Bankless Writer: Ben Giove

Whether it be during the height of a bull or the throes of a bear, during every crypto rally we ask ourselves the same question: Why is this project with seemingly dubious fundamentals pumping?

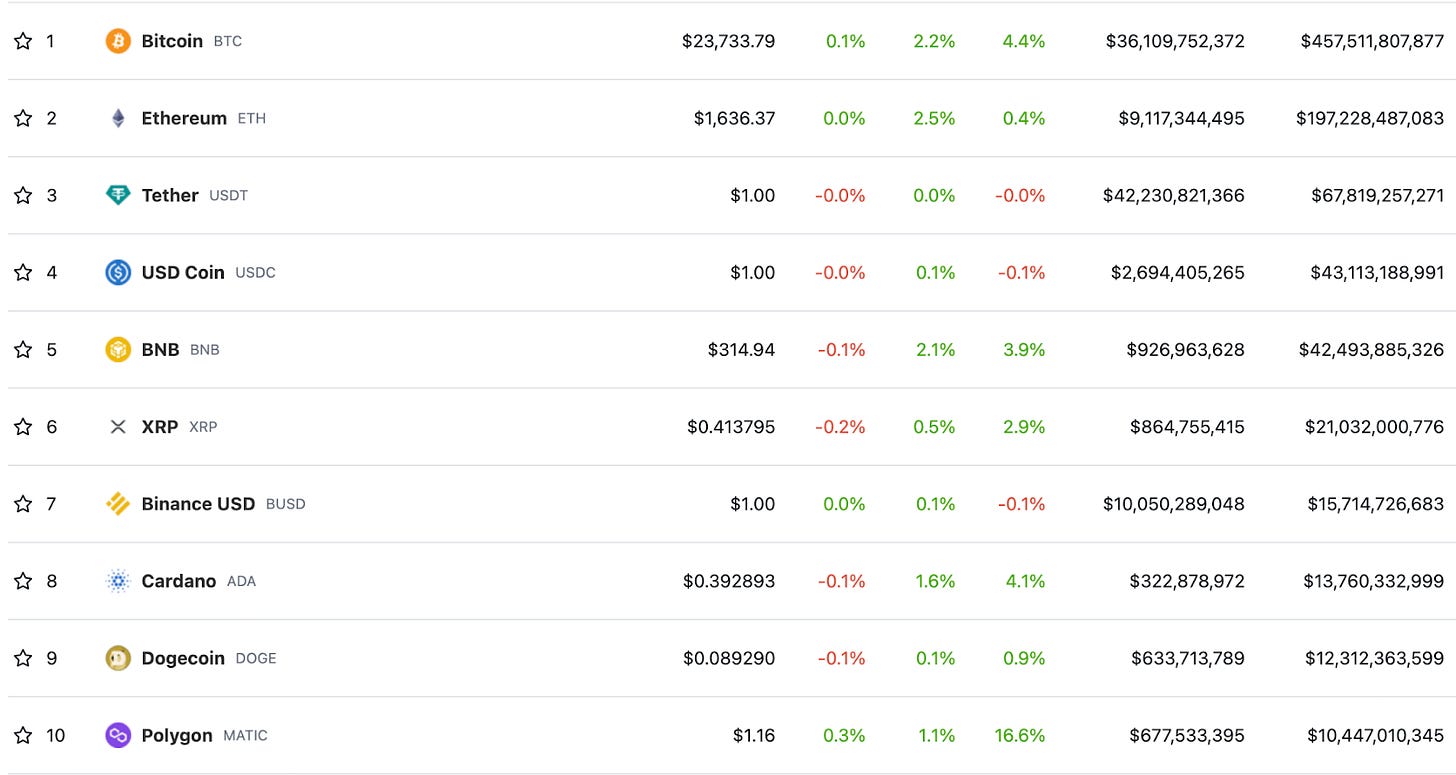

In many instances, it’s a valid question. While cryptoasset analysis has matured considerably over the past several years, several of the largest tokens by market-cap are still tied to projects with limited usage.

I’ll let you decide which of these belong and which don’t.

In 2021 the winners of the “most head-scratching pump” awards were dog coins like DOGE and SHIB. Their now infamous rallies were legendary, enriching normies while leaving fuming crypto natives trapped on the sidelines (maybe I’m just speaking for myself on that one).

To start 2023, the front-runner for this ignominious honor has to be Aptos (APT), which is up 459.5% YTD and has been the best performing asset in the Top 200. The network now trades at a fully-diluted valuation (FDV) of $19.1B, good for sixth highest of any crypto project and nearly 10% that of Ethereum.

One of 2022’s most hyped projects, this pump comes despite Aptos having seen limited traction to date. It’s currently the 31st largest network by TVL at $63.6M, behind “lightly used” networks like EOS and Cardano.

This brings us back to our never ending question…why is this project with seemingly dubious fundamentals pumping?

Let’s explore and see if we can find an answer.

A History of Aptos

Aptos is an L1 developed by former engineers for Facebook’s Diem project. The network’s primary value proposition is scalability, claiming to be able to process 10,000 TPS while aiming to reach 100,000 TPS. Aptos also uses the Move programming language, which has been lauded by developers for its security properties and ease of use.

Aptos is also known for its massive venture raises at nosebleed valuations, raising $200M at a more than $1B valuation in March 2022 and $150M at a valuation north of $2B in July 2022. Notably, these rounds were participated in by the now-bankrupt FTX Ventures. Furthermore, a September follow-on investment from Binance valued the L1 at more than $4B.

Aptos launched in October 2022, with APT at as high as a $13B valuation on the day it went live.

The markets plunged following the collapse of FTX, but APT, along with other “Sam Coins” were acutely hit, falling 55.9% between November 7 and December 29. Its $3.08 low in December valued the network at roughly $3.1B FDV, below the valuation at its most recent raise.

Sentiment was pitch black across the entire space, but given Aptos’s limited usage and the threat of perpetual long-term sell pressure from its largest investor going belly up, APT was particularly radioactive.

The Mother Of All Short-Squeezes

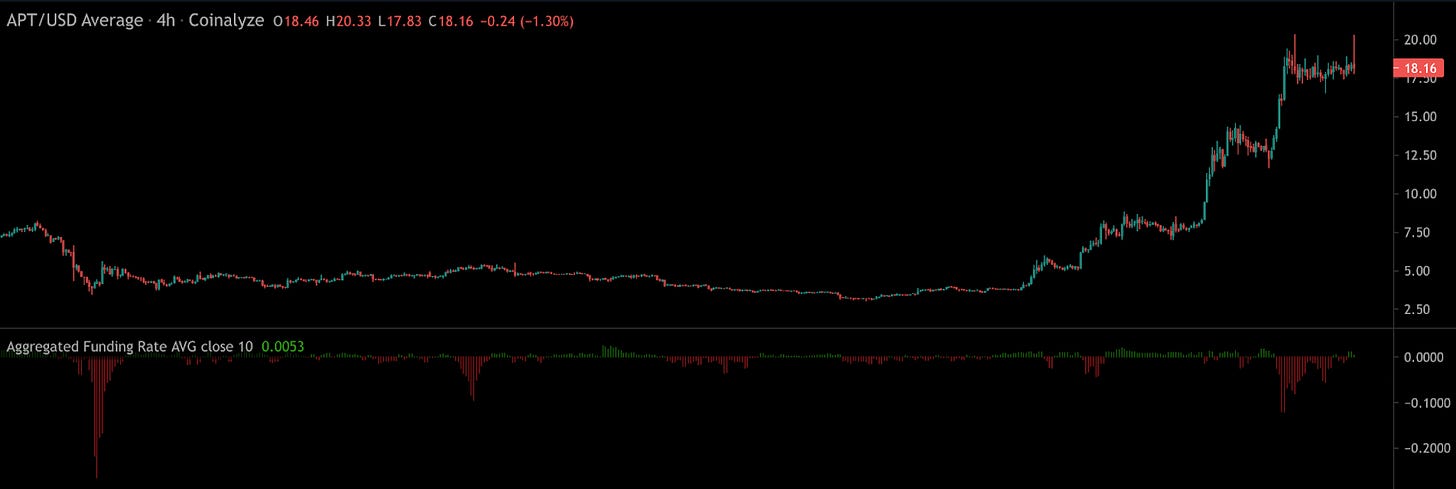

Bears smelt blood, and shorts unsurprisingly began to pile in. The annualized funding rate for APT was at times negative triple digits in the weeks following FTX and Alameda’s implosion. This means that demand to short APT was so great, traders were in essence willing to pay triple digits in annualized interest to do so.

It was an incredibly crowded trade, and the extreme negative positioning in the name laid the groundwork for a massive short-squeeze when the market began to turn.

Since January 8, the price of APT has exploded 368% from $3.88 to $18.16. The face-ripping rally has left a trail of bear carcasses in its wake, with $112.0M in short positions liquidated compared to $63.9M in long liquidations during this period.

Just as long liquidations provide fuel that exacerbate downward moves, short liquidations have a similar impact in the opposite direction, adding rocket fuel to pumps.

As we can see from those figures above, Aptos has had a lot of fuel in an illiquid market that is still reeling from FTX. This was compounded by bears seemingly choosing to fight the move by piling into more shorts, as APT funding again dipped into extreme negative territory, reaching as low as -136% annualized on January 25.

It may not just be Aptos bears who’ve gotten blown out by this massive pump. Conceivably, Aptos’s own investors could be among the casualties, as those looking to hedge their paper profits may have shorted APT perps to do so. Though given the opacity of CEXs, we’re just speculating here.

With APT investor unlocks not set to begin until October 2023, the token has also benefited from no structural sellers pushing down price. If January is any indication, it also means that any VCs hedging with APT perps have a long and treacherous road ahead of them.

What Comes Next

As we can see, there is a simple, rational reason as to why APT has pumped massively to begin the year: It underwent a good old-fashioned short-squeeze.

In the short-term, positioning and market structure overrule fundamentals. APT was oversold, with traders at times paying triple-digits in annualized funding to bet against the name. The unwinding of these bearish bets created violent price action, but to the upside rather than to the downside as we’ve become accustomed to over the past year plus.

Looking beyond this move, it’s unclear what the future holds for Aptos. Like with many L1s, perhaps this rally can be reflexive, spurring more users, developers, and liquidity to migrate onto the network.

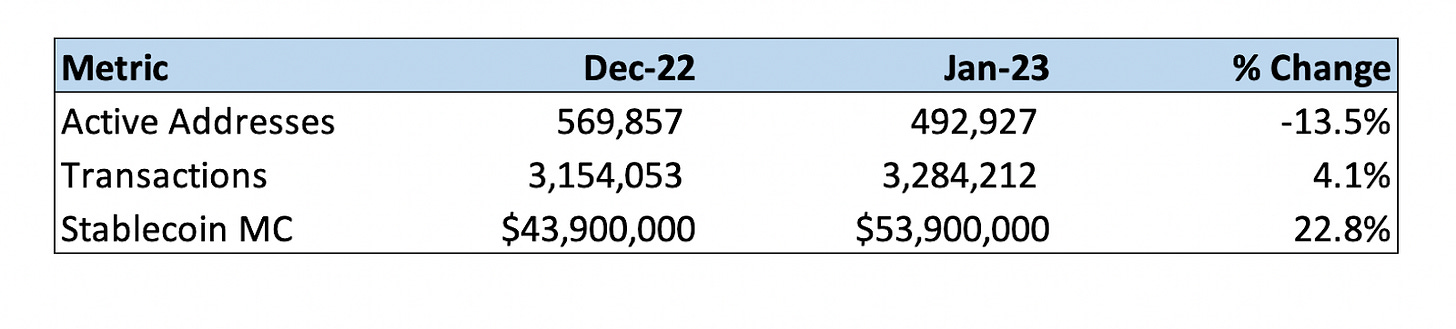

So far, we have not seen much evidence to suggest that is occurring, though there are some encouraging signs. While Monthly Active Addresses for January 2023 are on pace to be slightly down compared to December 2022, transactions and market cap of stablecoins on the network are both on track to slightly increase.

For APT to have a shot at backing up its massive FDV over the long-run, it will need to grow these metrics significantly over the coming months before VC unlocks kick-in. That seems like a tall task, but hyper-growth is always possible in crypto.

It’s unclear whether this short-squeeze has run its course, or whether more pain is in store for bears. But regardless of price, given the technical nature of the move, fundamental investors shouldn’t be pulling their hair out.