In this newsletter edition, we will cover Vitalik Buterins’ recent comments about disinterest in DeFi, $ETH’s current struggle underperforming against $BTC and other competitors, and what some are calling its identity crisis with questions around its use as ultrasound money or the cannibalistic nature of some L2s. As of today, $ETH is down YTD, down 5%, highlighting this matter. One area in which figures from the pro-ETH crowd and other sectors of crypto have been talking over each other comes down to the semantics of what is considered Ethereum. Regardless of whether L2s are or aren’t Ethereum, the growth of L2s like Arbitrum and Base has not benefitted $ETH very much as an asset. In crypto, people typically gauge narrative validation based on price, as this is the means by which they can profit.

Vitalik’s Disinterest in DeFi

Vitalik Buterin's recent comments on DeFi have sparked a heated debate within the crypto and Ethereum community. Vitalik argued that DeFi in its current form is unsustainable, comparing it to an Ouroboros - a snake eating its own tail. This situation has brought to the forefront questions about leadership within the Ethereum ecosystem. Unlike other competitors with clear figureheads, Ethereum's decentralized nature creates a unique challenge. The platform lacks a clear cheerleader for its marketing efforts when competing with other chains. Unlike Satoshi, he is a key thought leader with a real-world identity, but at the same time, he is not as strong of an advocate as others like Do Kwon used to be for the Terra Community (maybe there is a good reason behind it) or Anatoli on Solana (which has outperformed $ETH and also onboarded a large number of retail participants).

Some community members view DeFi as central to Ethereum's value proposition and are concerned about any perceived lack of support from key figures like Vitalik or even the Ethereum Foundation (most of whose members have simply held or sold $ETH through periods like DeFi summer). Together, it seems that those closer to the actual roadmap and highly technical implementation are prioritizing alternative use cases such as public goods, encrypted messaging, and quadratic voting among others—basically the opposite spectrum of the 24/7 infinite casino.

Despite Vitalik Buterin's skepticism towards DeFi, it's important to note that the current DeFi ecosystem, while circular in nature, has demonstrated the viability of an on-chain financial system. The infrastructure built for payments, swaps, lending, and derivatives has shown the potential to reduce counterparty risks, enhancing transparency, and lowering transaction costs. These achievements in market efficiency and financial primitives shouldn't be overlooked, even if the initial use cases have been largely speculative.

Meanwhile, the current on-chain DeFi appears to have hit a local maximum, with the core functionality of swapping largely unchanged since the advent of Bancor and Uniswap. Instead of simplifying, the consumer experience has become increasingly complex. Users now have to navigate new chains and Layer 2s, understand the intricacies of bridging assets, manage different gas tokens, and deal with various token representations. If anything, the actual innovation has been the introduction of intents and solvers, which actually centralizes order flow in the hands of a few sophisticated market makers—the opposite of the original vision to allow anyone to be a market maker in a permissionless manner, although relying on professionals offers better pricing for users after all.

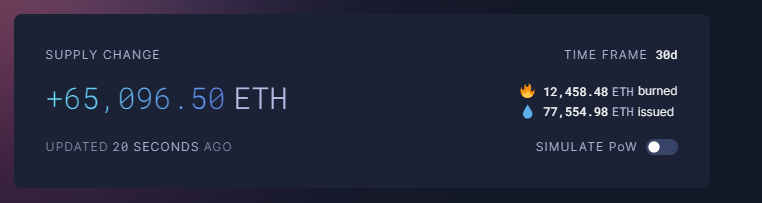

But Ethereum's identity crisis extends beyond Vitalik's comments on DeFi, touching on fundamental issues of value accrual and network economics. For months, gas fees on Ethereum have consistently remained low, ranging between 2-4 gwei—gone are the days of watching $ETH deflate on ultrasound.money. This has led to an increase in Ethereum's supply, challenging the "ultrasound money" narrative that gained traction during the last bull cycle. EIP-1559, implemented in August 2021 to make Ethereum deflationary by burning transaction fees, has been less effective in this low-fee environment with plenty of L2s (perhaps too many, and growing), which has resulted in net inflation rather than the anticipated deflation.

Further complicating matters is Ethereum's focus on Layer-2 solutions built on top of Ethereum and the upcoming upgrade EIP-4844. Kyle Samani, a VC investor and a Solana bull, argues that this strategy is problematic. He argues that Layer 2s are parasitic to Ethereum, potentially siphoning value away from the main network. Samani believes Ethereum's decision to outsource execution (the processing of transactions and smart contracts) to these Layer-2 networks was "catastrophically bad." He argues that the primary value of blockchain networks comes from MEV (profit validators can make through reordering transactions), which Ethereum is potentially forgoing with its Layer 2-centric roadmap. This frame of thought was first introduced by his partner at Multicoin Tushar Jain, who came up with an MEV-based framework for valuing asset ledgers almost two years ago. The fragmentation of liquidity and user activity across multiple Layer 2s has led to a poor user experience, contrasting single-layer chains like Solana. This fragmentation, Samani suggests, is a significant factor in Ethereum's recent underperformance and poses challenges for its future growth and adoption.

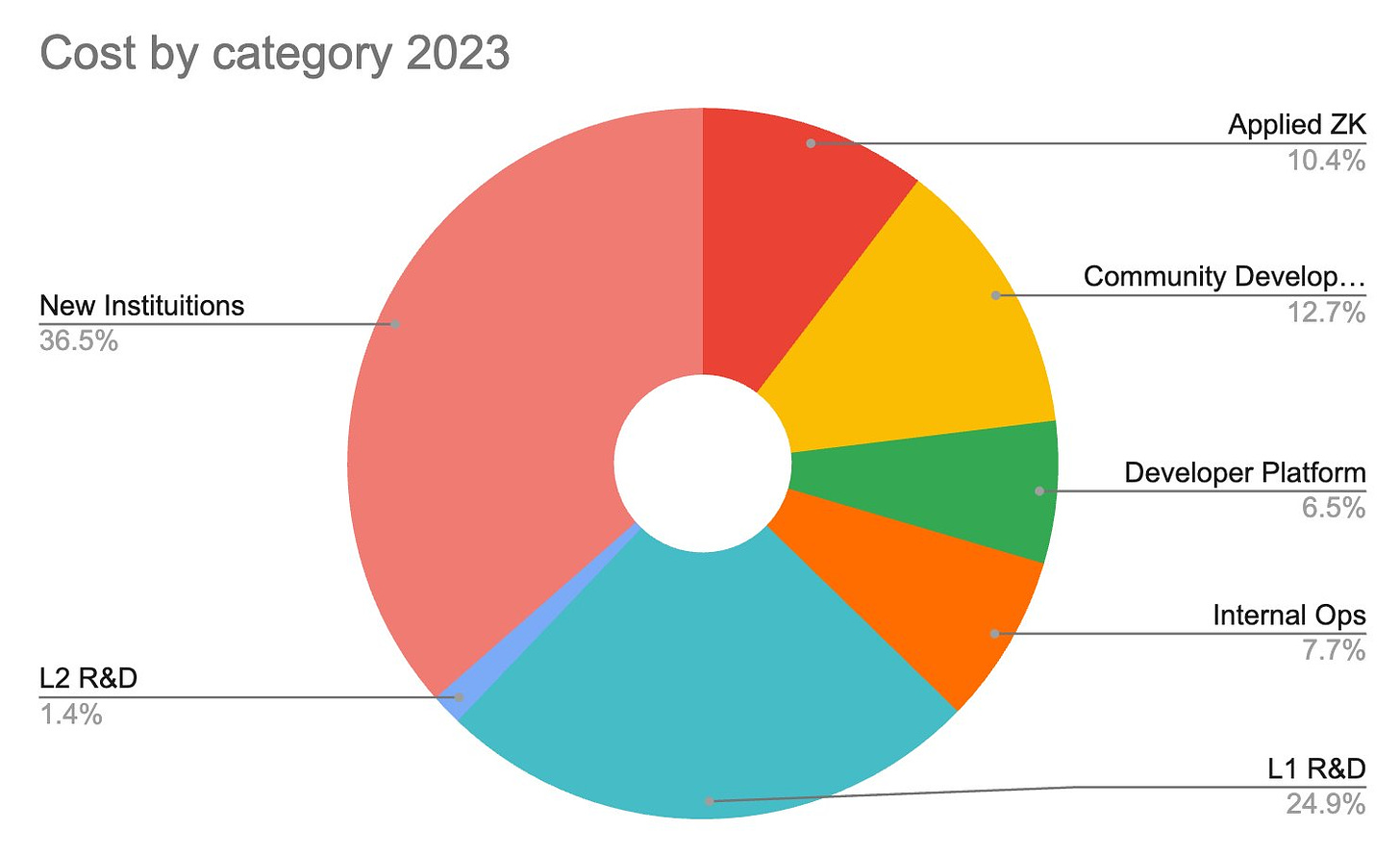

Adding fuel to this discussion is the revelation of the Ethereum Foundation's annual budget of around $100 million. This has sparked a debate about resource allocation and transparency within the ecosystem. While supporters argue that this level of funding is justified given Ethereum's scale and impact, some question whether it represents an efficient use of resources. The foundation's decision to sell large amounts of $ETH on exchanges like Kraken has raised eyebrows as the move to sell $ETH for the foundation happens even during market downturns adding fuel to the selling pressure.

Below you can find the costs by category spent by Ethereum Foundation in 2023:

Justin Bram in a recent Steady Lads podcast said that the Ethereum Foundation's decision-making power is concentrated in the hands of just three individuals. This includes Vitalik Buterin, one other core member, and a third person who serves as a hired regulatory expert. Such a structure within an organization has raised concerns about transparency and accountability. As the crypto industry matures, there's an increasing expectation for foundations and other centralized entities to provide clear explanations of their financial resource allocation. This call for transparency extends to governance structures, decision-making processes, and how these align with the broader goals of the platforms.

Despite the challenges facing Ethereum and the broader DeFi ecosystem, a potential path forward is emerging. The real question now is: what will drive the next wave of adoption in crypto, potentially bringing it to another 10-100x growth phase? While Vitalik's concerns about DeFi's sustainability merit serious consideration, they don't discount the potential of blockchain technology in finance. The answer may not lie in refining existing DeFi models or continuing the current speculative cycle, but in a more fundamental shift: the tokenization of traditional financial assets, or RWAs. This represents the largest untapped market for crypto, with the potential to bring trillions of dollars of capital on-chain. It could address some of Vitalik's concerns about DeFi's circularity by introducing substantial "real-world" assets into the ecosystem.

Consider the scale of the traditional financial markets: BlackRock alone manages assets worth nearly five times the entire market capitalization of the crypto market. By tokenizing assets such as bank deposits, commercial paper, treasuries, mutual funds, money market funds, stocks, and derivatives, we could unlock an unprecedented influx of capital into the crypto ecosystem. This capital could then be integrated into the DeFi infrastructure, which has already proven its utility in creating more transparent, accessible, and liquid markets. This potential for tokenization aligns with Larry Fink's narrative on Ethereum, which could still play out, potentially creating a compelling future for the platform.

As Ethereum matures, the platform finds itself at a crossroads of innovation and adoption. The ongoing debate about Ethereum's primary focus – whether to double down on DeFi or diversify into other applications – will shape its technical development, market position, and regulatory strategy. Vitalik's skepticism towards current DeFi models, while challenging, may ultimately drive the ecosystem towards more sustainable and innovative solutions. Meanwhile, the potential for tokenizing traditional assets presents an enormous opportunity, one that could propel Ethereum to the forefront of financial markets on-chain.

It’s important to balance the present with the future. Financial derivatives evolved as a way to manage risk and speculate on real things, like commodities, commodity contracts, shares of businesses, etc. Crypto basically skipped right to the derivatives part without much of the underlying assets. This is through little fault of the industry’s own, as regulatory problems prevent the tokenization of many of the most meaningful RWAs. Various top-ranked crypto assets essentially represent a platform for trade and speculation, where the assets being traded back and forth are highly speculative themselves.

Crypto isn’t alone on this front: how many of the most valued US companies even offer dividends? This was once the core proposition of a company going public, but has largely fallen out of favor to something akin to ‘greater fool theory’. Even things like gold are highly speculative in nature, as the actual use of the commodity in real things like semiconductors and other instruments is negligible relative to the asset’s marketcap. So the role of speculation in markets can’t be discounted especially during inflationary fiat regimes. No matter which way you look at it, $ETH’s price performance can perhaps only be described as pitiful recently. This is not only relative to crypto, but various other large-cap US stocks have outperformed the asset in recent years.

Not to mention the nay-sayers who point out that more DePIN-type protocols are building on Solana and other chains as opposed to Ethereum. As mentioned above, BlackRock made its intentions of using Ethereum known; whether other TradFi additions along these lines continue to use Etheruem over other chains, and whether this value can successfully and meaningfully accrue to $ETH as an asset remains to be seen.

Criticism sometimes is exactly what a protocol, company, community, or foundation needs. With more regulatory easing potentially being on the horizon, and some interesting new developments in the RWA and DePIN space, those longing for a more ‘real’ DeFi landscape may get their wish, hopefully sooner rather than later.