Dear Investors,

Where do we go from here?

That’s the question every crypto investor wants to know.

With 2022 finally in the rearview mirror—a year of crashing prices, cascading bankruptcies, and epic frauds—investors are asking: Can crypto get up off the mat, or is it down for the count? Will we see a crypto spring, or is this a crypto Ice Age?

Over the past few days, the team at Bitwise gathered together to debate this very topic. We present the findings below: Our 10 best predictions for what will happen in 2023 (plus one big bonus prediction)!

Please note: As with all predictions, these are not guarantees. They represent our best informed estimate of what we expect to happen. The future is complex and conditional, and whether these pan out exactly as written will depend on many complicated factors. Nothing that follows below is investment advice.

Prediction #1: The crypto market recovery will be “U-shaped,” not “V-shaped.”

Crypto has historically moved in four-year cycles, with three up years followed by a year of pullback. 2022 fit that pattern perfectly.

Source: Bitwise Asset Management. Data from January 1, 2011, through December 31, 2022. Performance information is provided for informational purposes only. Returns reflect the return of bitcoin itself, and not of any fund or account, and do not include any fees. Backward-looking performance cannot predict how any investment strategy will perform in the future. Future crypto cycles may not be four years long; the four-year increment is based on historical data for illustrative purposes and is not a prediction of future results. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events, or a guarantee of future results.

As we enter 2023, crypto is well positioned to stage a recovery, in our view. Technological blockchain improvements like Ethereum’s Merge, scaling advances like the rise of Layer 2 solutions, and a simmering stew of emerging new applications have us bullish.

Recovery won’t be easy, though. The fraud-ridden implosion of FTX and the broader crypto credit crisis casts a long, dark shadow over the space. Regulators are circling, banking relationships are frayed, and investors are skeptical. In addition, new risks—like the planned release of 127,000 bitcoin from the Mt. Gox settlement later this year, and distress in the bitcoin mining space—loom on the horizon.

We suspect the market will grind sideways for a period before entering its next bullish phase. There is even a meaningful risk of another leg down, catalyzed by another crypto company failure, token blowup, or regulatory action.

In the end, however, we believe crypto will recover. Historically, crypto has bounced back from every major pullback. We don’t think this one will be different.

In fact, we think the next bull market in crypto will be the biggest yet—with new all-time highs and a wave of new applications that impact mainstream adoption.

Prediction #2: Crypto’s original promise of (effectively) free and (extremely) fast transactions will finally become reality in 2023.

When crypto burst onto the scene in 2009, it promised a world of extremely fast and essentially free transactions.

The legacy financial ecosystem is slow and corrupt, crypto said. We have a better way.

But if we’re being honest, reality has not quite measured up.

Yes, you can send a billion dollars anywhere in the world over the Bitcoin network, 24/7/365. But it will cost you $1-2 and will take 10-60 minutes. That may be better than your local bank, but $1 isn’t free and 10 minutes isn’t fast in the digital age.

Things aren’t much better with Ethereum: During the peak of the last bull market, the cost of a simple transaction on Ethereum topped $200. $200!

No major blockchain has fully delivered on the original core promise. So, you can forgive the skeptics for laughing.

In 2023, however, the combination of the rise of Layer 2 solutions and a planned upgrade of the Ethereum blockchain (called EIP 4844) should slash the average transaction cost on Ethereum by more than 1,000%. The result: Transaction costs will be reliably below 1/10th of a cent, and likely well below that level.

The implications are massive. Now, micropayments might actually work. Now, crypto networks really will have a 10x advantage over Visa. And now, non-financial transactions—like gaming, social networks, and other solutions—come into play.

(What do we mean by that last comment? Well, to take one example: People have been asking for a decentralized version of Twitter for years. But you’re not going to pay $200 every time you post. You might, however, pay $0.0007 if it meant a more secure, fair, and equitable network that could also reduce spam. We’re already seeing this concept take off on platforms like Farcaster and Lens, and it will accelerate dramatically in 2023.)

The market hasn’t recognized the importance of this development. Almost no one is talking about it. But it’s going to reshape crypto in 2023, and it will then reshape the world in the years to come.

Prediction #3: Coinbase’s market capitalization will increase 100% from year-end 2022 levels.

Coinbase’s stock fell 86% in 2022, making it one of the worst-performing large-cap stocks in the world. The business shed $47 billion in market value, ending the year with a market cap of approximately $9 billion. For context, the company raised money at an $8 billion valuation in 2018, meaning it effectively gained no value across the entire past cycle.

And yet, when viewed from a fundamentals perspective, Coinbase looks like a giant. From 2018 to 2022, revenues rose 7x from $520 million to $3.3 billion, users jumped almost 5x from 22 million to 101 million, and assets on the platform soared nearly 10x from $11 billion to $101 billion.

Simply put, the market just isn’t recognizing Coinbase’s fundamentals.

Today, Coinbase is the best-known and most trusted brand in crypto, with the largest installed user base in the U.S. It is run by an accomplished and focused CEO, and has navigated multiple bull and bear markets. We think it will not only navigate this one as well, but is well positioned for a resurgence when crypto recovers.

Don’t just take our word for it, though: As of January 8, 2023, the average price target among the 26 sell-side analysts covering the firm was $71.19, roughly double where it was trading.

Prediction #4: The amount of staked ETH will rise after the “Shanghai Upgrade”—which finally allows staked ETH withdrawals—by 50% or more.

Last September, the Ethereum blockchain transitioned its consensus mechanism from proof-of-work to proof-of-stake. As of January 5, 2023, there was $21 billion in ETH staked on the network, or roughly 14% of total supply.

Currently, that ETH cannot be “unstaked”; the transition to proof-of-stake was complex, and one way the Ethereum network controlled risk was by not allowing users to withdraw their staked ETH.

Sometime in 2023, however, the Ethereum blockchain will go through what’s called the “Shanghai Upgrade,” which will—among other things—allow staked ETH to be withdrawn.

Some market commentators worry this will unleash a massive wave of selling in the market, as investors, some of whom staked their ETH as early as December 2020, rush to unstake and sell. But, this claim misses the mark.

In the short term, mass sales are simply impossible: The Shanghai upgrade will limit the amount of ETH that can be unstaked at any given time to smooth out any sales pressure.

More importantly, in the long term, this pessimistic view misreads the market dynamic. In our view, allowing investors to unstake their ETH will lead to more ETH staking, not less.

Here’s why: Today, many investors who would like to stake ETH and earn yield are sitting on the sidelines. After all, most investment strategies can’t tolerate an indefinite lock-up. So, most investors stay out of the market. But once that indefinite lock-up is removed, the percentage of investors willing to stake their ETH will explode.

That’s why we expect the total amount of staked ETH to rise by at least 50% by year end.

Prediction #5: ETH will be deflationary in 2023, with total circulating supply declining by at least 1%.

Ethereum’s switch from proof-of-work to proof-of-stake last September dramatically reduced the amount of new ETH the blockchain issues on a daily basis. The reason is simple: proof-of-stake is more efficient than proof-of-work.

When you combine this lower issuance with the fact that ETH is burned (permanently removed from circulation) when people access the network, you create a situation where the net supply of ETH can theoretically decline.

We think that will be the case in 2023.

Before the switch to proof-of-stake, ETH’s circulating supply was rising at an annualized rate of approximately 2.5%. But since making the switch, net issuance has been nearly flat, with supply rising at a rate of just 0.011% per year.

We anticipate that there will be significantly more demand to access and use Ethereum applications in 2023 vs. 2022, which will increase the amount of ETH burned via transactions. As a result, the total amount of ETH in circulation will decrease by 1% or more, with huge implications for investors.

Prediction #6: Crypto’s correlation with the equity markets will fall sharply, dropping below 0.5 (and possibly down to 0.25).

A common criticism of crypto’s performance over the past two years is that it has been highly correlated with stocks. Crypto ripped upwards during the bull market that followed Covid’s emergence in March 2020, and peaked in late 2021 as the stock market started to pull back.

I thought crypto was supposed to be an uncorrelated asset, critics railed.

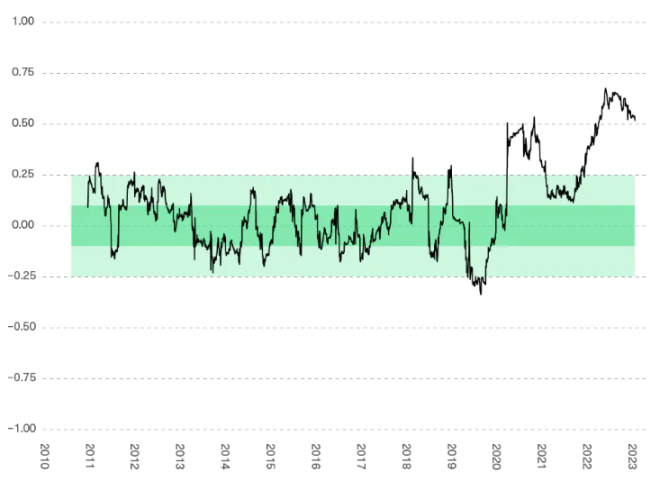

They had a point. As the table below shows, the correlation between bitcoin and the S&P 500 spiked at the start of 2020 and has never settled down. (The chart looks at the rolling 90-day correlation between the two assets since the inception of bitcoin’s trading.)

Correlation of Bitcoin and the S&P 500 Is Near Historic Highs

Source: Bitwise Asset Management with data from IEXCloud as of December 31, 2022.

Note: This chart displays rolling 90-day correlations. The S&P 500 is represented by the SPDR S&P 500 ETF Trust (SPY).

We think this metric will sink closer to its historical average in 2023, with correlations falling below 0.5 (and possibly below 0.25).

Crypto’s correlation with stocks spiked in 2020 because macro factors became the dominant force driving all capital assets. Stocks, bonds, commodities, crypto: All that mattered was what Fed Chairman Powell did with rates.

Macro factors will still be important in 2023, as we wrestle with an impending recession and continued geopolitical turmoil. But the market has now priced in the Fed’s rate-hiking regime, and the relative strength of the macro signal will diminish year-over-year.

That means crypto’s returns will be driven more by crypto-native factors—what’s happening with the technology, regulation, and other aspects—and these are generally not correlated with the stock market.

Crypto’s high correlation with equities is an anomaly. We expect things will start to return to normal in 2023.

Prediction #7: At least one significant piece of crypto legislation will pass the U.S. Congress in 2023.

The fallout from FTX has put crypto front and center on Washington’s agenda. But even before FTX collapsed, Congress was gearing up for multiple legislative initiatives, including a push for stablecoin regulation and steps to define which agency should regulate crypto (the CFTC vs. the SEC).

With crypto-friendly Congressman Pat McHenry (R-NC) chairing the House Financial Services Committee, expect to see at least one significant piece of crypto regulation pass in Washington in 2023.

For what it’s worth, our guess is that the legislation will be a mixed bag for crypto, with some parts that the industry likes and others that it worries about. On balance, however, the addition of regulatory clarity will be good for the space.

Prediction #8: USDC will surpass USDT (Tether) as the world’s largest stablecoin.

Stablecoins are one of crypto’s killer apps, with more than $130 billion in stablecoin AUM. The vast majority of that, however, is concentrated in just two names: Tether (USDT) with $66 billion and USD Coin (USDC) with $44 billion.

The two assets represent two different sides of the crypto community.

Tether is a largely unregulated stablecoin, relying on shadowy attestations and a long track record to convince investors that it holds sufficient collateral to back the asset. It’s predominantly used by offshore exchanges and entities outside of the U.S.

USDC, by contrast, is a U.S.-domiciled entity, created by Circle and Coinbase. It positions itself as the most regulated, transparent, and secure stablecoin.

We think that a defining theme of 2023 will be investors opting for transparency and sound regulation over the alternative. That means more flows into USDC. It’ll end the year on top.

Prediction #9: A crypto unicorn—a firm that previously raised money at a $1+ billion valuation—will fail this year.

FTX. BlockFi. Voyager. Celsius.

2022 saw many former unicorns forced into bankruptcy, swallowed up by scandal, mismanagement and crypto’s credit contagion.

We don’t think that’s over—2023 will see at least one additional crypto unicorn go bust (and maybe multiple).

Prediction #10: Uniswap will trade more volume than Coinbase in Q4 2023.

Decentralized exchanges grew their market share in 2022, as investors lost confidence in centralized exchanges and gained familiarity with decentralized alternatives. We expect that trend to accelerate in 2023. In fact, we think Uniswap will outpace Coinbase (the largest U.S. exchange) in total trading volume in Q4 2023.

This isn’t as shocking as it seems: Uniswap actually settled more trading volume than Coinbase in November 2022, as investors fled centralized exchanges in the wake of FTX. But the ratio reverted in December, as the markets settled down.

We think it flips more sustainably in Q4 2023, when Uniswap passes Coinbase and possibly never looks back.

The future is decentralized. Uniswap is already living it.

Bonus Prediction: A major new narrative in crypto in 2023 will be: “Crypto is the solution to the problems with big tech.”

Big tech is not popular these days.

Meta. Twitter. Apple: These are among the most hated companies in the world today. They are too big. Too profitable. Too powerful.

But more than anything, they effectively have monopoly power. The network effects surrounding these businesses are so strong that users are captive to them. If you have 50k followers on Twitter, you can’t leave for another social platform. If you talk to all your friends and relatives on Facebook, you can’t leave it for another tool.

This absolute control encourages private monopolies to abuse users. They make decisions in the interest of corporate profits, and not in the interest of users and the public good. And users have no choice but to take it. The switching costs are too high.

The good news? Crypto fixes this.

Blockchain technology allows for the creation of publicly owned networks, which are beholden to users and not to companies.

Ethereum, for instance, can be thought of as the first public computer: An operating system that is accessible to all but controlled by no one. No single individual, corporation, or even nation can change the way this computer works. But every single individual can build applications on it, and people and their data will not be captive to any individual corporate-owned entity.

This is more like how the underlying internet works, as opposed to how Facebook works. The internet’s open and reliable architecture allowed a million entrepreneurs to build new applications, knowing that the underlying substrate wouldn’t shift. Crypto and blockchain can restore that openness to other networks as well.

Crypto will push this narrative in Washington and in the media. It needs a new story; a reason for skeptics to root for it, rather than just call it a scam or a scheme.

This one will resonate. There will be op-eds, Congressional testimony, and impassioned support by leaders on the left and the right.

Blockchains are the solution to big tech. It has a good ring to it. And the beautiful thing about it is, it also happens to be true.