BY Matt Hougan

Market Overview

Dear Investors,

Earlier this month, FTX—the third-largest crypto exchange in the world—collapsed.

The firm’s CEO, a media darling whom Fortune magazine dubbed the “The Next Warren Buffett,” appears to have engaged in a massive and perhaps criminal fraud, appropriating customer assets and funneling them to an affiliated hedge fund. The firm filed for Chapter 11 bankruptcy protection on November 10 and reportedly has more than one million creditors.

The news has shaken the crypto industry and sent crypto prices down. Bitcoin, which had been trading around $20,000 before FTX’s meltdown, is now trading around $16,000. Ethereum, which was trading near $1,600, is now below $1,300.

Critics have characterized FTX’s downfall as proof that crypto itself is flawed, a failed idea built on sand. But that argument doesn’t stand up to scrutiny. Fraud, unfortunately, has cast a long shadow throughout the history of finance. The potential existence of fraud at FTX does not invalidate crypto and blockchain any more than the existence of Bernie Madoff invalidated stocks and options.

But arguments that FTX “doesn’t matter” are equally hollow. FTX was a high-profile firm. Its name was stamped on the uniforms of MLB umpires and on the stadium of the NBA’s Miami Heat. Its CEO, Sam Bankman-Fried (SBF), was well known in Washington, both for his crypto lobbying efforts and for his status as one of the largest political donors in America.

As such, FTX’s collapse will shape crypto for months and years to come, in ways both good and bad.

So in this month’s Investor Letter, let’s face up to FTX: what it means, what it doesn’t mean, and how it will shape crypto in the years to come.

Note: Bitwise has no affiliation with FTX. We did not trade or custody assets on FTX.

What FTX Doesn’t Change About Crypto

The place to start is what FTX does not change about crypto. It’s a long list.

The collapse of FTX does not change anything about blockchain technology. It does not change crypto’s ability to move money at the speed of the internet, program money like software, or create digital property rights. It does not change the advances of decentralized finance (DeFi), and it neither makes stablecoins less interesting nor truncates the long-term possibilities created by non-fungible tokens (NFTs). It does not reverse the incredible progress we have made in recent years on crypto infrastructure, from the rise of regulated custodians to the development of the regulated CME bitcoin futures market.

Similarly, it does not change the fact that there is a record number of developers working in crypto, or that Ethereum SDK installations—an indicator of how many applications are being built on Ethereum—have tripled in the past year alone. FTX’s alleged fraud does not change that Ethereum’s monthly revenue is up 32x over the past four years.

FTX does not alter the fact that crypto has received more venture capital in the past two years than it did in the preceding 10, nor does it detract from the incredible progress we’ve made recently in blockchain technology itself: 2022 has seen the successful execution of Ethereum’s Merge (which, among other impacts, cut that blockchain’s carbon consumption by 99%) along with the rise of Layer 2 solutions that (in combination with other technological upgrades) are expected to increase blockchain bandwidth more than 10,000-fold in the coming years.

In other words, FTX doesn’t change the fundamentals of crypto in any meaningful way. It does, however, alter the conditions we operate in.

What FTX Does Change About Crypto

In the short term, FTX’s collapse has destroyed trust and introduced uncertainty into the market. The marginal crypto investor will now think twice before signing up for an account, and many institutional investors will sit on the sidelines waiting to see what other shoes will drop. It’s a reasonable stance: We will likely see other firms pulled away by FTX’s undertow, and we don’t yet know the full extent of any contagion.

In the intermediate-to-long term, FTX’s collapse will accelerate and intensify regulatory scrutiny in the space. While regulators bear some of the blame for FTX’s unchecked rise—the lack of regulatory clarity in the U.S. pushed trading venues offshore—politicians and regulators alike will seize on the high-profile collapse to claim that we must tame the Wild West of crypto immediately. We are already seeing this in Congress, which is likely to hold hearings on the FTX debacle, and from SEC Chairman Gary Gensler, who lays the blame for FTX’s collapse on the lack of regulatory enforcement.

Long-term, increased regulatory clarity will be good for crypto. A murky regulatory environment keeps investors on the sidelines and stifles the creativity of crypto entrepreneurs. Ironically, the collapse of FTX may end up being a catalyst for the next bull market in crypto, which needs clear regulation to go mainstream.

But regulation made in haste brings risk, and FTX’s collapse increases the likelihood we see rules adopted in a manner that doesn’t give the industry time to adapt. (For a good review of what’s at stake from a regulatory perspective, read this insightful take from Chainalysis.)

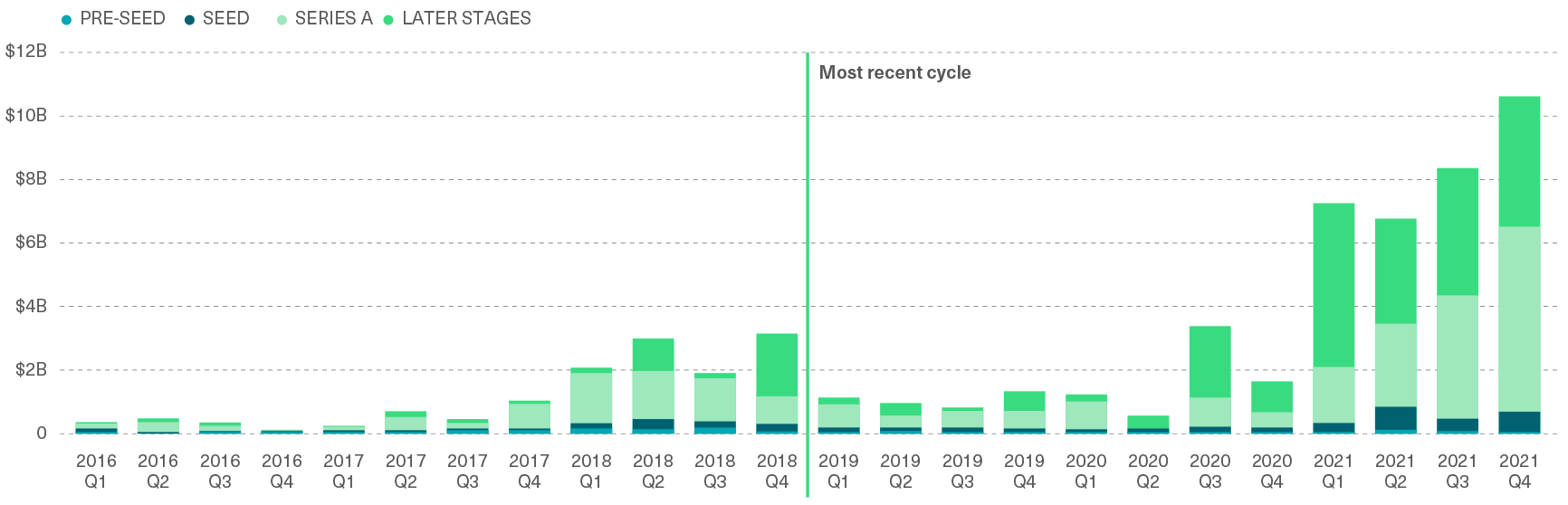

Beyond that, FTX’s collapse will also likely pause and/or diminish the flow of venture capital funding into crypto. A huge number of VC firms had exposure to FTX’s equity, and they will have to write that down to zero. Some, like Sequoia, heavily promoted their investment in FTX and now have egg on their faces. They will be unlikely to return to crypto quickly. Even funds that didn’t have exposure will find it harder to raise new assets, as their institutional clientele will want to know how they are protected from the “next FTX.” The venture capital spigot will likely slow to a trickle for a year or more as firms adapt.

VC Money Invested in Crypto/Blockchain by Stage

Source: Galaxy Digital Research, "2021: Crypto VC's Biggest Year Ever," January 6, 2022, with data from Pitchbook.

Note: New data on venture capital activity covering 2022 will not be made available on a standardized and comprehensive basis from Galaxy Research or other providers until early 2023. Other researchers have noted that venture capital activity has declined somewhat in 2022 vs. 2021. For instance, KPMG reported its "Pulse of Fintech" report that H1 2022 venture capital activity in crypto totaled $14.2 billion, the equivalent to $28.4 billion on an annualized basis (compared to their estimate of $32.1 billion in crypto venture activity in 2021).

So, What Does This All Mean for the Next Crypto Cycle?

In the past half year at Bitwise, we have been talking about the “next bull cycle in crypto.”

As we’ve discussed, crypto has historically moved in four-year waves, with three big up years followed by a year of pullback. The table below shows the annual returns of bitcoin as a proxy for crypto as a whole, and is updated with data through November 13, meaning it incorporates the FTX-induced pullback.

Crypto Has Historically Moved in a Four-Year Cycle

Source: Bitwise Asset Management. Data from January 1, 2011, through November 13, 2022. Performance information is provided for informational purposes only. Returns reflect the return of bitcoin itself, and not of any fund or account, and do not include any fees. Backward-looking performance cannot predict how any investment strategy will perform in the future. Future crypto cycles may not be four years long; the four-year increment is based on historical data for illustrative purposes and is not a prediction of future results. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events, or a guarantee of future results.

The pattern is striking, but it's not a coincidence. These waves are driven by major technological upgrades and represent the market’s response to those upgrades.

The first wave—from 2011 to 2014—was driven by Bitcoin itself. 2011 was the first year investors could buy bitcoin, with the launch of Coinbase, Mt. Gox, and other crypto on-ramps. These tools brought new investors into the space, pushed prices up, and inspired a wave of crypto engineers to think about what else blockchain technology could do.

The market pulled back when Mt. Gox collapsed; the exchange, built on rickety infrastructure and with no regulatory framework, couldn’t hold up under the surge of demand.

The second wave—from 2015 to 2018—was driven by entrepreneurs who were pulled into crypto by the first wave. These entrepreneurs created Ethereum in 2015 as the first general-purpose blockchain, among other achievements. This technological breakthrough sparked massive new opportunities for investors and kicked off the initial coin offering (ICO) boom, sending prices higher.

The market reset in 2018 as regulators clamped down on the excesses of ICOs; once again, crypto got ahead of itself. But the excitement around the 2015-2018 boom laid the groundwork for the next wave of crypto, bringing significant venture capital activity into the space. And from 2019 to 2021, VC- and angel-backed entrepreneurs created multiple new blockchain-based breakthroughs—DeFi! Stablecoins! NFTs!—which together catalyzed the most recent bull market.

That wave has, of course, crested and withdrawn, pulled back by a tough macro environment and once again by crypto expanding too fast and taking on too much risk, as evidenced by the crypto credit crisis that took down Celsius and BlockFi, and now the FTX fraud. But just as 2015-2018 laid the groundwork for 2019-2022, so too has this last boom sown the seeds of what’s to come.

From 2019 to H1 2022, investors have poured $57 billion of venture capital into crypto, according to KPMG—many times the amount that entered the market from 2015-2018. This money is funding a record number of engineers and entrepreneurs building in the space. And with the rapid improvements in blockchain technology, I feel confident we’ll see enormous new applications emerge in the coming years.

From my seat, the biggest impact FTX will have is that these entrepreneurs are likely to be building in a more carefully regulated, more sound, and more mainstream market. As one example, centralized exchanges are already adopting cryptographically native approaches to building investor trust through initiatives like “Proof of Reserves,” in which exchanges use the transparency of blockchains to prove that customer assets are held securely in stand-alone wallets.

Ingenuity often springs from adversity. As JPMorgan put it in a recent research note on FTX’s collapse:

[W]e see the news surrounding FTX as one step back, but one that could prove to be the catalyst to move the crypto economy two steps forward (further unlocking the utility value of blockchain). In fact, we see the establishment of a regulatory framework as the needed catalyst to massively ramp the institutional adoption of crypto.