Last month, Filecoin introduced the launch of FVM - the most ambitious development in the history of the 2.5 year old protocol known for its market leadership in the storage market.

This month, our team at Blockcrunch broke down what this means in an exclusive 30-page report, commissioned by Protocol Labs. Below, we will cover:

- Recap of Filecoin’s History

- 2020-2022 Quantitative Review of Filecoin

- Current Use Case Highlights

- Will $FIL Be Deflationary? Token and Inflation Simulations

- Competitive Breakdown

Let’s dive in.

THE FILECOIN STORY SO FAR

Perhaps the most common misconception about Filecoin is that it is “Dropbox, but on a blockchain”.

In fact, Filecoin’s origins are much broader in scope. Filecoin was created in 2014 by Juan Benet and his team at Protocol Labs based on a simple but grand premise: to decentralize the internet.

While the internet was created to be decentralized and not owned by any entity or person, it has been moving toward centralization over the past decade as content and connectivity are being concentrated into a small set of providers. According to Synergy Research Group, three cloud infrastructure service providers i.e. Amazon AWS, Microsoft Azure, and Google Cloud, own 66% of the market share in 2022.

For context, when a computer accesses a website on the internet, it’s accessing a set of files stored on a storage network. To illustrate, this report was uploaded to Substack’s storage provider, and for Alice to read it, it was sent from the storage provider over the internet and displayed on Alice’s browser. With cloud infrastructure providers playing such a pivotal role in storing data and disseminating them to users worldwide, the concentration of such providers is troubling as it introduces single point of failure risks such as loss of data and service stoppages/downtimes. For example, when Amazon Web Services went down in Dec 2021, it took out popular sites like Disney+ and Vice, and other times Twitch, Reddit, Shopify and even Amazon itself.

When only a small group of providers dominate the industry, they have little incentive to compete on price since they have greater bargaining power than the users, and users end up paying higher costs. Also, users are subjected to the censorship rules of centralized storage providers and may lose access to their data or be de-platformed – while such instances are rare, it has enormous consequences and goes against the ethos of an “open internet” intended by the inventor of the World Wide Web Tim Berners Lee.

Path to decentralizing the internet

Filecoin is building an economy for open data services on top of the InterPlanetary File System (IPFS).

Developed by Protocol Labs, IPFS is a peer-to-peer hypermedia protocol that allows users to store and access verifiable content-addressed data, wherein data files are stored by participating nodes and assigned and accessed via their unique cryptographic hash known as Content Identifiers (CID), instead of using a traditional address (like http://protocol.ai). This means that files will remain available on the Internet as long as one node of the IPFS network has the file in its cache. IPFS nodes can be operated by anyone (e.g. individuals, companies, non-profit organizations), and node operators can pin a file to keep it retrievable via IPFS (Pinning is the process of instructing the node to keep a file in a local cache indefinitely). This is intended to keep the web open and resilient.

However, one may encounter 2 challenges when storing data on IPFS.

- Without built-in mechanisms to incentivize nodes to store data for other people, there’s no guarantee that stored data will be available and not deleted since it relies on altruistic volunteers (i.e. data stored today, might not continue to be stored weeks or months from now)

- Even when paying for centralized pinning services for data storage, users must trust that these providers do their job since there are no built-in provisions to verify that data is being stored and correctly provided

In short, while IPFS guarantees that any content on the network is discoverable, it doesn’t guarantee that any content is persistently available nor accurately stored. IPFS was designed to be upgradeable however, with a “narrow-waist” around its core of content addressing. This means that specific IPFS implementations or complementary protocols can be built to solve those challenges, such as an incentivized storage network on top of IPFS. This is where Filecoin comes in.

Filecoin is a complementary protocol built on top of IPFS that adds longer-term data persistence using a built-in crypto-economic model to incentivize data storage providers, ensuring that data is verifiably safely stored and stays available for retrieval over time.

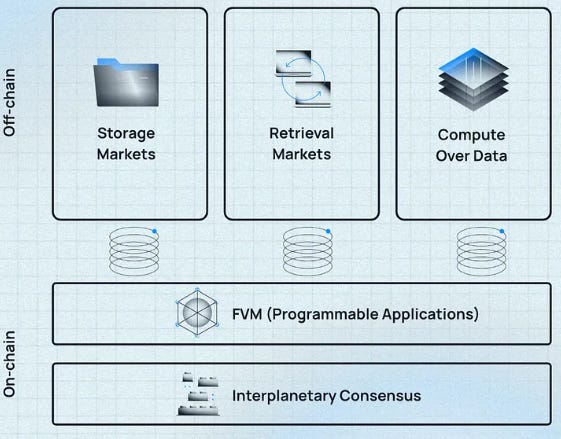

Today, Filecoin focuses primarily on storage as an open service, but that is only the first of three pillars that will support Filecoin’s grand vision. To allow for more complex applications and services required to support the decentralization of the internet, Filecoin has 2 core upgrades which the report discusses in a later segment.

Filecoin’s first pillar – Storage

Filecoin has a decentralized network of storage providers, in which anyone with the necessary hardware can join to provide storage services. To store data on Filecoin, users enter storage deals with these storage providers, where users pay them a fee to store data for a specified period of time. Users enter these deals either by communicating with the providers directly or via applications like Chainsafe, Estuary, that require no technical setup

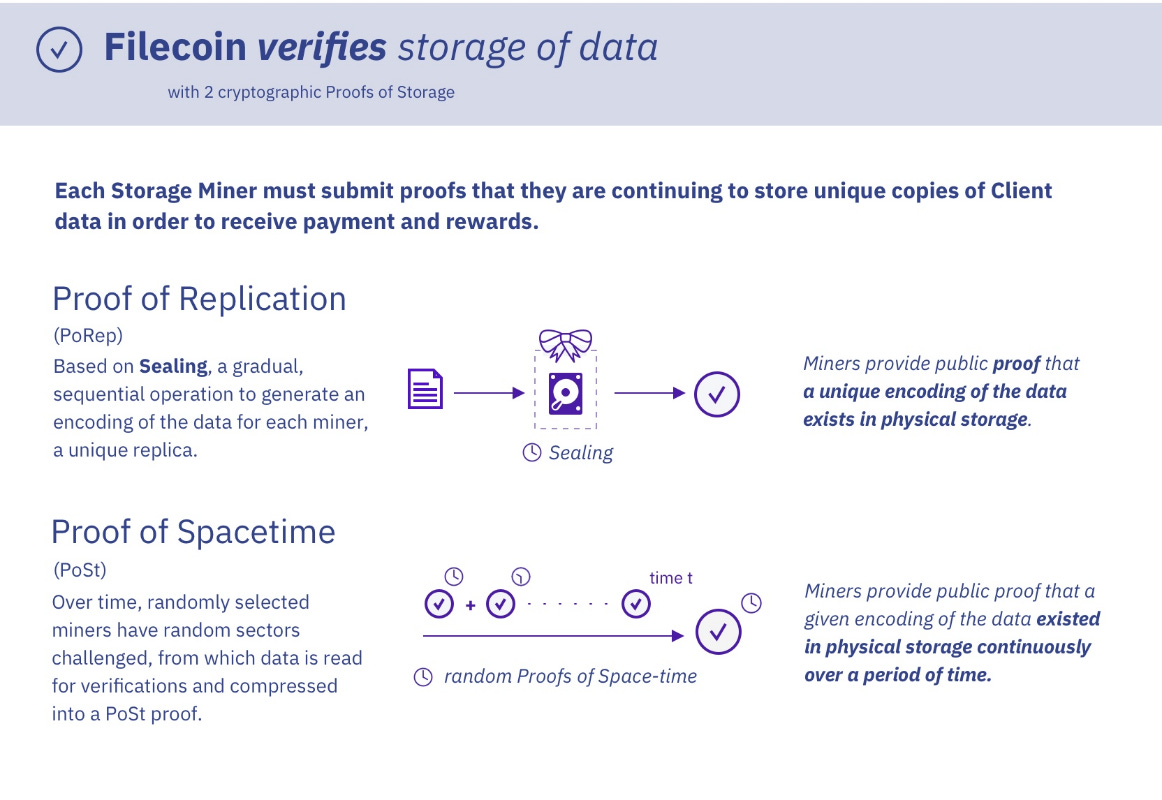

Rather than relying on the service provider’s reputation for assurance like you would with centralized providers, Filecoin uses cryptographic proofs that allows users to verify that their files are correctly stored by checking the Filecoin blockchain. Storage providers are required to submit these over the lifetime of the deal:

- Proof of Replication: storage providers demonstrate that they have received and stored all the data in a way unique to that storage provider. Unique encoding ensures that two deals for the same data cannot end up reusing the same disk

- Proof of Spacetime: submitted by providers every 24 hours to prove that they are continuing to dedicate storage space to that same data throughout the lifetime of the deal

Storage is also trustless, as the Filecoin network uses these proofs alongside crypto-economic incentives to ensure that storage providers keep up to their end of the deal – storage providers are rewarded with FIL tokens for submitting the proofs, and penalized by having their staked tokens slashed when they fail to do so.

Readers should also note that the cryptographic proofs are what is on-chain, and data is stored off-chain.

Before the launch of Filecoin Virtual Machine, the Filecoin network was best suited for cold storage i.e. files stored are usually huge and don’t need to be accessed regularly. For those that require frequent file access but still want storage guarantees, such as video recordings of online conferences, storage providers may couple cold archival with hot caching in IPFS for efficient distribution. - Huddle01, a decentralized video-conferencing platform leverages Filecoin and IPFS in this manner.

However, storage providers hot caching those files alone on IPFS may not be sufficient to meet the latency required in certain use cases such as video streaming – and that’s where the 2nd pillar, Retrieval comes in.

Filecoin’s second pillar – Retrieval

Low latency in data retrieval is required in many use cases, such as delivering this research memo on Substack to readers, songs on Spotify, or videos on Netflix since it affects the users’ experience – a study found that website conversion rates drop by an average of 4.42% with each additional second of load time.

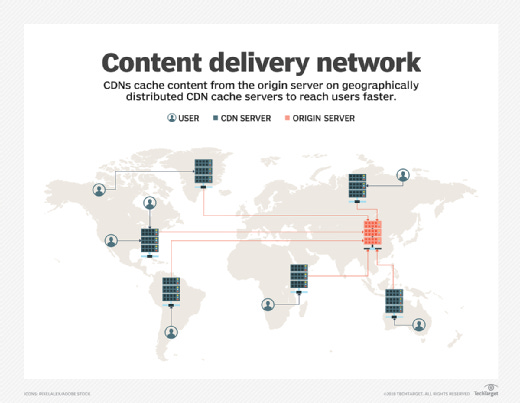

Group of servers known as content delivery networks (CDNs) work together to provide fast delivery of internet content. These servers replicate the data from an origin server and are distributed globally to minimize the physical distance between the user and the server to achieve the low latency required for speedier content loading.

Currently, the CDN provider market is extremely centralized, with the largest provider CloudFlare supporting up to 80% of websites that rely on CDNs, and only 7 CDN providers serve most of the market. The concentration of service providers is an issue because many sites could go down together during outages, such as when the Fastly outage in June 2021 took down Amazon, Twitch, Reddit and Paypal, and the Cloudflare outage a year later that took down crypto exchanges such as FTX, OKX and popular communication platform Discord.

However, the CDN market is a highly competitive space in which economies of scale dominate – the larger CDN providers can offer prices that are impossible for smaller CDN enterprises to compete with.

Furthermore, latency is still an issue in regions outside of the US, where most of the centralized CDN servers are based as data packets have further to travel, causing buffer latencies (referred to as speed of light problem). It is impossible for smaller, individual CDN providers to compete internationally since they do not have the financial resources required for global coverage – a feat that is impossible until Filecoin.

Filecoin’s unique infrastructure based on verifiable content-addressed data allows decentralized CDNs to be built, wherein anyone can join as a node to serve content. Paired with crypto-economic incentives to bootstrap nodes, a robust decentralized CDN network across the world can be created to compete with large centralized providers in terms of cost and performance i.e. data can be delivered to internet users worldwide with lower cost, latency, and outage risks.

For example, Protocol Labs founded Filecoin Saturn, its own decentralized CDN network in 2022 to accelerate retrievals of media files from the Filecoin Network. Anyone is allowed to join and contribute to the network and in return, they’d earn FIL in rewards. To date, more than 800 global node providers have joined the network, which is more than 2x the number in December 2022. Project Saturn is currently in its open beta test with smart-contract enabled payments planned by May 2023.

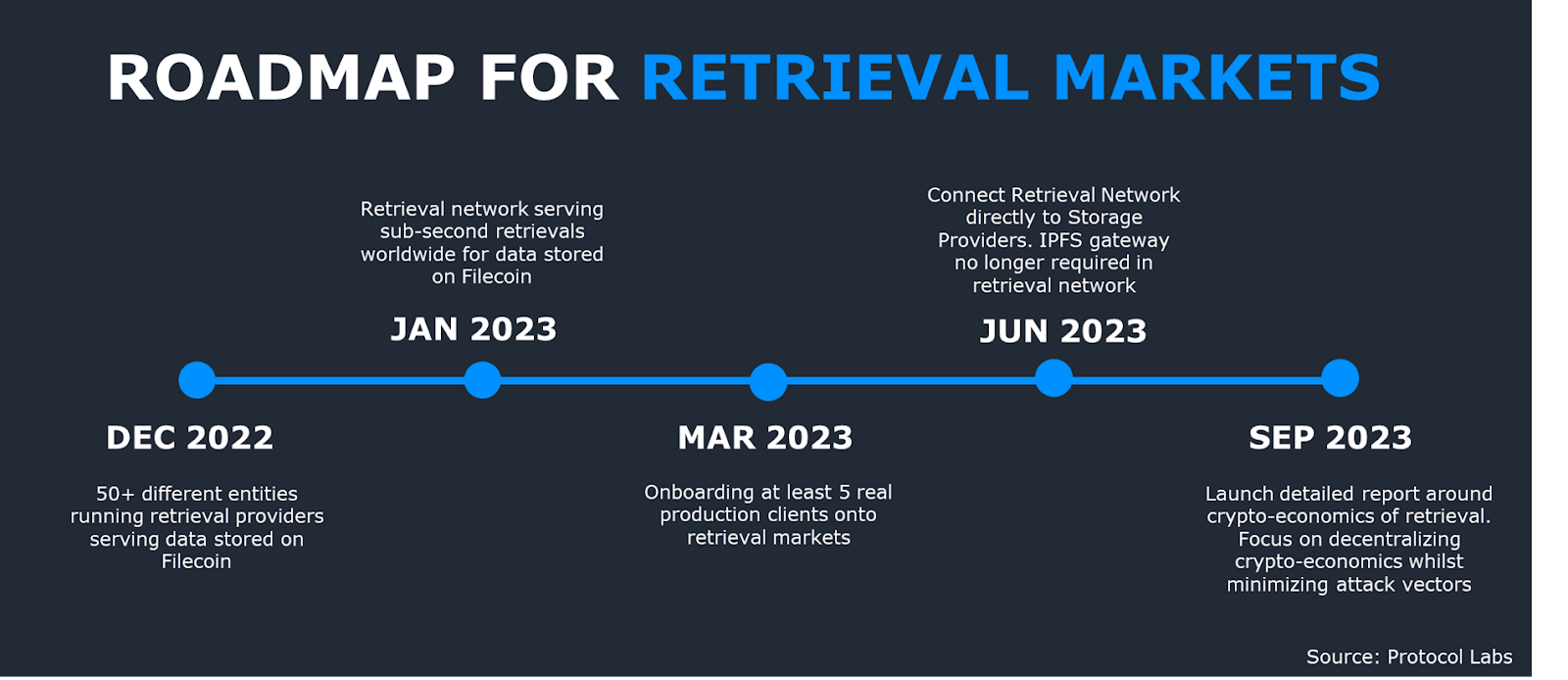

Overall, Protocol Labs is working on setting up a functional Retrievals Market by the end of 2023; complete with crypto-economics to incentivize network participation as they did with the Storage Markets. A key development Protocol Labs is aiming to achieve by June 2023 is to connect the Retrieval Markets directly to Storage Providers and bypassing the need for the IPFS Gateway.

Filecoin’s third pillar – Computation

The third and last pillar of Filecoin’s open service is computation. When it comes to data, other than storing and retrieving, users also want to be able to run computational work to transform the data.

One example where computation is essential is the big data sector. By 2025, the International Data Corporation predicts that the world will generate 175 zettabytes of data daily – that’s 175 trillion gigabytes or 50 times more data than we are generating today. These data may be analyzed to uncover critical insights that can help the world make better decisions and improve lives. However, the sheer size of big data makes them difficult, time-consuming and costly to handle and run computation work on, since data would need to be moved out of cold storage and or aggregated at one location before computation work can be done.

Filecoin is uniquely positioned to solve this issue because storage providers already own compute resources, specifically the hardware (GPUs, CPUs) required for them to generate and submit cryptographic proofs can also support computation work. Computing jobs can therefore run where the data is stored rather than having to move the data to external compute nodes. This is extremely critical in big data, as companies need not shift the data to a centralized storage location before running computation work which costs enormous amounts of time and money.

Several working groups are working on different types of computing on Filecoin.

For example, Lurk, a programming language that enables cryptographically verifiable compute with zero-knowledge proofs. Lurk also simplifies the development of zk-SNARK-based programs and can be integrated with Filecoin's Virtual Machine to enable application-specific, provable computations on the Filecoin blockchain. This allows for more secure and efficient smart contracts and data storage. In the long term, Lurk can improve Filecoin's scalability and flexibility through its potential application in Interplanetary Consensus

Another platform worth noting is Balcalhau which allows for large-scale parallel computing where data is generated and stored. It allows companies to improve their current workflows without major changes by using versatile tools called Docker containers and WebAssembly images. Bacalhau aims to revolutionize the way large data are handled, making it more cost-effective and efficient, while also making data processing accessible to more people. The ultimate goal is to build an open, cooperative computing environment that encourages incredible collaboration.

2020-2023: A TRACTION REVIEW

Data Storage Performance of the Filecoin Network

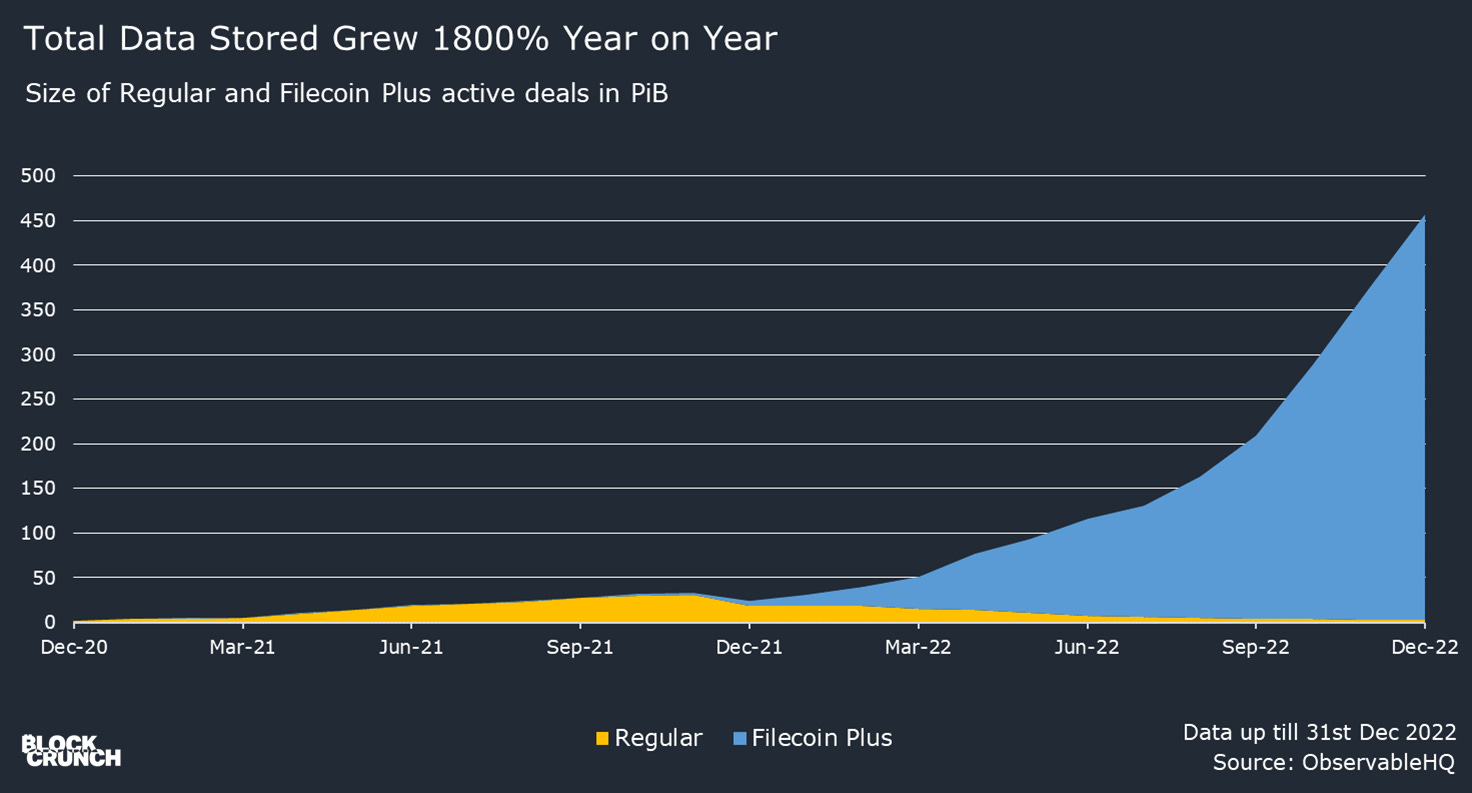

As of 31st December 2022, the Filecoin network stores 460 pebibytes (PiB) of data - for context, that is enough storage for 1 million years of songs and represents 97% of all data stored with decentralized storage providers. Compared to a year ago, that is 18x more data stored, and the impressive growth is attributed to the launch of Filecoin Plus, which accounts for 99% of the deals stored with Filecoin.

Filecoin Plus is an initiative where clients get to store large, useful datasets at a subsidized rate. Clients looking to onboard storage onto the network apply to a group of community-selected members known as Notaries, who are responsible for vetting and allocating a resource known as DataCap to the clients. The clients can then use the DataCap to subsidize their deals with storage providers.

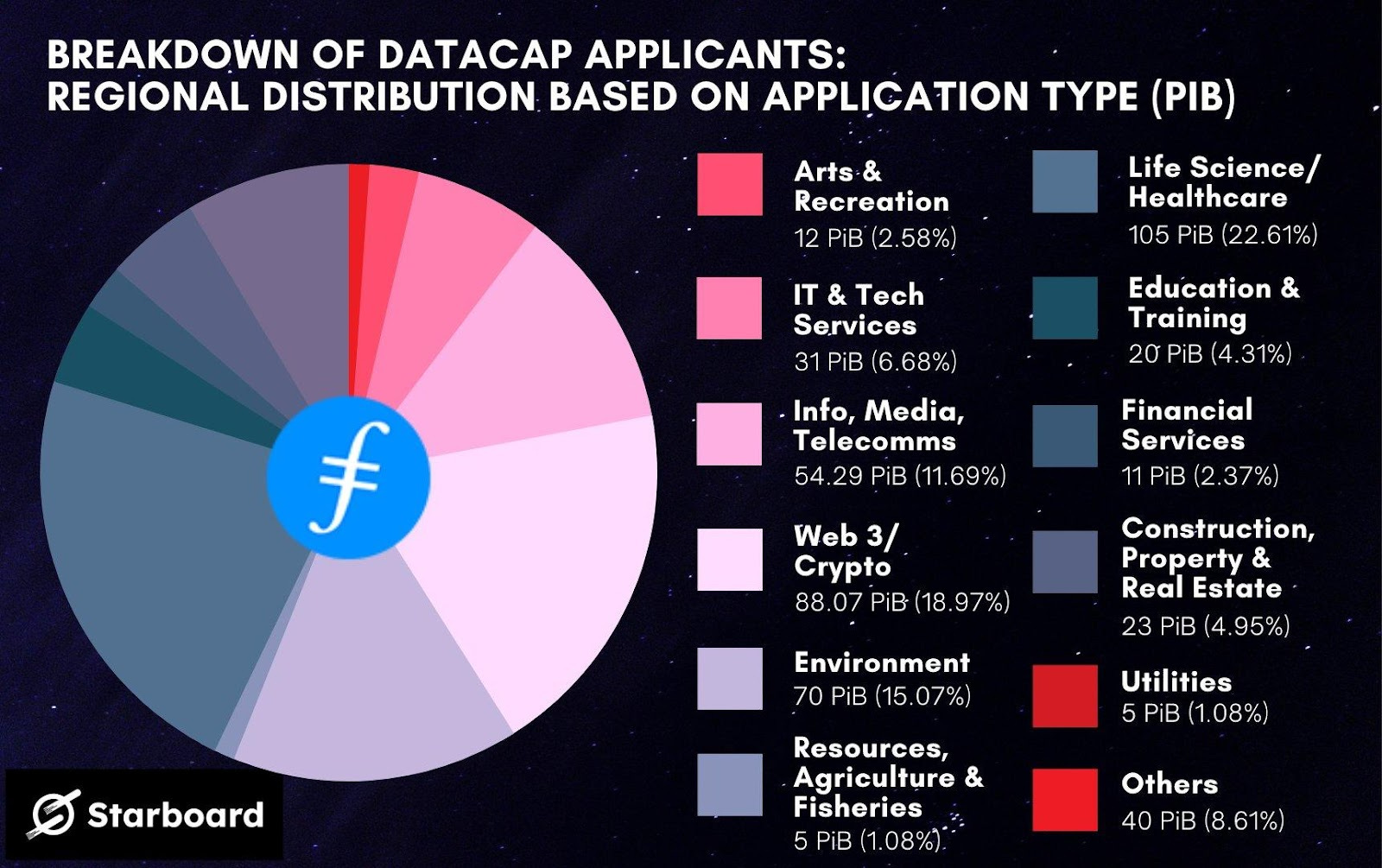

A diverse range of clients have onboarded the Filecoin Plus program, with Web 3/Crypto clients accounting for only 19% and the remaining 81% by Non-Crypto industries such as Life Science (22.6%) and Environment (15%). Some examples of Filecoin Plus clients include:

- National Oceanic and Atmospheric Administration (NOAA); storage for data produced by their satellite that are critical for weather forecasting

- National Aeronautics and Space Administration (NASA); stores collection of Earth science datasets, including climate change projections and satelitte images of Earth’s surface

- UC Berkeley Underground Physics Group; storage for neutrino research pertaining elements of the universe

- Ewesion; one of China’s fastest-growing platform for creative artists using Filecoin to store its photographs, illustrations and vectors

In return, storage providers receive a 10x boost to their quality-adjusted power for storage space offered in that deal, which increases the FIL token block rewards earned by the storage provider. Therefore, storage providers are incentivized to provide better services and lower storage costs (even free storage) to compete for Filecoin Plus storage deals.

In sum, the Filecoin Plus initiative can be described as killing 3 birds with 1 stone:

- Filecoin network receives higher network activity and persistent demand for block space for storing useful data

- Clients receive better service at extremely competitive rates

- Storage provider’s revenue increases from the increased FIL block rewards

Given that the active deals from Filecoin Plus overwhelmingly account for 99% of data stored on Filecoin today, it suffices to say that it has been successful at attracting more storage demand for the Filecoin network.

No. of Filecoin Clients Segmented by Size of Data Stored

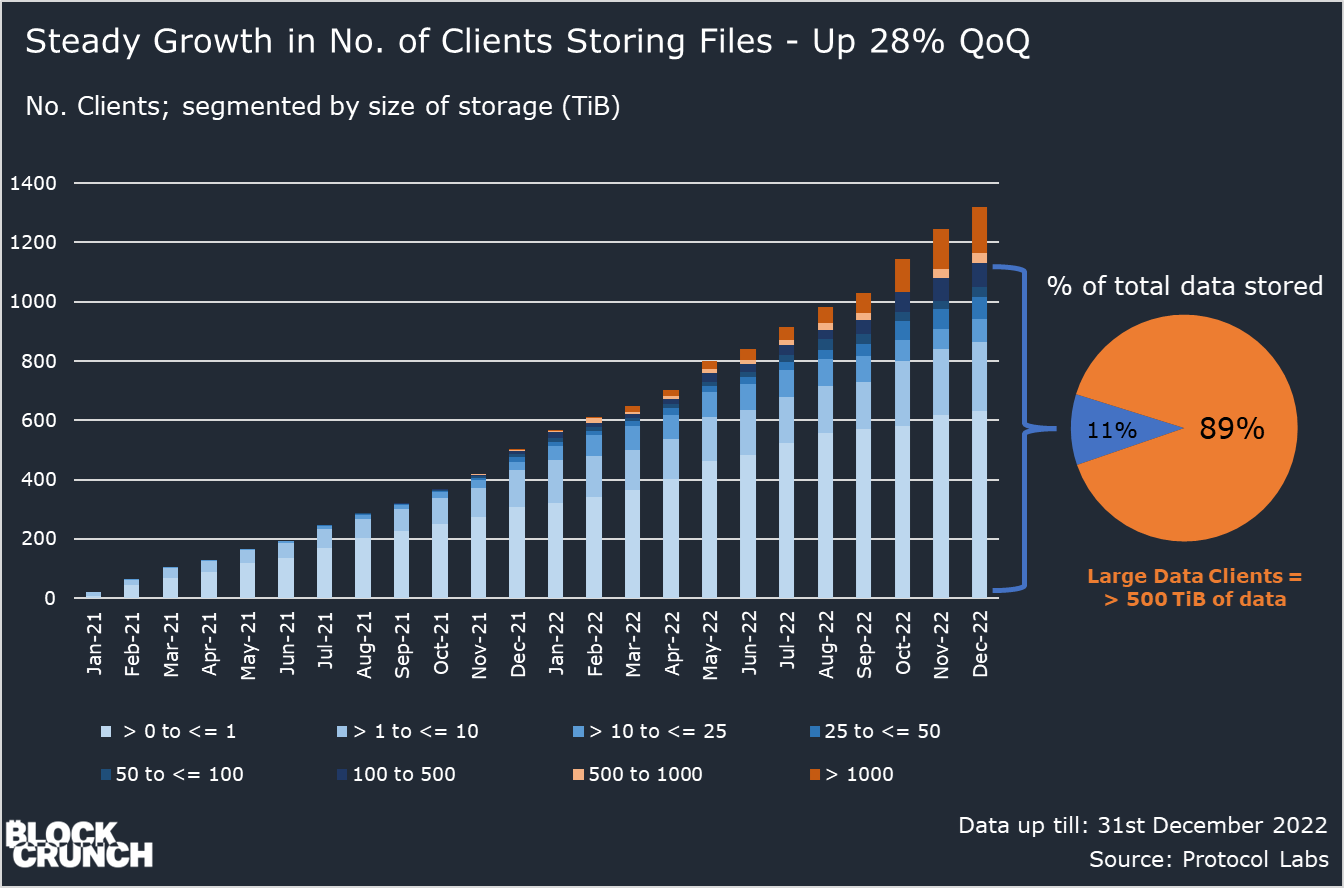

There has been a steady growth in the number of clients utilizing Filecoin for their storage purposes – 22% growth in the latest quarter to hit 1029 clients. Readers should note that the actual number of users is actually much higher, as applications like NFT.Storage and Web3.Storage that stores data on behalf of 20 – 50,000 users count as single clients

In the latest quarter, Filecoin onboarded 99 more large data clients (clients storing over 500 TiB) and serves 190 of them currently.

However, further research shows that large data clients account for most stored data. By our estimates, the 190 large data clients i.e. 14% of the total clients represented 89% of all data stored on Filecoin at the start of December. The concentration of data around large data clients is potentially an issue, as losing these clients (perhaps when their deal expires) would mean a significant loss of storage and network utilization. However, onboarding large data clients is part of Filecoin’s go-to-market strategy to increase potential clients’ confidence in the Filecoin network in order to onboard more of them.

Nevertheless, the segmentation of Filecoin clients is a metric that should be continuously monitored and ideally see a decrease in the concentration of large data clients.

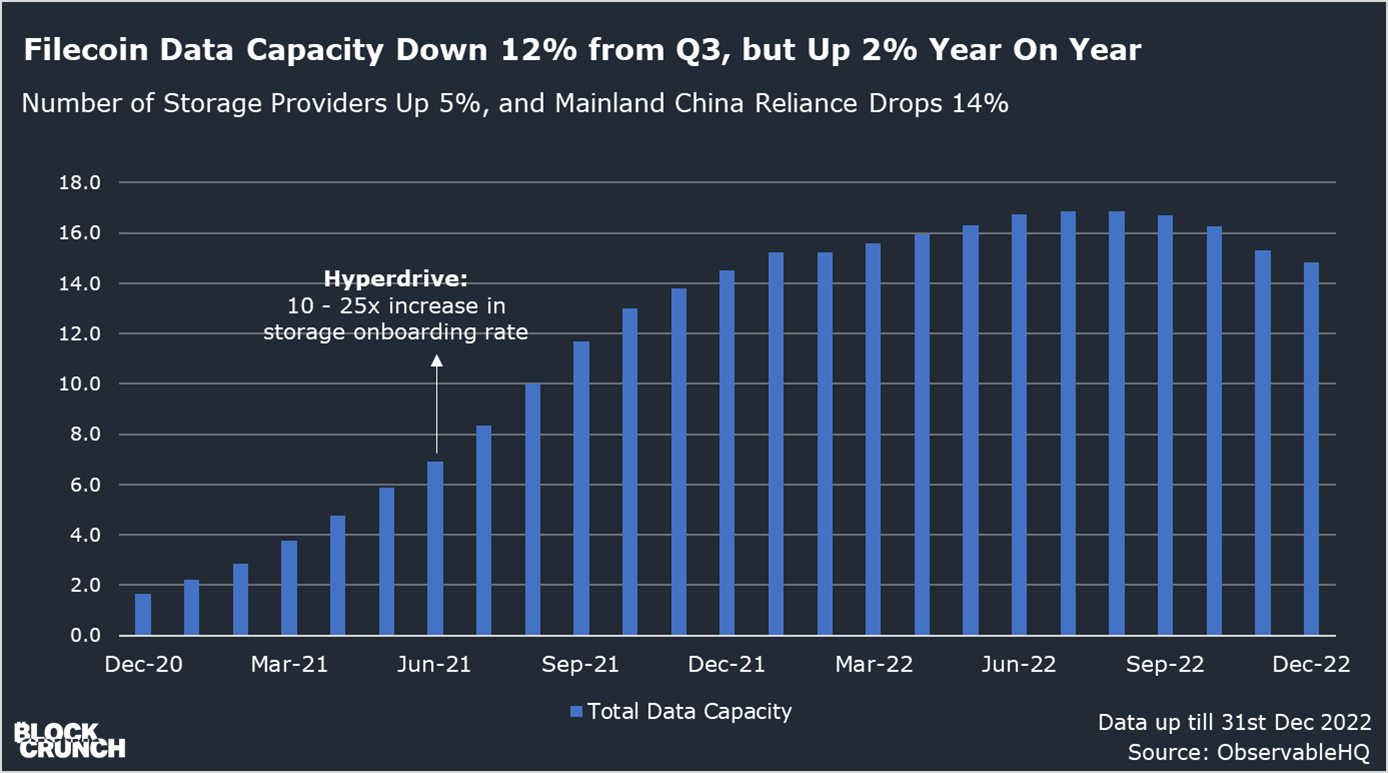

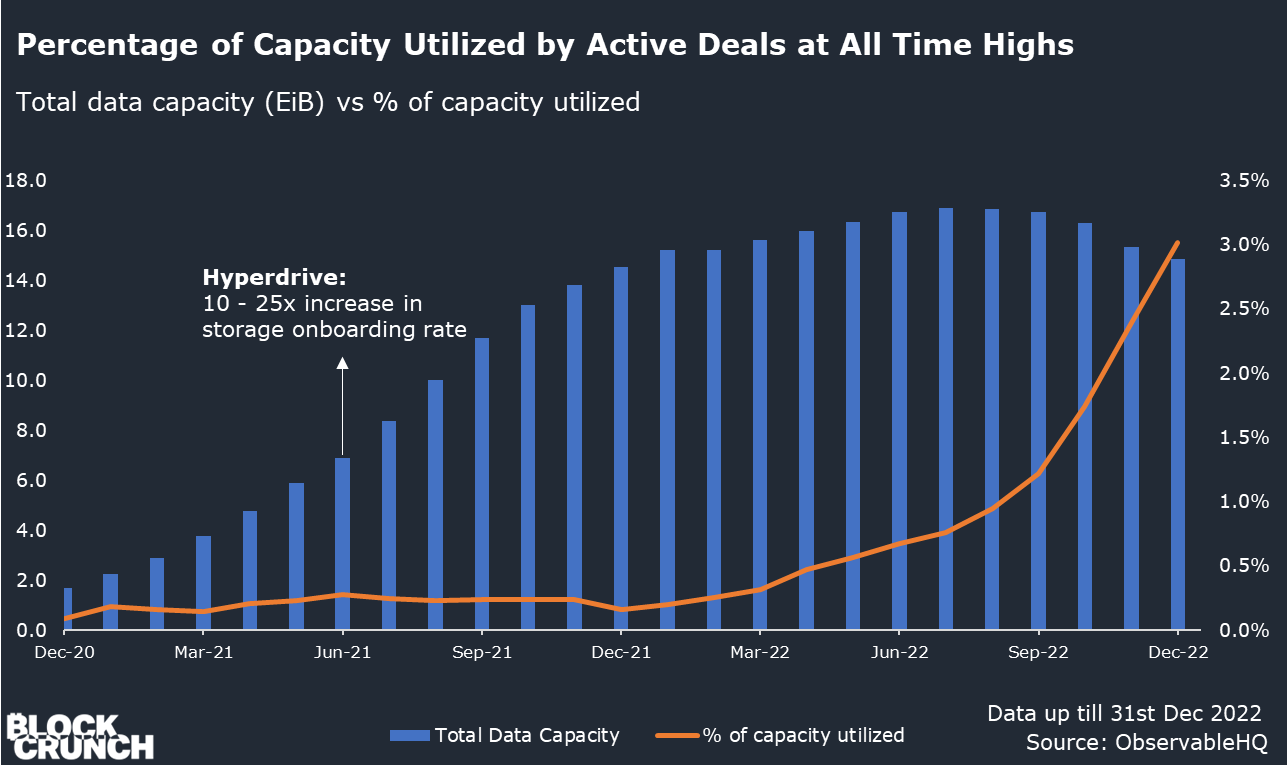

Storage Capacity Growth & Geographical Distribution of Storage Providers

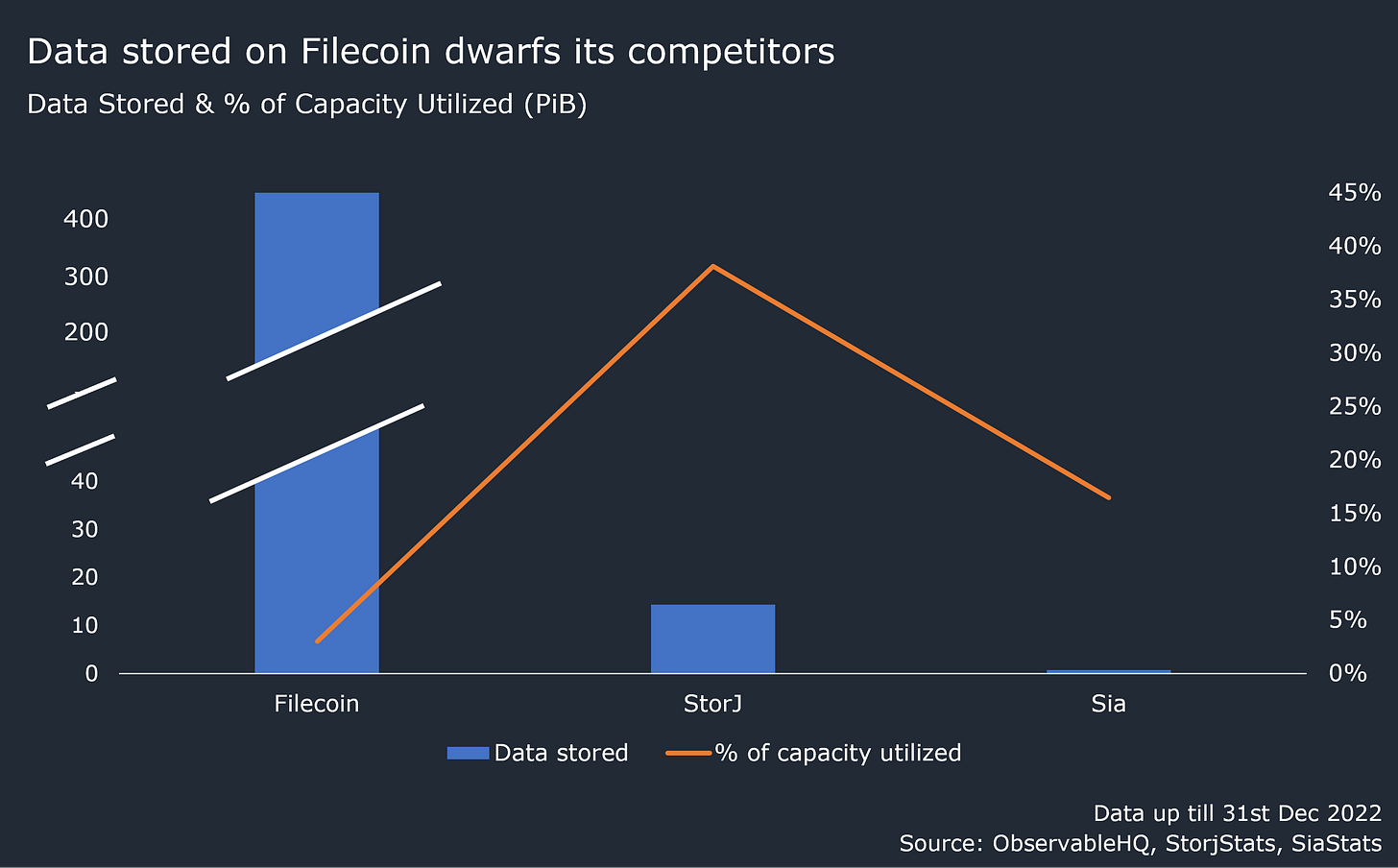

Storage capacity peaked at close to 17 EiB back in August 2022, and currently sits at 14.8 EiB and is 406x more than StorJ, which has 2nd highest storage capacity as a decentralized storage network. Filecoin’s capacity was already heaps ahead of its competitors before the Hyperdrive update in June 2021, but Hyperdrive allowed for its continued phenomenal capacity growth as it increased the storage onboarding rate up to 25x and allowed storage providers to commit new storage capacity at a much cheaper and quicker rate.

Despite the overall poor crypto market condition this year, storage capacity and the number of storage providers increased YoY, demonstrating resilience and reliability regardless of market condition, which should give users confidence in Filecoin’s network.

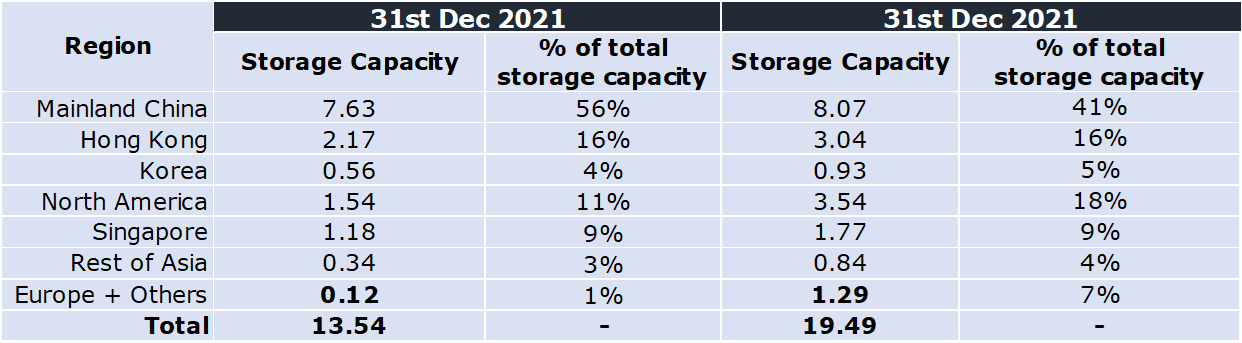

Geographical Distribution of Storage Capacity Provision (2021 vs 2022)

Geographical Distribution of Storage Capacity Provision (2021 vs 2022)

A common criticism of the Filecoin network was its over-concentration of Mainland China providers amongst the provider group, given that it accounted for 58% at the end of 2021. Geographical concentration is a risk because it could lead to service outages in the event of a power stoppage or regulatory ban, especially since the Chinese government announced a country-wide ban on cryptocurrency mining in 2021. However, this is less of a concern now that reliance on Mainland China storage providers decreased in 2022, and only accounts for 41% of the network compared to 56% in 2021.

*Note that the storage capacity data provided is based on quality-adjusted power, not raw byte power. Also, for providers with undisclosed regions, regions are probabilistically assigned using clues such as funding history

Utilization of Filecoin’s Storage Capacity

The percentage of storage utilized is currently at its all-time high of close to 3%, which outpaced the network’s total data capacity by approximately 10x since the Hyperdrive update. The 3% utilization may be perceived negatively at first glance since it overlooks how much data is actually stored on Filecoin in absolute terms.

As shared above, 460 PiB worth of data is currently stored on Filecoin, which, compared to 2nd best-performing decentralized storage platform Storj, is 29x the total data stored and even 12x the size of StorJ’s total storage capacity

Filecoin’s outstanding data storage performance compared to its competitors further uncovers the nuance of Filecoin’s low utilization rate – its data storage performance paired with low utilization rate signals that Filecoin does not have a data-supply issue and can still onboard significantly more data onto the Filecoin network, especially when compared to its competitors.

Filecoin’s Current Ecosystem and Use-Cases

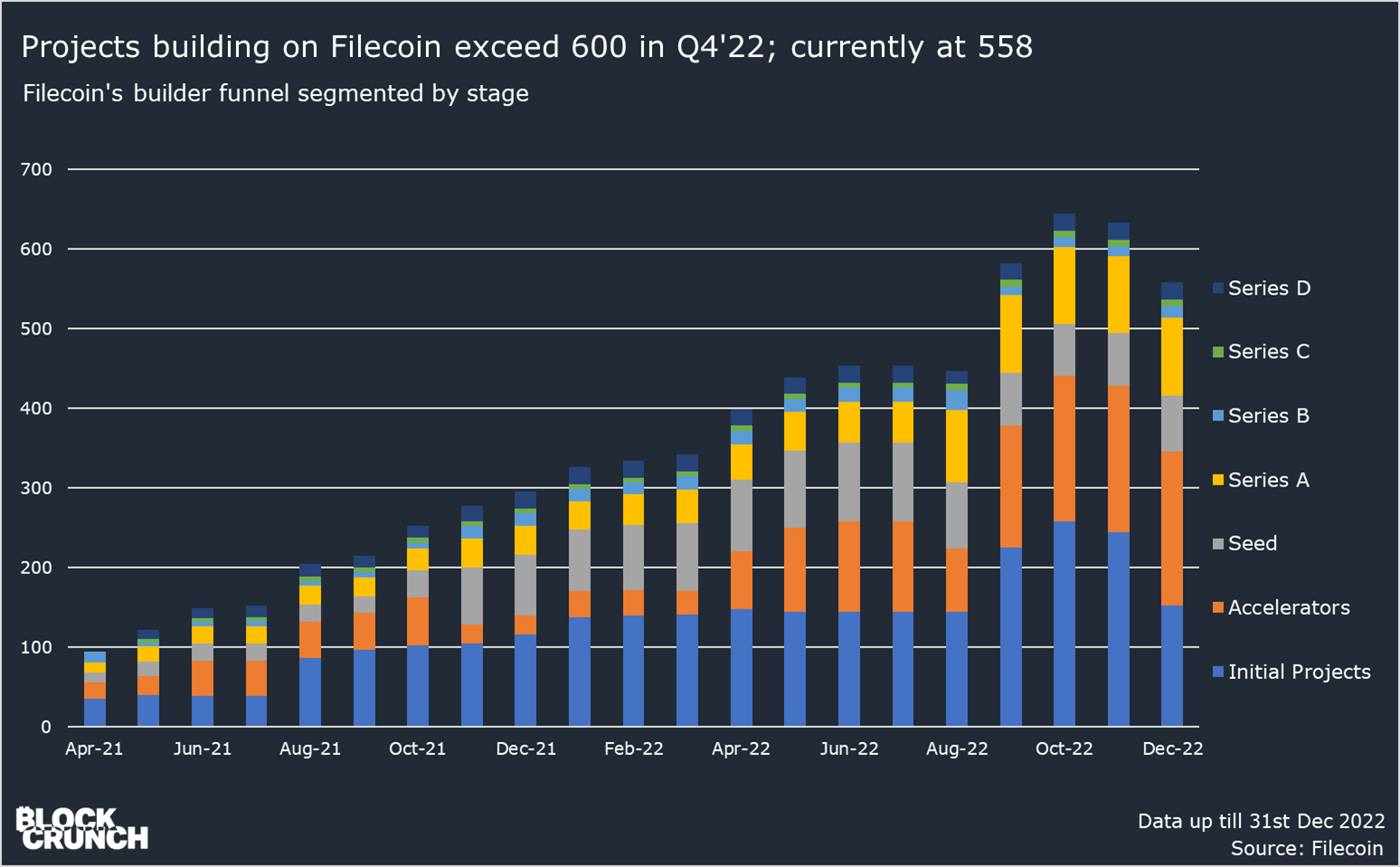

Filecoin has been actively developing a funnel of developers and builders through initiatives such as grants, hackathons and accelerator programs to onboard more applications onto the Filecoin network, which helps to increase storage and, consequently, network demand.

In Q4’22, the number of known projects building on Filecoin and IPFS exceeded 600 and currently sits at 558. Bulk of this growth can be attributed to Filecoin’s efforts in assisting early-stage projects and teams (Seed and earlier) in developing their ideas - the number of early-stage projects almost doubled year on year. Readers should also note these are not representation of all the projects on Filecoin, as technically there are significantly more projects leveraging IPFS and Filecoin through on-ramps like Web3.Storage and NFT.Storage (which the report explains in the later segment).

Currently, applications in the Filecoin ecosystem can be categorized into 5 non-exhaustive use cases:

1. Increasing developers’ access to decentralized storage

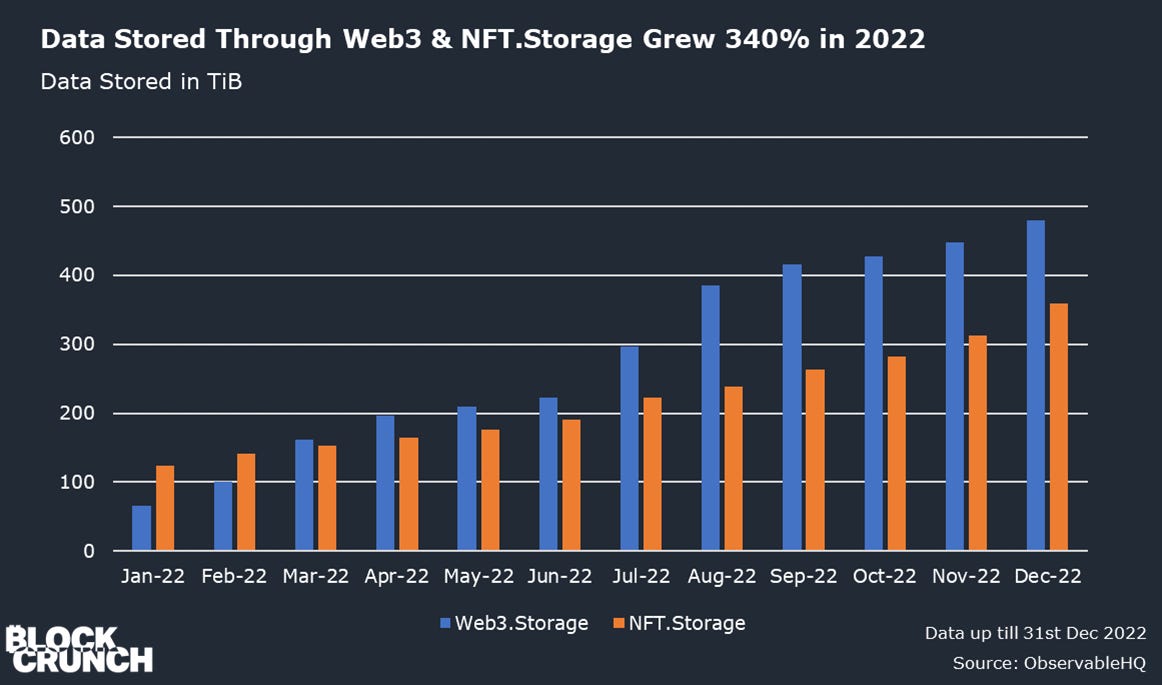

One of the reasons clients preferred centralized storage providers in the past was because there were tools available that made it extremely simple to store data with them. Conversely, storing on the decentralized web was difficult to manage and added complexity to the already crowded developer workflow, that is, until Web3.Storage

Web 3.Storage is a suite of interfaces, APIs, and services that make it easy for developers and other users to access data storage services on the Filecoin network. By handling a ton of the complexities of interacting directly with decentralized storage, developers can easily build applications with content-addressed data stored on Filecoin’s network of storage providers and pinned redundantly on IPFS.

NFT.Storage is a subsidiary service specializing in NFT data storage built on Web3.Storage. Generally, while the token portion of an NFT is stored on the blockchain, its metadata and media are stored off-chain because on-chain storage is costly.

As such, while the token itself is fundamentally decentralized, the metadata and media aren’t and are subject to the mercy and liveness of the storage provider. For example, all NFTs minted on FTX’s NFT marketplace use a centralized storage provider, which after the fall of FTX, has lost its metadata and images and instead redirects to FTX’s bankruptcy restructuring site. In fact, two separate studies found that 40 – 55% of NFTs on Ethereum are stored via an HTTP gateway or centralized servers – in other words, up to 55% of Ethereum NFTs are at risk of disappearing.

NFT.Storage thus provides NFT developers with an easy-to-use platform to store their NFT data securely and resiliently on IPFS and Filecoin. Specifically, data is hot-cached on IPFS for quick retrieval, while also stored securely on Filecoin, therefore allowing NFTs to achieve permanency and while being sufficiently decentralized at zero cost to the developers since it’s part of the Filecoin Plus program.

Some of NFT.Storage partners include OpenSea, Holaplex, Magic Eden and Rarible and NFT.Storage has processed close to 400 terabytes of NFT data as of 31st December 2022.

- Onboarding large datasets

Unlike Web3.Storage and NFT.Storage that focuses on serving Web 3 developers, these applications make it easy for anyone, typically institutional clients, to onboard large datasets onto the Filecoin network.

Estuary is one intermediary that allows users without technical knowledge to upload large datasets onto Filecoin. Users need not manually establish storage deals with different storage providers to achieve data permanence, as Estuary automatically replicates the data with 6 out of the 212 storage providers in Estuary’s list. Estuary has helped partners like GenRAIT host over 100 terabytes of genome research data and made it available for scientists and researchers worldwide. Currently, it stores 1.34 PiB worth of sealed storage on Filecoin (including 6x replication) over 140 thousand active storage deals.

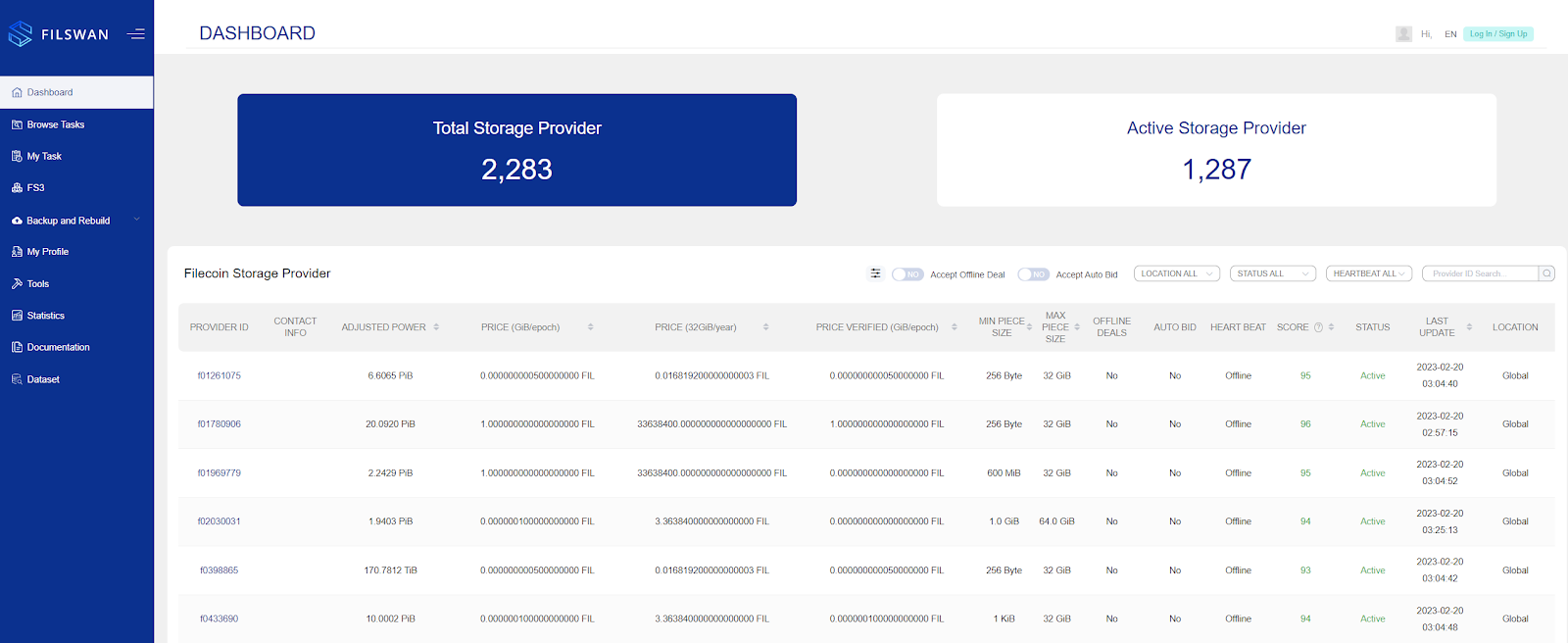

A look at FileSwan’s dashboard

A look at FileSwan’s dashboard

FilSwan built a bridge that allows users to seamlessly migrate over from Amazon S3 to the Filecoin network because they understand that switching costs is one of the barriers that prevents storage clients from adopting decentralized storage providers. FilSwan also has a platform that helps connects clients with the 2000+ storage providers on Filecoin and has features like deal-making, provider reputation ranking, and deal status monitoring

Lighthouse allows clients to store files perpetually with one single payment. Its perpetual storage model is unlike the typical rent-based cost model that requires clients to keep track and pay before expiration to avoid the loss of files. It also features built-in data encryption to offer users data privacy, unlike Estuary and FilSwan which is more suitable for public data.

- Making Filecoin more accessible to everyday users

While the above two use cases primarily serve developers and institutional clients, projects like Chainsafe and Slate are more consumer-oriented

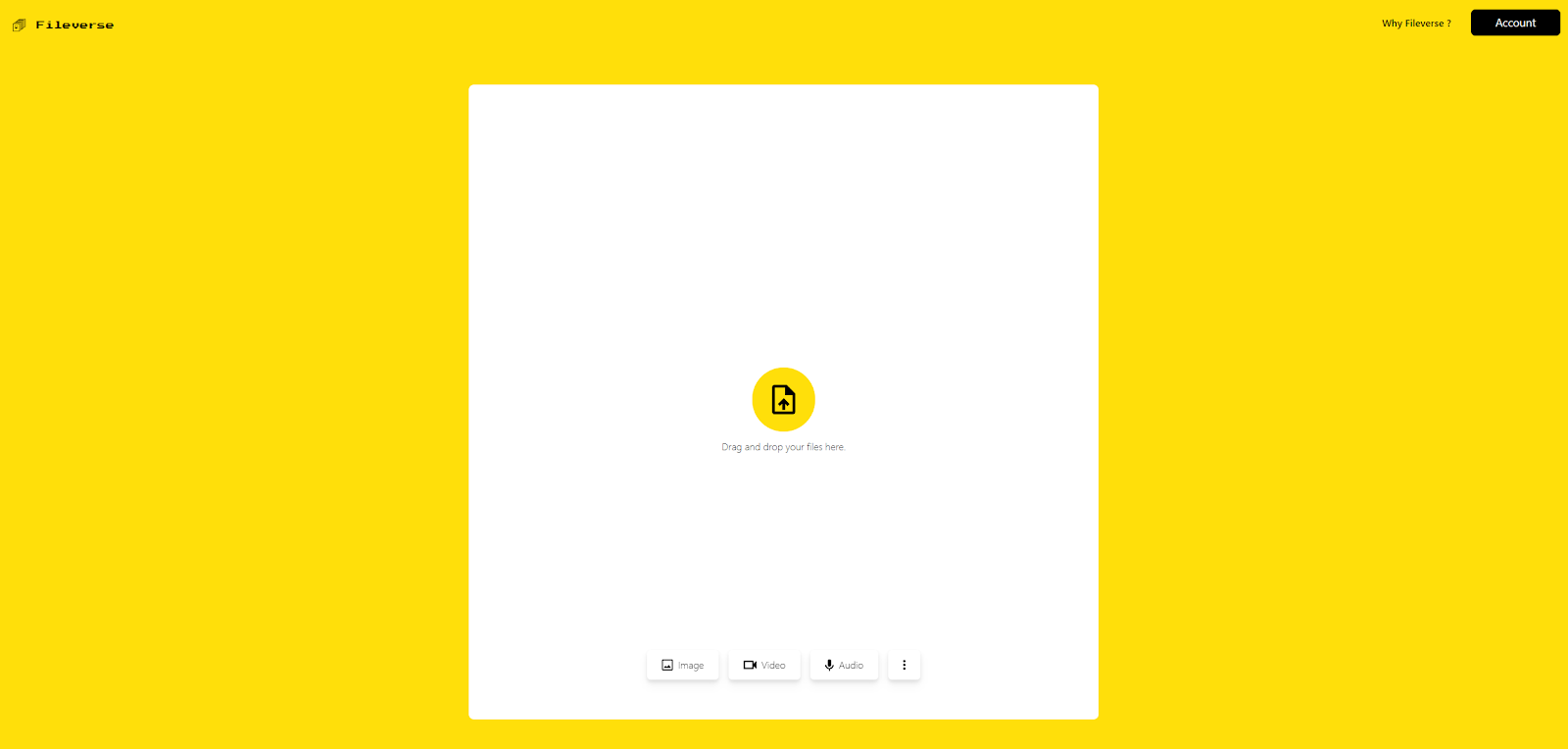

ChainSafe and Fileverse’s user-friendly interface are similar to Google Drive and DropBox, and has permission controls to support file-sharing and collaboration. Like Lighthouse, both also have built-in encryption for all uploaded content so that files can only be seen by the uploader and chosen others.

Fileverse’s Drag and Drop upload functionality

Fileverse’s Drag and Drop upload functionality

Rather than simply allowing users to upload files on Filecoin, Slate repackages Filecoin’s data storage into an effective tool. Slate is a search tool that will enable users to save and keep track of all the things they come across on the internet, such as links, images and files for easy referencing in the future.

- Metaverses and Games

The integration of Filecoin and IPFS with metaverses and games offers a range of benefits for players and developers alike. One of the key advantages is the ability to store and distribute vast amounts of in-game assets in a decentralized and secure manner. This not only enhances the user experience but also ensures those assets are stored indefinitely.

The upcoming Filecoin Virtual Machine (FVM) will also unlock the ability for users to interact with and control their digital assets, ensuring that their hard-earned virtual items are stored securely. This allows for a new level of trust and security in the virtual world, making the metaverse and gaming experience even more immersive and tangible.

Visiting one of Mona’s space, Neon City Streets. All 3D files are stored on IPFS & Filecoin

Visiting one of Mona’s space, Neon City Streets. All 3D files are stored on IPFS & Filecoin

Mona, a metaverse world-building platform, uses Filecoin and IPFS via NFT.Storage. Mona uses Filecoin/IPFS to store its data and 3D content because they believe that the metaverse must be open and decentralized to succeed, wherein users retain ownership over digital assets that are permanent, interoperable and free from censorship. Each AAA-quality Mona world contains large design files, and IPFS allows Mona to offer users a high-resolution experience while maintaining good performance. Today, more than 10,000 builders are building on Mona, and users can own Mona worlds in the form of NFTs on Ethereum and Polygon.

Another interesting metaverse-related project leveraging Filecoin is iPollo. iPollo is an infrastructure platform that provides rendering power for metaverses, allowing tens of thousands of players to exist concurrently on the same screen while enjoying low latency in-game. Similarly, iPollo believes that users should fully own their digital assets and need not worry about permanency and censorship – hence every digital asset minted via iPollo is an NFT with its data stored on Filecoin. Leveraging Filecoin not only allows increases iPollo’s efficiency since they can conveniently update metadata without changing the state on their own chain, but keep operating costs related to storage to the minimum as their business scales up. To date, iPollo has stored over 4 PiB in files with Filecoin.

- Audio and Video platforms

Storage is integral for audio and video platforms to provide services to their users. For example, audio/video files are stored somewhere before they are streamed to users, and users on video conferencing platforms such as Zoom may wish to record their audio/video meetings and transcripts for future playback

However, on top of censorship and single-point-of-failure risks, audio and video platforms often face cost issues when engaging a centralized storage provider. The high cost of operation has led to unfair monetization policies, especially in the music industry where artists get as little as 12% of the income generated. Filecoin thus offers these platforms a cheaper alternative, allowing cost savings for businesses and their users and a fairer monetization structure.

One audio platform utilizing IPFS/Filecoin is Audius, a decentralized digital streaming service designed to connect artists directly with their fans. By removing centralized intermediaries and adopting a decentralized storage backend, Audius allows artists to retain full ownership and control over their music. In the process, it offers a more equitable structure where artists receive as high as 90% of the revenue. Today, Audius features over 100,000 artists, is visited by 6 million unique fans every month and has clinched partnerships with social media giants like TikTok.

A look at Huddle01’s user interface and features

A look at Huddle01’s user interface and features

Huddle01, a decentralized video meeting platform, also utilizes Filecoin for its storage backend. Huddle01’s vision is to decentralize the video communication stack, wherein users can enjoy higher levels of privacy and performant video meetings and live streams. While video meetings are typically free, meeting recordings are costly because current centralized storage solutions are unstainable when used at scale. By utilizing Filecoin for storage, Huddle01 can offer the recording feature at low prices, allowing more users to review their meetings. Since its launch, Huddle01 has facilitated over 500,000 minutes over 30,000 sessions for 16,000 users

In summary, clients and applications primarily use Filecoin as their data storage backend, but will extend to retrieval and computation services once those services are ready. Furthermore, Filecoin plans to allow developers seeking to build more complex applications and solutions via user-programmable smart contracts, which will be available to developers soon via the Filecoin Virtual Machine.

FVM: FILECOIN’S PRESENT & FUTURE

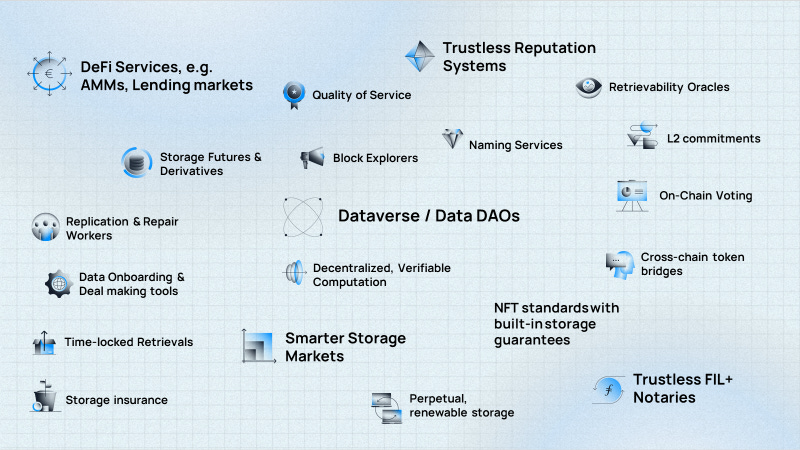

The Filecoin Virtual Machine (FVM), like the Ethereum Virtual Machine (EVM), offers the environment required for deploying and executing code in smart-contracts. With the FVM, the Filecoin network gains smart-contract capabilities on top of the existing storage network. For clarity, developers won’t be programming users’ stored data, but defining how it can automatically or conditionally behave after being stored on the network in a trustless manner via smart-contracts.

For example, to achieve data redundancy e.g to store data with 10 different storage providers, the client or storage application would have to manually set up and check the storage status without the FVM. With FVM, smart contracts can be deployed to automate storage deals against 10 different storage providers, and the state of the data can be constantly monitored for under-replication and automatically restored to the specified term of 10 providers – all in a trustless manner.

Other exciting use-cases possible include:

- Decentralized computation over data stored: Save cost and time by computing the data where it is custodied, rather than having to move it around

- Smarter storage markets: Richer functionality and automation features such as auto-renewal of deals or self-repairing deals in the event of sector issues using funds custodied in smart contracts.

- Data DAOs: DAOs whose mission revolves around the preservation, curation, augmentation and promotion of high-value datasets e.g large genomic or research databases. Primitives enabled by FVM such as tokenization, DeFi rails (lending/borrowing of funds) and verifiable storage on Filecoins makes it possible to implement such DAOs.

- Enabling specialized networks: Independent networks with specialized tasks to improve functionality of the Filecoin network. Some examples are trustless reputation systems (report quality of service/reputation score of storage providers based on on-chain metrics), data availability sampling networks (challenge storage providers to test their efficiency/reliability and awarding incentives depending on outcome) and content delivery networks (seamless and speedy retrieval and delivery of data stored in Filecoin network regardless of geographical location)

Developers and users can enjoy the upgraded Filecoin network as it went live Q1 of 2023. When launched, the FVM will support smart contracts written in Solidity or Yul; developers will also be able to port over existing Ethereum smart contracts with zero or minimal changes required to the source code. The ability to reuse audited and battle-tested smart contracts from the Ethereum network allows developers to save on development cost and time, and users can enjoy its utility with minimized risks.

In future updates, developers will also be able to deploy WASM-based smart contracts i.e., smart contracts written in Rust, AssemblyScript or Go, which will offer higher execution speed and lower gas fees.

FILECOIN TOKEN ECONOMY

Currently, the Filecoin economy runs on $FIL, which is used to pay for network fees, pay miners block rewards, and functions as the unit for collateral by miners. Although the token has lost 95% against $ETH since 2021 highs, the protocol has seen impressive data storage growth facilitated by Fil+.

Filecoin has a fixed maximum supply of two billion FIL; however, many of these tokens have not yet been released. Circulating Supply stands at 415.4M FIL as of 31, December 2022. Furthermore, unlike Bitcoin, these outstanding tokens are not tied to a fixed release schedule. Instead, their rate of distribution is tied to the overall utility of the Filecoin ecosystem and indexed to network storage capacity.

Token price dynamics are likely due to a confluence of factors both exogenous and endogenous to the Filecoin ecosystem, but the protocol’s tokenomics, and in particular, its rate of token issuance and consumption may help inform long-term value accrual to participants. Over the protocol’s lifetime (2.5 years), the network’s relatively high rate of token issuance has helped bootstrap a large amount of distributed committed storage capacity and onboarded data. A salient question as the protocol matures is how Filecoin can continue to translate demand for storage services into “sinks” to offset tapering token issuance.

$FIL Inflation

$FIL has two predominant sources of inflation: block rewards and team/investor vesting.

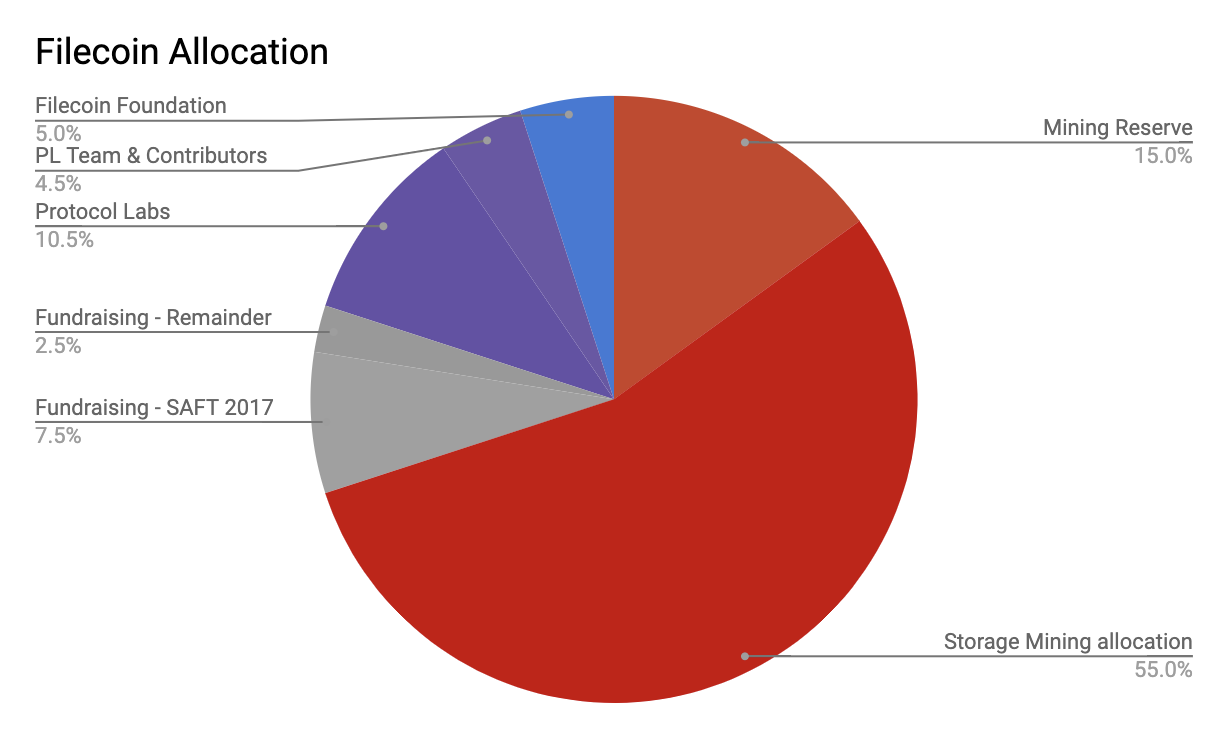

Filecoin Token Allocation

Filecoin Token Allocation

Seventy percent of Filecoin’s total token supply (1.4 billion tokens) is allocated to reward Storage Providers. These tokens are separated into three categories: simple minting rewards (330M), baseline minting rewards (770M), and a mining reserve (300M). Simple minting rewards are time-based and continuously exponentially decreasing with a six-year half-life. Baseline minting rewards, however, are based on the performance of the network, and emissions are indexed to network storage capacity. Block rewards earned by miners are also subject to vesting: while 25% of these rewards are made available immediately to improve miner cash flow, 75% percent rewards vest linearly over 180 days. The mining reserve is not yet scheduled to be released; it will be up to the community to decide if and how to best distribute these.

In 2022, ~105M $FIL tokens were printed, totalling ~256M over the lifetime of $FIL. At current prices ($8), 2022 $FIL block rewards equated to $840M in new issuance into the market. In addition, ~100M were unlocked for investors in 2022, totalling $324M all time.

In other words, combining inflation and investor unlocks, 205M $FIL came to market in 2022, which at current prices equated $1.6B of supply. Using the average monthly open price from Jan 2022 - Dec 2022 ($13.37), this translates to $2.74B of supply coming to market over 2022.

While this may seem like an large sum, for reference, the equivalent number for Ethereum in 2022 would be around 2 million units at $2,114, or $4.3B of supply printed to market.

$FIL Token Sink

There are also sources of token outflow from circulating supply. In Filecoin, this occurs when tokens are locked, such as when they are posted as collateral to incentivize reliable storage - Filecoin Plus deals, which offer miners ten times the block rewards, also require ten times the collateral. Outflow also occurs through network transaction fees, which see some tokens consumed and burnt to compensate for the computation and storage resources required to include messages on-chain.

It is also appropriate to bring up an important distinction here - Filecoin is a Layer 1 blockchain rather than simply a service protocol, with the distinction centering on how value accrues back to the protocol. Instead of relying on taking a rake on storage provision, Filecoin leverages demand for block space, wherein the base transaction fee (in $FIL) that users pay to interact with the blockchain is burnt (just like ETH in Ethereum’s EIP1559). In this case, several activities (posting proofs, token swaps now that FVM is live and more) accrue value back to the Filecoin network without cannibalizing storage/service costs, which in turn leads to cheaper fees for customers and consequently more demand for blockspace - a flywheel for network demand which has worked extremely well in bootstrapping storage demand and capacity.

Storage providers lock up $FIL as collateral so that if storage fails the collateral is slashed. This provides ample incentive for miners to maintain storage services, and the more demand there is for storage, there more $FIL should be locked up. In 2022, an additional ~7.38M $FIL was locked up (totalling ~134.5M total).

In addition, any fees that are generated on Filecoin are paid in $FIL and burnt, and at one time, it has reached as high as 250K $FIL a day. Fee types include base fees (a portion of network transaction fees that are burnt), a batch fee (paid when storage providers aggregate storage proofs), an overestimation fee, and penalty fees. To date ~34M $FIL has been burnt, and in 2022 about 5.17M $FIL were burnt.

Combined, about 12.55M $FIL were removed from circulating supply via collateral lockup and fees in 2022, or ~$168M in 2022 average monthly open prices. This meant about 6% of the incremental supply that came to market was removed.

Overall, about ~170M $FIL are currently locked or burned, approximately 8% of the fully diluted supply, or 30% of the supply that has been minted or vested (circulating supply*), which is inline with the 30% target initially outlined in Filecoin documentation.

*Note that CoinGecko’s reported ~390M circulating supply which does not account for tokens that are still within the original wallets for founders and team and hence the difference in circulating supply by ~50M tokens.

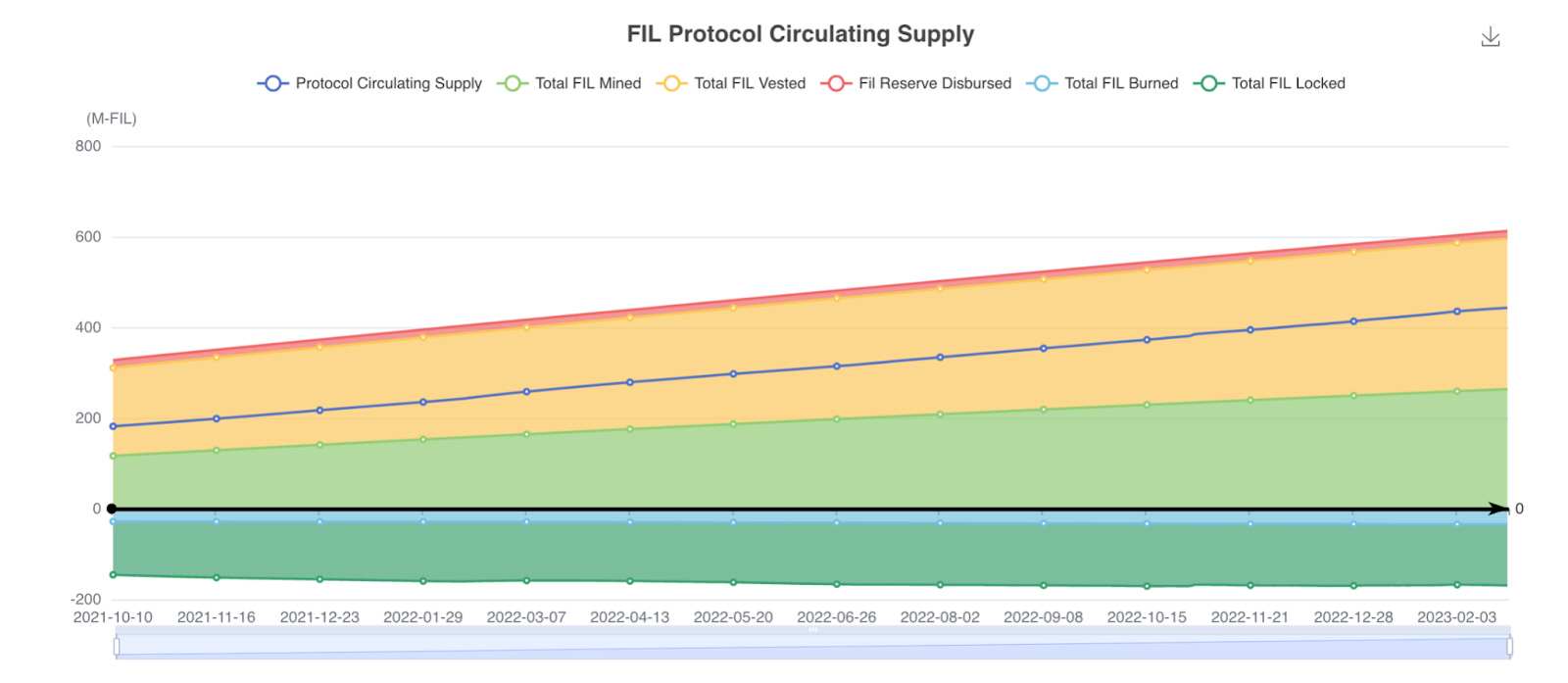

$FIL circulating supply

$FIL circulating supply

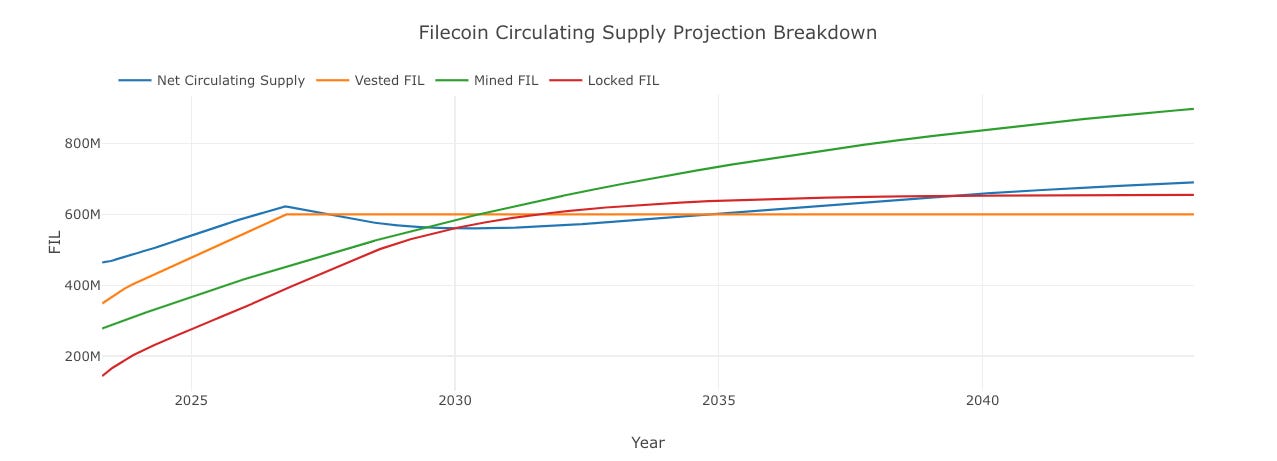

Can $FIL Become Deflationary?

While $FIL supply is dynamic based on the utility of the network, the network is expected to continue to taper its rate of token issuance and enter a more deflationary economic regime. Note that deflationary monetary policy is not necessary for value accrual; in fact most Layer 1s, including Ethereum until recently, have inflationary monetary policies.

The majority of Filecoin Foundation and Protocol Labs’ tokens are expected to finish unlocking by Q4 2023; however, 250M $FIL will also continually vest until October 2026. As such, it is unlikely for $FIL to enter a perpetually deflationary regime in the immediate term time horizon if current network trends hold.

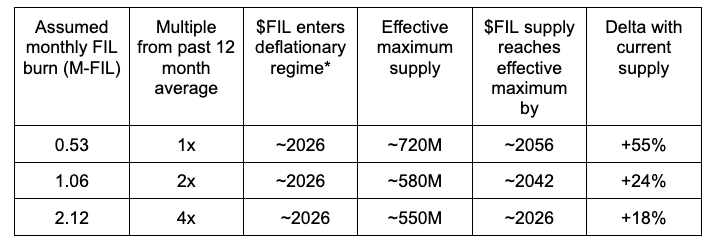

Over the past 12 months, approximately an average of 530,000 $FIL were burnt per month, whereas quality adjusted power of the network grew by approximately 2% per month over the past year. Assuming the above conditions hold, $FIL can reach a deflationary status by roughly 2026.

Given the development of applications on FVM likely most directly affects $FIL burnt, we shall hold other variables constant and present the following projected scenarios. Note that $FIL supply is multivariate, and the below model is a simplification. However, for readers who would like to test their own assumptions they can reference the model here).

*Assuming no changes to onboarding trends

In summation, at the current rate of token burn and storage onboarding, it is unlikely that $FIL begins to become strictly deflationary in the near term. Even under aggressive assumptions (4x $FIL burnt), it will take approximately 3 years before $FIL reaches its probable maximum effective circulating supply.

FILECOIN COMPETITIVE OVERVIEW

The report thus far has elucidated 2 critical facts about Filecoin:

First, Filecoin’s ambition goes beyond simply being a decentralized storage platform, but to turn major cloud services (storage, retrieval, compute) into permissionless markets to decentralize the internet.

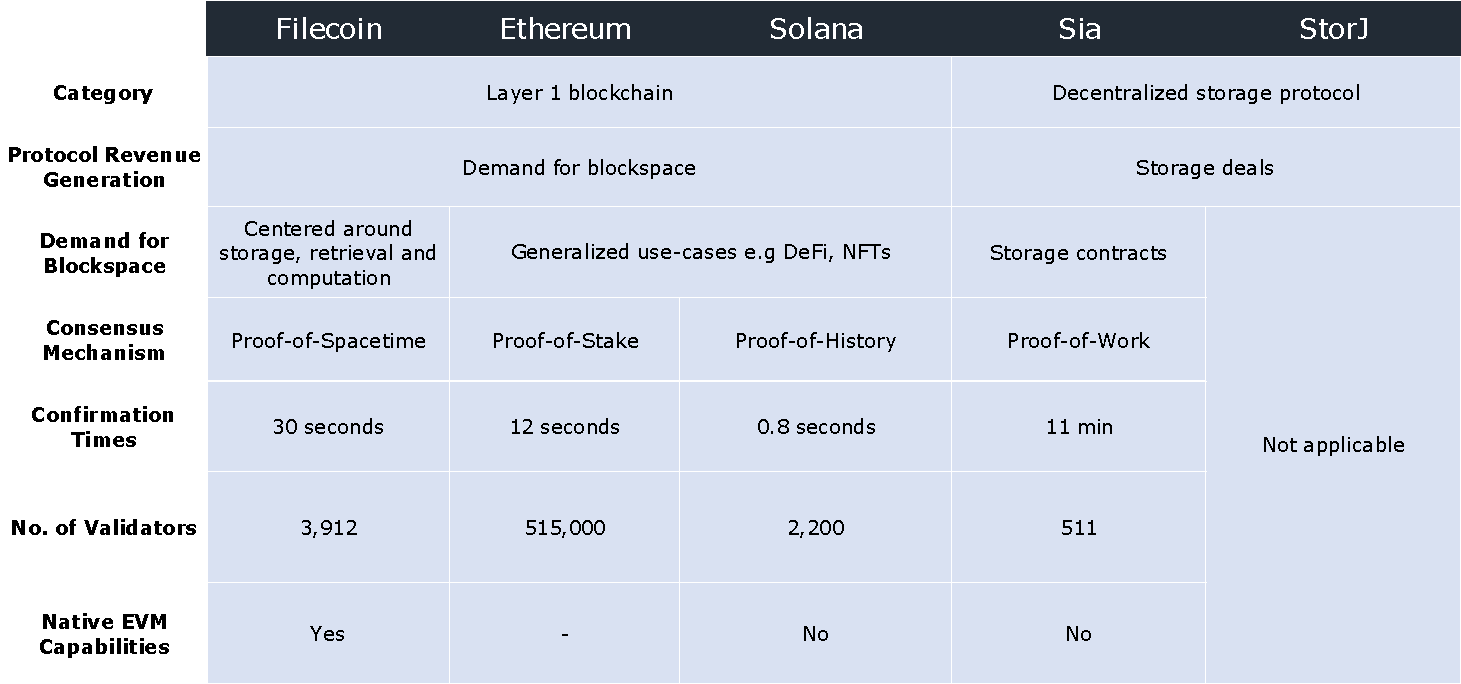

Second, beyond just a service protocol, it is more accurate to understand Filecoin as a Layer 1 blockchain since Filecoin makes revenue via demand for block space rather than taking a percentage cut on successful service deals.

Readers should keep these distinctions in mind, as it helps with understanding the difference between Filecoin’s infrastructure and its closest peers.

Note: Arweave is excluded due to lack of capacity data

Note: Arweave is excluded due to lack of capacity data

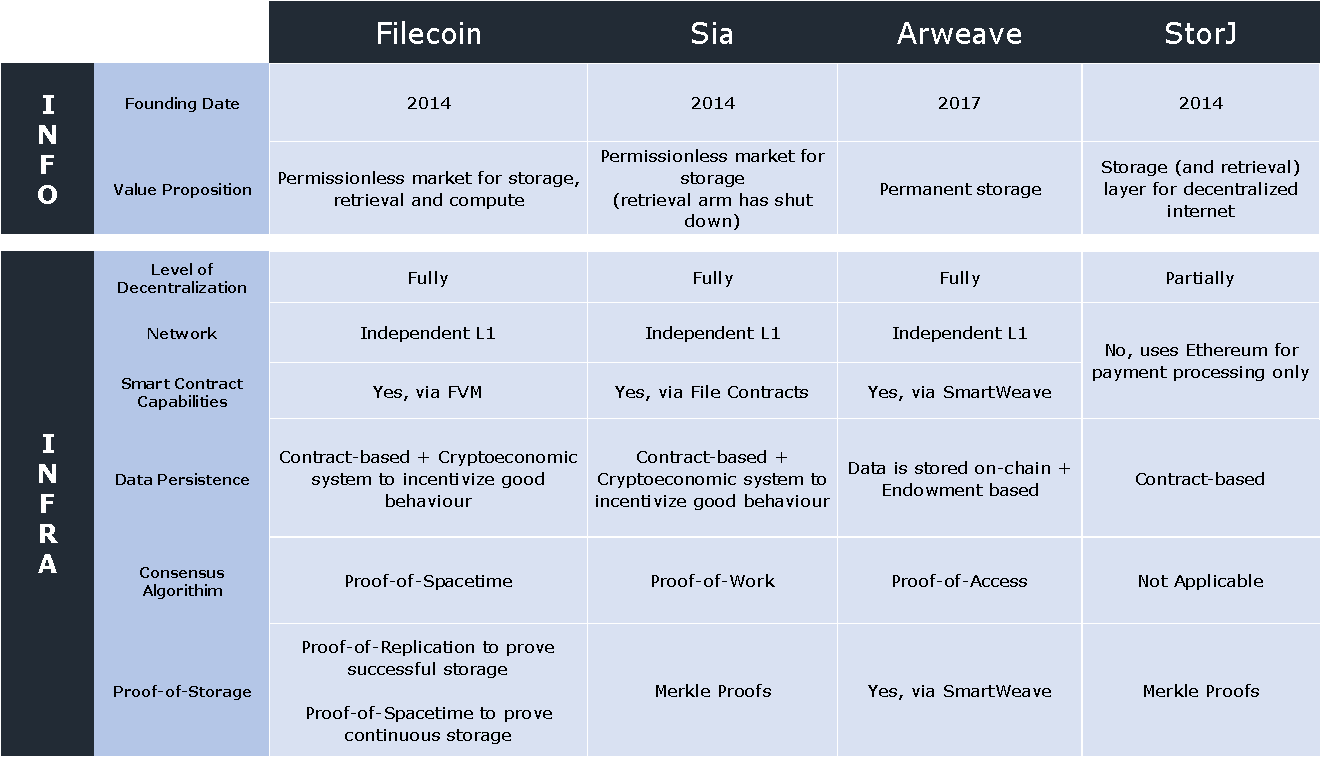

Filecoin versus other storage protocols

As it stands, Filecoin is the most scalable and comprehensive decentralized service network amongst its competitors for the following reasons:

- Has its own independent Layer 1 blockchain: Filecoin is fully decentralized, unlike StorJ (next closest competitor in terms of storage performance), which only utilizes blockchain to process payments. This means that Filecoin offers higher levels of transparency and accountability, whereas StorJ is partially decentralized - although any storage provider can join its network, it’s as opaque as centralized providers, and service liveness still depends on 1 centralized party i.e. StorJ

- Data is stored off-chain and verified continuously on-chain: Unlike Arweave, Filecoin does not store its data on-chain. While this means that data on Arweave have lower odds of being lost, storing data off-chain allows the Filecoin network to be more efficient and scalable to support the internet-level scale of storage. This is not to say that users are prone to losing their data on Filecoin, as Filecoin uses contracts and its crypto-economics system to incentivize and ensure that providers do their job properly. Furthermore, unlike other protocols that also store data off-chain, Filecoin providers are required to submit proof of storage not only when the contract starts but also every 24 hours until the contract ends (made possible by their invention of Proof-of-Spacetime), providing users a higher level of confidence and assurance that files are securely stored.

Compute-ready where data is stored: Unlike its competitors, Filecoin’s infrastructure and storage provision hardware requirements allow them to run computational jobs where data is stored - a service that other competitors are unlikely to be able to provide. As such, Filecoin also provides the most comprehensive servie out of all storage protocols.

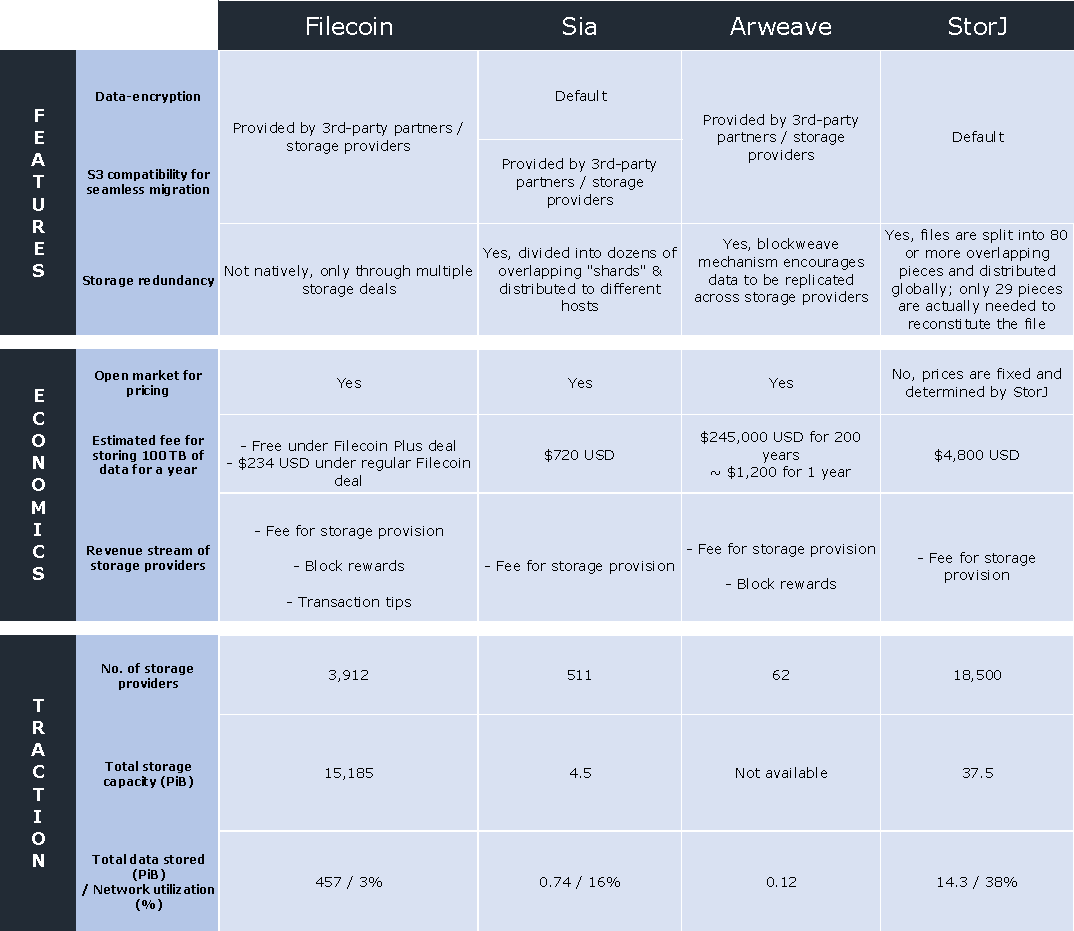

As of 31st December 2022, Filecoin is the largest storage provider by far in both network capacity and size of data stored – representing ~97% of all data stored on decentralized storage networks and 99% of all decentralized storage capacity. While Filecoin may natively lack features such as data encryption, S3 compatibility for seamless migration and storage redundancy, these features are offered by the storage providers and are thus typically non-factors in a client’s consideration process.

A contributing factor to Filecoin’s tremendous data capacity is its successful crypto-economic incentive, in which storage providers who commit more storage capacity to the network have higher odds of mining the next block and earning more FIL token rewards.

Filecoin’s tremendous data capacity has consequently allowed Filecoin to store an outsized amount of data compared to its competitors. Filecoin’s outstanding data storage performance is also attributed to its extremely competitive storage price offering. Filecoin’s storage providers offer up to 95% lower storage costs or even free data storage versus other decentralized competitors. The highly competitive prices are possible because Filecoin subsidizes storage costs with FIL token rewards.

Filecoin as an L1 blockchain

As the report mentioned in the Tokenomics section, the Filecoin network relies on demand for block space for revenue i.e. the base transaction fee (in FIL) that users pay to interact with the blockchain is burnt. In this case, it is more accurate to categorize Filecoin as a Layer 1 blockchain when understanding its revenue model.

Demand for block space on Filecoin currently comes only from on-chain activities associated with storage provision and will soon expand to include activities from retrieval and computation services and the smart contract capabilities enabled by the FVM. The framing of Filecoin as a Layer 1 blockchain also helps readers and investors understand that the upcoming service and network upgrades not only enhance the services provided on Filecoin but also accrue more value back to the Filecoin network/token, specifically via block space demand and transaction fee burns.

But, it is also important to note that while Filecoin is positioned as a Layer 1, it is not in direct competition with Ethereum or other Layer 1s. On the contrary, Filecoin is synergistic and serves as a complementary protocol to other Layer 1s and the decentralized applications in their ecosystem.

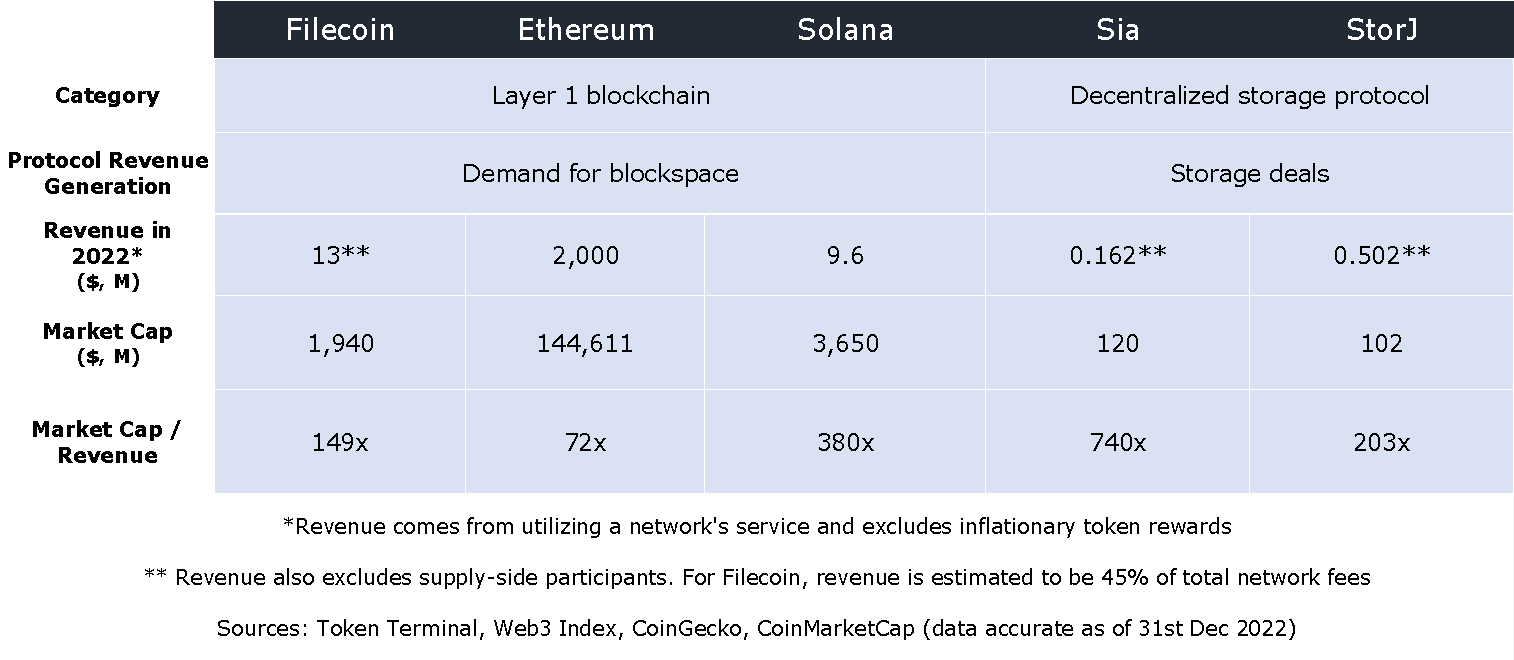

When solely looking at the market capitalization of Filecoin readers may observe that Filecoin trades closer to a Layer 1 blockchain than its decentralized storage peers. This comparison only includes demand-side revenue - when considering Filecoin’s total revenue (total fee burnt in 2022), Filecoin would be trading at a 66x revenue multiple; even lower than Ethereum’s valuation.

ASSESSMENT

In conclusion, Filecoin has successfully established itself as the most prominent player in the decentralized storage market, and its ambition goes beyond just storage. Its innovative approach to creating permissionless markets for storage, retrieval, and computing services is aimed at decentralizing the internet.

The network has demonstrated remarkable scalability, transparency, and security features, as well as competitive pricing for users, thanks to its robust crypto-economic incentives. While it may have been extremely successful at incentivizing storage capacity and utility, there are also concerns that the excessive use of Filecoin token incentive may lead to incessant inflationary pressure, leading to difficulty in value accrual. However, with continuous growth of storage capacity and the launch of the Filecoin Virtual Machine, inflationary pressures may be alleviated.

Also, as Filecoin positions itself more as a Layer 1 blockchain rather than just a decentralized storage provider, it trades at a more attractive valuation compared to its decentralized storage peers. The potential for increased block space demand, transaction fee burns, and integration with other Layer 1s and decentralized applications strengthen Filecoin's market position and Filecoin tokens’ prices.

Overall, Filecoin's innovative architecture, strong network effects, and ambitious goals make it a compelling project in the blockchain space. Its focus on decentralization, security, and scalability could drive significant growth in the coming years and make it a crucial component foundation to realizing the vision of a decentralized internet.

Subscribe

Disclaimer

The above report is commissioned by Protocol Labs, a financial sponsor of the Blockcrunch Podcast. Blockcrunch Podcast (“Blockcrunch”) is an educational resource intended for informational purposes only. Blockcrunch produces a weekly podcast and newsletter that routinely covers projects in Web 3 and may discuss assets that the host or its guests have financial exposure to.

Some Blockcrunch VIP posts are written by contractors to Blockcrunch and posts reflect the contractors’ independent views, not Blockcrunch’s official stance. Blockcrunch requires contractors to disclose their financial exposure to projects they write about but is not able to fully guarantee no such conflicts of interest exist. Blockcrunch itself will not buy or sell assets it covers 72 hours prior to and subsequent to the publication of a piece; however, its directors, employees, contractors and affiliates may buy or sell assets prior to or subsequent to publication of any content and will make disclosures on a best effort basis.

Views held by Blockcrunch’s guests are their own. None of Blockcrunch, its registered entity or any of its affiliated personnel are licensed to provide any type of financial advice, and nothing on Blockcrunch’s podcast, newsletter, website and social media should be construed as financial advice. Blockcrunch also receives compensation from its sponsor; sponsorship messages do not constitute financial advice or endorsement.

For more detailed disclaimers, visit https://blockcrunch.substack.com/about