Liquid staking tokens (LSTs) are all the rage around Ethereum lately.

You’ve heard of the big players here, like Lido (stETH), Rocket Pool (rETH), and Coinbase (cbETH) – these LSTs let users maintain liquidity and earn ETH staking rewards without the trouble of having to run their own validator setups.

The general promise? Deposit ETH to receive an LST that represents your deposit, then hold or use the LST as you please, all while it accrues ETH staking yields over time.

Plenty of platforms have sprung up by following that formula, but right now, in LST circles, there’s major excitement growing around restaking, a technique popularized by EigenLayer. Restaking uses LST deposits to extend validator services to projects that want external security infrastructure.

It’s a win-win model: depositors can earn ETH staking yields plus validation revenues from projects that tap EigenLayer, while these projects get to adopt Ethereum’s decentralization and security without having to create their own trust networks.

The catch? In these early days, EigenLayer enforces LST deposit caps, and so far, whenever the caps have been raised, the limits have been quickly reached. This dynamic isn’t surprising, as there’s currently huge anticipation around a future EigenLayer airdrop.

The good news? There’s a workaround. EigenLayer also offers native restaking, which is the ability to deploy actual validators through EigenLayer, for which there are, intriguingly, no deposit caps.

The even better news? There are projects out there that streamline native restaking, effectively turning the process into a single deposit. One such project of note here is ether.fi

Launched in 2023, ether.fi has created eETH, an LST that's underlying ETH deposits are natively restaked through EigenLayer. On top of staking rewards and the possibility of using eETH in DeFi, this looping flow allows depositors to simultaneously earn ether.fi Loyalty Points and EigenLayer Restaked Points, both of which presumably have airdrop eligibility implications.

Pretty interesting, right?

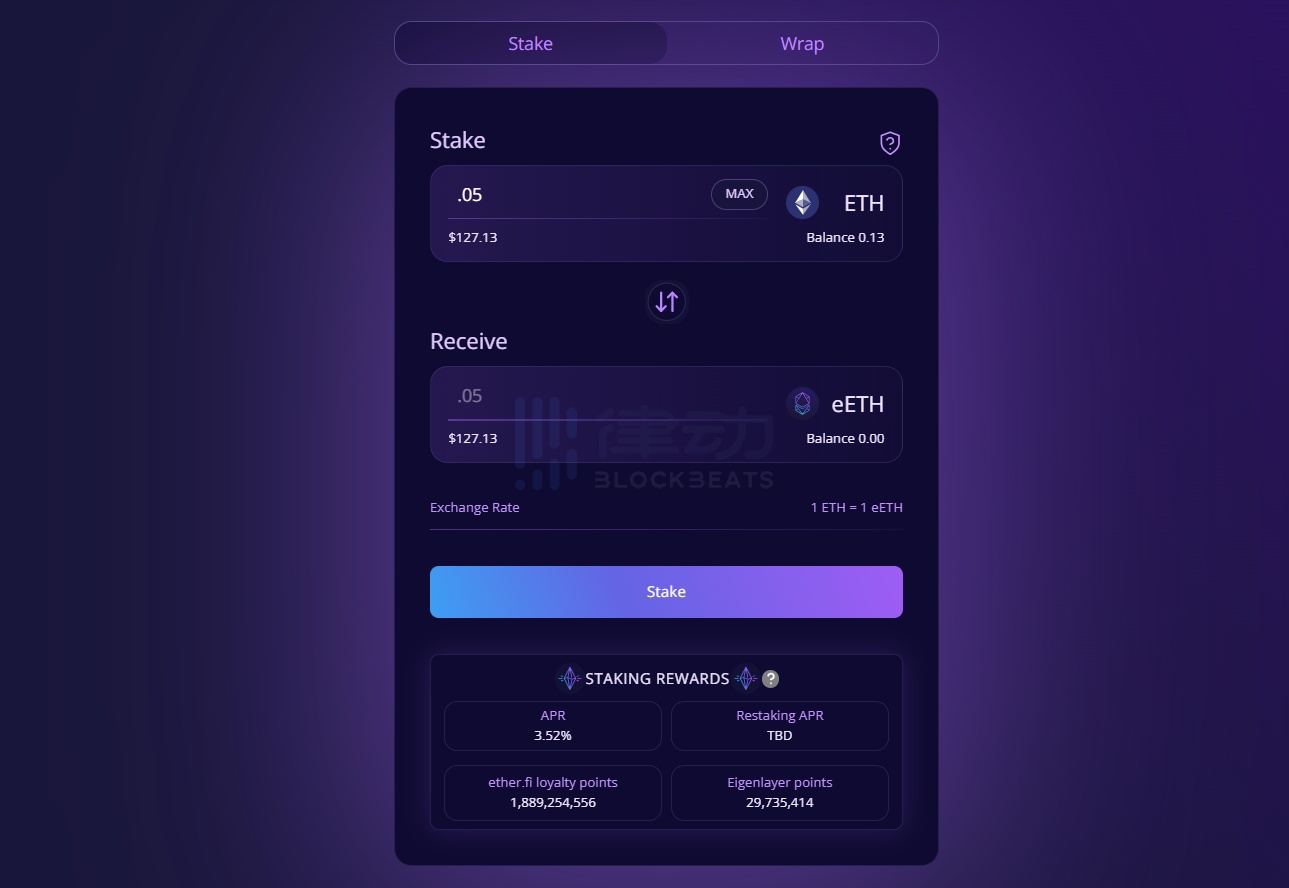

Take note, then, as capitalizing on this opportunity is straightforward. You simply deposit ETH (minimum = 0.001 ETH) to mint eETH on a 1:1 basis, at which point your eETH balance will start racking up points. The flow looks like this:

- 🌐 Head to app.ether.fi

- 👛 Connect your wallet

- 🪙 Input your desired deposit amount in the UI

- ⏩ Press “Stake”

- ✅ Sign the stake transaction with your wallet

Voila, that’s all it takes to get started with the ether.fi x2 points maneuver! Keep in mind that you can unstake and withdraw your ETH through this same interface; just click the arrow button in the middle of the UI to enter “Withdraw” mode to begin.

As for your points, you can track both your ether.fi and EigenLayer scores over time through the app.ether.fi/portfolio page. The ether.fi points formula is ETH staked x 1,000 x days staked, so for example, 1 ETH staked for one week will fetch you 7,000 points.

Whatever happens next in crypto, restaking is here to stay, so don’t sleep on “double whammy” restaking projects like ether.fi where you can maximize your rewards with a single deposit.