Bankless Writer: David Hoffman

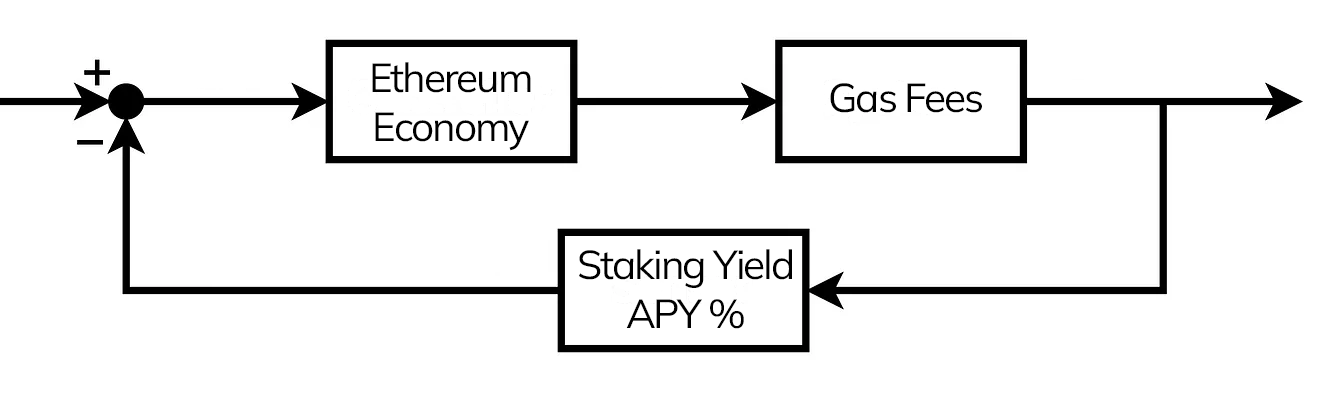

Ethereum naturally pays more for security, when there is less ETH staked to it.

As more ETH is staked to Ethereum, yields reduce and issuance increases, which softens the breaks on economic activity, by encouraging ETH outflows from staking and into the Ethereum economy.

MEV

MEV is an important part of the Ethereum economy. MEV is the pipe that connects DeFi activity to ETH yield rates. It’s a transfer of value from arbitragers to stakers.

When anyone does almost anything on Ethereum, they leave a small trail of arbitrage in their wake. Buying ETH on Uniswap dislocates the price, and creates a micro-opportunity for arbitragers to rebalance the pool.

Economic actors dislocate market equilibrium, and arbitragers automatically relocate the system.

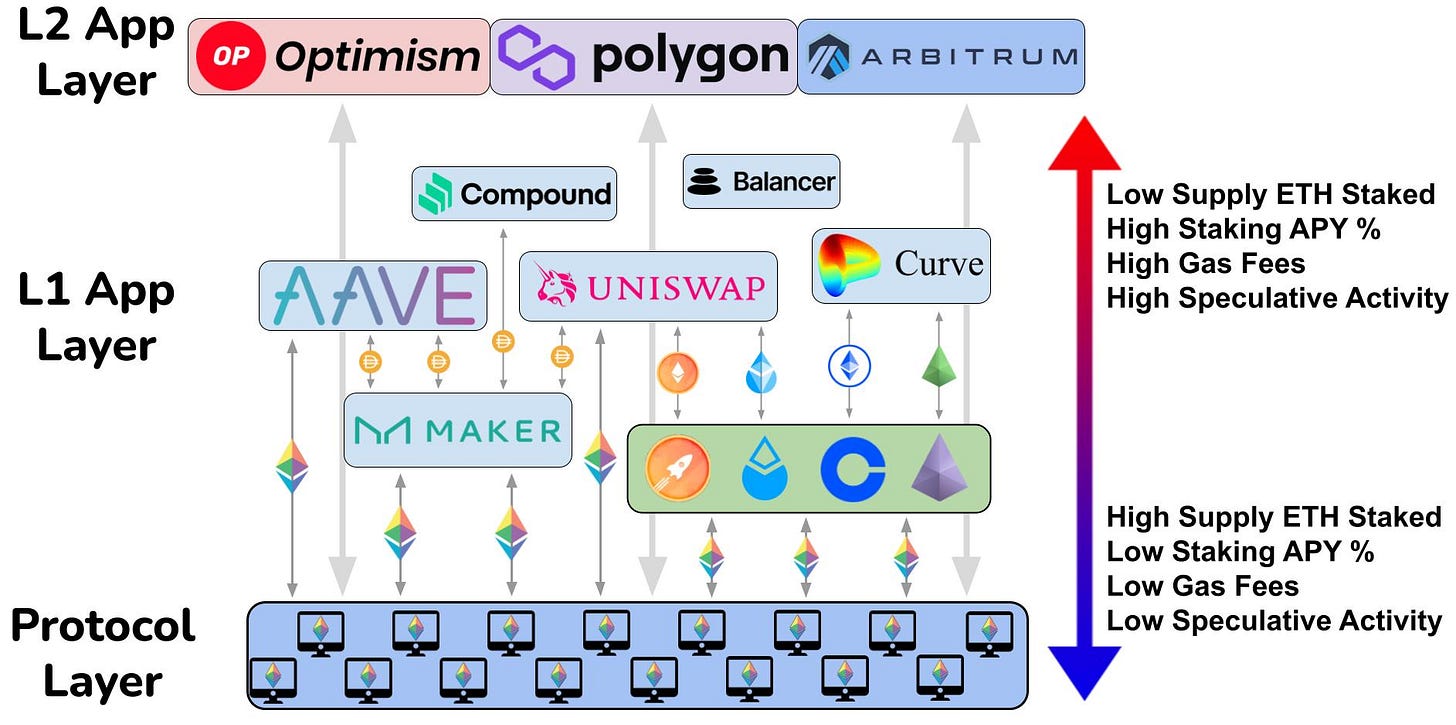

As the Ethereum economy heats up, arbitrage increases commensurately. Generalized economic activity on Ethereum shows up in the price of gas, but MEV activity specifically arises in gas ‘tips’; fees that are paid to ETH stakers beyond the required EIP1559 amount, to allow MEV transactors to skip the transaction queue and go first.

The net effect is a correlation between staking yields and the economic heat of Ethereum.

Finding Equilibrium

All of these various inputs into ETH issuance and ETH burn rates produce an organically balancing system, that allows Ethereum to be the hands-off crypto-economic system that produces the ‘sci-fi economics’ that make me so excited!

When the Ethereum economy is hot, gas prices are high, causing the ETH burn rate to be high. In this environment, MEV is high, raising the yields of ETH staking.

Higher ETH staking yields increase the incentive to stake ETH! This encourages capital outflows out of DeFi, and into the staking protocol, incurring an increase in the costs of capital inside of DeFi.

High ETH yields increase the opportunity cost of capital in DeFi, naturally raising the threshold on what is viable speculative activity.

Arbitragers will always ensure the costs of borrowing ETH in DeFi is higher than staking yields. If it’s not, then there is a free arbitrage opportunity to borrow from DeFi at a lower rate, to stake to the protocol and freely pocket the difference.

By increasing ETH yields at the base layer, Ethereum increases the cost of capital in DeFi.

This is Ethereum’s fantastically elegant homeostatic mechanism for balancing its own economy, and is what prevents humans from having to interfere in the economy. The only human input into the system is the aggregate of market activity! Ethereum does the rest.

As the Ethereum economy heats up, it naturally adds pressure to its own breaks! This also happens in reverse; as the economy cools, pressure is released. A cold economy incurs a high supply of ETH staked but low staking yields, causing external opportunities to look more attractive.

Economy 2.0

In TradFi, there is a tug-of-war between bond yields and equity valuations.

Low bond yields increase risk appetite, and capital flows from bonds to equities. Asset inflation sets in, and credit availability increases. The economy heats up and inflation sets in. The federal reserve responds by raising interest rates, and yields follow suit. Equities sell-off, as bond yields become enticing again.

The Fed has a hard job.

Humans are folly, and the Fed is not external to the system it governs. The inputs that the Fed uses to make governance decisions react to the Fed’s decisions.

Chaotic systems come in two shapes:

-

Systems that do not react to predictions made about them. The weatherman’s predictions do not change the weather.

-

Systems that do change as a result of predictions made by it.

Enter game theory.

The Fed is operating inside of a chaotic system that responds to the Fed’s own predictions about it. It is fundamentally constrained in its ability to produce stability for the economy it governs, because the Fed’s own inputs are a source of chaos in the system!

Of all the amazing technology that makes up Ethereum, its greatest achievement may simply be eliminating the focal point of a central manager of the economy. Economic participants can stop focusing on the Fed to make their financial decisions, because Ethereum put the Fed’s job into EIP1559 and Proof of Stake.

An internet industrial revolution

Ethereum is the first profitable blockchain in existence.

It is the first crypto-system that captures its own energy and directs it into productive output. By redirecting the blockspace revenue into ETH value, Ethereum naturally increases the aggregate value of capital in of DeFi!

DeFi grows as ETH absorbs flows from the Ethereum economy.

Because ETH is the dominant collateral in the DeFi economy, as the collateral grows in value, credit availability expands!

The Ethereum economy is denominated in ETH, and when ETH grows in value, everything downstream of ETH also grows in value.

Many tokens trade directly against ETH, through Uniswap or some other DEX. Tokens that denominate against ETH means that ETH appreciation is also token appreciation. Tokens that mostly trade with stablecoins still are influenced by ETH price, as the appetite for stablecoins grows when ETH can be used to borrow or mint them, and also borrow more of them as ETH becomes more valuable.

EIP1559 gives the entire Ethereum economy a tailwind of economic growth. As ETH grows in value, capital availability increases.

Wealth generation becomes easier. Investment in Ethereum grows.

The positive effects of EIP1559 don’t stop at simply increasing ETH’s value. ETH is intimately intertwined with DeFi, and ETH appreciation has significant positive downstream effects upon the entire Ethereum economy!

Call it: the “ETH Wealth Effect”.

Some people mistakenly think that ETH deflation will dampen economic activity on Ethereum. It’s exactly the opposite. ETH deflation increases the availability of all other forms of capital and encourages investment and activity of that capital

Ethereum will be able to finance itself into its own future.

Unlocking the Internet Industrial Revolution

We are watching the world of crypto-economics unlock a new engine of productivity for the internet age.

The internet revolution is incomplete without crypto-economics. Prior to digitally native money and finance, we were stuck in a pre-pubescent phase of the internet; the ‘data only’ version of the internet.

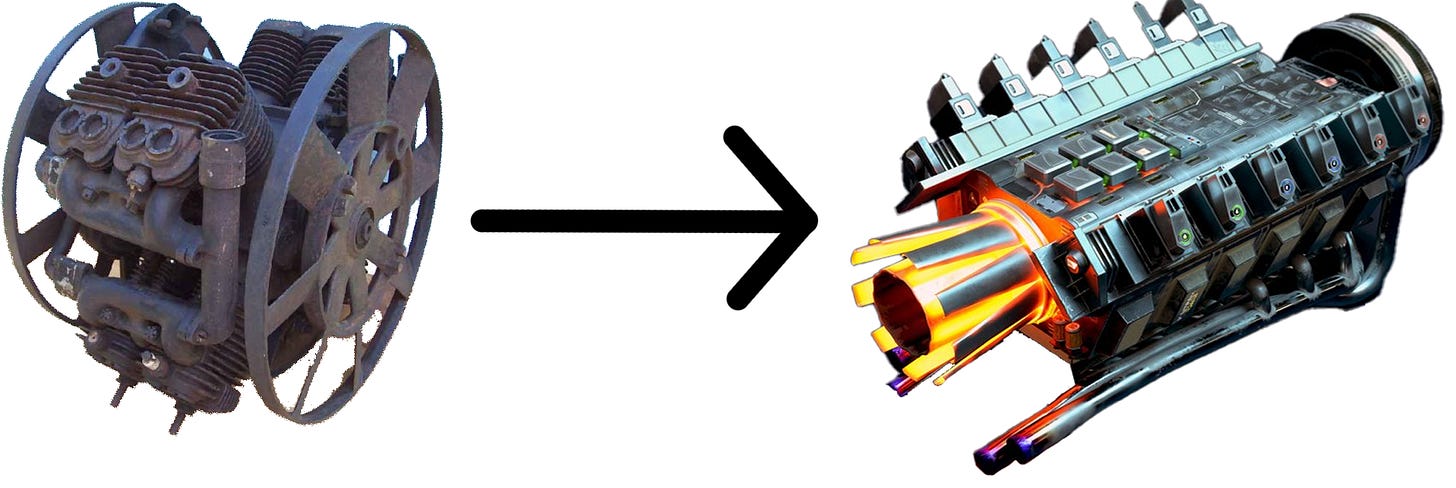

Crypto-economics is the study of building economic engines for the internet. With the invention of Bitcoin in 2009, a new engine class was discovered, and an entirely new industry was spawned around it.

Ethereum has been optimizing the science of crypto-economics ever since. What was previously a lossy and inefficient engine of productivity has been turned into a super-engine for the digital age.

Ethereum is heralding an industrial revolution on the internet. Similar to how the steam engine was the input required to kickstart the industrial revolution, Ethereum’s spiffy new crypto-economic engine is unlocking a new era of economic productivity and prosperity for the internet.

We’ve seen this story before. We know what happens next.

The dots being connected here are not that far apart.

Growth. Entrepreneurship. Inventions. Connectivity. Wealth. Prosperity. Increased standards of living and quality of life.

This is what lies ahead, as soon as we figure out how to drive the damn thing. 😅