They claimed that NFTs on Bitcoin were impossible.

They said that DeFi on Bitcoin was impossible.

As it turns out, they were mistaken.

BTCFi is a Zero to One innovation that I'm incredibly excited about (and invested in).

However, BTCFi is poorly marketed because most of the BEST content is either not in English or highly technical. It’s been a challenge for me to keep up. Yet, things are moving very fast with loads of opportunities.

In this post I want to take it slow and explain how we got here, cover protocols you can play with right now, share a few tips to get started, and talk on what’s next.

In the future, I’ll dive deeper into Bitcoin L2s etc.

And it’s a rewarding experience as airdrops are already rolling out for early users.

Welcome to the world of Bitcoin.

Why I am bullish on BTCFi

Until recently, Ordinals & BRC20s didn't meet all three of my criteria for a booming ecosystem. This is the framework I use to evaluate ecosystems and tokens.

Ordinals & BRC20s got me interested as it’s 1) innovative and 2) has great story telling power.

Yet, BRC20 tokens were inflating way too fast without any flywheel effect to contain the inflation. BRC20s were freely mintable in a "fair launch" but without any diversification or use case backing them. Like memecoins. This risked diluting user attention and money entering the ecosystem. It’s how the 2017-18 ICO ERC20 boom ended.

But things have changed since then.

- First, ORDI token has solidified itself as the first memecoin on Bitcoin with listing on major CEXes.

- Second, real native dApps launched on Bitcoin (not L2s) that are somewhat usable and have native tokens.

- Third, CEXes like OKx and Binance are investing heavily into inscriptions by launching their own inscription services, marketplaces and listing BTCFi assets.

- Fourth, airdrops have arrived to Bitcoin, rewarding users for holding specific assets.

- Finally, a new fungible token standard will launch on Bitcoin halving block to challenge BRC20 dominance.

Now, BTCFi is a fast-growing category of crypto with a hardcore community, that seems to be dominated by non-western users! It might explain the lack of interest on Crypto Twitter.

The total market cap of all BRC20s reached $2.8B which is significant enough to pay attention, but low enough to be early and enjoy an 100x upside.

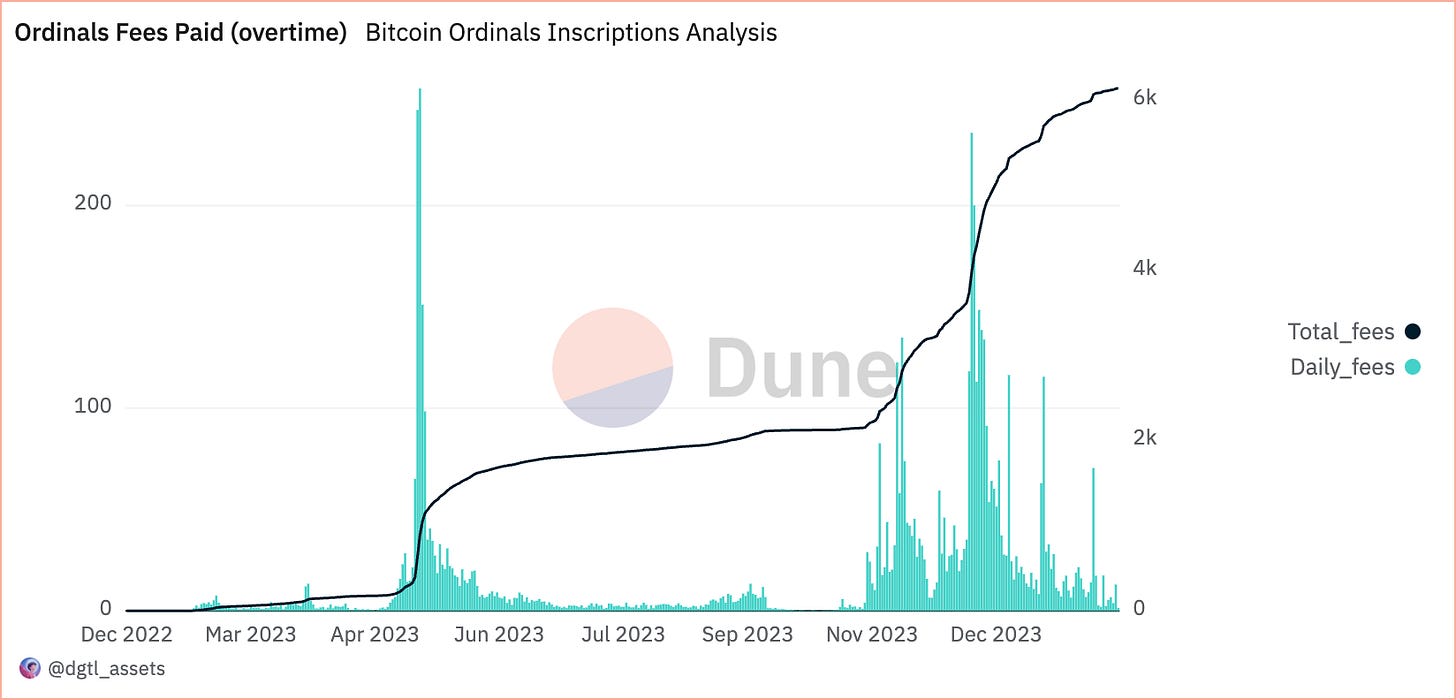

Plus, Ordinal inscriptions is a lifeline for BTC security as $306M in BTC fees has been paid to miners.

Notice a big increase in inscription txs in March, and how they resurface again in late 2023.

Notice a big increase in inscription txs in March, and how they resurface again in late 2023.

Top Ordinal NFT collections are selling high, too. “Genesis Cat” by Taproot Wizards sold for $254K USD at Sotheby’s sale. The current floor price is $13K USD. 3 out of top 20 NFTs by floor price are Bitcoin NFTs. More will join the top soon.

But why would someone pay so much? Let's briefly revisit where it all began to understand.

How it All Started

This history has been shared by @_0xSea_ on twitter in Chinese. There’s a full translation by WuBlockchain here.

But here’s a short story on what matters.

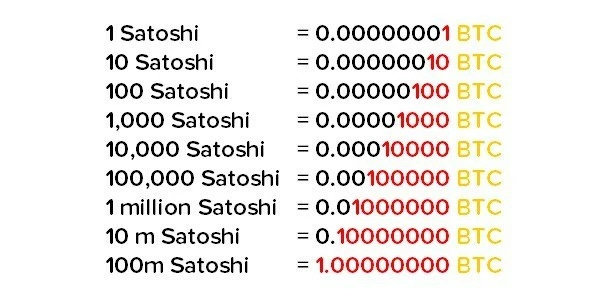

It begins with Casey Rodarmor's introduction of the Ordinals protocol in December 2022, enabling each satoshi of Bitcoin (the smallest unit of BTC) to carry unique data, including NFTs.

1 Bitcoin = 100,000,000 satoshis.

Ordinal NFTs are not your Ethereum NFTs with a link to an off-chain storage. Ordinal JPEGs are forever inscribed onto the satoshi. I think Ordinal NFTs can become the ultimate choice for exclusive collections & PFPs.

Think about this: A single satoshi with a JPEG inscribed on it can potentially be worth more than its market price. This fact alone makes the entire BTC chain worth more than the total market cap of Bitcoin. (Same can be applied to other chains but let me sound smart).

This innovation, however, remained under the radar until March 8, 2023, when an anon developer “domo” introduced BRC-20 tokens.

BRC-20 tokens use JSON data (text-based data format) inscribed on satoshis. They are not perfect and are tradable more like NFTs than fungible tokens. For example, you need to “inscribe” (by doing an on-chain transaction on BTC) BEFORE you can sell or transfer those tokens.

In any case, BRC-20's launch attracted attention and speculative activity, despite Casey's criticisms of the protocol for deviating from his original vision and cluttering the Ordinals space.

Almost at the same time, another anon dev, Beny, launched multiple projects that introduced a complex governance model within the Ordinals ecosystem. It was the first attempt to create a unified ecosystem with a flywheel effect that I was looking for.

These included the TRAC token, Tap Protocol, and Pipe protocol, each interlinked and expanding upon the initial concept of Ordinals and BRC-20.

TRAC Token: A governance token for the ecosystem, including TAP and PIPE protocols.

TAP Protocol: Enables swaps, liquidity pools, airdrops, and staking on Bitcoin.

PIPE Protocol :A UTXO-based protocol for tokens and NFTs on Bitcoin, inspired by the RUNES protocol (that is being developed).

Addressing perceived limitations in Ordinals, another anon dev launched Atomicals & ARC20 tokens. Atomicals use Bitcoin's UTXO model for minting tokens where 1 token = 1 sat.

To put it simply, 1k ORDI BRC20 tokens could be inscribed on 1 satoshi. That’s why you need to “fracture” BRC20 tokens on more satoshis by inscribing them, before you can sell them. But one Atomical ARC-20 is always equal one 1 satoshi.

You can trade ARC-20s on Unisat marketplace with Unisat wallet.

Casey, seemingly not a fan of all the increase of protocols like BRC-20, proposed Runes, a new token protocol based on the Bitcoin's UTXO tech (same as Atomicals), aiming to integrate a more “orthodox” approach to token issuance on Bitcoin.

Runes Protocol aims to bring more transaction fee revenue, developers, and users to Bitcoin, all while maintaining the integrity of the blockchain.

But Rune’s Protocol is not yet developed, and the community is already speculating on what’s going to happen during the first Bitcoin halving block in April.

More on this speculation at the end of the blog post.

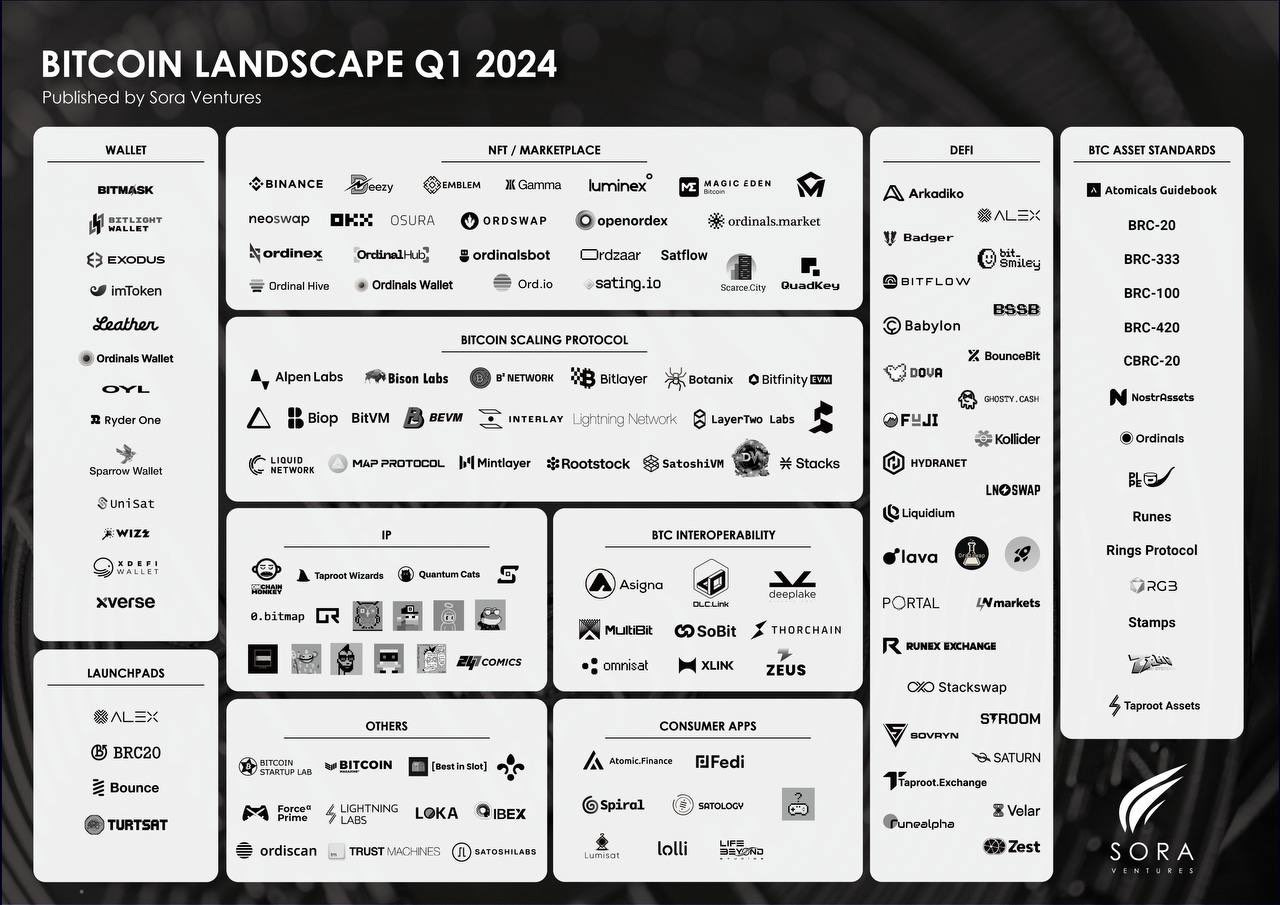

As you can see, Bitcoin ecosystem is large and growing with multiple BTC asset standards. Not all of the DeFi apps mentioned above are true native BTC dApps so in this post let’s explore the real native Bitcoin ecosystem.

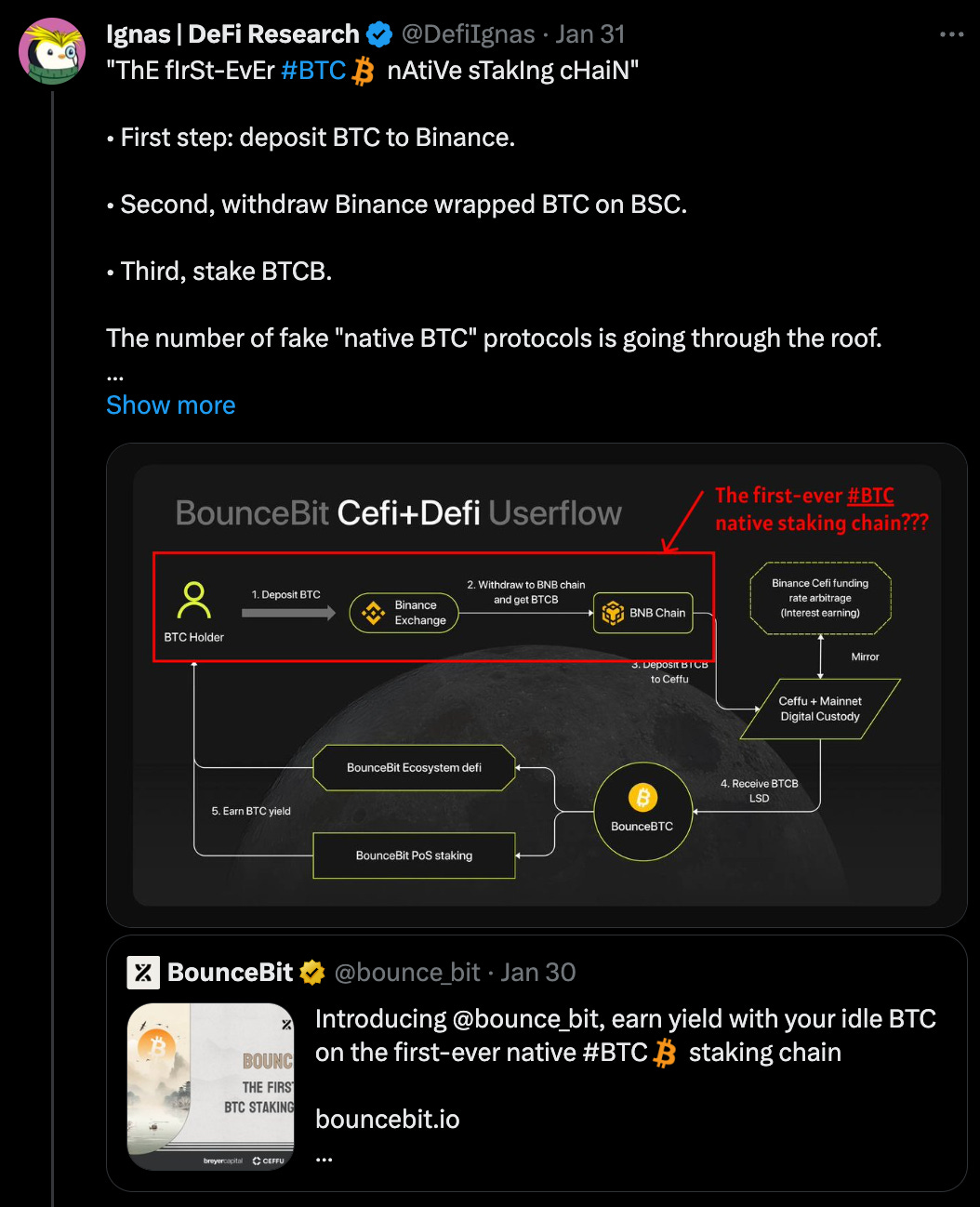

Building on Bitcoin requires specific knowledge, and only a few protocols come to fruition. In this tweet by Wazz, all the mentioned protocols are ERC20 tokens. As numerous fake Bitcoin or BTC L2s continue to launch they will also claim to be on Bitcoin, even though they are not.

Let’s start exploring the Bitcoin-verse.

Xverse/Unisat, OKX Web3: Bitcoin wallets

My three wallets. Xverse is my main one, but some websites don’t support it.

When you download and install it on your PC or mobile device from here, you'll notice that it provides you with three addresses:

1) Bitcoin address: This is a funding wallet used for purchasing Ordinals.

2) Ordinals & BRC20 wallet: Here, you receive and store Ordinals.

3) Optional Stacks L2 wallet.

Unisat (download here) is useful if you plan to trade Atomical ARC-20 tokens.

I use Xverse and Unisat wallets.

OKx Web3 wallet is cool for transferring BTC between your Nested SegWit, Taproot, and native SegWit bitcoin addresses. Don’t worry if you don’t know what it means for now.

Asigna.btc - Multisig Wallet

If you want to complicate (secure) your life more, you can use your Ledger to create a multisig for Ordinals, BRC20s, TAP, and Bitcoin.

Check it out here.

Saturn - Trade Rare Sat

Saturn is the first non-custodial peer-to-peer orderbook for Satoshis.

You can trade individual satoshis for other satoshis. But why, dear Ignas, would I want to do that?!

You see, each satoshi can be unique or “rare” depending on its prominence.

Rare satoshis attracted interest among collectors due to their unique characteristics and historical significance, categorized by rarity levels.

This fascination is a growing niche markets with enthusiasts (or degens) keen on securing satoshis that carry a unique story or value beyond their monetary worth.

Some rare or exotic sats:

- Mythic: The first sat of the genesis block.

- Epic: The first sat of each halving epoch.

- Pizza: Sats involved in the famous pizza transaction from 2010.

- Hitman: Sats involved in the transaction made by Ross Ulbricht to hire a hitman.

- Silkroad: Sats seized from Silk Road and auctioned off on June 27, 2014 by US Marshals.

For example, a Black Rare Sat sold for $165k USD (3.9 BTC), making it the highest sale ever for a rare sat.

Or each Pizza Ninja Ordinal NFT comes with Pizza Sats bundled together.

Don’t you get a weird memecoin potential while reading this?

Saturn last week airdropped $RUG token to Ordinal NFT communities, and Saturn early users. RUG is built on the new “Rings token standard”. The main feature of it is ability to distribute tokens for free on BTC chain.

As you can see, fungible token standards are wide and varied.

There’s a great guide by Xverse Wallet on how to start trading. I would appreciate if you used my ref link.

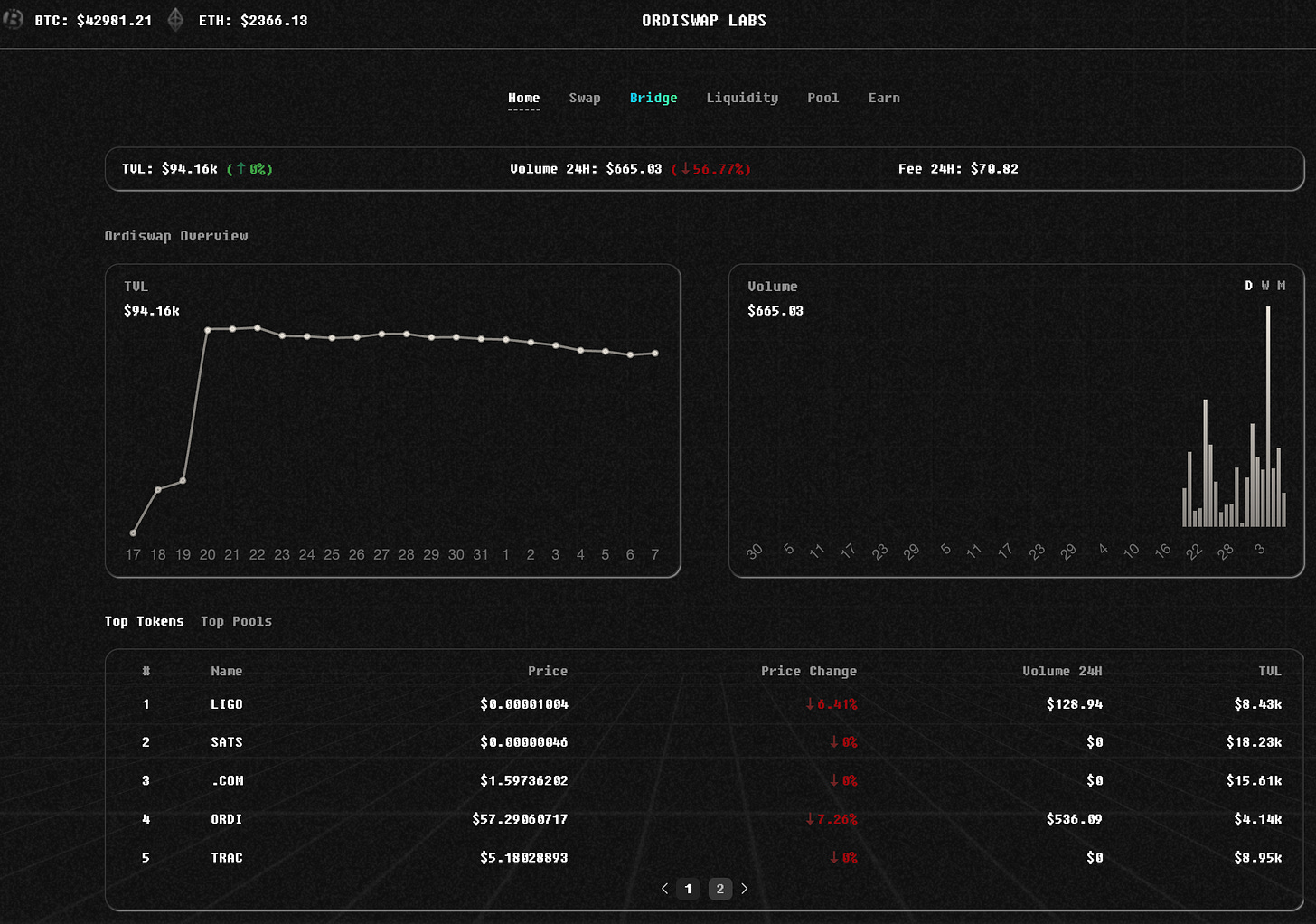

Ordiswap - The Name Says It All.

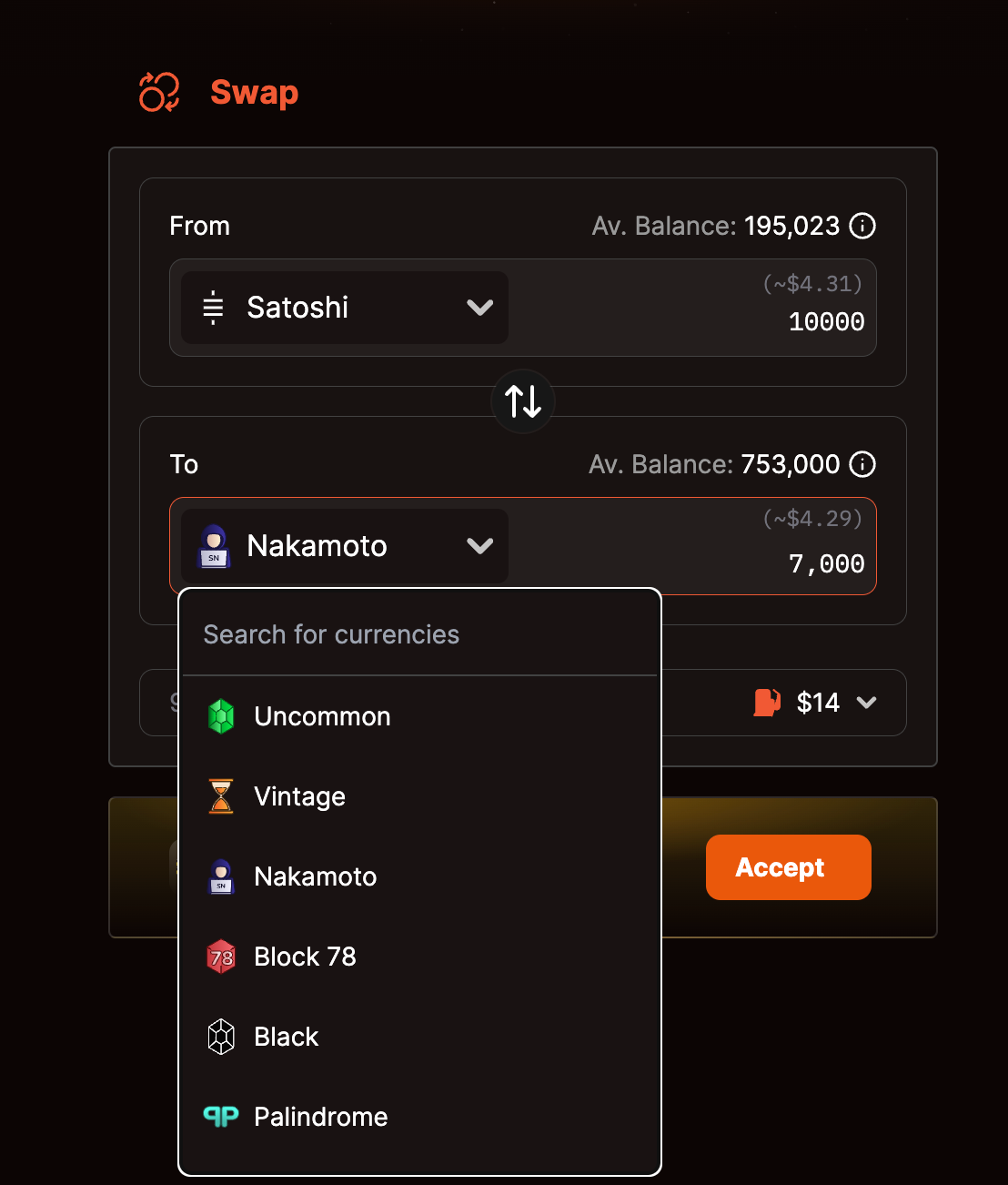

It’s like Uniswap but for BRC20 tokens. You can swap, add liquidity and bridge BRC20

As you can see, liquidity is very low ($94k) and volumes are almost non-existent. I’d say go farm for an airdrop, but the ORDS token is already out.

They don’t support Xverse yet as well, so you’ll need Unisat or OKX Web3 Wallet.

To be honest, my txs failed while testing but the V2 with multiple improvements is coming.

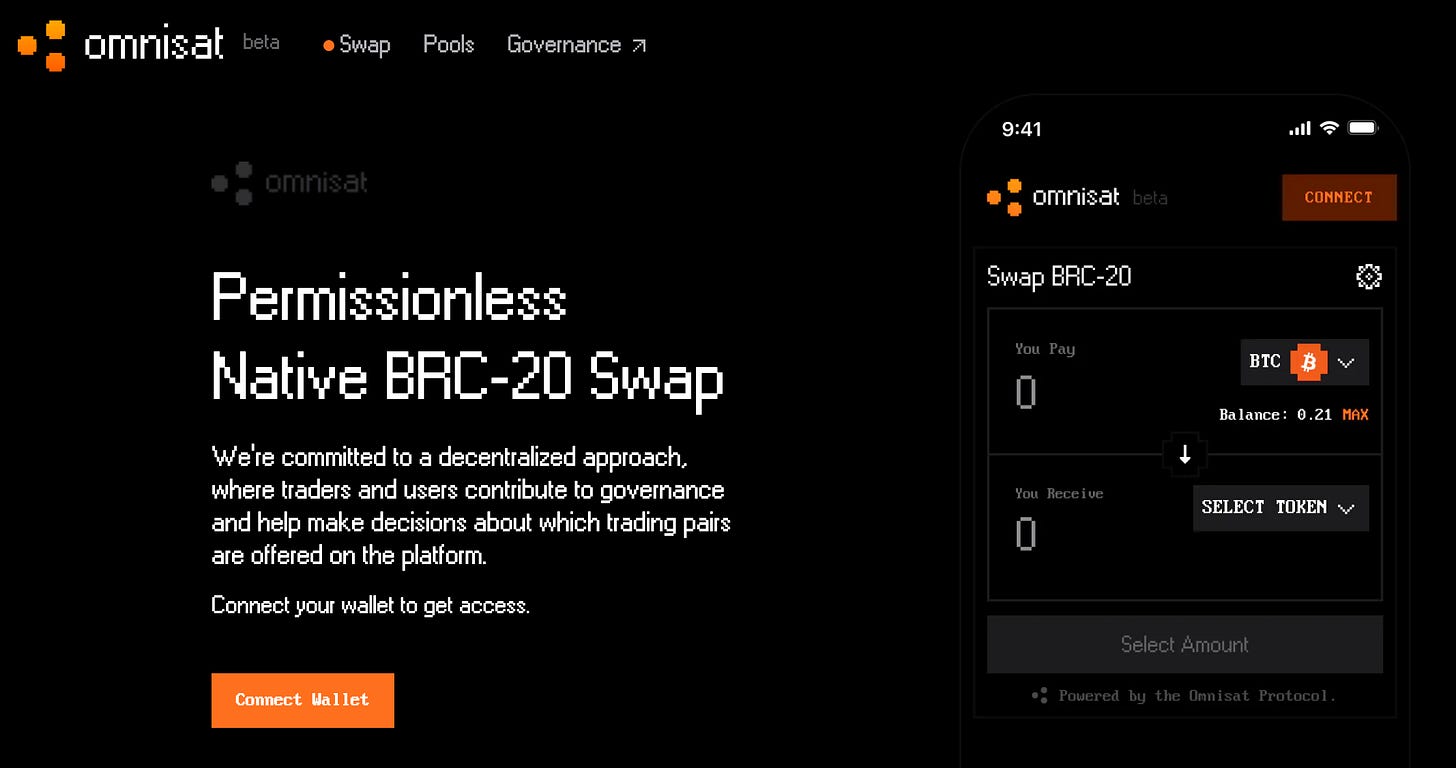

Omnisat - DEX

You can try it for free as it’s currently on testnet. And I would try because airdrop is possible. Like on Omniswap, you can swap BRC-20s and provide liquidity.

How to try it out:

- Get your Xverse or Unisat wallet to testnet in settings.

- Go to Omnisat page here.

- Click on “Get Testnet BTC”. Try a few until it works.

- Swap some BTC for a BRC20 token.

- Provide some liquidity.

BitSmiley - MakerDAO of Bitcoin

bitSmiley allows minting an over-collateralized stablecoin: bitUSD (based on its bitRC-20 standard). Backed by OKx Ventures.

It’s the first bitcoin native stablecoin. Ambitions are immense as BTC is volatile for payments, so stablecoins are used instead.

But that’s not all. They’ll also launch:

- bitLending a Bitcoin-native peer-to-peer lending protocol.

- Credit Default Swaps (CDS) this entails bundling similar loans and evaluating credit defaults based on default rates.

The protocol is not live, but speculation on the token is with two NFTs

- bit Disc Gold : Limited to 100 NFTs, offering exclusive perks. Invitation only.

- bit Disc Black : Early access to bitSmiley and a token airdrop. Key missing point is what % of the total token supply will be airdropped to Disc holders.

Can buy NFTs on OKx Marketplace or MagicEden.

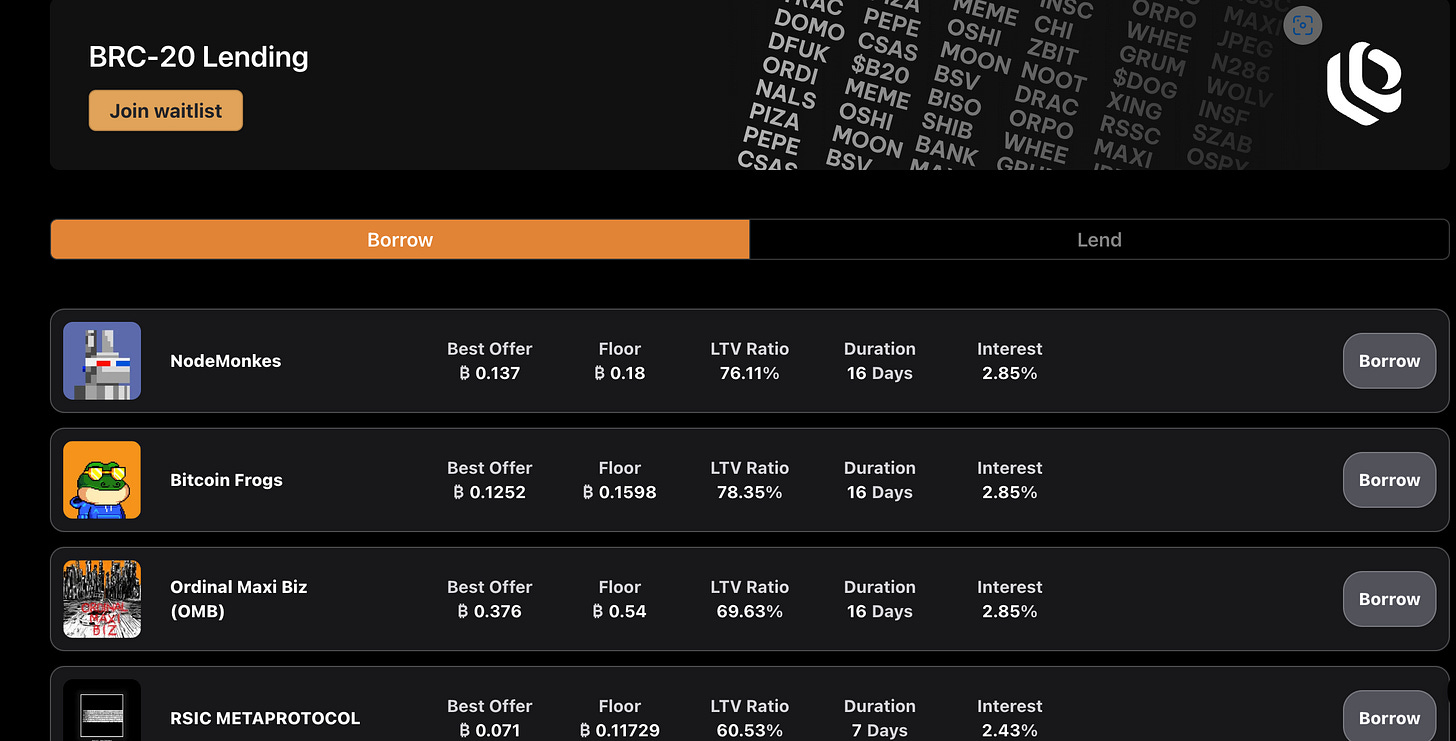

Liquidium - Ordinal Lending place

Liquidium is also simple to understand. You can borrow BTC if you hold expensive Ordinals. Or borrow “expensive” NFTs to short them.

The lending mechanism is supported by Partially Signed Bitcoin Transactions (PSBT) and Discrete Log Contracts (DLC). I shared it to sound smart, but not sure how it works in detail lol.

Liquidium has raise $1.25M in pre-seed investment showing that VC interest in the space is growing.

You can submit a waitlist to join with the link in their website here.

Bitmap & Bitmap Tech - Metaverse and the L2

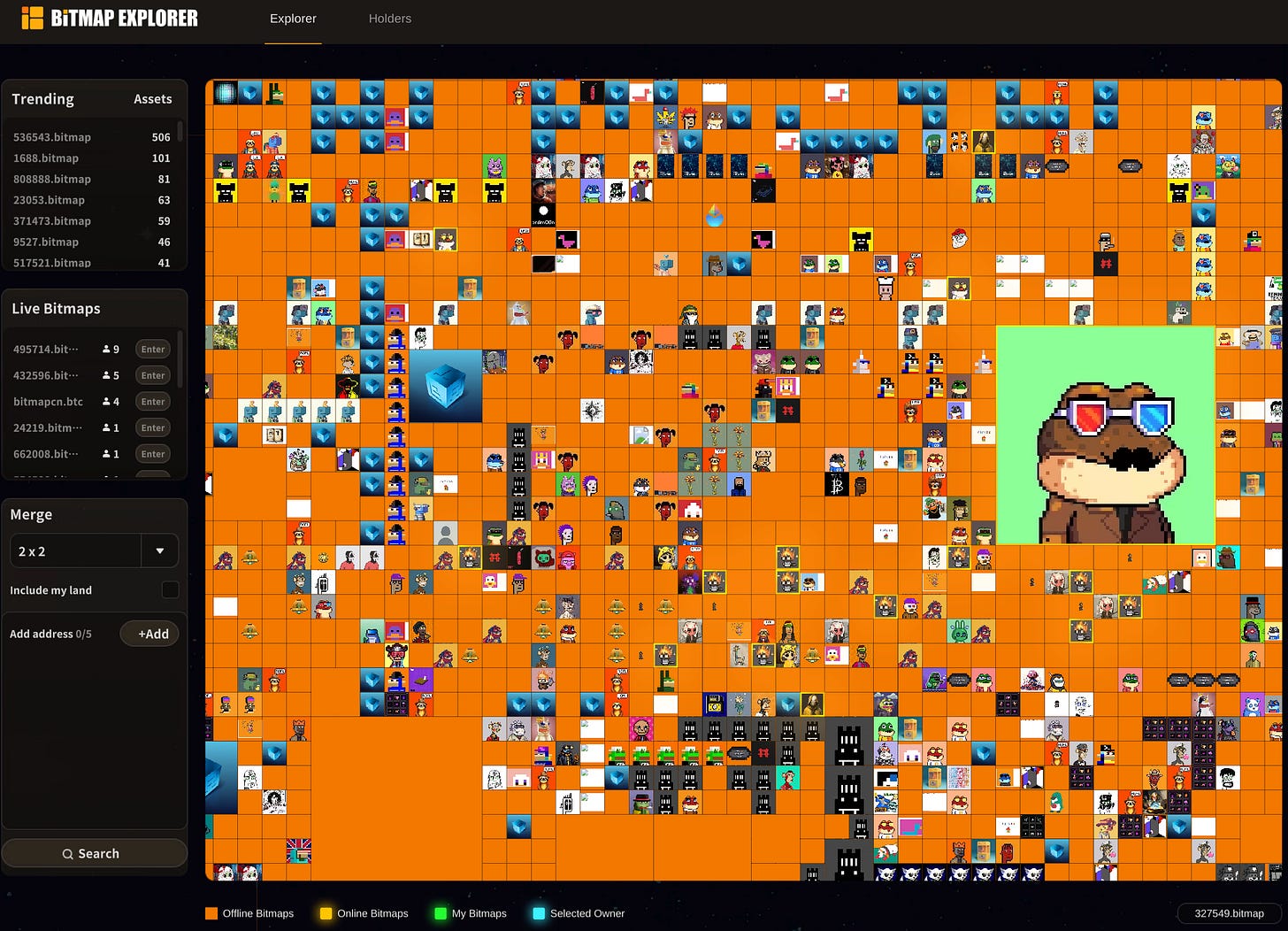

You must’ve seen the below Ordinal on Magic Eden or even on Bitcoin explorer here.

309915.bitmap - Bitcoin block transactions inscribed on individual satoshi Bitmap allows to claim the geospatial digital real estate of a Bitcoin Block by inscribing blocknumber.bitmap unto a Satoshi.

Bitmap transforms Bitcoin's blockchain data into a spatial land. So, it turns them into parcels of a virtual land like The Sandbox is doing on Ethereum. These bitmaps trade for $275 USD each, but bitmaps can be “Rare sats”, costing > 0.5 BTC. Here's a great thread on X explaining it.

The creator of Bitmap is blockamoto.

Then other teams can built on top. Bitmap tech, for example, let’s you to put your JPEG on the map, but Bitmap Tech goes further than that.

Bitmap Tech invented BRC420 token, introducing complex, monetizable asset formats for the Metaverse within the Ordinals ecosystem, supporting 2D and 3D inscriptions. Even games themselves. It allows creators to set usage rights and royalties.

The first BRC420 minted by the team, called “Blue Boxes” are selling for $33K USD each! It’s a bet on it becoming the new ORDI of BRC20. But there’s another explanation for the high price.

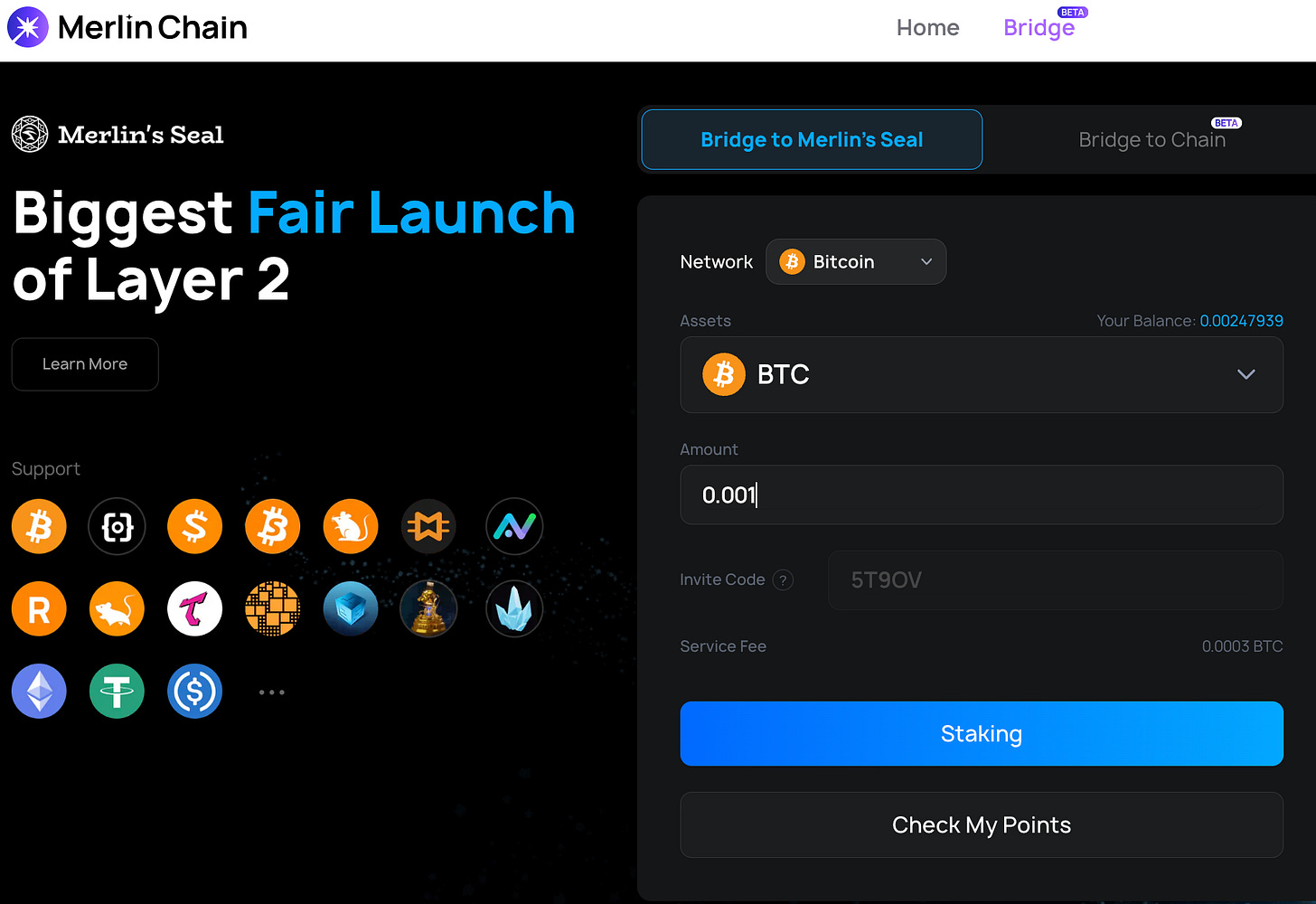

Bitmap is launching an Zk-rollup L2 on Bitcoin, Merlin Chain, and is running a liquidity mining/airdrop campaign for 20% of all tokens.

You can stake native BTC, BRC20 tokens, these Bitmap Ordinals, and “Blue Boxes” to get points. Ethereum and Arbitrum’s ETH/stables are also supported.

At first, I was sceptical as you can’t withdraw until April and I got rekt on Manta’s similar scheme. But OKx ventures announced investment and TVL grew to $530M in just 1 day! DYOR and read the details here.

You can join my team with invite code: 5T9OV. If you need a code, ask me in the comments or DMs on X.

The Bitcoin L2 narrative is picking up fast, but there are many wannabe L2s and things are more complicated that I thought.

I’ll talk more about Bitcoin L2s in the future posts so make sure to subscribe.

Now, let’s talk about the next big meta in BTCFi - speculation & airdrops related to Runes protocol.

Runes Protocol - The Next Big Thing on Bitcoin.

In this interview (recommend watching) Casey (creator of Ordinals theory) said that “Runes is an attempt to bring that speculation, gambling and fun to Bitcoin.” So, the fun times are coming.

The protocol will be live at the first Bitcoin halving block, sometime in April. But speculation is already here.

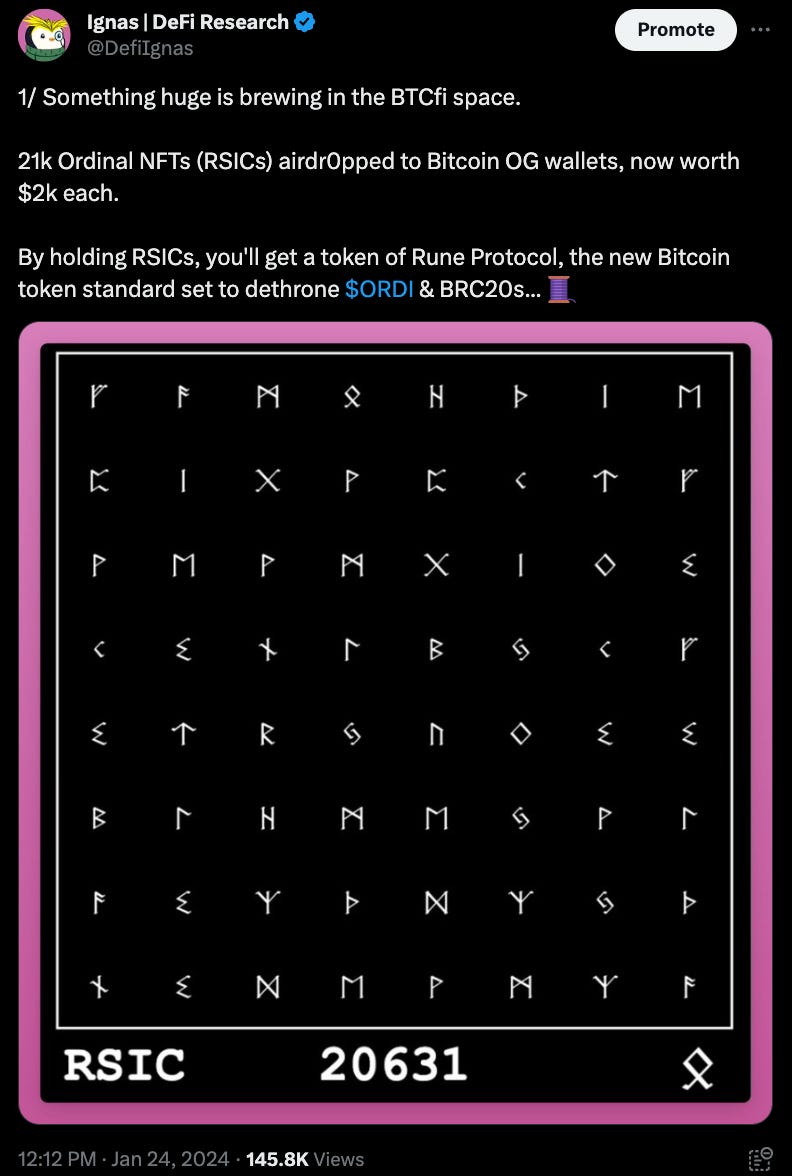

These mysterious RSIC NFTs dropped to Ordinal collectors’ wallets. They quickly pumped 10x and then dropping to $3.2k each as degens speculated it will become the first ever Rune token.

The game here is to hold them and “mine” Rune tokens. Check on how it works in this cheat sheet.

During that interview on February 8th, Casey mentioned the possibility of personally inscribing the first 10 Rune tokens. This statement caused a big drop in RSIC price.

What’s more, the Ordinal community expressed dissatisfaction with RSIC due to the RISC team retaining 10% of the token supply and unclear airdrop criteria.

In response, an ordfluencer Leonidas spearheaded an airdrop campaign for Runestone tokens, distributing them to over 100K wallets held by individuals with 3+ Ordinals.

At present, it’s unclear which protocol will emerge as the top token. But Casey's plan to inscribe the initial 10 Rune tokens has diminished some of the hype…

So, why am I writing about this?!

- First, Rune’s protocol will restart the BTCFi hype during the Bitcoin halving. I want you to have a least basic understanding on what’s happening!

- Secondly, there’s finally a reward system for holding specific assets. Either BRC20s for mining Merlin Chain L2 tokens or receiving many-to-come airdrops.

- Finally, the complexity of the OrdFi/BTCFi offers many opportunities for those willing to learn! Crypto Twitter is late to this meta. Dominated by English speakers, CT is absolutely confused, and the narrative is led by Chinese/Japanese Will they dump on Westerners this time? And Koreans, where are you?

I’ll be honest. Bitcoin DeFi ecosystem is in early stages, buggy, and isn’t easy to use. But here’s where opportunities are.

My advice is to get a bitcoin wallet, consider checking Ordinal NFTs on Magic Eden, try using native BTC dApps (Omnisat on Testnet is free!), maybe farm some Merlin Chain L2 tokens, but most importantly, try to keep up to date on Rune’s protocol.

I believe that the first 10 Runes token are going to print. In the future, I’ll cover Bitcoin L2s, so make sure to subscribe.