If you’re like most investors watching America’s debt spiral, you’ve probably wondered if there’s any realistic way out of the $37 trillion hole without economic catastrophe.

You’ve likely seen politicians promise solutions while economists debate whether the US can simply “grow its way out” of this unprecedented debt level, leaving you uncertain about what this means for your investments and financial future.

I’ve been studying monetary innovation and debt crises for over fifteen years, and what’s happening with stablecoins right now represents the most promising debt management breakthrough I’ve seen.

Major financial institutions, from ARK Invest to the Bank for International Settlements, are analyzing how digital assets could create entirely new pathways for sovereign debt sustainability.

By the end of this article, you’ll understand exactly how stablecoins backing US Treasuries could create a self-reinforcing cycle that reduces debt pressure, why a strategic digital asset reserve might be the key to maintaining America’s financial dominance, and most importantly, how to position your portfolio for what could be the most significant monetary innovation since the Federal Reserve’s creation.

You’ll also discover why this isn’t just theoretical — legislative bodies are already considering digital asset stockpiles as part of national debt strategy.

Ready to understand how digital finance could reshape everything?

Why Traditional Debt Solutions Keep Failing America

Here’s what frustrates me about most debt crisis analysis: economists focus on spending cuts and tax increases while completely ignoring how technological innovation could create entirely new revenue streams and debt management tools.

You’ve probably heard endless debates about austerity versus stimulus without anyone mentioning how digital assets could fundamentally change the game.

The problem isn’t that traditional fiscal policy tools don’t work — it’s that they’re politically difficult and economically disruptive at the scale needed to address $37 trillion in debt.

➜ I’ve watched decades of deficit reduction plans fail because they assume tomorrow’s economy will work exactly like yesterday’s, ignoring how digital finance creates new possibilities.

What I’ve learned from studying debt crises throughout history is this: sustainable solutions come from expanding the economic pie, not just redistributing existing resources.

The most successful debt resolutions have involved monetary innovations that created new forms of value and demand — from the establishment of central banking to the development of modern bond markets.

➜ The reality is that when debt reaches levels that threaten systemic stability, the solution usually comes from financial innovation rather than traditional fiscal adjustment.

It’s not your fault that conventional debt analysis feels inadequate — most experts are analyzing 21st-century problems with 20th-century frameworks.

In my experience, breakthrough solutions emerge when three factors converge:

- technological capability,

- market demand, and

- regulatory clarity.

Right now, stablecoins are creating all three simultaneously in ways that could transform how sovereign debt works.

But here’s what I discovered that changes everything about debt sustainability…

The 4-Stage Digital Asset Strategy That Could Eliminate Debt Pressure

After analyzing projections from leading financial institutions and government research, I’ve identified four interconnected stages of how stablecoins and digital assets could create a sustainable path out of the debt crisis.

The beauty of this approach is that each stage reinforces the others, creating compound benefits.

➝ Stage 1: Stablecoin-Driven Treasury Demand Explosion

What’s happening: Stablecoin reserves, primarily held in US Treasuries, could grow from current levels to $1–2 trillion by 2028, creating massive new demand for short-term US debt instruments.

Why this matters: Unlike traditional foreign investors who might reduce Treasury holdings for political reasons, stablecoin issuers need Treasuries for operational stability. This creates structural, apolitical demand for US debt that grows automatically as the digital economy expands.

The mathematical impact: If stablecoin reserves reach $1.5 trillion backed by Treasuries, that’s $1.5 trillion in guaranteed US debt demand — roughly 4% of current debt levels with built-in growth as digital payments expand globally.

Implementation insight: The GENIUS Act and similar legislation are already aligning stablecoin reserves with ultra-secure assets like Treasuries, creating regulatory frameworks that tie digital asset growth directly to US debt demand.

➝ Stage 2: Strategic Digital Asset Reserve Creation

The mechanism: The US government creates a digital asset reserve backed by stablecoins holding Treasuries, Bitcoin, and other digital assets, diversifying the investor base and reducing refinancing risk.

Why this creates value: A strategic digital asset reserve could capture global digital transaction flows and serve as collateral for innovation in payments and asset issuance. Unlike traditional reserves, digital assets can generate fee-based revenue streams while appreciating in value.

Real-world example: If the government holds Bitcoin that appreciates from $60K to $120K while also earning transaction fees from digital treasury products, the reserve creates value that directly offsets debt service costs.

The network effect: As blockchain-based treasuries circulate internationally, they capture transaction and holding fees — potentially generating billions annually in new government revenue streams.

➝ Stage 3: Interest Rate Policy Coordination

The strategic approach: Deliberately reducing interest rates supports both debt service costs and digital asset reserve appreciation, creating a balanced approach that helps both traditional debt management and new growth channels.

Why timing matters now: Lower rates reduce the government’s annual debt service costs (currently over $1 trillion annually) while making digital assets more attractive to institutional investors seeking yield alternatives.

The multiplier effect: Reduced debt service costs combined with appreciating digital asset reserves could create a double benefit — lower expenses plus higher revenues from the same policy coordination.

Historical precedent: This mirrors how previous monetary innovations created self-reinforcing cycles of debt sustainability through expanded economic activity and new revenue sources.

➝ Stage 4: Global Digital Dollar Dominance Reinforcement

The ultimate outcome: Stablecoins become essential infrastructure for global payments, driving worldwide dollar demand and helping “reboot” America’s international monetary privilege even as traditional foreign sovereign demand declines.

Strategic importance: Rather than fighting declining foreign Treasury purchases, this approach creates new forms of dollar demand through digital infrastructure that’s harder for other nations to avoid or replace.

Market expansion: Increased stablecoin adoption spurs growth in new digital financial products, further deepening the US Treasury’s digital asset footprint and creating sustainable competitive advantages.

The convergence advantage: When these four stages work together, they create what economists call “network effects” — each user or participant makes the system more valuable for everyone else, creating sustainable growth that compounds over time.

Get AltSeason CoPilot’s stories in your inbox

Join Medium for free to get updates from this writer.

Subscribe

Key insight: This isn’t about replacing traditional debt management — it’s about adding a digital layer that creates new forms of value and demand while strengthening existing dollar-based systems.

The technology exists, the market demand is growing, and the regulatory framework is developing.

⫸ What This Digital Debt Revolution Means for Your Investment Strategy

When you analyze these four stages together, it becomes clear why major financial institutions are taking this approach seriously and why early positioning could be crucial for portfolio performance. Based on current growth trajectories and institutional adoption patterns, here’s what investors should realistically expect:

➢ Within the next 12–18 months:

Expect accelerated regulatory clarity around stablecoin reserves and Treasury holdings. The government will likely announce specific digital asset reserve initiatives, creating immediate opportunities in both traditional Treasury markets and digital asset infrastructure companies.

➢ Stablecoin market expansion:

Current projections suggest stablecoin market cap could triple from current levels, with most growth backed by Treasury holdings. **This creates sustained, structural demand for US debt that’s independent of foreign government policy decisions.**

➢ Interest rate environment:

If this strategy gains political support, expect coordinated monetary policy that balances debt service reduction with digital asset market development. Traditional bond investors should prepare for a potentially flatter yield curve with new dynamics in short-term Treasury demand.

➢ Digital asset infrastructure boom:

Companies building stablecoin technology, Treasury tokenization platforms, and digital payment systems could see explosive growth as government adoption legitimizes and scales these markets.

➢ Currency stability implications:

Success of this approach could strengthen dollar dominance through digital channels, potentially making dollar-denominated assets more attractive even as traditional geopolitical relationships shift.

➢ Timeline for portfolio impact:

The most significant opportunities will likely emerge over 2–5 years as regulatory frameworks solidify and institutional adoption accelerates. Early positioning in the right digital asset infrastructure and Treasury-backed instruments could capture disproportionate gains.

➢ Risk considerations:

Market fragility during transition periods could create volatility, especially if stablecoin redemptions stress Treasury markets. However, successful implementation could reduce long-term debt sustainability risks significantly.

➢ Global competitive response:

Other nations will likely accelerate their own digital currency initiatives, potentially creating a multipolar digital monetary system with both opportunities and complexities for international investors.

This isn’t about betting on a single outcome — it’s about recognizing that digital assets are creating new pathways for debt sustainability that didn’t exist even five years ago.

The convergence of technology, regulation, and fiscal necessity is creating investment opportunities at the intersection of traditional finance and digital innovation.

Your Digital Treasury Investment Strategy: 5 Ways to Position for the Debt Solution Revolution

The research and institutional analysis clearly show that stablecoin-Treasury integration is accelerating, creating specific investment opportunities that most portfolios aren’t positioned to capture.

Here’s exactly how to align your investments with this potential transformation:

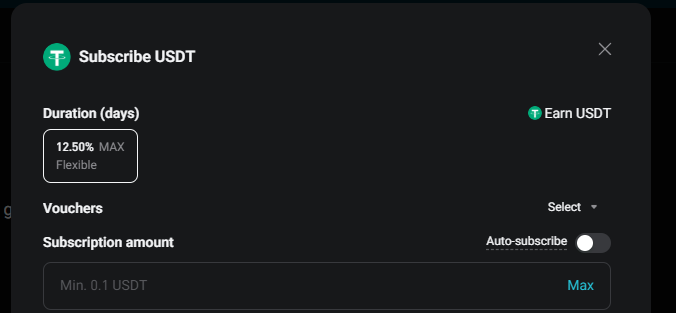

Don’t just buy generic cryptocurrencies — focus on stablecoins with transparent Treasury backing like USDC or USDT, which benefit directly from increased government legitimization. The easiest way to begin is allocating 5–10% of your stable value investments to these instruments and provide liquidity on an exchange like Bitget for passive income that compounds.

Target firms building stablecoin technology, Treasury tokenization platforms, and payment processing systems that will benefit from increased government adoption. Look for companies with existing government contracts or clear pathways to serving institutional Treasury markets.

Step 3: Rebalance your fixed income allocation strategically.

Consider increasing your Treasury exposure while reducing corporate bond positions, as Treasury demand from stablecoin backing could compress yields favorably. Focus on shorter-duration Treasuries that align with stablecoin reserve requirements.

Step 4: Position for coordinated monetary policy benefits.

If interest rate reductions support both debt service and digital asset appreciation, consider investments that benefit from this coordination — Treasury-backed digital assets, dividend-growing stocks that benefit from lower rates, and digital infrastructure REITs.

Step 5: Diversify into Bitcoin and strategic digital assets thoughtfully.

If the government creates a strategic digital asset reserve, early positioning in Bitcoin and established cryptocurrencies could benefit from institutional adoption and legitimization. Allocate 5–15% of your growth investments to established digital assets with clear regulatory pathways.

Our community of forward-thinking investors are actively positioning for the intersection of traditional Treasury markets and digital asset innovation. The most successful investors during major financial transitions share research and strategies rather than trying to navigate alone.

Grab the 7 day free trial to the AltSeason CoPilot, our digital asset positioning guide that includes specific allocation recommendations, timing strategies, and risk management frameworks for different implementation scenarios. This isn’t theoretical — it’s based on what institutional investors are already implementing.

The stablecoin-Treasury revolution isn’t coming someday — it’s happening now through regulatory development, institutional adoption, and government research.

Your ability to recognize and position for this convergence of traditional debt management and digital innovation could determine whether you capture these opportunities or watch them unfold from the sidelines.

Let me know in the comments: Are you already investing in Treasury-backed digital assets?

Which companies in the digital Treasury infrastructure space are you watching?

Your insights often reveal opportunities and risks that aren’t apparent from institutional research alone.