer interest and interest from plenty of high-profile investors, including the likes of Vitalik Buterin and many other leading venture firms.

With a public token sale scheduled to begin on 27 October 2025, this edition looks into what MegaETH is, how it works under the hood, and why the upcoming token auction structure is worth understanding.

Stay informed in the markets ⬇️

Why Real-Time Blockchains Matter

MegaETH addresses a core latency bottleneck in the Ethereum L1. Traditional blockchains finalize transactions in seconds, which is acceptable for transfers but breaks user experience in trading or gaming which are more high-frequency.

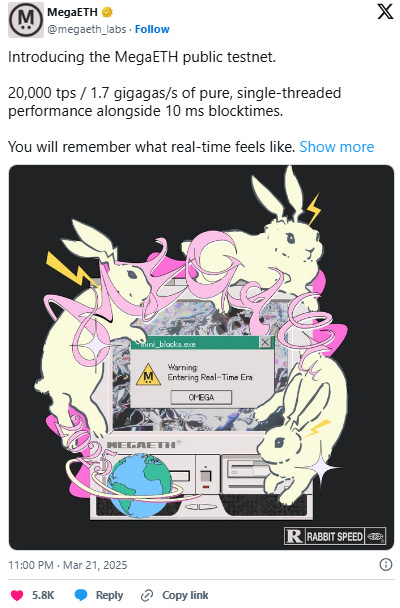

Research suggests that human perception starts feeling “non‑instantaneous” once delays exceed 100 milliseconds. MegaETH’s current 10ms block times enable interactive experiences like “tap trading” and on‑chain gaming.

By offloading heavy computation to sequencers and provers while anchoring state commitments to Ethereum and EigenDA for data availability, MegaETH aims to unlock use cases from high‑frequency derivatives exchanges to multiplayer games and real‑time AI inference.

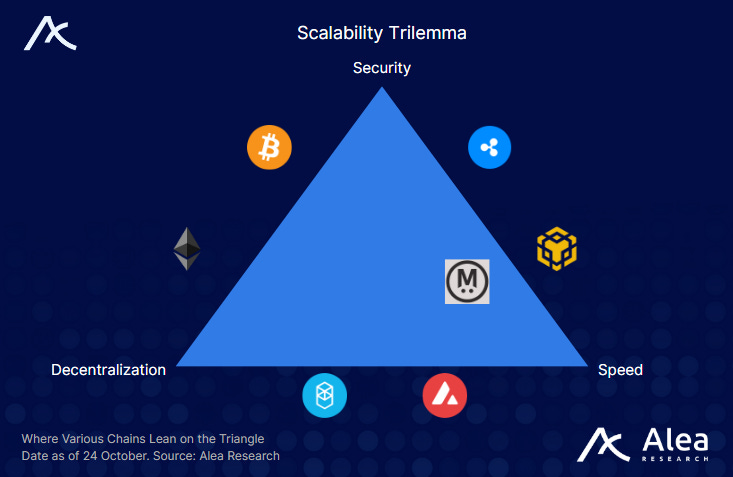

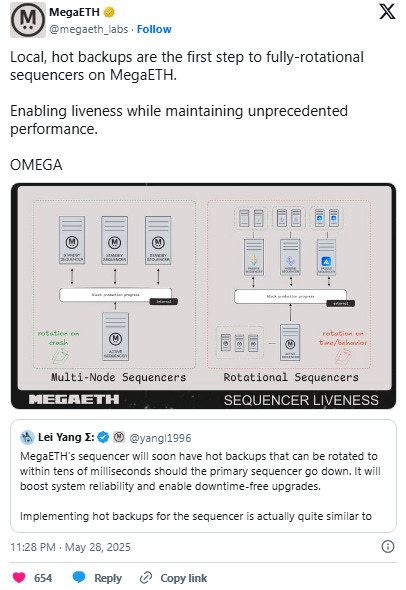

MegaETH’s design choices however come with the classic blockchain trilemma trade‑offs. Centralizing the sequencer and relying on specialized nodes can raise concerns around censorship or single‑point failure. Critics argue that sacrificing decentralization for speed undermines Ethereum’s ethos. However, MegaETH counters by highlighting that its sequencer is still rotational and that critical security functions such as proof generation and data availability remain decentralized on Ethereum and EigenDA.

The question is whether the performance gains justify a more concentrated architecture and whether trust assumptions remain acceptable for targeted use cases like trading venues.

Introduction to MegaETH

While most L2s emphasize decentralization and scalability through batch orders, MegaETH optimizes for performance by centralizing sequencing to remove latency.

MegaETH uses a single powerful sequencer instead of trying to decentralize block production. Blocks are produced every ~10ms, many times faster than mainstream rollups, and security is anchored back to Ethereum through a rotational sequencer model.

MegaETH’s performance comes from node specialisation rather than simply increasing hardware. Roles are split into sequencers, full nodes and provers.

- Sequencers order and execute transactions

- Full nodes receive and apply state updates without re‑executing them, allowing them to run on modest hardware

- Provers verify blocks independently off‑chain, reducing on‑chain workload

This design, combined with advanced data structures like Non‑Ordered Merkle Trees (NOMT) and just‑in‑time compilation, targets that 100k TPS and sub-ms blocktimes.

When MegaETH launched its testnet in March 2025, results show the network reliably processes 15–20k TPS

MegaETH Public Sale

MegaETH’s upcoming 27 October sale sees 500M $MEGA representing 5% of the 10B supply being sold via Sonar, lasting 72 hours. This is done via an English auction format where bids are placed in USDT on Ethereum, starting at a $1M FDV up to $999M FDV (realistically, this is going to be at that $1B FDV mark).

Individual contributions range from $2,650 to $186,282, and bidders can opt to lock their allocation for one year to receive a 10% discount.

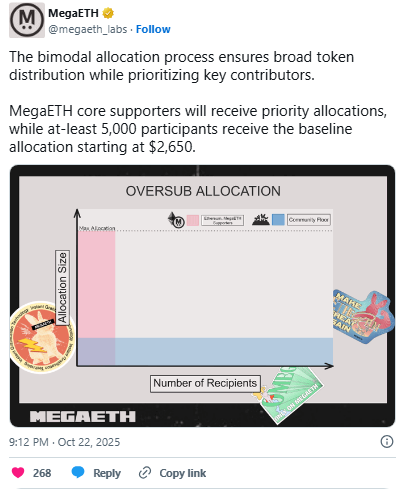

Should the auction be oversubscribed, MegaETH will deploy a “U‑shaped allocation” to balance depth and breadth. The system prioritizes larger allocations for wallets that can verify a history of meaningful contribution to MegaETH or Ethereum (e.g., long‑term on‑chain activity or NFT ownership) while ensuring that at least 5,000 participants receive a baseline allocation.

Tokenomics

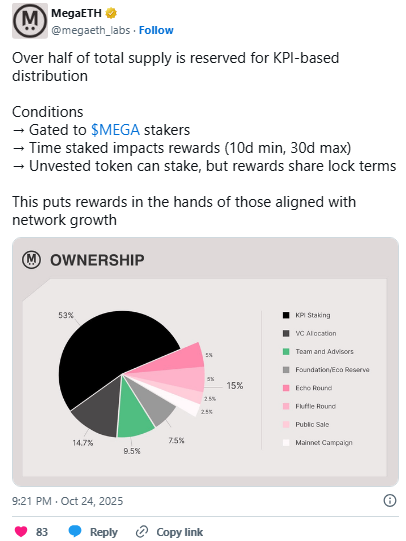

MegaETH has a total supply of 10B, distributed as follows:

- Team - 9.5%

- Foundation/Ecosystem Reserve - 7.5%

- KPI Staking Rewards - 53.3%

- VCs - 14.7%

- Echo Sale - 5%

- 27 Oct Public Sale - 5%

- Fluffle Sale - 2.5%

- Sonar Reward Pool - 2.5%

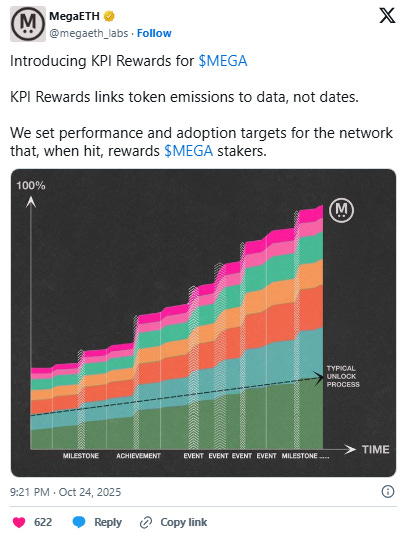

MegaETH’s ecosystem retains 70.3% of the total supply for long‑term incentives and ecosystem development, where a substantial 53.3% is earmarked for performance‑based staking rewards. The KPIs mentioned include:

- Ecosystem Growth

- Technical Performance

- MegaETH Decentralization

- Ethereum Decentralization

with unlocks associated with each KPI still yet to be disclosed.

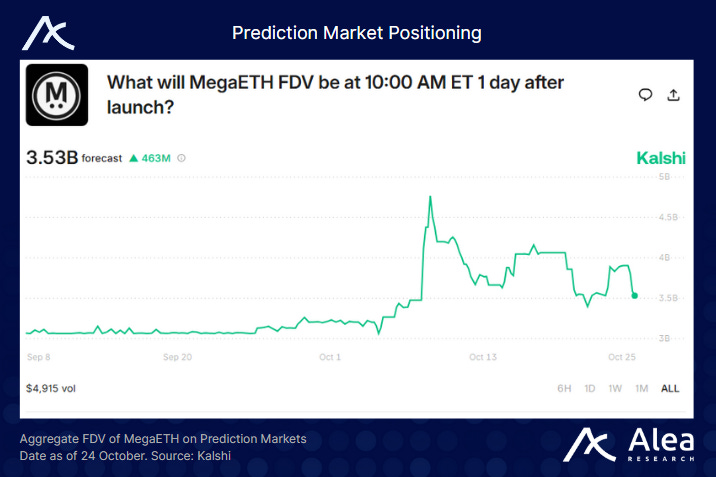

While the auction sets the official starting valuation, derivatives markets already offer rough market expectations. MEGA‑USD perpetual futures on Hyperliquid have been trading at an implied ~$5B FDV ahead of the sale, while prediction markets like Kalshi price it at ~$3.5B FDV.

Become a Premium member today to unlock all our research & reports.

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $149/month, you can access our full suite of offerings:

- Gain access to Deep Dives, Blueprints, Perspectives, Theses, Benchmarks & Outlooks.

- Weekly market update reports and key actionable insights, keeping you informed as the market evolves.

- Full access to historical research archive, including hundreds of long-form reports.